Global Heated Razor Starter Kits Market

Market Size in USD Million

CAGR :

%

USD

333.01 Million

USD

495.76 Million

2024

2032

USD

333.01 Million

USD

495.76 Million

2024

2032

| 2025 –2032 | |

| USD 333.01 Million | |

| USD 495.76 Million | |

|

|

|

|

Heated Razor Starter Kits Market Size

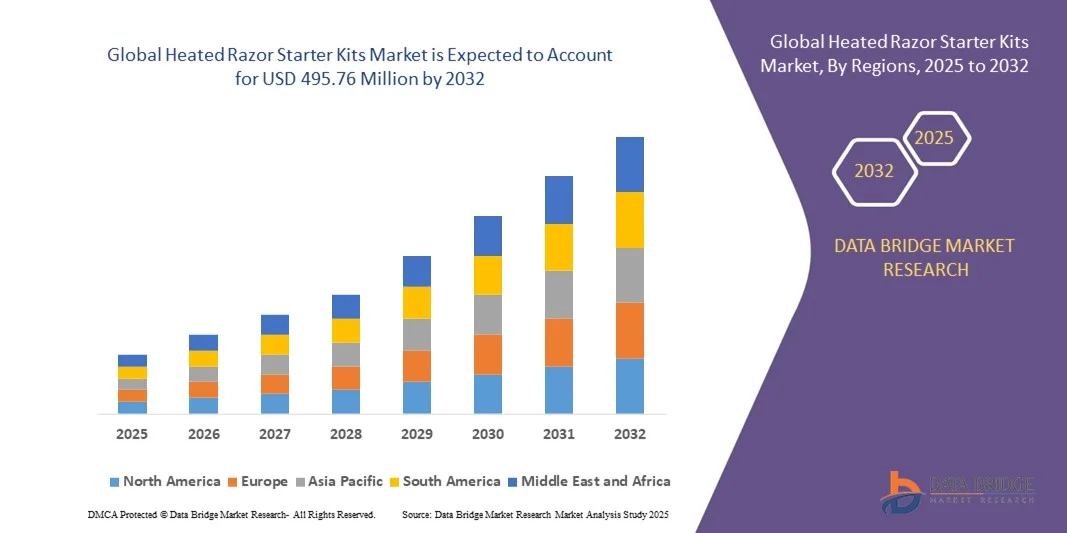

- The global heated razor starter kits market size was valued at USD 333.01 million in 2024 and is expected to reach USD 495.76 million by 2032, at a CAGR of 5.10% during the forecast period

- The market growth is largely fueled by increasing consumer awareness of personal grooming, rising demand for premium shaving experiences, and the integration of advanced heating technologies in razors. These innovations provide smoother, skin-friendly shaving and enhance user comfort, driving higher adoption of heated razor starter kits across adults and teenagers

- Furthermore, growing e-commerce penetration, direct-to-consumer subscription models, and expanding offline retail availability are making heated razor starter kits more accessible to a broader audience. These converging factors are accelerating product adoption, boosting market growth, and encouraging brands to introduce feature-rich, technologically advanced grooming solutions

Heated Razor Starter Kits Market Analysis

- Heated razor starter kits, offering advanced temperature-controlled shaving solutions, ergonomic designs, and enhanced skin comfort, are becoming essential grooming tools for adults and tech-savvy consumers seeking convenience, efficiency, and premium grooming experiences

- The escalating demand for these kits is primarily fueled by rising disposable incomes, increased interest in self-care routines, and growing consumer preference for products that combine functionality with skin-friendly technology. The market is further driven by innovations such as rechargeable units, adjustable heat settings, and bundled starter kits that enhance overall consumer satisfaction

- North America dominated heated razor starter kits market with a share of 32.1% in 2024, due to rising awareness of personal grooming, premium shaving routines, and increasing disposable incomes

- Asia-Pacific is expected to be the fastest growing region in the heated razor starter kits market during the forecast period due to increasing urbanization, rising disposable incomes, and growing grooming awareness in countries such as China, Japan, and India

- Adults segment dominated the market with a market share of 52.8% in 2024, due to the growing grooming awareness and premium shaving routines among working professionals. Adults increasingly prefer heated razors for their skin-friendly features, smoother shaving experience, and time efficiency in daily grooming. The availability of advanced features such as adjustable heat settings, ergonomic designs, and rechargeable systems further boosts adoption in this segment. In addition, marketing campaigns targeting adult consumers and endorsements by grooming influencers have reinforced trust and demand. Adults also represent a consistent and high-spending consumer base, which strengthens the market share of this segment. The compatibility of heated razors with various skin types and shaving needs further solidifies their dominance

Report Scope and Heated Razor Starter Kits Market Segmentation

|

Attributes |

Heated Razor Starter Kits Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Heated Razor Starter Kits Market Trends

