Global High Temperature Coatings Market

Market Size in USD Billion

CAGR :

%

USD

1.80 Billion

USD

2.84 Billion

2024

2032

USD

1.80 Billion

USD

2.84 Billion

2024

2032

| 2025 –2032 | |

| USD 1.80 Billion | |

| USD 2.84 Billion | |

|

|

|

|

What is the Global High Temperature Coatings Market Size and Growth Rate?

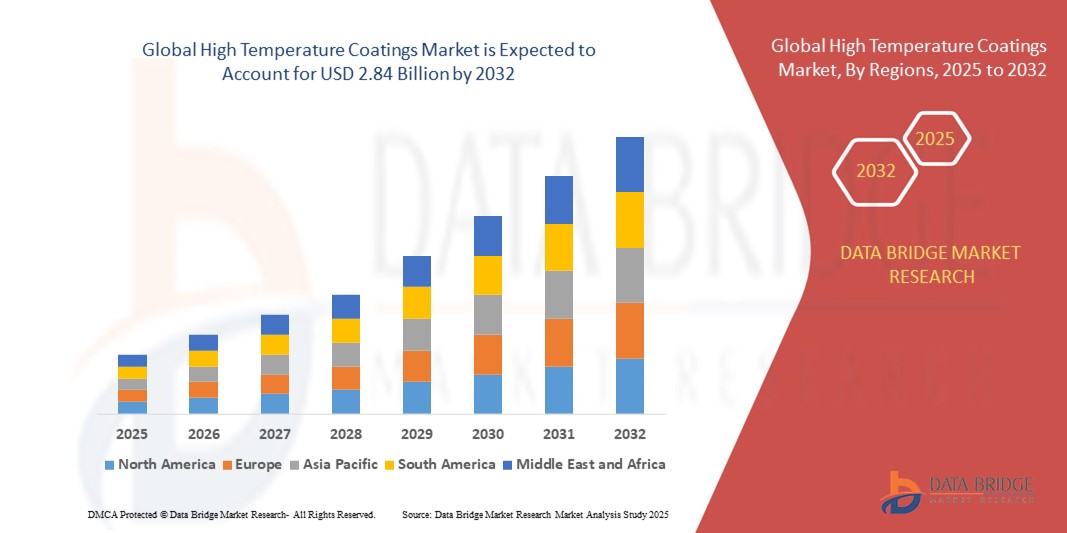

- The global high temperature coatings market size was valued at USD 1.80 billion in 2024 and is expected to reach USD 2.84 billion by 2032, at a CAGR of 5.80% during the forecast period

- The global high temperature coatings market is poised for robust growth, driven by increasing demand across diverse sectors such as automotive, aerospace, and industrial machinery. Advancements in technology, particularly in the formulation of heat-resistant coatings, are propelling market expansion

- Rising industrialization in emerging economies coupled with stringent regulatory requirements regarding corrosion protection and fire resistance further fuel market growth. In addition, growing awareness about the benefits of high temperature coatings in enhancing durability and performance of substrates contributes to market traction

What are the Major Takeaways of High Temperature Coatings Market?

- The global high temperature coatings market is ripe with opportunities for expansion and innovation. One significant opportunity lies in the development of advanced coatings with superior heat resistance properties, capable of withstanding even higher temperatures while maintaining performance and durability. Industries such as aerospace, automotive, and energy generation constantly seek materials that can endure extreme conditions, creating a growing demand for high temperature coatings

- Asia-Pacific dominated the high temperature coatings market with the largest revenue share of 42.5% in 2024, driven by rapid urbanization, rising disposable incomes, and widespread technological adoption across the region

- North America is poised to be the fastest-growing region, with a projected CAGR of 5.54% from 2025 to 2032, driven by rising demand for smart, sustainable building materials and increasing integration of high temperature coatings in energy-efficient construction

- The epoxy segment dominated the high temperature coatings market with the largest market revenue share of 38.5% in 2024, driven by its excellent adhesion, chemical resistance, and thermal stability across various industrial applications

Report Scope and High Temperature Coatings Market Segmentation

|

Attributes |

High Temperature Coatings Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the High Temperature Coatings Market?

