Global Herbicides Residue Testing Market

Market Size in USD Billion

CAGR :

%

USD

42.82 Billion

USD

74.68 Billion

2024

2032

USD

42.82 Billion

USD

74.68 Billion

2024

2032

| 2025 –2032 | |

| USD 42.82 Billion | |

| USD 74.68 Billion | |

|

|

|

|

Global Herbicides Residue Testing Market Size

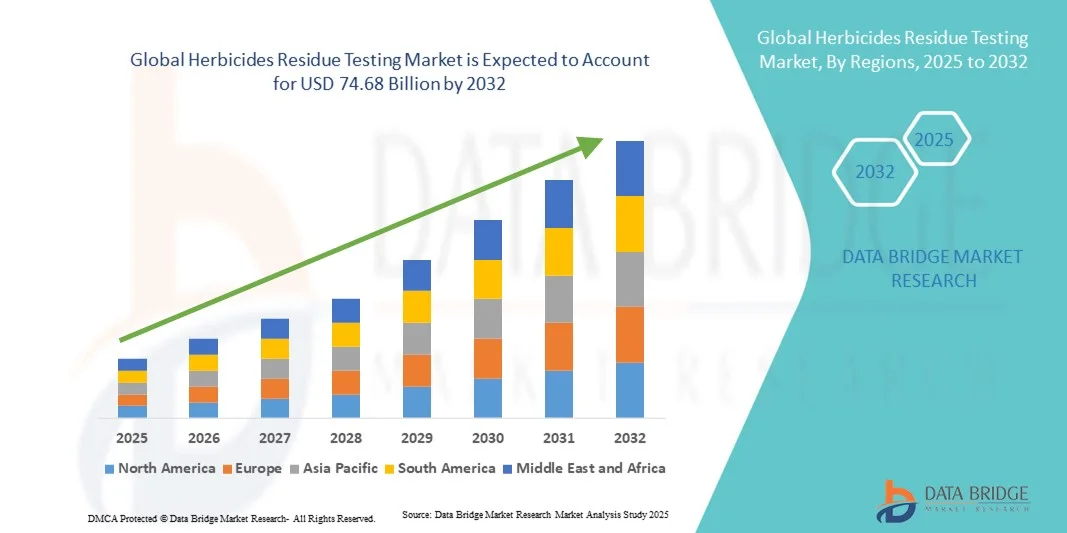

- The global Herbicides Residue Testing Market size was valued at USD 42.82 billion in 2024 and is expected to reach USD 74.68 billion by 2032, growing at a CAGR of 7.20% during the forecast period.

- The market growth is primarily driven by the increasing focus on food safety, stringent regulatory standards, and advancements in testing technologies ensuring compliance with maximum residue limits (MRLs) across agricultural produce.

- Furthermore, the rising global awareness regarding health impacts of pesticide residues and the growing adoption of advanced analytical methods such as LC-MS/MS and GC-MS are accelerating the demand for precise herbicide residue testing, thereby fueling significant market expansion.

Global Herbicides Residue Testing Market Analysis

- Herbicides residue testing, which involves the detection and quantification of chemical residues in food, feed, and environmental samples, is becoming an essential component of modern agricultural quality control and food safety systems due to its role in ensuring compliance with regulatory limits and protecting consumer health.

- The escalating demand for herbicides residue testing is primarily fueled by stringent food safety regulations, rising global trade of agricultural commodities, and increasing consumer awareness regarding pesticide contamination and its health impacts.

- Europe dominated the Global Herbicides Residue Testing Market with the largest revenue share of 32.4% in 2024, supported by well-established food safety frameworks, advanced analytical infrastructure, and the strong presence of key testing service providers. The U.S. led the regional market due to continuous innovations in chromatography and mass spectrometry technologies, along with increasing enforcement of EPA and FDA residue standards.

