Global Heart Failure Drugs Market

Market Size in USD Million

CAGR :

%

USD

8,010.62 Million

USD

24,919.55 Million

2023

2030

USD

8,010.62 Million

USD

24,919.55 Million

2023

2030

| 2024 –2030 | |

| USD 8,010.62 Million | |

| USD 24,919.55 Million | |

|

|

|

|

Heart Failure Drugs Market Analysis and Size

The increase in the rate of cardiovascular cases among people and the growing geriatric population globally are the major factors driving the heart failure drugs market. The increase in the need for these drugs as they treat different symptoms of the disorder and the patient's dependency on them accelerates the growth of heart failure drugs. The change in lifestyle, such as excessive alcohol consumption, smoking, and unhealthy diet habits, causes heart problems propelling the heart failure drugs market. The increase in investment by key players and the increase in research and development activities influence the heart failure drugs market. Additionally, increased heart problems due to obesity and lack of physical activities boost the heart failure drugs market. Furthermore, the rise in demand for effective drugs and treatment and product approval extends profitable opportunities to the market of heart failure drugs.

However, the side effects of consuming these drugs are expected to obstruct the heart failure drug market growth. Rising concerns regarding increasing contractility may damage the myocardium and shorten the survival of these patients is projected to challenge the heart failure drugs market.

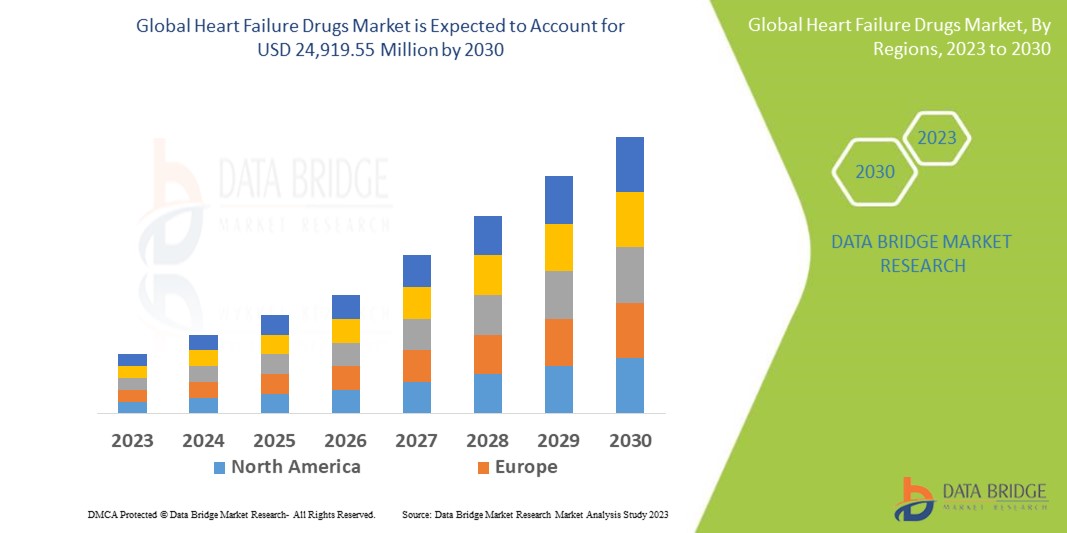

Data Bridge Market Research analyses that the heart failure drugs market which was USD 8,010.62 million in 2023, would rocket up to USD 24,919.55 million by 2030, and is expected to undergo a CAGR of 15.56% during the forecast period. This indicates that the market value. "Beta blockers" dominates the type segment of the heart failure drugs market due to increasing awareness about heart failure drugs. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Heart Failure Drugs Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

By Type (ACE Inhibitors, Angiotensin Receptor Blockers, Beta Blockers, Diuretics, Others), Application (Injection, Capsule, Tablets), Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies), End Users (Hospitals, Specialty Centres, Others) |

|

Countries Covered |

U.S., Canada, Mexico, Germany, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Brazil, Argentina, Rest of South America, South Africa, Saudi Arabia, U.A.E., Egypt, Israel, Rest of Middle East and Africa |

|

Market Players Covered |

Amgen Inc. (U.S.), AstraZeneca (U.K.), Bayer AG (Germany), Novartis AG (Switzerland), Gilead Sciences, Inc (U.S.), GlaxoSmithKline plc (U.K.), Pfizer Inc. (U.S.), Teva Pharmaceutical Industries Ltd (Israel), Cardurion Pharmaceuticals (U.S.), Cardior Pharmaceuticals (Germany), Actelion Pharmaceuticals Ltd (Switzerland), Boehringer Ingelheim International GmbH (Germany), Bristol-Myers Squibb Company (U.S.), CYTOKINETICS, INC. (U.S.), and Eli Lilly and Company (U.S.) among others. |

|

Market Opportunities |

|

Market Definition

The heart failure drugs market refers to the global pharmaceutical industry segment that encompasses developing, producing, and commercializing medications specifically designed to treat heart failure. Heart failure is a chronic medical condition characterized by the heart's inability to pump enough blood to meet the body's demands. This market focuses on drugs that aim to alleviate symptoms, improve heart function, and enhance patients' quality of life.

Heart failure drugs include a range of therapeutic agents targeting different aspects of the condition, such as reducing fluid build-up, managing blood pressure, improving cardiac contractility, and addressing underlying causes. These medications can include diuretics, angiotensin-converting enzyme (ACE) inhibitors, angiotensin receptor blockers (ARBs), beta-blockers, aldosterone antagonists, and others.

