Global High Horsepower Tractor Market

Market Size in USD Billion

CAGR :

%

USD

3.99 Billion

USD

6.60 Billion

2024

2032

USD

3.99 Billion

USD

6.60 Billion

2024

2032

| 2025 –2032 | |

| USD 3.99 Billion | |

| USD 6.60 Billion | |

|

|

|

|

High Horsepower Tractor Market Size

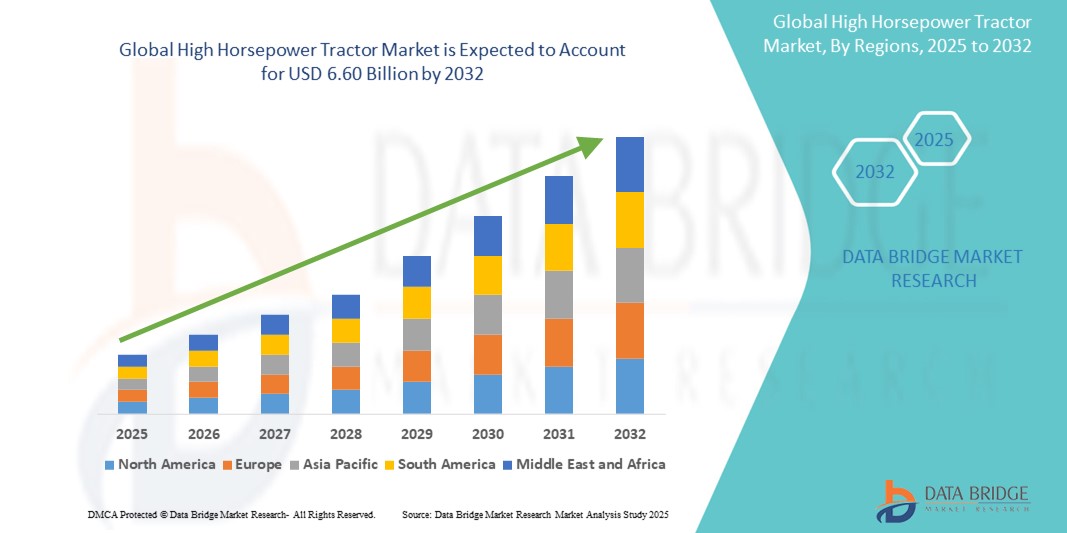

- The global high horsepower tractor market size was valued at USD 3.99 billion in 2024 and is expected to reach USD 6.60 billion by 2032, at a CAGR of 6.5% during the forecast period

- The market growth is largely fuelled by the increasing demand for mechanized farming, rising labor shortages, and the need for enhanced productivity in large-scale agricultural operations, particularly across developing regions

- In addition, the integration of advanced technologies such as GPS guidance systems, telematics, and autonomous operation capabilities is further propelling the adoption of high horsepower tractors, as farmers seek greater efficiency, precision, and reduced operational costs

High Horsepower Tractor Market Analysis

- The high horsepower tractor market is witnessing consistent growth due to the increasing adoption of precision farming and modern agricultural practices across large farms

- Manufacturers are focusing on enhancing tractor efficiency and durability through technology integration and product innovation to meet evolving farming needs

- North America dominated the high horsepower tractor market with the largest revenue share in 2024, driven by large-scale mechanized farming, favorable government subsidies, and increased adoption of precision agriculture technologies

- The Asia-Pacific region is expected to witness the highest growth rate in the global high horsepower tractor market, driven by increasing mechanization in agriculture, expanding commercial farming operations, and rising investments in advanced farming technologies

- The 200–250 horsepower segment held the largest market revenue share in 2024, attributed to its versatility and cost-effectiveness for medium to large-scale farming. These tractors are widely used in row-crop farming and can efficiently handle multiple operations such as plowing, seeding, and harvesting. Their fuel efficiency and compatibility with a wide range of attachments make them a preferred choice across developed and developing markets

Report Scope and High Horsepower Tractor Market Segmentation

|

Attributes |

High Horsepower Tractor Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

High Horsepower Tractor Market Trends

“Rising Adoption of Autonomous and Semi-Autonomous High Horsepower Tractors”

- Rising labor shortages in developed agricultural economies such as North America and Western Europe are accelerating the adoption of autonomous tractors

- For instance, John Deere introduced its fully autonomous 8R tractor in 2022, featuring GPS and AI capabilities to perform tasks without operator intervention

