Global High Resolution Dispensing Systems Market

Market Size in USD Billion

CAGR :

%

USD

6.22 Billion

USD

12.48 Billion

2024

2032

USD

6.22 Billion

USD

12.48 Billion

2024

2032

| 2025 –2032 | |

| USD 6.22 Billion | |

| USD 12.48 Billion | |

|

|

|

|

High Resolution Dispensing Systems Market Size

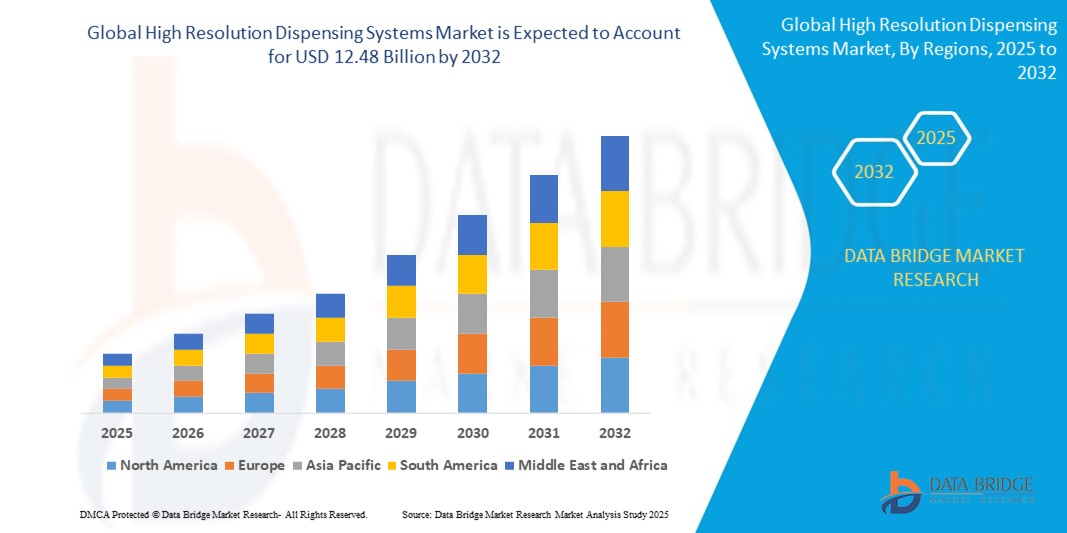

- The global high resolution dispensing systems market size was valued at USD 6.22 billion in 2024 and is expected to reach USD 12.48 billion by 2032, at a CAGR of 9.1% during the forecast period

- The market growth is primarily driven by increasing demand for precision manufacturing in industries such as electronics, automotive, and aerospace, coupled with advancements in automation technologies and the growing adoption of smart manufacturing processes

- Rising needs for high-precision dispensing solutions to support miniaturization in electronics and complex assembly processes in automotive and aerospace sectors are establishing high resolution dispensing systems as critical tools in modern industrial applications. These factors are significantly accelerating market growth

High Resolution Dispensing Systems Market Analysis

- High resolution dispensing systems, designed for precise application of materials such as adhesives, sealants, and liquids, are integral to advanced manufacturing processes, offering enhanced accuracy, repeatability, and integration with automated production lines

- The surge in demand is fueled by the rapid growth of the electronics industry, increasing automation in manufacturing, and the need for high-quality, reliable dispensing solutions in complex applications

- Asia-Pacific dominated the high resolution dispensing systems market with the largest revenue share of 42.5% in 2024, driven by its robust electronics manufacturing sector, large-scale industrial automation, and the presence of key market players in countries such as China, Japan, and South Korea

- North America is expected to be the fastest-growing region during the forecast period, propelled by rapid advancements in automotive and aerospace industries, increasing R&D investments, and the adoption of Industry 4.0 technologies

