Global Healthcare Human Resources Hr Software Market

Market Size in USD Billion

CAGR :

%

USD

1.54 Billion

USD

2.19 Billion

2025

2033

USD

1.54 Billion

USD

2.19 Billion

2025

2033

| 2026 –2033 | |

| USD 1.54 Billion | |

| USD 2.19 Billion | |

|

|

|

|

Healthcare Human Resources (HR) Software Market Size

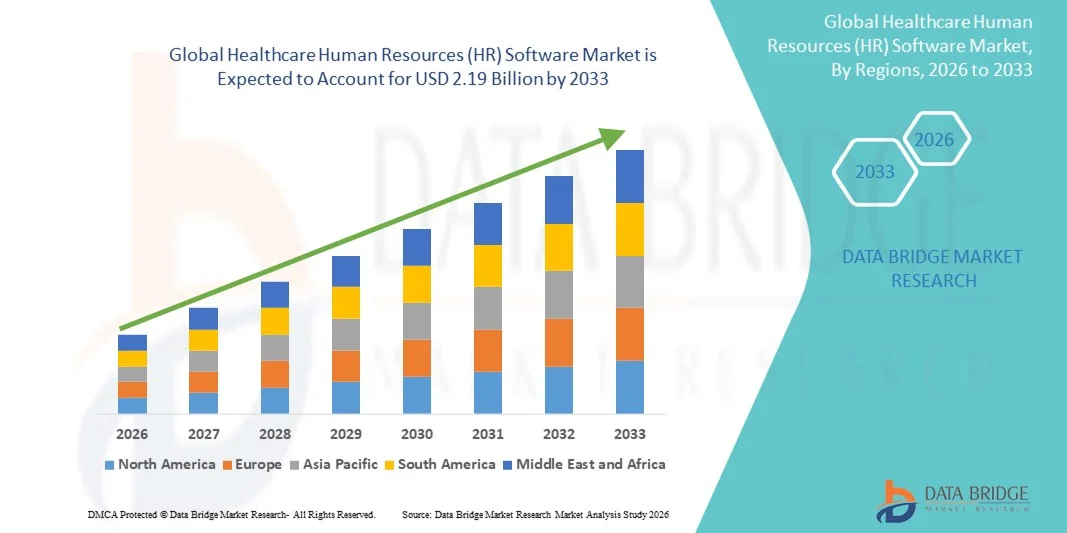

- The global healthcare human resources (HR) software market size was valued at USD 1.54 billion in 2025 and is expected to reach USD 2.19 billion by 2033, at a CAGR of 4.55% during the forecast period

- The market growth is largely fueled by the increasing adoption of digital solutions in healthcare facilities, coupled with advancements in cloud computing, AI, and data analytics, leading to more efficient management of workforce operations, payroll, scheduling, and compliance across hospitals, clinics, and other healthcare organizations

- Furthermore, rising demand for streamlined human resources processes, enhanced staff productivity, reduced administrative burden, and improved employee engagement is establishing Healthcare Human Resources (HR) Software as a critical tool for modern healthcare management. These converging factors are accelerating the uptake of Healthcare HR Software solutions, thereby significantly boosting the overall growth of the market

Healthcare Human Resources (HR) Software Market Analysis

- Healthcare Human Resources (HR) Software, encompassing solutions for workforce management, payroll, scheduling, credentialing, and compliance, is increasingly vital in modern healthcare organizations due to its ability to streamline administrative tasks, optimize staff allocation, and improve overall operational efficiency

- The escalating demand for Healthcare HR Software is primarily fueled by the growing need for efficient management of healthcare personnel, rising pressure to reduce administrative burdens, and increasing adoption of digital solutions for employee engagement, training, and performance monitoring. Integration with cloud platforms, AI, and analytics is further enhancing adoption across hospitals, clinics, and other healthcare facilities

- North America dominated the healthcare HR software market with the largest revenue share of approximately 39.5% in 2025, driven by the presence of advanced healthcare infrastructure, high adoption of digital HR solutions, and the strong presence of key software providers. The U.S. accounted for the majority of regional demand, supported by widespread implementation in hospitals, healthcare networks, and large clinics

