Global Healthcare Navigation Platform Market

Market Size in USD Billion

CAGR :

%

USD

1.01 Billion

USD

3.16 Billion

2024

2032

USD

1.01 Billion

USD

3.16 Billion

2024

2032

| 2025 –2032 | |

| USD 1.01 Billion | |

| USD 3.16 Billion | |

|

|

|

|

Healthcare Navigation Platform Market Size

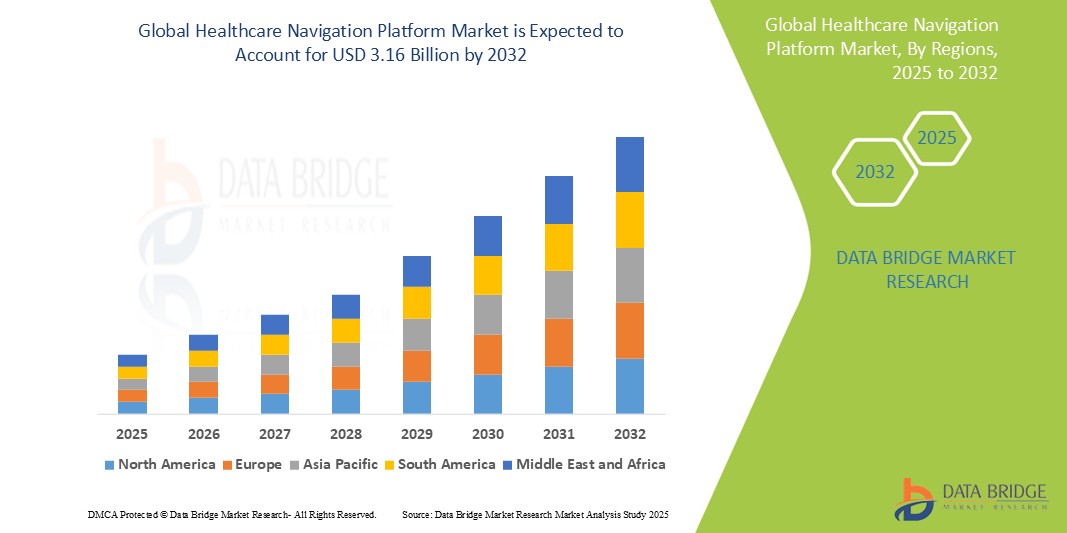

- The global healthcare navigation platform market size was valued at USD 1.01 billion in 2024 and is expected to reach USD 3.16 billion by 2032, at a CAGR of 15.30% during the forecast period

- This growth is driven by factors such as the increasing complexity of healthcare systems and rising demand for personalized, value-based care, which boost the adoption of digital navigation platforms to enhance patient engagement and care coordination

Healthcare Navigation Platform Market Analysis

- Healthcare navigation platforms are digital tools that assist patients in managing their healthcare journey by providing guidance on insurance, care options, cost transparency, and provider selection

- The demand for these platforms is significantly driven by the increasing complexity of healthcare systems and the growing emphasis on personalized, value-based care

- North America is expected to dominate the healthcare navigation platforms market with a market share of 43.5%, due to advanced digital health infrastructure, strong presence of major navigation platform providers, and increasing adoption among employers and payers

- Asia-Pacific is expected to be the fastest growing region in the healthcare navigation platform market with a market share of 21.5%, during the forecast period due to rising healthcare digitization, expanding middle-class populations, and growing awareness of health benefits

- Cloud-based segment is expected to dominate the market with a market share of 64.5% due to its scalability, ease of deployment, and lower upfront costs compared to on-premise solutions

Report Scope and Healthcare Navigation Platform Market Segmentation

|

Attributes |

Healthcare Navigation Platform Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Healthcare Navigation Platform Market Trends

“Rising Adoption of AI and Personalization in Healthcare Navigation Platforms”

- One prominent trend in healthcare navigation platforms is the growing integration of artificial intelligence (AI) and machine learning to deliver personalized care recommendations and improve user experience

