Global Hematology Analyzer Market

Market Size in USD Billion

CAGR :

%

USD

6.00 Billion

USD

8.34 Billion

2025

2033

USD

6.00 Billion

USD

8.34 Billion

2025

2033

| 2026 –2033 | |

| USD 6.00 Billion | |

| USD 8.34 Billion | |

|

|

|

|

Hematology Analyser Market Size

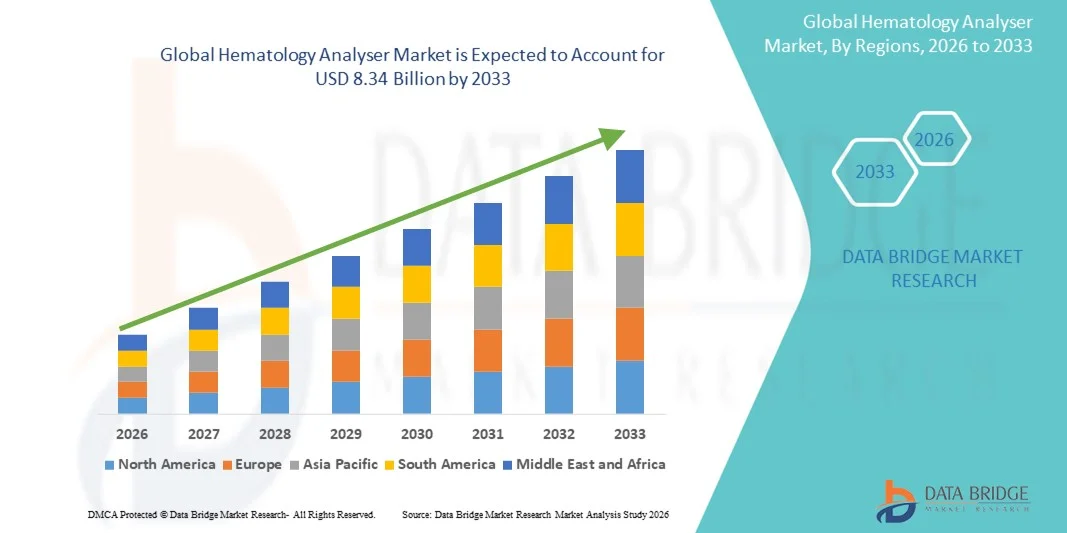

- The global hematology analyser market size was valued at USD 6.00 billion in 2025 and is expected to reach USD 8.34 billion by 2033, at a CAGR of 4.20% during the forecast period

- The market growth is largely fueled by the increasing prevalence of blood-related disorders, rising demand for early disease diagnosis, and technological advancements in automated and point-of-care hematology analysers, leading to improved efficiency and accuracy in clinical diagnostics

- Furthermore, growing investments in healthcare infrastructure, coupled with the rising adoption of advanced laboratory solutions in hospitals, clinics, and diagnostic centers, are positioning hematology analysers as essential diagnostic tools. These converging factors are accelerating the uptake of hematology analyser solutions, thereby significantly boosting the industry's growth

Hematology Analyser Market Analysis

- Hematology analysers, providing automated or semi-automated blood testing and analysis, are increasingly vital components of modern clinical laboratories and diagnostic workflows in hospitals, clinics, and research centers due to their enhanced accuracy, speed, and ability to handle high sample volumes

- The escalating demand for hematology analysers is primarily fueled by the rising prevalence of blood-related disorders, increasing awareness of preventive healthcare, and a growing need for rapid and reliable diagnostic results

- North America dominated the hematology analyser market with the largest revenue share of 39.6% in 2025, characterized by advanced healthcare infrastructure, high adoption of automated laboratory solutions, and a strong presence of leading diagnostic equipment manufacturers, with the U.S. experiencing substantial growth in hospital and laboratory installations, driven by innovations in flow cytometry, digital microscopy, and point-of-care testing

