Global Hematology Biosimilars Market

Market Size in USD Billion

CAGR :

%

USD

257.40 Billion

USD

535.91 Billion

2025

2033

USD

257.40 Billion

USD

535.91 Billion

2025

2033

| 2026 –2033 | |

| USD 257.40 Billion | |

| USD 535.91 Billion | |

|

|

|

|

Hematology Biosimilars Market Size

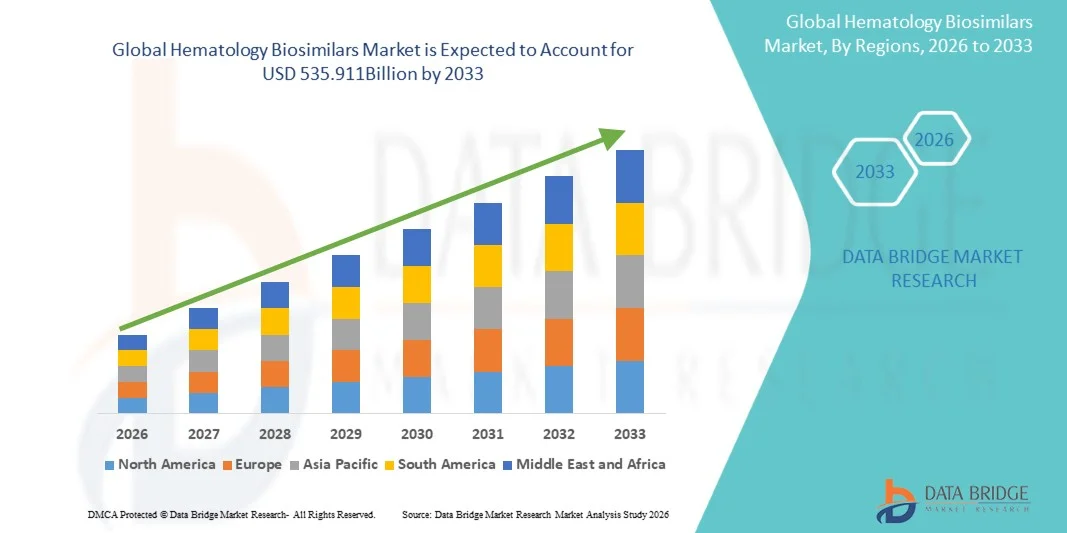

- The global hematology biosimilars market size was valued at USD 257.4 billion in 2025 and is expected to reach USD 535.911 billion by 2033, at a CAGR of 9.60% during the forecast period

- The market growth is largely fueled by the increasing prevalence of blood disorders, rising demand for cost-effective treatment alternatives, and ongoing technological advancements in biologics and biosimilars manufacturing

- Furthermore, growing awareness among healthcare providers and patients regarding the efficacy and safety of hematology biosimilars is driving adoption, thereby significantly boosting the growth of the Hematology Biosimilars market

Hematology Biosimilars Market Analysis

- Hematology biosimilars, offering cost-effective and clinically equivalent alternatives to reference biologics, are increasingly vital components in the treatment of blood disorders such as anemia, hemophilia, and leukemia due to their ability to reduce treatment costs and expand patient access

- The escalating demand for hematology biosimilars is primarily fueled by the growing prevalence of hematologic disorders, increasing pressure to reduce healthcare costs, and rising awareness among healthcare providers and patients about the efficacy and safety of biosimilars

- North America dominated the hematology biosimilars market with the largest revenue share of 42.5% in 2025, characterized by advanced healthcare infrastructure, high adoption of biosimilars, strong presence of key industry players, and supportive regulatory frameworks, with the U.S. experiencing substantial growth in biosimilar usage driven by cost-containment initiatives and increasing insurance coverage

- Asia-Pacific is expected to be the fastest-growing region in the hematology biosimilars market during the forecast period, with a CAGR of 10.2%, due to rising prevalence of blood disorders, increasing healthcare expenditure, expanding healthcare infrastructure, and growing patient awareness in countries such as India, China, and Japan

- The Anemia segment accounted for the largest market revenue share of approximately 44.8% in 2025, driven by the rising prevalence of CKD, cancer-related anemia, and surgical blood loss