- Widespread adoption of semi-autonomous features, including auto-steering, GPS-guided route mapping, and obstacle detection systems, is helping reduce operator fatigue during long operational hours, especially in large-scale farming

- Advancements in smart technologies, notably IoT sensors, AI, and machine vision, are making autonomous functions more accurate, dependable, and scalable for real-world deployment in mainstream agriculture

- Higher productivity and cost savings offered by these systems are encouraging farm owners to shift from conventional to autonomous models, as they enable optimized fuel use, reduced downtime, and better resource management

- Leading manufacturers such as CNH Industrial and AGCO Corporation are ramping up investments in R&D to develop scalable autonomous tractor platforms suited to both developed and emerging markets

High Horsepower Tractor Market Dynamics

Driver

“Expanding Mechanization in Large-Scale Agriculture”

- Expanding farm sizes in regions such as North America, South America, and Asia-Pacific are driving the need for high horsepower tractors to perform labor-intensive tasks such as deep plowing, tilling, and harvesting across large agricultural tracts

- High horsepower tractors (above 150 HP) enhance productivity and reduce dependence on increasingly scarce manual labor, making them essential for modern, large-scale farming operations

- Government support through subsidies and financial schemes is making advanced farm machinery more accessible

- For instance, India’s Sub-Mission on Agricultural Mechanization (SMAM) provides financial aid to farmers for purchasing high-powered equipment

- Rising adoption of precision farming practices in developed countries is increasing demand for tractors equipped with GPS, telematics, and auto-steering features to improve field efficiency and resource optimization

- Climate variability and the urgency for timely farming activities are compelling farmers to invest in high-capacity, reliable tractors that ensure continuous operation regardless of environmental disruptions

Restraint/Challenge

“High Initial Investment and Maintenance Costs”

- High initial purchase cost of high horsepower tractors (150+ HP)—ranging from tens of thousands to over USD 100,000—remains a major barrier for small and marginal farmers, especially in developing countries with labor-intensive and seasonal farming systems

- Advanced features such as GPS, telematics, and automated steering require regular servicing and skilled technicians. In regions with poor service infrastructure, such as rural parts of Africa and Southeast Asia, maintenance becomes a costly and time-consuming challenge

- Limited availability and high cost of replacement parts in remote agricultural areas further increases the total cost of ownership, discouraging long-term investment by smallholder farmers

- While subsidies exist, such as under Brazil’s "Moderfrota" program for agricultural equipment financing, bureaucratic delays and limited farmer awareness often restrict effective utilization of such support in practice

- For small plot holders, the cost-benefit ratio is often unfavorable, prompting many to opt for shared equipment or compact tractors. This limits the market potential for high horsepower tractors in regions with fragmented landholdings

High Horsepower Tractor Market Scope

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the high horsepower tractor market is segmented into 200–250 horsepower, 250–300 horsepower, 300–350 horsepower, and >350 horsepower. The 200–250 horsepower segment held the largest market revenue share in 2024, attributed to its versatility and cost-effectiveness for medium to large-scale farming. These tractors are widely used in row-crop farming and can efficiently handle multiple operations such as plowing, seeding, and harvesting. Their fuel efficiency and compatibility with a wide range of attachments make them a preferred choice across developed and developing markets.

The >350 horsepower segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increased adoption in large-scale mechanized agriculture and high-efficiency farming. These tractors are designed for extensive land holdings and high-performance tasks such as deep tillage and large-scale harvesting. Their rising demand is also fueled by technological advancements, including GPS-guided steering and telematics, enhancing productivity and operational efficiency.

- By Application

On the basis of application, the market is segmented into farm, rent, and others. The farm segment accounted for the largest revenue share in 2024 due to increasing mechanization in agriculture and the demand for high-output machinery to improve yield and efficiency. Farmers are increasingly investing in high horsepower tractors to support intensive farming practices and meet rising food production demands.

The rent segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the cost advantages and flexibility it offers to small and mid-sized farmers. With the high upfront cost of ownership, rental services provide access to modern high horsepower tractors without the long-term financial commitment. The rising number of farm equipment rental startups and government-supported schemes is further driving the growth of this segment.