- The automatic dispensing systems segment dominated the largest market revenue share of 62.3% in 2024, driven by their widespread adoption in high-volume manufacturing environments, particularly in electronics and automotive industries, where precision, speed, and automation are critical for operational efficiency

Report Scope and High Resolution Dispensing Systems Market Segmentation

|

Attributes |

High Resolution Dispensing Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

High Resolution Dispensing Systems Market Trends

“Increasing Integration of Automation and Industry 4.0 Technologies”

- The global high resolution dispensing systems market is experiencing a significant trend toward the integration of automation and Industry 4.0 technologies

- These technologies enable precise control, real-time monitoring, and enhanced efficiency in dispensing processes, providing improved accuracy in applications such as adhesive and sealant dispensing

- Automation-driven dispensing systems, particularly robotic systems with advanced sensors, allow for seamless integration into smart manufacturing environments, reducing human error and increasing productivity

- For instance, companies are developing robotic dispensing platforms that use IoT and AI to optimize material application in real-time, adjusting for variables such as viscosity and environmental conditions

- This trend is enhancing the appeal of high resolution dispensing systems for industries such as electronics and automotive, where precision and scalability are critical

- Advanced software control systems analyze dispensing patterns, ensuring consistent application and minimizing material waste, which is particularly valuable in high-cost material applications

High Resolution Dispensing Systems Market Dynamics

Driver

“Rising Demand for Precision Manufacturing and Miniaturization”

- The increasing demand for precision in manufacturing processes, particularly in industries such as electronics and automotive, is a major driver for the high resolution dispensing systems market

- These systems enable accurate dispensing of small volumes of materials, such as adhesives, sealants, and coatings, critical for assembling miniaturized components in smartphones, wearables, and automotive sensors

- Government regulations and industry standards, especially in regions such as Europe and Asia-Pacific, are pushing for higher quality and reliability in manufacturing, further driving adoption of high resolution dispensing systems

- The proliferation of IoT and advancements in robotics are enabling more sophisticated dispensing applications, offering faster processing and precise material placement for complex assemblies

- Manufacturers are increasingly incorporating high resolution dispensing systems as standard equipment in production lines to meet stringent quality requirements and enhance product durability

Restraint/Challenge

“High Initial Costs and Integration Complexities”

- The significant upfront investment required for high resolution dispensing systems, including hardware, software, and integration into existing production lines, poses a barrier to adoption, particularly for small and medium-sized enterprises in emerging markets

- Retrofitting these systems into legacy manufacturing setups can be complex and costly, requiring specialized expertise and downtime

- In addition, concerns over material compatibility and system maintenance present challenges, as dispensing systems must handle diverse materials with varying viscosities and chemical properties, necessitating frequent calibration and upgrades

- The lack of standardized protocols across industries for dispensing system integration complicates scalability and interoperability for global manufacturers

- These factors can deter potential adopters and limit market growth in cost-sensitive regions or industries with less advanced technological infrastructure

High Resolution Dispensing Systems market Scope

The market is segmented on the basis of type, application, and end users.

- By Type

On the basis of type, the global high resolution dispensing systems market is segmented into automatic dispensing systems and semi-automatic dispensing systems. The automatic dispensing systems segment dominated the largest market revenue share of 62.3% in 2024, driven by their widespread adoption in high-volume manufacturing environments, particularly in electronics and automotive industries, where precision, speed, and automation are critical for operational efficiency.

The semi-automatic dispensing systems segment is expected to witness the fastest growth rate of 10.2% from 2025 to 2032, fueled by their cost-effectiveness and flexibility, making them suitable for small to medium-scale operations and industries transitioning to automated processes.

- By Application

On the basis of application, the global high resolution dispensing systems market is segmented into glue dispensers, adhesive & sealant dispensers, powder dispensers, liquid material dispensers, and others. The adhesive & sealant dispensers segment dominated the market with a revenue share of 38.7% in 2024, driven by their critical role in electronics manufacturing for bonding components, encapsulating circuits, and ensuring product durability, as well as their extensive use in automotive and aerospace industries.

