Global Hemp Fiber Market

Market Size in USD Million

CAGR :

%

USD

390.54 Million

USD

666.02 Million

2024

2032

USD

390.54 Million

USD

666.02 Million

2024

2032

| 2025 –2032 | |

| USD 390.54 Million | |

| USD 666.02 Million | |

|

|

|

|

Hemp Fiber Market Size

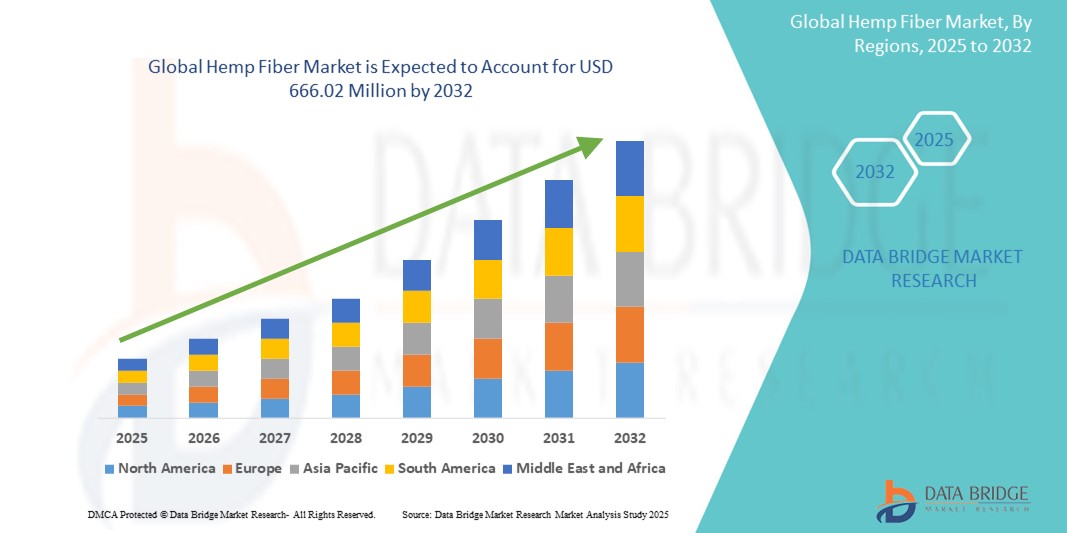

- The global hemp fiber market size was valued at USD 390.54 million in 2024 and is expected to reach USD 666.02 million by 2032, at a CAGR of 6.90% during the forecast period

- The market growth is primarily driven by increasing demand for sustainable and eco-friendly materials, coupled with the rising adoption of hemp-based products across various industries such as textiles, food, and pharmaceuticals

- Growing consumer awareness of environmental concerns and the push for biodegradable alternatives to synthetic materials are further accelerating the adoption of hemp fiber, establishing it as a preferred choice for sustainable applications

Hemp Fiber Market Analysis

- Hemp fiber, derived from the Cannabis sativa plant, is a versatile and sustainable material used in a wide range of applications, from textiles and construction to food and personal care products, due to its durability, biodegradability, and low environmental impact

- The escalating demand for hemp fiber is fueled by increasing regulatory support for hemp cultivation, growing consumer preference for natural and organic products, and advancements in hemp processing technologies

- North America dominated the hemp fiber market with the largest revenue share of 38.5% in 2024, driven by favorable legislation, early adoption of hemp-based products, and a strong presence of key industry players

- Asia-Pacific is expected to be the fastest-growing region in the hemp fiber market during the forecast period, propelled by rapid urbanization, increasing disposable incomes, and growing awareness of sustainable materials

- The Conventional segment dominated the largest market revenue share of 65% in 2024, driven by its cost-effectiveness and scalability for large-scale industrial applications such as textiles, construction materials, and automotive parts

Report Scope and Hemp Fiber Market Segmentation

|

Attributes |

Hemp Fiber Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Hemp Fiber Market Trends