- Asia-Pacific is expected to be the fastest-growing region in the healthcare HR software market during the forecast period, due to increasing healthcare digitization, rising investments in hospital infrastructure, expanding private healthcare sector, and growing demand for workforce optimization solutions in countries such as India, China, and Japan

- The Cloud-Based segment dominated the largest market revenue share of 46.3% in 2025, owing to its flexibility, reduced IT costs, ease of maintenance, and support for remote access across multiple healthcare facilities

Report Scope and Healthcare Human Resources (HR) Software Market Segmentation

|

Attributes |

Healthcare Human Resources (HR) Software Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Oracle Corporation (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Healthcare Human Resources (HR) Software Market Trends

Digital Transformation in Healthcare Workforce Management

- A significant and accelerating trend in the global healthcare human resources (HR) software market is the increasing adoption of cloud-based and integrated workforce management solutions. Healthcare organizations are leveraging HR software to streamline recruitment, scheduling, payroll, compliance, and employee performance tracking, enabling more efficient management of large, complex workforces

- For instance, in 2024, Cerner introduced a cloud-based HR platform specifically designed for hospitals and clinics, enabling seamless integration of employee data, credentialing, and scheduling across multiple facilities

- The growing need for real-time analytics, automated reporting, and centralized HR management is driving the trend toward comprehensive software solutions that can support both administrative and operational decision-making

- Increasing emphasis on workforce productivity, retention, and engagement in healthcare settings is encouraging providers to adopt advanced HR solutions that improve employee satisfaction and reduce administrative burdens

- In addition, integration with other hospital management systems and electronic health records (EHRs) is making HR software a critical tool for holistic organizational management, helping ensure compliance with regulatory standards and labor laws

- Overall, the trend toward digitalization, process automation, and workforce analytics is reshaping healthcare HR management and improving operational efficiency

Healthcare Human Resources (HR) Software Market Dynamics

Driver

Rising Need for Efficient Workforce Management and Compliance

- The growing complexity of healthcare operations, increasing staff shortages, and regulatory compliance requirements are major drivers of the Healthcare HR Software market. Efficient HR management helps healthcare organizations optimize staff scheduling, maintain credential compliance, and ensure proper staff-to-patient ratios, ultimately improving patient care outcomes

- For instance, in 2023, a large hospital network in the U.S. adopted Kronos Workforce Central to automate staff scheduling and credential tracking, resulting in a 15% improvement in operational efficiency

- The expansion of healthcare facilities and rising demand for multi-specialty care centers are increasing the need for scalable HR solutions that can manage large, distributed workforces

- Growing adoption of performance management, talent retention programs, and automated payroll systems is further driving market demand

- Government regulations regarding healthcare labor compliance, employee training, and credential verification also contribute to the rising adoption of integrated HR software solution

Restraint/Challenge

High Implementation Costs and Integration Complexity

- Despite the benefits, the high cost of implementation and complexity of integrating HR software with existing healthcare IT systems remain significant challenges. Small and mid-sized healthcare providers may face difficulties adopting comprehensive solutions due to budget constraints and limited IT expertise

- For instance, several community hospitals in Europe reported delays in deploying new HR software due to challenges in integrating with legacy payroll and scheduling systems

- Data security, privacy concerns, and adherence to healthcare regulations such as HIPAA can increase implementation costs and require additional compliance measures

- Customization and maintenance requirements for large-scale deployments can also limit adoption, especially in resource-constrained facilities

- Addressing these challenges through affordable subscription models, modular software options, and support services is critical for broad adoption and sustained growth of the Healthcare HR Software market

Healthcare Human Resources (HR) Software Market Scope

The market is segmented on the basis of administration software, type of software, organization type, deployment type, and application.

