Global High Density Polyethylene Hdpe Resins Market

Market Size in USD Billion

CAGR :

%

USD

32.00 Billion

USD

48.96 Billion

2024

2032

USD

32.00 Billion

USD

48.96 Billion

2024

2032

| 2025 –2032 | |

| USD 32.00 Billion | |

| USD 48.96 Billion | |

|

|

|

|

High Density Polyethylene (HDPE) Resins Market Size

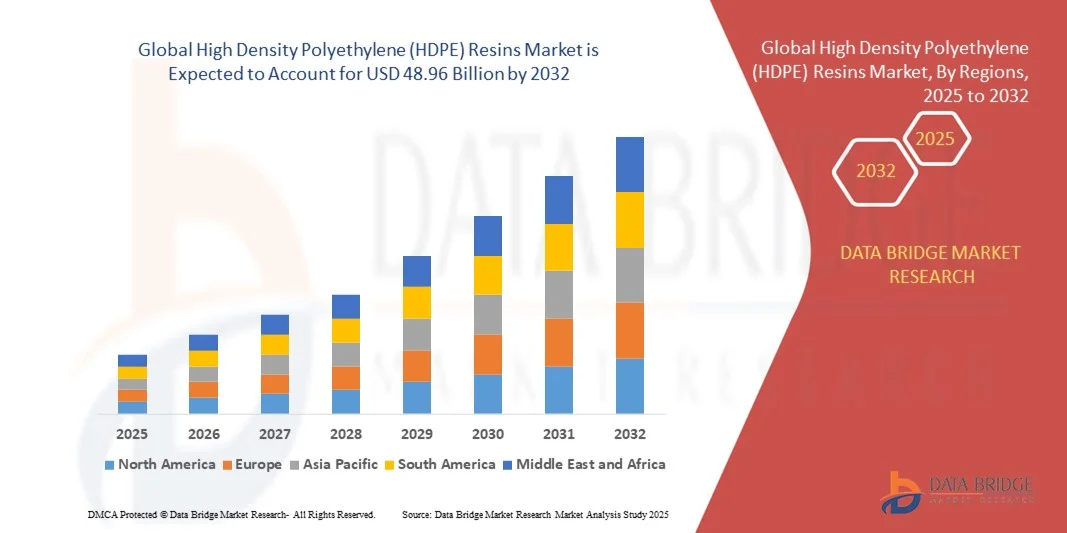

- The global high-density polyethylene (HDPE) resins market size was valued at USD 32.00 billion in 2024 and is expected to reach USD 48.96 billion by 2032, at a CAGR of 5.46% during the forecast period

- The market growth is largely fuelled by the increasing demand for durable, lightweight, and cost-effective packaging materials across food & beverage, consumer goods, and industrial applications

- Rising adoption of HDPE in piping, automotive components, and construction materials due to its chemical resistance, high tensile strength, and recyclability is further boosting market expansion

High Density Polyethylene (HDPE) Resins Market Analysis

- Increasing investment in flexible packaging and container manufacturing is driving demand for HDPE resins in emerging and developed economies

- Technological advancements in polymerization processes and high-performance grades of HDPE are enabling manufacturers to cater to specialized applications, such as high-strength pipes and automotive parts

- North America dominated the HDPE resins market with the largest revenue share in 2024, driven by strong demand from packaging, construction, automotive, and consumer goods sectors

- Asia-Pacific region is expected to witness the highest growth rate in the global high-density polyethylene (HDPE) resins market, driven by rising urbanization, increased disposable income, expanding industrial applications, and government initiatives supporting sustainable plastic production and usage

- The Adhesive Type segment held the largest market revenue share in 2024, driven by its widespread use in packaging and industrial applications due to excellent bonding properties and versatility. Adhesive type HDPE resins are favored for their strong adhesion, chemical resistance, and compatibility with multilayer materials, making them ideal for food, beverage, and industrial packaging solutions