Report Scope and Hematology Biosimilars Market Segmentation

|

Attributes |

Hematology Biosimilars Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Hematology Biosimilars Market Trends

“Increasing Adoption of Biosimilars in Hematology Therapeutics”

- A key trend in the global hematology biosimilars market is the growing acceptance of biosimilar drugs as cost-effective alternatives to original biologics for the treatment of blood disorders such as anemia, hemophilia, and neutropenia. The rising focus on healthcare affordability, coupled with an increasing prevalence of hematological disorders worldwide, is driving healthcare providers and payers to integrate biosimilars into treatment protocols

- For instance, in 2024, the European Medicines Agency (EMA) approved a new biosimilar version of epoetin alfa, enabling hospitals across Germany, France, and Italy to provide affordable anemia management for chronic kidney disease patients while maintaining clinical efficacy comparable to the reference biologic

- Innovations in formulation, such as pre-filled syringes, subcutaneous delivery systems, and improved stability, are making biosimilars more convenient and safer for both healthcare professionals and patients

- The increasing collaboration between pharmaceutical companies and regulatory agencies is streamlining approval processes for biosimilars, encouraging faster market entry and enhanced accessibility across developed and emerging markets

- Adoption of patient support programs, reimbursement schemes, and hospital formulary inclusion are further strengthening the market penetration of hematology biosimilars globally

Hematology Biosimilars Market Dynamics

Driver

“Rising Prevalence of Hematological Disorders and Cost-Containment Pressures”

- The growing global burden of blood-related disorders, including anemia, hemophilia, and neutropenia, is a key driver for hematology biosimilars. The increasing number of patients requiring long-term biologic therapy has prompted healthcare systems to seek affordable alternatives without compromising clinical outcomes

- For instances, in 2023, Novartis expanded its biosimilar portfolio in the U.S. by introducing a pegfilgrastim biosimilar, targeting hospitals and oncology clinics to manage chemotherapy-induced neutropenia at lower costs, which is expected to enhance accessibility for underinsured patients

- Healthcare expenditure control initiatives and government policies promoting the use of biosimilars in national formularies are further incentivizing their adoption

- The increasing availability of real-world clinical evidence demonstrating the safety and efficacy of hematology biosimilars is building confidence among physicians and patients, boosting market growth

- Rising awareness among clinicians regarding the interchangeability of biosimilars with originator biologics is encouraging broader prescription, particularly in oncology and chronic anemia treatment protocols

Restraint/Challenge

“Regulatory Complexity and Market Acceptance Issues”

- Despite rapid growth, the hematology biosimilars market faces challenges such as regulatory hurdles, limited awareness in certain regions, and hesitancy among prescribers to switch from established biologics

- For instance, in 2022, several hospitals in the U.S. delayed adoption of a newly approved biosimilar due to concerns over varying state-level substitution policies and payer reimbursement uncertainties

- Variability in biosimilar approval pathways across regions can create market entry delays and limit accessibility, particularly in emerging economies

- Intellectual property disputes and litigation over reference biologics can also slow down the launch of biosimilars, affecting overall market momentum

- Educating healthcare professionals and patients about the equivalence and safety of biosimilars, as well as incentivizing formulary inclusion, are essential strategies to overcome market resistance

Hematology Biosimilars Market Scope

The market is segmented on the basis of product type and application/indication.

• By Product Type

On the basis of product type, the Hematology Biosimilars market is segmented into Erythropoietin (EPO) Biosimilars, Granulocyte Colony-Stimulating Factor (G-CSF) Biosimilars, Thrombopoietin Receptor Agonists, and Others. The Erythropoietin (EPO) Biosimilars segment dominated the largest market revenue share of around 42.5% in 2025, driven by the high prevalence of chronic kidney disease (CKD) and chemotherapy-induced anemia. EPO biosimilars are widely adopted due to cost-effectiveness compared to originator biologics. Hospitals, cancer treatment centers, and dialysis clinics prefer EPO biosimilars for anemia management. Strong government reimbursement policies and inclusion in national formularies further strengthen demand. Continuous clinical support and improved patient compliance also enhance usage. Expansion of biosimilar manufacturing capacities globally supports consistent supply. Rising awareness among clinicians regarding biosimilar efficacy contributes to adoption. Established distribution networks ensure wide availability. Long-term treatment protocols for anemia boost recurring demand. The segment benefits from strong patent expirations of originator products. Price-sensitive healthcare systems favor biosimilars. Strategic collaborations and licensing agreements by leading players further consolidate market dominance.

