Global Hemoglobin Testing Market

Market Size in USD Billion

CAGR :

%

USD

2.81 Billion

USD

5.67 Billion

2025

2033

USD

2.81 Billion

USD

5.67 Billion

2025

2033

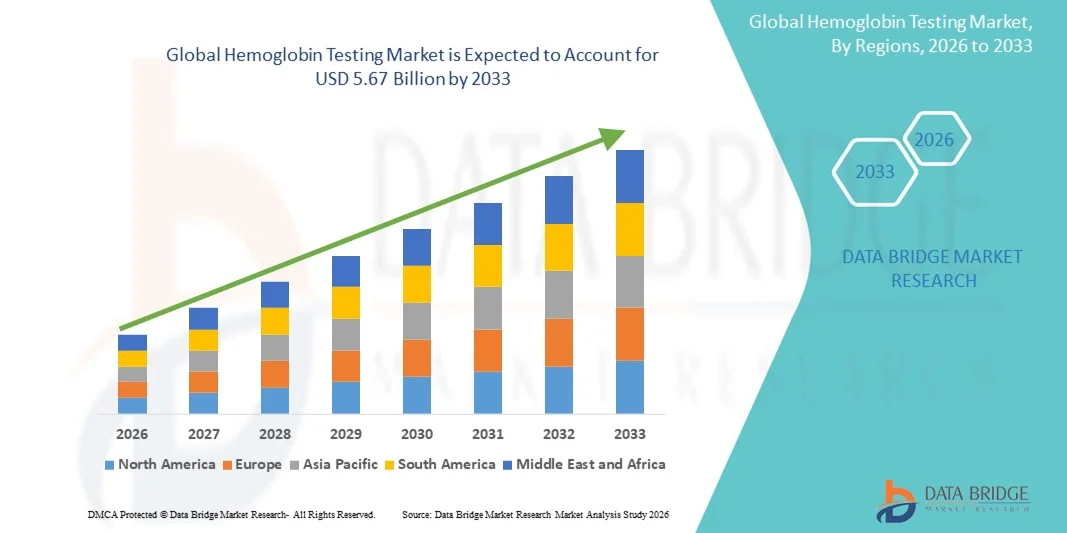

| 2026 –2033 | |

| USD 2.81 Billion | |

| USD 5.67 Billion | |

|

|

|

|

Hemoglobin Testing Market Size

- The global Hemoglobin Testing market size was valued at USD 2.81 billion in 2025 and is expected to reach USD 5.67 billion by 2033, at a CAGR of 9.18% during the forecast period

- The market growth is largely fueled by the increasing prevalence of anemia, rising awareness regarding early diagnosis of hemoglobin-related disorders, and ongoing technological advancements in point-of-care testing devices, which are enabling faster, more accurate, and more accessible hemoglobin measurement across hospitals, clinics, and home-care settings

- Furthermore, growing consumer demand for portable, user-friendly, and cost-efficient hemoglobin analyzers—supported by government screening programs, expanding maternal & child health initiatives, and rising adoption of automated hematology analyzers—is accelerating the uptake of Hemoglobin Testing solutions, thereby significantly boosting the industry’s growth

Hemoglobin Testing Market Analysis

- Hemoglobin testing, which involves quantitative measurement of hemoglobin levels using devices such as point-of-care analyzers, automated hematology systems, and portable diagnostic kits, is becoming increasingly vital across hospitals, clinics, and home-care settings due to its crucial role in anemia screening, surgical assessment, maternal health monitoring, and chronic disease management

- The escalating demand for hemoglobin testing is primarily fueled by the rising global burden of anemia, expanding government-led screening programs, growing preference for rapid and minimally invasive point-of-care diagnostics, and continuous advancement in compact, user-friendly hemoglobin analyzers

- North America dominated the Hemoglobin Testing market with the largest revenue share of 36.8% in 2025, driven by strong healthcare infrastructure, high adoption of point-of-care diagnostic devices, increasing prevalence of anemia among women and the elderly, and significant investments in automated hematology technologies, particularly across the U.S. and Canada

- Asia-Pacific is expected to be the fastest-growing region in the Hemoglobin Testing market during the forecast period, projected to grow at a CAGR of 10.4% from 2026 to 2033, supported by rising maternal health initiatives, expanding diagnostic laboratories, increasing awareness of anemia screening, and rapid adoption of portable testing devices across India, China, and Southeast Asia

- The Automated Hematology Analyzers segment dominated the largest market revenue share of 47.5% in 2025, driven by their high accuracy, rapid throughput, and integration with laboratory information systems (LIS) in hospitals and diagnostic centers

