Global High Performance Composites Market

Market Size in USD Billion

CAGR :

%

USD

10.89 Billion

USD

17.49 Billion

2024

2032

USD

10.89 Billion

USD

17.49 Billion

2024

2032

| 2025 –2032 | |

| USD 10.89 Billion | |

| USD 17.49 Billion | |

|

|

|

|

Global High Performance Composites Market Size

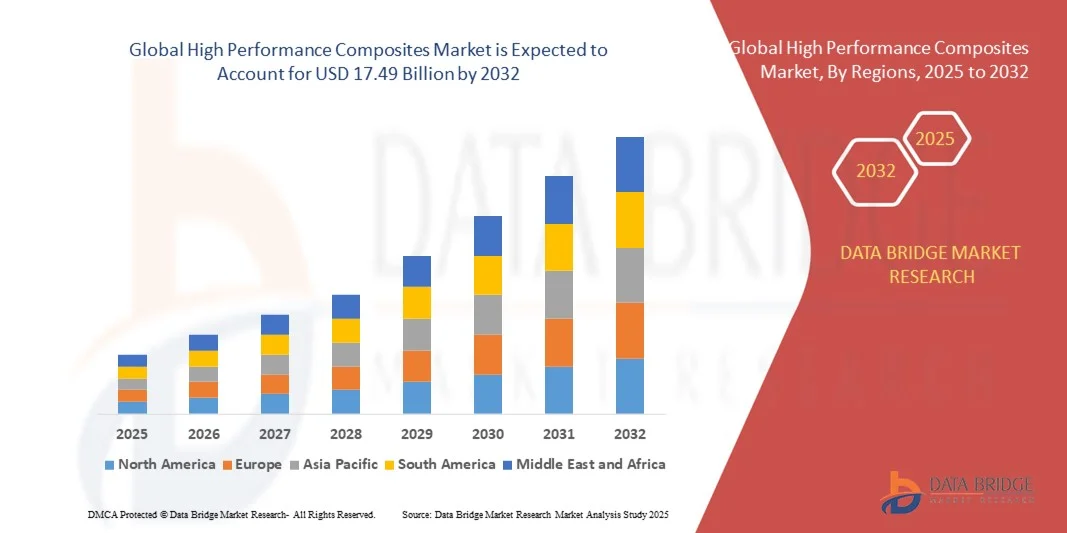

- The global High Performance Composites Market size was valued at USD 10.89 billion in 2024 and is projected to reach USD 17.49 billion by 2032, growing at a CAGR of 6.10% during the forecast period.

- The market expansion is primarily driven by the rising demand for lightweight, durable, and high-strength materials across industries such as aerospace, automotive, wind energy, and construction, where performance efficiency and fuel savings are key priorities.

- Additionally, technological advancements in composite manufacturing processes and the increasing use of carbon and glass fiber composites for sustainable and high-performance applications are accelerating product adoption, thereby propelling the overall market growth.

Global High Performance Composites Market Analysis

- High performance composites, known for their exceptional strength-to-weight ratio, corrosion resistance, and durability, are becoming essential materials in advanced engineering applications across aerospace, automotive, energy, and construction sectors due to their superior performance characteristics and design flexibility.

- The increasing demand for high performance composites is primarily driven by the growing emphasis on lightweight materials to improve fuel efficiency, reduce emissions, and enhance overall structural integrity in various end-use industries.

- Asia-Pacific dominated the Global High Performance Composites Market with the largest revenue share of 36.1% in 2024, supported by the strong presence of major aerospace and automotive manufacturers, robust R&D investments, and early adoption of advanced composite technologies across industrial applications.

- North America is expected to be the fastest growing region in the Global High Performance Composites Market during the forecast period, owing to rapid industrialization, infrastructure development, and rising demand for fuel-efficient vehicles and renewable energy solutions.

- The High Performance Thermoset Composites segment dominated the market with the largest revenue share of 62.4% in 2024, driven by its superior mechanical strength, thermal stability, and widespread use in aerospace and automotive applications.

Report Scope and Global High Performance Composites Market Segmentation

|

Attributes |

High Performance Composites Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global High Performance Composites Market Trends

Technological Advancements Driving Material Innovation

- A significant and accelerating trend in the Global High Performance Composites Market is the continuous advancement in material science and manufacturing technologies such as automated fiber placement, 3D printing of composites, and resin transfer molding (RTM). These innovations are enhancing material performance, production efficiency, and design flexibility across industries.

- For instance, aerospace manufacturers such as Boeing and Airbus are adopting next-generation carbon fiber composites to reduce aircraft weight, improve fuel efficiency, and extend lifecycle performance, while automotive leaders such as BMW and Tesla are incorporating advanced composites to achieve superior strength and reduced emissions.

