Global Health Cybersecurity Market

Market Size in USD Billion

CAGR :

%

USD

22.77 Billion

USD

73.59 Billion

2024

2032

USD

22.77 Billion

USD

73.59 Billion

2024

2032

| 2025 –2032 | |

| USD 22.77 Billion | |

| USD 73.59 Billion | |

|

|

|

|

Health Cybersecurity Market Size

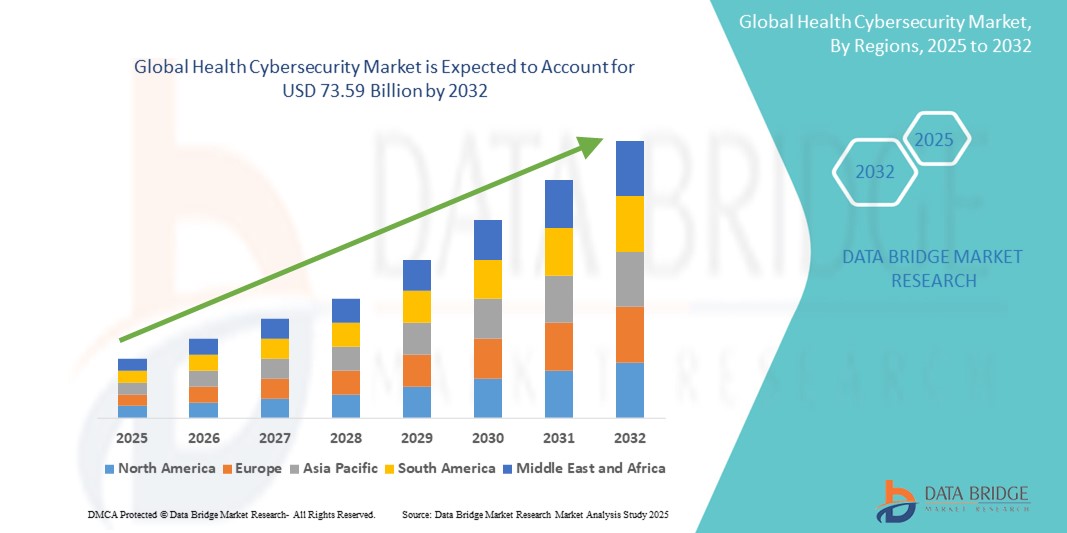

- The global health cybersecurity market size was valued at USD 22.77 billion in 2024 and is expected to reach USD 73.59 billion by 2032, at a CAGR of 15.79% during the forecast period

- The market growth is largely fueled by the growing adoption and technological progress within connected healthcare systems and digital health technologies, leading to increased digitalization across hospitals, clinics, and remote care environments

- Furthermore, rising demand for secure, user-friendly, and integrated cybersecurity solutions to protect sensitive patient data, medical devices, and electronic health records (EHRs) is establishing health cybersecurity as the cornerstone of modern healthcare infrastructure. These converging factors are accelerating the uptake of Health Cybersecurity solutions, thereby significantly boosting the industry's growth

Health Cybersecurity Market Analysis

- The health cybersecurity market is experiencing robust growth, driven by the increasing digitization of healthcare systems and the widespread adoption of electronic health records (EHRs), telemedicine, and connected medical devices. As healthcare organizations expand their digital footprint, the risk of cyber threats—such as ransomware attacks, data breaches, and phishing campaigns—has surged significantly. This has created a pressing need for advanced cybersecurity solutions that protect patient data, ensure regulatory compliance, and maintain the integrity of clinical operations

- The surge in demand for health cybersecurity solutions is largely attributed to the widespread adoption of smart healthcare infrastructure, escalating data security concerns, and a growing preference for automated, keyless access systems within hospitals, clinics, and diagnostic centers

- North America dominated the health cybersecurity market, capturing the largest revenue share of 41.2% in 2024. This dominance is driven by early adoption of smart healthcare technologies, high per capita healthcare spending, and the strong presence of key cybersecurity solution providers. The U.S. is at the forefront, witnessing significant Health Cybersecurity installations in new hospitals and smart medical campuses, supported by innovations from both established tech giants and agile startups focusing on AI-driven, voice-activated access solutions

- Asia-Pacific is projected to be the fastest-growing region in the health cybersecurity market during the forecast period, fueled by rapid urbanization, expanding healthcare infrastructure, increasing digitization, and rising disposable incomes, particularly in countries such as China, India, and South Korea

