Global Hemato Oncology Testing Market

Market Size in USD Billion

CAGR :

%

USD

8.13 Billion

USD

14.83 Billion

2024

2032

USD

8.13 Billion

USD

14.83 Billion

2024

2032

| 2025 –2032 | |

| USD 8.13 Billion | |

| USD 14.83 Billion | |

|

|

|

|

Hemato Oncology Testing Market Size

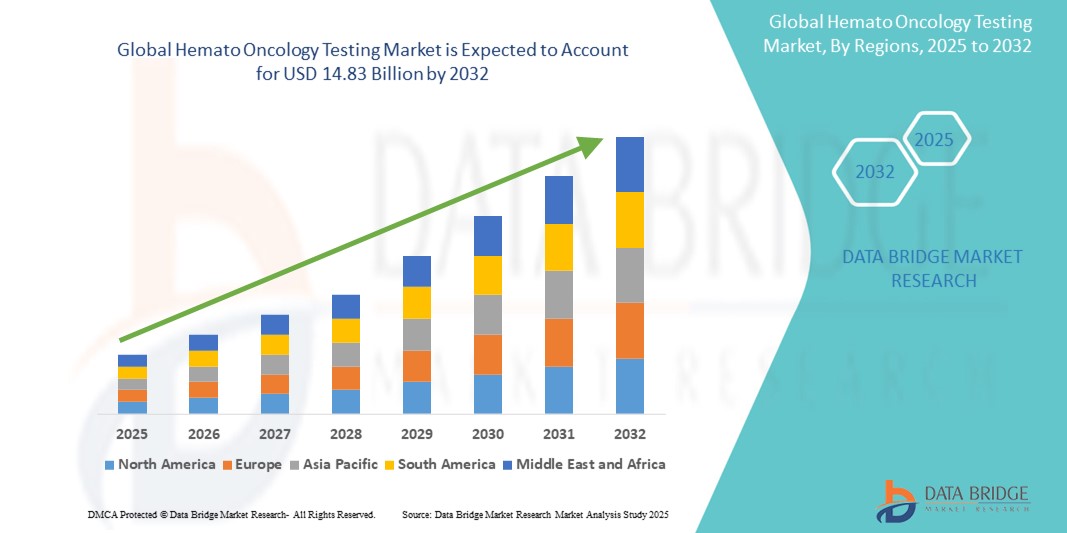

- The global hemato oncology testing market was valued at USD 8.13 billion in 2024 and is expected to reach USD 14.83 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 7.80% , primarily driven by the rising incidence of blood cancers

- This growth is driven by factors such as rising incidence of blood cancers, advancements in genomic technologies and supportive government & research funding

Hemato Oncology Testing Market Analysis

- Hemato-oncology testing plays a vital role in diagnosing and monitoring blood cancers such as leukemia, lymphoma, and myeloma. These tests are essential for identifying genetic mutations, determining disease subtypes, and guiding personalized treatment strategies

- The market is primarily driven by the rising global incidence of hematologic malignancies and growing demand for early and precise diagnostic tools. Technological advancements in molecular diagnostics, such as next-generation sequencing (NGS), flow cytometry, and PCR—are further accelerating adoption

- North America emerges as a leading region in the hemato-oncology testing market, attributed to its robust healthcare infrastructure, extensive R&D activities, and high awareness among healthcare providers

- For instance, the U.S. sees a growing number of hematologic cancers diagnoses annually, prompting widespread use of genetic and biomarker testing across major hospitals, research institutions, and diagnostic laboratories

- Globally, hemato-oncology testing is considered one of the most crucial components in cancer diagnostics. Its role is central to enabling precision oncology, improving patient outcomes, and supporting the shift toward value-based healthcare solutions

Report Scope and Hemato Oncology Testing Market Segmentation

|

Attributes |

Hemato Oncology Testing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Hemato Oncology Testing Market Trends

“Advancements in Molecular Diagnostics and Integration of Genomic Data for Personalized Cancer Care”

- A key trend in the hemato-oncology testing market is the rapid advancement in molecular diagnostic technologies, particularly the integration of next-generation sequencing (NGS), digital PCR, and high-throughput genomic platforms

