Global High Performance Data Analytics Hpda Market

Market Size in USD Billion

CAGR :

%

USD

223.16 Billion

USD

3,668.39 Billion

2025

2033

USD

223.16 Billion

USD

3,668.39 Billion

2025

2033

| 2026 –2033 | |

| USD 223.16 Billion | |

| USD 3,668.39 Billion | |

|

|

|

|

High Performance Data Analytics Market Size

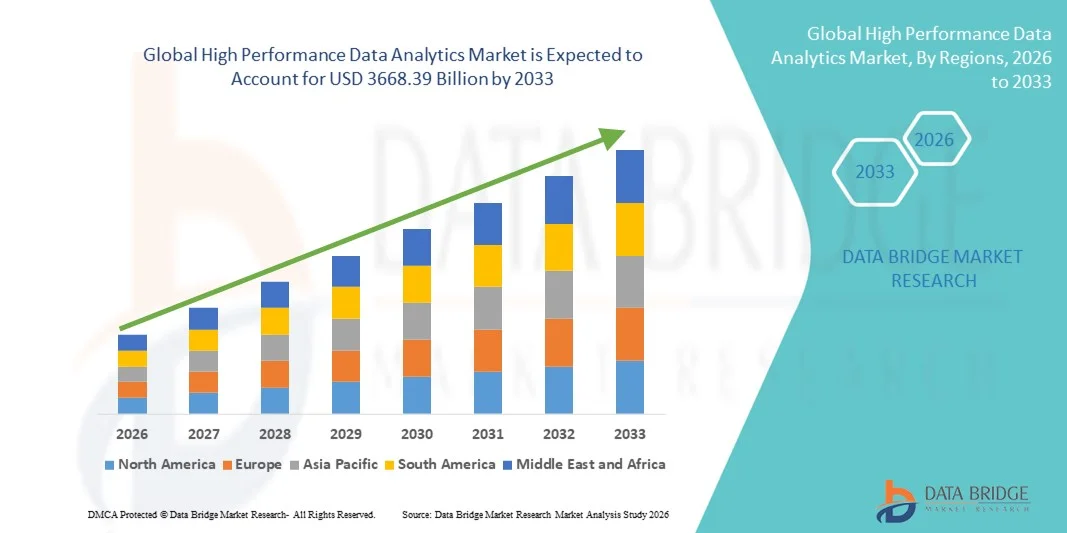

- The global high performance data analytics market size was valued at USD 223.16 billion in 2025 and is expected to reach USD 3668.39 billion by 2033, at a CAGR of 41.90% during the forecast period

- The market growth is largely fueled by the increasing volume of structured and unstructured data generated across enterprises, along with rapid advancements in cloud computing, artificial intelligence, and big data technologies, leading to greater adoption of high-performance data analytics solutions across industries

- Furthermore, rising demand for real-time insights, predictive analytics, and data-driven decision-making is establishing High Performance Data Analytics as a critical component of digital transformation strategies. These converging factors are accelerating the uptake of High Performance Data Analytics solutions, thereby significantly boosting the industry's growth

High Performance Data Analytics Market Analysis

- High Performance Data Analytics solutions, including advanced data processing platforms, real-time analytics engines, and AI-driven business intelligence tools, are increasingly vital components of modern enterprise ecosystems due to their ability to process massive datasets, generate actionable insights, and support strategic decision-making across industries

- The escalating demand for high performance data analytics is primarily fueled by rapid digital transformation, exponential growth of big data, increasing cloud adoption, and rising need for predictive and prescriptive analytics to gain competitive advantage

- North America dominated the high performance data analytics market with the largest revenue share of approximately 41.7% in 2025, supported by strong presence of leading technology providers, early adoption of AI and machine learning solutions, advanced IT infrastructure, and high enterprise spending on data-driven technologies, particularly in the U.S.

