Global Heat Treated Steel Plates Market

Market Size in USD Billion

CAGR :

%

USD

6.59 Billion

USD

9.31 Billion

2022

2030

USD

6.59 Billion

USD

9.31 Billion

2022

2030

| 2023 –2030 | |

| USD 6.59 Billion | |

| USD 9.31 Billion | |

|

|

|

|

Heat-Treated Steel Plates Market Analysis and Size

In recent years, steel plates with a high product weight, which is realized by thicker, wider and longer plates, have been in high demand in plates due to upscaling of equipment and to lessen construction time and costs. The heat-treated steel plates market will also be driven by growing urbanization, construction activity in emerging economies and large-scale investments in the infrastructure and industrial industries all over the globe. Other factors which are predicted to fuel the market expansion include the growing usage of heat-treated steel plates in shipbuilding, industrial machinery and automotive and defence vehicles.

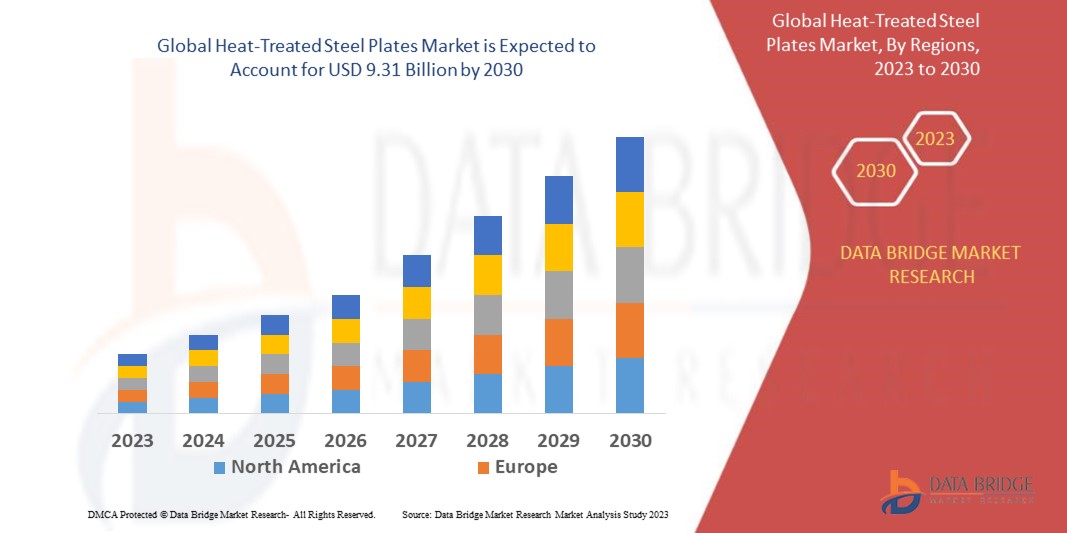

Data Bridge Market Research analyses that the heat-treated steel plates market is expected to reach USD 9.31 billion by 2030, which is USD 6.59 billion in 2022, registering a CAGR of 4.40% during the forecast period of 2023 to 2030. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Heat-Treated Steel Plates Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 - 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Steel Type (Carbon Steel, Stainless Steel, and Alloy Steel), Heat Treatment Type (Annealing, Tempering, Normalizing, and Quenching), End-user Industry (Automotive and Heavy Machinery, Building and Construction, Ship Building and Off-shore Structures, Energy and Power, and Other End-user Industries) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Market Players Covered |

ArcelorMittal (Luxembourg), POSCO (South Korea), Voestalpine AG (Austria), Baosteel (China), Nippon Steel Corporation (Japan), United States Steel Corporation (U.S.), SAIL (India), TATA Steel (India), Thyssenkrupp AG (Germany), JFE Steel Corporation (Japan), Esteel (South Korea), Hesteel Group Tangsteel Company (China) ChinaSteel (Taiwan), ESL Steel Ltd. (India), Jiangsu Shagang Group Su ICP (China), Union Electric Steel Corporation (U.S.), hebei puyang iron and steel group (China), Aperam (Luxemborg), Cleveland-Cliffs Inc. (U.S.), Slovenian Steel Group (Slovenia) and Sko-Die Inc (U.S.) |

|

Market Opportunities |

|

Market Definition

Heat treatment is a method of changing the microstructure of alloys and metals, such as steel, to impart qualities that increase the working life of components. Annealing, tempering, normalizing and quenching are different types of heat-treating techniques. The heat treatment method helps in improving and raising the steel’s hardness, elasticity, flexibility and toughness. Heat-treated steel plates play a vital part in the infrastructure, construction and industrial machinery markets owing to their advantages.

