Global Hepato Pancreatico Biliary Hpb Surgeries Surgical Devices Market

Market Size in USD Billion

CAGR :

%

USD

5.13 Billion

USD

9.86 Billion

2024

2032

USD

5.13 Billion

USD

9.86 Billion

2024

2032

| 2025 –2032 | |

| USD 5.13 Billion | |

| USD 9.86 Billion | |

|

|

|

|

Hepato-Pancreatico-Biliary (HPB) Surgeries Surgical Devices Market Size

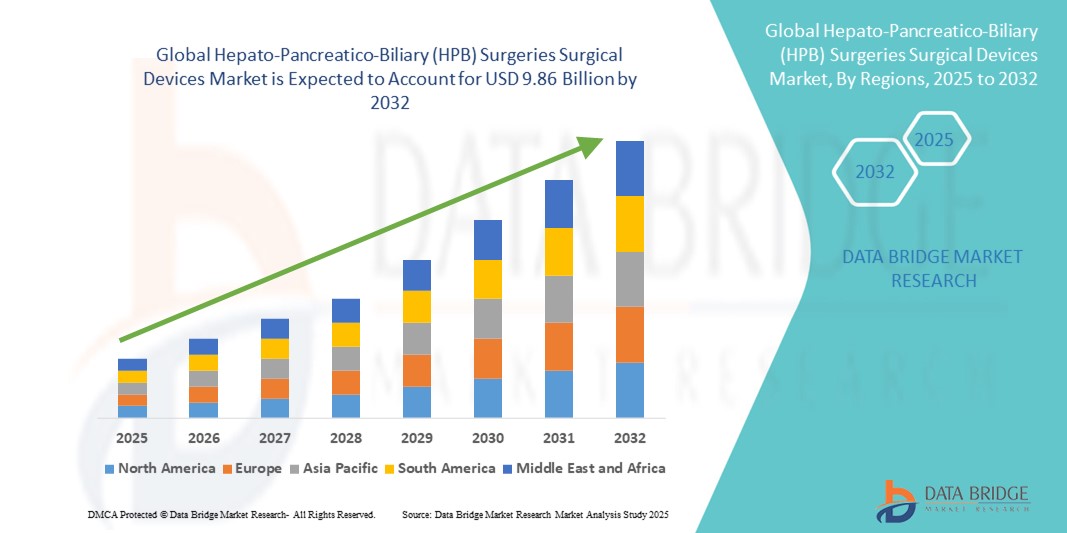

- The global hepato-pancreatico-biliary (HPB) surgeries surgical devices market size was valued at USD 5.13 billion in 2024 and is expected to reach USD 9.86 billion by 2032, at a CAGR of 8.50% during the forecast period

- The market growth is largely fueled by the growing adoption and technological advancements in HPB surgical devices, leading to enhanced precision, safety, and efficiency in complex surgical procedures. Increasing integration of minimally invasive and robotic-assisted technologies is transforming surgical approaches, improving patient recovery times, and reducing post-operative complications

- Furthermore, rising demand for advanced surgical solutions among healthcare facilities, coupled with growing patient preference for less invasive treatments, is positioning HPB surgical devices as a critical component of modern surgical care. These converging factors are accelerating the uptake of HPB surgeries surgical devices, thereby significantly boosting the industry's growth

Hepato-Pancreatico-Biliary (HPB) Surgeries Surgical Devices Market Analysis

- The Hepato-Pancreatico-Biliary (HPB) surgeries surgical devices market is witnessing significant growth globally, driven by continuous advancements in surgical technology and increasing prevalence of liver, pancreatic, and biliary tract diseases. Enhanced precision, minimally invasive techniques, and robotic assistance in surgeries are improving patient outcomes and fueling market demand across healthcare facilities worldwide

- Increasing awareness among patients and healthcare providers regarding the benefits of advanced surgical devices, coupled with rising healthcare expenditure and expanding hospital infrastructure, are key factors accelerating the adoption of HPB surgical devices. The trend towards early diagnosis and treatment of HPB conditions is also contributing to market expansion