Report Scope and High Density Polyethylene (HDPE) Resins Market Segmentation

|

Attributes |

High Density Polyethylene (HDPE) Resins Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

High Density Polyethylene (HDPE) Resins Market Trends

Increasing Adoption of HDPE Resins Across Packaging and Industrial Applications

- The growing shift toward HDPE resins is transforming the packaging and industrial materials landscape by enabling lightweight, durable, and recyclable solutions. The versatility of HDPE allows manufacturers to produce containers, pipes, and films with superior chemical resistance, contributing to longer product life and reduced environmental impact

- Rising demand for high-performance packaging in food, beverage, and personal care sectors is accelerating the adoption of HDPE resins. These resins are particularly valued for their strength-to-weight ratio, moisture resistance, and compatibility with automated filling and sealing systems

- The affordability and availability of HDPE resins compared to alternative materials are making them attractive for large-scale industrial applications, such as piping, automotive components, and construction materials. Their ease of processing and adaptability support a wide range of manufacturing processes

- For instance, in 2023, several European packaging manufacturers replaced conventional plastics with HDPE resins in bottle production, improving durability, reducing packaging weight, and increasing recyclability. These implementations encouraged other manufacturers to transition toward HDPE-based solutions

- While HDPE resins are driving efficiency and sustainability, their market expansion depends on continued material innovation, supply chain stability, and compliance with environmental regulations. Manufacturers must focus on sustainable sourcing and product standardization to fully capitalize on growing demand

High Density Polyethylene (HDPE) Resins Market Dynamics

Driver

Rising Demand for Lightweight, Durable, and Sustainable Packaging Solutions

- The increasing need for sustainable and recyclable packaging is driving the adoption of HDPE resins across various sectors. These resins reduce material consumption, improve product safety, and align with consumer preferences for environmentally friendly packaging. Manufacturers are also leveraging HDPE to develop innovative designs and reduce overall carbon footprint, which strengthens brand reputation and meets evolving regulatory standards

- HDPE resins offer excellent mechanical strength, chemical resistance, and versatility, making them ideal for applications in food, beverage, personal care, and industrial products. Manufacturers benefit from improved operational efficiency, reduced packaging costs, and enhanced logistics performance due to lighter-weight materials. In addition, the adaptability of HDPE enables customization for specialized packaging solutions, supporting market differentiation

- The global push toward circular economy initiatives and regulations promoting recyclable materials is further accelerating HDPE adoption. Companies are increasingly integrating HDPE resins in their supply chains to meet sustainability targets, reduce landfill contributions, and ensure compliance with environmental legislation. Adoption is also supported by growing consumer awareness and brand-driven eco-friendly initiatives

- For instance, in 2023, a leading U.S. beverage company transitioned its beverage bottles to HDPE resins, achieving a 30% reduction in packaging weight and increased recyclability, positively impacting the brand’s sustainability profile. This change also reduced transportation costs, improved handling efficiency, and demonstrated corporate responsibility, influencing competitors to explore HDPE-based solutions

- While the demand for HDPE resins is growing, supply chain reliability, regulatory compliance, and price volatility remain key factors influencing market expansion. Market players are investing in local production capacities, advanced processing technologies, and strategic raw material sourcing to ensure consistent supply and mitigate potential operational risks

Restraint/Challenge

Price Fluctuations and Raw Material Dependency

- The global HDPE resins market is highly dependent on petroleum-based feedstocks, making it vulnerable to price volatility and supply chain disruptions. Fluctuating raw material costs can impact production expenses and pricing strategies for manufacturers, forcing them to adjust profit margins or pass costs to end-users. Strategic partnerships with suppliers and long-term procurement contracts are increasingly being adopted to stabilize supply

