Global Heat Seal Coatings Market

Market Size in USD Billion

CAGR :

%

USD

9.59 Billion

USD

12.95 Billion

2024

2032

USD

9.59 Billion

USD

12.95 Billion

2024

2032

| 2025 –2032 | |

| USD 9.59 Billion | |

| USD 12.95 Billion | |

|

|

|

|

Heat Seal Coatings Market Size

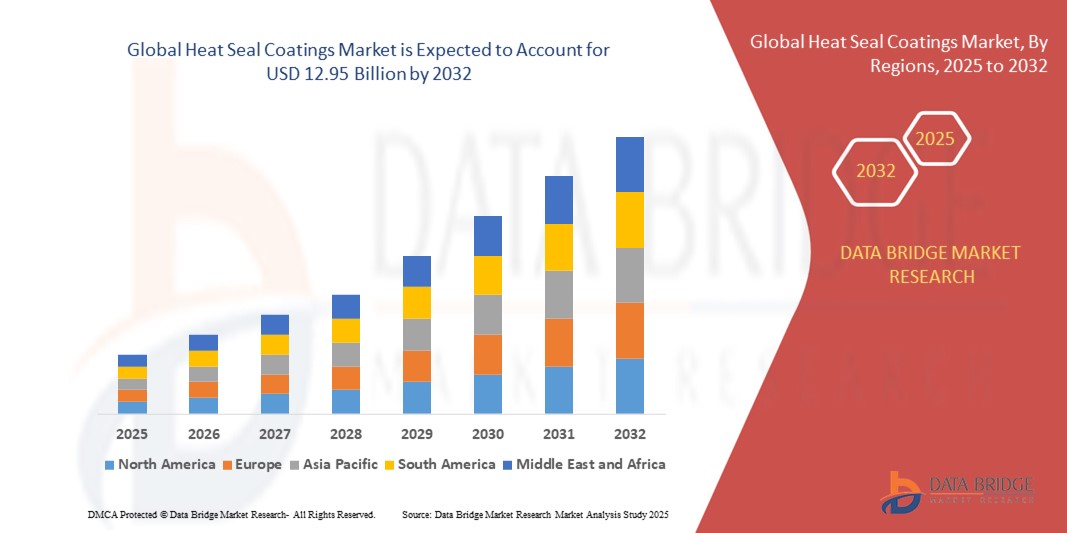

- The global heat seal coatings market size was valued at USD 9.59 billion in 2024 and is expected to reach USD 12.95 billion by 2032, at a CAGR of 6.2% during the forecast period

- The market growth is largely fuelled by the increasing demand for flexible packaging solutions, rising consumption of packaged food and beverages, and growing use of heat seal coatings in pharmaceutical blister packaging

- The surge in e-commerce and online retail is further boosting the adoption of secure and durable packaging, driving demand for heat seal coatings across diverse applications

Heat Seal Coatings Market Analysis

- The market is driven by the shift toward sustainable and lightweight packaging, with manufacturers focusing on coatings that enhance seal integrity, product safety, and shelf-life

- Innovation in water-based and solvent-free coatings is gaining traction as companies align with stringent environmental regulations and sustainability goals

- Asia-Pacific dominated the heat seal coatings market with the largest revenue share of 41.2% in 2024, driven by the rapid expansion of the packaged food and beverage industry, pharmaceutical growth, and large-scale manufacturing capacity in countries such as China, India, and Japan

- North America region is expected to witness the highest growth rate in the global heat seal coatings market, driven by innovation in eco-friendly coatings, a mature healthcare sector, and strict regulatory standards encouraging sustainable packaging solutions

- The water-based segment held the largest market revenue share in 2024, driven by its eco-friendly formulation, regulatory compliance, and suitability for a wide range of packaging substrates. Growing demand for sustainable solutions across food and personal care industries further strengthened its dominance

Report Scope and Heat Seal Coatings Market Segmentation

|

Attributes |

Heat Seal Coatings Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Heat Seal Coatings Market Trends

Growing Demand For Sustainable And Eco-Friendly Packaging Solutions

- The rising consumer preference for eco-friendly packaging is reshaping the heat seal coatings industry. Manufacturers are focusing on bio-based, solvent-free, and water-based formulations that meet both performance and environmental requirements, reducing reliance on traditional solvent-heavy coatings. This trend aligns with global sustainability goals and stricter packaging regulations

- The surge in demand for recyclable and compostable packaging materials is driving innovation in coatings that offer strong adhesion without compromising recyclability. These coatings are gaining traction in food, beverage, and consumer goods sectors where sustainability credentials influence purchasing decisions. With rising regulatory pressure, companies that fail to adapt risk losing competitive ground