- In addition, the integration of smart manufacturing systems and digital twin technologies allows for real-time monitoring, predictive maintenance, and optimization of composite production processes, ensuring consistent quality and minimizing material waste.

- The development of high-performance thermoplastic composites with improved recyclability and rapid processing capabilities is also gaining traction, supporting sustainability goals and enabling cost-effective mass production.

- This technological evolution is further supported by extensive R&D investments from companies such as Toray Industries, Solvay, and Hexcel Corporation, which are introducing innovative fiber reinforcements and resin systems to meet demanding performance standards across aerospace, wind energy, and defense applications.

- The growing focus on innovation, lightweight engineering, and sustainability is reshaping the competitive landscape of the high performance composites market, driving widespread adoption across both developed and emerging economies.

Global High Performance Composites Market Dynamics

Driver

Growing Demand Driven by Lightweighting and Sustainability Goals

- The increasing emphasis on reducing carbon emissions, improving fuel efficiency, and achieving sustainability targets across industries is a major driver for the growing demand for high performance composites. These materials offer superior strength-to-weight ratios, corrosion resistance, and design flexibility, making them ideal alternatives to metals in advanced engineering applications.

- For instance, aerospace manufacturers such as Airbus and Boeing are incorporating carbon fiber composites to lower aircraft weight and improve operational efficiency, while automotive leaders such as BMW and General Motors are expanding composite usage to enhance vehicle performance and meet stringent emission regulations.

- As industries continue to prioritize energy efficiency and sustainability, high performance composites are gaining traction in wind energy, marine, and infrastructure projects due to their durability and minimal maintenance requirements.

- Furthermore, increasing investments in renewable energy projects, particularly wind turbine blade production, are accelerating composite adoption globally. The ability of composites to extend product lifespan and reduce overall lifecycle costs is a key factor driving their demand.

- The growing push toward eco-friendly production methods, including bio-based resins and recyclable composites, is aligning with global sustainability initiatives, making high performance composites a cornerstone of next-generation material innovation across multiple sectors.

Restraint/Challenge

High Production Costs and Recycling Challenges

- The high cost of raw materials such as carbon fibers, aramid fibers, and advanced resins remains a significant restraint to the widespread adoption of high performance composites. Manufacturing processes such as autoclave curing and precision molding are capital-intensive, limiting their use primarily to high-end applications such as aerospace and defense.

- For instance, the complex fabrication and quality control required for aerospace-grade composites substantially increase production expenses compared to conventional materials such as aluminum or steel, creating barriers for cost-sensitive industries.

- Another critical challenge lies in the limited recyclability of composite materials. The difficulty in separating fiber and resin components hampers the development of efficient recycling processes, leading to environmental and waste management concerns.

- Companies such as Toray Industries, Solvay, and SGL Carbon are actively investing in R&D to develop low-cost precursors and recyclable composite solutions to address these challenges. However, achieving cost-effective scalability and environmental sustainability remains an ongoing hurdle.

- Overcoming these obstacles through advancements in automated manufacturing, development of thermoplastic composites, and implementation of circular economy principles will be essential for ensuring sustainable growth and broader adoption of high performance composites worldwide.

Global High Performance Composites Market Scope

The high performance composites market is segmented on the basis of resin type, fiber type, manufacturing, and application.

- By Resin Type

On the basis of resin type, the Global High Performance Composites Market is segmented into High Performance Thermoset Composites and High Performance Thermoplastic Composites. The High Performance Thermoset Composites segment dominated the market with the largest revenue share of 62.4% in 2024, driven by its superior mechanical strength, thermal stability, and widespread use in aerospace and automotive applications. Thermoset composites, such as epoxy and phenolic resins, provide exceptional bonding and structural integrity, making them ideal for high-stress environments.

The High Performance Thermoplastic Composites segment is projected to witness the fastest CAGR during 2025–2032, fueled by their recyclability, shorter processing cycles, and capability for reshaping and reprocessing. Growing demand from the transportation and consumer goods sectors for lightweight and sustainable materials is accelerating the adoption of thermoplastic composites as manufacturers seek cost-effective and eco-friendly alternatives to conventional thermoset systems.

- By Fiber Type

On the basis of fiber type, the Global High Performance Composites Market is segmented into Carbon Fiber Composites, S-Glass Composites, Aramid Fiber Composites, and Others. The Carbon Fiber Composites segment dominated the market with a revenue share of 48.9% in 2024, attributed to their exceptional strength-to-weight ratio, stiffness, and corrosion resistance, which make them the material of choice in aerospace, automotive, and wind energy industries. Carbon fibers provide high fatigue resistance and dimensional stability, critical for precision engineering applications.

