Global High Silica Zeolite Market

Market Size in USD Billion

CAGR :

%

USD

1.24 Billion

USD

1.37 Billion

2024

2032

USD

1.24 Billion

USD

1.37 Billion

2024

2032

| 2025 –2032 | |

| USD 1.24 Billion | |

| USD 1.37 Billion | |

|

|

|

|

Global High Silica Zeolite Market Size

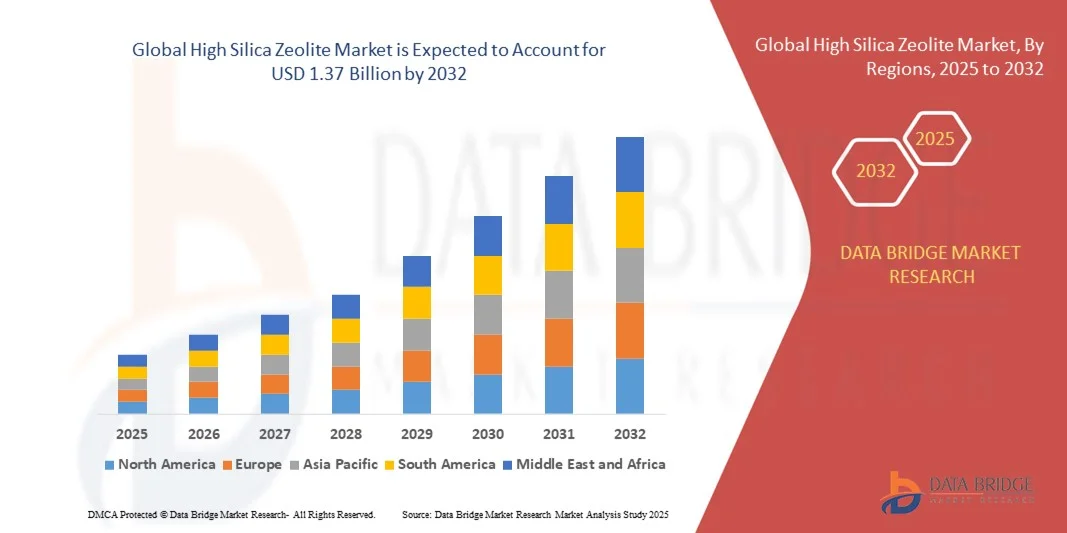

- The global High Silica Zeolite Market size was valued at USD 1.24 billion in 2024 and is expected to reach USD 1.37 billion by 2032, at a CAGR of 1.20% during the forecast period.

- The market growth is largely driven by the increasing demand for efficient catalysts and adsorbents in the chemical, petrochemical, and environmental sectors, which is boosting the utilization of high silica zeolites in various industrial applications.

- Furthermore, the rising focus on sustainable processes, energy efficiency, and water treatment solutions is promoting the adoption of high silica zeolites as effective materials for purification, separation, and catalysis. These converging factors are accelerating market expansion, thereby significantly enhancing the industry's growth.

Global High Silica Zeolite Market Analysis

- High silica zeolites, microporous crystalline solids primarily used as catalysts, adsorbents, and molecular sieves, are increasingly vital components in chemical, petrochemical, and environmental applications due to their high thermal stability, large surface area, and selective adsorption properties.

- The escalating demand for high silica zeolites is primarily fueled by the growing emphasis on sustainable chemical processes, energy-efficient catalysis, and advanced water and air purification technologies.

- Europe dominated the Global High Silica Zeolite Market with the largest revenue share of 35.4% in 2024, characterized by the presence of major chemical and petrochemical industries, high industrial standards, and strong R&D investments, with the U.S. experiencing substantial growth in zeolite applications for refining, adsorption, and separation processes, driven by innovations from both established chemical companies and specialty material startups.

- North America is expected to be the fastest-growing region in the Global High Silica Zeolite Market during the forecast period due to rapid industrialization, increasing investments in sustainable manufacturing, and rising demand from emerging economies like China and India.

- The ZSM-5 type dominated the market with the largest revenue share of 45.6% in 2024, driven by its widespread application in petroleum refining and petrochemical processes, particularly for catalytic cracking, isomerization, and hydrocarbon conversion.

Report Scope and Global High Silica Zeolite Market Segmentation

|

Attributes |

High Silica Zeolite Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global High Silica Zeolite Market Trends

Advanced Applications in Catalysis and Adsorption

- A significant and accelerating trend in the global High Silica Zeolite Market is the expanding use of high silica zeolites in advanced catalysis, adsorption, and separation processes across chemical, petrochemical, and environmental applications. This adoption is significantly enhancing process efficiency, selectivity, and sustainability.

