Global Hepatitis C Diagnosis And Treatment Market

Market Size in USD Billion

CAGR :

%

USD

59.43 Billion

USD

143.50 Billion

2025

2033

USD

59.43 Billion

USD

143.50 Billion

2025

2033

| 2026 –2033 | |

| USD 59.43 Billion | |

| USD 143.50 Billion | |

|

|

|

|

Hepatitis C Diagnosis and Treatment Market Size

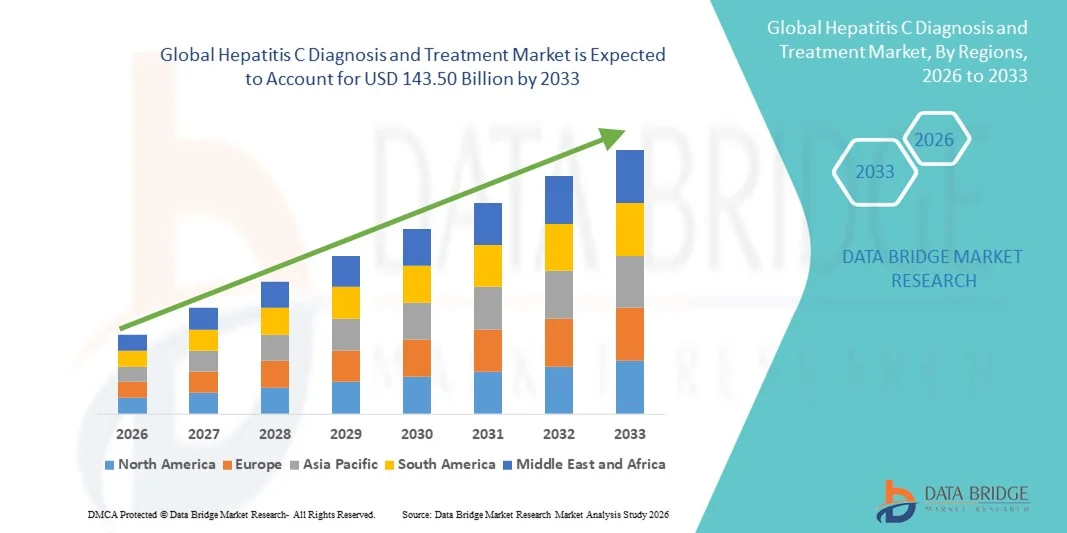

- The global hepatitis C diagnosis and treatment market size was valued at USD 59.43 billion in 2025 and is expected to reach USD 143.50 billion by 2033, at a CAGR of 11.65% during the forecast period

- The market growth is largely fueled by the rising prevalence of hepatitis C infections and continuous technological advancements in diagnostic tools, including highly sensitive molecular assays and point-of-care testing, which are improving early detection rates across hospitals, diagnostic laboratories, and public health screening programs

- Furthermore, increasing awareness, government-led screening initiatives, and the widespread adoption of highly effective direct-acting antiviral (DAA) therapies are significantly improving treatment outcomes and cure rates. These converging factors are accelerating the uptake of hepatitis C diagnosis and treatment solutions, thereby substantially boosting overall market growth

Hepatitis C Diagnosis and Treatment Market Analysis

- Hepatitis C diagnosis and treatment solutions, encompassing advanced diagnostic assays and highly effective antiviral therapies, are becoming increasingly critical components of modern healthcare systems due to their role in early disease detection, prevention of liver complications, and achievement of sustained virologic response (SVR) in infected patients across hospital and clinical settings

- The escalating demand for hepatitis C diagnosis and treatment is primarily fueled by the rising global burden of hepatitis C infection, expanding screening programs, growing awareness, and the widespread adoption of direct-acting antivirals (DAAs) that offer high cure rates with shorter treatment durations and fewer side effects

- North America dominated the hepatitis C diagnosis and treatment market with the largest revenue share of approximately 38.4% in 2025, supported by strong healthcare infrastructure, high screening and diagnosis rates, favorable reimbursement policies, and early adoption of novel antiviral therapies, with the U.S. accounting for the majority of regional revenue due to large treated patient populations and continuous product innovation

- Asia-Pacific is expected to be the fastest-growing region in the hepatitis C diagnosis and treatment market during the forecast period, registering a robust CAGR of around 9.3%, driven by large undiagnosed patient populations, increasing government-led elimination programs, improving access to diagnostics and antivirals, and rising healthcare expenditure in countries such as China and India