Heart Failure Drugs Market Dynamics

Drivers

- Increasing Prevalence of Heart Failure

The global prevalence of heart failure is rising due to an aging population, sedentary lifestyles, unhealthy dietary habits, and increased risk factors like obesity, diabetes, and hypertension. This growing patient population fuels the demand for effective heart failure drugs.

- Rising Awareness and Early Diagnosis

Increasing awareness about heart failure symptoms, risk factors, and the importance of early diagnosis has resulted in more patients seeking medical help at an earlier stage. Timely diagnosis enables prompt initiation of treatment, leading to a greater demand for heart failure drugs.

- Growing Healthcare Expenditure

Rising healthcare expenditure globally, especially in developed economies, increases access to healthcare services and medications. Governments and private insurers often cover a significant portion of the costs associated with heart failure drugs, making them more accessible to patients.

Opportunities

- Technological Advancements and Medical Innovations

Medical research and technological advances have led to development of novel therapeutic approaches and drug formulations for heart failure treatment. These innovations include introducing new drug classes, improved drug delivery systems, and targeted therapies, enhancing the effectiveness and safety of heart failure drugs.

Restraint/Challenge

- High Development Costs

The research, development, and clinical trial costs of bringing a heart failure drug to market can be substantial. The extensive investment required and the risk of failure during the development process can deter some pharmaceutical companies from pursuing research in this field. High development costs may limit the number of new drugs entering the market and potentially slow innovation.

This heart failure drugs market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the Heart failure drugs market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Development

- In September 2022, Bayer launched a novel heart failure drug in India that it has co-developed with Merck at one-fifteenth of the global price at Rs 127 per pill. It's a one-pill-a-day therapy. Verquvo (vericiguat) is the first novel treatment approved to reduce the risk of cardiovascular deaths and repeated hospitalization among worsening heart failure patients.

Global Heart Failure Drugs Market Scope

The heart failure drugs market is segmented on the basis of type, application, distribution channel, and end users. The growth amongst these segments will help you meagre growth segments in the industries and provide the users with a valuable market overview and insights to help them make strategic decisions for identifying core market applications.

Type

- ACE Inhibitors

- Angiotensin Receptor Blockers

- Beta Blockers

- Diuretics

- Others

Application

- Injection

- Capsule

- Tablets

Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

End Users

- Hospitals

- Specialty Centres

- Others

Heart failure drugs Market Regional Analysis/Insights

The Heart failure drugs market is analysed and market size insights and trends are provided by country, type, application, distribution channel, and end usesr as referenced above.

The countries covered in the Heart failure drugs market report is U.S., Canada, Mexico, Germany, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Brazil, Argentina, Rest of South America, South Africa, Saudi Arabia, U.A.E, Egypt, Israel, Rest of Middle East and Africa.

North America is expected to dominate the global heart failure drugs market due to the increasing prevalence of heart disease in that region.

Asia-Pacific is the fastest-growing region due to increasing awareness and interest in health and wellness.

The country section of the report also provides individual market impacting factors and domestic regulation changes that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure growth Installed base and New Technology Penetration

The heart failure drugs market also provides you with detailed market analysis for every country growth in healthcare expenditure for capital equipment, installed base of different kind of products for heart failure drugs market, impact of technology using life line curves and changes in healthcare regulatory scenarios and their impact on the market. The data is available for historic period 2015-2020.

Competitive Landscape and Heart Failure Drugs Market Share Analysis

The heart failure drugs market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to the market.

Some of the major players operating in the heart failure drugs market are:

- Amgen Inc. (U.S.)

- AstraZeneca (U.K.)

- Bayer AG (Germany)

- Novartis AG (Switzerland)

- Gilead Sciences, Inc (U.S.)

- GlaxoSmithKline plc (U.K.)

- Pfizer Inc. (U.S.)

- Teva Pharmaceutical Industries Ltd (Israel)

- Cardurion Pharmaceuticals (U.S.)

- Cardior Pharmaceuticals (Germany)

- Actelion Pharmaceuticals Ltd (Switzerland)

- Boehringer Ingelheim International GmbH (Germany)

- Bristol-Myers Squibb Company (U.S.)

- CYTOKINETICS, INC. (U.S.)

- Eli Lilly and Company (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL HEART FAILURE DRUGS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL HEART FAILURE DRUGS MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 SALES VALUE , VOLUME AND ASP

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL HEART FAILURE DRUGS MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 EPIDEMIOLOGY ANALYSIS