- Asia-Pacific is expected to be the fastest-growing region in the hematology analyser market during the forecast period due to rising healthcare investments, increasing laboratory automation, and growing awareness about early disease diagnosis

- Hematology products and services segment dominated the market with a market share of 44.8% in 2025, driven by their widespread use in routine blood analysis, chronic disease management, and early detection of hematological disorders across hospitals, diagnostic centers, and research institutions

Report Scope and Hematology Analyser Market Segmentation

|

Attributes |

Hematology Analyser Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Hematology Analyser Market Trends

Advancements in Automation and AI-Driven Diagnostics

- A significant and accelerating trend in the global hematology analyser market is the integration of advanced automation and artificial intelligence (AI) in diagnostic workflows, enhancing accuracy, throughput, and laboratory efficiency

- For instance, Sysmex XN-Series analysers utilize AI-driven algorithms to flag abnormal blood cell morphologies, assisting lab technicians in faster decision-making and reducing manual errors

- AI integration in hematology analysers enables predictive insights, such as suggesting potential hematological disorders based on historical patient data and improving anomaly detection in blood samples. For instance, Abbott’s CELL-DYN analysers incorporate AI to enhance flagging of abnormal cells and streamline workflow prioritization

- The seamless integration of hematology analysers with laboratory information systems (LIS) and hospital data platforms facilitates centralized management of test results, sample tracking, and reporting, enabling more coordinated clinical decision-making

- This trend toward intelligent, automated, and interconnected diagnostic systems is fundamentally transforming laboratory operations. Consequently, companies such as Beckman Coulter are developing AI-enabled hematology analysers capable of advanced cell classification, predictive alerts, and integration with digital hospital systems

- The demand for hematology analysers offering automation, AI-based insights, and LIS connectivity is growing rapidly across hospital and research laboratories, as healthcare providers prioritize efficiency, accuracy, and early disease detection

- There is an increasing trend of miniaturized and point-of-care hematology analysers that allow rapid blood testing at remote or decentralized locations, improving accessibility and timely clinical decision-making. For instance, Horiba’s ABX Pentra portable systems are enabling on-site blood diagnostics in smaller clinics and emergency settings

Hematology Analyser Market Dynamics

Driver

Rising Prevalence of Blood Disorders and Growing Diagnostic Needs

- The increasing prevalence of anemia, leukemia, and other blood disorders, coupled with rising awareness of preventive healthcare, is a significant driver for the heightened demand for hematology analysers

- For instance, in March 2025, Siemens Healthineers announced the launch of the ADVIA 2120i with enhanced workflow automation, aiming to improve diagnostic efficiency in hospitals and clinical laboratories

- As healthcare providers focus on early diagnosis and monitoring of hematological conditions, hematology analysers offer rapid, reliable, and standardized results, providing a critical upgrade over manual blood testing methods

- Furthermore, the growing number of hospital laboratories, diagnostic centers, and research institutes is increasing the adoption of automated hematology analysers to meet rising sample volumes and throughput requirements

- The need for integrated, high-throughput testing, coupled with advanced reporting and sample management capabilities, is propelling the adoption of hematology analysers in clinical, commercial, and academic laboratories globally

- Technological advancements such as multi-parameter testing and integration of immunohematology features are further driving demand, enabling comprehensive blood analysis in a single platform. For instance, Beckman Coulter’s DxH series combines multiple testing modalities to reduce turnaround time

- Increasing government and private healthcare initiatives promoting early disease screening and preventive diagnostics are also boosting the adoption of hematology analysers, especially in emerging markets. For instance, several public health programs in India and Brazil are investing in automated blood testing infrastructure for rural and urban hospitals

Restraint/Challenge

High Cost of Advanced Analysers and Regulatory Compliance Hurdles

- The relatively high cost of advanced hematology analysers and consumables can be a significant barrier to adoption, particularly in developing regions or smaller laboratories with limited budgets