“Increasing Integration of Advanced Processing Technologies and Sustainable Practices”

- The global hemp fiber market is experiencing a significant trend toward the integration of advanced processing technologies, such as improved decortication and enzymatic treatments, to enhance fiber quality and extraction efficiency

- These technologies enable the production of stronger, longer fibers suitable for diverse applications, including textiles, construction materials, and bioplastics

- Sustainable practices, such as closed-loop systems that minimize waste and environmental impact, are being adopted to align with growing consumer demand for eco-friendly products

- For instance, initiatives such as Hemp4Circularity, backed by the European Union, are promoting the development of sustainable, long-fiber hemp textile industries in Europe

- This trend enhances the value proposition of hemp fiber, making it more appealing to industries seeking renewable and biodegradable alternatives to conventional materials

- Advanced processing techniques also allow for better analysis of hemp fiber properties, enabling customized applications in industries such as automotive and construction

Hemp Fiber Market Dynamics

Driver

“Rising Demand for Sustainable and Eco-Friendly Materials”

- Increasing consumer and industry demand for sustainable materials, driven by environmental concerns, is a major driver for the global hemp fiber market

- Hemp fiber offers superior strength, durability, breathability, and biodegradability, making it an attractive alternative to synthetic fibers and traditional crops such as cotton

- Government policies and regulations, particularly in North America and Europe, are supporting hemp cultivation, further boosting market growth

- The proliferation of eco-conscious consumer trends and the development of hemp-based products, such as textiles, bioplastics, and construction materials, are driving demand across various industries

- Manufacturers are increasingly incorporating hemp fiber into products such as clothing, automotive parts, and hempcrete to meet sustainability goals and consumer preferences

Restraint/Challenge

“High Processing Costs and Regulatory Complexities”

- The high initial investment required for advanced hemp fiber processing facilities, such as decortication and spinning equipment, poses a significant barrier to market expansion, particularly for smaller players

- The complex, multi-step process of hemp fiber extraction and preparation can be costly and capital-intensive

- Regulatory complexities and varying legal frameworks across countries regarding hemp cultivation and processing create challenges for international manufacturers and suppliers

- Concerns about limited awareness of hemp’s benefits and misconceptions about its association with marijuana can deter adoption in some regions

- The availability of substitute fibers, such as flax and jute, which may offer similar properties at lower costs, further complicates market growth in price-sensitive markets

Hemp Fiber market Scope

The market is segmented on the basis of source, application, and product.

- By Source

On the basis of source, the Global Hemp Fiber Market is segmented into Organic and Conventional. The Conventional segment dominated the largest market revenue share of 65% in 2024, driven by its cost-effectiveness and scalability for large-scale industrial applications such as textiles, construction materials, and automotive parts. Conventional hemp cultivation benefits from established agricultural practices and lower production costs compared to organic methods, making it a preferred choice for manufacturers.

The Organic segment is expected to witness the fastest growth rate of 8.5% from 2025 to 2032, fueled by rising consumer demand for eco-friendly and natural products. Increasing awareness of sustainable practices and certifications, such as Regenerative Organic Certified™, is driving adoption in textiles, food, and personal care products, particularly in environmentally conscious markets.

- By Application

On the basis of application, the Global Hemp Fiber Market is segmented into Food, Beverages, Personal Care Products, Textiles, Pharmaceuticals, and Others. The Textiles segment dominated the market with a revenue share of 40% in 2024, driven by hemp fiber’s strength, durability, and eco-friendly properties, making it a sustainable alternative to cotton and synthetic fibers. The rising demand for sustainable fashion and supportive government policies in regions such as Europe and North America further bolster this segment.

The Food segment is anticipated to experience the fastest growth rate of 9.2% from 2025 to 2032. Hemp seeds and oils, rich in proteins, omega-3 and omega-6 fatty acids, and vitamins, are increasingly used in health foods, dietary supplements, and functional beverages, driven by growing consumer awareness of their nutritional benefits and the trend toward plant-based diets.