Advancements in Eco-Friendly and Durable Coating Technologies

- A prominent trend in the global high temperature coatings market is the development and adoption of eco-friendly, low-VOC (volatile organic compounds) formulations that provide enhanced thermal resistance and durability while meeting stringent environmental regulations

- For instance, companies such as BASF and Akzo Nobel are innovating with waterborne and silicone-based coatings that withstand extreme temperatures and corrosive environments, offering longer service life and reduced environmental impact

- Advances in nanotechnology are enabling high temperature coatings with improved adhesion, abrasion resistance, and heat stability, significantly enhancing performance in industries such as aerospace, automotive, and power generation

- The integration of multifunctional properties, such as corrosion resistance combined with thermal insulation, is allowing manufacturers to offer coatings that deliver comprehensive protection under harsh operating conditions

- This trend toward sustainable, high-performance coatings is driving R&D investments and encouraging end-users to switch from traditional coatings to advanced high temperature solutions that extend equipment lifespan and reduce maintenance costs

- Demand for coatings that comply with evolving environmental standards while maintaining superior heat resistance is rapidly growing across industrial, manufacturing, and energy sectors worldwide

What are the Key Drivers of High Temperature Coatings Market?

- Rising industrialization and increasing demand for energy-efficient and durable materials in sectors such as power generation, automotive, aerospace, and manufacturing are major drivers fueling market growth

- For instance, in 2024, several coating manufacturers announced innovations in silicone and ceramic-based high temperature coatings aimed at improving thermal barrier performance in gas turbines and engines

- Stricter government regulations on emissions and hazardous substances compel industries to adopt eco-friendly high temperature coatings with reduced VOC content, boosting market demand

- The growing need to enhance equipment lifespan and reduce downtime in harsh operating environments encourages the use of high-performance coatings that offer corrosion protection and heat resistance

- Increasing focus on lightweight materials in automotive and aerospace applications drives the demand for specialized coatings that can endure high temperatures without compromising material integrity

- The expansion of emerging markets and infrastructure development also contribute to rising demand for high temperature coatings in industrial applications worldwide

Which Factor is challenging the Growth of the High Temperature Coatings Market?

- The high cost of advanced high temperature coatings and the complexity of their application processes pose significant challenges, particularly for small and medium-sized enterprises

- Some industries are reluctant to switch from traditional coatings due to concerns about long-term performance and compatibility with existing substrates and manufacturing methods

- Limited awareness about the benefits and application techniques of innovative high temperature coatings in developing regions hinders widespread adoption

- Environmental regulations, while driving eco-friendly formulations, also increase compliance costs for manufacturers, which can raise product prices and affect demand

- Volatility in raw material prices, such as for specialty resins and pigments, impacts coating costs and supply chain stability

- Overcoming these challenges through cost-effective manufacturing, enhanced application technologies, and awareness programs will be essential for sustained growth of the high temperature coatings market

How is the High Temperature Coatings Market Segmented?

The market is segmented on the basis of type, technology, and end use.

- By Type

On the basis of type, the market is segmented into epoxy, silicone, polyester, acrylic, alkyd, and others. The epoxy segment dominated the high temperature coatings market with the largest market revenue share of 38.5% in 2024, driven by its excellent adhesion, chemical resistance, and thermal stability across various industrial applications. Epoxy coatings are widely preferred for their durability and protective qualities in harsh environments, especially in petrochemical and automotive sectors.

The silicone segment is expected to witness the fastest CAGR of 19.8% from 2025 to 2032, fueled by its superior heat resistance and flexibility, making it ideal for aerospace and defense applications requiring high-performance thermal protection.

- By Technology

On the basis of technology, the market is segmented into water-based, solvent-based, and powder coatings. The solvent-based segment held the largest market share of 45.7% in 2024, owing to its widespread use in industrial coatings that require strong adhesion and resistance to extreme temperatures.

However, the water-based segment is projected to record the fastest growth rate during the forecast period, driven by increasing environmental regulations and demand for eco-friendly coating solutions.

- By End Use

On the basis of end use, the high temperature coatings market is segmented into aerospace and defense, automotive, petrochemical, building and construction, and others. The petrochemical segment accounted for the largest revenue share of 35.6% in 2024, attributed to the critical need for corrosion and heat-resistant coatings on pipelines, storage tanks, and refinery equipment.

The aerospace and defense segment is expected to grow at the fastest CAGR due to the rising demand for lightweight, heat-resistant coatings that improve fuel efficiency and durability in aircraft components.

Which Region Holds the Largest Share of the High Temperature Coatings Market?

- Asia-Pacific dominated the high temperature coatings market with the largest revenue share of 42.5% in 2024, driven by rapid urbanization, rising disposable incomes, and widespread technological adoption across the region

- Consumers and businesses in Asia-Pacific increasingly prioritize smart, energy-efficient, and secure coatings solutions, supported by government initiatives promoting digital infrastructure and smart city projects

- The region's strong manufacturing base for high temperature coatings components ensures affordability and accessibility, making these coatings highly favored in residential, commercial, and industrial applications

China High Temperature Coatings Market Insight

China captured the largest revenue share within Asia-Pacific, accounting for 55% of the regional market in 2024. The expanding middle class, accelerated urban development, and high adoption rates of smart home and industrial automation solutions fuel demand. The country’s emphasis on sustainable and technologically advanced coatings for energy-efficient buildings and infrastructure drives market growth.