- These technologies enable real-time analysis of patient data, guiding individuals to appropriate providers, services, and cost-effective treatment options based on their unique needs and health history

- For instance, AI-driven navigation tools can proactively alert users to preventive care opportunities, manage chronic conditions, and optimize care pathways, enhancing both patient satisfaction and outcomes

- This trend is transforming healthcare navigation by making it more efficient, user-centric, and data-driven, fueling demand among employers, insurers, and healthcare systems for intelligent platform solutions

Healthcare Navigation Platform Market Dynamics

Driver

“Rising Demand for Simplified Access to Complex Healthcare Systems”

- The increasing complexity of healthcare systems, including insurance networks, provider options, and treatment pathways, is driving the need for healthcare navigation platforms that can simplify the patient journey

- Patients often face challenges in understanding their benefits, locating appropriate care providers, and managing healthcare costs—issues that navigation platforms are designed to address efficiently

- These platforms provide tailored support, cost transparency, and decision-making tools that empower patients to make informed healthcare choices, improving engagement and outcomes

For instance,

- In a 2022 survey by Accenture, 60% of consumers reported difficulty navigating the healthcare system, indicating a strong need for digital solutions that can guide them through care access, insurance, and cost management

- As a result of the growing demand for simplified and personalized healthcare access, healthcare navigation platforms are seeing increased adoption among payers, providers, and employers

Opportunity

“Enhancing Patient Engagement and Outcomes through AI and Predictive Analytics”

- The integration of artificial intelligence and predictive analytics into healthcare navigation platforms offers significant opportunities to personalize care, improve decision-making, and enhance patient outcomes

- AI-powered platforms can analyze vast amounts of patient data, including claims, medical history, and behavioral patterns, to proactively guide users to preventive care, high-quality providers, and cost-effective treatment options

- These platforms can also deliver personalized health insights, reminders, and risk assessments, helping individuals better manage chronic conditions and navigate complex care pathways

For instance,

- In February 2024, a report by McKinsey & Company highlighted that AI-driven navigation tools can reduce healthcare costs by up to 15% and improve patient satisfaction through timely interventions and targeted care recommendations

- By leveraging AI and predictive analytics, healthcare navigation platforms can not only streamline access but also support early intervention, leading to better health outcomes, reduced hospitalizations, and higher system efficiency

Restraint/Challenge

“Data Privacy Concerns and Regulatory Compliance Issues”

- One of the major challenges hindering the growth of healthcare navigation platforms is the concern over data privacy and the complexity of meeting stringent healthcare regulations, such as HIPAA in the U.S. and GDPR in Europe

- These platforms handle sensitive personal health information (PHI), making them potential targets for data breaches, which can erode user trust and result in significant legal and financial consequences

- Ensuring end-to-end encryption, secure data storage, and regulatory compliance requires significant investment in cybersecurity and infrastructure, which may be a barrier for smaller platform providers

For instance,

- In March 2023, the U.S. Department of Health and Human Services reported a 93% increase in major healthcare data breaches over the past five years, underscoring the growing threat landscape and the need for robust security measures in digital health solutions

- Consequently, ongoing concerns about data privacy, consent, and legal liability can slow down adoption rates and limit the scalability of healthcare navigation platforms, particularly in highly regulated markets

Healthcare Navigation Platform Market Scope

The market is segmented on the basis of deployment and end use

|

Segmentation |

Sub-Segmentation |

|

By Deployment |

|

|

By End use |

|

In 2025, the cloud-based segment is projected to dominate the market with a largest share in deployment segment

The cloud-based segment is expected to dominate the healthcare navigation platform market with the largest share of 64.5% in 2025 due to its scalability, ease of deployment, and lower upfront costs compared to on-premise solutions. Cloud platforms enable real-time data access, integration with multiple healthcare systems, and support remote navigation services. In addition, growing adoption of telehealth and digital health tools further accelerates the demand for cloud-based solutions