- The cloud security segment dominated the health cybersecurity market with a market share of 36.1% in 2024. This is due to the widespread shift toward cloud-based storage, Electronic Health Records (EHR) platforms, and virtual care delivery solutions across healthcare systems, making cloud infrastructure a critical component for safeguarding sensitive patient data and ensuring operational continuity

Report Scope and Health Cybersecurity Market Segmentation

|

Attributes |

Health Cybersecurity Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Health Cybersecurity Market Trends

“Proactive Defense Through AI-Powered Threat Detection”

- A major and rapidly evolving trend in the global health cybersecurity market is the deployment of artificial intelligence (AI)-powered threat detection systems that enable proactive and predictive defense mechanisms. These intelligent technologies are revolutionizing how healthcare institutions detect, analyze, and respond to cyber threats, shifting the model from reactive response to pre-emptive protection.

- For example, advanced cybersecurity platforms such as Darktrace, CrowdStrike Falcon, and Microsoft Defender for Endpoint are being widely adopted by hospitals and healthcare networks. These platforms use machine learning algorithms to continuously monitor network traffic, user behavior, and system logs to identify deviations from normal patterns. If an anomaly is detected—such as an unauthorized attempt to access patient records or an unusual command execution on a connected device—the system automatically flags or even mitigates the threat in real time.

- AI enables security systems to analyze vast volumes of healthcare data from connected medical devices, hospital IT infrastructure, and cloud-hosted platforms. Unlike traditional rule-based firewalls or antivirus software, AI systems evolve through continuous learning, enabling them to identify sophisticated threats like zero-day attacks, insider breaches, and ransomware attempts that might otherwise go unnoticed.

- This intelligent threat detection drastically reduces incident response times, often allowing breaches to be contained within seconds, which is critical in a healthcare setting where operational continuity can mean life or death. It also minimizes reliance on overburdened IT teams, who would otherwise struggle to manually detect and respond to threats across increasingly complex digital ecosystems.

- The growing reliance on AI-driven cybersecurity solutions reflects a broader shift within the healthcare sector towards intelligent, automated, and scalable defense systems that can adapt to evolving threats. With the proliferation of electronic health records (EHRs), telemedicine, Internet of Medical Things (IoMT) devices, and cloud-based systems, healthcare providers are embracing AI not just for efficiency, but to ensure patient safety, privacy, and compliance with regulations such as HIPAA and GDPR

Health Cybersecurity Market Dynamics

Driver

“Growing Need Due to Rising Security Concerns and Digital Health Adoption”

- The increasing prevalence of cyber threats targeting healthcare systems, combined with the rapid digitalization of hospitals, clinics, and remote care platforms, is a significant driver for the heightened demand for health cybersecurity solutions

- For instance, in April 2024, Fortinet, Inc. announced new advancements in healthcare cybersecurity architecture, focusing on AI-driven threat detection and zero-trust network access, designed to combat ransomware and phishing attacks targeting hospital networks. Such strategic innovations by key companies are expected to drive the Health Cybersecurity industry growth in the forecast period

- As healthcare organizations become more aware of potential vulnerabilities and seek enhanced protection for electronic health records (EHRs), connected medical devices, and patient data, cybersecurity solutions offer essential tools like real-time threat monitoring, data encryption, and intrusion detection systems

- Furthermore, the increasing use of telemedicine, remote patient monitoring, and cloud-based health IT platforms is making cybersecurity an integral component of healthcare IT infrastructure, offering seamless protection across decentralized systems

- The need for regulatory compliance with standards such as HIPAA, GDPR, and HITECH, along with rising incidents of healthcare-targeted cyberattacks, is propelling the adoption of robust cybersecurity frameworks among both large healthcare systems and small private practices. The growing availability of user-friendly and scalable Health Cybersecurity solutions further contributes to market expansion

Restraint/Challenge

“Concerns Regarding Evolving Threats and High Implementation Costs”

- Evolving and sophisticated cyber threats, such as ransomware-as-a-service and AI-generated phishing attacks, pose a continuous challenge to healthcare organizations, requiring constant investment in advanced cybersecurity infrastructure and skilled personnel

- For instance, high-profile ransomware attacks on health systems in the U.S. and Europe have caused service disruptions, data leaks, and financial losses, raising alarms about the resilience of healthcare IT networks

- Addressing these cybersecurity threats through AI-based threat detection, zero-trust frameworks, and regular system audits is crucial for building long-term protection