- Growing collaborations between packaging manufacturers and coating suppliers are accelerating the development of customized solutions tailored to end-use applications. This enables companies to balance functionality with environmental compliance, strengthening their competitive positioning. Such partnerships also speed up commercialization and market acceptance of sustainable technologies

- For instance, in 2023, several packaging companies in Europe partnered with coating producers to develop water-based heat seal coatings for snack and confectionery packaging. These solutions delivered high sealing performance while ensuring compliance with EU recycling directives. The successful rollout demonstrates how innovation and regulation can align to drive adoption

- While sustainable solutions are driving market opportunities, scalability, cost efficiency, and consistent performance across diverse substrates remain areas requiring further innovation and investment. Meeting these challenges will determine the pace at which sustainable heat seal coatings replace traditional formulations globally

Heat Seal Coatings Market Dynamics

Driver

Rising Adoption Of Flexible Packaging Across Food And Pharmaceutical Industries

- Flexible packaging has emerged as a preferred choice due to its lightweight, cost-effective, and convenient features. Heat seal coatings play a critical role in ensuring secure seals that protect product integrity, making them essential in high-volume packaged food applications. Their role in extending product shelf-life makes them indispensable for fast-moving consumer goods

- In pharmaceuticals, blister packaging is experiencing rapid adoption, with coatings ensuring tamper-evidence, moisture protection, and extended shelf-life. This is creating sustained demand from healthcare sectors globally. Rising healthcare awareness and stricter drug safety standards are further supporting this demand across developed and emerging markets

- Changing consumer lifestyles and the increasing demand for ready-to-eat, frozen, and convenience foods are further fueling the adoption of flexible packaging, boosting the consumption of advanced seal coatings. Manufacturers are leveraging this trend to introduce innovative coatings that enhance packaging resilience during storage and transit

- For instance, in 2022, multiple FMCG companies in North America and Asia adopted high-performance heat seal coatings to improve packaging durability and extend product freshness across fast-moving categories such as snacks and dairy. Their adoption highlighted how coatings directly influence both product safety and consumer satisfaction

- While flexible packaging continues to drive demand, manufacturers are challenged to balance cost pressures with performance requirements, making innovation and cost optimization critical. Companies investing in next-gen coating technologies will be better positioned to capture long-term opportunities

Restraint/Challenge

Volatility In Raw Material Prices And Stringent Environmental Regulations

- The cost of raw materials used in heat seal coatings, such as resins, polymers, and solvents, is highly volatile due to fluctuations in global crude oil and petrochemical supply chains. These variations significantly impact profit margins for manufacturers, particularly smaller firms that lack pricing flexibility

- Environmental concerns and evolving regulatory frameworks pose additional challenges, with stricter restrictions on volatile organic compounds (VOCs) and non-recyclable materials. Compliance often requires high investment in R&D and reformulation. Companies unwilling or unable to adapt risk penalties, reduced demand, or loss of certifications

- Smaller producers face hurdles in scaling eco-friendly alternatives due to the high cost of development and lack of advanced processing infrastructure, limiting their ability to compete with larger global players. Without adequate funding, many local firms struggle to maintain long-term viability

- For instance, in 2023, packaging suppliers across Asia-Pacific reported margin pressures following a sharp increase in resin and solvent prices, which directly affected the pricing of heat seal coatings for high-volume applications. These supply chain shocks underscored the vulnerability of the industry to raw material dependency

- While innovation in bio-based coatings is addressing part of this challenge, long-term success depends on ensuring raw material stability, global supply chain resilience, and alignment with environmental mandates. Building more localized and diversified sourcing strategies will be key to mitigating future risks

Heat Seal Coatings Market Scope

The market is segmented on the basis of product type and application.

- By Product Type

On the basis of product type, the heat seal coatings market is segmented into Solid Resins, Water-Based Heat Seal Coatings, and Solvent-Based Heat Seal Coatings. The water-based segment held the largest market revenue share in 2024, driven by its eco-friendly formulation, regulatory compliance, and suitability for a wide range of packaging substrates. Growing demand for sustainable solutions across food and personal care industries further strengthened its dominance.

The solvent-based segment is expected to witness the fastest growth rate from 2025 to 2032, supported by its strong adhesion properties, versatility, and ability to perform under challenging sealing conditions. These coatings are widely used in industrial and medical packaging applications where high bond strength and durability are essential.

- By Application

On the basis of application, the heat seal coatings market is segmented into Food & Beverage, Home & Personal Care, Medical & Pharmaceutical, and Industrial. The food & beverage segment accounted for the largest revenue share in 2024, fueled by the increasing consumption of packaged and ready-to-eat foods. Heat seal coatings play a critical role in ensuring product safety, extended shelf life, and tamper resistance in this sector.