- By Administration Software

On the basis of administration software, the Healthcare HR Software market is segmented into Payroll, Time and Attendance, Benefits Management, and Others. The Payroll segment dominated the largest market revenue share of 38.5% in 2025, primarily due to the critical importance of accurate salary disbursement, compliance with tax and labor regulations, and comprehensive employee record management in healthcare organizations. Payroll software is increasingly integrated with other HR modules like time tracking and benefits administration, reducing manual errors and streamlining operations. Hospitals, clinics, and large healthcare networks rely on payroll software to handle complex employee structures, including shift-based staff, temporary employees, and part-time workers. In addition, payroll systems with cloud integration provide real-time analytics, enhancing workforce planning and strategic decision-making. Rising adoption of automation in HR functions, increasing regulatory compliance requirements, and growing digitization of healthcare processes also drive segment growth. Advanced payroll solutions now include self-service portals for employees, automated tax calculation, and reporting features, making them indispensable for modern HR management in healthcare. The segment’s dominance is also strengthened by integration with mobile apps and software that provide remote access for payroll management.

The Time and Attendance segment is expected to witness the fastest CAGR of 20.4% from 2026 to 2033, driven by rising demand for automated tracking of employee working hours, shift management, and labor cost optimization across hospitals and pharmaceutical facilities. Time and attendance software enables accurate capture of work hours, overtime calculations, and absenteeism tracking, reducing human errors and administrative overhead. Adoption of biometric systems, RFID cards, and mobile app–based attendance solutions is increasing in healthcare organizations to ensure workforce accountability. Integration with payroll modules ensures seamless processing of salaries and compliance with labor laws. Advanced systems also provide data-driven insights on workforce utilization, staffing requirements, and productivity trends. Cloud-based and SaaS models further boost adoption by allowing multi-location management and real-time monitoring of employee attendance. The COVID-19 pandemic accelerated the need for digital solutions to manage workforce scheduling and attendance remotely. Organizations are also adopting AI-enabled scheduling to predict staffing needs and optimize resource allocation. Growing awareness of operational efficiency and the cost-saving potential of automated attendance solutions contributes to the segment’s rapid growth.

- By Type of Software

On the basis of type of software, the market is segmented into Recruiting, Software-as-a-Service (SaaS), Core HR, and Others. The Core HR segment held the largest market revenue share of 41.2% in 2025, as it provides central management of employee data, facilitates integration across HR modules, and ensures regulatory compliance. Core HR software is essential for hospitals, clinics, and pharmaceutical companies to maintain accurate personnel records, track training, manage onboarding and offboarding, and generate analytics for workforce planning. Its integration with payroll, benefits management, and performance evaluation systems enhances operational efficiency and reduces manual intervention. Large healthcare organizations especially prefer Core HR systems for handling diverse employee profiles, unionized staff, and multiple locations. Cloud-enabled Core HR solutions enable real-time access to employee data across geographies, enhancing strategic decision-making. The segment benefits from rising digitization, mobile access, and the demand for data-driven HR insights. Increasing focus on employee experience, compliance with healthcare labor regulations, and workforce analytics further strengthens the dominance of Core HR solutions in healthcare. Integration with AI-based predictive analytics for attrition management and staffing optimization also fuels adoption.

The Software-as-a-Service (SaaS) segment is projected to witness the fastest CAGR of 22.8% from 2026 to 2033, driven by the flexibility, lower upfront costs, and scalability of cloud-based HR solutions. SaaS models allow healthcare organizations, especially medium-sized hospitals and clinics, to deploy HR software without significant IT infrastructure investment. These solutions provide continuous software updates, mobile access, and secure data storage. SaaS HR software supports recruitment, payroll, benefits, and employee engagement modules in a single platform. The rising trend of remote workforce management, increasing digitalization of HR processes, and demand for centralized workforce analytics accelerate adoption. Integration with time and attendance, payroll, and performance evaluation modules further enhances value. Healthcare organizations also benefit from SaaS models’ predictive analytics, automated reporting, and compliance monitoring. The ability to access real-time HR data across multiple locations contributes to operational efficiency. Increased demand for subscription-based models that reduce IT burden and allow faster implementation drives the rapid growth of this segment.