Heat-Treated Steel Plates Market Dynamics

Drivers

- Increasing demand for heat-treated steel plates in automotive and transportation sector

Automotive and transportation developed as the largest sector in 2019. Steel is measured to be a sustainable material owing to their recyclability. Thus, increasing concerns regarding service life, environmental pollution and driving comfort are expected to drive the demand for the heat treated steel plates in the automotive and transportation. Moreover, in the automotive and transportation sector, case hardening is mainly used to increase hardness and dynamic and static strength of components over hardened and quench steel because they are not enough sufficient to withstand rotating and bending stress. Numerous grades of steel plates are used in long member of automotive sections, trucks and structural parts of railways.

- Surging demand of heat-treated steel plates in multiple application

The construction industry’s upbeat position in developing nations and augmented investment in railways, highways and bridges are anticipated to drive up the demand for heat-treated steel plates in the market. The increasing demand of heat-treated steel plates among end-use industries for augmented toughness, hardness, and strength in many areas, tempering and quenching are anticipated to increase at a steady pace. Increasing demand for heat-treated steel plates in industries such as aerospace, construction, automotive and military, among others, is expected to deliver significant revenue potential for the manufacturers of heat-treated steel plate manufacturers, accordingly driving market growth.

Opportunities

- Increasing strategic collaboration

Business collaboration is a major trend which is gaining popularity in the heat-treated steel plate market. Major companies which are operating in the heat-treated steel plate sector are highly focused on business collaboration through strategic partnerships, business contracts and MoUs to strengthen their position. For instance, Tenova LOI Thermprocess is a leading global company in the field of heat treatment plants based in Essen. This company has been contracted by VIZ-Stal which is a part of the Russian NLMK Group, to supply a coating line (DCL) an d decarburization for VIZ-Ekaterinburg Stal's factory in Russia in July 2021. This contract involves heat treatment, supply and monitoring, mechanical and process equipment engineering, and related electrical, control, measurement systems for a DCL line.

Restraints/ Challenges

- Issues associated with usage of heat-treated steel plates

The growth of the heat-treated steel plates market is anticipated to be hindered by the unexpected fluctuations in the prices of raw materials. As a result of this, it disrupted the supply chain of heat-treated steel plates raw materials and pose a major challenge for manufacturers.

This heat-treated steel plates market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the heat-treated steel plates market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Covid-19 Impact on Heat-Treated Steel Plates Market

The growing number of shipbuilding activities is considerably driving the heat-treated steel plate market growth. Heat-treated steel plates are highly used in the construction of passenger ships and cargo, boats, offshore drilling platforms, and other structures and vessels. According to the review of UNCTAD’s maritime transport 2021, ship deliveries were decreased by 12% in 2020, due to lockdown and shut down during covid-19 pandemic. However, there has been an increase in new orders since early 2021. The first half of 2021 saw the uppermost level of new shipbuilding investment, with record-breaking orders for container ships approximately eight times that of the first half of 2020.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Recent Development

- In 2021, Tata Steel restarted work on a cold-roll mill complex and pellet plant growth at Tata Steel Kalinganagar. It was paused due to the lockdowns. The growth of the Kalinganagar plant to around 8 million metric tons per annum from 3 million metric tons per annum is anticipated to incur a price of about INR 25,000 crore.

- In 2020, Arjas Steel, one of India's top alloy steel makers, has acquired auto components, Modern Steels' steel and heat treatment equipment for an undisclosed sum. This acquisition delivers Arjas Steel with a total capacity of 4, 50,000 tonnes in specialty steel for the stainless steel, automotive sector, bright bars, and a manufacturing base. Modern Steels meets the requirements of the bearing, engineering, automotive, and allied industries for alloy steel-hot rolled bars.