Report Scope and Hemoglobin Testing Market Segmentation

|

Attributes |

Hemoglobin Testing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Abbott (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Hemoglobin Testing Market Trends

Rising Demand for Point-of-Care and Home Testing Solutions

- A major trend in the global hemoglobin testing market is the increasing adoption of point-of-care (POC) and home-based testing solutions, which enable faster, more convenient hemoglobin monitoring outside traditional laboratory settings

- For instance, Roche Diagnostics launched its CoaguChek Hb test in 2023, enabling rapid hemoglobin monitoring for patients with anemia or other hematological conditions at home or in clinical environments

- The trend is driven by the growing need for rapid results, especially in outpatient care, rural areas, and resource-limited settings, where traditional lab-based testing may be delayed

- Furthermore, the incorporation of mobile connectivity and easy-to-read displays in new POC devices enhances usability for both healthcare providers and patients, supporting wider adoption of hemoglobin testing across various care settings

- Rising consumer preference for self-monitoring and preventive healthcare is also contributing to increased demand for portable hemoglobin testing kits

- Hospitals and diagnostic centers are increasingly deploying high-throughput automated hemoglobin analyzers to improve workflow efficiency and patient turnaround times

- Integration of hemoglobin testing with broader health check-up panels and chronic disease management programs is becoming common, enhancing the appeal of these tests in clinical and community health settings

Hemoglobin Testing Market Dynamics

Driver

Increasing Prevalence of Anemia and Chronic Blood Disorders

- The global rise in anemia, iron-deficiency cases, and chronic blood disorders is a primary driver of the Hemoglobin Testing market

- For instance, according to WHO data released in 2024, over 1.6 billion people worldwide were affected by anemia, emphasizing the critical need for regular monitoring and early detection

- Growing awareness among healthcare providers and patients about the importance of monitoring hemoglobin levels, particularly in vulnerable populations such as pregnant women and children, is fueling market growth

- In addition, the expansion of healthcare infrastructure, especially in developing regions, and initiatives promoting preventive care and regular blood testing are contributing to increased demand for hemoglobin testing systems

- Rising government and NGO initiatives focused on maternal and child health are promoting regular hemoglobin screening in public healthcare programs

- Increasing hospital and clinic investments in digital laboratories and advanced diagnostic facilities are supporting the adoption of automated hemoglobin testing

- Growing adoption of routine hemoglobin monitoring in chronic disease management programs, such as for kidney disease or chemotherapy patients, is also driving market growth

Restraint/Challenge

High Cost and Limited Accessibility in Certain Regions

- One of the key challenges limiting market growth is the high cost of advanced hemoglobin testing devices, particularly fully automated analyzers used in clinical settings

- For instance, laboratory-grade hemoglobin analyzers can cost several thousand dollars, making them less accessible for smaller clinics or rural healthcare facilities

- In addition, limited availability of test strips, reagents, or trained personnel in some regions can impede widespread adoption of hemoglobin testing, especially in low-resource countries

- Overcoming these challenges through the development of affordable, portable, and easy-to-use testing devices, along with improved distribution channels and training programs, is essential to ensure broader market penetration and sustained growth

- Regulatory hurdles and varying approval timelines for diagnostic devices across countries can delay market entry of new hemoglobin testing products

- Some end-users may prefer traditional laboratory testing methods due to familiarity or perceived reliability, which can slow adoption of new POC or automated devices

- Logistical challenges, including supply chain constraints for reagents and consumables, may also affect consistent testing availability in remote or underserved regions

Hemoglobin Testing Market Scope

The market is segmented on the basis of product type, technology, and end users.

- By Product Type

On the basis of product type, the Hemoglobin Testing market is segmented into Automated Hematology Analyzers, Point-of-Care, and Reagents & Consumables. The Automated Hematology Analyzers segment dominated the largest market revenue share of 47.5% in 2025, driven by their high accuracy, rapid throughput, and integration with laboratory information systems (LIS) in hospitals and diagnostic centers. The increasing prevalence of anemia and hemoglobinopathies across the globe fuels the demand for advanced automated testing systems. Hospitals and large diagnostic chains prefer automated analyzers for handling high-volume testing efficiently. Government-funded screening programs for blood disorders further support segment growth. Technological advancements, including AI-based interpretation and connectivity with electronic health records, enhance workflow efficiency. Continuous adoption in emerging markets is supported by the modernization of laboratory infrastructure. Analysts and clinicians prefer these analyzers due to their reliability, consistency, and ability to detect multiple hemoglobin variants. Rising investments in research and diagnostic capabilities further reinforce segment dominance.

