Global High Drug To Antibody Ratio Adc Therapies Market

Market Size in USD Billion

CAGR :

%

USD

2.12 Billion

USD

7.96 Billion

2025

2033

USD

2.12 Billion

USD

7.96 Billion

2025

2033

| 2026 –2033 | |

| USD 2.12 Billion | |

| USD 7.96 Billion | |

|

|

|

|

High Drug-to-Antibody Ratio ADC Therapies Market Size

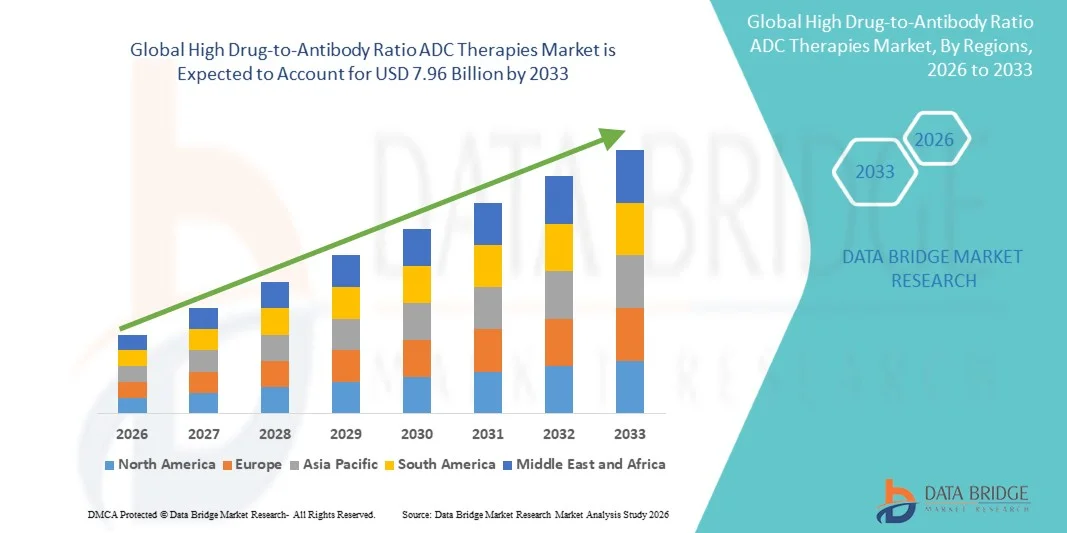

- The global high drug-to-antibody ratio ADC therapies market size was valued at USD 2.12 billion in 2025 and is expected to reach USD 7.96 billion by 2033, at a CAGR of 18.00% during the forecast period

- The market growth is largely fueled by increasing adoption of high Drug-to-Antibody Ratio (DAR) Antibody-Drug Conjugates (ADCs) in oncology, driven by their enhanced therapeutic efficacy, ability to deliver higher cytotoxic payloads directly to tumor cells, and advancements in linker technologies that improve stability and reduce off-target toxicity

- Furthermore, rising demand for targeted cancer therapies, growing incidence of hematologic and solid tumors, and increasing investment in ADC research and clinical development are accelerating the uptake of high DAR ADC therapies, thereby significantly boosting overall market growth

High Drug-to-Antibody Ratio ADC Therapies Market Analysis

- High Drug-to-Antibody Ratio (DAR) ADC therapies, designed to deliver higher payloads of cytotoxic drugs directly to tumor cells, are increasingly vital in oncology due to their improved efficacy, reduced systemic toxicity, and ability to treat both hematologic and solid malignancies, driving adoption in clinical and hospital settings

- The escalating demand for high DAR ADC therapies is primarily fueled by rising cancer prevalence, growing focus on targeted therapies, and continuous innovations in ADC linker and conjugation technologies, which enhance treatment outcomes and patient compliance

- North America dominated the High Drug-to-Antibody Ratio ADC Therapies market with the largest revenue share of approximately 39.5% in 2025, supported by advanced oncology infrastructure, high R&D investment, strong regulatory frameworks, and the presence of leading ADC developers and biotech startups in the U.S.