- Companies such as IBM and Palo Alto Networks emphasize threat intelligence and proactive defense in their solutions to reassure healthcare institutions

- In addition, the relatively high implementation cost of comprehensive cybersecurity systems—covering cloud, endpoint, and network security—can be a barrier for small-to-mid-sized hospitals and rural care providers

- While cost-effective solutions are emerging, many institutions in developing regions remain constrained by limited budgets and IT expertise. The perception that cybersecurity is a “cost center” rather than a “patient safety enabler” can also hinder rapid adoption

- Overcoming these challenges through government incentives, public-private cybersecurity partnerships, and scalable cloud-based solutions tailored to healthcare will be vital for sustained health cybersecurity market growth

Health Cybersecurity Market Scope

The market is segmented on the basis of threat, security type, and end user.

- By Threat

On the basis of threat, the health cybersecurity market is segmented into ransomware, malware and spyware, DDoS, APT (Advanced Persistent Threats), and phishing. The ransomware segment accounted for the largest revenue share of 32.6% in 2024, driven by the increasing frequency of high-impact ransomware attacks targeting hospitals and healthcare networks that rely on real-time access to patient data.

The APT segment is projected to witness the fastest CAGR of 18.4% from 2025 to 2032, as attackers employ stealthy, long-term intrusion techniques to steal data, disrupt services, or sabotage critical infrastructure.

- By Security Type

On the basis of security type, the health cybersecurity market is segmented into cloud security, application security, endpoint security, and network security. The cloud security segment held the largest market revenue share of 36.1% in 2024, owing to the widespread shift to cloud-based storage, EHR platforms, and virtual care delivery solutions across healthcare systems.

The endpoint security segment is expected to register the fastest CAGR of 17.2% from 2025 to 2032, supported by the growing adoption of connected medical devices and smart IoT infrastructure in hospitals and clinics.

- By End User

On the basis of end user, the health cybersecurity market is segmented into healthcare providers and payers. The healthcare providers segment dominated the market with a revenue share of 68.9% in 2024, driven by their expansive digital footprints, increasing cyber vulnerability, and regulatory compliance needs.

The payers segment is anticipated to grow at the highest CAGR of 15.6% during the forecast period, as insurance companies enhance their cybersecurity frameworks to protect policyholder data and ensure secure digital transactions.

Health Cybersecurity Market Regional Analysis

- North America dominated the health cybersecurity market with the largest revenue share of 41.2% in 2024, driven by the rising volume of cyberattacks on healthcare organizations, strong regulatory frameworks like HIPAA, and rapid digital transformation in healthcare

- The region also benefits from advanced infrastructure, high cybersecurity spending, and widespread adoption of electronic health records (EHRs)

- Increased investments in AI-based threat detection, cloud security, and endpoint protection further reinforce North America's leadership position in the Health Cybersecurity market

U.S. Health Cybersecurity Market Insight

The U.S. health cybersecurity market captured the largest revenue share of 61% in 2024 within North America, propelled by the high adoption of connected medical devices, cloud-based health IT systems, and remote healthcare platforms. Hospitals and healthcare providers are prioritizing robust cybersecurity strategies to protect sensitive patient data from ransomware and phishing threats.Federal initiatives and funding—such as the 405(d) Program and the HITECH Act—along with a strong vendor presence and strategic public-private partnerships, continue to drive growth.

Europe Health Cybersecurity Market Insight

The Europe health cybersecurity market is projected to grow at a substantial CAGR of 17.6% during the forecast period, primarily driven by GDPR compliance mandates and rising cyberattack incidents targeting healthcare infrastructure. Countries across the EU are increasing cybersecurity investments in both public and private health sectors. Growth is especially pronounced in hospitals, clinical laboratories, and telehealth platforms. Enhanced data privacy laws, technological modernization, and AI adoption are key enablers.

U.K. Health Cybersecurity Market Insight

The U.K. health cybersecurity market is anticipated to grow at a CAGR of 16.2%, fueled by the NHS’s digitization efforts and increasing threats to patient data integrity. The adoption of cloud-based EHRs, IoT in healthcare, and government focus on digital security—like the NHS Cyber Security Strategy—are accelerating the demand for cybersecurity solutions across both public and private care providers.

Germany Health Cybersecurity Market Insight

The Germany health cybersecurity market is expected to expand at a CAGR of 15.8%, driven by stringent national data protection laws and a strong focus on healthcare innovation. Germany’s Digital Healthcare Act (DVG) and increasing use of telemedicine platforms have heightened the need for endpoint and cloud security solutions. The country's robust IT infrastructure and emphasis on patient data privacy are key to sustained growth.