- In developing regions, limited processing infrastructure and technological expertise can restrict the adoption of advanced HDPE resins. This affects product quality, operational efficiency, and competitiveness in international markets. Manufacturers face challenges in setting up robust production lines, ensuring consistent resin quality, and training skilled personnel to optimize manufacturing processes

- Environmental concerns related to plastic waste management and stringent regulations on single-use plastics can pose challenges to the HDPE market. Manufacturers must invest in recycling, eco-design, and sustainable production methods to remain compliant and competitive. Regulatory pressures are also prompting R&D for bio-based HDPE alternatives and circular material streams, which require additional capital and innovation

- For instance, in 2023, several packaging manufacturers in Asia faced production delays and cost escalations due to crude oil price fluctuations, affecting the overall supply of HDPE resins. The situation also led to increased product pricing, potential supply shortages, and delayed contract fulfillments, highlighting the critical need for risk mitigation strategies

- While HDPE resins continue to offer versatility and sustainability, addressing price volatility, feedstock dependency, and regulatory pressures is essential for long-term market growth. Companies are focusing on supply chain diversification, adoption of advanced polymer grades, and investment in recycling infrastructure to ensure resilience and meet growing global demand

High Density Polyethylene (HDPE) Resins Market Scope

The market is segmented on the basis of type, application, and end-user.

- By Type

On the basis of type, the HDPE resins market is segmented into Adhesive Type HDPE Resin and Coating Type HDPE Resin. The Adhesive Type segment held the largest market revenue share in 2024, driven by its widespread use in packaging and industrial applications due to excellent bonding properties and versatility. Adhesive type HDPE resins are favored for their strong adhesion, chemical resistance, and compatibility with multilayer materials, making them ideal for food, beverage, and industrial packaging solutions.

The Coating Type segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its ability to provide enhanced barrier properties, surface protection, and improved mechanical strength. Coating type HDPE resins are increasingly used in applications such as films, pipes, and containers where durability, chemical resistance, and surface quality are critical, supporting demand across industrial and construction sectors.

- By Application

On the basis of application, the HDPE resins market is segmented into Film and Sheet, Injection Molding, Blow Molding, Pipe and Profile, Wire and Cables, and Others. The Film and Sheet segment held the largest market revenue share in 2024, driven by the growing demand for lightweight, recyclable, and durable packaging solutions across food, beverage, and consumer goods industries. Film and sheet applications benefit from excellent chemical resistance, flexibility, and ease of processing, making them a preferred choice for sustainable packaging initiatives.

The Injection Molding segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by its use in manufacturing high-precision, complex-shaped components for automotive, household, and industrial applications. Injection molding HDPE resins offer superior impact resistance, dimensional stability, and cost-effectiveness, which supports increased adoption across multiple end-use industries.

- By End User

On the basis of end user, the HDPE resins market is segmented into Packaging, Agriculture, Building and Construction, Personal Care, Household, Industrial Containers and Bottles, Automotive, and Others. The Packaging segment held the largest revenue share in 2024, driven by the rising demand for sustainable, lightweight, and durable packaging solutions in food, beverage, and personal care industries. Packaging applications benefit from HDPE’s excellent chemical resistance, strength, and recyclability, making it ideal for meeting regulatory and environmental standards.

The Automotive segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the increasing use of HDPE resins in manufacturing lightweight vehicle components to improve fuel efficiency and reduce emissions. HDPE resins offer high impact resistance, thermal stability, and design flexibility, supporting their growing adoption in interior, exterior, and under-the-hood automotive applications.