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, driven by increasing cancer incidence, improving healthcare infrastructure, expanding clinical trial activities, and growing adoption of targeted therapies in countries such as China, Japan, and India

- The Commercialized Products segment dominated the market with a revenue share of 44.3% in 2025, driven by the presence of FDA-approved ADCs and their widespread clinical adoption

Report Scope and High Drug-to-Antibody Ratio ADC Therapies Market Segmentation

|

Attributes |

High Drug-to-Antibody Ratio ADC Therapies Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

High Drug-to-Antibody Ratio ADC Therapies Market Trends

“Expansion Through Innovative Payload Technologies and Clinical Advancements”

- A significant and accelerating trend in the global high drug-to-antibody ratio (DAR) ADC therapies market is the development of novel linker and payload technologies that allow higher drug-to-antibody ratios while maintaining stability and targeted delivery. This approach is enhancing therapeutic efficacy and expanding the range of treatable cancers, particularly in hematologic malignancies and solid tumors

- For instance, in 2024, Seagen introduced a next-generation high-DAR ADC candidate targeting HER2-positive breast cancer, showing promising preclinical results with improved cytotoxic payload delivery and minimized off-target toxicity. Similarly, Daiichi Sankyo’s enhancement of trastuzumab deruxtecan demonstrated increased DAR while preserving antibody specificity, enabling higher potency in clinical trials. These advances are improving clinical outcomes and patient tolerability, supporting broader adoption across oncology centers

- Moreover, advancements in site-specific conjugation techniques and bioconjugation chemistry are allowing manufacturers to optimize DAR without compromising antibody stability, reducing immunogenicity risks and improving pharmacokinetic profiles

- The trend toward higher DAR ADCs is also supported by the increasing number of clinical trials investigating combinations with immunotherapies, checkpoint inhibitors, and standard-of-care chemotherapies, reflecting the growing importance of ADCs in comprehensive cancer management strategies

- The integration of improved manufacturing technologies, such as automated conjugation platforms and enhanced purification methods, is accelerating the development of scalable high-DAR ADCs, enabling rapid transition from preclinical testing to clinical applications

- These innovations collectively are shaping expectations for more effective, targeted, and patient-friendly ADC therapies, driving increased investment and research interest in high-DAR ADC development

High Drug-to-Antibody Ratio ADC Therapies Market Dynamics

Driver

“Rising Demand for Targeted Cancer Therapies and Improved Clinical Outcomes”

- The increasing global incidence of cancer, coupled with the growing demand for precision medicine, is a significant driver for the adoption of high-DAR ADC therapies

- For instance, the FDA’s accelerated approval of fam-trastuzumab deruxtecan in 2022 for HER2-positive metastatic breast cancer highlighted the clinical benefits of high-DAR ADCs, including improved progression-free survival and reduced systemic toxicity. Similarly, ongoing clinical trials of Gemtuzumab ozogamicin in acute myeloid leukemia demonstrate enhanced efficacy in patients previously unresponsive to conventional chemotherapy

- Expanding awareness among oncologists about the advantages of ADCs in selectively targeting tumor cells while minimizing adverse effects is further fueling market growth

- In addition, increased funding from both private and public sectors for ADC research and development, alongside collaborations between biopharma companies and academic institutions, is accelerating innovation in high-DAR payload technologies

- The rising prevalence of difficult-to-treat cancers and the need for personalized treatment regimens continue to drive investment in ADC platforms, with a focus on optimizing therapeutic windows and patient outcomes

Restraint/Challenge

“High Development Costs, Regulatory Hurdles, and Safety Concerns”

- The relatively high cost of developing high-DAR ADC therapies, including complex conjugation chemistry, rigorous quality control, and expensive clinical trials, poses a significant barrier to market expansion