- Asia-Pacific is expected to be the fastest-growing region in the Global Herbicides Residue Testing Market during the forecast period, driven by rapid agricultural modernization, rising export-oriented food production, and tightening regulatory policies in countries such as China and India.

- The LC-MS/GC-MS segment dominated the market with the largest revenue share of 46.5% in 2024, owing to its superior sensitivity, precision, and capability to detect multiple herbicide residues simultaneously at trace levels.

Report Scope and Global Herbicides Residue Testing Market Segmentation

|

Attributes |

Herbicides Residue Testing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Herbicides Residue Testing Market Trends

Technological Advancements in Analytical and Detection Methods

- A significant and accelerating trend in the Global Herbicides Residue Testing Market is the continuous integration of advanced analytical technologies such as liquid chromatography-tandem mass spectrometry (LC-MS/MS), gas chromatography-mass spectrometry (GC-MS), and high-performance liquid chromatography (HPLC). These innovations are enhancing testing accuracy, speed, and reliability, enabling laboratories to detect even trace levels of herbicide residues in complex food and environmental matrices.

- For instance, the adoption of LC-MS/MS allows simultaneous detection of multiple herbicide residues with high sensitivity, while GC-MS is increasingly used for volatile and semi-volatile compounds. Companies are also integrating automated sample preparation systems and data analysis software to streamline workflows and minimize human error.

- AI and machine learning are emerging as transformative tools in herbicide residue testing, capable of analyzing large datasets, predicting contamination trends, and improving detection accuracy. For example, AI-based systems can optimize chromatographic conditions and assist in identifying unknown residue compounds more efficiently than traditional manual analysis.

- The integration of cloud-based data management platforms and Internet of Things (IoT)-enabled laboratory instruments allows real-time monitoring, remote data access, and improved traceability, ensuring regulatory compliance and faster decision-making for food safety authorities and agricultural exporters.

- This shift toward more automated, intelligent, and digitally connected testing systems is redefining the standards of residue analysis worldwide. Consequently, leading companies such as SGS SA, Eurofins Scientific, and Bureau Veritas are investing heavily in R&D to develop high-throughput, AI-assisted residue testing platforms capable of handling growing global testing demands.

- The demand for rapid, precise, and cost-effective herbicide residue detection solutions is increasing across food producers, regulatory agencies, and contract laboratories, as stakeholders prioritize consumer safety, export compliance, and sustainable agricultural practices.

Global Herbicides Residue Testing Market Dynamics

Driver

Growing Need Due to Rising Food Safety Concerns and Stricter Regulatory Standards

- The increasing prevalence of food safety concerns among consumers and regulatory bodies, coupled with the tightening of global residue limits for agricultural products, is a significant driver for the heightened demand for herbicides residue testing.

- For instance, in May 2024, the European Food Safety Authority (EFSA) updated its guidelines on pesticide and herbicide residue limits, introducing stricter maximum residue levels (MRLs) for key crops. Such regulatory advancements are expected to drive the expansion of herbicide residue testing services over the forecast period.

- As consumers become more aware of the health implications associated with chemical residues in food, there is growing demand for transparent labeling and certified residue-free products, compelling producers and exporters to invest in robust testing mechanisms.

- Furthermore, the rising global trade of agricultural goods and the increasing emphasis on export compliance are making herbicide residue testing an indispensable part of the agricultural supply chain, ensuring that food products meet the safety standards of international markets.

- The integration of advanced analytical technologies such as LC-MS/MS, GC-MS, and HPLC, along with rapid test kits and digital traceability platforms, is further propelling the adoption of herbicide residue testing across both public and private laboratories. This growing reliance on precision testing solutions underscores the industry’s critical role in supporting food safety, environmental monitoring, and sustainable agriculture practices.

Restraint/Challenge

High Testing Costs and Limited Infrastructure in Developing Regions

- The high cost of advanced analytical instruments and limited availability of accredited testing facilities, particularly in developing and rural regions, pose significant challenges to the widespread adoption of herbicide residue testing. Establishing and maintaining laboratories equipped with LC-MS/MS or GC-MS systems requires substantial investment in both equipment and skilled personnel.

