Global High Potency Api Hpapi Market

Market Size in USD Billion

CAGR :

%

USD

27.60 Billion

USD

53.20 Billion

2024

2032

USD

27.60 Billion

USD

53.20 Billion

2024

2032

| 2025 –2032 | |

| USD 27.60 Billion | |

| USD 53.20 Billion | |

|

|

|

|

High Potency API HPAPI Market Size

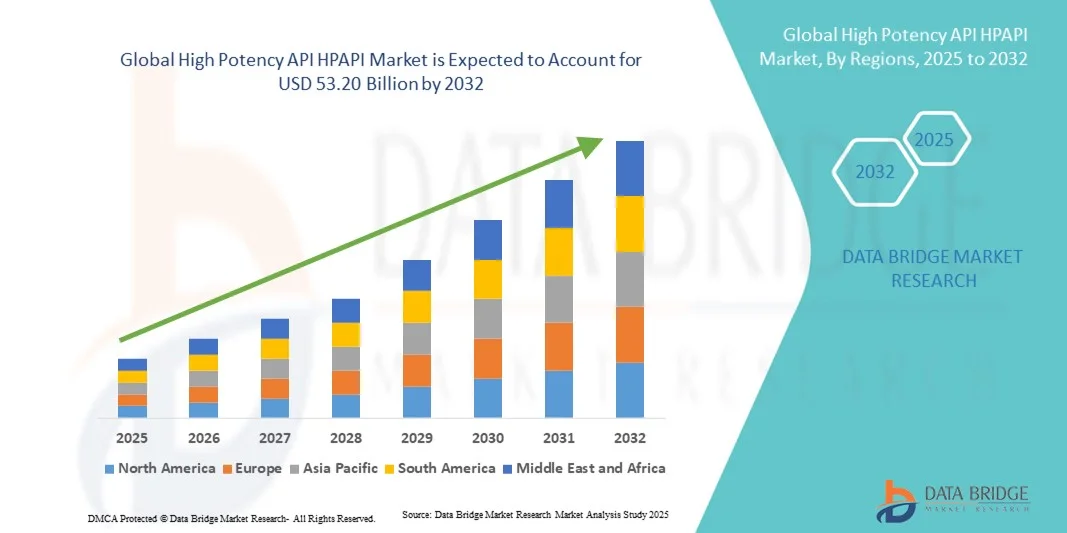

- The global High Potency API HPAPI market size was valued at USD 27.60 billion in 2024 and is expected to reach USD 53.20 billion by 2032, at a CAGR of 8.55% during the forecast period

- The market growth is largely fueled by the rising prevalence of cancer, cardiovascular disorders, and other chronic diseases, which has led to an increasing demand for targeted therapies and specialized drug formulations utilizing High Potency APIs (HPAPIs). Advancements in oncology research and the growing shift towards precision medicine are further driving the adoption of these compounds

- Furthermore, the rising outsourcing trend among pharmaceutical companies, coupled with the increasing need for cost-efficient and flexible manufacturing solutions, is accelerating the uptake of HPAPI contract manufacturing services. These converging factors are significantly boosting the growth of the High Potency API (HPAPI) industry across global markets

High Potency API HPAPI Market Analysis

- High Potency APIs (HPAPIs), offering highly effective therapeutic action at low dosages, are increasingly vital components in modern pharmaceuticals, particularly in oncology, immunology, and hormonal therapies, due to their enhanced efficacy, targeted treatment capabilities, and ability to reduce systemic side effects

- The escalating demand for HPAPIs is primarily fueled by the widespread adoption of precision medicine, the growing pipeline of oncology drugs, and rising investments in biopharmaceutical R&D across both developed and emerging markets

- North America dominated the global High Potency API HPAPI market with the largest revenue share of 38.5% in 2024, characterized by strong pharmaceutical infrastructure, advanced manufacturing capabilities, and the presence of leading biotech and pharma players, with the U.S. experiencing substantial growth in HPAPI production driven by innovative therapies and increasing outsourcing to specialized CDMOs

- Asia-Pacific is expected to be the fastest growing region in the global High Potency API HPAPI market during the forecast period due to expanding manufacturing capacity in India and China, rising healthcare expenditure, favorable government policies, and the increasing demand for cost-effective yet advanced oncology and biologic drugs

- The oncology segment dominated the global High Potency API HPAPI market with the largest market share of 71.9% in 2024, reflecting the fact that the majority of HPAPIs are used in cancer treatments, particularly in small-molecule inhibitors and ADCs