- North America dominated the Hepato-Pancreatico-Biliary (HPB) surgeries surgical devices market with the largest revenue share of 38.5% in 2024. This dominance is attributed to the region’s advanced healthcare infrastructure, significant investments in medical technologies, high patient awareness, and presence of major manufacturers and research institutions driving innovation in HPB surgical solutions

- Asia-Pacific is projected to be the fastest-growing region in the Hepato-Pancreatico-Biliary (HPB) surgeries surgical devices market during the forecast period, with an expected CAGR of 24%. Factors such as rapid urbanization, rising disposable incomes, expansion of healthcare facilities, and increasing prevalence of HPB disorders in populous countries like China, India, and Japan are the primary growth drivers in this region

- The electrosurgery instruments segment dominated the Hepato-Pancreatico-Biliary (HPB) surgeries surgical devices market with a market share of 43.2% in 2024. The preference for electrosurgical tools stems from their precision, reduced operation time, and improved safety profiles, making them essential in complex HPB surgeries

Report Scope and Hepato-Pancreatico-Biliary (HPB) Surgeries Surgical Devices Market Segmentation

|

Attributes |

Hepato-Pancreatico-Biliary (HPB) Surgeries Surgical Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Hepato-Pancreatico-Biliary (HPB) Surgeries Surgical Devices Market Trends

Advancements in Precision Surgical Technologies and Minimally Invasive Procedures

- A key and rapidly growing trend in the global hepato-pancreatico-biliary (HPB) surgeries surgical devices market is the continuous development and adoption of precision surgical technologies that improve procedural outcomes and reduce patient recovery times. This includes enhanced imaging systems, robotic-assisted surgical platforms, and advanced energy-based devices that facilitate minimally invasive interventions

- For instance, many manufacturers are integrating high-definition visualization tools and real-time intraoperative navigation systems into HPB surgical suites. These innovations enable surgeons to perform delicate procedures such as liver resections and pancreatic tumor removals with improved accuracy and safety

- The focus on minimally invasive surgery (MIS) is driving demand for compact, ergonomically designed instruments that reduce trauma and post-operative complications. Surgical staplers, vessel sealing devices, and flexible endoscopes optimized for laparoscopic and robotic approaches are increasingly standard in HPB surgeries

- Furthermore, ongoing advancements in fluid management systems and energy-based devices contribute to better hemostasis and reduced operation times, which are critical in complex HPB surgeries

- Leading companies are investing heavily in research and development to create integrated surgical platforms that combine imaging, navigation, and advanced instrumentation, offering comprehensive solutions that streamline workflows and improve patient outcomes

- The trend towards precision and minimally invasive techniques is reshaping surgeon and hospital preferences globally, fueling growth in markets with robust healthcare infrastructure and increasing demand for high-quality surgical care

Hepato-Pancreatico-Biliary (HPB) Surgeries Surgical Devices Market Dynamics

Driver

Growing Need Due to Rising Healthcare Awareness and Technological Adoption

- The increasing prevalence of liver, pancreatic, and biliary tract diseases, coupled with expanding healthcare infrastructure and rising awareness about advanced surgical options, is a significant driver for the growing demand for hepato-pancreatico-biliary (HPB) surgeries surgical devices

- For instance, in April 2024, leading medical device companies announced advancements in minimally invasive surgical instruments and robotic-assisted surgical systems designed specifically for HPB procedures. Such innovations are expected to propel the growth of the hepato-pancreatico-biliary (HPB) surgeries surgical devices market during the forecast period

- As healthcare providers and patients become more informed about the benefits of advanced HPB surgical devices — including improved precision, reduced recovery times, and enhanced surgical outcomes — the adoption rate of these technologies continues to rise globally

- Furthermore, the growing emphasis on early diagnosis and treatment of HPB diseases, supported by government healthcare initiatives and increased funding for specialized surgical centers, is fueling market expansion

- The integration of advanced imaging, visualization, and robotic technologies in HPB surgeries enhances procedural accuracy and safety, which encourages wider acceptance of these devices in hospitals, specialty clinics, and ambulatory surgical centers