The Granulocyte Colony-Stimulating Factor (G-CSF) Biosimilars segment is expected to witness the fastest CAGR of around 10.2% from 2026 to 2033, driven by increasing incidence of neutropenia in cancer patients undergoing chemotherapy. G-CSF biosimilars reduce the risk of infection and improve treatment outcomes. Growing adoption in emerging markets is fueled by cost advantages and expanding oncology infrastructure. Rising awareness about neutropenia management among oncologists enhances demand. Regulatory approvals for multiple G-CSF biosimilars encourage market penetration. Hospital protocols and oncology guidelines support routine use. Increasing cancer prevalence globally drives higher usage rates. Technological improvements in biosimilar formulations improve safety and efficacy. Expanded production capabilities ensure availability in both developed and developing countries. Patient assistance programs further boost adoption. Partnerships between local distributors and global manufacturers improve accessibility. Digital marketing and medical education campaigns support awareness. Government incentives for biosimilar adoption strengthen uptake.

• By Application/Indication

On the basis of application, the Hematology Biosimilars market is segmented into Anemia, Neutropenia, Thrombocytopenia, Hemophilia, and Other Hematological Disorders. The Anemia segment accounted for the largest market revenue share of approximately 44.8% in 2025, driven by the rising prevalence of CKD, cancer-related anemia, and surgical blood loss. EPO biosimilars dominate treatment protocols, with hospitals and dialysis centers leading adoption. Government health programs and insurance reimbursement policies support widespread utilization. Chronic anemia management protocols drive recurring consumption. Clinical guidelines recommend biosimilars for cost-effective anemia management. Awareness programs for healthcare providers enhance adoption. Emerging markets show increasing demand due to affordable pricing. Hospital formularies include biosimilars to reduce treatment costs. High patient volumes in renal and oncology units sustain strong market share. Strategic partnerships with distributors improve accessibility. Educational initiatives for physicians promote confidence in biosimilars. Long-term treatment strategies increase demand predictability.

The Neutropenia segment is expected to register the fastest CAGR of around 9.8% from 2026 to 2033, driven by the growing number of chemotherapy procedures worldwide and the rising incidence of febrile neutropenia. G-CSF biosimilars are preferred due to efficacy, safety, and cost benefits. Expanding oncology infrastructure in emerging countries supports adoption. Hospital protocols and national treatment guidelines encourage use. Increased clinical trials for biosimilars demonstrate effectiveness, enhancing confidence among clinicians. Awareness campaigns improve knowledge of neutropenia management. Growth in cancer patient population contributes to higher utilization. Improved supply chain networks ensure timely availability. Partnerships with key oncology centers boost market penetration. Training programs for healthcare providers enhance correct usage. Insurance coverage and government incentives accelerate adoption. Technological improvements in formulation increase patient compliance. Rising outpatient chemotherapy settings support continuous growth.

Hematology Biosimilars Market Regional Analysis

- North America dominated the hematology biosimilars market with the largest revenue share of 42.5% in 2025

- Characterized by advanced healthcare infrastructure, high adoption of biosimilars

- Strong presence of key industry players, and supportive regulatory frameworks

U.S. Hematology Biosimilars Market Insight

The U.S. hematology biosimilars market captured a significant portion of the North American market, driven by substantial growth in biosimilar usage due to cost-containment initiatives, increasing insurance coverage, and high clinician confidence in therapeutic equivalence. The presence of major pharmaceutical manufacturers and robust clinical research activities further propel the market expansion.

Europe Hematology Biosimilars Market Insight

The Europe hematology biosimilars market is projected to grow steadily throughout the forecast period, supported by increasing awareness of cost-effective biologic alternatives, well-established healthcare systems, and reimbursement policies favoring biosimilar adoption. Key markets such as Germany, the U.K., and France are expected to drive regional growth.

U.K. Hematology Biosimilars Market Insight

The U.K. hematology biosimilars market is expected to witness notable growth, driven by supportive government policies, expanding adoption in hospitals and specialty clinics, and rising awareness among healthcare providers about the clinical and economic benefits of biosimilars.