- By Product

On the basis of product, the Global Hemp Fiber Market is segmented into Seeds, Fiber, and Shivs. The Fiber segment held the largest market revenue share of 45% in 2024, attributed to its versatility and wide-ranging applications in textiles, composites, and industrial usage. Advancements in processing techniques, such as decortication and enzymatic treatment, have improved fiber quality, enhancing its commercial viability in sustainable textiles and construction materials.

The Seeds segment is expected to witness the fastest growth rate of 8.8% from 2025 to 2032. Hemp seeds are gaining traction in the food and beverage industry due to their high nutritional content, including proteins and essential fatty acids, and their use in nutraceuticals and dietary supplements. The increasing legalization of hemp cultivation and rising demand for plant-based products are key drivers for this segment.

Hemp Fiber Market Regional Analysis

- North America dominated the hemp fiber market with the largest revenue share of 38.5% in 2024, driven by favorable legislation, early adoption of hemp-based products, and a strong presence of key industry players

- Consumers prioritize hemp fiber for its versatility, sustainability, and applications in textiles, food, beverages, and personal care products, particularly in regions with strong environmental awareness

- Growth is supported by advancements in hemp processing technologies, favorable regulatory changes, and rising adoption in both industrial and consumer segments

U.S. Hemp Fiber Market Insight

The U.S. hemp fiber market captured the largest revenue share of 75.6% in 2024 within North America, fueled by robust demand in textiles, food, and pharmaceutical applications. Growing consumer awareness of hemp’s environmental benefits and increasing legalization of hemp cultivation drive market expansion. The trend toward sustainable products and integration of hemp fiber in diverse industries, including construction and bioplastics, further supports growth.

Europe Hemp Fiber Market Insight

The European hemp fiber market is expected to witness significant growth, driven by stringent regulations promoting sustainable materials and eco-friendly manufacturing practices. Consumers demand hemp fiber for its applications in textiles, personal care products, and construction, particularly in countries such as Germany and France, where environmental consciousness and urban development fuel market uptake.

U.K. Hemp Fiber Market Insight

The U.K. market for hemp fiber is expected to witness rapid growth, driven by increasing demand for sustainable textiles and eco-friendly personal care products in urban and suburban markets. Rising awareness of hemp’s low environmental impact and versatility encourages adoption. Evolving regulations supporting hemp cultivation and sustainable practices further influence consumer preferences, balancing quality with compliance.

Germany Hemp Fiber Market Insight

Germany is expected to witness rapid growth in the hemp fiber market, attributed to its advanced industrial sector and strong focus on sustainability and energy efficiency. German consumers prefer high-quality hemp fibers for textiles, automotive components, and construction materials, contributing to reduced carbon footprints. The integration of hemp in premium products and aftermarket applications supports sustained market growth.

Asia-Pacific Hemp Fiber Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by expanding agricultural production, rising disposable incomes, and growing awareness of sustainable materials in countries such as China, India, and Japan. Increasing demand for hemp-based textiles, food, and personal care products, coupled with government initiatives promoting eco-friendly solutions, boosts market growth.

Japan Hemp Fiber Market Insight

Japan’ hemp fiber market is expected to witness rapid growth due to strong consumer preference for high-quality, sustainable materials that enhance product durability and environmental benefits. The presence of major manufacturers and the integration of hemp fiber in textiles and food industries accelerate market penetration. Rising interest in eco-conscious consumer products also contributes to growth.

China Hemp Fiber Market Insight

China holds the largest share of the Asia-Pacific hemp fiber market, propelled by rapid urbanization, increasing agricultural output, and growing demand for sustainable materials. The country’s expanding middle class and focus on green manufacturing support the adoption of hemp fiber in textiles, pharmaceuticals, and construction. Strong domestic production capabilities and competitive pricing enhance market accessibility.