High Density Polyethylene (HDPE) Resins Market Regional Analysis

- North America dominated the HDPE resins market with the largest revenue share in 2024, driven by strong demand from packaging, construction, automotive, and consumer goods sectors

- End-users in the region highly value HDPE resins for their durability, chemical resistance, and versatility, making them ideal for containers, films, pipes, and household products

- The widespread adoption is further supported by advanced manufacturing infrastructure, focus on sustainable materials, and initiatives to enhance recyclability, establishing HDPE resins as a preferred solution across multiple industries

U.S. High Density Polyethylene (HDPE) Resins Market Insight

The U.S. HDPE resins market captured the largest revenue share in North America in 2024, fueled by growing industrialization, rising demand from packaging and construction sectors, and strong consumer awareness regarding recyclable materials. Manufacturers are increasingly adopting advanced HDPE resins for enhanced strength, barrier properties, and processability. The push for sustainability, coupled with government regulations promoting eco-friendly materials, is further driving market expansion and technological innovation.

Europe High Density Polyethylene (HDPE) Resins Market Insight

The Europe HDPE resins market is expected to witness significant growth from 2025 to 2032, driven by stringent regulations promoting recyclable and sustainable materials, increasing urbanization, and rising demand across packaging, automotive, and construction sectors. European manufacturers are adopting high-performance HDPE resins to enhance durability, chemical resistance, and operational efficiency. The region is also witnessing a shift toward lightweight, eco-conscious packaging solutions, further propelling HDPE resin usage in both industrial and consumer applications.

U.K. High Density Polyethylene (HDPE) Resins Market Insight

The U.K. HDPE resins market is expected to witness the fastest growth rate from 2025 to 2032, driven by the increasing adoption of sustainable packaging solutions, industrial containers, and consumer goods applications. Growing awareness of environmental impact, along with the integration of HDPE in food, beverage, and healthcare packaging, is supporting market growth. In addition, the U.K.’s strong R&D capabilities, manufacturing standards, and regulatory push toward recyclable materials are accelerating HDPE resin adoption across sectors.

Germany High Density Polyethylene (HDPE) Resins Market Insight

The Germany HDPE resins market is expected to witness strong growth from 2025 to 2032, fueled by high industrial activity, focus on advanced manufacturing, and adoption of eco-friendly materials. German manufacturers are leveraging HDPE resins for applications in automotive, packaging, and construction, benefiting from superior chemical resistance, mechanical strength, and processability. The integration of HDPE in circular economy initiatives and recyclable packaging solutions is further enhancing market penetration.

Asia-Pacific High Density Polyethylene (HDPE) Resins Market Insight

The Asia-Pacific HDPE resins market is expected to witness rapid growth from 2025 to 2032, driven by rising industrialization, urbanization, and demand across packaging, agriculture, and construction sectors in countries such as China, India, and Japan. The region’s growing focus on sustainable materials, government support for circular economy initiatives, and expansion of HDPE resin manufacturing capacities are contributing to widespread adoption. APAC is also emerging as a hub for innovative HDPE applications, improving affordability and accessibility for end-users.

Japan High Density Polyethylene (HDPE) Resins Market Insight

The Japan HDPE resins market is expected to witness substantial growth from 2025 to 2032, owing to the country’s advanced manufacturing infrastructure, focus on high-performance materials, and rising demand for durable and recyclable packaging solutions. Japanese manufacturers are increasingly using HDPE resins in automotive, consumer goods, and industrial applications. The integration of HDPE into lightweight and sustainable packaging formats is also supporting growth, especially in food and beverage sectors.

China High Density Polyethylene (HDPE) Resins Market Insight

The China HDPE resins market accounted for the largest revenue share in the Asia-Pacific region in 2024, driven by rapid industrialization, urbanization, and a growing middle class demanding sustainable packaging and consumer goods. China’s focus on domestic HDPE production, coupled with government initiatives promoting eco-friendly materials, is fueling market growth. Widespread adoption in packaging, construction, and automotive sectors, along with cost-effective production capabilities, is enhancing the market’s expansion across both domestic and export markets.

High Density Polyethylene (HDPE) Resins Market Share

The High Density Polyethylene (HDPE) Resins industry is primarily led by well-established companies, including:

- Dow (U.S.)

- Exxon Mobil Corporation (U.S.)