Restraint/Challenge

High Costs and Need for Skilled Workforce

- The widespread adoption of sophisticated Hepato-Pancreatico-Biliary (HPB) surgical devices is significantly hindered by their high cost, which remains a critical barrier to market penetration, especially in developing regions where healthcare budgets are limited and resources are constrained. These advanced devices, including robotic surgical systems and cutting-edge energy-based instruments, often require substantial initial investment, making them less accessible to many healthcare providers outside of well-funded metropolitan hospitals

- Furthermore, the complexity of these technologies necessitates specialized training and highly skilled surgeons to operate them safely and effectively. This demand for expert personnel limits the adoption of HPB surgical devices in rural and semi-urban healthcare settings, where access to trained professionals is often scarce. As a result, a pronounced disparity exists in the availability and utilization of these advanced surgical tools between major urban medical centers and smaller, less-equipped healthcare facilities

- In addition to upfront costs and training requirements, the ongoing expenses associated with maintenance, calibration, and periodic software updates further increase the total cost of ownership. These recurring costs can be prohibitive for budget-conscious institutions, impacting their ability to sustain and maximize the use of such sophisticated technologies over time

- To overcome these challenges, it is imperative for stakeholders in the healthcare industry to prioritize investments in comprehensive training programs aimed at upskilling medical professionals, ensuring proficient use of HPB surgical devices across various healthcare tiers

- Simultaneously, manufacturers must focus on cost optimization strategies, including designing more affordable models without compromising performance and reliability. Developing scalable, cost-effective HPB surgical solutions tailored to the needs of emerging markets will be vital for expanding access, improving surgical outcomes, and driving sustained growth in the global HPB surgeries surgical devices market

Hepato-Pancreatico-Biliary (HPB) Surgeries Surgical Devices Market Scope

The market is segmented on the basis of product, indication, type of surgery, age group, end user, and distribution channel.

- By Product

On the basis of product, the Hepato-Pancreatico-Biliary (HPB) surgeries surgical devices market is segmented into electrosurgery instruments, endoscope, visualization and robotic surgical system, hand instruments, access instruments, surgical suture and stapler devices, energy/vessel sealing devices, fluid management system, stents, and others. Among these, the visualization and robotic surgical system segment held a commanding lead with a revenue share of 28.5% in 2024. This dominance is attributable to the increasing integration of advanced imaging and robotic technologies in complex HPB procedures, which enhances surgical precision and patient outcomes.

The surgical suture and stapler devices segment is anticipated to experience the fastest growth, registering a CAGR of 11.2% from 2025 to 2032. This surge is driven by rising demand for minimally invasive surgical solutions and innovations in suturing technologies that offer improved efficiency and reduced operative times.

- By Indication

On the basis of indication, the hepato-pancreatico-biliary (HPB) surgeries surgical devices market is segmented into liver cancer, pancreatic cancer, gall stones, bile duct cancer, cirrhosis, pancreatitis, cholecystitis, and others. The liver cancer segment emerged as the clear market leader in 2024, accounting for 32.1% of total revenue. This dominance is largely attributed to the high incidence of liver malignancies across the region, coupled with advancements in specialized surgical devices designed specifically for oncological procedures. These devices enhance precision in tumor resection and improve patient survival rates, making them indispensable in liver cancer management.

In contrast, the pancreatitis segment is expected to register the fastest growth, with a CAGR of 12.5% during the forecast period. This rapid expansion is driven by growing awareness about the disease, improvements in early diagnostic techniques, and an increased adoption of surgical interventions to manage both acute and chronic pancreatitis cases, which are becoming more prevalent due to lifestyle changes and rising healthcare access.

- By Type of Surgery

On the basis of type of surgery, the hepato-pancreatico-biliary (HPB) surgeries surgical devices market is segmented into open surgery and minimally invasive surgery. Minimally invasive surgery commanded a significant share of 61.7% in 2024, reflecting a strong regional shift toward less invasive procedures. These surgical approaches are favored due to their numerous patient benefits, including shorter hospital stays, reduced post-operative pain, quicker recovery times, and lower complication rates. The rising availability of laparoscopic and robotic-assisted surgical devices tailored for HPB procedures further supports this preference. Moreover, this segment is forecasted to experience the highest growth rate with a CAGR of 13.8% from 2025 to 2032, driven by continuous technological innovations and the growing confidence of surgeons and patients in minimally invasive techniques.