6 PREMIUM INSIGHTS

6.1 PESTEL ANALYSIS

6.2 PORTER’S 5 FORCES

6.3 PATENT ANALYSIS

6.4 REIMBURSEMENT SCENARIO

6.5 GLOBAL HEART FAILURE DRUGS MARKET ANALYSIS (QUALITATIVE AND QUANTITATIVE ANALYSIS)

7 INDUSTRY INSIGHTS

7.1 DEMOGRAPHIC TRENDS: IMPACTS ON ALL INCIDENCE RATES

7.2 KEY PRICING STRATEGIES

7.3 INTERVIEWS WITH DRUG COMPANIES

7.4 INTERVIEWS WITH PHYSICIANS AND TECHNICIANS

7.5 OTHER KOL SNAPSHOTS

8 REGULATORY FRAMWORKAS

9 PIPELINE ANALYSIS

9.1 PHASE III CANDIDATES

9.2 PHASE II CANDIDATES

9.3 PHASE I CANDIDATES

9.4 PRECLINICAL & RESEARCH CANDIDATES

10 GLOBAL HEART FAILURE DRUGS MARKET, BY DRUG CLASS

10.1 OVERVIEW

10.2 ANGIOTENSIN-CONVERTING ENZYME (ACE) INHIBITORS

10.2.1 BY TYPE

10.2.1.1. CAPTOPRIL

10.2.1.1.1. MARKET VALUE (USD MN)

10.2.1.1.2. MARKET VOLUME (SU)

10.2.1.1.3. AVERAGE SELLING PRICE (USD)

10.2.1.2. ENALAPRIL

10.2.1.2.1. MARKET VALUE (USD MN)

10.2.1.2.2. MARKET VOLUME (SU)

10.2.1.2.3. AVERAGE SELLING PRICE (USD)

10.2.1.3. FOSINOPRIL

10.2.1.3.1. MARKET VALUE (USD MN)

10.2.1.3.2. MARKET VOLUME (SU)

10.2.1.3.3. AVERAGE SELLING PRICE (USD)

10.2.1.4. PERINDOPRIL

10.2.1.4.1. MARKET VALUE (USD MN)

10.2.1.4.2. MARKET VOLUME (SU)

10.2.1.4.3. AVERAGE SELLING PRICE (USD)

10.2.1.5. QUINAPRIL

10.2.1.5.1. MARKET VALUE (USD MN)

10.2.1.5.2. MARKET VOLUME (SU)

10.2.1.5.3. AVERAGE SELLING PRICE (USD)

10.2.1.6. TRANDOLAPRIL

10.2.1.6.1. MARKET VALUE (USD MN)

10.2.1.6.2. MARKET VOLUME (SU)

10.2.1.6.3. AVERAGE SELLING PRICE (USD)

10.2.1.7. OTHERS

10.2.2 BY ROUTE OF ADMINISTRATION

10.2.2.1. ORAL

10.2.2.1.1. MARKET VALUE (USD MN)

10.2.2.1.2. MARKET VOLUME (SU)

10.2.2.1.3. AVERAGE SELLING PRICE (USD)

10.2.2.2. PARENTERAL

10.2.2.2.1. MARKET VALUE (USD MN)

10.2.2.2.2. MARKET VOLUME (SU)

10.2.2.2.3. AVERAGE SELLING PRICE (USD)

10.2.2.3. OTHERS

10.2.3 BY DRUG TYPE

10.2.3.1. BRANDED

10.2.3.1.1. MARKET VALUE (USD MN)

10.2.3.1.2. MARKET VOLUME (SU)

10.2.3.1.3. AVERAGE SELLING PRICE (USD)

10.2.3.2. GENERIC

10.2.3.2.1. MARKET VALUE (USD MN)

10.2.3.2.2. MARKET VOLUME (SU)

10.2.3.2.3. AVERAGE SELLING PRICE (USD)

10.3 ANGIOTENSIN II RECEPTOR BLOCKERS (ARB OR AIIRA)

10.3.1 BY TYPE

10.3.1.1. CANDESARTAN

10.3.1.1.1. MARKET VALUE (USD MN)

10.3.1.1.2. MARKET VOLUME (SU)

10.3.1.1.3. AVERAGE SELLING PRICE (USD)

10.3.1.2. LOSARTAN

10.3.1.2.1. MARKET VALUE (USD MN)

10.3.1.2.2. MARKET VOLUME (SU)

10.3.1.2.3. AVERAGE SELLING PRICE (USD)

10.3.1.3. VALSARTAN

10.3.1.3.1. MARKET VALUE (USD MN)

10.3.1.3.2. MARKET VOLUME (SU)

10.3.1.3.3. AVERAGE SELLING PRICE (USD)

10.3.1.4. OTHERS

10.3.2 BY ROUTE OF ADMINISTRATION

10.3.2.1. ORAL

10.3.2.1.1. MARKET VALUE (USD MN)

10.3.2.1.2. MARKET VOLUME (SU)

10.3.2.1.3. AVERAGE SELLING PRICE (USD)

10.3.2.2. PARENTERAL

10.3.2.2.1. MARKET VALUE (USD MN)

10.3.2.2.2. MARKET VOLUME (SU)

10.3.2.2.3. AVERAGE SELLING PRICE (USD)

10.3.2.3. OTHERS

10.3.3 BY DRUG TYPE

10.3.3.1. BRANDED

10.3.3.1.1. MARKET VALUE (USD MN)

10.3.3.1.2. MARKET VOLUME (SU)

10.3.3.1.3. AVERAGE SELLING PRICE (USD)

10.3.3.2. GENERIC

10.3.3.2.1. MARKET VALUE (USD MN)

10.3.3.2.2. MARKET VOLUME (SU)

10.3.3.2.3. AVERAGE SELLING PRICE (USD)

10.4 BETA BLOCKERS

10.4.1 BY TYPE

