Global High Availability Server Market

Market Size in USD Billion

CAGR :

%

USD

13.30 Billion

USD

20.50 Billion

2024

2032

USD

13.30 Billion

USD

20.50 Billion

2024

2032

| 2025 –2032 | |

| USD 13.30 Billion | |

| USD 20.50 Billion | |

|

|

|

|

High Availability Server Market Size

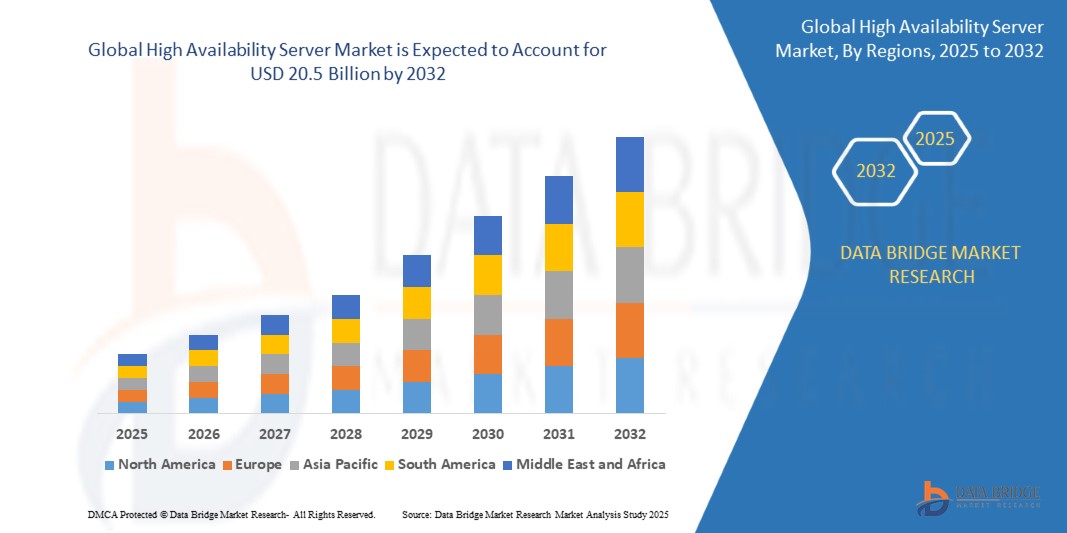

- The Global High Availability Server Market Size was valued at USD 13.3 Billion in 2024 and is expected to reach USD 20.5 Billion by 2032, at a CAGR of 6.4% during the forecast period

- The growth of the Global High Availability Server Market is fueled by the increasing demand for uninterrupted business operations and rising adoption of cloud-based services.

High Availability Server Market Analysis

- The Global High Availability Server Market is witnessing significant momentum as businesses across industries, especially automotive manufacturers and suppliers, increasingly focus on enhancing system uptime, ensuring uninterrupted digital operations, and achieving robust disaster recovery. This market includes a broad range of components and services such as failover systems, clustering solutions, load balancing, redundant hardware, and high-availability software, all designed to maintain continuous service availability and minimize downtime.

- A key factor fueling this growth is the rapid digital transformation across sectors like automotive, healthcare, BFSI, and IT. Organizations are adopting high availability solutions integrated with real-time monitoring, cloud computing, AI-driven analytics, and IoT to ensure critical workloads are consistently operational. The rise of automation in data centers, virtualization, and predictive analytics for failure prevention is driving greater efficiency and resilience in IT infrastructure.

- The growing adoption of electric vehicles (EVs) and connected cars is reshaping IT requirements, necessitating advanced server solutions to handle vast data volumes, latency-sensitive applications, and edge computing. Moreover, with rising cross-border operations and remote work environments, businesses are demanding cloud-based high availability infrastructure that ensures service continuity and rapid scalability across geographies.

- Cloud-based platforms are gaining traction due to benefits such as real-time failover, centralized monitoring, cost efficiency, and integration with enterprise applications. These platforms are particularly appealing to small and mid-sized enterprises (SMEs) aiming to maintain enterprise-grade resilience without heavy infrastructure investments.

- However, the market faces challenges such as high initial deployment costs, complexity in integrating legacy systems, cybersecurity threats, and limited technical expertise in developing economies. Additionally, regulatory compliance concerning data privacy and uptime SLAs adds operational complexity, especially in highly regulated sectors like healthcare and finance.

- Despite these hurdles, the Global High Availability Server Market is poised for sustained growth, driven by the demand for business continuity, resilient IT ecosystems, and digital innovation. Organizations that prioritize high availability in their digital strategy, invest in redundant infrastructure, and adopt AI-enabled monitoring tools will be better positioned to thrive in an increasingly digital and interconnected world.

