Global Healthcare Generative Ai Market

Market Size in USD Billion

CAGR :

%

USD

4.07 Billion

USD

27.39 Billion

2024

2032

USD

4.07 Billion

USD

27.39 Billion

2024

2032

| 2025 –2032 | |

| USD 4.07 Billion | |

| USD 27.39 Billion | |

|

|

|

|

Healthcare Generative AI Market Size

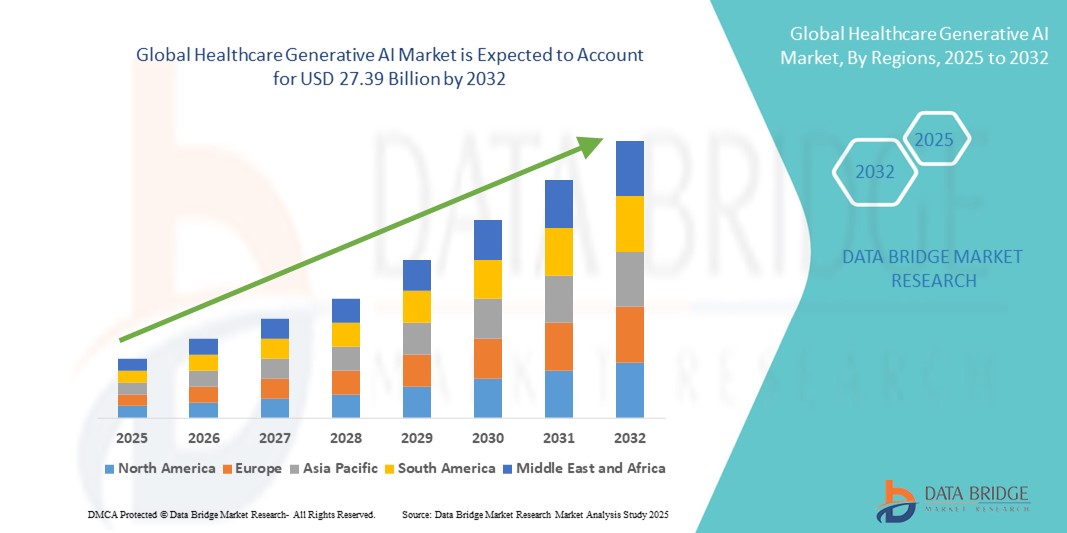

- The global healthcare generative AI market size was valued at USD 4.07 billion in 2024 and is expected to reach USD 27.39 billion by 2032, at a CAGR of 26.90% during the forecast period

- The market growth is largely fueled by the increasing integration of AI-driven tools in clinical diagnostics, drug discovery, and personalized medicine, enhancing efficiency and innovation across healthcare workflows

- Furthermore, rising demand for intelligent automation, cost-effective solutions, and improved patient outcomes is establishing generative AI as a transformative force in healthcare delivery. These converging factors are accelerating adoption, thereby significantly boosting the industry's growth

Healthcare Generative AI Market Analysis

- Generative AI in healthcare, leveraging advanced algorithms to generate medical content, support clinical decisions, and accelerate drug development, is becoming a critical enabler of precision medicine and operational efficiency across both clinical and administrative settings

- The escalating demand for healthcare generative AI is primarily fueled by rising healthcare data volumes, growing investments in AI-powered research and diagnostics, and the need to enhance patient care while reducing costs and clinician workload

- North America dominated the healthcare generative AI market with the largest revenue share of 42.3% in 2024, driven by strong digital infrastructure, high R&D spending, and early adoption of AI-enabled platforms in healthcare systems, especially in the U.S., where clinical decision support and drug discovery applications are seeing rapid deployment

- Asia-Pacific is expected to be the fastest growing region in the healthcare generative AI market during the forecast period, supported by government-led digital health initiatives, rising healthcare IT investment, and increasing collaborations between tech firms and medical institutions

- Software segment dominated the healthcare generative AI market by offering with a market share of 61.8% in 2024, driven by high demand for generative models and AI platforms in diagnostics, imaging, and patient engagement applications

Report Scope and Healthcare Generative AI Market Segmentation

|

Attributes |

Healthcare Generative AI Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Healthcare Generative AI Market Trends

Transformation of Clinical Workflows Through AI-Powered Insights

- A major and accelerating trend in the global healthcare generative AI market is the integration of advanced AI models, such as large language models (LLMs) and multimodal AI, into healthcare delivery systems. This integration is revolutionizing clinical workflows by automating documentation, enhancing diagnostics, and enabling real-time, data-driven decision-making

