Global Hepatitis D Market

Market Size in USD Million

CAGR :

%

USD

766.41 Million

USD

970.86 Million

2024

2032

USD

766.41 Million

USD

970.86 Million

2024

2032

| 2025 –2032 | |

| USD 766.41 Million | |

| USD 970.86 Million | |

|

|

|

|

Hepatitis D Market Size

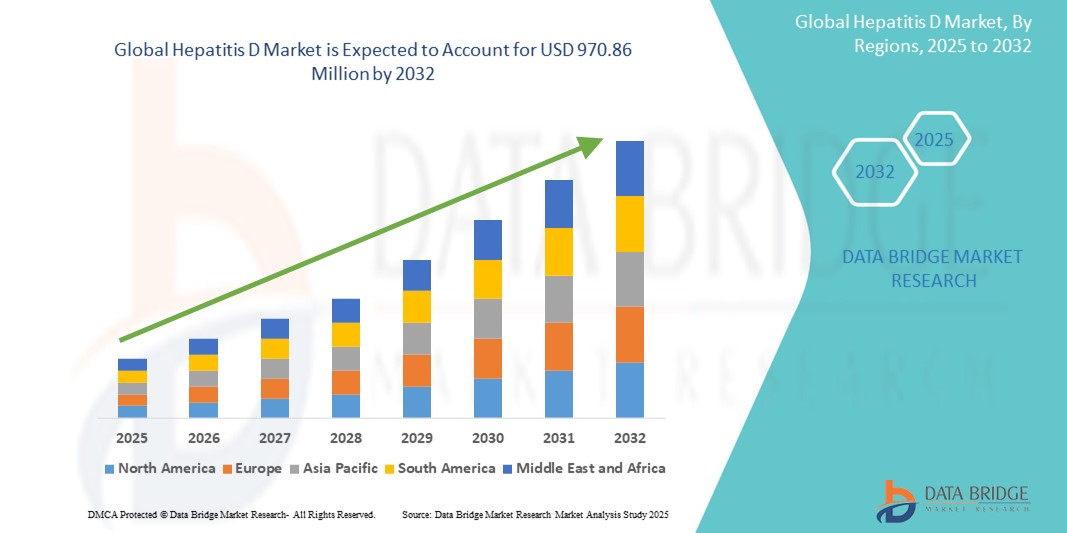

- The global hepatitis D market size was valued at USD 766.41 million in 2024 and is expected to reach USD 970.86 million by 2032, at a CAGR of 3.00% during the forecast period

- The market growth is largely fueled by the increasing prevalence of co-infections with Hepatitis B virus (HBV) and the growing need for effective antiviral therapies targeting Hepatitis D, leading to expanded research and therapeutic development globally

- Furthermore, rising demand for early diagnosis, improved patient management, and the development of novel treatment options—such as entry inhibitors and interferon-free regimens—is establishing Hepatitis D solutions as a critical area of focus in hepatology. These converging factors are accelerating the uptake of Hepatitis D solutions, thereby significantly boosting the industry's growth

Hepatitis D Market Analysis

- Hepatitis D, a severe form of viral hepatitis caused by the hepatitis D Virus (HDV), continues to pose a significant global health burden, especially in regions with high rates of co-infection with Hepatitis B. The market is driven by rising awareness, improving diagnostic capabilities, and advancements in antiviral therapeutics

- The growing demand for effective diagnostic tools and treatment options is primarily fueled by increased disease surveillance efforts, the integration of hepatitis testing in routine screenings, and rising government and NGO-led initiatives targeting hepatitis elimination

- North America dominated the hepatitis D market with the largest revenue share of 26.8% in 2024, supported by well-established healthcare infrastructure, a high prevalence of Hepatitis B (which HDV requires to replicate), and ongoing clinical trials for HDV-targeted therapies. The U.S. leads the region due to early access to innovative antivirals, improved diagnostic access, and policy support for hepatitis elimination strategies

- Asia-Pacific is expected to be the fastest-growing region in the Hepatitis D market during the forecast period, owing to a high disease burden in countries such as China, India, and Mongolia, along with rising healthcare expenditure, expanding public health programs, and increasing access to HBV/HDV co-infection screening