- For instance, many small- and medium-sized producers in emerging markets struggle to comply with stringent export residue regulations due to the lack of affordable testing options and inadequate laboratory infrastructure, hindering their participation in global trade.

- Additionally, the complexity of testing protocols and the need for continuous calibration and validation of instruments increase operational costs, making it difficult for smaller labs to maintain efficiency and profitability.

- While technological innovations such as portable residue analyzers and AI-assisted data processing are helping to lower costs and simplify workflows, the initial investment and training requirements still act as barriers to adoption in resource-constrained areas.

- Overcoming these challenges through capacity building, government-funded laboratory initiatives, international partnerships, and technology-driven cost reductions will be essential to ensure broader accessibility and sustained growth of the global herbicides residue testing market.

Global Herbicides Residue Testing Market Scope

Herbicides residue testing market is segmented on the basis of technology, food tested, and class.

- By Technology

On the basis of technology, the Global Herbicides Residue Testing Market is segmented into LC-MS/GC-MS, High-Performance Liquid Chromatography (HPLC), Gas Chromatography, and Others. The LC-MS/GC-MS segment dominated the market with the largest revenue share of 46.5% in 2024, owing to its superior sensitivity, precision, and capability to detect multiple herbicide residues simultaneously at trace levels. Its versatility in analyzing both polar and non-polar compounds makes it the preferred choice for regulatory compliance testing in food and environmental samples.

The High-Performance Liquid Chromatography (HPLC) segment is projected to witness the fastest CAGR from 2025 to 2032, driven by its cost-effectiveness, ease of operation, and broad applicability in routine screening. Continuous advancements in HPLC detectors and column technologies are further enhancing detection efficiency, positioning it as a crucial tool for laboratories focused on large-scale, high-throughput herbicide residue analysis.

- By Food Tested

On the basis of food tested, the Global Herbicides Residue Testing Market is segmented into Meat and Poultry, Dairy Products, Processed Food, Fruits and Vegetables, Cereals, Grains and Pulses, and Others. The Fruits and Vegetables segment dominated the market with the largest revenue share of 39.8% in 2024, driven by the high frequency of herbicide application in crop cultivation and the increasing scrutiny from regulatory authorities to ensure food safety. Testing in this segment is crucial due to direct consumer exposure and the perishable nature of fresh produce.

The Processed Food segment is expected to record the fastest growth rate from 2025 to 2032, fueled by rising global consumption of packaged foods and stringent international trade regulations. With the growing demand for traceability and residue-free labeling, processed food manufacturers are increasingly implementing rigorous herbicide residue testing to maintain brand credibility and meet export compliance requirements.

- By Class

On the basis of class, the Global Herbicides Residue Testing Market is segmented into Organochlorines, Organophosphates, Organonitrogens, Carbamates, and Others. The Organophosphates segment held the largest market revenue share of 41.2% in 2024, attributed to their widespread use in agriculture and heightened regulatory monitoring due to potential neurotoxic effects. Advanced testing technologies, including LC-MS/MS and GC-MS, are extensively employed to detect trace organophosphate residues in food and environmental samples.

The Carbamates segment is anticipated to witness the fastest CAGR from 2025 to 2032, driven by growing global concerns over their persistence and toxicity. Increasing government initiatives to monitor and limit carbamate levels in crops and water sources are expanding demand for advanced detection techniques. The evolution of rapid and portable testing kits is also enhancing carbamate residue monitoring in field applications, ensuring timely and accurate results.

Global Herbicides Residue Testing Market Regional Analysis

- Europe dominated the Global Herbicides Residue Testing Market with the largest revenue share of 32.4% in 2024, driven by stringent food safety regulations, advanced testing infrastructure, and high consumer awareness regarding pesticide and herbicide residues in food products.