The Aramid Fiber Composites segment is expected to record the fastest CAGR during 2025–2032, driven by their excellent impact resistance and thermal stability. Increasing utilization in defense, ballistic protection, and industrial equipment is fueling the growth of aramid composites. Additionally, continuous advancements in hybrid fiber technologies are enhancing performance characteristics and expanding usage across diverse industrial sectors.

- By Manufacturing Process

On the basis of manufacturing process, the Global High Performance Composites Market is segmented into Lay-Up Process, Compression Molding Process, Resin Transfer Molding (RTM) Process, and Other Processes. The Lay-Up Process segment dominated the market with a share of 41.3% in 2024, primarily due to its extensive application in aerospace, marine, and wind energy industries where design flexibility and precision layering are crucial. This method allows for high-quality surface finishes and structural customization.

The Resin Transfer Molding Process is anticipated to exhibit the fastest CAGR during 2025–2032, supported by increasing automation, reduced material wastage, and suitability for mass production. RTM’s ability to produce complex, high-strength components with consistent quality is driving its adoption across automotive and industrial applications. Furthermore, technological innovations in closed-mold processes are improving efficiency and reducing production costs, fostering widespread use in next-generation composite manufacturing.

- By Application

On the basis of application, the Global High Performance Composites Market is segmented into Aerospace and Defense, Automotive, Pressure Vessels, Wind Turbines, Medical, Construction, and Others. The Aerospace and Defense segment dominated the market with a revenue share of 45.7% in 2024, owing to the extensive use of lightweight, high-strength materials for aircraft structures, engine components, and defense equipment to enhance fuel efficiency and performance. Increasing aircraft production and fleet modernization are key contributors to this dominance.

The Automotive segment is forecasted to register the fastest CAGR during 2025–2032, propelled by the rising need for lightweight vehicles to meet stringent emission norms and improve fuel economy. Automakers are increasingly incorporating carbon and glass fiber composites in body panels, chassis, and interior parts. Additionally, expanding applications in renewable energy and infrastructure are contributing to the broader adoption of high performance composites globally.

Global High Performance Composites Market Regional Analysis

- Asia-Pacific dominated the Global High Performance Composites Market with the largest revenue share of 36.1% in 2024, driven by strong demand from aerospace, automotive, and defense sectors, as well as ongoing investments in renewable energy and infrastructure projects.

- Manufacturers in the region prioritize lightweight, high-strength materials to improve fuel efficiency, reduce emissions, and enhance performance across multiple applications, including aircraft structures, automotive components, and wind turbine blades.

- This widespread adoption is further supported by advanced manufacturing capabilities, high R&D investments, and a strong presence of key industry players, establishing North America as a leader in the development and application of high performance composite materials.

U.S. High Performance Composites Market Insight

The U.S. high performance composites market captured the largest revenue share of 35% in North America in 2024, driven by the robust demand from aerospace, automotive, and defense sectors. The focus on lightweight, high-strength materials to improve fuel efficiency and performance in aircraft and vehicles is a key growth driver. Advanced manufacturing capabilities, high R&D investments, and strong government support for innovation further bolster market expansion. Additionally, increasing adoption of composites in renewable energy applications, such as wind turbine blades and energy storage systems, is contributing to steady growth in the U.S. market.

Europe High Performance Composites Market Insight

The Europe high performance composites market is projected to grow at a significant CAGR during the forecast period, driven by stringent environmental and performance regulations in aerospace, automotive, and construction sectors. The region’s focus on sustainability and energy-efficient solutions promotes the use of lightweight composites. Increasing industrialization, urbanization, and the modernization of transportation and infrastructure are further supporting market growth. European manufacturers are also investing in advanced composite technologies, enhancing product performance and expanding application areas across multiple industries.

U.K. High Performance Composites Market Insight

The U.K. high performance composites market is expected to register notable growth during the forecast period, driven by the adoption of lightweight materials in aerospace, automotive, and defense applications. The emphasis on reducing carbon emissions and improving energy efficiency in transportation is accelerating the use of high performance composites. Furthermore, government initiatives supporting advanced manufacturing, combined with a skilled workforce and strong research ecosystem, are fostering innovation and expanding application opportunities in the U.K. market.

Germany High Performance Composites Market Insight

The Germany high performance composites market is anticipated to expand at a considerable CAGR during the forecast period, fueled by strong demand in the automotive, aerospace, and industrial sectors. The country’s emphasis on precision engineering, technological advancement, and sustainable manufacturing practices promotes the adoption of composite materials. Germany’s well-established infrastructure, coupled with innovation-focused R&D investments, supports the development of high-strength, lightweight composites for next-generation applications. Additionally, increasing adoption of renewable energy solutions, including wind turbine components, further strengthens market growth.