- Asia-Pacific is expected to be the fastest-growing region in the high performance data analytics market during the forecast period, projected to grow at a CAGR of approximately 18.9%, driven by expanding digital economies, increasing cloud penetration, rising investments in AI and big data platforms, and rapid enterprise modernization across China, India, and Southeast Asia

- The unstructured data segment dominated the largest market revenue share of 46.8% in 2025, owing to the exponential growth of social media content, multimedia files, IoT data streams, and enterprise documents

Report Scope and High Performance Data Analytics Market Segmentation

|

Attributes |

High Performance Data Analytics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

High Performance Data Analytics Market Trends

Increasing Adoption of Real-Time and Cloud-Based Advanced Analytics Solutions

- A significant and accelerating trend in the global High Performance Data Analytics market is the growing adoption of real-time data processing and cloud-based analytics platforms that enable organizations to derive actionable insights from massive and complex datasets

- Enterprises are increasingly shifting from traditional batch-processing models to high-speed, distributed computing environments that support real-time decision-making

- For instance, in November 2023, Amazon Web Services expanded its high-performance analytics capabilities with enhancements to Amazon Redshift and AWS EMR, enabling faster large-scale data processing for enterprise clients. Similarly, in June 2024, Microsoft strengthened its Azure Synapse Analytics platform with improved real-time data streaming capabilities to support mission-critical analytics workloads

- The rising use of edge computing and in-memory analytics is also transforming the market, allowing organizations in sectors such as banking, healthcare, and telecommunications to process large volumes of data closer to the source, thereby reducing latency and improving operational efficiency

- Furthermore, organizations are increasingly integrating advanced visualization tools and predictive modeling frameworks into high-performance analytics systems, enhancing strategic planning, risk assessment, and customer behavior analysis

- The trend toward scalable, flexible, and hybrid cloud analytics infrastructures is fundamentally reshaping enterprise data management strategies, encouraging organizations to invest in high-performance computing architectures capable of handling structured and unstructured data at scale

High Performance Data Analytics Market Dynamics

Driver

Growing Demand for Data-Driven Decision Making Across Industries

- The increasing reliance on data-driven decision-making across industries such as finance, healthcare, retail, manufacturing, and government is a major driver fueling the High Performance Data Analytics market. Organizations are leveraging advanced analytics to optimize operations, enhance customer engagement, and gain competitive advantages

- For instance, in February 2024, JPMorgan Chase expanded its high-performance analytics infrastructure to support real-time fraud detection and risk modeling, demonstrating the growing importance of advanced analytics in financial services. Similarly, in September 2023, Walmart enhanced its big data analytics systems to optimize supply chain forecasting and inventory management across its global operations

- The exponential growth of data generated from IoT devices, digital transactions, social media platforms, and enterprise applications is compelling organizations to adopt powerful analytics platforms capable of processing petabyte-scale datasets efficiently

- In addition, regulatory requirements for data reporting, compliance monitoring, and cybersecurity analytics are encouraging enterprises to invest in sophisticated analytics solutions that ensure transparency, accuracy, and operational resilience

- The rapid digital transformation initiatives undertaken by enterprises worldwide are further accelerating investments in high-performance analytics platforms, strengthening long-term market growth

Restraint/Challenge

High Implementation Costs and Data Security Concerns

- Despite strong growth prospects, the high performance data analytics market faces challenges related to high infrastructure costs, complex system integration, and skilled workforce shortages. Implementing advanced analytics systems often requires substantial investments in hardware, cloud infrastructure, and specialized software solutions

- For instance, in April 2024, Gartner reported that large-scale enterprise analytics deployments can require multimillion-dollar investments in computing infrastructure and data management systems, limiting adoption among small and medium-sized enterprises

- Data security and privacy concerns also pose significant challenges, particularly when handling sensitive financial, healthcare, or government data. Organizations must ensure compliance with regulations such as GDPR and HIPAA while maintaining robust cybersecurity frameworks

- The shortage of skilled data scientists, analytics engineers, and high-performance computing specialists further constrains market expansion, especially in emerging economies

- Addressing these challenges through cost-optimized cloud models, enhanced cybersecurity protocols, workforce training programs, and scalable infrastructure solutions will be critical to sustaining long-term growth in the High Performance Data Analytics market

High Performance Data Analytics Market Scope

The market is segmented on the basis of component, data type, deployment model, and application.