10.4.1.1. BISOPROLOL

10.4.1.1.1. MARKET VALUE (USD MN)

10.4.1.1.2. MARKET VOLUME (SU)

10.4.1.1.3. AVERAGE SELLING PRICE (USD)

10.4.1.2. METOPROLOL SUCCINATE

10.4.1.2.1. MARKET VALUE (USD MN)

10.4.1.2.2. MARKET VOLUME (SU)

10.4.1.2.3. AVERAGE SELLING PRICE (USD)

10.4.1.3. CARVEDILOL

10.4.1.3.1. MARKET VALUE (USD MN)

10.4.1.3.2. MARKET VOLUME (SU)

10.4.1.3.3. AVERAGE SELLING PRICE (USD)

10.4.1.4. CARVEDILOL CR

10.4.1.4.1. MARKET VALUE (USD MN)

10.4.1.4.2. MARKET VOLUME (SU)

10.4.1.4.3. AVERAGE SELLING PRICE (USD)

10.4.1.5. OTHERS

10.4.2 BY ROUTE OF ADMINISTRATION

10.4.2.1. ORAL

10.4.2.1.1. MARKET VALUE (USD MN)

10.4.2.1.2. MARKET VOLUME (SU)

10.4.2.1.3. AVERAGE SELLING PRICE (USD)

10.4.2.2. PARENTERAL

10.4.2.2.1. MARKET VALUE (USD MN)

10.4.2.2.2. MARKET VOLUME (SU)

10.4.2.2.3. AVERAGE SELLING PRICE (USD)

10.4.2.3. OTHERS

10.4.3 BY DRUG TYPE

10.4.3.1. BRANDED

10.4.3.1.1. MARKET VALUE (USD MN)

10.4.3.1.2. MARKET VOLUME (SU)

10.4.3.1.3. AVERAGE SELLING PRICE (USD)

10.4.3.2. GENERIC

10.4.3.2.1. MARKET VALUE (USD MN)

10.4.3.2.2. MARKET VOLUME (SU)

10.4.3.2.3. AVERAGE SELLING PRICE (USD)

10.5 ALDOSTERONE ANTAGONISTS

10.5.1 BY TYPE

10.5.1.1. SPIRONOLACTONE

10.5.1.1.1. MARKET VALUE (USD MN)

10.5.1.1.2. MARKET VOLUME (SU)

10.5.1.1.3. AVERAGE SELLING PRICE (USD)

10.5.1.2. EPLERENONE

10.5.1.2.1. MARKET VALUE (USD MN)

10.5.1.2.2. MARKET VOLUME (SU)

10.5.1.2.3. AVERAGE SELLING PRICE (USD)

10.5.1.3. OTHERS

10.5.2 BY ROUTE OF ADMINISTRATION

10.5.2.1. ORAL

10.5.2.1.1. MARKET VALUE (USD MN)

10.5.2.1.2. MARKET VOLUME (SU)

10.5.2.1.3. AVERAGE SELLING PRICE (USD)

10.5.2.2. PARENTERAL

10.5.2.2.1. MARKET VALUE (USD MN)

10.5.2.2.2. MARKET VOLUME (SU)

10.5.2.2.3. AVERAGE SELLING PRICE (USD)

10.5.2.3. OTHERS

10.5.3 BY DRUG TYPE

10.5.3.1. BRANDED

10.5.3.1.1. MARKET VALUE (USD MN)

10.5.3.1.2. MARKET VOLUME (SU)

10.5.3.1.3. AVERAGE SELLING PRICE (USD)

10.5.3.2. GENERIC

10.5.3.2.1. MARKET VALUE (USD MN)

10.5.3.2.2. MARKET VOLUME (SU)

10.5.3.2.3. AVERAGE SELLING PRICE (USD)

10.6 DIURETICS

10.6.1 BY TYPE

10.6.1.1. FUROSEMIDE

10.6.1.1.1. MARKET VALUE (USD MN)

10.6.1.1.2. MARKET VOLUME (SU)

10.6.1.1.3. AVERAGE SELLING PRICE (USD)

10.6.1.2. BUMETANIDE

10.6.1.2.1. MARKET VALUE (USD MN)

10.6.1.2.2. MARKET VOLUME (SU)

10.6.1.2.3. AVERAGE SELLING PRICE (USD)

10.6.1.3. TORSEMIDE

10.6.1.3.1. MARKET VALUE (USD MN)

10.6.1.3.2. MARKET VOLUME (SU)

10.6.1.3.3. AVERAGE SELLING PRICE (USD)

10.6.1.4. CHLORTHIAZIDE

10.6.1.4.1. MARKET VALUE (USD MN)

10.6.1.4.2. MARKET VOLUME (SU)

10.6.1.4.3. AVERAGE SELLING PRICE (USD)

10.6.1.5. AMILORIDE

10.6.1.5.1. MARKET VALUE (USD MN)

10.6.1.5.2. MARKET VOLUME (SU)

10.6.1.5.3. AVERAGE SELLING PRICE (USD)

10.6.1.6. HYDROCHLORTHIAZIDE

10.6.1.6.1. MARKET VALUE (USD MN)

10.6.1.6.2. MARKET VOLUME (SU)

10.6.1.6.3. AVERAGE SELLING PRICE (USD)

10.6.1.7. INDAPAMIDE

10.6.1.7.1. MARKET VALUE (USD MN)

10.6.1.7.2. MARKET VOLUME (SU)

10.6.1.7.3. AVERAGE SELLING PRICE (USD)

10.6.1.8. METOLAZONE

10.6.1.8.1. MARKET VALUE (USD MN)

10.6.1.8.2. MARKET VOLUME (SU)

10.6.1.8.3. AVERAGE SELLING PRICE (USD)

10.6.1.9. TRIAMTERENE

10.6.1.9.1. MARKET VALUE (USD MN)