- These technologies enable high-resolution detection of genetic mutations, chromosomal rearrangements, and minimal residual disease, significantly improving the precision and sensitivity of blood cancer diagnostics

- For instance, NGS panels tailored for hematologic malignancies now offer comprehensive mutation profiling, supporting risk stratification, therapy selection, and monitoring of treatment response, especially in conditions like acute myeloid leukemia and chronic lymphocytic leukemia

- The use of integrated genomic data is also enhancing personalized treatment approaches, allowing clinicians to tailor therapies based on a patient’s unique genetic landscape. This is further supported by the rise of companion diagnostics and real-time molecular monitoring

- These innovations are revolutionizing the hemato-oncology landscape by facilitating early diagnosis, optimizing therapeutic outcomes, and driving the global demand for sophisticated, data-driven diagnostic solutions in hematologic cancers

Hemato Oncology Testing Market Dynamics

Driver

“Rising Incidence of Hematologic Malignancies and the Shift Toward Precision Medicine”

- The increasing global burden of hematologic cancers such as leukemia, lymphoma, and multiple myeloma is a primary driver for the growing demand for hemato-oncology testing. These conditions require accurate and timely diagnosis for effective treatment planning and monitoring

- The World Health Organization (WHO) reports a steady rise in blood cancer cases worldwide, with non-Hodgkin lymphoma and leukemia ranking among the top ten most common cancers in many regions. This rising disease prevalence necessitates advanced testing solutions that can identify genetic mutations, chromosomal abnormalities, and other molecular markers crucial for diagnosis and prognosis

- The growing shift toward precision medicine has further highlighted the need for molecular and genetic testing in hemato-oncology. These tests enable the selection of targeted therapies based on a patient’s unique genetic profile, improving treatment efficacy and minimizing side effects

- Technological advancements such as next-generation sequencing (NGS), digital PCR, and flow cytometry have enhanced the accuracy and depth of cancer profiling, enabling early disease detection, minimal residual disease monitoring, and relapse prediction

- As the focus shifts to personalized and data-driven oncology care, healthcare systems, research institutions, and pharmaceutical companies are increasingly adopting hemato-oncology testing to guide clinical decisions and improve patient outcomes

For instance,

- In September 2023, BioSpace reported that nearly every 3 minutes, one person in the U.S. is diagnosed with a blood cancer. This rising incidence is pushing forward the demand for comprehensive diagnostic testing solutions that support tailored treatment strategies.

- As a result, the expanding prevalence of blood cancers and the emphasis on personalized treatment pathways are significantly driving the global hemato-oncology testing market, fostering innovation and adoption of cutting-edge diagnostic tools

Opportunity

“Transforming Hemato-Oncology Testing Through Artificial Intelligence”

- The integration of artificial intelligence (AI) and big data analytics in hemato-oncology testing presents a transformative opportunity to enhance diagnostic accuracy, streamline data interpretation, and support personalized treatment strategies for blood cancers

- AI algorithms can analyze complex genomic, transcriptomic, and proteomic data from hemato-oncology tests with high speed and precision, enabling faster identification of mutations, risk stratification, and therapy recommendations based on real-world evidence

- Additionally, AI-driven tools can assist pathologists and oncologists in interpreting large-scale molecular datasets, tracking disease progression, predicting relapse, and identifying minimal residual disease, thereby improving clinical decision-making and patient management

For instance,

- In January 2025, according to an article published by NCBI, A systematic review and meta-analysis revealed that AI models demonstrate high accuracy and sensitivity in identifying true-positive AML cases. This highlights a promising opportunity for AI-driven diagnostics in hemato-oncology

- In June 2020, as per the article published by NCBI, AI is transforming hemato-oncology testing, as shown by survival prediction models like RSF, which achieved the best performance with a C-index of 0.798 and IBS of 0.099 in fivefold cross-validation. The immunomodulator group showed superior survival outcomes, highlighting AI's potential to guide treatment strategies. Optimized resampling methods further enhance model accuracy, supporting personalized patient care

- By integrating AI and big data into hemato-oncology testing, healthcare providers can accelerate diagnostic workflows, reduce human error, and enhance patient outcomes. This trend represents a major opportunity to advance personalized cancer care and expand access to high-quality diagnostics across global markets

Restraint/Challenge

“High Cost and Limited Accessibility of Advanced Diagnostic Technologies”

