Global Health Screening Market

Market Size in USD Billion

CAGR :

%

USD

327.68 Billion

USD

840.75 Billion

2024

2032

USD

327.68 Billion

USD

840.75 Billion

2024

2032

| 2025 –2032 | |

| USD 327.68 Billion | |

| USD 840.75 Billion | |

|

|

|

|

Health Screening Market Size

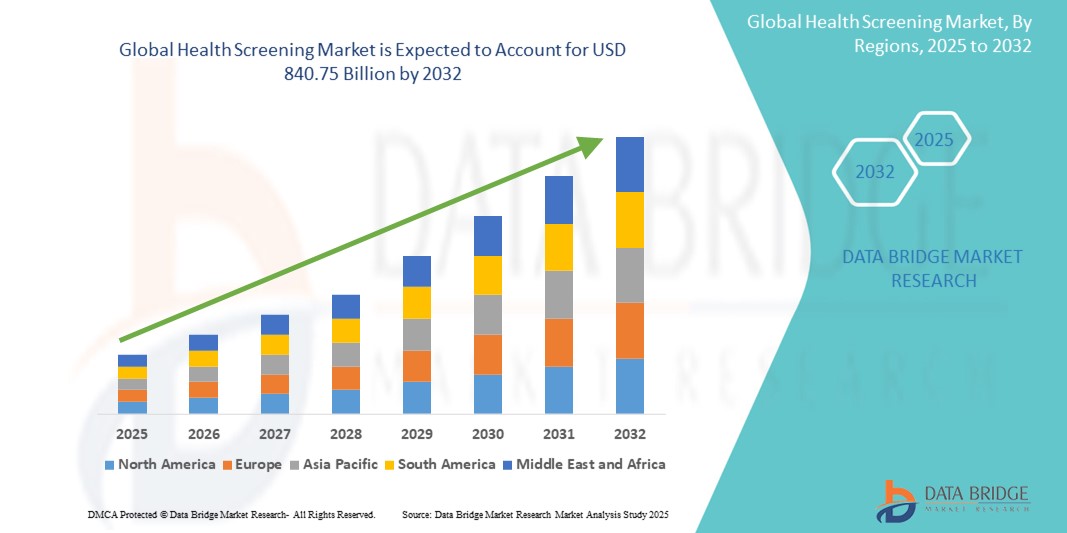

- The global health screening market size was valued at USD 327.68 billion in 2024 and is expected to reach USD 840.75 billion by 2032, at a CAGR of 12.50% during the forecast period

- The market growth is largely fueled by the growing adoption of preventive healthcare practices and increasing awareness about early disease detection, driving individuals and healthcare providers toward routine health screening services. Technological progress in diagnostic tools and point-of-care testing is making health screenings more accessible, accurate, and efficient across various settings, including hospitals, clinics, and home care

- Furthermore, rising consumer demand for timely, secure, and personalized health insights is establishing health screening as a foundational component of modern healthcare systems. These converging factors are accelerating the uptake of Health Screening solutions, thereby significantly boosting the industry's growth across both developed and emerging economies

Health Screening Market Analysis

- Health screening services, encompassing a wide range of diagnostic tests and preventive evaluations, are becoming increasingly essential in both hospital and outpatient settings due to the growing emphasis on early disease detection, personalized medicine, and population health management. These services enable timely intervention, reduce healthcare costs, and improve patient outcomes by identifying risk factors and latent conditions before they progress

- The rising demand for health screening is primarily driven by an aging population, increasing prevalence of chronic diseases such as diabetes and cardiovascular conditions, and growing health awareness among consumers. In addition, workplace wellness initiatives and insurance-led screening mandates are accelerating market adoption across both developed and developing regions

- North America dominated the health screening market with the largest revenue share of 39.5% in 2024, fueled by well-established healthcare infrastructure, high awareness levels, favorable reimbursement policies, and the presence of key players offering advanced screening technologies. The U.S. has seen significant uptake of health screening services in retail clinics, diagnostic centers, and corporate wellness programs