Report Scope and High Availability Server Market Segmentation

|

Attributes |

High Availability Server Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

High Availability Server market Trends

Increasing adoption of cloud, hybrid, and edge computing environments

- The Global High Availability Server Market is experiencing rapid growth as organizations increasingly adopt cloud-based, hybrid, and edge computing environments. These architectures require highly reliable server infrastructures to ensure consistent uptime, low latency, and seamless performance across distributed systems. As businesses shift critical workloads to the cloud and expand their operations geographically, the need for resilient, scalable, and always-on infrastructure has become more pressing than ever.

- A significant trend driving this market is the integration of artificial intelligence (AI) and machine learning (ML) into server management. These technologies enable predictive maintenance, real-time system monitoring, and automated failover capabilities. By using AI-driven analytics, businesses can detect system anomalies before they cause disruptions, allowing for proactive troubleshooting and reducing operational downtime significantly.

- Additionally, the rise of containerization and software-defined infrastructure is transforming how organizations deploy and manage their IT environments. Cloud-native technologies such as containers and orchestration platforms like Kubernetes support modular, scalable, and fault-tolerant systems. These innovations make it easier to maintain high availability even in complex and dynamic multi-cloud environments, enhancing operational agility and performance.

- The demand for high availability servers is particularly strong in mission-critical sectors such as banking, healthcare, telecommunications, and manufacturing. These industries depend on uninterrupted digital services to maintain compliance, support real-time decision-making, and ensure customer trust. As a result, they are leading adopters of advanced high availability solutions that safeguard data integrity and system uptime.

- Sustainability is also emerging as a vital consideration in the deployment of high availability infrastructure. With rising energy costs and growing environmental concerns, organizations are seeking energy-efficient server systems and eco-friendly data centers. The industry is responding with greener technologies, including low-power processors, efficient cooling systems, and renewable energy integration, all while maintaining high performance and reliability standards.

High Availability Server market Dynamics

Driver

Growing need for uninterrupted business operations and robust disaster recovery systems in an increasingly digital economy.

- The growing need for uninterrupted business operations and robust disaster recovery systems in an increasingly digital economy is one of the most significant forces driving the Global High Availability Server Market. In today’s world, businesses operate in real time—whether it's financial transactions, online retail, cloud services, healthcare diagnostics, or digital communications. Even a few seconds of downtime can result in lost revenue, damaged customer trust, regulatory penalties, and competitive disadvantage. This has created immense pressure on IT systems to be continuously available, no matter the circumstances.

- As organizations digitize their operations and shift towards cloud-based platforms, the reliance on IT infrastructure has become more critical than ever. Any disruption—be it due to hardware failure, cyberattacks, natural disasters, or software glitches—can bring operations to a standstill. High availability servers are therefore essential because they ensure that critical applications and services remain accessible, even in the face of failures. These systems use redundancy, clustering, load balancing, and failover mechanisms to automatically switch operations to backup systems without any noticeable downtime.

- Disaster recovery is also a key concern in this context. Companies must not only prevent disruptions but also be able to recover quickly when they occur. High availability infrastructure supports advanced disaster recovery strategies by enabling real-time data replication, backup automation, and rapid system restoration. This minimizes business risk and supports continuity planning.

- In an economy where digital services are a core part of value creation and customer engagement, maintaining constant uptime is no longer a luxury it’s a business imperative. As a result, investing in robust high availability and disaster recovery solutions has become a top priority for companies seeking resilience, trust, and long-term sustainability in the digital age.

Restraint/Challenge

High cost associated with deploying and maintaining high availability infrastructure

- The high cost associated with deploying and maintaining high availability (HA) infrastructure is one of the most significant restraints in the Global High Availability Server Market. Building an HA environment goes far beyond simply purchasing powerful servers it involves a comprehensive investment in redundant hardware, specialized software, networking equipment, and continuous monitoring systems. Organizations must purchase duplicate servers, storage systems, and network connections to ensure that if one component fails, another can instantly take over without service interruption. This redundancy dramatically increases the initial capital expenditure (CapEx).

- In addition to hardware, companies must also invest in advanced failover and load-balancing software, which ensures seamless switching between systems in the event of a failure. These platforms are not only expensive to acquire but also require regular updates and maintenance to remain effective and secure. Furthermore, maintaining a high availability environment often demands 24/7 IT support, including skilled professionals who can design, implement, monitor, and troubleshoot complex systems. The shortage of such specialized talent increases hiring and training costs.

- Operational expenses (OpEx) also rise as HA systems require ongoing maintenance, regular testing, security audits, and data backup procedures to ensure performance reliability. Energy consumption is another cost factor running multiple redundant servers simultaneously significantly increases electricity and cooling requirements, particularly in large data centers.