Growing Use of Tech-Enabled, Skin-Friendly Heated Razors

- The market for heated razor starter kits is growing rapidly as consumers increasingly seek technologically advanced grooming solutions that combine comfort, efficiency, and luxury. Heated razors integrate precise temperature control features to mimic the soothing warmth of a traditional barbershop experience, enhancing skin comfort and reducing irritation during shaving

- For instance, Gillette, a brand under Procter & Gamble, pioneered the heated razor segment with the launch of the GilletteLabs Heated Razor. This product integrates stainless steel warming bars that maintain consistent heat throughout the shaving process, transforming the grooming routine into a premium, spa-like experience for consumers globally

- The growing appeal of smart grooming devices equipped with sensors, rechargeable batteries, and ergonomic designs is redefining the shaving segment. These innovations focus on personalized comfort by delivering an even heat distribution that softens facial hair and minimizes razor drag, offering a smoother and safer shave

- Rising awareness surrounding skin sensitivity and irritation reduction is encouraging the adoption of heated razors that combine advanced temperature regulation with moisture retention technology. As consumers gravitate toward self-care and professional home grooming setups, heated razors are positioned as the next evolution in men’s grooming accessories

- The expansion of e-commerce has accelerated the distribution of technologically advanced grooming devices across multiple regions. Online platforms enable consumers to compare performance, read reviews, and access premium starter kits combining heated razors with specialized gels, blades, and charging stations

- This overall trend toward innovation-driven grooming is transforming consumer perception of shaving from a routine task to a personalized experience. Heated razor starter kits exemplify this shift, merging technology, style, and functionality to meet the growing demand for comfort and sophistication in daily grooming essentials

Heated Razor Starter Kits Market Dynamics

Driver

Rising Demand for Premium and Convenient Shaving Experiences

- The increasing consumer preference for premium and time-efficient grooming experiences is driving the demand for heated razor starter kits. These products offer a distinctive value proposition by merging advanced engineering with the promise of enhanced comfort and precision, appealing particularly to professionals and urban consumers with busy lifestyles

- For instance, Philips and Gillette have both invested heavily in developing temperature-controlled electric razors catering to consumers seeking salon-grade grooming results at home. Their marketing strategies highlight the combination of comfort, design, and longevity as essential factors that justify their premium positioning

- The pursuit of convenience and superior quality has elevated consumer expectations in the grooming category. Heated razor starter kits provide instant warmth without requiring additional accessories such as hot towels or pre-shave treatments, effectively simplifying the grooming process while maintaining a luxurious feel

- In addition, the rising trend of male self-care and skincare awareness is contributing significantly to the growth of this category. Men are increasingly viewing grooming tools as lifestyle accessories that reflect personal care and modern aesthetics

- The ongoing innovation in razor blade materials, ergonomic handle designs, and long-lasting battery performance is broadening the appeal of heated razors. As a result, this segment continues to gain traction among consumers seeking both technological innovation and refined grooming experiences

Restraint/Challenge

High Cost Limiting Adoption in Emerging Markets

- The relatively high cost of heated razor starter kits serves as a key restraint to their widespread adoption, particularly across emerging markets. Advanced components such as temperature regulation modules, rechargeable lithium-ion batteries, and precision-engineered blades contribute to a pricing structure that can deter price-sensitive consumers

- For instance, the GilletteLabs Heated Razor is positioned in the premium category, often priced significantly higher than conventional electric or manual razors. In developing regions such as Southeast Asia and Latin America, where grooming spending per capita remains lower, this price disparity limits market penetration potential

- The maintenance and replacement costs associated with cartridges and specialized heating elements further add to long-term ownership expenses. Consumers accustomed to inexpensive disposable razors may hesitate to switch to high-cost alternatives lacking immediate functional necessity

- Market penetration is also influenced by limited retail availability and underdeveloped aftersales service networks in several emerging economies. This restricts consumer access to warranty coverage, replacement parts, and reliable maintenance support

- To overcome these cost-related barriers, manufacturers are expected to focus on cost optimization, modular product design, and localized production. As affordability improves through technological scaling and competitive pricing strategies, the adoption of heated razor starter kits is anticipated to expand gradually across both developed and emerging markets

Heated Razor Starter Kits Market Scope

The market is segmented on the basis of application and distribution channel.

- By Application

On the basis of application, the heated razor starter kits market is segmented into elderly, adults, and teenagers. The adults segment dominated the market with the largest revenue share of 52.8% in 2024, driven by the growing grooming awareness and premium shaving routines among working professionals. Adults increasingly prefer heated razors for their skin-friendly features, smoother shaving experience, and time efficiency in daily grooming. The availability of advanced features such as adjustable heat settings, ergonomic designs, and rechargeable systems further boosts adoption in this segment. In addition, marketing campaigns targeting adult consumers and endorsements by grooming influencers have reinforced trust and demand. Adults also represent a consistent and high-spending consumer base, which strengthens the market share of this segment. The compatibility of heated razors with various skin types and shaving needs further solidifies their dominance.