- For instance, high silica zeolites such as ZSM-5 and Beta are widely used as catalysts in hydrocarbon cracking, isomerization, and alkylation processes, enabling higher yields and improved energy efficiency. Similarly, high silica zeolites are employed in gas separation and water purification systems, effectively removing contaminants and improving resource recovery.

- Integration with emerging process technologies allows high silica zeolites to provide smarter, more optimized solutions. For example, some advanced zeolite formulations are tailored to selectively adsorb carbon dioxide or volatile organic compounds, contributing to cleaner industrial emissions and enhanced environmental compliance.

- The adoption of high silica zeolites in modular and integrated chemical processing systems facilitates centralized control over multiple reaction and purification steps. By combining zeolite catalysts and adsorbents with process automation, industries can achieve more efficient, scalable, and sustainable operations.

- This trend toward more intelligent, high-performance, and versatile zeolite applications is fundamentally reshaping expectations for industrial efficiency and sustainability. Consequently, companies such as Zeochem, BASF, and Zeolyst are developing next-generation high silica zeolites with enhanced thermal stability, selectivity, and adsorption capacity.

- The demand for high silica zeolites with advanced catalytic and adsorptive properties is growing rapidly across both chemical and environmental sectors, as industries increasingly prioritize energy efficiency, process optimization, and environmental compliance.

Global High Silica Zeolite Market Dynamics

Driver

Growing Demand Driven by Sustainability and Industrial Efficiency

-

The increasing emphasis on sustainable chemical processes, energy efficiency, and environmental regulations is a significant driver for the heightened demand for high silica zeolites.

- For instance, in 2024, BASF and Zeochem announced new high-performance zeolite catalysts designed for cleaner hydrocarbon processing and improved selectivity in chemical reactions. Such innovations by key companies are expected to drive growth in the High Silica Zeolite Market during the forecast period.

- As industries face stricter environmental compliance requirements and seek optimized production processes, high silica zeolites offer advanced features such as selective adsorption, high thermal stability, and superior catalytic performance, providing a compelling alternative to conventional materials.

- Furthermore, the growing adoption of modular and automated processing systems is making high silica zeolites an integral component of modern industrial setups, facilitating seamless integration with reactors, separation units, and purification systems.

- The ability to improve energy efficiency, reduce waste, and enable cost-effective purification or separation processes are key factors propelling the adoption of high silica zeolites in both chemical and environmental applications. The trend toward sustainable manufacturing and the increasing availability of high-performance zeolite formulations further contribute to market growth.

Restraint/Challenge

High Production Costs and Performance Limitations in Specific Applications

- The relatively high production and processing costs of high silica zeolites, compared to conventional adsorbents or catalysts, pose a significant challenge to broader market penetration, particularly in price-sensitive industrial segments.

- For instance, producing ultra-high silica zeolites with tailored pore structures or advanced functionalization can require specialized synthesis methods and higher raw material inputs, limiting their accessibility for smaller-scale operations.

- Addressing these challenges through innovations in cost-effective synthesis, scalable production techniques, and improved performance-to-cost ratios is crucial for wider adoption. Companies such as Zeolyst and Clariant focus on optimizing production efficiency while maintaining high purity and performance to meet industrial demands.

- Additionally, certain high silica zeolites may exhibit limitations in specific applications, such as lower acidity for some catalytic processes or reduced adsorption for polar molecules, requiring careful selection and customization.

- Overcoming these challenges through continuous R&D, tailored product solutions, and process optimization will be vital for sustained market growth in the global High Silica Zeolite industry.

Global High Silica Zeolite Market Scope

High silica zeolite market is segmented on the basis of type, sales channel, and application.

- By Type

On the basis of type, the Global High Silica Zeolite Market is segmented into ZSM-5 type, USY type, Beta type, and others. The ZSM-5 type dominated the market with the largest revenue share of 45.6% in 2024, driven by its widespread application in petroleum refining and petrochemical processes, particularly for catalytic cracking, isomerization, and hydrocarbon conversion. ZSM-5 zeolites are highly valued for their high thermal stability, superior acidity, and shape-selective catalytic properties, making them a preferred choice in large-scale industrial operations.

The Beta type is expected to witness the fastest CAGR of 22.3% from 2025 to 2032, fueled by its versatility in various chemical reactions and increasing use in environmental applications, including gas separation and wastewater treatment. Its larger pore size and high silica content make it suitable for processing bulkier molecules, driving adoption in specialized industrial segments. Growing industrial automation and sustainability trends further accelerate Beta type utilization across emerging economies.