High Horsepower Tractor Market Regional Analysis

- North America dominated the high horsepower tractor market with the largest revenue share in 2024, driven by large-scale mechanized farming, favorable government subsidies, and increased adoption of precision agriculture technologies

- The region benefits from strong demand for high-capacity machinery to boost efficiency and manage vast agricultural lands, particularly in the U.S. and Canada

- The presence of major tractor manufacturers, advanced farming practices, and investments in autonomous and connected agricultural solutions further propel market growth

U.S. High Horsepower Tractor Market Insight

The U.S. high horsepower tractor market captured the majority share in North America in 2024, primarily supported by large farm holdings and the need for powerful equipment to manage extensive crop acreage. Adoption of tractors over 300 HP is significant in grain-producing states such as Iowa and Nebraska, where efficiency and time-saving machinery are essential. In addition, rising integration of GPS, auto-steering, and telematics in farming operations continues to drive demand.

Europe High Horsepower Tractor Market Insight

The Europe high horsepower tractor market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing mechanization in Eastern Europe and sustained demand in countries such as Germany and France. Regulatory support for sustainable farming practices and precision agriculture is boosting the adoption of technologically advanced tractors. Moreover, EU subsidies and modernization of agriculture in countries such as Poland are enhancing market opportunities.

Germany High Horsepower Tractor Market Insight

The Germany high horsepower tractor market is expected to witness the fastest growth rate from 2025 to 2032, supported by the country's robust agricultural machinery sector and emphasis on innovation. German farmers prioritize efficient and environmentally friendly equipment, fueling demand for tractors with emission-compliant engines and advanced controls. The country’s leading role in agricultural exports also necessitates continuous upgrades in farm machinery to maintain competitiveness.

U.K. High Horsepower Tractor Market Insight

The U.K. high horsepower tractor market is expected to witness the fastest growth rate from 2025 to 2032, driven by the modernization of agriculture and a shift toward sustainable, high-efficiency machinery. British farmers are increasingly investing in 200 HP+ tractors to manage large-scale arable farms and enhance productivity amid rising labor shortages. The market is also supported by government grants under programs such as the Farming Equipment and Technology Fund (FETF), promoting the adoption of precision and eco-friendly equipment. The demand for tractors with GPS and automation features is rising, especially in regions such as East Anglia and Yorkshire.

Asia-Pacific High Horsepower Tractor Market Insight

The Asia-Pacific high horsepower tractor market is expected to witness the fastest growth rate from 2025 to 2032, fueled by rapid agricultural modernization, population growth, and increasing food demand. Countries such as India, China, and Australia are leading this trend, with rising adoption of high-powered machinery to meet labor shortages and enhance productivity. Government schemes promoting farm mechanization further support regional market expansion.

China High Horsepower Tractor Market Insight

The China accounted for a substantial share of the Asia-Pacific high horsepower tractor market in 2024, attributed to the country’s extensive push toward agricultural modernization and consolidation of farmland. High-powered tractors are increasingly used in large-scale grain and corn farms, particularly in northeastern provinces. Domestic manufacturers, supported by state-led innovation and automation goals, are introducing cost-effective models tailored to local farming needs.

Japan High Horsepower Tractor Market Insight

The Japan’s high horsepower tractor market is expected to witness the fastest growth rate from 2025 to 2032, driven by the country’s focus on agricultural automation and labor-saving technologies. While small tractors remain dominant due to fragmented farmland, demand for 200 HP+ tractors is increasing in Hokkaido and other regions with large-scale farms. Japan’s aging farming population is fueling interest in autonomous and remote-controlled machinery. Domestic manufacturers are collaborating with tech firms to develop advanced models that meet both productivity and precision requirements, contributing to the market's gradual expansion.

High Horsepower Tractor Market Share

The High Horsepower Tractor industry is primarily led by well-established companies, including:

- Sonalika International Tractors Limited (India)

- Kubota Corporation (Japan)

- CNH Industrial N.V. (U.K.)

- Mahindra & Mahindra Ltd. (India)

- Escorts Limited (India)

- Deere & Company (U.S.)

- V.S.T. Tillers & Tractors Ltd (India)

- Tractors and Farm Equipment Ltd (India)

- HMT Limited (India)

- Force Motors Limited (India)

Latest Developments in Global High Horsepower Tractor Market

- In January 2025, John Deere announced a significant product development by unveiling a new lineup of autonomous tractors and construction equipment at CES 2025. These include fully self-driving tractors, an articulated dump truck, and a smart orchard tractor, all powered by Nvidia GPUs and equipped with advanced computer vision systems. The innovation is aimed at addressing labor shortages in agriculture and landscaping while enhancing productivity and precision. The autonomous machines are expected to be available commercially by fall 2025, marking a major step toward fully automated farming operations. This development is set to accelerate the adoption of AI-powered equipment, influencing the broader trajectory of the global high horsepower tractor market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.