Global High Purity Aluminium Sulphate Market

Market Size in USD Billion

CAGR :

%

USD

1.26 Billion

USD

1.66 Billion

2024

2032

USD

1.26 Billion

USD

1.66 Billion

2024

2032

| 2025 –2032 | |

| USD 1.26 Billion | |

| USD 1.66 Billion | |

|

|

|

|

Global High Purity Aluminium Sulphate Market Size

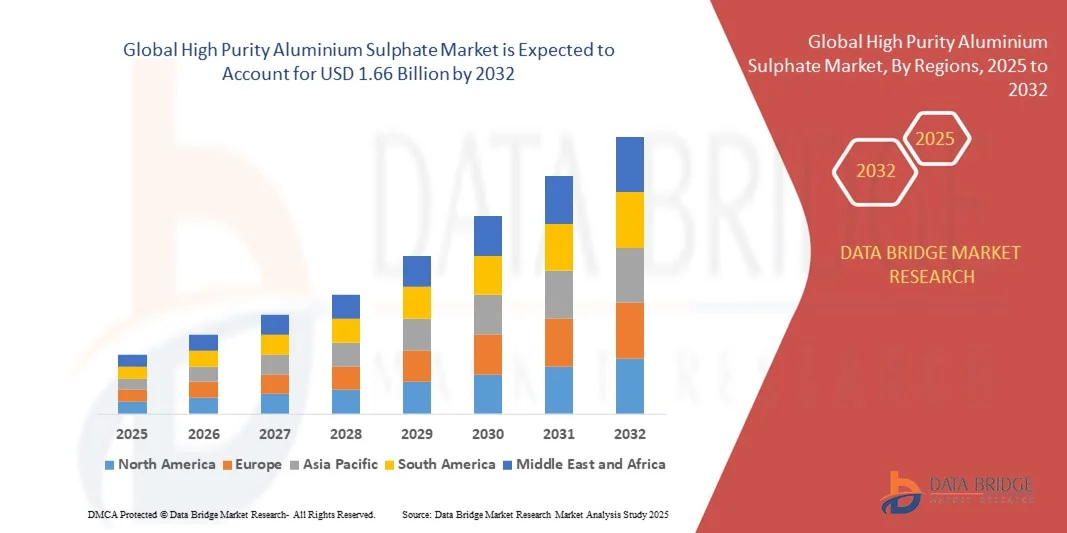

- The global high purity aluminium sulphate market size was valued at USD 1.26 billion in 2024 and is expected to reach USD 1.66 billion by 2032, growing at a CAGR of 3.50% during the forecast period.

- Market growth is primarily driven by the increasing demand for high-purity chemicals in water treatment, paper manufacturing, and pharmaceutical applications, fueled by stringent environmental regulations and industrial quality standards.

- Moreover, the expansion of infrastructure and industrial projects, especially in emerging economies, is creating a surge in demand for efficient coagulants like high purity aluminium sulphate, significantly propelling industry growth.

Global High Purity Aluminium Sulphate Market Analysis

- High purity aluminium sulphate, a refined chemical compound used primarily as a coagulant in water treatment and as a sizing agent in the paper industry, is gaining significant traction due to its high efficiency, low impurity levels, and broad industrial applicability across municipal, commercial, and pharmaceutical sectors.

- The surging demand for high purity aluminium sulphate is largely driven by increasing environmental regulations, rising global emphasis on clean water access, and the growing need for sustainable, high-quality industrial chemicals.

- North America dominated the high purity aluminium sulphate market with the largest revenue share of 44.6% in 2024, led by rapid industrialization, stringent wastewater treatment norms, and robust paper production activities, particularly in China, India, and Southeast Asia.

- Asia-Pacific is projected to be the fastest-growing region during the forecast period, supported by advanced manufacturing capabilities, increased infrastructure development, and growing investment in pharmaceutical and water treatment technologies.

- The Electronic Grade segment dominated the market with the largest market revenue share of 58.4% in 2024, driven by its critical role in high-tech manufacturing processes, including semiconductors, electronics, and precision optical materials

Report Scope and Global High Purity Aluminium Sulphate Market Segmentation

|

Attributes |

High Purity Aluminium Sulphate Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global High Purity Aluminium Sulphate Market Trends

Advanced Purification Technologies Driving Product Quality and Industrial Applications

- A significant and accelerating trend in the global High Purity Aluminium Sulphate Market is the adoption of advanced purification and manufacturing technologies, aimed at minimizing impurities and enhancing product consistency for critical applications such as water treatment, electronics, and pharmaceuticals. This emphasis on purity is becoming a key differentiator in competitive markets where regulatory compliance and performance standards are increasingly stringent.