- By Application

On the basis of application, the Global High Silica Zeolite Market is segmented into petroleum refining catalysts, petrochemical catalysts, and others. The petroleum refining catalysts segment dominated the market with the largest revenue share of 50.8% in 2024, driven by the increasing global demand for gasoline, diesel, and clean fuels. High silica zeolites such as ZSM-5 are widely used in catalytic cracking and hydrocarbon conversion processes due to their excellent thermal stability and selective catalytic properties, which enhance refinery efficiency and product yields.

The petrochemical catalysts segment is anticipated to witness the fastest CAGR of 21.5% from 2025 to 2032, fueled by the growing production of olefins, aromatics, and specialty chemicals. Rising industrialization, particularly in Asia-Pacific and the Middle East, coupled with advancements in sustainable chemical processes, is boosting demand for high silica zeolites in petrochemical applications. Increasing adoption of environmentally compliant catalysts further supports market expansion.

- By Sales Channel

On the basis of sales channel, the Global High Silica Zeolite Market is segmented into direct channel and distribution channel. The direct channel dominated the market with the largest revenue share of 57.2% in 2024, driven by direct supply agreements between zeolite manufacturers and major petrochemical, refining, and chemical companies. Direct sales offer advantages such as customized product solutions, bulk procurement, technical support, and stronger post-sale service, which are highly valued in large-scale industrial operations.

The distribution channel is expected to witness the fastest CAGR of 19.8% from 2025 to 2032, fueled by increasing penetration of high silica zeolites in small- and medium-scale enterprises, research institutions, and emerging industrial regions. Distributors provide flexible purchasing options, smaller quantities, and local availability, supporting adoption in diverse applications. Growing e-commerce platforms for industrial chemicals and global supply chain integration further accelerate the growth of distribution-based sales.

Global High Silica Zeolite Market Regional Analysis

- Europe dominated the Global High Silica Zeolite Market with the largest revenue share of 35.4% in 2024, driven by high demand from the petroleum refining and petrochemical industries, along with well-established chemical manufacturing infrastructure.

- Industries in the region highly value the efficiency, thermal stability, and selective catalytic properties of high silica zeolites, which enhance process yields, reduce energy consumption, and support compliance with stringent environmental regulations.

- This widespread adoption is further supported by advanced industrial technology, strong R&D capabilities, and the presence of leading global zeolite manufacturers, establishing high silica zeolites as a preferred solution for catalytic and adsorption applications in both large-scale refineries and specialty chemical production facilities.

U.S. High Silica Zeolite Market Insight

The U.S. high silica zeolite market captured the largest revenue share of 35% in 2024 within North America, driven by the country’s robust petroleum refining and petrochemical sectors. High silica zeolites are highly valued for their superior catalytic performance, thermal stability, and selective adsorption properties, which enhance process efficiency and product yield. Additionally, stringent environmental regulations and growing emphasis on cleaner fuels are encouraging the adoption of high-performance zeolite catalysts. The U.S. market is further supported by advanced industrial infrastructure, strong R&D capabilities, and the presence of key global manufacturers, ensuring a steady demand across chemical, refining, and specialty applications.

Europe High Silica Zeolite Market Insight

The Europe high silica zeolite market is projected to grow at a substantial CAGR throughout the forecast period, primarily driven by stringent environmental and emission regulations across the region. The rising demand for sustainable chemical processes and energy-efficient refining technologies is fostering adoption. High silica zeolites are widely applied in petroleum refining and petrochemical industries for hydrocarbon conversion, separation, and purification. Countries such as Germany, France, and Italy are witnessing growth due to advanced industrial infrastructure, increasing awareness about eco-friendly catalysts, and investments in modernized refineries and chemical plants.

U.K. High Silica Zeolite Market Insight

The U.K. high silica zeolite market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by the country’s focus on green energy solutions and sustainable chemical production. Industrial stakeholders are increasingly adopting high silica zeolites to improve catalytic efficiency and reduce environmental impact. The demand is particularly strong in refining and petrochemical sectors, where selective adsorption and high thermal stability of these zeolites optimize production. Additionally, the U.K.’s growing R&D ecosystem and initiatives for sustainable industrial practices are expected to further stimulate market growth.

Germany High Silica Zeolite Market Insight

The Germany high silica zeolite market is expected to expand at a considerable CAGR during the forecast period, driven by the country’s emphasis on industrial innovation, sustainability, and energy efficiency. Germany’s well-established chemical and refining industries are major adopters of high silica zeolites for catalytic and adsorption applications. The integration of high-performance zeolites in petrochemical and specialty chemical production enhances product yield, energy efficiency, and process sustainability. Strong regulatory support for eco-friendly technologies, combined with Germany’s focus on advanced manufacturing, is boosting the adoption of high silica zeolites.