- For instance, high-end analysers with integrated AI and LIS connectivity from companies such as Beckman Coulter or Sysmex are often priced significantly higher than mid-range models, limiting penetration in cost-sensitive markets

- Regulatory requirements and stringent quality standards for medical devices pose additional challenges for manufacturers seeking market approval in multiple regions, potentially delaying product launches. For instance, delays in FDA or CE certification can affect the introduction of new analyser models in key markets

- Addressing these challenges through the development of cost-effective analysers, modular solutions, and simplified compliance pathways is crucial for expanding adoption

- While prices are gradually decreasing and more mid-range options are emerging, the premium for high-end, fully automated hematology analysers can still hinder widespread adoption, particularly for small clinics and research labs

- Overcoming these challenges through pricing strategies, regulatory support, and awareness programs on clinical benefits will be vital for sustained market growth

- Limited technical expertise in smaller or decentralized laboratories can also restrict the optimal utilization of advanced analysers, making training and support essential for adoption. For instance, some regional labs rely on vendor-provided training programs to operate sophisticated Sysmex or Abbott systems effectively

Hematology Analyser Market Scope

The market is segmented on the basis of products and services, price range, and end-user.

- By Products and Services

On the basis of products and services, the market is segmented into hematology products and services, haemostasis products and services, and immunohematology products and services. The Hematology Products and Services segment dominated the market with the largest market revenue share of 44.8% in 2025, driven by its essential role in routine blood analysis, diagnosis of anemia, infections, and blood disorders. Hospitals and diagnostic centers heavily rely on these analysers due to their ability to deliver fast, accurate, and high-throughput results, which are crucial for both emergency and routine testing. The segment’s dominance is further supported by continuous technological upgrades, including automation, AI-enabled cell counting, and multi-parameter testing, which enhance laboratory efficiency and reduce human error. Rising awareness about preventive healthcare and early disease detection also contributes to sustained demand. In addition, Hematology Products and Services have wide compatibility with laboratory information systems, allowing seamless integration in clinical workflows.

The Haemostasis Products and Services segment is anticipated to witness the fastest growth rate from 2026 to 2033, driven by increasing prevalence of clotting disorders and cardiovascular diseases. These analysers are critical for monitoring blood coagulation parameters, guiding anticoagulant therapy, and detecting conditions such as hemophilia or deep vein thrombosis. Growth in this segment is fueled by technological innovations, including point-of-care and fully automated haemostasis analysers, which provide faster results and improve patient management. Emerging markets are witnessing heightened adoption as hospitals and diagnostic centers upgrade their laboratory infrastructure. In addition, collaborations between manufacturers and healthcare providers to provide tailored haemostasis solutions contribute to market growth.

- By Price Range

On the basis of price range, the market is segmented into high-end, mid-range, and low-end analysers. The High-End segment dominated the market in 2025 due to its advanced automation, multi-parameter testing capabilities, and AI-enabled diagnostics, which are essential for large hospital laboratories and research institutes handling high sample volumes. These analysers are preferred for their reliability, accuracy, and integration with digital hospital systems, making them crucial in critical care, oncology, and hematology departments. The segment is also supported by ongoing R&D investments by key players to introduce cutting-edge features such as predictive analytics and cloud-based data management.

The Mid-Range segment is expected to witness the fastest CAGR from 2026 to 2033, driven by growing adoption in small- to medium-sized hospitals, diagnostic centers, and emerging markets where cost-effective yet reliable solutions are sought. These analysers balance affordability with essential automated features, providing efficient workflows without the premium pricing of high-end systems. Increasing healthcare spending and expanding laboratory infrastructure in developing regions further support this segment’s rapid growth.