Report Scope and High Potency API HPAPI Market Segmentation

|

Attributes |

High Potency API HPAPI Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

High Potency API HPAPI Market Trends

Rising Importance of Targeted and Personalized Therapies

- A significant and accelerating trend in the global high potency API (HPAPI) market is the growing adoption of targeted and personalized therapies in oncology, autoimmune disorders, and rare diseases. This shift is driving pharmaceutical companies to focus on HPAPIs that can deliver strong therapeutic efficacy at very low dosages, minimizing systemic side effects

- For instance, the increasing approvals of antibody-drug conjugates (ADCs) by regulatory agencies in the U.S., Europe, and Japan are highlighting the crucial role of HPAPIs as payloads, thereby boosting demand for contract manufacturers with specialized containment and production capabilities

- HPAPI manufacturing is increasingly supported by advanced containment technologies such as isolators, restricted access barrier systems (RABS), and continuous manufacturing platforms. These innovations ensure both operator safety and product quality, making HPAPI production more efficient and reliable across the U.S., Switzerland, and Germany

- The growing integration of automation and digital process control in HPAPI production is helping companies achieve compliance with stringent regulatory frameworks from the FDA, EMA, and PMDA. Advanced monitoring systems are also reducing human error, ensuring higher reproducibility in high-potency drug manufacturing

- This trend toward safer, highly specialized, and more efficient HPAPI manufacturing systems is fundamentally reshaping the pharmaceutical value chain, encouraging both large pharma and CDMOs to expand capabilities globally. Companies in India, China, and South Korea are also rapidly scaling up HPAPI production to meet regional and global demand

- The demand for HPAPIs used in oncology, central nervous system disorders, and hormonal therapies continues to grow rapidly across both developed and emerging economies, reflecting the global movement toward innovative, precision-based treatments

High Potency API HPAPI Market Dynamics

Driver

Growing Demand for Oncology and Biologic Therapies

- The increasing prevalence of cancer and the rising number of biologics and targeted therapies in development are significant drivers for the heightened demand for HPAPIs. Oncology alone accounts for the largest share of HPAPI applications, particularly with the approval of novel small-molecule inhibitors and ADCs

- For instance, in March 2024, Lonza announced an expansion of its HPAPI manufacturing capacity in Switzerland to support the growing global oncology drug pipeline, particularly ADC payloads. Such capacity expansions by leading players are expected to accelerate HPAPI industry growth in the forecast period

- As pharmaceutical pipelines shift heavily toward biologics and highly potent drugs, the need for advanced HPAPI facilities with stringent containment, quality assurance, and regulatory compliance is increasing across North America and Europe

- Furthermore, the rising demand for outsourcing by small and mid-sized biotech companies is fueling opportunities for specialized CDMOs in countries like India and Singapore, where cost-efficient and high-quality HPAPI manufacturing is being prioritized

- The push for precision medicine, coupled with regulatory approvals of novel therapies, is expected to remain a critical driver, encouraging continuous investment in HPAPI innovation and production infrastructure

Restraint/Challenge

High Manufacturing Costs and Stringent Regulatory Compliance

- The complexity and high cost associated with the containment infrastructure required for safe HPAPI manufacturing remain major challenges to broader adoption. Facilities must comply with strict occupational exposure limits (OELs) and invest in advanced technologies, making capital requirements very high

- For instance, establishing a new HPAPI facility can take several years and require investments exceeding hundreds of millions of dollars, creating barriers for smaller companies to enter the market

- Stringent regulatory requirements from the U.S. FDA, EMA, and other authorities demand continuous validation, cleaning, and monitoring, adding operational complexity. Non-compliance risks can result in heavy penalties or facility shutdowns, further discouraging new entrants

- In addition, the limited availability of highly skilled professionals trained in handling potent compounds creates workforce challenges, particularly in emerging regions such as Latin America and parts of Southeast Asia

- The combination of high initial investment, ongoing operational costs, and strict compliance requirements continues to restrict wider industry participation. Addressing these restraints through partnerships, workforce training, and modular facility designs will be critical for sustained HPAPI market growth

High Potency API HPAPI Market Scope

The market is segmented on the basis of synthesis, product type, manufacturer, and therapy.