- The chronic hepatitis C segment dominated the market with a revenue share of approximately 71.4% in 2025, driven by the high global prevalence of long-standing HCV infections and delayed diagnosis in many patients

Report Scope and Hepatitis C Diagnosis and Treatment Market Segmentation

|

Attributes |

Hepatitis C Diagnosis and Treatment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• AbbVie (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Hepatitis C Diagnosis and Treatment Market Trends

Shift Toward Early Screening and Highly Effective Direct-Acting Antivirals (DAAs)

- A major and accelerating trend in the global hepatitis C diagnosis and treatment market is the increasing focus on early screening, rapid diagnosis, and widespread adoption of direct-acting antiviral (DAA) therapies, which have significantly improved cure rates and reduced treatment durations

- For instance, many countries have expanded routine HCV screening programs for high-risk populations, such as people who inject drugs and patients undergoing dialysis, to enable earlier detection and timely initiation of therapy

- Advances in molecular diagnostic technologies, including high-sensitivity PCR-based viral load tests and point-of-care diagnostics, are enabling faster and more accurate confirmation of hepatitis C infection across diverse healthcare settings

- On the treatment side, next-generation pan-genotypic DAAs are simplifying clinical decision-making by reducing the need for genotype-specific regimens, thereby improving treatment accessibility and adherence

- This trend aligns with global public health goals, including the World Health Organization’s objective to eliminate hepatitis C as a public health threat, driving sustained demand for both diagnostic solutions and curative therapies worldwide

Hepatitis C Diagnosis and Treatment Market Dynamics

Driver

Rising Global Burden of Hepatitis C and Government-Led Elimination Initiatives

- The increasing prevalence of hepatitis C infection, particularly in developing and underserved regions, is a primary driver of growth in the Hepatitis C diagnosis and treatment market. Millions of individuals remain undiagnosed globally, creating a strong need for expanded testing and treatment access

- For instance, several national health agencies have launched large-scale hepatitis elimination programs, increasing funding for screening campaigns and subsidized antiviral treatments to reduce disease transmission and long-term complications

- Growing awareness of the severe consequences of untreated hepatitis C, including liver cirrhosis and hepatocellular carcinoma, is prompting healthcare providers to prioritize early diagnosis and timely treatment

- Improvements in healthcare infrastructure, increasing availability of affordable generic DAAs, and integration of hepatitis testing into routine medical check-ups are further accelerating market growth

- Together, these factors are significantly expanding the treated patient population, driving sustained demand for diagnostic kits, laboratory services, and antiviral therapies across global markets

Restraint/Challenge

High Treatment Costs and Limited Access in Low-Resource Settings

- Despite therapeutic advancements, high treatment costs and uneven access to diagnostics and antiviral therapies continue to pose significant challenges to the global Hepatitis C diagnosis and treatment market

- For instance, in several low- and middle-income countries, limited healthcare budgets and inadequate reimbursement frameworks restrict patient access to advanced diagnostic tests and branded antiviral drugs

- Insufficient laboratory infrastructure, shortage of trained healthcare professionals, and lack of awareness in rural and remote regions further contribute to delayed diagnosis and under-treatment

- In additional, social stigma and asymptomatic disease progression often result in poor screening uptake, preventing timely identification of infected individuals

- Addressing these challenges through price reductions, expanded generic drug availability, strengthened healthcare systems, and increased public awareness campaigns will be critical for achieving equitable market growth and global hepatitis C elimination targets

Hepatitis C Diagnosis and Treatment Market Scope

The market is segmented on the basis of type, diagnosis, treatment, route of administration, and end user.

- By Type

On the basis of type, the Global Hepatitis C Diagnosis and Treatment market is segmented into Acute Hepatitis C, Chronic Hepatitis C, and Others. The chronic hepatitis C segment dominated the market with a revenue share of approximately 71.4% in 2025, driven by the high global prevalence of long-standing HCV infections and delayed diagnosis in many patients. Chronic HCV cases require prolonged monitoring, repeated diagnostic testing, and long-term antiviral therapy, significantly increasing healthcare spending. The asymptomatic nature of early chronic infection leads to late detection, raising treatment complexity. Rising incidence of liver cirrhosis and hepatocellular carcinoma linked to chronic HCV further drives demand. Government screening programs increasingly identify chronic cases. Expanding access to direct-acting antivirals (DAAs) supports segment dominance. Higher hospitalization rates contribute to revenue. Growing awareness among clinicians strengthens diagnosis rates. Aging infected populations increase disease burden. Public health elimination initiatives emphasize chronic HCV management. Strong reimbursement coverage in developed regions supports adoption. Pharmaceutical focus on chronic therapy sustains leadership.