- By Age Group

On the basis of age group, the hepato-pancreatico-biliary (HPB) surgeries surgical devices market is segmented into pediatric, adult, and geriatric. The adult age group dominated the market in 2024 with a share of 70.8%, owing to the higher prevalence of HPB diseases such as liver cancer, pancreatitis, and gallstones in this demographic. The adult population’s increasing healthcare access and rising incidence of lifestyle-related conditions further reinforce this segment’s leadership.

Meanwhile, the geriatric segment is poised for the fastest growth during the forecast period, with a CAGR of 10.9% through 2032. This growth is largely fueled by the aging population across countries and the corresponding rise in age-associated HPB disorders, which necessitate specialized surgical management. The increasing focus on geriatric care and advancements in surgical techniques adapted for older patients are also contributing to this upward trend.

- By End User

On the basis of end user, the hepato-pancreatico-biliary (HPB) surgeries surgical devices market is segmented into hospitals, specialty clinics, ambulatory surgical centers, trauma centers, and others. Hospitals continue to dominate as the largest end-user segment, commanding a revenue share of 74.2% in 2024. This dominance is primarily due to hospitals’ well-established infrastructure, advanced surgical facilities, and ability to manage complex Hepato-Pancreatico-Biliary (HPB) surgeries that require multidisciplinary teams and specialized equipment. Large hospital networks also benefit from higher patient volumes and stronger purchasing power, further solidifying their leadership in this segment.

On the other hand, Ambulatory Surgical Centers (ASCs) are projected to register the fastest growth, with a CAGR of 12.3% from 2025 to 2032. This surge is driven by the increasing preference for outpatient surgical procedures that offer reduced hospital stays, lower costs, and faster patient turnover. ASCs are becoming attractive alternatives for less complex HPB surgeries, supported by advancements in minimally invasive techniques that enable safe and efficient treatment outside traditional hospital settings.

- By Distribution Channel

On the basis of distribution channel, the hepato-pancreatico-biliary (HPB) surgeries surgical devices market is segmented into direct tender, retail sales, and others. The direct tender segment held the dominant position with a substantial market share of 65.3% in 2024. This leadership is attributed to procurement strategies adopted by governments and large healthcare institutions that favor bulk purchasing agreements and long-term supply contracts to ensure consistent availability and cost-effectiveness of surgical devices. Direct tenders also facilitate streamlined logistics and regulatory compliance, making them a preferred choice in public healthcare sectors across the region.

Meanwhile, the Retail Sales is anticipated to experience the fastest growth, registering a robust CAGR of 14.1% during the forecast period. This rapid expansion is fueled by the rising penetration of e-commerce platforms, improved internet accessibility, and changing consumer preferences that favor the convenience of online purchasing. In addition, online channels enable manufacturers and distributors to reach a broader customer base, offer detailed product information, and provide flexible delivery and return policies, all of which contribute to accelerating market growth in this segment.

Hepato-Pancreatico-Biliary (HPB) Surgeries Surgical Devices Market Regional Analysis

- North America dominated the hepato-pancreatico-biliary (HPB) surgeries surgical devices market with the largest revenue share of 38.5% in 2024, primarily driven by substantial investments in healthcare infrastructure and the increasing prevalence of complex HPB conditions such as liver cancer, pancreatic diseases, and biliary tract disorders

- The region benefits from early adoption of cutting-edge minimally invasive and robotic-assisted surgical technologies, supported by a strong presence of leading medical device manufacturers and favorable reimbursement policies

- These factors collectively contribute to the robust growth of the market in North America

U.S. Hepato-Pancreatico-Biliary (HPB) Surgeries Surgical Devices Market Insight

The U.S. hepato-pancreatico-biliary (HPB) surgeries surgical devices market accounted for a commanding 65% revenue share within North America in 2024. This dominant position is driven by the rapid expansion and modernization of specialized HPB surgical centers across the country, which are increasingly adopting cutting-edge surgical tools to enhance precision and patient outcomes. The growing demand for minimally invasive and robotic-assisted procedures, combined with the integration of advanced imaging and navigation technologies, is further fueling market growth. In addition, strong investments in healthcare infrastructure and favorable reimbursement policies contribute to the accelerated adoption of innovative HPB surgical devices throughout the U.S.