- By Synthesis

On the basis of synthesis, the global High Potency API HPAPI market is segmented into synthetic and biotech. The synthetic segment dominated the largest market revenue share of 61.4% in 2024, driven by its widespread use in oncology, hormonal therapies, and central nervous system drugs. Synthetic HPAPIs remain the backbone of pharmaceutical formulations due to their cost-effectiveness, well-established manufacturing processes, and scalable production capabilities. Large pharmaceutical players continue to prefer synthetic routes because of robust regulatory familiarity and the ability to optimize yields for complex molecules. In addition, synthetic HPAPIs are supported by extensive infrastructure globally, especially in North America and Europe, where advanced containment facilities ensure safety and compliance. The dominance of this segment also stems from the fact that a majority of small-molecule cancer drugs fall under high potency classifications, making synthetic chemistry indispensable. With continuous advancements in process chemistry, synthetic HPAPIs are being manufactured at higher purity levels and reduced costs, which further enhances their appeal. Moreover, the ability to apply continuous manufacturing technologies in synthetic production makes this segment even more competitive.

The biotech segment is expected to witness the fastest CAGR of 10.8% from 2025 to 2032, fueled by the growing pipeline of biologics, targeted therapies, and antibody-drug conjugates (ADCs). Biotech-derived HPAPIs are increasingly important in precision medicine, especially as ADCs utilize highly potent biological payloads for cancer treatment. The biotech route ensures higher specificity and reduced off-target effects, which is driving pharmaceutical companies to invest heavily in this area. Furthermore, global regulatory approvals of biotech-based therapies are accelerating adoption, with North America and Asia-Pacific emerging as hotspots for biotech HPAPI development. CDMOs are rapidly upgrading facilities with isolator-based containment systems to handle biologically derived potent compounds safely. The rising investment in recombinant technology, monoclonal antibodies, and personalized treatment approaches further strengthens growth. While production costs are higher, the superior efficacy and reduced toxicity profiles of biotech HPAPIs make them increasingly favored for innovative drug pipelines. This growing demand for biologics ensures sustained momentum for the biotech synthesis segment.

- By Product Type

On the basis of product type, the global High Potency API HPAPI market is segmented into innovative and generic. The innovative segment dominated the market with the largest revenue share of 67.2% in 2024, driven by the robust global demand for novel oncology drugs, rare disease treatments, and highly targeted biologics. Pharmaceutical giants continue to allocate substantial R&D budgets towards innovative HPAPIs, particularly for advanced targeted therapies and immuno-oncology drugs. These APIs offer greater clinical outcomes, improved patient safety, and higher therapeutic value, making them the preferred choice in developed markets. The dominance of this segment is also reinforced by the steady stream of FDA and EMA approvals of new molecular entities classified as HPAPIs. High barriers to entry and the need for specialized infrastructure make innovative HPAPIs less vulnerable to price erosion, thereby sustaining revenue dominance. In addition, partnerships between biotech firms and CDMOs are boosting production of innovative HPAPIs at commercial scale. With the shift toward personalized medicine, innovative HPAPIs are becoming a central focus in the drug development landscape.

The generic segment is projected to register the fastest CAGR of 9.7% from 2025 to 2032, supported by the patent expiries of blockbuster HPAPI-based drugs. Generic manufacturers are increasingly entering the HPAPI space to provide cost-effective alternatives to innovative therapies, particularly in oncology and hormonal treatments. Emerging markets such as India, China, and Brazil are witnessing strong adoption of generic HPAPIs due to government support for affordable healthcare and the growing presence of low-cost manufacturing facilities. Generic HPAPIs also benefit from the rising global demand for essential medicines at reduced costs, especially in regions with limited healthcare budgets. CDMOs in Asia-Pacific are heavily investing in containment and compliance infrastructure to cater to multinational clients seeking cost savings. Furthermore, the increasing acceptance of generics in developed economies, particularly in Europe, is boosting growth. As more innovative HPAPI patents expire in the forecast period, the generics segment will gain rapid traction, becoming a critical growth engine for the global market.

- By Manufacturer

On the basis of manufacturer, the High Potency API (HPAPI) market is segmented into captive and merchant. The captive segment accounted for the largest revenue share of 58.6% in 2024, as major pharmaceutical companies prefer in-house manufacturing to maintain control over quality, intellectual property, and regulatory compliance. Captive facilities provide end-to-end oversight of synthesis, containment, and supply chain, reducing risks associated with outsourcing. Big pharma companies in North America and Europe continue to invest heavily in expanding their captive HPAPI capacities, particularly for oncology and biologics. Captive production also ensures strict adherence to occupational safety standards, protecting workers from high-potency exposure risks. The dominance of captive facilities is supported by the increasing demand for specialized formulations that require proprietary technologies, which companies prefer to keep within internal facilities. This control over critical manufacturing is vital in ensuring supply chain stability for life-saving therapies.