- By Component

On the basis of component, the Global High Performance Data Analytics market is segmented into hardware, software, and services. The hardware segment dominated the largest market revenue share of 41.6% in 2025, driven by rising investments in high-performance computing infrastructure, advanced processors, GPUs, and high-speed storage systems. Organizations handling massive datasets require scalable servers and parallel processing architectures to ensure faster computation and real-time analytics. Increasing demand for AI-enabled analytics platforms further strengthens hardware adoption. Enterprises across BFSI, healthcare, and government sectors are investing heavily in data centers to support mission-critical analytics workloads. Growth in edge computing and IoT-based analytics also boosts hardware deployment. High bandwidth networking equipment is increasingly adopted to reduce latency. Cloud providers are expanding hyperscale data center capacity, further driving hardware revenues. Demand for energy-efficient and high-density servers is rising to reduce operational costs. Continuous innovation in chip design and accelerators enhances processing efficiency. Integration of advanced cooling systems and modular infrastructure supports scalability. The strong capital expenditure by enterprises ensures sustained dominance of the hardware segment.

The software segment is expected to witness the fastest CAGR of 22.4% from 2026 to 2033, driven by the growing adoption of AI-powered analytics platforms and advanced data visualization tools. Enterprises increasingly rely on predictive analytics, machine learning algorithms, and real-time processing software to gain competitive insights. Cloud-native analytics platforms are expanding rapidly across industries. Organizations prefer scalable and subscription-based software models for flexibility. The integration of automation and intelligent dashboards enhances decision-making efficiency. Rising cybersecurity concerns encourage the deployment of secure analytics software solutions. Demand for big data management tools supporting structured and unstructured data fuels growth. Open-source frameworks and advanced analytics engines are gaining popularity. Continuous updates and innovation in analytics capabilities strengthen market expansion. SMEs are increasingly adopting cost-effective analytics software solutions. Hybrid cloud environments further accelerate demand. The need for business intelligence and real-time insights supports sustained high CAGR growth.

- By Data Type

On the basis of data type, the Global High Performance Data Analytics market is segmented into unstructured, semi-structured, and structured data. The unstructured data segment dominated the largest market revenue share of 46.8% in 2025, owing to the exponential growth of social media content, multimedia files, IoT data streams, and enterprise documents. Organizations are leveraging advanced analytics to derive insights from videos, images, emails, and sensor data. The rapid digitization of enterprises generates vast volumes of unstructured information. AI and natural language processing technologies further increase adoption. Healthcare and life sciences sectors use unstructured clinical notes for predictive diagnostics. BFSI institutions analyze customer behavior through unstructured interaction data. Cloud platforms are increasingly optimized to process such complex datasets. Demand for real-time analytics on streaming data supports dominance. Investments in big data lakes and storage systems drive growth. Businesses aim to convert raw unstructured data into actionable intelligence. Integration with machine learning platforms enhances value extraction. Rising digital transformation initiatives further reinforce market leadership.

The semi-structured data segment is expected to witness the fastest CAGR of 21.1% from 2026 to 2033, driven by the growing use of XML, JSON, and log file data formats. Enterprises are increasingly adopting hybrid data environments that require flexible analytics tools. Semi-structured data enables faster querying compared to fully unstructured data. Rapid growth in web applications and API-driven ecosystems fuels expansion. IoT devices generate semi-structured logs supporting predictive maintenance analytics. Cloud-based platforms simplify integration of semi-structured datasets. Retail and e-commerce sectors analyze customer interaction data efficiently. The flexibility of schema-on-read architecture encourages adoption. Rising need for scalable data management tools supports growth. Automation and AI-driven parsing tools enhance analytics accuracy. Organizations prefer semi-structured formats for interoperability. Increased digital transactions across industries accelerate segment expansion. Continuous innovation in database technologies sustains high CAGR growth.

- By Deployment Model

On the basis of deployment model, the Global High Performance Data Analytics market is segmented into on-premises, on-demand, and on-cloud. The on-premises segment dominated the largest market revenue share of 44.2% in 2025, due to heightened concerns regarding data security, compliance, and control over critical information. Government, defense, and BFSI sectors prefer on-premises solutions for sensitive workloads. Enterprises with legacy IT infrastructure continue investing in internal analytics systems. Customization and direct system control strengthen adoption. High initial capital investment supports advanced hardware integration. On-premises deployment ensures reduced dependency on external service providers. Large corporations benefit from dedicated analytics environments. Regulatory requirements in healthcare and finance favor localized data storage. Performance optimization for mission-critical applications drives demand. Integration with internal ERP and CRM systems supports seamless operations. Long-term cost predictability further strengthens dominance. Strategic data governance policies reinforce continued adoption.