- For instance, manufacturing site-specific conjugation ADCs requires specialized facilities and highly skilled personnel, increasing the upfront investment for small and mid-sized biotech firms. This may delay market entry for innovative candidates

- Regulatory challenges, including stringent requirements from agencies such as the FDA and EMA for safety, stability, and efficacy, can slow approval timelines and add to development costs

- Concerns over potential off-target toxicity and immunogenicity of high-DAR ADCs may limit widespread adoption until long-term clinical safety data are available

- Addressing these challenges through optimized manufacturing processes, robust preclinical validation, and strategic collaborations with regulatory experts will be crucial for sustaining growth in the high-DAR ADC market

High Drug-to-Antibody Ratio ADC Therapies Market Scope

The market is segmented on the basis of Payload Type, Indication, and Development Stage.

• By Payload Type

On the basis of payload type, the High Drug-to-Antibody Ratio ADC Therapies market is segmented into Topoisomerase Inhibitors, Microtubule Inhibitors, DNA Damaging Agents, and Others. The Topoisomerase Inhibitors segment dominated the largest market revenue share of 41.5% in 2025, driven by their proven efficacy in targeted cancer therapy and reduced off-target toxicity. These inhibitors are widely adopted in breast cancer and hematologic malignancies due to their ability to induce DNA damage selectively in rapidly dividing tumor cells. Pharmaceutical companies prefer Topoisomerase-based payloads for their predictable pharmacokinetics and established safety profiles. The compatibility of these payloads with high drug-to-antibody ratios allows for potent therapeutic outcomes while minimizing systemic side effects. Increasing clinical success and regulatory approvals for Topoisomerase ADCs further bolster market dominance. Adoption is especially high in North America and Europe, where oncology pipelines are mature and advanced biologics infrastructure exists.

The DNA Damaging Agents segment is expected to witness the fastest CAGR of 22.1% from 2026 to 2033, fueled by ongoing clinical trials targeting difficult-to-treat cancers such as lung and colorectal malignancies. DNA-damaging ADCs offer a high therapeutic index and can be tailored for combination therapies, increasing their clinical attractiveness. Growth is accelerated by expanding research into novel linkers and antibody technologies that enhance payload delivery efficiency. Emerging markets are increasingly adopting DNA Damaging ADCs due to their potential in precision oncology and personalized medicine approaches.

• By Indication

On the basis of indication, the market is segmented into Breast Cancer, Hematologic Malignancies, Lung Cancer, Colorectal Cancer, and Others. Breast cancer therapies held the largest revenue share of 38.7% in 2025, owing to high incidence rates globally and the adoption of ADCs in HER2-positive and triple-negative breast cancer treatments. The established clinical protocols, along with favorable reimbursement policies in major markets, further drive dominance. Top-tier pharmaceutical players continue to focus on breast cancer ADCs due to strong clinical trial outcomes, expanding patient awareness, and adoption in both private and public healthcare systems.

The Hematologic Malignancies segment is expected to register the fastest CAGR of 21.5% from 2026 to 2033, driven by the increasing prevalence of leukemias, lymphomas, and multiple myeloma. ADCs targeting hematologic cancers benefit from higher response rates and reduced systemic toxicity, encouraging accelerated development pipelines. Clinical studies continue to expand indications across relapsed and refractory patient populations. Emerging biologics and the integration of novel payloads like DNA Damaging Agents and Topoisomerase inhibitors further accelerate growth in this segment.

• By Development Stage

On the basis of development stage, the market is segmented into Preclinical, Clinical Trials, and Commercialized Products. The Commercialized Products segment dominated the market with a revenue share of 44.3% in 2025, driven by the presence of FDA-approved ADCs and their widespread clinical adoption. These products provide validated safety and efficacy data, making them preferred choices for oncologists and healthcare institutions. Established commercial products also benefit from brand recognition, insurance coverage, and robust distribution networks.