- Asia-Pacific is projected to be the fastest-growing region in the health screening market during the forecast period (2025–2032), with a CAGR of 9.2%, driven by increasing urbanization, rising disposable incomes, expanding middle-class population, and government initiatives aimed at improving preventive healthcare infrastructure, especially in countries such as China, India, and Japan

- The multi-test panels segment dominated the health screening market with a revenue share of 61.7% in 2024, favored for its cost-efficiency and ability to deliver comprehensive diagnostic results in a single package. The growing preference for bundled testing solutions among healthcare providers and patients has significantly contributed to the segment’s widespread adoption

Report Scope and Health Screening Market Segmentation

|

Attributes |

Health Screening Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Health Screening Market Trends

“Rising Demand for Preventive Healthcare and Personalized Screening Services”

- A significant and accelerating trend in the global health screening market is the growing emphasis on preventive healthcare, driven by rising health awareness, increasing prevalence of chronic diseases, and early diagnosis initiatives globally

- For instance, various national health programs such as the NHS Health Check in the U.K. and Preventive Health Guidelines in the U.S. are promoting routine health screenings for conditions such as cardiovascular disease, diabetes, and certain cancers. These programs are boosting public participation in early detection, thereby improving outcomes and reducing long-term healthcare costs

- Technological advancements have enabled comprehensive screening panels, mobile diagnostic services, and home-based testing kits, all of which are reshaping consumer expectations for convenience and accuracy in diagnostics. Many companies now offer mail-in testing kits for cholesterol, genetic conditions, food intolerances, and even cancer biomarkers, allowing users to monitor their health from home

- Moreover, the personalization of screening services is emerging as a key driver. Tailored health screening packages based on age, gender, lifestyle, and family medical history are gaining popularity, particularly among corporate employees and individuals with predisposed risk factors

- Healthcare providers and diagnostic labs are integrating electronic health records (EHRs) and cloud platforms to streamline test result delivery and enable continuous health monitoring. This is fostering a shift from episodic treatment to proactive, data-driven health management

- The demand for affordable, accessible, and proactive health screening is expanding rapidly across both developed and developing regions. Governments, employers, and insurers are increasingly investing in screening initiatives to detect diseases early and reduce treatment costs—thereby propelling the health screening market into a pivotal role within global healthcare ecosystems

Health Screening Market Dynamics

Driver

“Growing Need Due to Increasing Disease Burden and Preventive Healthcare Awareness”

- The rising prevalence of chronic and lifestyle-related diseases such as diabetes, cardiovascular conditions, and cancers, along with growing public awareness about the benefits of early diagnosis, is significantly driving demand for regular health screenings

- For instance, in May 2024, the World Health Organization (WHO) launched a global awareness campaign emphasizing early detection as the key to reducing mortality rates associated with non-communicable diseases. Such initiatives are expected to accelerate the growth of the Health Screening industry in the forecast period

- As patients and healthcare providers recognize the cost-effectiveness of preventive diagnostics, there is increasing adoption of comprehensive screening packages that include metabolic, cardiovascular, and genetic tests

- Furthermore, the expanding geriatric population and increasing health consciousness among younger demographics are making routine health screening a vital part of annual healthcare plans

- The convenience of home-based screening kits, telemedicine consultation, and mobile health apps offering test scheduling and result tracking are also contributing to the growing adoption of health screening services across urban and semi-urban populations

Restraint/Challenge

“High Cost of Advanced Tests and Limited Accessibility in Rural Regions”

- Despite growing demand, the high cost of certain advanced diagnostic screenings (such as, genetic testing or full-body scans) can pose affordability barriers, particularly in low- and middle-income countries

- For instance, many comprehensive health packages offered by private healthcare providers remain out of reach for economically weaker populations, creating disparities in access to early diagnosis

In addition, healthcare infrastructure in rural and remote regions often lacks sophisticated diagnostic tools, trained personnel, and logistics for efficient sample transportation, which restricts the expansion of health screening services

- For instance, many comprehensive health packages offered by private healthcare providers remain out of reach for economically weaker populations, creating disparities in access to early diagnosis

- Efforts are needed to bridge these gaps through government-funded screening programs, mobile health units, and public-private partnerships aimed at improving affordability and outreach

- Moreover, improving digital literacy and trust in digital health platforms is crucial to ensuring the effective use of home-based testing kits and online result reporting systems

- Overcoming these challenges through infrastructure development, insurance coverage for preventive care, and cost-effective testing innovations will be pivotal in unlocking the full potential of the health screening market

Health Screening Market Scope

The market is segmented on the basis of test type, package type, panel type, sample type, technology, condition, sample collection sites, and distribution channel.