- By End-User

On the basis of end-user, the market is segmented into hospital laboratories, commercial service providers, government reference laboratories, and research and academic institutes. The Hospital Laboratories segment dominated the market in 2025 due to the high demand for rapid, reliable, and standardized hematology testing across various departments, including emergency care, oncology, and chronic disease management. Hospitals prioritize automated and integrated solutions that can manage large sample volumes efficiently and reduce human error. Moreover, hospitals are increasingly upgrading their laboratories with AI-enabled and LIS-compatible analysers to improve patient care and operational efficiency.

The Commercial Service Providers segment is anticipated to witness the fastest growth from 2026 to 2033, driven by the expansion of outsourced diagnostic testing services, rising demand for specialized laboratory services, and the increasing number of preventive health checkups. Commercial laboratories benefit from high-throughput and automated analysers that reduce turnaround times and increase testing capacity. Growth in this segment is further fueled by rising collaborations between healthcare providers and diagnostic service companies, as well as the proliferation of wellness and preventive health programs in both developed and emerging markets.

Hematology Analyser Market Regional Analysis

- North America dominated the hematology analyser market with the largest revenue share of 39.6% in 2025, characterized by advanced healthcare infrastructure, high adoption of automated laboratory solutions, and a strong presence of leading diagnostic equipment manufacturers

- Healthcare providers in the region prioritize high-throughput, accurate, and automated hematology analysers that can seamlessly integrate with laboratory information systems (LIS) and hospital digital platforms, enhancing workflow efficiency and patient care

- This widespread adoption is further supported by strong research and development capabilities, high healthcare spending, and the presence of major market players such as Abbott, Sysmex, and Beckman Coulter, establishing hematology analysers as critical diagnostic tools in both hospital and research settings

U.S. Hematology Analyser Market Insight

The U.S. hematology analyser market captured the largest revenue share of 82% in 2025 within North America, driven by the widespread adoption of automated laboratory solutions and the increasing prevalence of blood disorders. Hospitals and diagnostic laboratories are prioritizing high-throughput, accurate, and AI-enabled analysers to support early disease detection and efficient patient management. The growing demand for integrated systems that connect with laboratory information systems (LIS) and hospital digital platforms further propels market growth. Moreover, robust healthcare infrastructure, high research funding, and the presence of leading manufacturers such as Abbott, Sysmex, and Beckman Coulter are significantly contributing to the market’s expansion.

Europe Hematology Analyser Market Insight

The Europe hematology analyser market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent healthcare regulations, rising prevalence of hematological disorders, and increasing investment in laboratory infrastructure. The demand for accurate, automated blood testing solutions is rising across hospitals, diagnostic centers, and research facilities. European healthcare providers are also focused on enhancing workflow efficiency and integrating multi-parameter analysers with LIS platforms. The region is witnessing growth in both routine and specialized hematology testing, supported by advancements in automation and digital laboratory solutions.

U.K. Hematology Analyser Market Insight

The U.K. hematology analyser market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the increasing adoption of laboratory automation and advanced diagnostic technologies. Rising cases of anemia, leukemia, and other blood disorders are encouraging hospitals and diagnostic labs to invest in high-throughput analysers for faster and more reliable results. In addition, the U.K.’s strong healthcare infrastructure, research initiatives, and emphasis on preventive diagnostics are expected to sustain market growth. The integration of analysers with hospital networks and LIS systems further enhances laboratory efficiency and patient care.

Germany Hematology Analyser Market Insight

The Germany hematology analyser market is expected to expand at a considerable CAGR during the forecast period, fueled by rising awareness of hematological health, technological advancements in analysers, and increasing adoption of automated laboratory solutions. Germany’s well-established healthcare infrastructure and focus on research and innovation support the demand for high-performance analysers in hospitals and reference laboratories. The integration of analysers with LIS and advanced reporting tools is becoming increasingly prevalent, enabling efficient workflow management and timely diagnosis. Moreover, hospitals and clinics are emphasizing reliable, secure, and sustainable laboratory solutions, aligning with local expectations for quality healthcare.