The Clinical Trials segment is expected to witness the fastest CAGR of 23.4% from 2026 to 2033, as pharmaceutical companies aggressively expand ADC pipelines targeting unmet oncology needs. Innovation in linker technology, higher drug-to-antibody ratios, and novel payloads fuel rapid clinical development. The surge in global oncology research funding, regulatory incentives for breakthrough therapies, and collaborations between biotech startups and large pharma further drive growth. Emerging markets are also increasingly participating in clinical trials, expanding patient access and accelerating global adoption of next-generation ADCs.

High Drug-to-Antibody Ratio ADC Therapies Market Regional Analysis

- North America dominated the high drug-to-antibody ratio ADC therapies market with the largest revenue share of approximately 39.5% in 2025, supported by advanced oncology infrastructure, high R&D investment, strong regulatory frameworks, and the presence of leading ADC developers and biotech startups in the U.S.

- In addition, strategic partnerships between pharmaceutical companies and academic cancer centers are driving accelerated development and commercialization of novel ADC therapies

- The widespread adoption is further supported by high healthcare expenditure, the availability of specialized oncology centers, and favorable reimbursement policies, establishing North America as the leading market for high-DAR ADC therapies

U.S. High Drug-to-Antibody Ratio ADC Therapies Market Insight

The U.S. high drug-to-antibody ratio ADC therapies market captured the largest revenue share within North America in 2025, fueled by extensive clinical trial activities, strong collaboration between biopharma and academic research institutes, and high patient awareness of targeted therapies. For instance, the FDA approval of fam-trastuzumab deruxtecan for HER2-positive breast cancer and ongoing trials of Gemtuzumab ozogamicin for acute myeloid leukemia highlight the region’s rapid adoption of innovative ADCs. The strong R&D pipeline and established oncology infrastructure continue to propel the U.S. market.

Europe High Drug-to-Antibody Ratio ADC Therapies Market Insight

The Europe high drug-to-antibody ratio ADC therapies market is projected to expand at a substantial CAGR during the forecast period, driven by rising cancer prevalence, increasing government support for oncology research, and stringent regulatory standards for biologics. For instance, in 2023, Roche and AstraZeneca initiated high-DAR ADC clinical programs across multiple European oncology centers, aiming to address unmet therapeutic needs in breast and lung cancers. The region’s emphasis on precision medicine and growing adoption of targeted therapies is expected to further stimulate market growth.

U.K. High Drug-to-Antibody Ratio ADC Therapies Market Insight

The U.K. high drug-to-antibody ratio ADC therapies market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by expanding cancer treatment infrastructure, increasing clinical trial participation, and rising healthcare expenditure on innovative biologics. For instance, collaboration between U.K.-based hospitals and global ADC developers is supporting trials for novel high-DAR ADC candidates targeting hematologic malignancies, enhancing accessibility and accelerating adoption.

Germany High Drug-to-Antibody Ratio ADC Therapies Market Insight

The Germany high drug-to-antibody ratio ADC therapies market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s focus on biotechnology innovation, advanced healthcare facilities, and regulatory incentives for clinical research. For example, BioNTech and other German biotech firms are investing in ADC development platforms to enhance targeted payload delivery, reflecting a growing trend toward precision oncology.

Asia-Pacific High Drug-to-Antibody Ratio ADC Therapies Market Insight

The Asia-Pacific high drug-to-antibody ratio ADC therapies market is poised to grow at the fastest CAGR during the forecast period, driven by increasing cancer incidence, improving healthcare infrastructure, expanding clinical trial activities, and growing adoption of targeted therapies in countries such as China, Japan, and India. For instance, in China, regulatory approval of multiple ADC candidates and the expansion of oncology centers in Tier-1 cities are facilitating broader patient access. In India, collaborations between domestic biotech companies and global ADC developers are enabling local production and clinical studies. Similarly, Japan’s investment in high-tech oncology research and adoption of innovative therapies for breast, lung, and hematologic cancers are driving market growth across the region.