- For instance, several manufacturers are employing multi-stage crystallization, membrane filtration, and automated quality control systems to achieve ultra-high purity levels suitable for semiconductor-grade and pharmaceutical-grade aluminium sulphate. These advancements ensure low heavy metal content, reduced insoluble matter, and consistent particle size distribution.

- Enhanced purification enables high purity aluminium sulphate to meet the specific requirements of municipal water treatment plants, where product purity directly affects coagulation efficiency and downstream processes. In pharmaceutical and biotech applications, ultra-pure variants are crucial for minimizing contamination risks during sensitive formulations and processes.

- Furthermore, industries are leveraging real-time process monitoring and data analytics to maintain purity and performance consistency across batches. These technologies also support more sustainable manufacturing practices by reducing waste, optimizing resource use, and improving overall process efficiency.

- Companies such as Merck KGaA and Thermo Fisher Scientific Inc. are investing in state-of-the-art production facilities and analytical capabilities to meet growing global demand for high-purity chemicals that conform to international standards like USP, EP, and JP.

- The demand for high purity aluminium sulphate with enhanced quality and reliability is rising sharply across sectors, particularly in emerging markets, where industrial expansion, urbanization, and stricter environmental regulations are driving the need for premium-grade materials and technologically advanced treatment solutions.

Global High Purity Aluminium Sulphate Market Dynamics

Driver

Growing Need Due to Stricter Environmental Regulations and Industrial Water Treatment Demand

-

The rising global focus on sustainable development and environmental protection, combined with the increasing demand for efficient industrial water treatment solutions, is a key factor driving growth in the global High Purity Aluminium Sulphate Market. Governments and environmental bodies are enforcing stricter regulations on wastewater discharge, compelling industries and municipalities to adopt high-performance coagulants.

- For instance, in 2024, several countries in the Asia-Pacific region, including China and India, introduced tighter water quality standards and incentives for the adoption of eco-friendly treatment chemicals. These measures are expected to significantly boost demand for high purity aluminium sulphate, known for its low impurity levels and superior coagulation properties.

- As industries ranging from textiles to food processing seek to improve their water recycling efficiency and reduce ecological footprints, high purity aluminium sulphate offers reliable performance and compliance with global environmental norms. Its ability to effectively remove suspended particles, heavy metals, and organic impurities makes it a preferred solution across multiple sectors.

- Moreover, the ongoing expansion of the pharmaceutical, semiconductor, and paper & pulp industries—especially in developing economies—is increasing demand for ultra-pure chemicals that ensure process reliability and product integrity. High purity aluminium sulphate meets these needs by providing chemical consistency and low contamination risk.

- Improved infrastructure development, increasing urbanization, and investment in clean water technologies are further accelerating the adoption of advanced water treatment chemicals. In particular, high-growth regions like Asia-Pacific and the Middle East are witnessing rising demand across both municipal and industrial applications, reinforcing the importance of quality and performance in coagulant selection.

Restraint/Challenge

Fluctuating Raw Material Prices and Supply Chain Volatility

- One of the major challenges in the global High Purity Aluminium Sulphate Market is the volatility in raw material prices, particularly aluminium hydroxide and sulfuric acid, which are crucial for the production process. Any fluctuations in these input costs directly impact the profitability and pricing strategies of manufacturers.

- For instance, recent disruptions in global supply chains due to geopolitical tensions and energy shortages have caused significant variability in raw material availability and transportation costs, especially in regions dependent on imports.

- This unpredictability can strain production schedules, increase operational costs, and reduce the competitiveness of smaller or regional players. Maintaining consistent product purity and quality under cost pressure becomes challenging, especially when energy-intensive purification processes are involved.

- In addition, limited local sourcing options in certain regions force manufacturers to rely on volatile international markets, making them susceptible to sudden cost surges and longer lead times.

- To address these challenges, companies are increasingly investing in vertical integration, local sourcing partnerships, and advanced process automation to optimize material usage and reduce dependency on external suppliers. However, the high capital investment required for upgrading production facilities and securing a stable supply chain remains a barrier for new entrants and smaller producers.

- Ensuring cost-effective scalability while maintaining ultra-high product purity is essential for long-term growth and competitiveness in this market.

Global High Purity Aluminium Sulphate Market Scope

The high purity aluminium sulphate market is segmented on the basis of application, grade form, and end-use.

- By Application

On the basis of application, the market is segmented into Water Treatment, Paper Manufacturing, Food Industry, Cosmetics, and Textile Dyeing. The Water Treatment segment dominated the market with the largest revenue share of 38.5% in 2024, driven by the increasing demand for clean water and stringent environmental regulations worldwide. Coagulants and flocculants play a vital role in removing suspended particles and contaminants from water, making them indispensable for municipal and industrial treatment plants. Rising urbanization and infrastructure development have further contributed to the steady demand in this segment.