Global Heat-Treated Steel Plates Market Scope

The heat-treated steel plates market is segmented on the basis of steel type, heat treatment type and end-user industry. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Steel Type

- Carbon Steel

- Stainless Steel

- Alloy Steel

Heat Treatment Type

- Annealing

- Tempering

- Normalizing

- Quenching

End-user Industry

- Automotive and Heavy Machinery

- Building and Construction

- Ship Building and Off-shore Structures

- Energy and Power

- Other End-user Industries

Heat-Treated Steel Plates Market Regional Analysis/Insights

The heat-treated steel plates market is analyzed and market size insights and trends are provided by country, steel type, heat treatment type and end-user industry as referenced above.

The countries covered in the heat-treated steel plates market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

Asia-pacific is expected to dominate the heat-treated steel plates market owing to the strong presence of major market players and a higher consumer demand in this region.

Europe in anticipated to be the fastest growing region in heat-treated steel plates market during the forecast period of 2023-2030 due to the growing major end-user industries such as defence, ship building and automotive in countries in this region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Heat-Treated Steel Plates Market Share Analysis

The heat-treated steel plates market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to heat-treated steel plates market.

Some of the major players operating in the heat-treated steel plates market are:

- ArcelorMittal (Luxembourg)

- POSCO (South Korea)

- Voestalpine AG (Austria)

- Baosteel (China)

- Nippon Steel Corporation (Japan)

- United States Steel Corporation (U.S.)

- SAIL (India)

- TATA Steel (India)

- Thyssenkrupp AG (Germany)

- JFE Steel Corporation (Japan)

- Esteel (South Korea)

- Hesteel Group Tangsteel Company (China)

- ChinaSteel (Taiwan)

- ESL Steel Ltd. (India)

- Jiangsu Shagang Group Su ICP (China)

- Union Electric Steel Corporation (U.S.)

- Hebei puyang iron and steel group (China)

- Aperam (Luxemborg)

- Sko-Die Inc (U.S.)

- Cleveland-Cliffs Inc. (U.S.)

- Slovenian Steel Group (Slovenia)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL HEAT-TREATED STEEL PLATES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL HEAT-TREATED STEEL PLATES MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 IMPORT AND EXPORT DATA

2.15 SECONDARY SOURCES

2.16 GLOBAL HEAT-TREATED STEEL PLATES MARKET : RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PRODUCTION CONSUMPTION ANALYSIS