Asia-Pacific Health Cybersecurity Market Insight

The Asia-Pacific health cybersecurity market is forecasted to grow at the fastest CAGR of 20.4% from 2025 to 2032, owing to rapid digitization in healthcare, government-led smart hospital initiatives, and increasing cybercrime activity. Emerging economies like China, India, and Southeast Asia are significantly increasing investments in health IT and data protection. The region’s growth is further supported by improved internet penetration, growing medical tourism, and increasing deployment of IoT medical devices.

Japan Health Cybersecurity Market Insight

The Japan health Cybersecurity market is gaining momentum, supported by a highly connected healthcare environment, a tech-savvy population, and regulatory push for data security in medical institutions. Japan’s focus on smart hospitals, AI-driven diagnosis, and eldercare solutions is boosting the demand for sophisticated cybersecurity tools to ensure patient safety and protect critical infrastructure from breaches.

China Health Cybersecurity Market Insight

The China health cybersecurity market accounted for the largest revenue share in Asia-Pacific in 2024, driven by aggressive investments in digital healthcare infrastructure, widespread adoption of mobile health apps, and government-backed cybersecurity mandates. China’s push towards smart hospitals, coupled with a rise in ransomware incidents and strong domestic cybersecurity vendors, is accelerating the market’s growth. Data protection laws like the Personal Information Protection Law (PIPL) are also strengthening security frameworks across healthcare institutions.

Health Cybersecurity Market Share

The health cybersecurity industry is primarily led by well-established companies, including:

- FireEye, Inc. (U.S.)

- Palo Alto Networks (U.S.)

- Sophos Ltd. (U.S.)

- Juniper Networks, Inc. (U.S.)

- Fortinet, Inc. (U.S.)

- Cisco Systems, Inc. (U.S.)

- Checkpoint Software Technologies Ltd. (U.S.)

- Imperva (U.S.)

- IBM Corporation (U.S.)

- Intel Corporation (U.S.)

- McAfee LLC (U.S.)

- LogRhythm, Inc. (U.S.)

- NortonLifeLock Inc. (U.S.)

- Crowdstrike Holdings, Inc. (U.S.)

- FORTIFIED Health Security (U.S.)

- CLOUDWAVE SENSATO CYBERSECURITY (U.S.)

- Kaspersky Lab (Russia)

- Northrop Grumman (U.S.)

- Medigate (U.S.)

Latest Developments in Global Health Cybersecurity Market

- In January 2025, the U.S. Department of Health and Human Services (HHS) proposed major revisions to the HIPAA Security Rule, mandating measures such as multi-factor authentication, endpoint encryption, and annual risk assessments. The updated rule aims to modernize healthcare cybersecurity in response to increased ransomware attacks. The proposed implementation would cost healthcare providers approximately USD 9 billion in the first year and USD 6 billion annually thereafter

- In May 2024, the U.S. Advanced Research Projects Agency for Health (ARPA-H) launched the UPGRADE initiative (Universal Patching and Remediation for Autonomous Defense), providing hospitals with tools such as digital twins, automated patch deployment, and real-time threat modeling. This initiative addresses persistent vulnerabilities in outdated medical devices and systems used across healthcare institutions

- In March 2024, Honeywell International Inc. successfully deployed Phase One of the Bengaluru Safe City Project in India, integrating over 7,000 AI-enabled surveillance systems across healthcare and public safety zones. The project includes centralized security management, highlighting the role of Health Cybersecurity in modern urban resilience strategies

- In May 2022, Clearwater acquired CynergisTek, which provides cybersecurity, compliance, and IT services to help highly regulated industries tackle security and privacy issues, for USD 17.7 million. This partnership strengthens CynergisTek's people-centric approach to cybersecurity, privacy, and audit and its essential role in serving the healthcare industry and its clients

- In November 2021, With its plan to purchase ReaQta, a Dutch cybersecurity threat detection and response company, IBM Security announced an extension of its cybersecurity threat detection and response capabilities. Endpoint security solutions from ReaQta use artificial intelligence (AI) to automatically identify and control threats while staying invisible to attackers. This deal will strengthen IBM's position in the extended detection and response (XDR) industry, consistent with the company's aim of providing security through an open approach that spans diverse technologies, data, and hybrid cloud settings

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.