The Food Industry segment is anticipated to witness the fastest growth rate of 20.3% from 2025 to 2032, fueled by growing concerns regarding food safety and the need for high-purity processing chemicals. The demand for food-grade coagulants is rising, especially in dairy processing, beverage production, and meat processing, where clarity and safety are paramount.

- By Grade

On the basis of grade, the market is segmented into Acidic, Basic, and Neutral. The Acidic grade segment held the largest market revenue share of 45.1% in 2024, primarily due to its widespread application in water treatment and industrial processes. Acidic coagulants such as aluminum sulfate and ferric chloride are extensively used to destabilize suspended particles, making them a cost-effective and efficient choice for large-scale operations. Their strong performance across a range of pH levels contributes to their dominance.

The Neutral grade segment is expected to witness the fastest CAGR from 2025 to 2032, owing to its increasing use in sensitive applications such as food processing and cosmetics. Neutral coagulants are often preferred in environments requiring lower reactivity and more controlled treatment processes, especially where product integrity and safety are essential.

- By Form

On the basis of form, the market is segmented into Liquid and Powder. The Liquid segment dominated the market in 2024 with a market share of 59.4%, driven by its ease of handling, rapid solubility, and uniform distribution during application. Liquid coagulants are widely used in municipal water treatment and industrial effluent processing due to their operational efficiency and compatibility with automated dosing systems.

The Powder segment is projected to witness the fastest growth rate of 18.6% from 2025 to 2032, supported by its longer shelf life, ease of transportation, and reduced storage requirements. Powdered forms are gaining traction in remote or decentralized applications where on-site preparation is feasible and cost-effective.

- By End Use

On the basis of end use, the market is segmented into Municipal, Industrial, Agricultural, and Pharmaceutical. The Municipal segment held the largest market revenue share of 42.7% in 2024, largely attributed to the rising demand for safe drinking water and effective wastewater treatment. Government mandates and environmental policies are driving consistent investments in municipal infrastructure, thereby sustaining the demand for coagulants and flocculants in this sector.

The Pharmaceutical segment is expected to record the fastest CAGR from 2025 to 2032, driven by the stringent purity requirements and growing production volumes in the industry. High-grade coagulants are increasingly used in API manufacturing, effluent treatment, and cleanroom applications where contamination control is crucial.

Global High Purity Aluminium Sulphate Market Regional Analysis

- North America dominated the High Purity Aluminium Sulphate Market with the largest revenue share of 44.6% in 2024, driven by rapid industrialization, expanding urban infrastructure, and increasing demand for high-efficiency water treatment solutions.

- Countries such as China, India, and South Korea are leading in consumption due to their strong manufacturing bases in electronics, paper & pulp, and pharmaceuticals, all of which require ultra-pure chemical inputs.

- The region's growth is further supported by strict environmental regulations, rising investments in clean water and sanitation, and the growing adoption of high purity chemicals for industrial process optimization, positioning Asia-Pacific as a key hub for both production and end-use of high purity aluminium sulphate.

U.S. Global High Purity Aluminium Sulphate Market Insight

The U.S. Global High Purity Aluminium Sulphate Market captured the largest revenue share of 82% in 2024 within North America, driven by extensive industrial water treatment needs and stringent environmental regulations. Growing investments in municipal water infrastructure and wastewater management projects are fueling demand for ultra-pure coagulants. Additionally, expansion in pharmaceutical, electronics, and battery manufacturing sectors, which require high-purity chemicals, supports the market’s growth. Increasing awareness of water quality standards and technological advancements in purification processes further strengthen the market position in the U.S.

Europe Global High Purity Aluminium Sulphate Market Insight

The Europe Global High Purity Aluminium Sulphate Market is projected to expand at a substantial CAGR throughout the forecast period, propelled by rigorous environmental policies and rising investments in sustainable water treatment solutions. The region’s emphasis on reducing industrial pollution and enhancing municipal water treatment capacity fosters demand for high-purity aluminium sulphate. Growing industrial applications in pharmaceuticals and electronics, along with increasing urbanization, contribute to steady market expansion across countries such as France, Italy, and Spain.

U.K. Global High Purity Aluminium Sulphate Market Insight

The U.K. Global High Purity Aluminium Sulphate Market is anticipated to witness notable growth during the forecast period, driven by heightened regulatory focus on water quality and industrial effluent treatment. Rising investments in smart city initiatives and clean water infrastructure projects are encouraging adoption. The pharmaceutical and electronics sectors also increasingly rely on ultra-pure chemicals, further propelling market demand. The country’s commitment to sustainability and water conservation is expected to maintain robust market momentum.

