Global Heat Shrink Bands Market

Market Size in USD Billion

CAGR :

%

USD

1.29 Billion

USD

3.56 Billion

2024

2032

USD

1.29 Billion

USD

3.56 Billion

2024

2032

| 2025 –2032 | |

| USD 1.29 Billion | |

| USD 3.56 Billion | |

|

|

|

|

Heat Shrink Bands Market Size

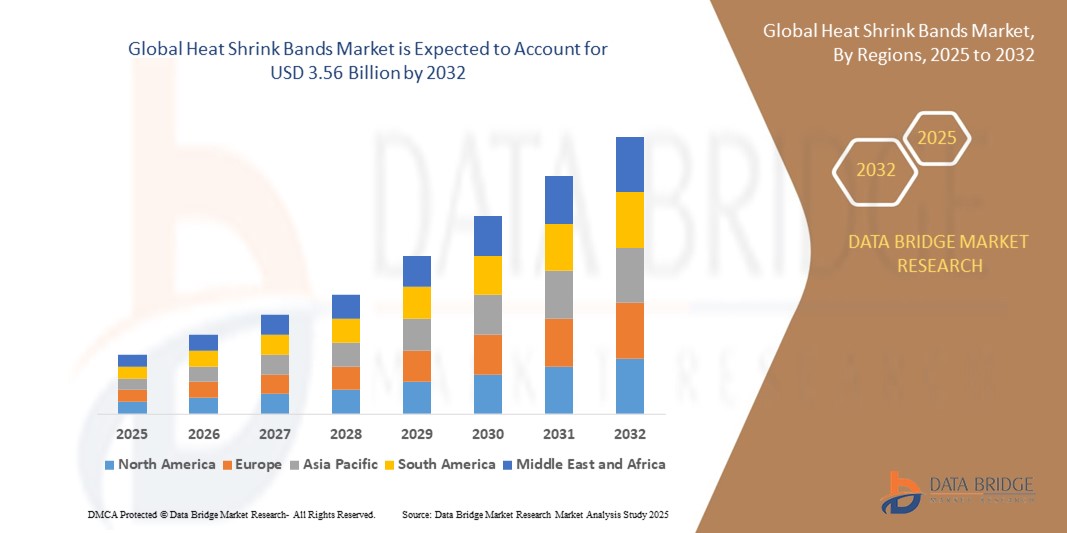

- The global heat shrink bands market size was valued at USD 1.29 billion in 2024 and is expected to reach USD 3.56 billion by 2032, at a CAGR of 13.5% during the forecast period

- The market growth is increasing demand for reliable insulation and protection solutions in electrical, telecom, and industrial applications, coupled with advancements in material technologies enhancing durability and performance

- Rising adoption in emerging industries such as renewable energy and electric vehicles, along with the need for efficient packaging and cable management solutions, is accelerating the market's expansion

Heat Shrink Bands Market Analysis

- Heat shrink bands, used for insulation, protection, and bundling in various industries, are critical for ensuring safety, durability, and efficiency in electrical and mechanical systems. Their ability to conform to complex shapes and provide robust sealing drives their adoption

- The market is propelled by growing industrialization, increasing infrastructure development, and the rising need for high-performance materials in harsh environments

- Asia-Pacific dominated the heat shrink bands market with the largest revenue share of 42.5% in 2024, driven by rapid industrialization, large-scale manufacturing, and strong demand in countries such as China, Japan, and India

- North America is expected to be the fastest-growing region during the forecast period, fueled by advancements in the automotive, aerospace, and renewable energy sectors, along with increasing investments in infrastructure modernization

- The tubes segment dominated the largest market revenue share of 45% in 2024, driven by its widespread use in electrical insulation, cable bundling, and component protection across industries such as electrical and automotive

Report Scope and Heat Shrink Bands Market Segmentation

|

Attributes |

Heat Shrink Bands Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Heat Shrink Bands Market Trends

“Increasing Integration of Advanced Materials and Customization”

- The global heat shrink bands market is experiencing a significant trend toward the integration of advanced materials and customization to meet specific industry needs

- Advanced materials such as polyolefin, fluoropolymer, and polyethylene terephthalate glycol (PETG) are being utilized for their enhanced properties, including flame retardancy, chemical resistance, and flexibility, catering to demanding applications in industries such as electrical, automotive, and aerospace

- Customization of heat shrink bands, such as tailored lengths and specific shrink ratios, allows manufacturers to address unique requirements, improving product performance and application efficiency

- For instances, companies are developing dual-wall heat shrink bands with adhesive linings to provide superior moisture protection and insulation for high-voltage applications in telecommunications and utilities