The elderly segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising awareness of skin sensitivity and convenience in grooming routines. For instance, companies such as Philips have introduced heated razors designed specifically for older users, offering gentle trimming and easy handling. Growing health-conscious trends among the elderly and the desire for comfortable shaving solutions contribute to adoption. Heated razors in this segment often feature safety mechanisms and simplified controls to reduce the risk of cuts or irritation. The shift towards self-care and grooming independence in elderly populations also drives market expansion. Furthermore, online tutorials and educational campaigns highlighting benefits for older consumers enhance visibility and preference. The growing demand from elderly users represents a promising growth opportunity in emerging and developed markets.

- By Distribution Channel

On the basis of distribution channel, the heated razor starter kits market is segmented into offline retail stores and online. The offline retail stores segment dominated the market in 2024, driven by consumers’ preference for physically inspecting products before purchase and receiving personalized advice from store staff. In-store experiences provide an opportunity for consumers to evaluate the ergonomic design, heat settings, and build quality of razors before purchase. Established retail chains and grooming specialty stores contribute to wide product availability and customer trust. Offline channels also allow consumers to avail of immediate product replacement and after-sales services, which enhances buyer confidence. Promotions, in-store demos, and loyalty programs further strengthen sales through offline stores. The physical presence of brands in prominent retail outlets reinforces market dominance.

The online segment is expected to witness the fastest CAGR from 2025 to 2032, driven by convenience, wider product variety, and attractive pricing offers. For instance, Amazon and other e-commerce platforms provide easy comparison of features, customer reviews, and doorstep delivery, accelerating consumer adoption. Online sales are further supported by growing digital payment penetration and increasing smartphone usage. Brands are leveraging targeted social media campaigns, subscription models, and exclusive online launches to capture younger, tech-savvy consumers. The ability to access niche models, bundles, and starter kits online enhances market appeal. Rapid logistical networks and efficient return policies further encourage online purchases. The increasing trust in e-commerce platforms ensures this segment continues to grow at a faster pace.

Heated Razor Starter Kits Market Regional Analysis

- North America dominated the heated razor starter kits market with the largest revenue share of 32.1% in 2024, driven by rising awareness of personal grooming, premium shaving routines, and increasing disposable incomes

- Consumers in the region highly value convenience, advanced heating technology, and ergonomic designs that enhance the shaving experience. This widespread adoption is further supported by a technologically inclined population and growing preference for high-quality, time-saving grooming products

- In addition, marketing campaigns, influencer endorsements, and in-store experiences are reinforcing the popularity of heated razors across adult and teenage segments. The presence of leading brands and easy access to offline and online retail channels further strengthens market dominance

U.S. Heated Razor Starter Kits Market Insight

The U.S. market captured the largest revenue share in North America in 2024, fueled by rapid adoption of advanced grooming tools and a strong focus on self-care and personal wellness. Consumers increasingly prefer heated razor starter kits for smoother shaving, skin-friendly designs, and enhanced convenience. The growing trend of online purchases, subscription models, and product bundles is further propelling market growth. In addition, brand awareness and celebrity/influencer endorsements significantly influence buying behavior. The demand for multi-functional kits offering adjustable heat settings, rechargeable batteries, and ergonomic designs is expanding across adult and teenage users.

Europe Heated Razor Starter Kits Market Insight

The Europe market is projected to grow at a steady CAGR during the forecast period, driven by rising grooming consciousness and increasing disposable incomes. Urbanization and a high focus on personal care routines are promoting the adoption of heated razor kits. European consumers value product safety, skin-friendly technologies, and high-quality materials in shaving tools. The region is experiencing growth across retail and online distribution channels, with consumers preferring both premium and mid-range starter kits. In addition, sustainability initiatives and eco-friendly product designs are gaining importance in purchasing decisions.

U.K. Heated Razor Starter Kits Market Insight

The U.K. market is anticipated to expand at a notable CAGR, driven by increasing awareness of personal grooming and a desire for convenient, efficient shaving solutions. Concerns regarding skin sensitivity and irritation are encouraging consumers to adopt heated razor starter kits. The growth of e-commerce platforms, coupled with strong offline retail networks, facilitates easy access to a wide range of products. Consumers are increasingly choosing kits offering multiple accessories, adjustable heat levels, and ergonomic designs. The popularity of premium grooming brands further strengthens market expansion in the region.