10.6.1.9.2. MARKET VOLUME (SU)

10.6.1.9.3. AVERAGE SELLING PRICE (USD)

10.6.1.10. OTHERS

10.6.2 BY ROUTE OF ADMINISTRATION

10.6.2.1. ORAL

10.6.2.1.1. MARKET VALUE (USD MN)

10.6.2.1.2. MARKET VOLUME (SU)

10.6.2.1.3. AVERAGE SELLING PRICE (USD)

10.6.2.2. PARENTERAL

10.6.2.2.1. MARKET VALUE (USD MN)

10.6.2.2.2. MARKET VOLUME (SU)

10.6.2.2.3. AVERAGE SELLING PRICE (USD)

10.6.2.3. OTHERS

10.6.3 BY DRUG TYPE

10.6.3.1. BRANDED

10.6.3.1.1. MARKET VALUE (USD MN)

10.6.3.1.2. MARKET VOLUME (SU)

10.6.3.1.3. AVERAGE SELLING PRICE (USD)

10.6.3.2. GENERIC

10.6.3.2.1. MARKET VALUE (USD MN)

10.6.3.2.2. MARKET VOLUME (SU)

10.6.3.2.3. AVERAGE SELLING PRICE (USD)

10.7 IF CHANNEL BLOCKER

10.7.1 BY TYPE

10.7.1.1. IVABRADINE

10.7.1.1.1. MARKET VALUE (USD MN)

10.7.1.1.2. MARKET VOLUME (SU)

10.7.1.1.3. AVERAGE SELLING PRICE (USD)

10.7.1.2. OTHERS

10.7.2 BY ROUTE OF ADMINISTRATION

10.7.2.1. ORAL

10.7.2.1.1. MARKET VALUE (USD MN)

10.7.2.1.2. MARKET VOLUME (SU)

10.7.2.1.3. AVERAGE SELLING PRICE (USD)

10.7.2.2. PARENTERAL

10.7.2.2.1. MARKET VALUE (USD MN)

10.7.2.2.2. MARKET VOLUME (SU)

10.7.2.2.3. AVERAGE SELLING PRICE (USD)

10.7.2.3. OTHERS

10.7.3 BY DRUG TYPE

10.7.3.1. BRANDED

10.7.3.1.1. MARKET VALUE (USD MN)

10.7.3.1.2. MARKET VOLUME (SU)

10.7.3.1.3. AVERAGE SELLING PRICE (USD)

10.7.3.2. GENERIC

10.7.3.2.1. MARKET VALUE (USD MN)

10.7.3.2.2. MARKET VOLUME (SU)

10.7.3.2.3. AVERAGE SELLING PRICE (USD)

10.8 COMBINATION DRUGS

10.8.1 BY TYPE

10.8.1.1. HYDRALAZINE AND ISOSORBIDE DINITRATE

10.8.1.1.1. MARKET VALUE (USD MN)

10.8.1.1.2. MARKET VOLUME (SU)

10.8.1.1.3. AVERAGE SELLING PRICE (USD)

10.8.1.2. SACUBTRIL VALSARTAN (ARNIS)

10.8.1.2.1. MARKET VALUE (USD MN)

10.8.1.2.2. MARKET VOLUME (SU)

10.8.1.2.3. AVERAGE SELLING PRICE (USD)

10.8.1.3. OTHERS

10.8.2 BY ROUTE OF ADMINISTRATION

10.8.2.1. ORAL

10.8.2.1.1. MARKET VALUE (USD MN)

10.8.2.1.2. MARKET VOLUME (SU)

10.8.2.1.3. AVERAGE SELLING PRICE (USD)

10.8.2.2. PARENTERAL

10.8.2.2.1. MARKET VALUE (USD MN)

10.8.2.2.2. MARKET VOLUME (SU)

10.8.2.2.3. AVERAGE SELLING PRICE (USD)

10.8.2.3. OTHERS

10.8.3 BY DRUG TYPE

10.8.3.1. BRANDED

10.8.3.1.1. MARKET VALUE (USD MN)

10.8.3.1.2. MARKET VOLUME (SU)

10.8.3.1.3. AVERAGE SELLING PRICE (USD)

10.8.3.2. GENERIC

10.8.3.2.1. MARKET VALUE (USD MN)

10.8.3.2.2. MARKET VOLUME (SU)

10.8.3.2.3. AVERAGE SELLING PRICE (USD)

10.9 SODIUM-GLUCOSE COTRANSPORTER-2 (SGL2) INHIBITOR

10.9.1 BY TYPE

10.9.1.1. DAPAGLIFLOZIN

10.9.1.1.1. MARKET VALUE (USD MN)

10.9.1.1.2. MARKET VOLUME (SU)

10.9.1.1.3. AVERAGE SELLING PRICE (USD)

10.9.1.2. EMPAGLIFLOZIN

10.9.1.2.1. MARKET VALUE (USD MN)

10.9.1.2.2. MARKET VOLUME (SU)

10.9.1.2.3. AVERAGE SELLING PRICE (USD)

10.9.1.3. OTHERS

10.9.2 BY ROUTE OF ADMINISTRATION

10.9.2.1. ORAL

10.9.2.1.1. MARKET VALUE (USD MN)

10.9.2.1.2. MARKET VOLUME (SU)

10.9.2.1.3. AVERAGE SELLING PRICE (USD)

10.9.2.2. PARENTERAL

10.9.2.2.1. MARKET VALUE (USD MN)

10.9.2.2.2. MARKET VOLUME (SU)

10.9.2.2.3. AVERAGE SELLING PRICE (USD)

10.9.2.3. OTHERS

10.9.3 BY DRUG TYPE

10.9.3.1. BRANDED

10.9.3.1.1. MARKET VALUE (USD MN)

10.9.3.1.2. MARKET VOLUME (SU)