- By Organization Type

On the basis of organization type, the market is segmented into Medium Businesses, Large Enterprises, and Small Business. The Large Enterprises segment accounted for the largest market revenue share of 44.7% in 2025, driven by the complexity of HR processes, large workforce size, and stringent regulatory requirements in hospitals, pharmaceutical companies, and healthcare networks. Large organizations invest in integrated HR software solutions to manage payroll, recruitment, benefits administration, and compliance reporting efficiently. They also require advanced analytics for workforce productivity, attrition management, and strategic HR decision-making. Cloud-enabled solutions are increasingly deployed to support multi-location operations and remote access for HR managers. Integration with enterprise-wide management systems like ERP enhances operational efficiency. Advanced HR software enables large organizations to automate HR workflows, minimize manual intervention, and improve employee engagement. The growing trend of digital transformation in healthcare and demand for AI-driven workforce insights further strengthens the dominance of large enterprises in HR software adoption.

The Medium Businesses segment is expected to register the fastest CAGR of 21.5% from 2026 to 2033, driven by rising adoption of scalable HR solutions in midsize hospitals, clinics, and regional pharmaceutical firms. Medium-sized organizations seek cloud-based, cost-effective HR software to optimize workforce management, track attendance, automate payroll, and manage recruitment efficiently. SaaS solutions are particularly attractive due to low upfront costs, ease of deployment, and minimal IT requirements. The growing need to maintain compliance, ensure data security, and manage multiple employee locations fuels adoption. Mobile access, employee self-service portals, and automated reporting capabilities further accelerate the growth of this segment. Increasing awareness of HR digitalization benefits and competitive pressures in healthcare drive medium businesses to adopt modern HR solutions. Integration with training, performance management, and benefits modules enhances operational efficiency and supports talent retention strategies.

- By Deployment Type

On the basis of deployment type, the market is segmented into On-Premise and Cloud-Based solutions. The Cloud-Based segment dominated the largest market revenue share of 46.3% in 2025, owing to its flexibility, reduced IT costs, ease of maintenance, and support for remote access across multiple healthcare facilities. Cloud-based HR solutions provide real-time analytics, seamless integration with payroll and benefits management, and enhanced security. Hospitals and healthcare networks prefer cloud deployment for multi-location access, mobile support, and ease of scalability. Cloud solutions reduce dependency on internal IT teams and allow automatic software updates and compliance tracking. Integration with AI-driven analytics and workforce planning modules improves decision-making. Cloud adoption also supports remote workforce management, data-driven insights, and employee self-service portals. The segment benefits from growing digital transformation, the need for cost-efficient solutions, and increasing demand for scalable HR systems.

The On-Premise segment is expected to witness the fastest CAGR of 19.6% from 2026 to 2033, as some healthcare organizations prefer maintaining sensitive employee and payroll data on internal servers for regulatory or security reasons. On-premise solutions provide full control over customization, data governance, and integration with existing IT infrastructure. Organizations with strict data privacy requirements or operating in regions with rigorous healthcare data regulations tend to favor on-premise deployment. On-premise software allows deep integration with existing hospital information systems, ERP platforms, and other legacy tools. It also ensures compliance with internal IT policies, provides high reliability, and supports advanced reporting and analytics features.

- By Application

On the basis of application, the Healthcare HR Software market is segmented into Pharmaceutical Industries, Hospitals, and Others. The Hospitals segment accounted for the largest market revenue share of 42.8% in 2025, driven by the large workforce size, high compliance needs, and complexity of operations. Hospitals require HR software for payroll management, time tracking, recruitment, onboarding, benefits administration, and employee engagement. Integration with performance management, training modules, and compliance tracking improves operational efficiency. Digital transformation initiatives and the growing adoption of cloud-based HR solutions in hospitals further enhance this segment’s dominance. Hospitals also prioritize real-time workforce analytics, automated reporting, and employee self-service capabilities. The segment is supported by growing awareness of the benefits of HR automation, mobile-enabled access, and predictive analytics for staffing needs.