- For small and mid-sized enterprises (SMEs), these costs can be particularly prohibitive. Many lack the budget to invest in enterprise-grade infrastructure or staff, which often leads them to rely on less resilient systems, increasing their vulnerability to outages. Even for larger corporations, the return on investment (ROI) for HA solutions may take time to realize, especially if downtime events are rare or difficult to quantify financially.

- As a result, while high availability infrastructure is essential for operational continuity, its cost-intensive nature remains a key challenge that slows down widespread adoption particularly in cost-sensitive industries or regions with limited IT budgets.

Automotive logistics market Scope

The market is segmented on the basis of Component, Operating System, Deployment Mode, Application.

- By Component

The Global High Availability Server Market, when segmented by component, comprises hardware, software, and services. Hardware remains the backbone of HA infrastructure, including servers, storage systems, and network devices built with redundancy and failover capabilities to minimize downtime. As demand for robust and scalable physical infrastructure grows—especially in data centers and critical business environments hardware continues to command a significant share. Software plays a crucial role in enabling fault tolerance through features like clustering, load balancing, failover management, and real-time monitoring. With the rise in virtualization and cloud-native applications, the demand for HA software is expanding rapidly. Services encompass installation, integration, maintenance, training, and consulting. As organizations adopt more complex HA architectures, the need for expert-managed services is increasing, particularly in sectors with minimal in-house IT resources.

- By Operating System

Based on operating systems, the market includes Windows, Linux, and Unix platforms. Windows-based high availability servers dominate enterprise environments, especially in small and mid-sized businesses, due to their user-friendly interfaces, compatibility with a wide range of enterprise applications, and strong vendor support from Microsoft. Linux-based servers are gaining momentum due to their open-source nature, cost-efficiency, security, and strong community support. Linux is widely adopted in cloud computing and web server environments, making it a popular choice for scalable HA deployments. Unix-based systems, while declining in relative market share, are still critical in certain legacy environments such as banking, government, and telecom, where stability, robustness, and performance are paramount.

- By Deployment Mode

In terms of deployment, the market is segmented into on-premises and cloud-based solutions. On-premises high availability servers are preferred by organizations that require full control over their IT infrastructure, especially in industries like healthcare, banking, and government, where data security and regulatory compliance are top priorities. These deployments offer customizable, dedicated resources but come with higher upfront costs and maintenance responsibilities. On the other hand, cloud-based HA servers are seeing rapid growth as enterprises seek scalability, cost-efficiency, and ease of deployment. Cloud platforms allow automatic failover, distributed redundancy, and seamless updates, making them ideal for dynamic workloads and startups. Hybrid deployments, combining on-prem and cloud, are also emerging to balance control with flexibility.

- By Application

The application-based segmentation shows the wide range of industries adopting high availability servers. The BFSI (Banking, Financial Services, and Insurance) sector is a leading adopter due to its need for real-time transaction processing, fraud prevention, and compliance with uptime regulations. IT and Telecom companies rely on HA systems to ensure uninterrupted network operations, data services, and cloud platforms. In healthcare, HA servers support electronic health records, remote monitoring, and critical diagnostic systems where even seconds of downtime can impact patient care. Government agencies use these servers for national security, public data management, and service delivery platforms. The manufacturing sector uses HA infrastructure to support industrial automation, IoT, and real-time supply chain systems. In retail, continuous uptime is essential for point-of-sale systems, inventory management, and online shopping platforms. Lastly, energy and utilities leverage HA systems to manage smart grids, energy distribution, and real-time monitoring of infrastructure to ensure public safety and service reliability.

High Availability Server market Regional Analysis

- North America holds a dominant position in the high availability server market, driven by its advanced IT infrastructure, strong presence of leading technology companies, and early adoption of digital transformation. The United States, in particular, leads the region due to its high concentration of data centers, cloud service providers, and enterprises operating in critical sectors such as finance, healthcare, and e-commerce. Increasing investments in AI, edge computing, and cybersecurity further propel the demand for resilient and fail-safe server infrastructure. Additionally, strict regulatory compliance around data privacy and uptime mandates in industries like BFSI and healthcare drives the need for robust HA solutions.

- Europe represents a mature and steadily growing market for high availability servers, with significant demand from countries like Germany, the UK, France, and the Netherlands. The region benefits from a strong industrial base, widespread cloud adoption, and a regulatory framework emphasizing data protection and operational continuity (such as the GDPR and NIS Directive). The need for reliable server infrastructure in banking, telecom, and government sectors is fostering investment in HA solutions. Moreover, sustainability goals across the EU are encouraging the deployment of energy-efficient and high-performance server infrastructure within green data centers.