Asia-Pacific Hematology Analyser Market Insight

The Asia-Pacific hematology analyser market is poised to grow at the fastest CAGR of 23% during the forecast period of 2026 to 2033, driven by increasing healthcare investments, rising prevalence of blood disorders, and expanding laboratory infrastructure in countries such as China, Japan, and India. Growing awareness about early diagnosis, preventive healthcare programs, and government initiatives to modernize laboratories are fueling adoption. Furthermore, APAC is emerging as a manufacturing hub for laboratory equipment, improving affordability and accessibility of hematology analysers for hospitals, diagnostic centers, and research institutions.

Japan Hematology Analyser Market Insight

The Japan hematology analyser market is gaining momentum due to the country’s advanced healthcare system, aging population, and demand for efficient diagnostic solutions. The increasing number of automated laboratories and smart hospital initiatives is driving the adoption of high-throughput analysers. Integration with hospital information systems, AI-enabled diagnostics, and point-of-care testing capabilities are further enhancing efficiency and accuracy. In addition, the focus on early detection of blood disorders and the growing emphasis on preventive healthcare are contributing to the market’s growth in Japan.

India Hematology Analyser Market Insight

The India hematology analyser market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid healthcare infrastructure development, increasing prevalence of blood disorders, and rising awareness of diagnostic testing. India’s expanding hospitals, diagnostic centers, and research facilities are adopting automated and AI-enabled analysers to improve testing accuracy and efficiency. Government initiatives for digital health and preventive care, coupled with affordable analyser options and domestic manufacturing capabilities, are key factors propelling the market in India.

Hematology Analyser Market Share

The Hematology Analyser industry is primarily led by well-established companies, including:

- Abbott (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Sysmex Asia Pacific Pte Ltd (Singapore)

- Beckman Coulter, Inc. (U.S.)

- Siemens Healthcare AG (Germany)

- Bayer AG (Germany)

- HORIBA (Japan)

- Bio-Rad Laboratories, Inc. (U.S.)

- NIHON KOHDEN CORPORATION (Japan)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China)

- BioSystems (Spain)

- Diatron (Hungary)

- Drew Scientific (U.S.)

- EKF Diagnostics (U.K.)

- Ortho Clinical Diagnostics (U.S.)

- Antech Diagnostics, Inc. (U.S.)

- Perlong Medical Equipment Co., Ltd. (China)

- Shenzhen Landwind Industry Co., Ltd. (China)

What are the Recent Developments in Global Hematology Analyser Market?

- In June 2024, HORIBA Medical’s Yumizen H2500 hematology analyzer received 510(k) clearance from the U.S. Food and Drug Administration (FDA), enabling its sale in the U.S. This system delivers CBC + WBC differential + additional leukocyte immaturity & body‑fluid analyses, processing up to 120 samples/hour representing a major regulatory and market access milestone for a non‑mainstream analyzer vendor

- In February 2024, Sysmex Corporation and CellaVision AB expanded their strategic alliance to broaden the hematology solutions portfolio, specifically targeting next‑generation cell morphology analyzers. The collaboration aims to improve precision and standardization of morphological cell classification in hematology labs a sign of convergence of traditional analyzers with digital morphology/image‑based diagnostics

- In January 2024, HORIBA Medical launched a fully‑automated modular hematology platform under the name HELO 2.0, aimed at mid‑ to large‑scale laboratories offering scalable configurations, integrated workflow automation, and capacity for high-throughput hematology diagnostics

- In May 2023, Siemens Healthineers launched the Atellica HEMA 570 and Atellica HEMA 580 high‑volume hematology analyzers offering up to 120 tests per hour, integrated automation, intelligence features extended cell‑parameter panels and compatibility with lab information systems (LIS) to streamline workflow in high‑volume labs

- In May 2023, the same company also entered into an agreement with Scopio Labs to distribute its full‑field digital cell morphology technology allowing labs to shift from manual microscopy to AI‑powered digital morphology workflows, enhancing remote review and digital pathology integration alongside traditional CBC analyzers

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.