The Pharmaceutical Industries segment is projected to witness the fastest CAGR of 22.1% from 2026 to 2033, fueled by the rising workforce in R&D, manufacturing, and regulatory departments. HR software adoption helps manage specialized roles, training compliance, recruitment, and performance evaluation. Cloud-based and SaaS HR solutions are preferred for their scalability, mobile access, and integrated analytics. The growing emphasis on regulatory compliance, efficiency, and digital workforce management drives segment growth. Adoption of automated workflows, remote workforce monitoring, and AI-enabled predictive analytics further accelerate growth in pharmaceutical companies.

Healthcare Human Resources (HR) Software Market Regional Analysis

- North America dominated the healthcare HR software market with the largest revenue share of approximately 39.5% in 2025, driven by the presence of advanced healthcare infrastructure, high adoption of digital HR solutions, and the strong presence of key software providers

- The region’s growth is primarily supported by widespread implementation of HR software in hospitals, healthcare networks, and large clinics, facilitating efficient workforce management, payroll processing, and compliance

- High healthcare IT spending, the focus on digital transformation, and increasing demand for talent management and workforce optimization solutions are further strengthening North America’s leading position

U.S. Healthcare Human Resources (HR) Software Market Insight

The U.S. healthcare HR software market accounted for the majority of regional demand in 2025, fueled by rapid adoption of digital HR platforms for employee management, performance tracking, and recruitment. Hospitals and large healthcare networks are increasingly investing in integrated HR solutions to streamline administrative processes, enhance employee engagement, and maintain compliance with regulatory standards. The availability of cloud-based and mobile-enabled platforms further accelerates market growth.

Europe Healthcare Human Resources (HR) Software Market Insight

The Europe healthcare HR software market is projected to grow at a significant CAGR during the forecast period, supported by increasing digital transformation in healthcare institutions, regulatory mandates, and rising awareness about workforce efficiency. Countries such as Germany, France, and the U.K. are witnessing strong adoption of HR software in hospitals and clinics to optimize staffing, payroll management, and employee training programs.

U.K. Healthcare Human Resources (HR) Software Market Insight

The U.K. healthcare HR software market is expected to register steady growth during the forecast period, driven by digital adoption in the public and private healthcare sectors. Hospitals and large care facilities are deploying HR solutions to manage staff scheduling, compliance, and recruitment efficiently, while improving overall workforce productivity.

Germany Healthcare Human Resources (HR) Software Market Insight

The Germany healthcare HR software market is anticipated to grow at a healthy CAGR, fueled by well-established healthcare infrastructure and high adoption of digital HR solutions. Hospitals and healthcare networks are increasingly implementing software platforms for workforce planning, payroll automation, and performance evaluation, contributing to market expansion.

Asia-Pacific Healthcare Human Resources (HR) Software Market Insight

The Asia-Pacific healthcare HR software market is expected to be the fastest-growing region during the forecast period, driven by increasing healthcare digitization, rising investments in hospital infrastructure, expanding private healthcare sector, and growing demand for workforce optimization solutions in countries such as India, China, and Japan. Cloud-based and mobile HR solutions are being increasingly adopted to improve operational efficiency and manage large healthcare workforces.

Japan Healthcare Human Resources (HR) Software Market Insight

The Japan healthcare HR software market is gaining traction due to rising digital adoption in hospitals, nursing centers, and clinics. Healthcare providers are investing in software solutions to streamline workforce management, enhance compliance, and improve employee engagement. The aging population and need for optimized staffing in healthcare facilities are further driving market demand.

China Healthcare Human Resources (HR) Software Market Insight

The China healthcare HR software market accounted for the largest revenue share in the Asia-Pacific region in 2025, supported by rapid digitization in hospitals and healthcare networks. Growing private healthcare facilities, rising adoption of integrated HR platforms, and government initiatives to modernize healthcare management are key factors propelling market growth. Cloud-based HR solutions and mobile applications are playing a crucial role in expanding adoption across the country.

Healthcare Human Resources (HR) Software Market Share

The Healthcare Human Resources (HR) Software industry is primarily led by well-established companies, including:

• Oracle Corporation (U.S.)

• SAP SE (Germany)

• Workday, Inc. (U.S.)

• ADP, Inc. (U.S.)

• UKG Inc. (U.S.)

• Paychex, Inc. (U.S.)