The Point-of-Care segment is expected to witness the fastest CAGR of 13.2% from 2026 to 2033, driven by the increasing demand for rapid hemoglobin testing in clinics, emergency care, and homecare settings. Portable devices offer immediate results, improving patient management and reducing hospital visits. Rising awareness among patients for self-monitoring and preventive care boosts point-of-care adoption. Technological improvements, including connectivity with mobile applications, enhance usability and data tracking. Emerging markets are witnessing higher uptake due to limited access to centralized laboratories. The convenience of minimal sample volume and ease of use support growth in rural and remote areas. Expansion of primary healthcare facilities and mobile health units accelerates adoption. Healthcare providers are increasingly integrating point-of-care testing for anemia screening, prenatal care, and chronic disease monitoring.

- By Technology

On the basis of technology, the Hemoglobin Testing market is segmented into Chromatography, Immunoassay, and Others. The Chromatography segment dominated the largest market revenue share of 44.3% in 2025, owing to its precision in separating hemoglobin variants and detecting rare hemoglobinopathies. Hospitals and diagnostic laboratories prefer chromatography for complex cases requiring accurate quantification of hemoglobin types. Government-funded neonatal screening and research programs contribute to high adoption rates. The method’s robustness, reproducibility, and reliability make it the standard in clinical and research laboratories. Continuous advancements, including HPLC and capillary electrophoresis, enhance accuracy and speed. Increasing awareness about sickle cell disease, thalassemia, and other hemoglobin disorders supports sustained growth. Laboratories benefit from low inter-laboratory variability and compatibility with automated systems. High adoption in academic institutions and clinical trials further reinforces dominance. The segment is strengthened by international collaborations and global guidelines recommending chromatography as a reference method.

The Immunoassay segment is expected to witness the fastest CAGR of 12.8% from 2026 to 2033, driven by high sensitivity, ease of use, and applicability in point-of-care devices. Immunoassays are increasingly used for rapid anemia detection and hemoglobin variant screening. Rising demand in decentralized and homecare settings fuels adoption. Integration with portable analyzers improves convenience for clinicians and patients. Expanding healthcare access in emerging regions supports market growth. Continuous improvements in reagent stability and device miniaturization accelerate uptake. Immunoassay kits are widely used for both adult and pediatric testing. Funding from public health initiatives for anemia screening enhances adoption. Technological advancements are enabling multiplexed detection, further strengthening growth prospects.

- By End Users

On the basis of end users, the Hemoglobin Testing market is segmented into Hospitals, Research Centers, Laboratories, Diagnostic Centers, Homecare Settings, and Others. The Hospitals segment dominated the largest market revenue share of 49.7% in 2025, due to high patient throughput, comprehensive diagnostic services, and the increasing prevalence of anemia, hemoglobinopathies, and chronic diseases. Hospitals are increasingly investing in automated analyzers and chromatography systems to handle large volumes with accuracy. Government health initiatives for anemia screening and blood disorder management further drive hospital adoption. Hospitals benefit from centralized lab services providing faster turnaround times and integrated patient data management. Rising demand for prenatal, neonatal, and geriatric hemoglobin testing enhances utilization. Continuous hospital expansion and modernization in the Middle East & Africa and Asia-Pacific support growth. Hospitals also prefer high-accuracy tests to comply with clinical guidelines. Increasing collaborations with research institutions and public health bodies reinforce segment dominance.

The Homecare Settings segment is expected to witness the fastest CAGR of 13.6% from 2026 to 2033, driven by rising consumer awareness, chronic disease monitoring, and increasing adoption of portable hemoglobin testing devices. Patients prefer home testing for convenience, reduced travel, and real-time monitoring. Technological advancements such as smartphone connectivity, wireless reporting, and miniaturized devices improve adoption. Telemedicine integration enhances usability in remote areas. Expanding insurance coverage and reimbursement for home testing accelerate uptake. Awareness campaigns for anemia and hemoglobin disorders further boost adoption. Increasing prevalence of chronic conditions and aging populations in developed and emerging regions support growth. Manufacturers are investing in user-friendly, accurate, and low-cost home testing solutions to capture market potential.