- For instance, Microsoft’s Nuance DAX (Dragon Ambient eXperience) uses generative AI to automatically document physician-patient interactions, significantly reducing administrative burdens on healthcare professionals. Similarly, Google DeepMind’s Med-PaLM is being tested to support clinical question-answering with improved accuracy and contextual understanding

- Generative AI enables healthcare systems to analyze vast unstructured data—such as patient histories, imaging, lab results, and genomic data—and generate insights, summaries, or treatment suggestions with unprecedented efficiency. AI-generated tools are increasingly used for personalized care recommendations and research document generation

- The seamless integration of generative AI into clinical platforms, electronic health records (EHRs), and telemedicine tools allows providers to manage diagnostics, documentation, and patient communication within a single interface. This creates a streamlined, cohesive, and intelligent healthcare environment

- This trend toward intelligent automation and real-time decision support is fundamentally reshaping clinical expectations and administrative operations. As a result, leading technology companies such as NVIDIA, AWS, and IBM are developing secure, scalable AI models tailored to healthcare, while startups are innovating across diagnostics and therapeutics

- The growing demand for clinical efficiency, personalized treatment, and reduced physician burnout is rapidly accelerating the adoption of generative AI across hospitals, pharmaceuticals, payers, and research institutions

Healthcare Generative AI Market Dynamics

Driver

Surge in AI Integration Across Diagnostics, Drug Development, and Virtual Care

- The growing demand for advanced healthcare solutions, coupled with rising digital transformation and the need for cost optimization, is significantly driving the adoption of generative AI in the healthcare sector

- For instance, in February 2024, NVIDIA and Amgen announced a partnership to integrate generative AI for accelerating drug discovery processes, enabling faster simulations and target identification demonstrating how AI is reshaping pharmaceutical R&D

- The widespread application of generative AI in clinical decision support, patient triage, radiology, mental health assessments, and documentation automation is leading to enhanced operational efficiency and patient outcomes

- Increasing reliance on virtual care platforms and AI-powered chatbots for remote patient engagement has strengthened the role of generative AI in modern healthcare. In addition, AI-driven systems are enabling predictive analytics and real-time risk analysis to assist physicians and healthcare administrators

- Governments and healthcare institutions in regions such as North America and Europe are also investing heavily in AI innovation, supported by favorable regulations and public-private collaborations, further accelerating market growth

Restraint/Challenge

Ethical, Regulatory, and Data Privacy Challenges

- Despite the growing potential, the healthcare generative AI market faces considerable challenges related to data privacy, algorithmic transparency, and ethical use, which can hinder widespread adoption

- For instance, concerns over compliance with regulations such as HIPAA (U.S.) and GDPR (EU), particularly in the context of patient data usage and AI decision-making, remain a major barrier. Healthcare providers are cautious about deploying AI systems without clear clinical validation or oversight

- High-profile concerns around biased AI outputs, lack of explainability in model decisions, and potential misdiagnoses have prompted calls for stronger guidelines and human-in-the-loop frameworks to ensure safe implementation

- In addition, the high cost of developing and training sophisticated generative AI models, combined with limited technical expertise among healthcare professionals, can restrict adoption in small- to mid-sized organizations and developing economies

- Overcoming these challenges through enhanced regulatory frameworks, secure AI infrastructures, investment in workforce training, and transparent AI practices will be critical for ensuring long-term growth and trust in healthcare generative AI solutions

Healthcare Generative AI Market Scope

The market is segmented on the basis of offering, technology, application, and end user.

- By Offering

On the basis of offering, the healthcare generative AI market is segmented into hardware, software, and services. The software segment dominated the market with the largest revenue share of 61.8% in 2024, driven by the growing adoption of AI models and platforms for applications such as clinical decision support, medical documentation, diagnostics, and drug discovery. Healthcare providers and pharmaceutical companies are increasingly investing in AI software solutions due to their scalability, flexibility, and ability to rapidly process complex data across multiple modalities.

The services segment is anticipated to witness the fastest growth rate from 2025 to 2031, owing to the increasing need for AI integration support, customization, consulting, and ongoing training of AI systems. The rise in demand for managed services, particularly in hospitals and research institutions that lack in-house AI expertise, is driving this segment's growth.

- By Technology

On the basis of technology, the healthcare generative AI market is segmented into machine learning and natural language processing (NLP). The machine learning segment held the largest market revenue share of 57.8% in 2024, driven by its broad utility in predictive analytics, diagnostics, and treatment planning. Machine learning algorithms enable accurate pattern recognition from vast healthcare datasets, significantly improving diagnostic precision and clinical outcomes.