10.9.3.1.3. AVERAGE SELLING PRICE (USD)

10.9.3.2. GENERIC

10.9.3.2.1. MARKET VALUE (USD MN)

10.9.3.2.2. MARKET VOLUME (SU)

10.9.3.2.3. AVERAGE SELLING PRICE (USD)

10.1 DIGOXIN

10.10.1 BY ROUTE OF ADMINISTRATION

10.10.1.1. ORAL

10.10.1.1.1. MARKET VALUE (USD MN)

10.10.1.1.2. MARKET VOLUME (SU)

10.10.1.1.3. AVERAGE SELLING PRICE (USD)

10.10.1.2. PARENTERAL

10.10.1.2.1. MARKET VALUE (USD MN)

10.10.1.2.2. MARKET VOLUME (SU)

10.10.1.2.3. AVERAGE SELLING PRICE (USD)

10.10.1.3. OTHERS

10.10.2 BY DRUG TYPE

10.10.2.1. BRANDED

10.10.2.1.1. MARKET VALUE (USD MN)

10.10.2.1.2. MARKET VOLUME (SU)

10.10.2.1.3. AVERAGE SELLING PRICE (USD)

10.10.2.2. GENERIC

10.10.2.2.1. MARKET VALUE (USD MN)

10.10.2.2.2. MARKET VOLUME (SU)

10.10.2.2.3. AVERAGE SELLING PRICE (USD)

10.11 VERICIGUAT

10.11.1 BY ROUTE OF ADMINISTRATION

10.11.1.1. ORAL

10.11.1.1.1. MARKET VALUE (USD MN)

10.11.1.1.2. MARKET VOLUME (SU)

10.11.1.1.3. AVERAGE SELLING PRICE (USD)

10.11.1.2. PARENTERAL

10.11.1.2.1. MARKET VALUE (USD MN)

10.11.1.2.2. MARKET VOLUME (SU)

10.11.1.2.3. AVERAGE SELLING PRICE (USD)

10.11.1.3. OTHERS

10.11.1.3.1. MARKET VALUE (USD MN)

10.11.1.3.2. MARKET VOLUME (SU)

10.11.1.3.3. AVERAGE SELLING PRICE (USD)

10.11.2 BY DRUG TYPE

10.11.2.1. BRANDED

10.11.2.1.1. MARKET VALUE (USD MN)

10.11.2.1.2. MARKET VOLUME (SU)

10.11.2.1.3. AVERAGE SELLING PRICE (USD)

10.11.2.2. GENERIC

10.11.2.2.1. MARKET VALUE (USD MN)

10.11.2.2.2. MARKET VOLUME (SU)

10.11.2.2.3. AVERAGE SELLING PRICE (USD)

10.12 OTHERS

10.12.1 ANTICOAGULANTS

10.12.1.1. MARKET VALUE (USD MN)

10.12.1.2. MARKET VOLUME (SU)

10.12.1.3. AVERAGE SELLING PRICE (USD)

10.12.2 CHOLESTEROL-LOWERING DRUGS

10.12.2.1. MARKET VALUE (USD MN)

10.12.2.2. MARKET VOLUME (SU)

10.12.2.3. AVERAGE SELLING PRICE (USD)

10.12.3 OTHERS

10.12.4 BY ROUTE OF ADMINISTRATION

10.12.4.1. ORAL

10.12.4.1.1. MARKET VALUE (USD MN)

10.12.4.1.2. MARKET VOLUME (SU)

10.12.4.1.3. AVERAGE SELLING PRICE (USD)

10.12.4.2. PARENTERAL

10.12.4.2.1. MARKET VALUE (USD MN)

10.12.4.2.2. MARKET VOLUME (SU)

10.12.4.2.3. AVERAGE SELLING PRICE (USD)

10.12.4.3. OTHERS

10.12.5 BY DRUG TYPE

10.12.5.1. BRANDED

10.12.5.1.1. MARKET VALUE (USD MN)

10.12.5.1.2. MARKET VOLUME (SU)

10.12.5.1.3. AVERAGE SELLING PRICE (USD)

10.12.5.2. GENERIC

10.12.5.2.1. MARKET VALUE (USD MN)

10.12.5.2.2. MARKET VOLUME (SU)

10.12.5.2.3. AVERAGE SELLING PRICE (USD)

11 GLOBAL HEART FAILURE DRUGS MARKET, BY DRUG TYPE

11.1 OVERVIEW

11.2 GENERICS

11.3 BRANDED

12 GLOBAL HEART FAILURE DRUGS MARKET, BY ROUTE OF ADMINISTRATION

12.1 OVERVIEW

12.2 ORAL

12.3 PARENTERAL

12.4 OTHERS

13 GLOBAL HEART FAILURE DRUGS MARKET, BY MODE OF PURCHASE

13.1 OVERVIEW

13.2 PRESCRIPTION

13.3 OVER THE COUNTER (OTC)

14 GLOBAL HEART FAILURE DRUGS MARKET, BY END USER

14.1 OVERVIEW

14.2 HOSPITALS & CLINICS

14.3 AMBULATORY SURGICAL CENTERS

14.4 OTHERS

15 GLOBAL HEART FAILURE DRUGS MARKET, BY DISTRIBUTION CHANNEL

15.1 OVERVIEW

15.2 HOSPITAL PHARMACY

15.3 RETAIL PHARMACY

15.4 ONLINE PHARMACY

15.5 OTHERS

16 GLOBAL HEART FAILURE DRUGS MARKET, BY GEOGRAPHY

GLOBAL HEART FAILURE DRUGS MARKET (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