- Asia-Pacific is expected to witness the fastest growth in the high availability server market due to rapid industrialization, expanding digital infrastructure, and the surge in data center development across countries like China, India, Japan, South Korea, and Singapore. Government-led initiatives promoting smart cities, 5G deployment, and digital economy models are significantly boosting the demand for always-on IT infrastructure. The growth of e-commerce, mobile banking, and telehealth in the region is also contributing to the rising need for high availability systems. However, budget constraints among SMEs and the shortage of skilled IT professionals in certain areas may present short-term adoption challenges.

- The high availability server market in Latin America is growing gradually, with Brazil, Mexico, and Argentina emerging as key markets. The region is experiencing increased cloud adoption, digital payments, and automation in industries such as retail, manufacturing, and energy. While infrastructure and investment limitations have traditionally slowed the adoption of advanced IT systems, growing awareness of the importance of uptime and operational resilience is encouraging more enterprises to consider HA deployments. Strategic partnerships with global tech providers and government-backed digital transformation programs are expected to further stimulate market growth.

- In the Middle East & Africa region, the high availability server market is still developing but shows strong potential, particularly in the Gulf Cooperation Council (GCC) countries such as the UAE and Saudi Arabia. The rapid expansion of smart city initiatives, digital banking, and government e-services is driving demand for highly reliable server infrastructure. Additionally, the rise of local data centers and investments in AI and cloud technologies are strengthening the region’s digital backbone. In Africa, despite infrastructure challenges and limited IT budgets, sectors like telecom, fintech, and public services are beginning to invest in HA solutions to support critical operations and improve service delivery.

United States

The U.S. leads the high availability server market in North America due to the strong presence of hyperscale data centers, cloud service providers, and enterprise IT infrastructure. Growth is driven by increasing demand for uninterrupted services across sectors like banking, healthcare, and e-commerce, along with advancements in virtualization and disaster recovery technologies.

Germany

Germany anchors the European market with high adoption of fault-tolerant server systems across manufacturing, automotive, and financial sectors. The country’s emphasis on Industry 4.0, data sovereignty, and mission-critical infrastructure supports demand for high availability solutions.

China

China dominates the Asia-Pacific market, backed by rapid digitalization, expansion of data centers, and strong demand from telecom and government sectors. Domestic players and international investments are fueling large-scale deployment of high availability systems to support smart city and cloud infrastructure projects.

India

India is an emerging market with growing investment in IT infrastructure, cloud computing, and digital services. Government initiatives like Digital India and increased adoption of high availability solutions by BFSI, healthcare, and e-commerce sectors are driving demand.

South Korea

South Korea’s market is driven by its advanced ICT ecosystem and strong presence of global tech and telecom companies. The push for resilient data infrastructure, 5G deployment, and increasing focus on cybersecurity are accelerating the adoption of high availability servers in both public and private sectors.

High Availability Server Market Share

The Global High Availability Server Industry is primarily led by well-established companies, including:

- IBM Corporation (Armonk, USA)

- Hewlett Packard Enterprise (HPE) (Spring, USA)

- Dell Technologies Inc. (Round Rock, USA)

- Cisco Systems, Inc. (San Jose, USA)

- Oracle Corporation (Austin, USA)

- NEC Corporation (Tokyo, Japan)

- Fujitsu Ltd. (Tokyo, Japan)

- Stratus Technologies (Maynard, USA)

- Lenovo Group Ltd. (Beijing, China / Morrisville, USA)

- Huawei Technologies Co., Ltd. (Shenzhen, China)

Latest Developments in Global High Availability Server Market

- In May 2025, Super Micro Computer announced an expansion of its U.S.-based server production facilities, including new plants in Texas and Mississippi. This move is aimed at meeting the rising global demand for AI-optimized high availability servers and supporting the localization of AI infrastructure. Despite growth momentum, the company adjusted its FY2025 revenue forecast due to delays in orders caused by new trade tariffs, highlighting the sensitivity of the HA server supply chain to geopolitical shifts.

- In March 2025, Dell Technologies unveiled updates to its PowerEdge server lineup, integrating NVIDIA GPUs and enhanced failover features to support AI, ML, and critical workload environments. The upgraded systems are designed for high-density deployments and offer improved redundancy, power efficiency, and disaster recovery, addressing the growing need for fault-tolerant infrastructure in hyperscale and enterprise data centers.

- In February 2025, Lenovo announced a partnership with Red Hat to deliver fully integrated, high-availability server solutions for cloud-native applications. The collaboration focuses on enabling faster deployment of Kubernetes environments with automated failover, real-time monitoring, and AI-powered predictive maintenance, targeting financial services, healthcare, and telecom sectors where uptime is critical.

- In January 2025, Amazon Web Services (AWS) introduced new EC2 instances with built-in high availability configurations aimed at simplifying disaster recovery for SMEs. These pre-configured instances offer automated scaling, geo-redundancy, and SLA-backed uptime guarantees, lowering the entry barrier for smaller businesses to adopt enterprise-grade high availability infrastructure in the cloud.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.