Europe Hepato-Pancreatico-Biliary (HPB) Surgeries Surgical Devices Market Insight

The Europe hepato-pancreatico-biliary (HPB) surgeries surgical devices market is forecasted to experience significant expansion over the coming years, propelled by multiple key factors. An aging population across Europe has led to a rise in the prevalence of hepatobiliary cancers and related disorders, increasing the demand for advanced surgical interventions. In addition, continuous investments in healthcare infrastructure and cutting-edge medical technologies are enabling healthcare providers to adopt sophisticated HPB surgical devices that improve surgical outcomes and patient safety. Leading European countries such as Germany, France, Italy, and the U.K. are spearheading this growth, supported by their robust healthcare systems and proactive governmental initiatives focused on cancer treatment innovation, minimally invasive surgery, and enhanced surgical precision. These factors collectively contribute to a strong and sustained market growth trajectory across the region.

Germany Hepato-Pancreatico-Biliary (HPB) Surgeries Surgical Devices Market Insight

The Germany hepato-pancreatico-biliary (HPB) surgeries surgical devices market emerged as the leader within the European HPB surgical devices market, holding the largest revenue share of approximately 28.7% in 2024. This market dominance is attributed to the country’s advanced and comprehensive healthcare system, which includes a high density of specialized HPB surgical centers equipped with the latest surgical technologies. In addition, Germany’s government actively promotes innovations in cancer treatment and surgical techniques through funding and supportive policies, which encourages continuous adoption of advanced HPB surgical devices. The country’s robust focus on research and development, alongside a well-structured reimbursement system, enables healthcare providers to readily invest in state-of-the-art surgical solutions, fostering steady market growth.

Italy Hepato-Pancreatico-Biliary (HPB) Surgeries Surgical Devices Market Insight

The Italy hepato-pancreatico-biliary (HPB) surgeries surgical devices market is anticipated to record the fastest CAGR of around 12.6% during the forecast period, reflecting a growing public awareness of HPB diseases and their early diagnosis. This growth is further propelled by the country’s rapid uptake of minimally invasive surgical procedures, supported by increasing investments aimed at modernizing hospital surgical departments across both urban and rural areas. Government healthcare reforms focusing on enhancing access to advanced medical technologies and the expansion of healthcare services beyond metropolitan areas are expected to accelerate demand for HPB surgical devices in Italy significantly.

Asia-Pacific Hepato-Pancreatico-Biliary (HPB) Surgeries Surgical Devices Market Insight

The Asia-Pacific Hepato-Pancreatico-Biliary (HPB) Surgeries Surgical Devices market is set to achieve the fastest CAGR of 24% between 2025 and 2032, driven by rapid urbanization, rising disposable incomes, and ongoing technological advancements, particularly in countries like China, Japan, and India. The region is witnessing considerable expansion in healthcare infrastructure, supported by proactive government initiatives aimed at improving cancer care and surgical outcomes. These developments are enhancing the accessibility and adoption of innovative HPB surgical devices, including robotic-assisted systems and advanced energy-based instruments.

Japan Hepato-Pancreatico-Biliary (HPB) Surgeries Surgical Devices Market Insight

The Japan hepato-pancreatico-biliary (HPB) surgeries surgical devices market is gaining strong momentum due to its high-tech medical culture, growing elderly population, and increasing demand for convenient and effective surgical solutions. The country’s healthcare providers are progressively integrating smart surgical technologies, such as advanced imaging and robotic assistance, into their treatment protocols to improve precision and patient recovery. The rise in smart hospital initiatives and government support for medical technology innovation are also key factors contributing to the growth of this market segment in Japan.