16.1 NORTH AMERICA

16.1.1 U.S.

16.1.1.1. U.S HEART FAILURE DRUGS MARKET BY DRUG CLASS

16.1.1.2. U.S HEART FAILURE DRUGS MARKET BY DRUG TYPE

16.1.1.3. U.S HEART FAILURE DRUGS MARKET BY ROUTE OF ADMINISTRATION

16.1.1.4. U.S HEART FAILURE DRUGS MARKET BY MODE OF PURCHASE

16.1.1.5. U.S HEART FAILURE DRUGS MARKET BY END USER

16.1.1.6. U.S HEART FAILURE DRUGS MARKET BY DISTRIBUTION CHANNEL

16.1.2 CANADA

16.1.3 MEXICO

16.2 EUROPE

16.2.1 GERMANY

16.2.2 FRANCE

16.2.3 U.K.

16.2.4 ITALY

16.2.5 SPAIN

16.2.6 RUSSIA

16.2.7 TURKEY

16.2.8 BELGIUM

16.2.9 DENMARK

16.2.10 SWEDEN

16.2.11 POLAND

16.2.12 NORWAY

16.2.13 FINLAND

16.2.14 NETHERLANDS

16.2.15 SWITZERLAND

16.2.16 REST OF EUROPE

16.3 ASIA-PACIFIC

16.3.1 JAPAN

16.3.2 CHINA

16.3.3 SOUTH KOREA

16.3.4 INDIA

16.3.5 AUSTRALIA

16.3.6 SINGAPORE

16.3.7 THAILAND

16.3.8 MALAYSIA

16.3.9 INDONESIA

16.3.10 PHILIPPINES

16.3.11 TAIWAN

16.3.12 INDONESIA

16.3.13 VIETNAM

16.3.14 REST OF ASIA-PACIFIC

16.4 SOUTH AMERICA

16.4.1 BRAZIL

16.4.2 ARGENTINA

16.4.3 REST OF SOUTH AMERICA

16.5 MIDDLE EAST AND AFRICA

16.5.1 SOUTH AFRICA

16.5.2 SAUDI ARABIA

16.5.3 UAE

16.5.4 EGYPT

16.5.5 BAHRAIN

16.5.6 KUWAIT

16.5.7 QATAR

16.5.8 OMAN

16.5.9 ISRAEL

16.5.10 REST OF MIDDLE EAST AND AFRICA

16.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

17 GLOBAL HEART FAILURE DRUGS MARKET, COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: GLOBAL

17.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

17.3 COMPANY SHARE ANALYSIS: EUROPE

17.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

17.5 MERGERS & ACQUISITIONS

17.6 NEW PRODUCT DEVELOPMENT & APPROVALS

17.7 EXPANSIONS

17.8 REGULATORY CHANGES

17.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

18 GLOBAL HEART FAILURE DRUGS MARKET, SWOT AND DBMR ANALYSIS

19 GLOBAL HEART FAILURE DRUGS MARKET, COMPANY PROFILE

19.1 DAIICHI SANKYO

19.1.1 COMPANY OVERVIEW

19.1.2 REVENUE ANALYSIS

19.1.3 GEOGRAPHIC PRESENCE

19.1.4 PRODUCT PORTFOLIO

19.1.5 RECENT DEVELOPMENTS

19.2 ASTRAZENECA

19.2.1 COMPANY OVERVIEW

19.2.2 REVENUE ANALYSIS

19.2.3 GEOGRAPHIC PRESENCE

19.2.4 PRODUCT PORTFOLIO

19.2.5 RECENT DEVELOPMENTS

19.3 PFIZER

19.3.1 COMPANY OVERVIEW

19.3.2 REVENUE ANALYSIS

19.3.3 GEOGRAPHIC PRESENCE

19.3.4 PRODUCT PORTFOLIO

19.3.5 RECENT DEVELOPMENTS

19.4 NOVARTIS

19.4.1 COMPANY OVERVIEW

19.4.2 REVENUE ANALYSIS

19.4.3 GEOGRAPHIC PRESENCE

19.4.4 PRODUCT PORTFOLIO

19.4.5 RECENT DEVELOPMENTS

19.5 SANOFI

19.5.1 COMPANY OVERVIEW

19.5.2 REVENUE ANALYSIS

19.5.3 GEOGRAPHIC PRESENCE

19.5.4 PRODUCT PORTFOLIO

19.5.5 RECENT DEVELOPMENTS

19.6 DR REDDY LABORATORIES

19.6.1 COMPANY OVERVIEW

19.6.2 REVENUE ANALYSIS

19.6.3 GEOGRAPHIC PRESENCE

19.6.4 PRODUCT PORTFOLIO

19.6.5 RECENT DEVELOPMENTS

19.7 SUN PHARMACEUTICALS

19.7.1 COMPANY OVERVIEW

19.7.2 REVENUE ANALYSIS

19.7.3 GEOGRAPHIC PRESENCE

19.7.4 PRODUCT PORTFOLIO

19.7.5 RECENT DEVELOPMENTS

19.8 FRESENIUS KABI

19.8.1 COMPANY OVERVIEW

19.8.2 REVENUE ANALYSIS

19.8.3 GEOGRAPHIC PRESENCE

19.8.4 PRODUCT PORTFOLIO