- Consumers and food producers in the region place strong emphasis on compliance with regulatory standards established by agencies such as the U.S. Environmental Protection Agency (EPA) and the Food and Drug Administration (FDA), leading to consistent demand for precise and accredited residue testing services.

- This widespread adoption is further supported by the presence of leading testing service providers, technological advancements in chromatography and mass spectrometry, and the region’s strong agricultural trade network, establishing North America as a key hub for herbicide residue testing in both domestic and export-oriented food industries.

U.S. Herbicides Residue Testing Market Insight

The U.S. herbicides residue testing market captured the largest revenue share of 78.6% in 2024 within North America, driven by stringent food safety regulations enforced by agencies such as the U.S. Environmental Protection Agency (EPA) and the Food and Drug Administration (FDA). The growing emphasis on safe agricultural practices and compliance with maximum residue limits (MRLs) is propelling the demand for advanced analytical testing solutions. Increasing consumer awareness regarding chemical residues in food, coupled with a surge in exports requiring certification, further fuels market expansion. The widespread adoption of technologies such as LC-MS/MS and GC-MS, along with the presence of leading testing laboratories like SGS SA and Eurofins Scientific, continues to strengthen the U.S. market’s dominance.

Europe Herbicides Residue Testing Market Insight

The Europe herbicides residue testing market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by strict regulatory frameworks established by the European Food Safety Authority (EFSA) and the European Commission. The region’s focus on sustainable agriculture and consumer health has led to increasing testing volumes across food categories, including fruits, vegetables, and grains. Growing demand for organic and residue-free produce, combined with technological innovations in chromatography and spectrometry, supports market growth. Europe is witnessing high testing activity across both domestic production and export monitoring, with laboratories in countries like Germany, the U.K., and France actively contributing to food safety compliance and traceability initiatives.

U.K. Herbicides Residue Testing Market Insight

The U.K. herbicides residue testing market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising public awareness of food quality, environmental protection, and pesticide regulation. Following its post-Brexit policy independence, the U.K. has implemented stricter national residue monitoring programs to ensure compliance with international trade standards. Increasing consumer preference for organic and traceable food products, along with the growing export of agricultural goods, is encouraging the expansion of testing facilities. Continuous investments in laboratory infrastructure and AI-driven data analysis tools are further enhancing testing precision and efficiency across the country.

Germany Herbicides Residue Testing Market Insight

The Germany herbicides residue testing market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s advanced laboratory infrastructure and strong emphasis on environmental sustainability. Germany’s adherence to strict EU pesticide regulations and its leadership in agricultural innovation drive steady demand for reliable residue testing. The nation’s growing focus on reducing chemical inputs in farming and promoting eco-friendly agricultural practices further strengthens testing adoption. Additionally, the integration of automated and AI-assisted analytical systems is enhancing detection accuracy and supporting faster turnaround times for both domestic and export-related testing.

Asia-Pacific Herbicides Residue Testing Market Insight

The Asia-Pacific herbicides residue testing market is poised to grow at the fastest CAGR of 23.5% during the forecast period (2025–2032), driven by increasing agricultural exports, rising food safety concerns, and expanding regulatory frameworks in countries such as China, Japan, and India. Rapid urbanization, technological advancements, and the emergence of contract testing laboratories are also contributing to market growth. Governments across the region are strengthening residue monitoring programs to ensure compliance with international food safety standards. Moreover, the growing popularity of organic produce and the adoption of modern testing technologies are broadening the market’s reach across both developed and developing economies in the region.

Japan Herbicides Residue Testing Market Insight

The Japan herbicides residue testing market is gaining momentum due to the country’s highly regulated food safety environment and growing consumer focus on health and product transparency. Japan’s Ministry of Health, Labour and Welfare enforces strict limits on pesticide residues, encouraging widespread testing across agricultural products. The nation’s technological sophistication supports the adoption of advanced analytical systems such as LC-MS/MS, ensuring ultra-trace detection accuracy. Moreover, increasing imports and exports of agricultural commodities, alongside Japan’s focus on sustainable and residue-free food production, are further driving demand for comprehensive herbicide residue testing services.