The large enterprises is expected to account for the largest share during the forecast period in end use market

In 2025, the large enterprises segment is expected to dominate the market with the largest market share of 76.5% due to its greater financial capacity to invest in advanced healthcare navigation technologies and its need to manage complex, large-scale employee health benefits efficiently. These organizations prioritize improving healthcare outcomes, reducing absenteeism, and enhancing employee well-being

Healthcare Navigation Platform Market Regional Analysis

“North America Holds the Largest Share in the Healthcare Navigation Platform Market”

- North America dominates the healthcare navigation platform market with a market share of estimated 43.5%, driven, by advanced digital health infrastructure, strong presence of major navigation platform providers, and increasing adoption among employers and payers

- U.S. holds a market share of 58.5%, due to rising healthcare costs, growing emphasis on employee well-being, and the need for tools that simplify care access and improve health outcomes

- Supportive government initiatives, expanding insurance coverage, and heightened consumer demand for transparency and personalized healthcare experiences are further fueling platform adoption

- In addition, the increased investment in AI and data analytics technologies by U.S.-based health tech companies is contributing to the rapid development and expansion of navigation capabilities across the region

“Asia-Pacific is Projected to Register the Highest CAGR in the Healthcare Navigation Platform Market”

- Asia-Pacific is expected to witness the highest growth rate in the healthcare navigation platform market with a market share of 21.5%, driven by rising healthcare digitization, expanding middle-class populations, and growing awareness of health benefits

- Countries such as India, China, and Japan are emerging as key markets due to increasing healthcare expenditures, complex healthcare systems, and the growing demand for efficient care coordination tools

- Japan, with its focus on aging population care and health technology innovation, is advancing digital health solutions to support care navigation and patient engagement

- India is projected to register the highest CAGR of 12.2% in the healthcare navigation platform market, driven by rapid growth in health insurance adoption, government-backed digital health initiatives such as Ayushman Bharat Digital Mission, and rising consumer awareness about healthcare rights and access

Healthcare Navigation Platform Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Quantum Health, Inc. (U.S.)

- Accolade (U.S.)

- Included Health, Inc. (U.S.)

- Sharecare, Inc. (U.S.)

- Health Advocate (U.S.)

- Transcarent (U.S.)

- HealthJoy (U.S.)

- Wellframe (U.S.)

- Vera Whole Health (U.S.)

- Rightway (U.S.)

- Castlight Health (U.S.)

- League, Inc. (Canada)

- Carenet Health (U.S.)

- Lyra Health, Inc. (U.S.)

- Spring Care, Inc. (U.S.)

- Ping An Good Doctor (China)

- Oscar Insurance (U.S.)

- Find Solace, Inc. (U.S.)

- Tebra Technologies, Inc (U.S.)

- Greenway Health, LLC (U.S.)

Latest Developments in Global Healthcare Navigation Platform Market

- In March 2025, League Inc. introduced a new AI-powered suite designed to facilitate seamless care navigation and enhance health engagement. This suite aims to provide personalized support, enabling users to efficiently access healthcare services and manage their health journeys

- In January 2025, Transcarent, a healthcare benefits navigation startup, announced its acquisition of Accolade for USD 621 million. This strategic move aims to expand Transcarent's capabilities in care navigation, enhancing its service offerings and market presence

- In January 2025, Tempus AI released 'Olivia,' an AI-enabled personal health app that centralizes patients' health data. The app integrates information from over 1,000 health systems, allowing users to manage their health records and receive AI-driven insights, thereby improving patient engagement and care coordination

- In October 2024, Talkdesk announced the incorporation of agentic AI into its Talkdesk Ascend AI™ platform. This advancement allows for natural language understanding and generation, automating decision-making and task management to streamline healthcare processes and improve patient interactions

- In September 2023, Orion Health unveiled the Virtuoso platform, featuring a multichannel interface that offers patients a single point of communication with the health system. It includes an AI-powered symptom-assessment tool, providing users with tailored information and advice on medical care options

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.