The acute hepatitis C segment is expected to register the fastest CAGR of around 8.6% from 2026 to 2033, due to expanding early screening initiatives and improved diagnostic sensitivity. Increased testing among high-risk populations such as intravenous drug users supports growth. Rising awareness of early treatment benefits accelerates diagnosis. Early intervention prevents progression to chronic disease, encouraging prompt therapy. Point-of-care testing expansion aids detection. Government-led elimination programs emphasize acute case identification. Improved surveillance systems contribute to higher reported incidence. Availability of rapid blood tests enhances diagnosis. Shorter treatment durations drive acceptance. Increased healthcare outreach boosts early care access. Preventive strategies strengthen market momentum. Public-private partnerships support early-stage management.

- By Diagnosis

On the basis of diagnosis, the market is segmented into Liver Function Tests, Liver Biopsy, Blood Tests, and Others. The blood tests segment dominated the market with a revenue share of nearly 54.8% in 2025, driven by widespread adoption of HCV antibody and RNA tests for screening and confirmation. Blood tests are minimally invasive, cost-effective, and highly accurate. Routine use in mass screening programs supports dominance. Rapid diagnostic kits enable early detection. High testing volumes in hospitals and diagnostic labs contribute significantly. Blood tests are essential for treatment monitoring. Technological advancements improve sensitivity and specificity. Growing awareness campaigns increase testing frequency. Strong regulatory approvals enhance trust. Integration into national screening programs supports demand. Ease of repeat testing sustains usage. Diagnostic centers rely heavily on blood-based assays.

The liver function tests segment is projected to grow at the fastest CAGR of approximately 7.9% from 2026 to 2033, driven by increased monitoring of liver damage and treatment response. Rising focus on disease staging supports demand. LFTs help assess fibrosis and cirrhosis risk. Growing chronic HCV burden increases testing frequency. Adoption in primary care settings expands reach. Cost-effective nature boosts use in developing regions. Technological improvements enhance accuracy. Integration with routine health checkups accelerates adoption. Increased physician awareness supports growth. Expansion of outpatient testing fuels demand. Government guidelines emphasize liver health monitoring. Broader diagnostic protocols drive uptake.

- By Treatment

On the basis of treatment, the market is segmented into Antiviral Medications, Immuno-Modulators, Liver Transplantation, and Others. The antiviral medications segment dominated the market with a revenue share of approximately 63.6% in 2025, driven by widespread use of direct-acting antivirals (DAAs). DAAs offer high cure rates exceeding 95%, making them the standard of care. Shorter treatment durations improve adherence. Reduced side-effect profiles enhance patient compliance. Strong clinical guideline support drives adoption. Expanding generic availability improves affordability. Government reimbursement programs support access. Pharmaceutical innovation sustains product pipelines. High treatment success reduces long-term complications. Large diagnosed patient pool sustains demand. Global elimination initiatives prioritize antiviral therapy. Hospital and outpatient use remains high.

The liver transplantation segment is expected to grow at the fastest CAGR of around 9.1% from 2026 to 2033, driven by increasing cases of end-stage liver disease due to untreated HCV. Rising cirrhosis and liver cancer incidence fuels demand. Improved transplant success rates support growth. Expansion of transplant infrastructure contributes. Improved post-transplant antiviral management enhances outcomes. Growing healthcare investments support availability. Increased organ donation awareness aids growth. Advanced surgical techniques improve safety. Specialized transplant centers expand globally. High unmet need drives adoption. Aging HCV population increases transplant demand. Clinical advancements support long-term survival.