• By Test Type

On the basis of test type, the health screening market is segmented into cholesterol tests, diabetes test, cancer screening, general check-up test, STDs, blood pressure test, and others. The diabetes test segment held the largest market revenue share of 24.6% in 2024, attributed to the growing global diabetes burden and demand for early detection.

The cancer screening segment is projected to grow at the fastest CAGR of 8.9% from 2025 to 2032, driven by increased awareness and screening mandates.

• By Package Type

On the basis of package type, the market is segmented into basic health screening, senior citizen profile, women health check, men health check, heart check, diabetes check, and others. The basic health screening segment dominated with a market share of 28.3% in 2024, supported by routine check-up demand.

The senior citizen profile segment is expected to expand at a fastest CAGR of 7.5% from 2025 to 2032, due to aging populations and age-related disease monitoring.

• By Panel Type

On the basis of panel type, the market is segmented into multi-test panels and single-test panels. The multi-test panels segment accounted for the largest share of 61.7% in 2024, favored for cost-efficiency and comprehensive results.

The single-test panels segment is expected to expand at a fastest CAGR of 6.8%, especially for condition-specific tests.

• By Sample Type

On the basis of sample type, the market is segmented into blood, urine, serum, saliva, and others. The blood sample segment held the dominant share of 48.2% in 2024, being the standard for most diagnostics.

The saliva segment is expected to expand at a fastest CAGR of 9.4% during the forecast period, owing to non-invasive and at-home testing trends.

• By Technology

On the basis of technology, the market is segmented into immunoassays, medical imaging, QPCR, Q-FISH, TRF, STELA, and others. Immunoassays led the market with a share of 31.6% in 2024, widely used for a range of disease markers.

QPCR is expected to expand at a fastest CAGR of 8.7% during the forecast period, boosted by its role in precision medicine and infectious disease diagnostics.

• By Condition

On the basis of condition, the market is segmented into cardiovascular disease, metabolic disorders, cancer, inflammatory conditions, musculoskeletal disorders, neurological conditions, hepatitis-C complications, immunology-related conditions, and others. The cardiovascular disease segment had the largest share at 22.5% in 2024, due to the high incidence of heart conditions globally.

Cancer is projected to witness the highest CAGR of 9.1% during the forecast period, supported by expanding screening programs and biomarker research.

• By Sample Collection Sites

On the basis of sample collection sites, the market is segmented into hospitals, homes, diagnostic laboratories, offices, and others. Hospitals dominated with a market share of 38.9% in 2024, driven by infrastructure and expertise availability.

The home segment is expected to grow at a CAGR of 10.3% during the forecast period, owing to self-testing kit adoption and telehealth growth.

• By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tenders, retail sales, and others. Direct tenders held the largest market share at 46.7% in 2024, owing to bulk procurement by public institutions and health ministries.

Retail Sales are projected to grow at a CAGR of 7.8% during the forecast period, with increasing access through e-commerce and pharmacies.

Health Screening Market Regional Analysis

- North America dominated the health screening market with the largest revenue share of 39.5% in 2024, driven by the rising burden of chronic diseases, widespread adoption of preventive health checkups, and advanced healthcare infrastructure

- The region’s emphasis on early detection and growing investments in personalized medicine are significantly fueling the demand for regular health screenings

- Consumers in the region increasingly prefer personalized wellness solutions, including at-home testing kits and digital diagnostic platforms. The availability of advanced technologies and well-established health systems further supports robust market growth

U.S. Health Screening Market Insight

The U.S. health screening market captured the largest revenue share of 81.0% in 2024 within North America, fueled by strong healthcare policy support, employer-sponsored wellness programs, and rising consumer awareness. The adoption of annual physical exams, cancer screenings, and home-based diagnostic kits continues to grow, with technological integration such as telehealth and mobile health screening services enhancing accessibility and convenience.