The merchant segment is expected to grow at the fastest CAGR of 10.3% from 2025 to 2032, driven by the rising outsourcing trend among small and mid-sized biopharma companies that lack the infrastructure to safely produce HPAPIs. CDMOs specializing in HPAPI manufacturing are rapidly expanding across Asia-Pacific, North America, and Europe to meet this demand. Outsourcing allows smaller companies to focus on R&D while leveraging the expertise and containment infrastructure of established CDMOs. Merchant manufacturers are also benefiting from increasing demand for ADC payloads, which require specialized containment technologies. Competitive pricing and the ability to provide flexible capacity make merchant manufacturers attractive partners. In addition, rising complexity in drug pipelines and the push for accelerated time-to-market are fueling the reliance on merchant producers. With expanding global partnerships, the merchant segment is positioned as the fastest-growing category during the forecast period.

- By Therapy

On the basis of therapy, the global High Potency API HPAPI market is segmented into oncology, glaucoma, hormonal imbalance, and others. The oncology segment dominated the largest market share of 71.9% in 2024, reflecting the fact that the majority of HPAPIs are used in cancer treatments, particularly in small-molecule inhibitors and ADCs. Rising global cancer incidence, combined with growing investment in targeted therapies, continues to fuel demand for oncology HPAPIs. Regulatory bodies such as the FDA and EMA are approving a steady stream of oncology drugs that rely on HPAPIs for their therapeutic potency. Pharmaceutical companies prioritize oncology due to its high unmet need, strong R&D funding, and rapid innovation cycles. Oncology drugs often require highly potent molecules at very small dosages, reinforcing the dominance of HPAPIs in this therapeutic class. In addition, the use of HPAPIs in combination therapies and next-generation targeted treatments further solidifies oncology’s market leadership.

The hormonal imbalance segment is anticipated to grow at the fastest CAGR of 9.9% from 2025 to 2032, driven by rising demand for treatments related to thyroid disorders, diabetes-related complications, and reproductive health conditions. The increasing prevalence of hormonal disorders globally, particularly among aging populations and women’s health segments, is boosting the need for effective HPAPI-based therapies. Hormonal imbalance HPAPIs are being increasingly utilized in both generic and innovative drug formulations, expanding their accessibility across developed and emerging markets. The affordability of hormonal imbalance drugs compared to oncology treatments makes them a critical growth driver in middle-income countries. Moreover, growing awareness of hormone-related conditions, coupled with improved diagnostic rates, is accelerating demand. With pharmaceutical companies diversifying beyond oncology, the hormonal imbalance category is emerging as the fastest-growing therapeutic area for HPAPIs.

High Potency API HPAPI Market Regional Analysis

- North America dominated the global High Potency API HPAPI market with the largest revenue share of 38.5% in 2024, characterized by strong pharmaceutical infrastructure, advanced manufacturing capabilities, and the presence of leading biotech and pharma players

- The market in particular is witnessing substantial growth in HPAPI production, driven by rising demand for innovative oncology therapies, targeted biologics, and the increasing outsourcing of HPAPI manufacturing to specialized CDMOs

- This leadership position is reinforced by robust R&D investments, favorable regulatory frameworks, and the rapid expansion of biologics and immuno-oncology pipelines across the region

U.S. High Potency API HPAPI Market Insight

The U.S. High Potency API HPAPI market captured the largest revenue share in 2024 within North America, fueled by the country’s strong dominance in oncology drug development and its advanced pharmaceutical manufacturing ecosystem. Growing investments in precision medicine, coupled with rising partnerships between Big Pharma and CDMOs, are accelerating HPAPI adoption. The expanding pipeline of antibody-drug conjugates (ADCs), hormonal therapies, and immunotherapies further drives demand. In addition, stringent safety regulations for HPAPI production in the U.S. ensure advanced containment technologies, strengthening the country’s market leadership.

Europe High Potency API HPAPI Market Insight

The Europe High Potency API HPAPI market is projected to grow steadily throughout the forecast period, supported by the region’s stringent regulatory framework for drug safety and quality. Countries such as Germany, Switzerland, and the U.K. host some of the world’s leading pharmaceutical and biotechnology companies, driving significant HPAPI consumption. The rising demand for oncology and hormonal imbalance treatments, combined with a strong network of CDMOs in the region, is enhancing market expansion. Furthermore, the focus on sustainable and green chemistry approaches is pushing European manufacturers to invest in advanced HPAPI synthesis technologies.

U.K. High Potency API HPAPI Market Insight

The U.K. High Potency API HPAPI market is anticipated to expand at a noteworthy CAGR during the forecast period, driven by strong government support for biopharmaceutical innovation and clinical research. With London and Cambridge serving as major hubs for biotech startups, the demand for HPAPIs in oncology and precision medicine is rising. Moreover, the country’s focus on fostering partnerships between academic institutions and pharmaceutical companies is expected to contribute to HPAPI advancements, especially in immuno-oncology and targeted therapies.