Hemoglobin Testing Market Regional Analysis

- North America dominated the hemoglobin testing market with the largest revenue share of 36.8% in 2025

- Driven by strong healthcare infrastructure, high adoption of point-of-care diagnostic devices

- Increasing prevalence of anemia among women and the elderly, and significant investments in automated hematology technologies, particularly across the U.S. and Canada

U.S. Hemoglobin Testing Market Insight

The U.S. hemoglobin testing market captured the largest revenue share within North America in 2025, fueled by the widespread adoption of point-of-care devices, growing demand for rapid diagnostic solutions, and rising awareness of anemia and blood disorders. The increasing use of automated hematology analyzers in hospitals, clinics, and diagnostic laboratories, combined with ongoing technological advancements, is significantly propelling market growth. Furthermore, government initiatives promoting maternal and child health screening programs are supporting the expansion of hemoglobin testing adoption across the country.

Europe Hemoglobin Testing Market Insight

The Europe hemoglobin testing market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing awareness of anemia, rising adoption of point-of-care testing, and expansion of diagnostic laboratories and hospital networks. Growing emphasis on preventive healthcare and government health programs are further accelerating market growth across both Western and Eastern Europe.

U.K. Hemoglobin Testing Market Insight

The U.K. hemoglobin testing market is anticipated to grow steadily during the forecast period due to a well-established healthcare infrastructure, high adoption of automated hematology technologies, and rising awareness of anemia screening in maternal and geriatric populations. Government initiatives supporting preventive healthcare and routine blood testing are further driving adoption across hospitals, clinics, and diagnostic centers.

Germany Hemoglobin Testing Market Insight

The Germany hemoglobin testing market is expected to expand at a significant CAGR during the forecast period, fueled by advanced healthcare infrastructure, increasing use of automated and point-of-care hemoglobin analyzers, and rising prevalence of anemia and blood disorders. Growing focus on preventive healthcare and integration of testing solutions in hospitals and diagnostic centers are key factors driving market growth.

Asia-Pacific Hemoglobin Testing Market Insight

The Asia-Pacific hemoglobin testing market is expected to be the fastest-growing region during the forecast period, projected to grow at a CAGR of 10.4% from 2026 to 2033. This growth is supported by rising maternal health initiatives, expanding diagnostic laboratories, increasing awareness of anemia screening, and rapid adoption of portable and point-of-care testing devices across India, China, and Southeast Asian countries. The region’s ongoing healthcare infrastructure development and government-led preventive care programs are further boosting market expansion.

Japan Hemoglobin Testing Market Insight

The Japan hemoglobin testing market is witnessing steady growth due to increasing healthcare awareness, technological advancements in diagnostic testing, and a strong focus on preventive healthcare. Rising demand for minimally invasive, rapid, and accurate testing methods is driving the adoption of both automated and point-of-care hemoglobin testing solutions in hospitals and clinics.

China Hemoglobin Testing Market Insight

The China hemoglobin testing market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to rapid healthcare infrastructure expansion, rising prevalence of anemia, government initiatives supporting maternal and child health, and increasing adoption of automated and portable hemoglobin testing devices across hospitals and diagnostic centers.

Hemoglobin Testing Market Share

The Hemoglobin Testing industry is primarily led by well-established companies, including:

• Abbott (U.S.)

• Sysmex Corporation (Japan)

• Beckman Coulter (U.S.)

• Siemens Healthineers (Germany)

• Roche Diagnostics (Switzerland)

• Becton Dickinson (U.S.)

• EKF Diagnostics (U.K.)

• HemoCue AB (Sweden)

• Nova Biomedical (U.S.)

• Ortho Clinical Diagnostics (U.S.)

• Bio-Rad Laboratories (U.S.)

• Mindray Medical International (China)

• HORIBA Medical (France)

• DiaSys Diagnostic Systems (Germany)

• Trinity Biotech (Ireland)

• Erba Diagnostics (India)

• Analytik Jena (Germany)

• Sinocare (China)

• Pelican BioScience (U.S.)

• Precipoint Diagnostics (Sweden)

Latest Developments in Global Hemoglobin Testing Market

- In February 2024, Sanguina, Inc. launched AnemoCheck Home, the first FDA‑cleared home hemoglobin test kit — enabling individuals to perform hemoglobin testing via finger‑prick at home without a full laboratory visit. This launch marked a significant step forward for home‑based anemia screening and self‑monitoring

- In June 2024, Horiba Ltd. launched a new series of compact hematology analyzers (Yumizen H550E, H500E CT, H500E OT) that support rapid hemoglobin (and full CBC) testing from whole blood, reducing turnaround times substantially and supporting diagnostic labs with improved throughput

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.