Asia-Pacific High Performance Composites Market Insight

The Asia-Pacific high performance composites market is poised to grow at the fastest CAGR of 22% during 2025–2032, driven by rapid industrialization, urbanization, and increasing automotive and aerospace production in countries such as China, Japan, and India. Government initiatives promoting advanced manufacturing and smart infrastructure projects are accelerating demand. The region is emerging as a hub for composite manufacturing, offering cost advantages and expanding production capacity. Rising awareness of lightweight, high-strength materials in construction, energy, and transportation is further boosting adoption across APAC markets.

Japan High Performance Composites Market Insight

The Japan high performance composites market is gaining momentum due to the country’s focus on advanced technology, automotive innovation, and aerospace development. High-quality standards and a growing emphasis on energy efficiency are driving the adoption of lightweight composite materials. Japan’s aging industrial base is encouraging automation and high-performance material integration, particularly in transportation, robotics, and renewable energy applications. Additionally, strong R&D initiatives and government support for sustainable materials are promoting growth in the Japanese market.

China High Performance Composites Market Insight

The China high performance composites market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by rapid industrial growth, urbanization, and expansion of aerospace, automotive, and renewable energy sectors. The country’s strong manufacturing base, coupled with increasing domestic R&D capabilities, is enhancing production of lightweight and high-strength composite materials. Government policies promoting smart manufacturing and sustainable energy solutions are further accelerating adoption. Affordable domestic production, coupled with increasing exports, is positioning China as a key global player in the high performance composites industry.

Global High Performance Composites Market Share

The High Performance Composites industry is primarily led by well-established companies, including:

• Toray Industries, Inc. (Japan)

• Solvay S.A. (Belgium)

• SGL Carbon SE (Germany)

• Hexcel Corporation (U.S.)

• Teijin Limited (Japan)

• Mitsubishi Chemical Group Corporation (Japan)

• Hexam Composites (France)

• Carbon Fiber Technology LLC (U.S.)

• Plasan Carbon Composites (U.S.)

• Cytec Industries Inc. (U.S.)

• Gurit Holding AG (Switzerland)

• TPI Composites, Inc. (U.S.)

• Avient Corporation (U.S.)

• Tencate Advanced Composites (Netherlands)

• DSM Engineering Materials (Netherlands)

• DuPont de Nemours, Inc. (U.S.)

• Saertex GmbH & Co. KG (Germany)

• Ashland Global Holdings Inc. (U.S.)

• AOC Aliancys (Netherlands)

• Nippon Graphite Fiber Corporation (Japan)

What are the Recent Developments in Global High Performance Composites Market?

- In April 2023, Hexcel Corporation, a global leader in advanced composites, launched a strategic initiative in South Africa to supply high-performance carbon fiber and thermoplastic composites for aerospace and automotive applications. This initiative underscores the company's commitment to delivering innovative, lightweight, and durable materials tailored to the evolving demands of regional industries. By leveraging its global expertise and advanced manufacturing capabilities, Hexcel is reinforcing its presence in the rapidly growing global high performance composites market.

- In March 2023, Toray Industries, a leading Japanese composite manufacturer, introduced its next-generation carbon fiber prepreg specifically engineered for wind turbine blades and aerospace structures. The high-strength, lightweight solution enhances structural performance and durability while reducing overall system weight. This advancement highlights Toray’s focus on developing cutting-edge composite materials that meet stringent performance and environmental requirements, supporting sustainable growth across multiple industries.

- In March 2023, Solvay successfully completed the deployment of high-performance thermoplastic composite panels for the Bengaluru Metro Rail Project, aimed at improving durability and reducing maintenance costs in urban infrastructure. This initiative demonstrates Solvay’s dedication to applying advanced composite solutions in large-scale construction and transportation projects, showcasing the increasing importance of lightweight, high-strength materials in urban development.

- In February 2023, Gurit AG, a leading provider of advanced composite materials for the marine and renewable energy sectors, announced a strategic partnership with a European wind energy consortium to supply lightweight, high-strength composite components for offshore wind turbines. The collaboration aims to enhance energy efficiency and structural longevity, highlighting Gurit’s commitment to innovation and sustainable industrial solutions.

- In January 2023, Owens Corning, a prominent manufacturer of fiberglass and composite materials, unveiled its next-generation high-performance insulation composites at the JEC World Composites Show 2023. The innovative product line offers superior thermal resistance and mechanical strength, enabling enhanced energy efficiency and durability for construction and industrial applications. This launch underscores Owens Corning’s focus on integrating advanced materials technology to meet evolving market needs and drive growth in the global high performance composites market.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global High Performance Composites Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global High Performance Composites Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global High Performance Composites Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.