- By Route of Administration

On the basis of route of administration, the market is segmented into Oral, Parenteral, and Others. The oral segment held the largest market share of approximately 68.9% in 2025, driven by the dominance of oral DAAs in hepatitis C treatment. Oral drugs offer ease of administration and high patient compliance. Home-based treatment reduces hospital visits. Short treatment regimens improve completion rates. Strong physician preference supports usage. Favorable safety profiles increase acceptance. Broad availability across regions sustains dominance. Cost reductions via generics boost adoption. Improved pharmacokinetics enhance outcomes. Integration into outpatient care supports growth. Patient convenience drives preference. Strong regulatory approvals reinforce leadership.

The parenteral segment is anticipated to grow at the fastest CAGR of about 7.4% from 2026 to 2033, driven by use in severe or complicated cases. Injectable therapies remain relevant in advanced liver disease. Hospital-based administration supports controlled treatment. Research into novel injectables fuels growth. Rising transplant-related care increases demand. Improved delivery technologies enhance safety. Specialized care settings support adoption. Growing clinical trials increase usage. Expansion of tertiary care hospitals drives growth. Targeted therapies support interest. Physician preference in critical cases boosts demand. Advancements in formulation enhance outcomes.

- By End User

On the basis of end user, the market is segmented into Hospitals & Clinics, Diagnostic Centers, and Others. The hospitals & clinics segment dominated the market with a revenue share of around 57.3% in 2025, driven by comprehensive diagnosis and treatment capabilities. Hospitals manage complex and chronic HCV cases. Availability of multidisciplinary care supports dominance. High patient inflow sustains revenue. Access to advanced diagnostics boosts usage. Strong reimbursement mechanisms support treatment delivery. Government hospitals play a key role in elimination programs. Skilled specialists enhance outcomes. Availability of antiviral therapy supports demand. Long-term patient management occurs primarily in hospitals. Emergency and inpatient care contribute. Established infrastructure sustains leadership.

The diagnostic centers segment is projected to witness the fastest CAGR of approximately 8.8% from 2026 to 2033, driven by expansion of standalone testing facilities. Growing screening initiatives boost demand. Cost-effective services attract patients. Increased preventive healthcare adoption supports growth. Technological advancements improve testing accuracy. Faster turnaround times enhance patient preference. Public-private partnerships support expansion. Rising outpatient testing drives volumes. Expansion in urban and semi-urban areas fuels growth. Home sample collection services support adoption. Awareness campaigns increase testing uptake. Decentralized diagnostics strengthen market presence.

Hepatitis C Diagnosis and Treatment Market Regional Analysis

- North America dominated the hepatitis C diagnosis and treatment market with the largest revenue share of approximately 38.4% in 2025, supported by a strong and well-established healthcare infrastructure, high screening and diagnosis rates, and favorable reimbursement frameworks

- The region benefits from early adoption of novel direct-acting antiviral (DAA) therapies, which offer high cure rates and shorter treatment durations. Widespread awareness initiatives, routine blood screening programs, and strong government support for hepatitis elimination strategies further contribute to market leadership

- The presence of major pharmaceutical companies and continuous product innovation also play a critical role in sustaining market growth across the region

U.S. Hepatitis C Diagnosis and Treatment Market Insight

The U.S. hepatitis C diagnosis and treatment market accounted for the majority of revenue within North America in 2025, driven by a large diagnosed and treated patient population and advanced diagnostic capabilities. High adoption of RNA testing, genotyping, and next-generation antiviral therapies has significantly improved treatment outcomes. Favorable insurance coverage, strong public health initiatives, and increasing focus on eliminating hepatitis C among high-risk populations such as intravenous drug users and baby boomers continue to fuel market expansion. Ongoing clinical research and rapid uptake of newly approved therapies further strengthen the U.S. market position.

Europe Hepatitis C Diagnosis and Treatment Market Insight

The Europe hepatitis C diagnosis and treatment market is expected to grow at a steady CAGR during the forecast period, supported by robust public healthcare systems and strong government-led hepatitis elimination programs. Several European countries have implemented national screening and treatment strategies aimed at reducing disease burden. Increasing access to affordable antiviral therapies, combined with rising awareness and early diagnosis initiatives, is driving market growth across the region.

U.K. Hepatitis C Diagnosis and Treatment Market Insight

The U.K. hepatitis C diagnosis and treatment market is projected to witness notable growth, driven by extensive screening programs and strong government commitment toward hepatitis C elimination. The National Health Service (NHS) plays a crucial role in expanding access to diagnostic testing and antiviral treatments. Increased focus on early detection, particularly among high-risk groups, and favorable treatment guidelines continue to support market expansion.