Asia-Pacific High Silica Zeolite Market Insight

The Asia-Pacific high silica zeolite market is poised to grow at the fastest CAGR of 23% during the forecast period of 2025 to 2032, driven by rapid industrialization, increasing petrochemical production, and rising demand for clean fuels in countries such as China, India, and Japan. Growing investments in refinery expansion, coupled with technological advancements in catalyst manufacturing, are accelerating market adoption. The region’s cost advantages, expanding chemical infrastructure, and government initiatives promoting sustainable industrial practices further enhance accessibility and utilization of high silica zeolites across multiple industrial sectors.

Japan High Silica Zeolite Market Insight

The Japan high silica zeolite market is gaining momentum due to the country’s focus on advanced industrial processes, energy-efficient refining, and environmental compliance. High silica zeolites are increasingly adopted in catalytic applications for petroleum refining and petrochemical production, enhancing selectivity and efficiency. Japan’s strong technological ecosystem, emphasis on sustainable production, and modernization of chemical and refinery infrastructure are key factors driving demand. Additionally, government policies encouraging clean energy and industrial optimization support the market’s expansion in both commercial and specialty applications.

China High Silica Zeolite Market Insight

The China high silica zeolite market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to rapid industrialization, growing petrochemical production, and strong domestic manufacturing capabilities. High silica zeolites are widely used in catalytic cracking, separation, and purification processes to improve efficiency and product quality. The government’s focus on clean fuel production, environmental compliance, and sustainable chemical processes further accelerates adoption. China’s robust manufacturing base, coupled with increasing refinery capacity and domestic innovation in zeolite production, positions the country as a major hub for high silica zeolite consumption and production in the region.

Global High Silica Zeolite Market Share

The High Silica Zeolite industry is primarily led by well-established companies, including:

• Zeochem (Switzerland)

• BASF SE (Germany)

• Clariant (Switzerland)

• China National Chemical Corporation (China)

• Chemtura Corporation (U.S.)

• Merck KGaA (Germany)

• Honeywell (U.S.)

• Zeolyst International (U.S.)

• Haldor Topsoe (Denmark)

• Liangshan Zeolite Co., Ltd. (China)

• Süd-Chemie Performance Materials (Germany)

• Grace Catalysts Technologies (U.S.)

• Chempoint Industries (U.S.)

• Jiangsu Zeolite Co., Ltd. (China)

• Toray Industries, Inc. (Japan)

• Micronized Zeolite Company (U.S.)

• Lonza Group AG (Switzerland)

• Shandong Hengsheng Zeolite Co., Ltd. (China)

• Kemira Oyj (Finland)

• Zeolyst Europe BV (Netherlands)

What are the Recent Developments in Global High Silica Zeolite Market?

- In April 2023, Zeolyst International (U.S.) launched a strategic initiative in South Africa to expand the adoption of high-performance high silica zeolites in petroleum refining and petrochemical applications. This initiative aims to optimize catalytic efficiency and improve fuel quality in the local market, highlighting Zeolyst’s commitment to delivering advanced, reliable zeolite solutions tailored to regional industrial needs. By leveraging its global expertise, Zeolyst reinforces its position in the rapidly growing Global High Silica Zeolite Market.

- In March 2023, Clariant AG (Switzerland) introduced a new line of high silica zeolite catalysts specifically designed for the petrochemical sector, offering enhanced selectivity and thermal stability. These catalysts are engineered to improve production efficiency and reduce environmental impact, underscoring Clariant’s dedication to innovative, sustainable solutions for industrial clients and advancing its market presence.

- In March 2023, BASF SE (Germany) successfully deployed advanced high silica zeolite catalysts in a major refinery upgrade project in Bengaluru, India. The project aimed to enhance hydrocarbon conversion efficiency and reduce emissions, showcasing BASF’s commitment to leveraging cutting-edge technologies for sustainable industrial operations. This deployment highlights the growing significance of high-performance zeolites in modern refining processes.

- In February 2023, Zeochem AG (Switzerland) announced a strategic partnership with a leading Asian petrochemical consortium to supply high silica zeolites for catalytic cracking and adsorption processes. This collaboration is designed to optimize refinery operations and enhance process efficiency, reflecting Zeochem’s focus on innovation and operational excellence in global zeolite markets.

- In January 2023, UOP LLC (Honeywell, U.S.) unveiled a new high silica zeolite product line at the International Petroleum Technology Conference (IPTC) 2023. The catalysts, featuring improved stability and selectivity, enable refiners to maximize fuel yields while minimizing energy consumption. UOP’s launch highlights the company’s commitment to integrating advanced materials into industrial processes, supporting sustainable and efficient production in the Global High Silica Zeolite Market.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global High Silica Zeolite Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global High Silica Zeolite Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global High Silica Zeolite Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.