Japan High Drug-to-Antibody Ratio ADC Therapies Market Insight

The Japanese high drug-to-antibody ratio ADC therapies market is gaining momentum due to advanced healthcare infrastructure, early adoption of innovative oncology therapies, and increasing cancer awareness. For instance, Japan’s participation in global high-DAR ADC clinical trials and the availability of government-supported research grants are accelerating the development and uptake of novel ADC therapies.

China High Drug-to-Antibody Ratio ADC Therapies Market Insight

The China high drug-to-antibody ratio ADC therapies market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rising cancer prevalence, expanding hospital networks, and a growing middle-class population seeking advanced cancer therapies. For example, Shanghai-based ADC developers have launched multiple high-DAR ADC candidates in Phase II and III clinical trials, demonstrating the region’s rapid adoption of cutting-edge oncology treatments. Government initiatives supporting biologics manufacturing and clinical research are further propelling the market.

High Drug-to-Antibody Ratio ADC Therapies Market Share

The High Drug-to-Antibody Ratio ADC Therapies industry is primarily led by well-established companies, including:

- Pfizer Inc. (U.S.)

- Roche Holding AG (Switzerland)

- AbbVie Inc. (U.S.)

- Amgen Inc. (U.S.)

- Astellas Pharma Inc. (Japan)

- Daiichi Sankyo Company, Limited (Japan)

- Mersana Therapeutics, Inc. (U.S.)

- Synaffix BV (Netherlands)

- Genmab A/S (Denmark)

- Innovent Biologics, Inc. (China)

- Wuxi Biologics (China)

- IGM Biosciences, Inc. (U.S.)

- RemeGen Co., Ltd. (China)

Latest Developments in Global High Drug-to-Antibody Ratio ADC Therapies Market

- In January 2025, the U.S. Food and Drug Administration approved Datopotamab Deruxtecan‑dlnk (Datroway), a Trop‑2‑directed antibody‑drug conjugate developed by Daiichi Sankyo and AstraZeneca for adults with unresectable or metastatic hormone receptor‑positive, HER2‑negative breast cancer, providing a new targeted ADC therapy option for patients who have received prior endocrine and chemotherapy treatment

- In April 2025, Datopotamab Deruxtecan (Datroway) received marketing authorization in the European Union, further expanding access to this ADC therapy for patients with unresectable or metastatic HR‑positive, HER2‑negative breast cancer

- In June 2025, the U.S. FDA approved Datroway for treatment of EGFR‑mutated non‑small cell lung cancer, marking the first approval of this ADC therapy in a lung cancer indication and expanding its clinical impact beyond breast cancer

- In June 2025, the U.S. Food and Drug Administration approved Datroway for advanced non‑small cell lung cancer, providing a targeted option for patients with EGFR‑mutated tumors resistant to other therapies and highlighting the expanding clinical utility of ADCs in multiple cancer types

- In October 2025, AstraZeneca and Daiichi Sankyo reported that Datroway significantly improved overall survival in patients with triple‑negative breast cancer in a late‑stage clinical trial, underscoring the potential therapeutic benefit and clinical progression of high‑potency ADC therapies

- In November 2025, Day One Biopharmaceuticals agreed to acquire Mersana Therapeutics for up to USD 285 million, bringing Mersana’s lead ADC asset Emi‑Le (targeting B7‑H4) into Day One’s oncology portfolio and signaling strong investor confidence in the potential of advanced ADC therapies

- In May 2025, Radiance Biopharma entered an exclusive licensing agreement for a ROR‑1‑targeted ADC, expanding development collaborations in the ADC space and supporting innovation in next‑generation conjugates

- In June 2025, SunRock Biopharma and Escugen announced a partnership to develop SRB123, a first‑in‑class CCR9‑targeted ADC intended to treat multiple solid tumors, demonstrating growing collaboration and diversification in ADC development pipelines

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.