- This trend enhances the versatility and appeal of heat shrink bands, making them increasingly attractive to original equipment manufacturers (OEMs) and aftermarket customers across diverse industries

- Advanced manufacturing technologies are also enabling precise control over thickness , ensuring compatibility with specific industry standards and environmental conditions

Heat Shrink Bands Market Dynamics

Driver

“Rising Demand for Electrical Insulation and Infrastructure Development”

- The increasing global demand for reliable electrical insulation solutions, driven by rapid industrialization and infrastructure development, is a major driver for the heat shrink bands market

- Heat shrink bands provide critical protection for wires and cables against abrasion, moisture, and environmental factors, making them essential in industries such as electrical, IT and telecom, construction, and transport

- Government initiatives, particularly in the Asia-Pacific region, to modernize aging electrical grids and expand transmission and distribution (T&D) systems are boosting the adoption of heat shrink bands, especially in low and medium voltage applications

- The rise in electric vehicle (EV) production and renewable energy projects further fuels demand for heat shrink bands in automotive and energy sectors, where they are used for wire harnessing and component protection

- The proliferation of IoT and advancements in telecommunications infrastructure, particularly in Asia-Pacific, are driving the need for heat shrink bands in high-speed data transmission applications

Restraint/Challenge

“High Production Costs and Regulatory Compliance Issues”

- The high initial costs associated with producing advanced materials such as fluoropolymers, polytetrafluoroethylene (PTFE), and perfluoroalkoxy alkane (PFA) pose a significant barrier to market growth, particularly in cost-sensitive emerging markets

- The complexity of manufacturing heat shrink bands with precise specifications, such as varying thicknesses and shrink ratios, increases production costs, which can deter smaller manufacturers or end-users

- Regulatory compliance and environmental concerns related to material usage, such as restrictions on polyvinyl chloride (PVC) due to toxic gas emissions, present challenges for manufacturers, particularly in regions with stringent environmental regulations such as Europe

- Data security is not a primary concern for heat shrink bands, but the need to comply with diverse industry standards across countries complicates operations for global manufacturers and service providers

- These factors can limit market expansion, particularly in regions with high cost sensitivity or strict regulatory frameworks, potentially slowing adoption in industries such as utilities, chemical, and telecommunication

Heat Shrink Bands market Scope

The market is segmented on the basis of products, length, types, voltage, material, ratio, industry, thickness, sales channel, and end-user.

- By Products

On the basis of products, the heat shrink bands market is segmented into tubes, sleeves, and other accessories. The tubes segment dominated the largest market revenue share of 45% in 2024, driven by its widespread use in electrical insulation, cable bundling, and component protection across industries such as electrical and automotive. Tubes offer versatility and durability, making them a preferred choice for various applications.

The sleeves segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand for protective packaging in the food and beverage and pharmaceutical industries. Sleeves provide tamper-evident solutions and enhance product aesthetics, driving their adoption.

- By Length

On the basis of length, the heat shrink bands market is segmented into spool, standard (1.2m), non-standard cut pieces, and custom. The spool segment dominated with a 40% market revenue share in 2024, owing to its cost-effectiveness and flexibility for high-volume applications in industries such as electrical and telecommunications. Spools allow for customized cutting, catering to diverse industrial needs.

The custom segment is anticipated to grow at the fastest rate from 2025 to 2032, driven by the rising demand for tailored solutions in specialized applications such as aerospace and automotive, where precise dimensions are critical for performance and safety.

- By Types

On the basis of type, the heat shrink bands market is segmented into single wall and dual wall types. The single wall segment accounted for the largest market revenue share of 60% in 2024, due to its affordability and widespread use in general-purpose insulation and protection applications across industries such as electronics and construction.

The dual wall segment is projected to experience the fastest growth from 2025 to 2032, driven by its enhanced sealing and environmental resistance properties, making it ideal for harsh environments in industries such as automotive and aerospace.

- By Voltage

On the basis of voltage, the heat shrink bands market is segmented into low voltage, medium voltage, and high voltage. The low voltage segment held the largest market revenue share of 55% in 2024, driven by its extensive use in consumer electronics, home appliances, and low-voltage electrical systems, where cost-effective insulation is critical.

The high voltage segment is expected to witness significant growth from 2025 to 2032, fueled by increasing demand for reliable insulation solutions in power transmission and distribution systems, particularly in renewable energy projects.