• Kronos Incorporated (U.S.)

• BambooHR LLC (U.S.)

• Ultimate Software Group, Inc. (U.S.)

• Infor, Inc. (U.S.)

• Cornerstone OnDemand, Inc. (U.S.)

• Zenefits, Inc. (U.S.)

• Zoho Corporation (India)

• Ramco Systems (India)

Latest Developments in Global Healthcare Human Resources (HR) Software Market

- In October 2023, HR for Health, a leading HR compliance software provider for healthcare practices, announced a strategic partnership with Provide to elevate HR compliance and financial empowerment for small and mid-sized medical and dental practices. This collaboration aims to integrate HR compliance automation with advanced financial tools to support healthcare professionals in managing workforce regulations, payroll, and employee performance, thereby improving operational efficiency and reducing administrative burden on practice owners. The partnership underscores the growing trend of specialized HR solutions tailored for healthcare providers’ unique needs, especially in decentralized clinical settings

- In May 2023, Bon Secours Mercy Health, a major U.S. health system with approximately 60,000 employees across 48 hospitals, announced its transformation to an AI-powered UKG workforce management suite to modernize HR and workforce operations. By migrating to a cloud-native HR platform, the health system improved real-time workforce planning, employee scheduling efficiency, and talent management, thereby enhancing both employee experience and patient care delivery. This move highlights the adoption of sophisticated HR technology to address complex staffing needs in large healthcare organizations

- In October 2023, HR for Health and Provide’s partnership also marked an industry push toward integrated HR and financial management workflows, emphasizing that specialized HR software tailored for healthcare practices is increasingly focused on relieving administrative and compliance burden through automation and strategic alliances

- In December 2024, the National Healthcare Group (NHG) in Singapore completed a major HR digital transformation by adopting a mobile-first, cloud-based HR platform powered by SAP, providing comprehensive workforce analytics and staff engagement tools for its 20,000 employees. The implementation enabled real-time workforce data visibility, predictive analytics for talent planning, and streamlined performance and engagement tracking, reflecting an increasing emphasis on mobile and data-driven HR systems in large healthcare networks

- In August 2025, Waystar, a healthcare finance and software company, announced the acquisition of Iodine Software for approximately USD 1.25 billion, combining Iodine’s AI-driven documentation and reimbursement tools with Waystar’s broader software suite. While not exclusively an HR software acquisition, this development signals accelerated investment in AI-enabled administrative platforms that increasingly include workforce efficiency enhancements, cost automation, and staffing support features relevant to HR operations in healthcare settings

- In September 2025, Oracle completed the acquisition of a prominent analytics firm to enhance its HR analytics and decision-making capabilities within Oracle HCM Cloud, bolstering predictive workforce planning and data-driven HR strategies for healthcare customers. Although specific details of the analytics firm were not disclosed, Oracle’s expanded analytics capabilities aim to support deeper talent insights, performance management, and strategic workforce optimization in complex healthcare environments

- In February 2025, My Michigan Health announced the completion of integration with Queda’s provider credentialing solutions, implementing an integrated platform that combines HR functions like credentialing, scheduling, and compliance tracking. This initiative reflects growing demand for unified HR and credential management systems that reduce “time-to-fill” for critical clinical roles and improve compliance across healthcare workforces

- In December 2024, HR for Health entered a strategic partnership with Unify to integrate HR compliance automation with enhanced technology efficiency tools for dental and medical practices, enabling smaller healthcare providers to automate HR compliance, payroll, and regulatory reporting functions more effectively and with less manual effort

- In August 2025, Oracle and AWS collaborated to launch Oracle Database@AWS, enabling healthcare HR and HCM workloads to run natively on AWS infrastructure, which promotes unified billing, support, and administration across cloud environments, enhancing flexibility and reducing barriers to deploying scalable HR solutions in cloud environments

- In March 2025, a notable trend in the HR software sector was observed with Ramco Systems advancing its AI-based HR and payroll solutions, leveraging artificial intelligence to automate and simplify payroll queries and HR transactions in healthcare settings, improving self-service capabilities and reducing HR administrative load

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.