5.2 IMPORT EXPORT SCENARIO

5.3 RAW MATERIAL PRODUCTION COVERAGE

5.4 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

5.5 LIST OF KEY BUYERS, BY REGION

5.5.1 NORTH AMERICA

5.5.2 EUROPE

5.5.3 ASIA PACIFIC

5.5.4 SOUTH AMERICA

5.5.5 MIDDLE EAST & AFRICA

5.6 PORTER’S FIVE FORCES

5.7 VENDOR SELECTION CRITERIA

5.8 PESTLE ANALYSIS

5.9 REGULATION COVERAGE

5.9.1 PRODUCT CODES

5.9.2 CERTIFIED STANDARDS

5.9.3 SAFETY STANDARDS

5.9.3.1. MATERIAL HANDLING & STORAGE

5.9.3.2. TRANSPORT & PRECAUTIONS

5.9.3.3. HARAD IDENTIFICATION

6 PRICING ANALYSIS

7 PRODUCTION CAPACITY OVERVIEW

8 SUPPLY CHAIN ANALYSIS

8.1 OVERVIEW

8.2 LOGISTIC COST SCENARIO

8.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

9 CLIMATE CHANGE SCENARIO

9.1 ENVIRONMENTAL CONCERNS

9.2 INDUSTRY RESPONSE

9.3 GOVERNMENT’S ROLE

10 GLOBAL HEAT-TREATED STEEL PLATES MARKET, BY PRODUCT, 2021-2030, (USD MILLION) (TONS)

10.1 OVERVIEW

10.2 CARBON STEEL

10.2.1 CARBON STEEL, BY TYPE

10.2.1.1. LOW

10.2.1.2. MEDIUM

10.2.1.3. HIGH

10.2.1.4. ULTRA-HIGH

10.2.1.5. OTHERS

10.2.2 CARBON STEEL, BY GRADE

10.2.2.1. 1045

10.2.2.2. 1095

10.2.2.3. 1040

10.2.2.4. 1050

10.2.2.5. OTHERS

10.3 STAINLESS STEEL

10.3.1 STAINLESS STEEL, BY TYPE

10.3.1.1. AUSTENITIC

10.3.1.2. FERRITIC

10.3.1.3. MARTENSITIC

10.3.1.4. PRECIPITATION-HARDENING STAINLESS STEEL

10.3.1.5. DUPLEX

10.3.2 STAINLESS STEEL, BY GRADE

10.3.2.1. 300 SERIES

10.3.2.2. 400 SERIES

10.3.2.2.1. 410

10.3.2.2.2. 416

10.3.2.2.3. 420

10.3.2.2.4. 440

10.3.2.2.4.1 440A

10.3.2.2.4.2 440B

10.3.2.2.4.3 440C

10.3.2.2.5. 500 SERIES

10.3.2.2.6. 600 SERIES

10.3.2.3. ALLOY STEEL

10.3.2.3.1. ALLOY STEEL, BY TYPE

10.3.2.3.1.1 LOW

10.3.2.3.1.1.1. AISI 4130

10.3.2.3.1.1.2. AISI 4140

10.3.2.3.1.1.3. AISI 4340

10.3.2.3.1.1.4. AISI 8620

10.3.2.3.1.1.5. ASTM A572

10.3.2.3.1.1.6. ASTM A387

10.3.2.3.1.1.7. ASTM A514

10.3.2.3.1.1.8. OTHERS

10.3.2.3.1.2 TOOL

10.3.2.3.1.2.1. D2

10.3.2.3.1.2.2. A2

10.3.2.3.1.2.3. H13

10.3.2.3.1.2.4. OTHERS

10.3.2.3.1.3 HIGH-SPEED STEEL

10.3.2.3.1.3.1. M1

10.3.2.3.1.3.2. M2

10.3.2.3.1.3.3. M3

10.3.2.3.1.3.4. M4

10.3.2.3.1.3.5. OTHERS

10.3.2.3.1.4 MARAGING STEEL

10.3.2.3.1.4.1. 250

10.3.2.3.1.4.2. 300

10.3.2.3.1.4.3. OTHERS

10.3.2.3.1.5 OTHERS

11 GLOBAL HEAT-TREATED STEEL PLATES MARKET, BY FORM, 2021-2030, (USD MILLION)

11.1 OVERVIEW

11.2 FLAT

11.3 LONG

12 GLOBAL HEAT-TREATED STEEL PLATES MARKET, BY CATEGORY, 2021-2030, (USD MILLION)

12.1 OVERVIEW

12.2 HOT ROLLED

12.3 COLD ROLLED

13 GLOBAL HEAT-TREATED STEEL PLATES MARKET, BY THICKNESS, 2021-2030, (USD MILLION)

13.1 OVERVIEW

13.2 THIN (< 4MM)

13.3 MEDIUM (4-60MM)

13.4 EXTRA THICK (60-115MM)

14 GLOBAL HEAT-TREATED STEEL PLATES MARKET, BY END-USE, 2021-2030 (USD MILLION)

14.1 OVERVIEW

14.2 AUTOMOTIVE AND TRANSPORTATION

14.2.1 AUTOMOTIVE AND TRANSPORTATION, BY TYPE

14.2.1.1. RAILWAYS

14.2.1.2. AIRCRAFTS

14.2.1.3. VEHICLES

14.2.1.3.1. 2-WHEELER

14.2.1.3.2. 4-WHEELER

14.2.1.4. OTHERS