- One of the major challenges in the global hemato-oncology testing market is the high cost associated with advanced diagnostic technologies such as next-generation sequencing (NGS), flow cytometry, and multiplex PCR, which limits accessibility—particularly in low- and middle-income countries

- The implementation of these cutting-edge tools often requires significant investment in specialized equipment, trained personnel, and laboratory infrastructure, making it difficult for smaller healthcare facilities and rural centers to offer such tests

- Additionally, the lack of standardized testing protocols and inconsistent reimbursement policies across regions further hinder the widespread adoption of these diagnostics, creating disparities in cancer care

For instance,

- In January 2022, according to the article published by NCBI, Low- and middle-income countries (LMICs) face a disproportionate burden of cancer-related deaths, largely due to the lack of accessible pathology and diagnostic services. This gap leads to delayed, incomplete, or inaccurate diagnoses, limiting timely treatment. Such disparities underscore a key challenge for the hemato-oncology testing market, as limited infrastructure restricts the reach of advanced diagnostic solution

- These limitations present a significant restraint to market growth, as they prevent timely and equitable access to life-saving hemato-oncology testing, particularly in underserved populations—posing a barrier to achieving global advancements in cancer diagnostics

Hemato Oncology Testing Market Scope

The market is segmented on the basis product and services, cancer type, technology and end user.

|

Segmentation |

Sub-Segmentation |

|

By Product and Services |

|

|

By Cancer Type |

|

|

By Technology |

|

|

By End User

|

|

Hemato Oncology Testing Market Regional Analysis

“North America is the Dominant Region in the Hemato Oncology Testing Market”

- North America leads the global hemato-oncology testing market, supported by a well-established healthcare system, widespread adoption of advanced molecular diagnostics, and the strong presence of leading biotechnology and diagnostic companies

- The U.S. contributes significantly to regional dominance due to the high incidence of blood cancers, increasing awareness about early cancer detection, and growing use of personalized medicine approaches

- Robust R&D activities, favorable reimbursement structures, and government funding for cancer research, through organizations like the National Cancer Institute—further bolster market growth

- The increasing adoption of next-generation sequencing (NGS), liquid biopsy, and companion diagnostics in both clinical and research settings is enhancing diagnostic accuracy and treatment outcomes, driving continued expansion across the region

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to experience the fastest growth in the hemato-oncology testing market, driven by a rising burden of hematologic cancers, expanding healthcare access, and growing investment in advanced diagnostic technologies

- Countries like China, India, and Japan are emerging as major markets due to increasing cancer incidence, a growing aging population, and greater awareness of genetic and molecular testing options

- Japan, with its established diagnostic infrastructure and early adoption of precision oncology tools, remains a key market for hemato-oncology testing, especially in academic and hospital-based laboratories

- In China and India, rapid improvements in healthcare infrastructure, the availability of cost-effective diagnostic solutions, and growing collaborations with international diagnostic companies are supporting market growth. Additionally, increasing government efforts in cancer screening and research are helping make advanced testing more accessible to a larger population

Hemato Oncology Testing Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- F. Hoffmann-La Roche Ltd (Switzerland)

- Abbott (U.S.)

- QIAGEN (Netherlands)

- Thermo Fisher Scientific (U.S.)

- Illumina, Inc. (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- MolecularMD (U.S.)

- ArcherDx, Inc. (U.S.)

- ARUP Laboratories (U.S.)

- Invivoscribe, Inc. (U.S.)

- CORE Diagnostics (India)

- Genoptix, Inc. (U.S.)

- GenPath (U.S.)

- NeoGenomics Laboratories, Inc. (U.S.)

- Siemens Healthineers (Germany)

Latest Developments in Global Hemato Oncology Testing Market

- In June 2022, Thermo Fisher Scientific Inc. expanded its extensive line of automated connective tissue disease tests by releasing the new EliA RNA Pol III and EliA Rib-P blood tests to assist in the diagnosis of Systemic Sclerosis and Systemic Lupus Erythematosus (SLE)

- In May 2020, The DxH 690T haematology analyzer was introduced by Beckman Coulter, a division of Danaher Corporation, in the United States. It enables mid-volume laboratories to optimise uptime and streamline workflow

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.