Japan High Temperature Coatings Market Insight

Japan’s market growth is supported by its advanced technology landscape and strong focus on eco-friendly innovations. Increasing integration of High Temperature Coatings with IoT devices in smart homes and commercial buildings boosts demand. Japan’s aging population further fuels the need for convenient, secure, and user-friendly coatings solutions.

India High Temperature Coatings Market Insight

India is emerging as a key growth driver with increasing urbanization, infrastructure expansion, and a growing preference for smart, energy-saving coatings. Government policies encouraging smart city development and industrial modernization contribute to rapid market expansion. The affordability and growing awareness among consumers also play important roles.

Which Region is the Fastest Growing Region in the High Temperature Coatings Market?

North America is poised to be the fastest-growing region, with a projected CAGR of 5.54% from 2025 to 2032, driven by rising demand for smart, sustainable building materials and increasing integration of high temperature coatings in energy-efficient construction. The U.S. market leads this growth, propelled by rapid adoption of smart home technologies, stringent environmental regulations, and expanding commercial infrastructure requiring advanced protective coatings. Technological innovations, such as coatings compatible with IoT devices and sustainable formulations, along with strong consumer focus on safety and energy savings, further accelerate market growth in North America.

U.S. High Temperature Coatings Market Insight

The U.S. holds the largest revenue share in North America. Growing investments in green buildings and smart infrastructure, combined with rising consumer demand for high-performance coatings, are key growth factors. The integration of coatings with smart automation platforms such as Alexa and Google Assistant is also gaining traction.

Canada High Temperature Coatings Market Insight

Canada’s market is expanding due to increasing industrial activity and government incentives promoting energy-efficient construction. Demand for durable, eco-friendly coatings that withstand extreme climates is rising, encouraging adoption across residential and commercial sectors.

Mexico High Temperature Coatings Market Insight

Mexico is witnessing steady growth with infrastructure modernization and increased industrial investments. The market benefits from growing awareness of sustainable materials and rising construction activities focused on durability and energy efficiency.

Which are the Top Companies in High Temperature Coatings Market?

The high temperature coatings industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Akzo Nobel N.V. (Netherlands)

- The Sherwin-Williams Company (U.S.)

- PPG Industries, Inc. (U.S.)

- Valspar (U.S.)

- Carboline Company (U.S.)

- Axalta Coating Systems, LLC (U.S.)

- Jotun (Norway)

- Aremco (U.S.)

- Belzona International Ltd. (U.K.)

- Chemco International Ltd (U.K.)

- Hempel A/S (Denmark)

- Weilburger Coatings GmbH (Germany)

- GENERAL MAGNAPLATE CORPORATION (U.S.)

What are the Recent Developments in Global High Temperature Coatings Market?

- In June 2023, PPG Industries, Inc. introduced PPG ENVIRO-PRIME EPIC 200R coatings, a series of electrocoat (e-coat) products that cure at lower temperatures compared to other technologies. These coatings provide sustainability benefits by lowering energy usage and reducing CO2 emissions during manufacturing, making them an eco-friendly choice for customers

- In June 2023, Sherwin-Williams launched a new range of Heat-Flex CUI-mitigation coatings, featuring Heat-Flex ACE (Advanced CUI Epoxy), an ultra-high-solids epoxy novolac with a unique chemical enhancement designed to effectively combat corrosion under insulation (CUI). This advanced formulation is claimed to outperform existing options in minimizing CUI-related risks, offering superior protection for industrial applications

- In May 2023, Akzo Nobel N.V. unveiled a bisphenol-free internal coating for beverage can ends, offering coil coaters and can manufacturers a BPA-free alternative as the industry accelerates its shift away from bisphenol-based coatings. This BPA-NI (Bisphenol A non-intent) coating addresses the rising demand for safer alternatives following the European Food Safety Authority’s (EFSA) updated restrictions on BPA in metal food and beverage packaging, supporting compliance with evolving regulations

- In October 2022, Dow introduced SiLASTIC SST-2650, a recyclable silicone self-sealing tire solution used in Bridgestone’s new B-SEALS recyclable tire sealant technology. However, its production process requires high-temperature applications and extensive laser cleaning of tire surfaces, which increase energy consumption and environmental impact, highlighting challenges in sustainable manufacturing

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global High Temperature Coatings Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global High Temperature Coatings Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global High Temperature Coatings Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.