The natural language processing segment is expected to grow at a notable pace through 2031, fueled by increasing deployment in medical transcription, EHR documentation, and AI chatbots. NLP enables meaningful extraction of insights from unstructured text data, helping automate administrative tasks and support clinical decision-making in real-time.

- By Application

On the basis of application, the healthcare generative AI market is segmented into patient data & risk analysis, medical imaging & diagnostics, precision medicine, drug discovery, lifestyle management & remote patient monitoring, virtual assistants, wearables, in-patient care & hospital management, research, emergency room & surgery, mental health, healthcare assistance, and robots and cybersecurity. The medical imaging & diagnostics segment dominated the market with the largest share of 22.6% in 2024, attributed to the increasing use of AI to enhance radiology and pathology image interpretation, identify anomalies, and reduce human error. Generative models are improving image reconstruction, segmentation, and early detection capabilities, leading to better clinical decisions.

The drug discovery segment is projected to experience the fastest growth from 2025 to 2031, propelled by rising R&D in pharma and biotech companies. Generative AI enables the rapid simulation and generation of molecular structures, reducing time and cost in the drug development lifecycle and supporting precision medicine initiatives.

- By End User

On the basis of end user, the healthcare generative AI market is segmented into hospitals, healthcare payers, pharmaceuticals and biotechnological companies, patients, and others. The hospitals segment accounted for the largest revenue share of 45.4% in 2024, driven by the increasing implementation of AI tools in diagnostics, clinical decision support, workflow automation, and administrative management. Hospitals are at the forefront of adopting generative AI due to the immediate benefits it offers in reducing clinician workload and improving patient outcomes.

The pharmaceuticals and biotechnological companies segment is expected to grow at the fastest rate over the forecast period, supported by the surge in AI-driven drug discovery programs, biomarker identification, and predictive modeling. Generative AI is being increasingly integrated into research pipelines to enhance the efficiency of clinical trials and accelerate product development.

Healthcare Generative AI Market Regional Analysis

- North America dominated the healthcare generative AI market with the largest revenue share of 42.3% in 2024, driven by strong digital infrastructure, high R&D spending, and early adoption of AI-enabled platforms in healthcare systems, especially in the U.S., where clinical decision support and drug discovery applications are seeing rapid deployment

- Healthcare providers in the region prioritize advanced AI solutions for clinical decision support, diagnostics, and workflow automation, benefiting from the availability of large healthcare datasets and the integration of generative AI into electronic health records and virtual care platforms

- This widespread implementation is further supported by high healthcare expenditure, robust R&D ecosystems, and strategic collaborations between technology firms and healthcare institutions, positioning North America as a global leader in generative AI adoption across the healthcare landscape

U.S. Healthcare Generative AI Market Insight

The U.S. healthcare generative AI market captured the largest revenue share of 79.5% in North America in 2024, driven by rapid digital transformation across hospitals, clinical research centers, and pharmaceutical companies. The country’s robust AI infrastructure, extensive electronic health records (EHR) usage, and strong regulatory support for digital health innovation are fueling growth. Rising investments in AI-driven diagnostics, clinical decision support, and drug development platforms, along with strategic collaborations between healthcare providers and technology firms, are accelerating adoption and integration of generative AI in both clinical and administrative settings.

Europe Healthcare Generative AI Market Insight

The Europe healthcare generative AI market is projected to grow at a substantial CAGR throughout the forecast period, supported by rising demand for AI-powered healthcare solutions, advanced research ecosystems, and stringent regulatory frameworks emphasizing data security and patient safety. The increasing use of generative AI in precision medicine, patient engagement, and administrative automation is gaining traction in hospitals and research institutions. EU initiatives supporting AI innovation in life sciences, combined with growing public-private partnerships, are further boosting market expansion across both Western and Central Europe.

U.K. Healthcare Generative AI Market Insight

The U.K. healthcare generative AI market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by ongoing efforts to modernize the National Health Service (NHS) and improve patient care through AI innovation. The country's proactive regulatory stance, supportive funding programs, and rising adoption of AI in diagnostics and clinical documentation are key contributors to growth. In addition, the use of generative AI for medical transcription, patient triage, and mental health support tools is gaining momentum across healthcare providers and tech startups.

Germany Healthcare Generative AI Market Insight

The Germany healthcare generative AI market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s strong medical technology base, emphasis on data security, and advanced research infrastructure. Germany is investing heavily in AI-driven solutions for hospital management, diagnostic automation, and pharmaceutical research. The integration of generative AI with health IT platforms is being adopted across academic hospitals and private healthcare providers, aligning with the country’s focus on digital health transformation and regulatory compliance.