Germany Hepatitis C Diagnosis and Treatment Market Insight

Germany hepatitis C diagnosis and treatment market is anticipated to register consistent growth in the Hepatitis C Diagnosis and Treatment market, supported by advanced diagnostic infrastructure and high healthcare expenditure. Strong physician awareness, early adoption of innovative antiviral therapies, and comprehensive insurance coverage contribute to increasing treatment uptake. Germany’s emphasis on preventive healthcare and early intervention further strengthens market growth.

Asia-Pacific Hepatitis C Diagnosis and Treatment Market Insight

Asia-Pacific hepatitis C diagnosis and treatment market is expected to be the fastest-growing region, registering a robust CAGR of around 9.3% during the forecast period, driven by large undiagnosed patient populations and rising disease prevalence. Increasing government-led hepatitis elimination initiatives, improving access to diagnostic testing, and expanding availability of cost-effective antiviral therapies are key growth drivers. Rising healthcare expenditure and growing awareness of hepatitis C management are accelerating market adoption across emerging economies.

Japan Hepatitis C Diagnosis and Treatment Market Insight

Japan’s hepatitis C diagnosis and treatment market is gaining steady momentum due to an aging population and a historically high prevalence of hepatitis C. Strong healthcare infrastructure, widespread screening practices, and high adoption of advanced antiviral therapies support market growth. Continuous innovation in diagnostics and treatment regimens further enhances patient outcomes in the country.

China Hepatitis C Diagnosis and Treatment Market Insight

China hepatitis C diagnosis and treatment market represents one of the largest markets in the Asia-Pacific region, driven by a substantial hepatitis C patient pool and increasing government focus on disease control. Expanding access to affordable diagnostics and domestically manufactured antiviral drugs is improving treatment penetration. National public health initiatives, coupled with rising healthcare investment, are expected to significantly boost market growth during the forecast period.

Hepatitis C Diagnosis and Treatment Market Share

The Hepatitis C Diagnosis and Treatment industry is primarily led by well-established companies, including:

• AbbVie (U.S.)

• Merck & Co., Inc. (U.S.)

• Johnson & Johnson (U.S.)

• Roche (Switzerland)

• Bristol-Myers Squibb (U.S.)

• Novartis (Switzerland)

• Vertex Pharmaceuticals (U.S.)

• Astellas Pharma (Japan)

• Shionogi & Co., Ltd. (Japan)

• ViiV Healthcare (U.K.)

• BioNTech SE (Germany)

• Chugai Pharmaceutical (Japan)

• Sun Pharmaceutical Industries (India)

• Cipla Limited (India)

• Hetero Drugs (India)

• Zydus Cadila (India)

• Emcure Pharmaceuticals (India)

• Lupin Pharmaceuticals (India)

• Teva Pharmaceutical Industries (Israel)

Latest Developments in Global Hepatitis C Diagnosis and Treatment Market

- In June 2025, the U.S. Food and Drug Administration (FDA) approved an expanded indication for AbbVie’s oral direct acting antiviral therapy MAVYRET (glecaprevir/pibrentasvir) as the first and only eight‑week pangenotypic treatment option for both acute and chronic hepatitis C virus (HCV) infection in adults and pediatric patients aged 3 years and older without cirrhosis or with compensated cirrhosis. This expanded approval allows healthcare providers to treat HCV patients immediately upon diagnosis, improving early intervention and supporting public health goals toward HCV elimination

- In June 2024, Cepheid received U.S. FDA marketing authorization for its Xpert HCV Viral Load test on the GeneXpert Xpress platform, enabling rapid, point‑of‑care hepatitis C virus RNA detection directly from a fingerstick blood sample in approximately one hour. This diagnostic breakthrough significantly enhances the ability to diagnose and link patients to care in a single visit, including in non‑traditional settings such as substance use disorder clinics and urgent care facilities

- In June 2022, the World Health Organization (WHO) published updated global guidance on hepatitis C infection that recommended simplified service delivery, expanded treatment of adolescents and children with the same pangenotypic regimens used in adults, and decentralization of testing and care to primary health settings. These updated recommendations aim to broaden access to HCV care and support global elimination targets by integrating services into wider healthcare delivery frameworks

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.