Germany Hematology Biosimilars Market Insight

Germany is anticipated to show steady growth due to a high prevalence of hematological disorders, strong healthcare infrastructure, and the early adoption of biosimilars across hospitals and specialty centers. Reimbursement frameworks and physician confidence in biosimilar efficacy further support market expansion.

Asia-Pacific Hematology Biosimilars Market Insight

Asia-Pacific hematology biosimilars market is expected to be the fastest-growing region in the Hematology Biosimilars market during the forecast period, with a CAGR of 10.2%, driven by rising prevalence of blood disorders, increasing healthcare expenditure, expanding healthcare infrastructure, and growing patient awareness. Countries such as India, China, and Japan are emerging as key growth markets due to improving access to biosimilars and supportive government initiatives.

Japan Hematology Biosimilars Market Insight

Japan hematology biosimilars market is witnessing increasing adoption of biosimilars in hospitals and specialty clinics due to cost-containment policies, high prevalence of hematologic conditions, and robust healthcare infrastructure. Rising awareness among clinicians about biosimilar safety and efficacy is further driving market growth.

China Hematology Biosimilars Market Insight

China hematology biosimilars market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rising blood disorder prevalence, expanding middle-class population, increasing healthcare expenditure, and strong domestic pharmaceutical manufacturing. Government initiatives promoting biosimilar usage and improved healthcare access are also key growth factors.

Hematology Biosimilars Market Share

The Hematology Biosimilars industry is primarily led by well-established companies, including:

- Novartis (Switzerland)

- Biocon (India)

- Samsung Bioepis (South Korea)

- Teva Pharmaceuticals (Israel)

- Regeneron Pharmaceuticals (U.S.)

- Biogen (U.S.)

- Zhejiang Hisun Pharmaceutical (China)

- Hanwha Biologics (South Korea)

- Gland Pharma (India)

- Cipla (India)

- Fresenius Kabi (Germany)

- Mitsubishi Tanabe Pharma (Japan)

- Japan Tobacco (Japan)

- Hikma Pharmaceuticals (U.K.)

- Celltrion Healthcare (South Korea)

Latest Developments in Global Hematology Biosimilars Market

- In March 2024, Sandoz, a Novartis division, launched a new formulation of its G‑CSF biosimilar, designed with improved stability and storage conditions to support broader hospital and oncology clinic use, particularly in markets prioritizing logistic efficiency and cold‑chain robustness. This launch helps address increasing demand for neutropenia management in patients undergoing chemotherapy and reflects manufacturers’ efforts to make biosimilars more user‑friendly and accessible

- In May 2024, Biocon Ltd. received regulatory approval for its G‑CSF biosimilar in multiple emerging markets, enabling commercial distribution in regions such as Southeast Asia and Latin America where expanded access to supportive hematology products is critical. These approvals are part of a broader strategy to increase penetration of biosimilar supportive therapies outside traditional Western markets

- In April 2024, Coherus BioSciences expanded its biosimilar manufacturing capacity for G‑CSF products to better meet rising global demand, particularly from oncology departments managing chemotherapy‑induced neutropenia. Expansion of manufacturing capabilities supports quicker supply responses and helps stabilize pricing across markets

- In June 2024, Pfizer initiated clinical trials for a next‑generation G‑CSF biosimilar formulation, reflecting increased R&D investment aimed at enhancing safety profiles and therapeutic performance in neutropenia prevention. Such clinical activity demonstrates continued innovation within hematology biosimilar pipelines

- In August 2025, a comprehensive market outlook highlighted that the biosimilars of G‑CSF for chemotherapy‑induced neutropenia market is projected to grow significantly, driven by rising cancer incidence, broader reimbursement, and an expanding pipeline of next‑generation formulations with extended half‑life and improved patient convenience. This forecast points to sustained growth in supportive hematology biosimilars

- In February 2025, the World Health Organization (WHO) issued guidance recommending that quality‑assured biosimilars be considered interchangeable with reference biologics and eligible for national procurement lists, improving confidence among healthcare systems and likely accelerating adoption of hematology biosimilars such as EPO and G‑CSF products. This strategic endorsement supports global biosimilar uptake

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.