Asia-Pacific Healthcare Generative AI Market Insight

The Asia-Pacific healthcare generative AI market is poised to grow at the fastest CAGR of 26.7% during the forecast period of 2025 to 2032, driven by increasing healthcare digitalization, government initiatives promoting AI adoption, and growing tech-driven medical infrastructure in countries such as China, India, and Japan. The region’s expanding population, rising disease burden, and growing R&D investments are encouraging healthcare providers to integrate AI in diagnostics, drug development, and patient monitoring. In addition, emerging startups and local tech giants are actively developing generative AI tools tailored to regional healthcare challenges.

Japan Healthcare Generative AI Market Insight

The Japan healthcare generative AI market is gaining momentum due to the country’s deep focus on robotics, AI, and precision healthcare. The adoption of generative AI is accelerating across hospitals and research institutes, particularly in applications such as medical imaging, elderly care, and administrative automation. Japan’s high rate of aging population is increasing demand for AI-assisted tools to streamline diagnosis, documentation, and remote patient care. Government-led initiatives to enhance healthcare innovation are also supporting strong market growth.

India Healthcare Generative AI Market Insight

The India healthcare generative AI market accounted for the largest revenue share in Asia Pacific in 2024, driven by rapid expansion of digital healthcare platforms, increasing telemedicine usage, and the growth of AI-based health startups. With rising demand for affordable, scalable healthcare solutions, generative AI is being applied in areas such as diagnostics, patient triaging, and clinical documentation. India’s ongoing push for smart health infrastructure, combined with strong government support for AI research and a large tech-savvy workforce, is further accelerating adoption across hospitals and pharmaceutical sectors.

Healthcare Generative AI Market Share

The Healthcare Generative AI industry is primarily led by well-established companies, including:

- Koninklijke Philips N.V. (Netherlands)

- Microsoft (U.S.)

- Siemens Healthineers AG (Germany)

- Intel Corporation (U.S.)

- NVIDIA Corporation (U.S.)

- Google Inc. (U.S.)

- GE HealthCare (U.S.)

- Medtronic (Ireland)

- Micron Technology, Inc (U.S.)

- Amazon.com Inc (U.S.)

- Oracle (U.S.)

- Johnson & Johnson and its affiliates (U.S.)

- Merative (U.S.)

- General Vision, Inc. (U.S.)

- CloudMedx (U.S.)

- Oncora Medical (U.S.)

- Enlitic (U.S.)

- Lunit Inc., (South Korea)

- Qure.ai (India)

- Stryker (U.S.)

- Biobeat (Israel)

What are the Recent Developments in Global Healthcare Generative AI Market?

- In April 2024, Google DeepMind announced advancements in its Med-PaLM 2 model, specifically tailored for the medical domain. Trained on a diverse set of medical datasets, Med-PaLM 2 demonstrated the ability to answer U.S. medical licensing exam questions with high accuracy. This development underscores Google's commitment to responsibly integrating generative AI into healthcare, enhancing clinical decision support and empowering physicians with more precise diagnostic tools through language understanding and generation capabilities

- In March 2024, Microsoft and Epic Systems expanded their strategic collaboration to integrate generative AI into electronic health records (EHRs). By embedding Microsoft’s Azure OpenAI Service within Epic’s software, the initiative aims to streamline administrative tasks such as patient note summarization and medical documentation. This development highlights the growing importance of generative AI in reducing clinician burnout and improving healthcare workflow efficiency

- In February 2024, NVIDIA partnered with Amgen, a global biopharmaceutical company, to accelerate drug discovery using generative AI. Leveraging NVIDIA’s BioNeMo platform, the partnership focuses on simulating protein structures and interactions to identify drug candidates faster. This collaboration showcases how generative AI is being deployed to significantly reduce the time and cost of pharmaceutical R&D, redefining the traditional drug development pipeline

- In January 2024, IBM Watson Health launched new generative AI capabilities within its Merge Imaging Suite, enabling automated image annotation and enhanced diagnostic accuracy for radiologists. This advancement empowers healthcare professionals to process and interpret imaging data faster, reinforcing IBM’s leadership in applying generative AI to clinical imaging and diagnostics

- In January 2024, AWS HealthLake expanded its generative AI offerings by integrating with Bedrock, enabling healthcare providers to generate summaries, patient instructions, and clinical documentation through customizable LLMs. This development reflects Amazon Web Services’ continued push to support scalable, HIPAA-compliant generative AI solutions in healthcare, improving patient communication and operational efficiency across clinical settings

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.