Germany Global High Purity Aluminium Sulphate Market Insight

The Germany Global High Purity Aluminium Sulphate Market is expected to grow at a considerable CAGR during the forecast period, supported by the country’s advanced manufacturing sector and stringent environmental standards. Germany’s focus on green technologies and water reuse systems drives demand for high-quality coagulants with low impurities. The pharmaceutical, semiconductor, and chemical industries are significant end-users, with increasing preference for environmentally friendly and efficient treatment chemicals, boosting the market outlook.

Asia-Pacific Global High Purity Aluminium Sulphate Market Insight

The Asia-Pacific Global High Purity Aluminium Sulphate Market is poised to grow at the fastest CAGR of 24% during 2025 to 2032, driven by rapid urbanization, rising industrialization, and increasing environmental awareness. Countries such as China, India, Japan, and South Korea are investing heavily in wastewater treatment infrastructure and clean water initiatives. Expansion of the electronics, pharmaceuticals, and battery manufacturing industries further fuels demand. Government policies promoting water safety and sustainable industrial practices accelerate the adoption of high purity aluminium sulphate in the region.

Japan Global High Purity Aluminium Sulphate Market Insight

The Japan Global High Purity Aluminium Sulphate Market is gaining momentum due to the country’s high-tech industrial base and stringent water quality regulations. Growing demand from semiconductor manufacturing, pharmaceuticals, and precision chemical sectors drives growth. Japan’s focus on sustainable water treatment and recycling technologies supports the uptake of ultra-pure coagulants. Additionally, increasing investments in smart water management systems and industrial modernization bolster market expansion.

China Global High Purity Aluminium Sulphate Market Insight

The China Global High Purity Aluminium Sulphate Market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid industrial growth, urbanization, and strict government regulations on water pollution control. The expanding pharmaceutical, electronics, and battery industries demand high-purity aluminium sulphate for critical manufacturing processes. China’s investment in clean water infrastructure and smart city projects further accelerates market growth. The presence of strong domestic manufacturers and competitive pricing also supports widespread adoption across commercial and industrial sectors.

Global High Purity Aluminium Sulphate Market Share

The High Purity Aluminium Sulphate industry is primarily led by well-established companies, including:

- Hawkins (U.S.)

- Solvay (Belgium)

- NCP Chlorchem (South Africa)

- Albemarle (U.S.)

- Mubadala (United Arab Emirates)

- Shree RRL (India)

- Gulbrandsen (U.S.)

- BASF (Germany)

- Mason Chemical (U.S.)

- Vertex Chemical (U.S.)

- USALCO (U.S.)

- MCP (United Kingdom)

- Chemtrade Logistics (Canada)

- Chemservice (Germany)

- (Taiwan)

- Fujairah Chemical (United Arab Emirates)

What are the Recent Developments in Global High Purity Aluminium Sulphate Market?

- In April 2023, GEO Specialty Chemicals, a global leader in chemical solutions, launched a new high purity aluminium sulphate production facility in South Africa aimed at addressing growing demand for advanced water treatment chemicals in residential and industrial sectors. This strategic initiative highlights GEO’s commitment to delivering high-quality, reliable coagulants tailored to regional water purification challenges, strengthening its position in the expanding Global High Purity Aluminium Sulphate Market.

- In March 2023, Chemtrade Logistics, a prominent North American chemical manufacturer, expanded its portfolio with a new line of battery-grade aluminium sulphate designed specifically for lithium-ion battery manufacturers. This development supports the growing energy storage and electric vehicle markets, emphasizing Chemtrade’s dedication to advancing high-purity materials critical for next-generation battery technologies.

- In March 2023, Merck KGaA successfully partnered with the Bengaluru Water Authority to supply high purity aluminium sulphate for the Safe Water Project, enhancing urban water treatment capabilities. This initiative showcases Merck’s role in driving innovative chemical solutions that contribute to safer and more sustainable urban water systems, underscoring the importance of high purity aluminium sulphate in municipal infrastructure development.

- In February 2023, Triveni Interchem Private Limited, a leading Indian chemical manufacturer, announced a strategic collaboration with major pharmaceutical companies to supply ultra-pure aluminium sulphate for use in advanced drug formulations. This partnership aims to improve drug quality and manufacturing efficiency, reinforcing Triveni Interchem’s commitment to innovation in pharmaceutical-grade chemicals.

- In January 2023, Nippon Light Metal Co., Ltd. unveiled its latest electronic grade high purity aluminium sulphate product at the Asia Water Expo 2023. This product, designed for semiconductor and electronics manufacturers, features enhanced purity and consistency, reflecting Nippon Light Metal’s focus on integrating advanced materials into critical high-tech applications, thereby boosting market presence in the Global High Purity Aluminium Sulphate Market.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global High Purity Aluminium Sulphate Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global High Purity Aluminium Sulphate Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global High Purity Aluminium Sulphate Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.