14.2.2 AUTOMOTIVE AND TRANSPORTATION ,BY CATEGORY

14.2.2.1. TRANSMISSION GEARS

14.2.2.2. ENGINE COMPONENTS

14.2.2.3. SUSPENSION PARTS

14.2.2.4. CHASSIS REINFORCEMENT

14.2.2.5. OTHERS

14.2.3 AUTOMOTIVE AND TRANSPORTATION ,BY PRODUCT

14.2.3.1. CARBON STEEL

14.2.3.2. STAINLESS STEEL

14.2.3.3. ALLOY STEEL

14.3 INDUSTRIAL MACHINERY AND HEAVY EQUIPMENT

14.3.1 INDUSTRIAL MACHINERY AND HEAVY EQUIPMENT, BY CATEGORY

14.3.1.1. SHAFTS

14.3.1.2. GEARS

14.3.1.3. BEARINGS

14.3.1.4. TOOLING

14.3.1.5. OTHERS

14.3.2 INDUSTRIAL MACHINERY AND HEAVY EQUIPMENT, BY PRODUCT

14.3.2.1. CARBON STEEL

14.3.2.2. STAINLESS STEEL

14.3.2.3. ALLOY STEEL

14.4 BUILDING AND CONSTRUCTION

14.4.1 BUILDING AND CONSTRUCTION, BY CATEGORY

14.4.1.1. BEAMS

14.4.1.2. COLUMNS

14.4.1.3. GIRDERS

14.4.1.4. BRIDGES

14.4.1.5. FACADES

14.4.1.6. OTHERS

14.4.2 BUILDING AND CONSTRUCTION, BY PRODUCT

14.4.2.1. CARBON STEEL

14.4.2.2. STAINLESS STEEL

14.4.2.3. ALLOY STEEL

14.5 SHIP BUILDING AND OFF-SHORE STRUCTURES

14.6 ENERGY AND POWER

14.6.1 ENERGY AND POWER, BY CATEGORY

14.6.1.1. HEAT EXCHANGERS

14.6.1.2. TURBINE BLADES

14.6.1.3. GENERATOR COMPONENTS

14.6.1.4. STEAM VALVES

14.6.1.5. OTHERS

14.6.2 ENERGY AND POWER, BY PRODUCT

14.6.2.1. CARBON STEEL

14.6.2.2. STAINLESS STEEL

14.6.2.3. ALLOY STEEL

14.7 METALWORKING

14.8 AEROSPACE AND DEFENSE

14.8.1 AEROSPACE AND DEFENSE, BY CATEGORY

14.8.1.1.1. AIRCRAFT COMPONENTS

14.8.1.1.2. DEFENSE EQUIPMENT

14.8.1.1.3. OTHER PARTS

14.8.2 AEROSPACE AND DEFENSE, BY PRODUCT

14.8.2.1. CARBON STEEL

14.8.2.2. STAINLESS STEEL

14.8.2.3. ALLOY STEEL

14.9 OTHERS

14.9.1 OTHERS, BY PRODUCT

14.9.1.1. CARBON STEEL

14.9.1.2. STAINLESS STEEL

14.9.1.3. ALLOY STEEL

15 GLOBAL HEAT-TREATED STEEL PLATES MARKET, BY GEOGRAPHY, 2021-2030 (USD MILLION) (TONS)

15.1 GLOBAL HEAT-TREATED STEEL PLATES MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

15.2 NORTH AMERICA

15.2.1 U.S.

15.2.2 CANADA

15.2.3 MEXICO

15.3 EUROPE

15.3.1 GERMANY

15.3.2 U.K.

15.3.3 ITALY

15.3.4 FRANCE

15.3.5 SPAIN

15.3.6 RUSSIA

15.3.7 SWITZERLAND

15.3.8 TURKEY

15.3.9 BELGIUM

15.3.10 NETHERLANDS

15.3.11 LUXEMBURG

15.3.12 REST OF EUROPE

15.4 ASIA-PACIFIC

15.4.1 JAPAN

15.4.2 CHINA

15.4.3 SOUTH KOREA

15.4.4 INDIA

15.4.5 SINGAPORE

15.4.6 THAILAND

15.4.7 INDONESIA

15.4.8 MALAYSIA

15.4.9 PHILIPPINES

15.4.10 AUSTRALIA & NEW ZEALAND

15.4.11 REST OF ASIA-PACIFIC

15.5 SOUTH AMERICA

15.5.1 BRAZIL

15.5.2 ARGENTINA

15.5.3 REST OF SOUTH AMERICA

15.6 MIDDLE EAST AND AFRICA

15.6.1 SOUTH AFRICA

15.6.2 EGYPT

15.6.3 SAUDI ARABIA

15.6.4 UNITED ARAB EMIRATES

15.6.5 ISRAEL

15.6.6 REST OF MIDDLE EAST AND AFRICA

16 GLOBAL HEAT-TREATED STEEL PLATES MARKET, COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: GLOBAL

16.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

16.3 COMPANY SHARE ANALYSIS: EUROPE

16.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

16.5 MERGERS AND ACQUISITIONS