19.8.5 RECENT DEVELOPMENTS

19.9 GLENMARK PHARMACEUTICALS

19.9.1 COMPANY OVERVIEW

19.9.2 REVENUE ANALYSIS

19.9.3 GEOGRAPHIC PRESENCE

19.9.4 PRODUCT PORTFOLIO

19.9.5 RECENT DEVELOPMENTS

19.1 TEVA PHARMACEUTICALS

19.10.1 COMPANY OVERVIEW

19.10.2 REVENUE ANALYSIS

19.10.3 GEOGRAPHIC PRESENCE

19.10.4 PRODUCT PORTFOLIO

19.10.5 RECENT DEVELOPMENTS

19.11 JOHNSONS & JOHNSONS (JANSSEN PHARMACEUTICALS)

19.11.1 COMPANY OVERVIEW

19.11.2 REVENUE ANALYSIS

19.11.3 GEOGRAPHIC PRESENCE

19.11.4 PRODUCT PORTFOLIO

19.11.5 RECENT DEVELOPMENTS

19.12 MERCK & CO., INC

19.12.1 COMPANY OVERVIEW

19.12.2 REVENUE ANALYSIS

19.12.3 GEOGRAPHIC PRESENCE

19.12.4 PRODUCT PORTFOLIO

19.12.5 RECENT DEVELOPMENTS

19.13 APOTEX CORPORATION

19.13.1 COMPANY OVERVIEW

19.13.2 REVENUE ANALYSIS

19.13.3 GEOGRAPHIC PRESENCE

19.13.4 PRODUCT PORTFOLIO

19.13.5 RECENT DEVELOPMENTS

19.14 ABBVIE

19.14.1 COMPANY OVERVIEW

19.14.2 REVENUE ANALYSIS

19.14.3 GEOGRAPHIC PRESENCE

19.14.4 PRODUCT PORTFOLIO

19.14.5 RECENT DEVELOPMENTS

19.15 HIKMA PHARMACEUTICALS

19.15.1 COMPANY OVERVIEW

19.15.2 REVENUE ANALYSIS

19.15.3 GEOGRAPHIC PRESENCE

19.15.4 PRODUCT PORTFOLIO

19.15.5 RECENT DEVELOPMENTS

19.16 ECI PHARMACEUTICALS

19.16.1 COMPANY OVERVIEW

19.16.2 REVENUE ANALYSIS

19.16.3 GEOGRAPHIC PRESENCE

19.16.4 PRODUCT PORTFOLIO

19.16.5 RECENT DEVELOPMENTS

19.17 BAXTER HEALTHCARE

19.17.1 COMPANY OVERVIEW

19.17.2 REVENUE ANALYSIS

19.17.3 GEOGRAPHIC PRESENCE

19.17.4 PRODUCT PORTFOLIO

19.17.5 RECENT DEVELOPMENTS

19.18 BAYER AG

19.18.1 COMPANY OVERVIEW

19.18.2 REVENUE ANALYSIS

19.18.3 GEOGRAPHIC PRESENCE

19.18.4 PRODUCT PORTFOLIO

19.18.5 RECENT DEVELOPMENTS

19.19 VALIDUS PHARMACEUTICALS

19.19.1 COMPANY OVERVIEW

19.19.2 REVENUE ANALYSIS

19.19.3 GEOGRAPHIC PRESENCE

19.19.4 PRODUCT PORTFOLIO

19.19.5 RECENT DEVELOPMENTS

19.2 BRISTOL MEYERS SQUIBB

19.20.1 COMPANY OVERVIEW

19.20.2 REVENUE ANALYSIS

19.20.3 GEOGRAPHIC PRESENCE

19.20.4 PRODUCT PORTFOLIO

19.20.5 RECENT DEVELOPMENTS

19.21 MYLAN PHARMACEUTICALS

19.21.1 COMPANY OVERVIEW

19.21.2 REVENUE ANALYSIS

19.21.3 GEOGRAPHIC PRESENCE

19.21.4 PRODUCT PORTFOLIO

19.21.5 RECENT DEVELOPMENTS

19.22 ELI LILLY & COMPANY

19.22.1 COMPANY OVERVIEW

19.22.2 REVENUE ANALYSIS

19.22.3 GEOGRAPHIC PRESENCE

19.22.4 PRODUCT PORTFOLIO

19.22.5 RECENT DEVELOPMENTS

19.23 AMGEN INC

19.23.1 COMPANY OVERVIEW

19.23.2 REVENUE ANALYSIS

19.23.3 GEOGRAPHIC PRESENCE

19.23.4 PRODUCT PORTFOLIO

19.23.5 RECENT DEVELOPMENTS

19.24 BAUSCH HEALTH

19.24.1 COMPANY OVERVIEW

19.24.2 REVENUE ANALYSIS

19.24.3 GEOGRAPHIC PRESENCE

19.24.4 PRODUCT PORTFOLIO

19.24.5 RECENT DEVELOPMENTS

19.25 CIPLA, INC

19.25.1 COMPANY OVERVIEW

19.25.2 REVENUE ANALYSIS

19.25.3 GEOGRAPHIC PRESENCE

19.25.4 PRODUCT PORTFOLIO

19.25.5 RECENT DEVELOPMENTS

19.26 BOEHRINGER INGELHEIM

19.26.1 COMPANY OVERVIEW

19.26.2 REVENUE ANALYSIS

19.26.3 GEOGRAPHIC PRESENCE

19.26.4 PRODUCT PORTFOLIO

19.26.5 RECENT DEVELOPMENTS

20 CONCLUSION

21 QUESTIONNAIRE

22 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.