Europe Health Screening Market Insight

The Europe health screening market is projected to expand at a substantial CAGR throughout the forecast period, driven by national cancer and cardiovascular screening programs and a rapidly aging population. The region is also experiencing a surge in digital health platforms and telemedicine-enabled screenings, making diagnostics more accessible across both urban and rural areas.

U.K. Health Screening Market Insight

The U.K. health screening market h is anticipated to grow at a noteworthy CAGR during the forecast period. Growth is driven by NHS-led programs such as Health Check and private sector offerings, which are increasingly being adopted for early detection of conditions such as hypertension, diabetes, and obesity.

Germany Health Screening Market Insight

The Germany health screening market is expected to expand at a considerable CAGR during the forecast period, supported by strong insurance reimbursement policies and corporate wellness initiatives. The market is expected to expand at a CAGR of 6.6%, with increasing demand for genetic and metabolic screening, especially among middle-aged and elderly populations.

Asia-Pacific Health Screening Market Insight

The Asia-Pacific health screening market held a 22.8% global revenue share in 2024 and is projected to grow at the fastest CAGR of 9.2% from 2025 to 2032. The surge is attributed to rising healthcare awareness, increasing disposable income, and widespread government programs promoting early detection of chronic and infectious diseases.

Japan Health Screening Market Insight

The Japan health screening market accounted for 27.2% of the Asia-Pacific market in 2024, owing to government-mandated annual health checks and strong participation from employers. The market is forecasted to grow at a CAGR of 8.1%, driven by demand for remote monitoring, smart diagnostics, and early detection services for an aging population.

China Health Screening Market Insight

The China health screening market led the Asia-Pacific market with a revenue share of 41.3% in 2024, supported by its massive population, increased healthcare spending, and rapid digitization in medical diagnostics. The market is projected to grow at a CAGR of 9.5%, driven by smart city initiatives, growing use of mobile diagnostic services, and expansion of private and public screening programs across rural and urban areas.

Health Screening Market Share

The health screening industry is primarily led by well-established companies, including:

- Quest Diagnostics Incorporated (U.S.)

- GRAIL (U.S.)

- Eurofins Scientific (Luxembourg)

- Exact Sciences Corporation (U.S.)

- SYNLAB International (Germany)

- UNILABS (Switzerland)

- LabPLUS (U.S.)

- BioReference Health, LLC (U.S.)

- Sonic Healthcare Limited (Australia)

- ACM Global Laboratories (U.S.)

- Cerba Healthcare (France)

- Quidel Corporation (U.S.)

- Innova Medical Group (U.S.)

- Amedes Holding GmbH (Germany)

- RadNet, Inc. (U.S.)

- Natera, Inc. (U.S.)

- Trinity Biotech (Ireland)

- Nuffield Health (UK)

- RepeatDx (Canada)

- NeoGenomics Laboratories (U.S.)

- H.U Group Holdings, Inc. (Japan)

- ARUP Laboratories (U.S.)

- Genova Diagnostics (GDX) (U.S.)

Latest Developments in Global Health Screening Market

- In November 2021, Evoq Technologies LLC had announced the launch of first smartphone-based product for retinal health testing. The "SmartERG" Platform is designed to assess the retinal health of the eye in novel ways. With the force multipliers of simple patient-provider connection, cloud-based analytical services, and a great fit for artificial intelligence, the SmartERG Platform will offer a breakthrough delivery approach for ophthalmic patient care

- In September 2021, Eurofins Scientific SE’s subsidiary Transplant Genomics had announced the launch of OmniGraf. It combines the Viracor TRAC donor-derived cell-free DNA assays with the TruGraf blood gene expression test. OmniGraf Kidney is the first diagnostic tool for renal transplant recipients that integrates cell-free DNA and gene expression data. When paired with TGI's unique technology and machine learning, the test provides patients with the most accurate and timely assessment of kidney transplant rejection