- Formosa Plastics Corporation (Taiwan)

- LyondellBasell Industries Holdings B.V. (Netherlands)

- USI Corporation (U.S.)

- Chevron Phillips Chemical Company LLC (U.S.)

- NOVA Chemicals Corporate (Canada)

- Shandong Gaoxin Chemical Co. Ltd (China)

- LG Chem (South Korea)

- INEOS (U.K.)

- Geo-Synthetics, LLC (U.S.)

- Total (France)

- Indian Oil Corporation Ltd. (India)

- SCG Chemicals Co., Ltd. (Thailand)

- Reliance Industries Limited (India)

- Versalis S.p.A. (Italy)

- Lone Star Chemical (U.S.)

- SABIC (Saudi Arabia)

- Braskem (Brazil)

- Afton Chemical (U.S.)

Latest Developments in Global High Density Polyethylene (HDPE) Resins Market

- In March 2024, INEOS completed the expansion of its HDPE production facility in Antwerp, Belgium. The increased output addresses growing European demand for high-performance polyethylene products. It also improves supply reliability for industrial and packaging sectors in the region

- In March 2024, TotalEnergies and Veolia announced plans to build a new plastic recycling plant in France. The facility will process post-consumer HDPE waste into high-quality recycled resin. This initiative promotes sustainability and increases the availability of circular plastics in Europe

- In February 2024, ExxonMobil launched a new sustainable HDPE resin for packaging applications. The resin offers improved recyclability and a lower carbon footprint. It enhances the company’s eco-friendly product portfolio and supports sustainable packaging adoption globally

- In February 2024, LyondellBasell appointed a new executive vice president for Olefins & Polyolefins. The role oversees global HDPE resin operations and strategic growth initiatives. The appointment aims to enhance operational efficiency and strengthen the company’s market leadership in HDPE

- In February 2024, Chevron Phillips Chemical and QatarEnergy reached final investment decision on an USD 8.5 billion petrochemical project in Texas. The project includes a new HDPE unit to bolster U.S. production capacity. It is expected to enhance regional supply and support industrial growth in North America

- In February 2024, Dow partnered with Mura Technology to scale advanced recycling technology for HDPE. The collaboration aims to produce circular plastics for packaging and consumer goods. This initiative promotes sustainability and supports the adoption of eco-friendly materials across industries

- In February 2024, SABIC launched a new HDPE resin designed for pressure pipe applications. The product offers improved performance, durability, and resistance for water and gas distribution networks. This development positions SABIC as a key supplier for infrastructure and construction applications globally

- In February 2024, LyondellBasell announced the construction of a new advanced recycling plant in Germany. The facility will convert plastic waste into feedstock for HDPE and polypropylene products. This initiative supports circular economy practices, enhances sustainability, and is expected to strengthen the company’s presence in the European HDPE market

- In January 2024, Sinopec started operations at a new HDPE plant in China. The expansion increases production capacity to meet growing demand in the Asia-Pacific region. It strengthens supply reliability and supports industrial and packaging sectors across the region

- In January 2024, Reliance Industries commissioned a new HDPE manufacturing plant in Jamnagar, India. The facility expands production capacity for both domestic and export markets. It strengthens India’s HDPE supply and meets the growing demand in packaging and industrial sectors

- In January 2024, Braskem and SCG Chemicals formed a joint venture to develop bio-based HDPE in Thailand. The venture targets sustainable packaging and consumer goods markets. This move strengthens the availability of eco-friendly HDPE and supports circular economy initiatives in Asia

- In January 2024, ExxonMobil commissioned a new polyethylene production unit at its Baytown, Texas complex. The expansion increases HDPE resin capacity to meet rising demand in packaging and industrial applications. The upgrade enhances production efficiency and strengthens supply for domestic and international markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global High Density Polyethylene Hdpe Resins Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global High Density Polyethylene Hdpe Resins Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global High Density Polyethylene Hdpe Resins Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.