- The chronic Hepatitis D segment dominated the hepatitis D market with a market share of 58.4% in 2024, driven by the higher disease burden and long-term complications associated with HDV co-infection, particularly in patients with chronic Hepatitis B. Chronic HDV infection accelerates liver fibrosis, cirrhosis, and the risk of hepatocellular carcinoma, necessitating consistent treatment and close clinical monitoring

Report Scope and Hepatitis D Market Segmentation

|

Attributes |

Hepatitis D Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Hepatitis D Market Trends

“Improved Diagnostic Precision and Treatment Access”

- A significant and accelerating trend in the global hepatitis D market is the growing focus on enhancing early detection and treatment accessibility, particularly in regions with high Hepatitis B co-infection rates. As HDV requires the presence of HBV to replicate, integrated screening programs are becoming increasingly important to identify dual infections early

- For instance, combination diagnostic kits that simultaneously detect HBV and HDV are gaining traction in clinical settings, helping healthcare providers initiate timely treatment. These tools support broader public health efforts aimed at achieving WHO's hepatitis elimination goals by 2030

- Innovations in HDV-targeted therapies—such as entry inhibitors, interferon-based regimens, and nucleic acid polymers—are improving treatment outcomes for patients with chronic Hepatitis D. Emerging oral drugs also promise to reduce side effects and improve adherence over long-term injectable therapies

- The expansion of molecular testing platforms and next-generation sequencing tools in both urban and resource-limited healthcare settings is facilitating broader surveillance of HDV genotypes and resistance patterns. These diagnostic advances enable physicians to tailor treatments based on patient-specific viral profiles

- This growing emphasis on personalized and data-driven treatment strategies is fundamentally reshaping clinical management of Hepatitis D, driving pharmaceutical companies and diagnostic developers to invest in advanced R&D pipelines

- The demand for accessible, affordable, and comprehensive HDV solutions is growing rapidly across both public and private healthcare systems, as governments and global health agencies increasingly prioritize viral hepatitis elimination through coordinated screening, vaccination, and therapeutic programs

Hepatitis D Market Dynamics

Driver

“Growing Need Due to Rising Prevalence of Co-infections and Advancements in Antiviral Therapies”

- The increasing global burden of hepatitis B and rising cases of co-infection with Hepatitis D virus (HDV) are significant drivers for the growing demand for effective diagnosis and treatment solutions for Hepatitis D

- For instance, in April 2024, Gilead Sciences announced promising results from a clinical trial evaluating a new class of entry inhibitors targeting HDV, showcasing the industry’s shift toward more targeted, effective therapeutics. Such strategies by key companies are expected to drive the Hepatitis D industry growth in the forecast period

- As healthcare providers and policymakers become more aware of the severe outcomes associated with chronic Hepatitis D, such as liver fibrosis and hepatocellular carcinoma, there is increased focus on early detection and comprehensive disease management

- Furthermore, the rising adoption of advanced diagnostic tools, such as PCR-based tests and serologic assays, along with global hepatitis elimination initiatives by organizations such as WHO, are accelerating the integration of Hepatitis D screening into standard HBV patient care

- The availability of new and investigational therapies, improved diagnostic access, and growing public health awareness—especially in endemic regions—are key factors propelling the adoption of Hepatitis D solutions. In addition, global collaborations and funding for rare liver diseases are contributing to research momentum and market expansion

Restraint/Challenge

“Limited Treatment Availability and High Diagnostic Costs”

- The lack of approved and widely accessible treatments for Hepatitis D remains a significant challenge for the market. While therapies such as pegylated interferon-alpha exist, their limited efficacy and side effects hinder broader clinical adoption

- For instance, many low-income and developing regions lack the infrastructure for routine HDV screening, leading to underdiagnosis and delayed treatment initiation

- Addressing these barriers through the development and approval of novel antiviral agents, such as bulevirtide, and the expansion of affordable screening tools is essential for increasing patient access

- Moreover, the relatively high cost of advanced diagnostic tests such as nucleic acid amplification testing (NAAT) and liver elastography can be a financial burden for both patients and healthcare systems

- While some countries are incorporating Hepatitis D screening in HBV-positive cases, global coverage is still inconsistent, especially in areas with limited healthcare funding

- Overcoming these challenges through international partnerships, government support for rare disease management, and broader inclusion of Hepatitis D solutions in national healthcare guidelines will be vital for sustained market growth

Hepatitis D Market Scope

The Hepatitis D market is segmented on the basis of type, treatment, diagnosis, transmission, end-users, and distribution channel.