Hemp Fiber Market Share

The hemp fiber industry is primarily led by well-established companies, including:

- Hempco (Canada)

- CBD Biotechnology Co., Ltd. (Taiwan)

- Ecofibre (Australia)

- Hemp Inc (U.S.)

- GenCanna (U.S.)

- HempFlax Group B.V. (Netherlands)

- Konoplex (Russia)

- Hemp Oil Canada (Canada)

- HemPoland (Poland)

- Dun Agro Hemp Group (Netherlands)

- Colorado Hemp Works, INC (U.S.)

- Canah (Romania)

- South Hemp (Argentina)

- Plains Industrial Hemp Processing Ltd. (Canada)

- MH medical hemp (Germany)

- Parkland Industrial Hemp Growers Co-Op. Ltd. (Canada)

- Botanical Genetics, LLC (U.S.)

- Marijuana Company of America, Inc. (U.S.)

- HempMeds Brasil (Brazil)

- Terra Tech Corp. (U.S.)

- American Cannabis Company Inc. (U.S.)

- Industrial Hemp Manufacturing, LLC (U.S.)

What are the Recent Developments in Global Hemp Fiber Market?

- In October 2024, Canopy Growth Corporation, through its U.S. subsidiary Canopy USA, completed the acquisition of Wana, encompassing Wana Wellness, LLC, The CIMA Group, LLC, and Mountain High Products, LLC. This strategic move grants Canopy USA 100% ownership of Wana’s equity interests, reinforcing its ambition to build a brand-driven cannabis company focused on state-legal markets and hemp-derived products across the U.S. The acquisition complements Canopy’s portfolio alongside Jetty and supports expansion into edibles and infused beverages, positioning the company for growth and category leadership in the American cannabis industry

- In June 2024, Curaleaf Holdings, Inc. launched new hemp-derived THC product lines under its Select and Zero Proof brands, expanding its footprint in the rapidly growing hemp market. These offerings include edibles and seltzer-based beverages, all manufactured in certified cGMP facilities and designed to meet high standards for safety and quality. Available in 25 states and the District of Columbia, the products are distributed via Curaleaf’s direct-to-consumer platform and national retail partnerships, including DoorDash. This strategic move reinforces Curaleaf’s commitment to accessible, Farm Bill-compliant cannabis alternatives

- In May 2024, Manitoba Harvest, a Canadian leader in hemp-based nutrition, launched its Bioactive Fiber Supplement featuring Brightseed’s upcycled hemp hulls. This innovative product harnesses the nutritional power of hemp fiber to support gut health, digestion, and regularity, while promoting sustainability through the use of repurposed plant materials. Powered by Brightseed® Bio Gut Fiber, the supplement contains unique bioactives shown to strengthen the gut lining and improve metabolic wellness. The launch reflects Manitoba Harvest’s commitment to functional wellness and eco-conscious innovation in the food supplement industry

- In March 2024, researchers at Rensselaer Polytechnic Institute (RPI) received a $1.5 million grant from the U.S. Department of Energy to develop hemp-based insulated siding for residential retrofits. The project aims to create Hemp Retrofit Structural Insulated Panels (HeRS)—durable, low-carbon siding systems that reduce HVAC energy use by 15–25%. Made from hemp wool fibers and recycled binders, HeRS panels offer a sustainable alternative to conventional materials, promoting energy efficiency and circular economy practices. This initiative supports the broader goal of decarbonizing the built environment while stimulating the U.S. hemp industry

- In April 2023, Panda Biotech formed a strategic partnership with the Southern Ute Growth Fund, specifically its subsidiary Aka-Ag, LLC, to advance sustainable hemp production across the U.S. This equity collaboration supports the development of the Panda High Plains Hemp Gin™ (PHPHG) in Wichita Falls, Texas—set to become the largest hemp decortication facility in the country. The alliance emphasizes environmentally responsible farming, leveraging hemp’s low resource requirements and carbon sequestration potential. Together, the partners aim to promote eco-conscious textile innovation and expand domestic hemp infrastructure

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.