The on-cloud segment is expected to witness the fastest CAGR of 23.6% from 2026 to 2033, driven by scalability, cost efficiency, and remote accessibility. Enterprises are rapidly migrating analytics workloads to public and hybrid cloud environments. Cloud platforms provide flexible computing power for large-scale data processing. Subscription-based pricing reduces capital expenditure barriers. SMEs increasingly adopt cloud analytics due to affordability. Integration with AI, IoT, and automation tools enhances performance. Real-time collaboration across global teams supports adoption. Disaster recovery and backup capabilities strengthen confidence. Rapid deployment and minimal maintenance requirements attract businesses. Continuous innovation from cloud service providers accelerates growth. Multi-cloud strategies are becoming common across enterprises. Increased digital transformation initiatives globally sustain high CAGR expansion.

- By Application

On the basis of application, the Global High Performance Data Analytics market is segmented into government & defense, manufacturing, academia & research, healthcare & life science, BFSI, and others. The BFSI segment accounted for the largest market revenue share of 29.4% in 2025, driven by the need for fraud detection, risk management, and real-time transaction monitoring. Financial institutions leverage advanced analytics to enhance customer insights and regulatory compliance. High-frequency trading platforms rely on high-performance data systems. Predictive analytics improves credit scoring and portfolio management. Rising cybersecurity threats increase demand for advanced monitoring tools. Banks adopt AI-powered analytics to personalize customer services. Large transaction volumes require scalable infrastructure. Regulatory reporting mandates advanced data management systems. Digital banking transformation further boosts demand. Integration with blockchain analytics enhances transparency. Growing fintech innovation strengthens sector dominance. Continuous modernization of banking infrastructure sustains market leadership.

The healthcare & life science segment is expected to witness the fastest CAGR of 24.1% from 2026 to 2033, driven by increasing adoption of predictive diagnostics, genomics research, and real-world evidence analytics. Hospitals use advanced analytics to optimize patient outcomes and operational efficiency. Growth in precision medicine and clinical trials generates massive datasets. AI-enabled imaging and diagnostic platforms accelerate adoption. Pharmaceutical companies rely on high-performance analytics for drug discovery. Wearable health devices produce real-time patient monitoring data. Rising healthcare digitization supports rapid expansion. Government investments in health IT infrastructure fuel growth. Cloud-based healthcare analytics platforms enhance accessibility. Integration of electronic health records improves decision-making. Increased focus on personalized treatment strategies drives adoption. Continuous innovation in biomedical analytics ensures sustained high CAGR growth.

High Performance Data Analytics Market Regional Analysis

- North America dominated the high performance data analytics market with the largest revenue share of approximately 41.7% in 2025, supported by the strong presence of leading technology providers, early adoption of artificial intelligence (AI) and machine learning (ML) solutions, advanced IT infrastructure, and high enterprise spending on data-driven technologies

- Organizations across industries such as BFSI, healthcare, retail, and manufacturing are increasingly leveraging high-performance analytics platforms to process large volumes of structured and unstructured data in real time

- Enterprises in the region highly prioritize scalable analytics infrastructure, cloud-based high-performance computing, and AI-enabled decision intelligence systems. The widespread availability of hyperscale data centers, strong cybersecurity frameworks, and continuous innovation in big data technologies further strengthen regional market leadership

U.S. High Performance Data Analytics Market Insight

The U.S. high performance data analytics market captured the largest revenue share of 81% in 2025 within North America, fueled by rapid digital transformation, extensive cloud adoption, and strong investments in AI, ML, and predictive analytics platforms. U.S. enterprises are increasingly deploying high-performance data analytics to optimize operations, enhance customer experience, and improve real-time decision-making. The country benefits from the presence of major cloud service providers, analytics software vendors, and AI innovators, which accelerates product development and deployment. Growing adoption across sectors such as financial services, healthcare analytics, autonomous systems, and e-commerce further propels market growth.

Europe High Performance Data Analytics Market Insight

The Europe high performance data analytics market is projected to expand at a substantial CAGR throughout the forecast period, driven by increasing investments in digital infrastructure, data governance frameworks, and AI integration across enterprises. Stringent data protection regulations such as GDPR encourage organizations to deploy secure and compliant analytics solutions. The region is witnessing growing adoption of advanced analytics in manufacturing (Industry 4.0), automotive, energy, and public sector applications. Cloud migration strategies and cross-border digital initiatives are also contributing to market expansion.