16.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

16.7 EXPANSIONS

16.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

17 SWOT AND DATA BRIDGE MARKET RESEARCH ANALYSIS

18 GLOBAL HEAT-TREATED STEEL PLATES MARKET – COMPANY PROFILE

18.1 ARCELORMITTAL

18.1.1 COMPANY SNAPSHOT

18.1.2 PRODUCT PORTFOLIO

18.1.3 REVENUE ANALYSIS

18.1.4 RECENT UPDATES

18.2 POSCO

18.2.1 COMPANY SNAPSHOT

18.2.2 PRODUCT PORTFOLIO

18.2.3 REVENUE ANALYSIS

18.2.4 RECENT UPDATES

18.3 VOESTALPINE AG

18.3.1 COMPANY SNAPSHOT

18.3.2 PRODUCT PORTFOLIO

18.3.3 REVENUE ANALYSIS

18.3.4 RECENT UPDATES

18.4 BAOSTEEL GROUP HU

18.4.1 COMPANY SNAPSHOT

18.4.2 PRODUCT PORTFOLIO

18.4.3 REVENUE ANALYSIS

18.4.4 RECENT UPDATES

18.5 NIPPON STEEL CORPORATION

18.5.1 COMPANY SNAPSHOT

18.5.2 PRODUCT PORTFOLIO

18.5.3 REVENUE ANALYSIS

18.5.4 RECENT UPDATES

18.6 UNITED STATES STEEL CORPORATION

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT PORTFOLIO

18.6.3 REVENUE ANALYSIS

18.6.4 RECENT UPDATES

18.7 SAIL

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 REVENUE ANALYSIS

18.7.4 RECENT UPDATES

18.8 TATA STEEL

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 REVENUE ANALYSIS

18.8.4 RECENT UPDATES

18.9 THYSSENKRUPP AG

18.9.1 COMPANY SNAPSHOT

18.9.2 PRODUCT PORTFOLIO

18.9.3 REVENUE ANALYSIS

18.9.4 RECENT UPDATES

18.1 JFE STEEL CORPORATION

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 REVENUE ANALYSIS

18.10.4 RECENT UPDATES

18.11 OUTOKUMPU

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 REVENUE ANALYSIS

18.11.4 RECENT UPDATES

18.12 NLMK

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 REVENUE ANALYSIS

18.12.4 RECENT UPDATES

18.13 ESSAR

18.13.1 COMPANY SNAPSHOT

18.13.2 PRODUCT PORTFOLIO

18.13.3 REVENUE ANALYSIS

18.13.4 RECENT UPDATES

18.14 AM/NS INDIA

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT PORTFOLIO

18.14.3 REVENUE ANALYSIS

18.14.4 RECENT UPDATES

18.15 JSW

18.15.1 COMPANY SNAPSHOT

18.15.2 PRODUCT PORTFOLIO

18.15.3 REVENUE ANALYSIS

18.15.4 RECENT UPDATES

18.16 JINDAL STEEL & POWER LIMITED

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 REVENUE ANALYSIS

18.16.4 RECENT UPDATES

18.17 METINVEST

18.17.1 COMPANY SNAPSHOT

18.17.2 PRODUCT PORTFOLIO

18.17.3 REVENUE ANALYSIS

18.17.4 RECENT UPDATES

18.18 HYUNDAI STEEL

18.18.1 COMPANY SNAPSHOT

18.18.2 PRODUCT PORTFOLIO

18.18.3 REVENUE ANALYSIS

18.18.4 RECENT UPDATES

18.19 APERAM

18.19.1 COMPANY SNAPSHOT

18.19.2 PRODUCT PORTFOLIO

18.19.3 REVENUE ANALYSIS

18.19.4 RECENT UPDATES

18.2 CHINASTEEL

18.20.1 COMPANY SNAPSHOT

18.20.2 PRODUCT PORTFOLIO

18.20.3 REVENUE ANALYSIS

18.20.4 RECENT UPDATES

19 CONCLUSION

20 QUESTIONNAIRE

21 RELATED REPORTS

22 ABOUT DATA BRIDGE MARKET RESEARCH

Global Heat Treated Steel Plates Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Heat Treated Steel Plates Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Heat Treated Steel Plates Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.