Germany High Potency API HPAPI Market Insight

The Germany High Potency API HPAPI market is expected to expand significantly during the forecast period, supported by its advanced pharmaceutical infrastructure and emphasis on research-driven innovation. Germany’s strong presence of both multinational pharma companies and CDMOs makes it a key hub for HPAPI development. The increasing demand for high-containment facilities, particularly for oncology and hormonal therapies, aligns with the country’s commitment to strict safety and regulatory compliance. Furthermore, Germany’s focus on sustainable production methods positions it as a leader in environmentally conscious HPAPI manufacturing.

Asia-Pacific High Potency API HPAPI Market Insight

The Asia-Pacific High Potency API HPAPI market is poised to grow at the fastest CAGR between 2025 and 2032, driven by expanding manufacturing capacity in India and China, rising healthcare expenditure, and supportive government policies that promote pharmaceutical production. India is becoming a global hub for cost-effective HPAPI manufacturing, with numerous CDMOs offering advanced containment technologies. China, with its rapidly expanding oncology and biologics markets, is also emerging as a leading producer and consumer of HPAPIs. Increasing collaborations with Western pharmaceutical companies and the focus on affordable yet advanced therapies are further accelerating market growth in the region.

Japan High Potency API HPAPI Market Insight

The Japan High Potency API HPAPI market is gaining traction due to the country’s strong emphasis on innovative drug development and a rapidly aging population requiring advanced treatments. Japan’s robust biotechnology ecosystem and government-backed initiatives for pharmaceutical R&D are boosting demand for HPAPIs, especially in oncology and hormonal therapies. The country’s focus on precision medicine and antibody-drug conjugates (ADCs) is expected to significantly increase HPAPI consumption in the coming years.

China High Potency API HPAPI Market Insight

The China High Potency API HPAPI market accounted for the largest revenue share in the Asia-Pacific region in 2024, supported by the country’s expanding middle class, rapid urbanization, and growing demand for advanced cancer therapies. China’s status as a leading global producer of generic drugs and its growing biologics sector makes it a critical hub for HPAPI manufacturing. The government’s push towards strengthening domestic pharmaceutical innovation, combined with significant investment in high-containment facilities, is fueling further expansion. Increasing collaborations with multinational pharmaceutical companies are also reinforcing China’s role in the global HPAPI supply chain.

High Potency API HPAPI Market Share

The High Potency API HPAPI industry is primarily led by well-established companies, including:

- GSK plc. (U.K.)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Novartis AG (Switzerland)

- Lilly USA, LLC. (U.S.)

- Pfizer Inc. (U.S.)

- Merck & Co., Inc. (U.S.)

- Bristol-Myers Squibb Company (U.S.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Boehringer Ingelheim International GmbH (Germany)

- Sanofi (France)

- AstraZeneca (U.K.)

- AbbVie Inc. (U.S.)

- Dr. Reddy’s Laboratories Ltd. (India)

- Medtronic (Ireland)

- Lonza (Switzerland)

- Novasep (France)

- Sandoz International GmbH (Germany)

- Bayer AG (Germany)

Latest Developments in Global High Potency API HPAPI Market

- In February 2023, Lonza Group (Switzerland) announced the completion of its bioconjugation facility expansion in Visp, Switzerland. The expansion includes two manufacturing suites and supporting infrastructure, enhancing Lonza's capabilities to support both clinical and commercial supply of bioconjugates and antibody-drug conjugates. This development underscores Lonza's commitment to meeting the growing market demand for bioconjugates

- In July 2024, CordenPharma (Luxembourg) announced a strategic investment of approximately EUR 900 million to expand its peptide technology platform in the USA and Europe. The expansions, covering both existing facilities and new constructions, aim to meet the pharmaceutical industry’s stringent quality and technical standards for short and long peptide manufacturing, including Biologics License Application (BLA) requirements

- In December 2024, Teva Pharmaceutical Industries (Israel) announced its intention to divest its active pharmaceutical ingredient (API) business, known as Teva API (TAPI). This strategic move is part of Teva's broader efforts to focus on its core therapeutic areas and improve operational efficiency. The divestiture is expected to impact TAPI's manufacturing and commercial activities

- In May 2025, Dr. Reddy’s Laboratories (India) reported that its API manufacturing facility in Middleburgh, New York, USA received a Form 483 with two observations from the US Food and Drug Administration (FDA). The observations highlight areas requiring corrective actions to ensure compliance with Good Manufacturing Practices (GMP)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.