- By Material

On the basis of material, the heat shrink bands market is segmented into polyolefin, polytetrafluoroethylene, fluoropolymer, polyvinyl chloride (PVC), neoprene, silicon elastomer or Viton, polyethylene (PE), perfluoroalkoxy alkane (PFA), fluorinated ethylene propylene (FEP), ethylene vinyl acetate (EVA), ethylene tetrafluoroethylene (ETFE), polyethylene terephthalate glycol (PETG), expanded polystyrene films, polylactic acid films, silicon, and others. The polyolefin segment dominated with a 50% market revenue share in 2024, owing to its excellent electrical insulation, chemical resistance, and cost-effectiveness, making it a preferred material across multiple industries.

The fluoropolymer segment is anticipated to grow at the fastest rate from 2025 to 2032, driven by its superior performance in high-temperature and harsh chemical environments, particularly in aerospace and chemical industries.

- By Ratio

On the basis of ratio, the heat shrink bands market is segmented into 2:1, 3:1, 4:1, and 6:1 shrink ratios. The 2:1 ratio segment held the largest market revenue share of 48% in 2024, due to its widespread use in standard applications requiring a snug fit, such as electrical insulation and wire bundling.

The 3:1 ratio segment is expected to witness the fastest growth from 2025 to 2032, driven by its flexibility and ability to accommodate irregularly shaped components, making it ideal for complex applications in telecommunications and automotive industries.

- By Industry

On the basis of industry, the heat shrink bands market is segmented into electrical, IT and telecom, construction, and transport. The electrical segment accounted for the largest market revenue share of 38% in 2024, driven by the critical need for insulation and protection in power distribution, wiring, and electrical components.

The transport segment is projected to experience rapid growth from 2025 to 2032, fueled by the increasing adoption of heat shrink bands in automotive and aerospace applications for wire harnessing and component protection, particularly with the rise of electric vehicles.

- By Thickness

On the basis of thickness, the heat shrink bands market is segmented into below 50 micron, 50-75 micron, 75-100 micron, and above 100 micron. The 50-75 micron segment held the largest market revenue share of 42% in 2024, offering a balance of flexibility and durability for applications in packaging, electronics, and automotive industries.

The above 100 micron segment is expected to grow at the fastest rate from 2025 to 2032, driven by its use in heavy-duty applications requiring enhanced mechanical protection, such as in pipelines and aerospace.

- By Sales Channel

On the basis of sales channel, the heat shrink bands market is segmented into original equipment manufacturers (OEMs) and aftermarket. The OEM segment dominated with a 65% market revenue share in 2024, driven by the integration of heat shrink bands during the manufacturing of electrical, automotive, and telecommunications equipment.

The aftermarket segment is anticipated to witness robust growth from 2025 to 2032, fueled by the increasing demand for replacement and retrofit solutions in maintenance and repair applications across various industries.

- By End-User

On the basis of end-user, the heat shrink bands market is segmented into utilities, chemical, automotive, aerospace, railways, pharmaceutical, telecommunication, food, beverages, electrical engineering goods and components, home appliances, defence, pipelines, pulp and paper, textile, packaging, electrical and electronics, energy, and others. The electrical and electronics segment held the largest market revenue share of 40% in 2024, driven by the high demand for insulation and protection in wiring, cables, and electronic components.

The automotive segment is expected to experience the fastest growth from 2025 to 2032, with a projected CAGR of 8.5%, fueled by the growing adoption of heat shrink bands in electric vehicle wiring harnesses, battery systems, and advanced driver-assistance systems (ADAS).

Heat Shrink Bands Market Regional Analysis

- Asia-Pacific dominated the heat shrink bands market with the largest revenue share of 42.5% in 2024, driven by rapid industrialization, large-scale manufacturing, and strong demand in countries such as China, Japan, and India

- Consumers prioritize heat shrink bands for insulation, protection against environmental damage, and strain relief, particularly in regions with high industrial activity and harsh environmental conditions

- Growth is supported by advancements in material technologies, such as polyolefin and fluoropolymer-based bands, alongside increasing adoption in both OEM and aftermarket segments

Japan Heat Shrink Bands Market Insight

Japan’s heat shrink bands market is expected to witness rapid growth due to strong consumer preference for high-quality, technologically advanced bands that enhance system reliability and safety. The presence of major electronics and automotive manufacturers accelerates market penetration through OEM integrations. Rising interest in aftermarket solutions for industrial applications also contributes to growth.

China Heat Shrink Bands Market Insight

China holds the largest share of the Asia-Pacific heat shrink bands market, propelled by rapid urbanization, increasing industrial output, and strong demand for protective solutions in electronics and automotive sectors. The country’s growing industrial base and focus on cost-effective, high-performance materials support the adoption of advanced heat shrink bands. Robust domestic manufacturing and competitive pricing enhance market accessibility.