- By Type

On the basis of type, the hepatitis D market is segmented into acute hepatitis D and chronic hepatitis D. Chronic hepatitis D held the largest market revenue share of 58.4% in 2024, driven by the higher disease burden and long-term complications associated with HDV co-infection, especially among patients with chronic Hepatitis B. Chronic HDV infection leads to rapid liver fibrosis, cirrhosis, and increased risk of hepatocellular carcinoma, which necessitates ongoing treatment and monitoring.

Acute Hepatitis D is expected to witness fastest growth rate from 2025 to 2032, driven by improvements in early diagnostic testing and rising awareness, particularly in high-risk populations.

- By Treatment

On the basis of treatment, the hepatitis D market is segmented into interferon alpha, lamivudine, liver transplant, and others. Interferon Alpha dominated the treatment segment in 2024 with a market share of 42.6%, as it remains the only FDA-approved therapy for Hepatitis D, despite limitations in response rates. Pegylated forms are commonly used in clinical practice.

Liver Transplant is is expected to witness the fastest CAGR from 2025 to 2032, due to increased cases of liver failure in patients with advanced HDV-related cirrhosis and hepatocellular carcinoma.

- By Diagnosis

On the basis of diagnosis, the hepatitis D market is segmented into blood tests, elastography, liver biopsy, serologic testing, and others. Serologic testing accounted for the largest revenue share of 37.9% in 2024, as these tests are widely used to detect anti-HDV antibodies and confirm co-infection in Hepatitis B patients.

Elastography is expected to witness the fastest CAGR from 2025 to 2032 due to its non-invasive approach and increasing deployment in hepatology clinics to assess liver fibrosis progression.

- By Transmission

On the basis of transmission, the hepatitis D market is segmented into exposure to infected blood, contaminated needles, blood and plasma product transfusion, and others. Exposure to infected blood led the segment in 2024 with a market share of 44.2%, as HDV spreads primarily through direct blood contact, especially in regions with low HBV vaccination coverage.

Contaminated Needles is expected to witness the fastest CAGR from 2025 to 2032, as it remains a major concern in developing countries and among high-risk groups, such as intravenous drug users.

- By End-Users

On the basis of end-users, the hepatitis D market is segmented into clinic, hospital, and others. Hospitals dominated the market with a revenue share of 63.5% in 2024, attributed to comprehensive care availability, diagnostic testing infrastructure, and the ability to manage liver-related complications.

Clinics is expected to witness the fastest CAGR from 2025 to 2032, due to increased availability of point-of-care testing and the expansion of hepatitis screening programs in community healthcare settings.

- By Distribution Channel

On the basis of distribution channel, the hepatitis D market is segmented into hospital pharmacy, retail pharmacy, and online pharmacy. Hospital pharmacies held the largest share of 57.8% in 2024, due to centralized treatment of chronic HDV cases and direct availability of interferon-based therapies.

Online pharmacies are expected to exhibit the fastest growth rate, driven by increased eHealth adoption, especially for follow-up medication access in remote or underserved regions.

Hepatitis D Market Regional Analysis

- North America dominated the hepatitis D market with the largest revenue share of 26.8% in 2024, driven by the increasing burden of co-infections with Hepatitis B virus (HBV), advanced healthcare infrastructure, and strong emphasis on early diagnosis and treatment

- The region benefits from wide access to interferon-based therapies and newly approved antiviral agents, with growing adoption of diagnostic screening in high-risk populations

- Government-supported hepatitis elimination programs and clinical research collaborations are further supporting regional market expansion

U.S. Hepatitis D Market Insight

The U.S. hepatitis D market captured the largest revenue share of 71.0% within North America in 2024, driven by proactive screening programs, high healthcare spending, and FDA approvals of innovative Hepatitis D drugs. Increasing awareness about chronic liver diseases, availability of specialized hepatology centers, and a large population of HBV-infected individuals fuel demand. The market is expected to grow steadily, supported by national health policies, access to clinical trials, and continued innovation in diagnostic and therapeutic approaches