The liquid material dispensers segment is anticipated to experience the fastest growth from 2025 to 2032, propelled by increasing demand for precise dispensing of liquids in pharmaceuticals, biotechnology, and advanced manufacturing processes, where accuracy is vital for product quality and safety.

- By End Users

On the basis of end users, the global high resolution dispensing systems market is segmented into electronics, automotive, aerospace, oil & gas, and others. The electronics segment accounted for the largest market revenue share of 45.1% in 2024, driven by the surging demand for miniaturized electronic devices, such as smartphones and wearables, requiring high-precision dispensing for adhesives, sealants, and coatings in circuit assembly and packaging.

The automotive segment is expected to witness rapid growth at a CAGR of 11.5% from 2025 to 2032, fueled by the increasing integration of advanced electronics in vehicles, such as electric and autonomous cars, necessitating precise dispensing for component bonding, sealing, and thermal management.

High Resolution Dispensing Systems Market Regional Analysis

- Asia-Pacific dominated the high resolution dispensing systems market with the largest revenue share of 42.5% in 2024, driven by its robust electronics manufacturing sector, large-scale industrial automation, and the presence of key market players in countries such as China, Japan, and South Korea

- Consumers prioritize high resolution dispensing systems for their accuracy in applying adhesives, sealants, and other materials, enhancing product reliability and performance, particularly in electronics and automotive applications

- Growth is supported by advancements in dispensing technology, including automated and robotic systems, alongside rising adoption in both OEM and aftermarket segments across various industries

U.S. High Resolution Dispensing Systems Market Insight

The U.S. high resolution dispensing systems market is expected to witness significant growth, fueled by strong demand in the electronics and aerospace sectors and growing awareness of precision and automation benefits. The trend towards smart manufacturing and Industry 4.0 technologies further boosts market expansion. Automakers’ and electronics manufacturers’ increasing integration of automated dispensing systems complements aftermarket sales, creating a robust product ecosystem.

Europe High Resolution Dispensing Systems Market Insight

The Europe high resolution dispensing systems market is expected to witness significant growth, supported by a strong emphasis on automation and precision in manufacturing. Consumers and industries seek systems that ensure accurate material application while improving production efficiency. The growth is prominent in both new installations and retrofit projects, with countries such as Germany and France showing significant uptake due to advanced industrial ecosystems and stringent quality standards.

U.K. High Resolution Dispensing Systems Market Insight

The U.K. market for high resolution dispensing systems is expected to witness rapid growth, driven by demand for precision in electronics and automotive manufacturing. Increased focus on automation and efficient production processes encourages adoption. In addition, evolving industry regulations promoting quality and reliability influence consumer and manufacturer choices, balancing precision with compliance.

Germany High Resolution Dispensing Systems Market Insight

Germany is expected to witness rapid growth in the high resolution dispensing systems market, attributed to its advanced manufacturing sector and high focus on production efficiency and precision. German industries prefer technologically advanced systems that enhance automation and reduce material waste. The integration of these systems in premium electronics and automotive manufacturing, along with aftermarket applications, supports sustained market growth.

Asia-Pacific High Resolution Dispensing Systems Market Insight

The Asia-Pacific region dominates the global high resolution dispensing systems market with the largest revenue share of 46% in 2024, driven by expanding electronics and automotive production in countries such as China, Japan, and South Korea. Increasing awareness of precision dispensing for adhesives, sealants, and other materials boosts demand. Government initiatives promoting automation and energy efficiency further encourage the adoption of advanced dispensing systems.

Japan High Resolution Dispensing Systems Market Insight

Japan’s high resolution dispensing systems market is expected to witness rapid growth due to strong consumer and industry preference for high-quality, technologically advanced dispensing systems that enhance production accuracy and efficiency. The presence of major electronics and automotive manufacturers and the integration of these systems in OEM applications accelerate market penetration. Rising interest in aftermarket automation also contributes to growth.