U.K. High Performance Data Analytics Market Insight

The U.K. high performance data analytics market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by strong fintech innovation, AI research initiatives, and expanding adoption of big data platforms across enterprises. The country’s advanced digital ecosystem and strong startup culture promote analytics-driven business models. In addition, increasing demand for real-time risk analytics, fraud detection systems, and customer intelligence platforms across banking and e-commerce sectors continues to stimulate market growth.

Germany High Performance Data Analytics Market Insight

The Germany high performance data analytics market is expected to expand at a considerable CAGR, fueled by the country’s strong industrial base and emphasis on digital manufacturing transformation. Adoption of high-performance analytics solutions is rising in automotive engineering, industrial automation, and supply chain optimization. Germany’s focus on precision engineering, data security, and enterprise modernization supports the integration of AI-powered analytics platforms, particularly within large enterprises and mid-sized manufacturing firms.

Asia-Pacific High Performance Data Analytics Market Insight

The Asia-Pacific high performance data analytics market is poised to grow at the fastest CAGR of approximately 18.9% during the forecast period, driven by expanding digital economies, increasing cloud penetration, rising investments in AI and big data platforms, and rapid enterprise modernization across China, India, Japan, and Southeast Asia.

Government initiatives promoting digital transformation, smart cities, and AI innovation are accelerating adoption. In addition, the increasing number of SMEs adopting cloud-based analytics solutions is broadening the market base.

Japan High Performance Data Analytics Market Insight

The Japan high performance data analytics market is gaining momentum due to advanced technological infrastructure, strong AI research capabilities, and rising demand for automation and predictive analytics. Japanese enterprises are increasingly utilizing high-performance analytics in robotics, manufacturing optimization, and financial services. The country’s focus on innovation, data accuracy, and operational efficiency supports steady adoption of next-generation analytics platforms.

China High Performance Data Analytics Market Insight

The China high performance data analytics market accounted for the largest revenue share in Asia Pacific in 2025, attributed to rapid digitalization, strong government backing for AI and big data initiatives, and significant investments in cloud computing infrastructure. China’s expanding e-commerce ecosystem, fintech sector, and smart manufacturing industry are major contributors to demand. The presence of large domestic technology providers and hyperscale data centers further strengthens market growth, making China a key revenue contributor in the region.

High Performance Data Analytics Market Share

The High Performance Data Analytics industry is primarily led by well-established companies, including:

- IBM (U.S.)

- Oracle (U.S.)

- Microsoft (U.S.)

- SAP (Germany)

- SAS Institute (U.S.)

- Teradata (U.S.)

- Hewlett Packard Enterprise (U.S.)

- Dell Technologies (U.S.)

- AWS (U.S.)

- Google (U.S.)

- Cloudera (U.S.)

- Splunk (U.S.)

- Palantir Technologies (U.S.)

- TIBCO Software (U.S.)

- Hitachi Vantara (Japan)

- Fujitsu (Japan)

- Alibaba Cloud (China)

- Huawei (China)

- Atos (France)

- Infosys (India)

Latest Developments in Global High Performance Data Analytics Market

- In June 2025, Firebolt Analytics, a cloud-native data warehousing company built for modern high-performance analytics, released Firebolt Core, a free self-hosted edition of its analytics engine designed for sub-second query performance and efficient data-intensive workloads, highlighting performance capabilities for large-scale analytics environments

- In April 2024, SAS unveiled a suite of new features within its analytics offerings aimed at helping users access and analyze data more efficiently, including a generative AI assistant and prebuilt AI models, to accelerate insights and improve analytic workflows

- In March 2024, Microsoft launched Power BI Copilot, an AI-assisted analytics capability that integrates natural-language query support and automated insights into the Power BI analytics service to help users interactively explore and visualize enterprise data

- In November 2024, Oracle expanded its cloud infrastructure analytics capabilities by introducing real-time AI-integrated analytics enhancements, enabling enterprises to run high-performance analytics through improved data processing and predictive capabilities

- In August 2023, Actian released DataConnect 12.2, an enhanced version of its data integration platform with improved support for data quality metrics generation, enabling better preparation and governance of data used in high-performance analytics workflows

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.