China Herbicides Residue Testing Market Insight

The China herbicides residue testing market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid industrialization of agriculture, expanding export activities, and the government’s push for improved food safety standards. China’s large-scale agricultural production and frequent use of herbicides have prompted a surge in demand for residue monitoring across crops, soil, and water. National initiatives such as the “Zero-Growth of Pesticide Use” policy are reinforcing the need for advanced testing and monitoring systems. Additionally, the presence of numerous domestic laboratories, technological advancements, and the increasing adoption of international testing standards position China as a leading hub for herbicides residue testing in the region.

Global Herbicides Residue Testing Market Share

The Herbicides Residue Testing industry is primarily led by well-established companies, including:

• SGS SA (Switzerland)

• Eurofins Scientific (Luxembourg)

• Bureau Veritas SA (France)

• Intertek Group plc (U.K.)

• ALS Limited (Australia)

• Microbac Laboratories, Inc. (U.S.)

• Merieux Nutrisciences Corporation (U.S.)

• AsureQuality Limited (New Zealand)

• TÜV SÜD (Germany)

• TÜV NORD GROUP (Germany)

• SYNLAB International GmbH (Germany)

• Neogen Corporation (U.S.)

• Charm Sciences, Inc. (U.S.)

• Fera Science Ltd. (U.K.)

• InterScientific Ltd. (U.K.)

• EMSL Analytical, Inc. (U.S.)

• Romer Labs (Austria)

• AGQ Labs (Spain)

• Chemical Analysis Pty Ltd (Australia)

• Covance Laboratories (U.S.)

What are the Recent Developments in Global Herbicides Residue Testing Market?

- In April 2023, Eurofins Scientific, a global leader in food and environmental testing, launched a strategic initiative in South Africa to expand herbicides residue testing capabilities across both agricultural and processed food products. The program aims to provide local farmers and food producers with advanced analytical solutions, ensuring compliance with international residue limits and improving consumer safety. By leveraging its global expertise and cutting-edge laboratory technologies, Eurofins is addressing regional food safety challenges while reinforcing its position in the rapidly growing Global Herbicides Residue Testing Market.

- In March 2023, SGS SA, a leading inspection, verification, testing, and certification company, introduced a specialized herbicide residue testing program targeting cereal and grain exports in Europe. The initiative focuses on rapid, high-accuracy testing to meet increasingly stringent EU regulations and international trade requirements. This development highlights SGS’s commitment to safeguarding food quality and supporting producers in maintaining compliance with global standards.

- In March 2023, Bureau Veritas, a global leader in compliance and testing solutions, successfully deployed an advanced residue testing framework for fruits and vegetables across multiple Indian states. This program leverages high-performance analytical instruments such as LC-MS/MS to ensure accurate detection of trace herbicides, supporting both domestic consumption and export compliance. The initiative underscores Bureau Veritas’s role in enhancing food safety through innovative testing solutions.

- In February 2023, Intertek Group plc, a leading provider of quality and safety services, announced a strategic partnership with agricultural cooperatives in China to develop a centralized herbicide residue testing network. The collaboration is designed to improve monitoring efficiency, provide reliable test results for producers, and ensure compliance with both domestic and international food safety standards. This effort reinforces Intertek’s commitment to advancing food safety and operational effectiveness in the agriculture sector.

- In January 2023, ALS Limited, a global testing, inspection, and certification provider, launched its upgraded high-throughput herbicide residue testing platform in North America. Utilizing state-of-the-art technologies such as LC-MS and HPLC, the platform enables faster, more precise detection across multiple food matrices, including dairy, meat, and fruits. The initiative demonstrates ALS’s focus on delivering innovative analytical solutions to meet growing regulatory demands and consumer expectations, supporting the expansion of the Global Herbicides Residue Testing Market.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.