China High Resolution Dispensing Systems Market Insight

China holds the largest share of the Asia-Pacific high resolution dispensing systems market, propelled by rapid industrialization, rising manufacturing output, and increasing demand for precision dispensing solutions. The country’s growing electronics and automotive sectors, along with a focus on smart manufacturing, support the adoption of advanced dispensing systems. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

High Resolution Dispensing Systems Market Share

The high resolution dispensing systems industry is primarily led by well-established companies, including:

- Nordson Corporation (U.S.)

- AptarGroup, Inc. (U.S.)

- Dover Corporation (U.S.)

- Franklin Fueling Systems (U.S.)

- Jensen Global, Inc. (U.S.)

- Graco Inc. (U.S.)

- Musashi Engineering, Inc. (Japan)

- Mycronic Sweden HQ (Sweden)

- Besi (Netherlands)

- ITW (U.S.)

- FISNAR (U.S.)

- DEMA Engineering Company (U.S.)

- Dymax (U.S.)

- ESYS Automation (Germany)

- JR Automation (U.S.)

What are the Recent Developments in Global High Resolution Dispensing Systems Market?

- In March 2024, Nordson EFD, a division of Nordson Corporation, unveiled its GVPlus and PROX series—next-generation automated fluid dispensing systems engineered for high-resolution applications in sectors such as electronics, automotive, and medical device manufacturing. These systems deliver best-in-class repeatability, enhanced vision capabilities, and larger workspaces. With features such as CCD smart vision cameras, linear motors, and proprietary DispenseMotion software, they ensure precise, adaptive dispensing even on challenging surfaces such as glass or plastics

- In June 2023, Henkel AG & Co. KGaA partnered with AptarGroup to co-develop innovative adhesive dispensing solutions tailored for the automotive industry. This collaboration combines Henkel’s advanced adhesive technologies with AptarGroup’s precision dispensing systems, aiming to enhance application accuracy, process efficiency, and material performance in demanding automotive assembly environments. The partnership reflects a broader industry push toward automated, high-resolution dispensing that supports lightweighting, structural bonding, and sustainability goals in vehicle manufacturing

- In October 2023, ABB launched the IRB 6300SC, a high-precision dispensing robot engineered for complex material application tasks across industries such as electronics, automotive, and medical device manufacturing. Designed to meet the rising demand for automated, accurate dispensing, the IRB 6300SC integrates seamlessly with ABB’s OmniCore™ controller, offering enhanced motion control, repeatability, and cleanroom compatibility. Its compact design and advanced vision capabilities make it ideal for applications such as adhesive dispensing, micro-dosing, and sealant application, where precision and consistency are critical

- In April 2023, Graco Inc. expanded its capabilities in high-resolution fluid dispensing by acquiring a specialized micro-dispensing technology startup. This strategic move enhances Graco’s ability to serve niche markets such as electronics assembly and pharmaceutical manufacturing, where precision, repeatability, and material compatibility are critical. Micro-dispensing systems are essential for applications such as MEMS packaging, medical device bonding, and semiconductor encapsulation, where even microliter-level accuracy can impact product performance

- In February 2023, Musashi Engineering and Mycronic formed a strategic partnership to co-develop next-generation high-resolution dispensing systems tailored for the electronics industry. This collaboration combines Musashi’s deep expertise in precision fluid dispensing—including non-contact jetting and micro-dosing—with Mycronic’s advanced automation platforms, such as the MYD series. The goal is to deliver high-speed, high-accuracy dispensing solutions that meet the evolving demands of semiconductor packaging, PCB assembly, and miniaturized component manufacturing

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global High Resolution Dispensing Systems Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global High Resolution Dispensing Systems Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global High Resolution Dispensing Systems Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.