The medical & pharmaceutical segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the rising adoption of blister packaging, sterile product requirements, and strict regulatory standards. The growing need for secure and contamination-free packaging in healthcare is significantly boosting demand for advanced heat seal coating solutions.

Heat Seal Coatings Market Regional Analysis

- Asia-Pacific dominated the heat seal coatings market with the largest revenue share of 41.2% in 2024, driven by the rapid expansion of the packaged food and beverage industry, pharmaceutical growth, and large-scale manufacturing capacity in countries such as China, India, and Japan

- The region’s rising disposable incomes, urbanization, and demand for convenient and hygienic packaging solutions are further supporting adoption

- In addition, strong government initiatives promoting sustainability, coupled with the region’s role as a global packaging hub, have positioned Asia-Pacific as the leading market for heat seal coatings

China Heat Seal Coatings Market Insight

The China heat seal coatings market captured the largest revenue share in 2024 within Asia-Pacific, fueled by rapid industrialization, a growing middle class, and high demand for packaged food and pharmaceutical products. China’s strong domestic manufacturing ecosystem, along with the availability of affordable packaging solutions, makes it a central player in the global market. Government regulations encouraging green packaging and recycling are also spurring the adoption of eco-friendly coatings.

Japan Heat Seal Coatings Market Insight

The Japan heat seal coatings market is expected to witness the fastest growth rate from 2025 to 2032, supported by its advanced packaging sector and strong consumer demand for convenience and safety. The adoption of blister packaging in healthcare and high-quality packaging in the food industry are key growth drivers. Furthermore, Japan’s focus on eco-friendly innovations and integration of advanced coating technologies aligns with the country’s sustainability and innovation-led growth agenda.

North America Heat Seal Coatings Market Insight

The North America heat seal coatings market is expected to witness the fastest growth rate from 2025 to 2032, supported by strong demand in food, beverage, and pharmaceutical packaging. Consumers in the region value safety, durability, and sustainable packaging options, fueling adoption. The presence of advanced supply chains and well-established FMCG and healthcare industries further supports steady growth.

U.S. Heat Seal Coatings Market Insight

The U.S. heat seal coatings market is expected to witness the fastest growth rate from 2025 to 2032, driven by consumer preference for convenience, tamper-proof packaging, and long shelf-life products. A strong emphasis on regulatory compliance and sustainable packaging materials is accelerating the shift toward water-based and recyclable coatings. The U.S. packaging industry’s focus on innovation continues to strengthen demand.

Europe Heat Seal Coatings Market Insight

The Europe heat seal coatings market is expected to witness the fastest growth rate from 2025 to 2032, supported by strict environmental regulations and the region’s strong focus on recyclable packaging. Rising consumer demand for eco-friendly, safe, and efficient packaging is boosting adoption across the food, beverage, and healthcare industries. Europe’s circular economy initiatives are further encouraging innovation and investment in sustainable coating solutions.

Germany Heat Seal Coatings Market Insight

The Germany heat seal coatings market is expected to witness the fastest growth rate from 2025 to 2032, driven by its advanced industrial base and high standards for sustainability and safety. Strong adoption of bio-based and water-based coatings is evident, particularly in food and pharmaceutical packaging. Germany’s innovation-driven approach and strong consumer expectations for eco-conscious products are major contributors to market growth.

U.K. Heat Seal Coatings Market Insight

The U.K. heat seal coatings market is expected to witness the fastest growth rate from 2025 to 2032, supported by rising packaged food demand, retail expansion, and consumer preference for secure, tamper-evident solutions. Concerns over hygiene and safety are accelerating adoption, while the country’s growing e-commerce industry is further fueling the need for durable packaging materials.

Heat Seal Coatings Market Share

The Heat Seal Coatings industry is primarily led by well-established companies, including:

- Michelman, Inc. (U.S.)

- Cattie Adhesive (U.S.)

- Arkema (France)

- TOYOCHEM CO., LTD. (Japan)

- H.B. Fuller Company (U.S.)

- Paramelt (Netherlands)

- Yasuhara Chemical Co., Ltd. (Japan)

- Henkel AG (Germany)

- Emax Label Solutions (U.S.)

- Dow (U.S.)

- Taihei Chemicals Limited (Japan)

- Trillium Products Ltd. (U.K.)

- Mitsui Chemicals, Inc. (Japan)

- Uflex Limited (India)

- Wacker Chemie AG (Germany)

- DuPont (U.S.)

- Sonoco Products Company (U.S.)

- Constantia (Austria)

- Bemis Company, Inc. (U.S.)

- Bostik SA (France)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Heat Seal Coatings Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Heat Seal Coatings Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Heat Seal Coatings Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.