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE GLOBAL HEALTH SCREENING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL HEALTH SCREENING MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL HEALTH SCREENING MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

6 INDUSTRY INSIGHTS

7 REGULATORY FRAMWORK

8 GLOBAL HEALTH SCREENING MARKET, BY TEST TYPE

8.1 OVERVIEW

8.2 CHOLESTEROL TESTS

8.2.1 TOTAL CHOLESTEROL TEST

8.2.2 LOW-DENSITY LIPOPROTEIN (LDL) CHOLESTEROL

8.2.3 HIGH-DENSITY LIPOPROTEIN (HDL) CHOLESTEROL

8.2.4 TRIGLYCERIDES

8.3 BLOOD PRESSURE TEST

8.4 DIABETES TEST

8.4.1 A1C TEST

8.4.2 FASTING/RANDOM BLOOD SUGAR TEST

8.4.3 GLUCOSE TOLERANCE TEST

8.5 STD’S

8.5.1 HIV

8.5.2 CHLAMYDIA

8.5.3 GONORRHEA

8.5.4 HPV

8.5.5 HEPATITIS B AND C

8.5.6 SYPHILIS

8.5.7 CHLAMYDIA

8.5.8 OTHERS

8.6 CANCER SCREENING

8.6.1 PROSTATE CANCER

8.6.2 BREAST CANCER

8.6.3 CERVICAL CANCER

8.6.4 COLORECTAL CANCER

8.6.5 LUNG CANCER

8.6.6 OTHERS

8.7 GENERAL TEST

8.7.1 VISION AND HEARING TESTS

8.7.2 BONE DENSITY TEST

8.7.3 OTHERS

8.8 OTHERS

9 GLOBAL HEALTH SCREENING MARKET, BY PANEL TYPE

9.1 OVERVIEW

9.2 MULTI-TEST PANELS

9.3 SINGLE-TEST PANELS

9.3.1 TELOMERE TESTS

9.3.2 OXIDATIVE STRESS TESTS

9.3.3 INFLAMMATION TESTS

9.3.4 HEAVY METAL TESTS

10 GLOBAL HEALTH SCREENING MARKET, BY SAMPLE TYPE

10.1 OVERVIEW

10.2 BLOOD

10.3 URINE

10.4 SALIVA

10.5 SERUM

10.6 OTHERS

11 GLOBAL HEALTH SCREENING MARKET, BY TECHNOLOGY

11.1 OVERVIEW

11.2 TRF (TERMINAL RESTRICTION FRAGMENT)

11.3 STELA (SINGLE TELOMERE LENGTH ANALYSIS)

11.4 IMMUNOASSAYS

11.5 MEDICAL IMAGING

11.6 QPCR

11.6.1 QPCR (QUANTITATIVE POLYMERASE CHAIN REACTION)

11.6.2 MMQPCR (MONOCHROME MULTIPLEX QPCR)

11.6.3 ATLQPCR (ABSOLUTE TELOMERE LENGTH QPCR)

11.7 Q-FISH (QUANTITATIVE FLUORESCENCE IN SITU HYBRIDIZATION)

11.7.1 PRINS (PRIMED IN SITU SUBTYPE OF Q-FISH)

11.7.2 FLOW-FISH

11.7.3 HT Q-FISH (HIGH THROUGHPUT Q-FISH)

11.8 OTHERS

12 GLOBAL HEALTH SCREENING MARKET, BY CONDITION

12.1 OVERVIEW

12.2 NEUROLOGICAL CONDITIONS

12.2.1 ALZHEIMER’S DISEASE

12.2.2 CHRONIC STRESS

12.3 METABOLIC DISORDERS

12.3.1 DIABETES MELLITUS

12.3.2 OBESITY

12.4 CARDIOVASCULAR DISEASE

12.4.1 ATHEROSCLEROSIS

12.4.2 CORONARY HEART DISEASE

12.5 MUSCULOSKELETAL DISORDERS

12.5.1 OSTEOPOROSIS

12.5.2 RHEUMATOID ARTHRITIS

12.6 IMMUNOLOGY-RELATED CONDITIONS

12.7 HEPATITIS C COMPLICATIONS

12.8 CANCER

12.8.1 BREAST CANCER