Germany Heated Razor Starter Kits Market Insight

The Germany market is expected to grow at a significant CAGR during the forecast period, fueled by rising interest in personal grooming, innovative product features, and high-quality standards. Consumers prioritize durable, skin-friendly razors with advanced heating technologies. Germany’s focus on sustainability and eco-conscious consumption supports the adoption of rechargeable, reusable starter kits. Availability through both offline retail and online channels enhances accessibility and convenience. The growing preference for premium grooming products in urban areas is further boosting market penetration.

Asia-Pacific Heated Razor Starter Kits Market Insight

The Asia-Pacific market is poised to grow at the fastest CAGR from 2025 to 2032, driven by increasing urbanization, rising disposable incomes, and growing grooming awareness in countries such as China, Japan, and India. Consumers in the region are showing a strong inclination toward technologically advanced, convenient shaving solutions. The expansion of e-commerce platforms and online marketing campaigns is facilitating wider reach. Emerging economies in APAC are witnessing increasing adoption of premium personal care products, supported by affordable product options and local manufacturing. Younger consumers and working adults are driving demand, further propelling market growth.

Japan Heated Razor Starter Kits Market Insight

The Japan market is gaining momentum due to the country’s high focus on personal grooming, technological adoption, and convenience-driven lifestyle. Japanese consumers prioritize safety, skin-friendly designs, and compact, easy-to-use starter kits. The integration of smart heating technology and ergonomic features enhances user experience. Growth is driven by urban adults and teenagers seeking high-quality grooming solutions. In addition, strong online retail infrastructure and e-commerce platforms are increasing accessibility and adoption rates.

China Heated Razor Starter Kits Market Insight

The China market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, rising disposable incomes, and increasing awareness of personal grooming. Heated razor starter kits are gaining popularity across adults and teenagers due to convenience, efficiency, and skin-friendly designs. The region’s expanding middle class and preference for premium grooming products are fueling adoption. Availability of affordable options, strong domestic manufacturers, and active e-commerce channels are key factors supporting market growth. Government initiatives promoting modern lifestyle products and digital marketing campaigns further enhance product visibility and penetration.

Heated Razor Starter Kits Market Share

The heated razor starter kits industry is primarily led by well-established companies, including:

- GilletteLabs (U.S.)

- Philips (Netherlands)

- Braun (Germany)

- Remington (U.S.)

- Wahl (U.S.)

- Andis (U.S.)

- BaByliss (France)

- MANGROOMER (U.S.)

- Bevel (U.S.)

- Harry’s (U.S.)

- Schick (U.S.)

- BIC (France)

- Dorco (South Korea)

- Feather (Japan)

- Merkur (Germany)

Latest Developments in Global Heated Razor Starter Kits Market

- In May 2025, Groomie secured a US$2 million media-for-equity investment from Mercurius Media Capital, enabling the brand to scale its direct-to-consumer grooming offerings and expand its national presence. This development reflects growing investor confidence in the heated razor starter kit segment and signals an intensifying competitive landscape, with niche players increasingly entering the market and challenging established brands. The funding also allows Groomie to innovate faster, expand its product range, and implement stronger marketing campaigns targeting younger, tech-savvy consumers

- In October 2023, Unilever announced the sale of its majority stake in Dollar Shave Club to private-equity investors, reflecting a strategic shift in the men’s grooming market. This move indirectly benefits premium and heated razor brands by reducing overlap in the subscription-based and starter kit segments, allowing legacy brands to concentrate on innovation and product differentiation. The exit also reshapes competitive dynamics, giving room for smaller and mid-sized companies to capture market share in the heated razor category

- In September 2021, GilletteLabs partnered with Bugatti to launch the “GilletteLabs | Bugatti Special Edition Heated Razor,” combining luxury design with advanced heating technology. This collaboration elevated consumer expectations for premium grooming devices and reinforced the concept of lifestyle-focused, tech-enabled grooming. The partnership also highlighted the potential for co-branding to position heated razors as aspirational products, attracting high-income consumers seeking both performance and design

- In November 2020, GilletteLabs introduced holiday gifting bundles around its heated razor, partnering with lifestyle brands to expand the product’s reach beyond traditional grooming audiences. This initiative enhanced the product’s visibility in the market, established heated razors as premium gifting options, and promoted cross-industry marketing strategies. It also demonstrated how bundled offerings could increase consumer engagement, strengthen brand loyalty, and encourage repeat purchases in the heated starter kit segment

- In October 2020, GilletteLabs launched its heated razor in the UAE, introducing its warming-bar technology to the Middle Eastern market. This geographic expansion increased regional accessibility, diversified the consumer base, and positioned heated razors as globally relevant personal care solutions. The launch reinforced the importance of tapping into emerging markets with high disposable income and growing grooming awareness, setting the stage for further international growth

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.