U.S. Heat Shrink Bands Market Insight

The U.S. heat shrink bands market is expected to witness significant growth, fueled by strong demand in the automotive and electrical sectors and growing awareness of insulation and protection benefits. The trend toward customized electrical systems and stringent safety regulations further boosts market expansion. The integration of heat shrink bands in OEM applications and robust aftermarket demand create a diverse product ecosystem.

Europe Heat Shrink Bands Market Insight

The Europe heat shrink bands market is expected to witness significant growth, supported by regulatory emphasis on safety and durability in industrial applications. Consumers seek bands that provide reliable insulation and environmental protection while meeting compliance standards. Growth is prominent in both new installations and retrofit projects, with countries such as Germany and France showing strong adoption due to advanced manufacturing and environmental concerns.

U.K. Heat Shrink Bands Market Insight

The U.K. market for heat shrink bands is expected to witness rapid growth, driven by demand for reliable insulation and protection in electrical and telecommunication systems. Increased focus on safety standards and environmental protection encourages adoption. Evolving regulations balancing performance and compliance further influence consumer choices in urban and industrial settings.

Germany Heat Shrink Bands Market Insight

Germany is expected to witness rapid growth in the heat shrink bands market, attributed to its advanced manufacturing sector and high consumer focus on durability and efficiency. German industries prefer technologically advanced bands, such as fluoropolymer-based solutions, for superior chemical and temperature resistance. Integration in premium electrical systems and aftermarket applications supports sustained market growth.

Heat Shrink Bands Market Share

The heat shrink bands industry is primarily led by well-established companies, including:

- ABB (Switzerland)

- 3M (U.S.)

- TE Connectivity. (Switzerland)

- Sumitomo Electric Industries, Ltd. (Japan)

- HellermannTyton (U.K.)

- Alpha Wire (U.S.)

- Insultab, PEXCO (U.S.)

- Shenzhen Woer Heat - Shrinkable Material Co., Ltd. (China)

- DYMO, Inc. (U.S.)

- Molex (U.S.)

- Huizhou Guanghai Electronic Insulation Materials Co.,Ltd. (China)

- PEXCO (U.S.)

- Techflex, Inc. (U.S.)

- Zeus Company Inc. (U.S.)

- Gupta Fancy Packs (India)

- Manoj Plastics Industries (India)

- Crystal Vision Packaging Co (India)

- Paras Traders. (India)

- Swati Enterprise (India)

- GMG International (India

What are the Recent Developments in Global Heat Shrink Bands Market?

- In March 2024, Amcor Plc entered a strategic partnership with a leading European beverage company to deliver custom-designed heat shrink bands for premium bottled products. These bands incorporate high-resolution graphics and tamper-evident features, aiming to elevate brand visibility while ensuring consumer protection. The collaboration not only reinforces Amcor’s commitment to innovation and safety but also strengthens its foothold in the European premium packaging market, where demand for visually striking and secure packaging continues to rise

- In February 2024, Traco Packaging unveiled an advanced heat shrink band embedded with RFID tags, marking a significant leap in secure packaging technology. Designed for the pharmaceutical and luxury goods sectors, this innovation enables real-time product tracking and authenticity verification, helping brands combat counterfeiting and streamline supply chain visibility. The RFID integration ensures that each packaged item carries a unique digital identity, enhancing traceability from production to point-of-sale.

- In November 2023, Multi-Color Corporation (MCC) partnered with a major global cosmetics brand to create heat shrink bands with anti-microbial properties, tailored for personal care products. These bands are designed to offer enhanced hygiene and tamper-evident protection, addressing growing consumer expectations for safe and secure packaging. The collaboration reflects MCC’s commitment to innovation in the beauty and personal care sector, where packaging plays a critical role in both brand appeal and product integrity

- In October 2023, Avery Dennison Corporation initiated a recall of a specific batch of heat shrink bands after detecting shrink performance inconsistencies that could compromise tamper-evident functionality. To address the issue, the company promptly implemented corrective actions, including reinforcing its quality control protocols. These measures were taken to uphold product reliability and preserve consumer confidence. The recall highlights Avery Dennison’s commitment to maintaining high standards in packaging integrity and responsiveness to potential risks in its supply chain

- In March 2023, Berry Global introduced eco-friendly shrink bands as part of its broader push toward sustainable packaging solutions. These shrink bands are designed to be recyclable and lightweight, aligning with increasing environmental regulations and rising consumer demand for greener alternatives. The launch reflects Berry’s commitment to reducing its environmental footprint and advancing its Impact 2025 strategy, which includes goals like achieving 86% reusable, recyclable, or compostable packaging and cutting Scope 1 and 2 emissions by 25%—a target the company met two years ahead of schedule

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Heat Shrink Bands Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Heat Shrink Bands Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Heat Shrink Bands Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.