12.8.2 PROSTATE CANCER

12.8.3 COLORECTAL CANCER

12.8.4 LUNG CANCER

12.8.5 CERVICAL CANCER

12.8.6 OTHERS

12.9 INFLAMMATORY CONDITIONS

12.9.1 ALLERGIES

12.9.2 ASTHMA

12.9.3 ARTHRITIS

12.9.4 AUTOIMMUNE CONDITIONS

12.9.5 INFLAMMATORY DIGESTIVE PROBLEMS

12.1 OTHERS

13 GLOBAL HEALTH SCREENING MARKET, BY SAMPLE COLLECTION SITES

13.1 OVERVIEW

13.2 HOME

13.3 OFFICES

13.4 HOSPITALS

13.4.1 PUBLIC

13.4.2 PRIVATE

13.5 DIAGNOSTIC LABORATORIES

13.6 OTHERS

14 GLOBAL HEALTH SCREENING MARKET, BY DISTRIBUTION CHANNEL

14.1 OVERVIEW

14.2 DIRECT TENDERS

14.3 RETAILS SALES

14.4 OTHERS

15 GLOBAL HEALTH SCREENING MARKET, BY REGION

GLOBAL HEALTH SCREENING MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

15.1 NORTH AMERICA

15.1.1 U.S.

15.1.2 CANADA

15.1.3 MEXICO

15.2 EUROPE

15.2.1 GERMANY

15.2.2 FRANCE

15.2.3 U.K.

15.2.4 ITALY

15.2.5 SPAIN

15.2.6 RUSSIA

15.2.7 TURKEY

15.2.8 BELGIUM

15.2.9 NETHERLANDS

15.2.10 SWITZERLAND

15.2.11 REST OF EUROPE

15.3 ASIA-PACIFIC

15.3.1 JAPAN

15.3.2 CHINA

15.3.3 SOUTH KOREA

15.3.4 INDIA

15.3.5 AUSTRALIA

15.3.6 SINGAPORE

15.3.7 THAILAND

15.3.8 MALAYSIA

15.3.9 INDONESIA

15.3.10 PHILIPPINES

15.3.11 REST OF ASIA-PACIFIC

15.4 SOUTH AMERICA

15.4.1 BRAZIL

15.4.2 ARGENTINA

15.4.3 REST OF SOUTH AMERICA

15.5 MIDDLE EAST AND AFRICA

15.5.1 SOUTH AFRICA

15.5.2 SAUDI ARABIA

15.5.3 UAE

15.5.4 EGYPT

15.5.5 ISRAEL

15.5.6 REST OF MIDDLE EAST AND AFRICA

15.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

16 GLOBAL HEALTH SCREENING MARKET, COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: GLOBAL

16.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

16.3 COMPANY SHARE ANALYSIS: EUROPE

16.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

16.5 MERGERS & ACQUISITIONS

16.6 NEW PRODUCT DEVELOPMENT & APPROVALS

16.7 EXPANSIONS

16.8 REGULATORY CHANGES

16.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

17 GLOBAL HEALTH SCREENING MARKET, SWOT AND DBMR ANALYSIS

18 GLOBAL HEALTH SCREENING MARKET, COMPANY PROFILE

18.1 QUEST DIAGNOSTICS

18.1.1 COMPANY OVERVIEW

18.1.2 REVENUE ANALYSIS

18.1.3 GEOGRAPHIC PRESENCE

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENTS

18.2 GRAIL

18.2.1 COMPANY OVERVIEW

18.2.2 REVENUE ANALYSIS

18.2.3 GEOGRAPHIC PRESENCE

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENTS

18.3 EXACT SCIENCES CORPORATION

18.3.1 COMPANY OVERVIEW

18.3.2 REVENUE ANALYSIS

18.3.3 GEOGRAPHIC PRESENCE