Europe Hepatitis D Market Insight

The Europe hepatitis D market is projected to expand at a considerable CAGR from 2025 to 2032, owing to rising prevalence of Hepatitis B and D co-infections in Eastern and Southern Europe. Europe accounted for a market share of 24.7% in 2024, with Germany, the U.K., France, and Italy leading in the adoption of screening protocols and treatment guidelines. Efforts by the European Association for the Study of the Liver (EASL) and local health authorities are fostering increased disease awareness and access to therapies

U.K. Hepatitis D Market Insight

The U.K. hepatitis D market accounted for 17.9% of the European market share in 2024, fueled by NHS-backed screening programs, rising liver disease cases, and availability of HDV-targeted therapies. Market growth is further supported by public health initiatives aimed at reducing transmission, along with academic and pharmaceutical research partnerships

Germany Hepatitis D Market Insight

The Germany hepatitis D market captured 21.6% of Europe’s market share in 2024, supported by high healthcare investment, advanced diagnostic capabilities, and a robust framework for treating viral hepatitis. National strategies focusing on early diagnosis and increasing clinical trial participation are further contributing to the country's market leadership

Asia-Pacific Hepatitis D Market Insight

The Asia-Pacific hepatitis D market is poised to grow at the fastest CAGR of 4.6% from 2025 to 2032, driven by the high HBV prevalence in countries such as China, India, and Southeast Asia. The region accounted for a market share of 22.3% in 2024, with governments increasingly integrating HDV screening into HBV management programs. Improved healthcare access, growing awareness campaigns, and international collaborations are accelerating market penetration

Japan Hepatitis D Market Insight

The Japan hepatitis D market held a market share of 16.4% in Asia-Pacific in 2024, supported by early adoption of innovative treatments and strong emphasis on liver health in national healthcare policy. Rising prevalence of chronic HBV and aging population dynamics are fueling demand for regular liver screenings and targeted antivirals

China Hepatitis D Market Insight

The China hepatitis D market accounted for the largest share in the Asia-Pacific region at 43.2% in 2024, due to its large HBV-infected population, government-backed hepatitis control programs, and expanding diagnostic and treatment access. The “Healthy China 2030” initiative, local pharmaceutical manufacturing, and large-scale screening campaigns are key factors driving rapid market growth

Hepatitis D Market Share

The Hepatitis D industry is primarily led by well-established companies, including:

- Biosidus (Argentina)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Zydus Group (India)

- NanoGen HealthCare Pvt. Ltd. (India)

- AMEGA Biotech (Argentina)

- MINAPHARM Pharmaceuticals (Egypt)

- PROBIOMED SA de CV (Mexico)

- 3SBio Group (China)

- Eiger BioPharmaceuticals (U.S.)

- Arrowhead Pharmaceuticals, Inc. (U.S.)

- Veru Inc. (U.S.)

- Anthos Therapeutics, Inc. (U.S.)

- PharmaEssentia Corporation (Taiwan)

- Replicor (Canada)

- Janssen Pharmaceuticals, Inc. (U.S.)

- Gilead Sciences, Inc. (U.S.)

- Hetero (India)

- Aurobindo Pharma (India)

- Viatris Inc. (U.S.)

- Apotex Inc. (Canada)

- ViiV Healthcare group of companies (U.K.)

- GSK plc (U.K.)

- Cipla (India)

- Sun Pharmaceutical Industries Ltd. (India)

- Merck & Co., Inc. (U.S.)

Latest Developments in Global Hepatitis D Market

- In April 2022, Antios Therapeutics, Inc., an international biopharmaceutical company, developed innovative therapies aimed at managing chronic Hepatitis D virus infections. Recently, the U.S. Patent and Trademark Office granted a patent for their application involving phosphoramidates for treating Hepatitis D virus. This patent includes the new Active Site Polymerase Inhibitor Nucleotide (ATI-2173) among various treatments and processes developed by Antios

- In June 2022, a virtual event called the “World Hepatitis Summit (WHS)” was held, bringing together global stakeholders committed to eliminating viral hepatitis. The summit served as a critical platform for exchanging insights, progress updates, and best practices across affected regions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.