China Hepato-Pancreatico-Biliary (HPB) Surgeries Surgical Devices Market Insight

The China hepato-pancreatico-biliary (HPB) surgeries surgical devices market held the largest market revenue share within the Asia-Pacific region in 2024, driven by its expanding middle class, rapid urbanization, and high adoption rates of advanced medical technologies. The government’s commitment to healthcare modernization, including significant investments in specialized HPB surgical centers, has catalyzed the market’s growth. The country is also a major manufacturing hub for HPB surgical devices, which has improved the availability and affordability of these technologies. Strong domestic competition and export activities further strengthen China’s leading position in the regional HPB surgical devices market.

Hepato-Pancreatico-Biliary (HPB) Surgeries Surgical Devices Market Share

The Hepato-Pancreatico-Biliary (HPB) surgeries surgical devices industry is primarily led by well-established companies, including:

- Medtronic (Ireland)

- Cook (U.S.)

- Olympus Corporation (Japan)

- B. Braun SE (Germany)

- TeleMed Systems, Inc. (U.S.)

- Boston Scientific Corporation (U.S.)

- CONMED Corporation (U.S.)

- BD (U.S.)

- CooperSurgical Inc. (U.S.)

- KARL STORZ (Germany)

- Medorah Meditek Pvt. Ltd (India)

- STERIS plc (U.S.)

- FUJIFILM Corporation (Japan)

- Johnson & Johnson and its affiliates (U.S.)

Latest Developments in Global Hepato-Pancreatico-Biliary (HPB) Surgeries Surgical Devices Market

- In June 2021, Ethicon (Johnson & Johnson) launched the ENSEAL X1 Curved Jaw Tissue Sealer, an advanced bipolar energy device whose marketing/IFU highlights adaptive tissue sensing, improved sealing and ergonomics intended to improve procedural efficiency in lap/open procedures — a technology class widely used in complex soft-tissue surgery including liver and biliary work. This product launch is documented in Ethicon / J&J press materials and trade coverage and is relevant because bipolar/energy sealing tools are core consumables in HPB resections

- In May 2024, Ethicon (J&J MedTech) launched the ECHELON LINEAR Cutter, described as a first-of-its-kind linear stapler combining 3D-stapling and Gripping Surface Technology (GST) — Ethicon reports clinical and bench data showing reduced staple-line leaks in initial studies and announced a U.S. commercial roll-out. Linear cutters and staplers are critical in hepatic and pancreatic transections and anastomoses, so this was an important device launch for HPB surgeons and OR teams

- In February 2024, CMR Surgical announced vLimeLite — an integrated fluorescence/ICG imaging update for its Versius robotic system (Versius Plus) that allows surgeons to visualise indocyanine green (ICG) signal with multiple viewing modes (overlay/greyscale, selectable colours). CMR positioned this as the first CE-marked surgical robot with an integrated ICG capability; ICG fluorescence directly aids identification of biliary anatomy, hepatic perfusion and vascular mapping — all highly relevant to HPB procedures.

- In April 2024 (and continuing into 2025), Intuitive and multiple large health systems expanded deployment and clinical studies of next-generation da Vinci systems (including real-world adoption of da Vinci SP in constrained/complex abdominal cases and the rollout of newer da Vinci models). Multiple hospitals reported early adoption and clinical studies using single-port and multiport da Vinci platforms for complex pancreatic and liver procedures, reflecting increasing acceptance of robotic minimally invasive approaches in HPB

- In February 2025, AdventHealth (Tampa & other sites) announced start of clinical initiatives/trials using the da Vinci SP (single-port) system for complex pancreatic, stomach, gallbladder and other upper-abdominal resections — explicitly including pancreatic cases — illustrating active, prospective clinical evaluation of SP robotic approaches for HPB pathology.

- In May 2025, Medtronic reported the first commercial procedures using its Hugo robotic-assisted surgery (RAS) system in Korea; the company noted that Hugo was used for a prostatectomy and a pancreaticoduodenectomy at the first center, showing Hugo being trialled/applied to complex hepatopancreatobiliary operations (pancreaticoduodenectomy is a canonical HPB procedure). This marks an important commercial milestone for a new entrant in RAS being applied to high-complexity HPB cases

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.