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENTS

18.4 EUROFINS SCIENTIFIC

18.4.1 COMPANY OVERVIEW

18.4.2 REVENUE ANALYSIS

18.4.3 GEOGRAPHIC PRESENCE

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENTS

18.5 UNILABS

18.5.1 COMPANY OVERVIEW

18.5.2 REVENUE ANALYSIS

18.5.3 GEOGRAPHIC PRESENCE

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENTS

18.6 LABPLUS

18.6.1 COMPANY OVERVIEW

18.6.2 REVENUE ANALYSIS

18.6.3 GEOGRAPHIC PRESENCE

18.6.4 PRODUCT PORTFOLIO

18.6.5 RECENT DEVELOPMENTS

18.7 BIOREFERENCE HEALTH®, LLC

18.7.1 COMPANY OVERVIEW

18.7.2 REVENUE ANALYSIS

18.7.3 GEOGRAPHIC PRESENCE

18.7.4 PRODUCT PORTFOLIO

18.7.5 RECENT DEVELOPMENTS

18.8 SONIC HEALTHCARE LIMITED

18.8.1 COMPANY OVERVIEW

18.8.2 REVENUE ANALYSIS

18.8.3 GEOGRAPHIC PRESENCE

18.8.4 PRODUCT PORTFOLIO

18.8.5 RECENT DEVELOPMENTS

18.9 CERBA HEALTHCARE

18.9.1 COMPANY OVERVIEW

18.9.2 REVENUE ANALYSIS

18.9.3 GEOGRAPHIC PRESENCE

18.9.4 PRODUCT PORTFOLIO

18.9.5 RECENT DEVELOPMENTS

18.1 INNOVA MEDICAL GROUP INC.

18.10.1 COMPANY OVERVIEW

18.10.2 REVENUE ANALYSIS

18.10.3 GEOGRAPHIC PRESENCE

18.10.4 PRODUCT PORTFOLIO

18.10.5 RECENT DEVELOPMENTS

18.11 AMEDES GROUP

18.11.1 COMPANY OVERVIEW

18.11.2 REVENUE ANALYSIS

18.11.3 GEOGRAPHIC PRESENCE

18.11.4 PRODUCT PORTFOLIO

18.11.5 RECENT DEVELOPMENTS

18.12 RADNET, INC

18.12.1 COMPANY OVERVIEW

18.12.2 REVENUE ANALYSIS

18.12.3 GEOGRAPHIC PRESENCE

18.12.4 PRODUCT PORTFOLIO

18.12.5 RECENT DEVELOPMENTS

18.13 NATERA, INC

18.13.1 COMPANY OVERVIEW

18.13.2 REVENUE ANALYSIS

18.13.3 GEOGRAPHIC PRESENCE

18.13.4 PRODUCT PORTFOLIO

18.13.5 RECENT DEVELOPMENTS

18.14 REPEATDX

18.14.1 COMPANY OVERVIEW

18.14.2 REVENUE ANALYSIS

18.14.3 GEOGRAPHIC PRESENCE

18.14.4 PRODUCT PORTFOLIO

18.14.5 RECENT DEVELOPMENTS

18.15 NEOGENOMICS LABORATORIES

18.15.1 COMPANY OVERVIEW

18.15.2 REVENUE ANALYSIS

18.15.3 GEOGRAPHIC PRESENCE

18.15.4 PRODUCT PORTFOLIO

18.15.5 RECENT DEVELOPMENTS

18.16 ARUP LABORATORIES

18.16.1 COMPANY OVERVIEW

18.16.2 REVENUE ANALYSIS

18.16.3 GEOGRAPHIC PRESENCE

18.16.4 PRODUCT PORTFOLIO

18.16.5 RECENT DEVELOPMENTS

18.17 GENOVA DIAGNOSTICS (GDX)

18.17.1 COMPANY OVERVIEW

18.17.2 REVENUE ANALYSIS

18.17.3 GEOGRAPHIC PRESENCE

18.17.4 PRODUCT PORTFOLIO

18.17.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST RELATED REPORTS

19 RELATED REPORTS

20 CONCLUSION

21 QUESTIONNAIRE

22 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.