Global High Voltage Battery Market

Market Size in USD Billion

CAGR :

%

USD

33.20 Billion

USD

269.30 Billion

2024

2032

USD

33.20 Billion

USD

269.30 Billion

2024

2032

| 2025 –2032 | |

| USD 33.20 Billion | |

| USD 269.30 Billion | |

|

|

|

|

Global High Voltage Battery Market Size

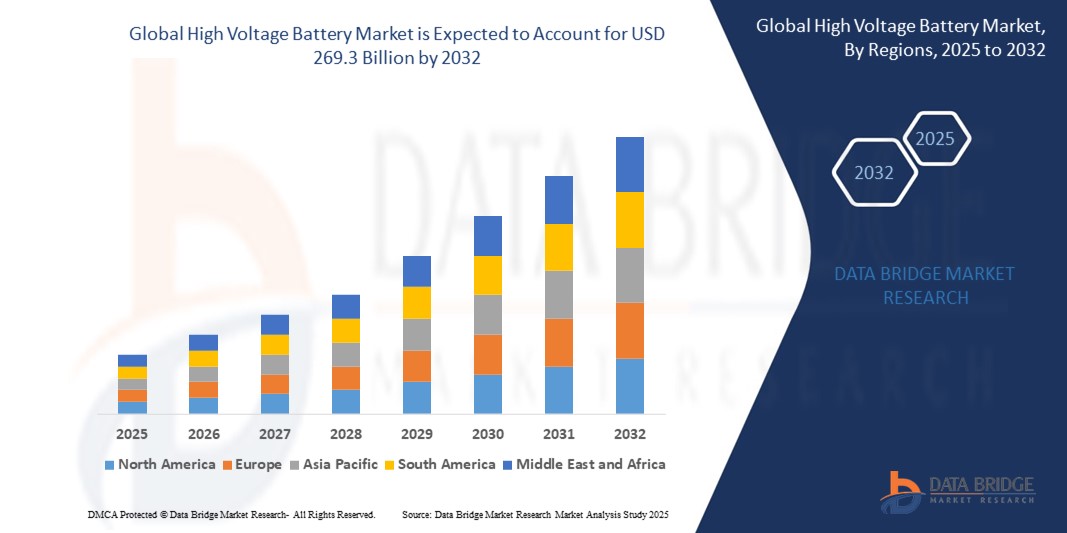

- The Global High Voltage Battery Market size was valued at USD 33.2 billion in 2024 and is expected to reach USD 269.3 billion by 2032, at a CAGR of 34.9% during the forecast period.

- This growth is driven by Surge in EV Adoption.

Global High Voltage Battery Market Analysis

- The global transition toward electric vehicles is driving the demand for high-voltage batteries (400V to 800V systems). Tesla, BYD, and Volkswagen expanded their EV lineups in 2023–2024 with high-voltage battery platforms for faster charging and improved range.

- Stringent emission norms in the EU, U.S., and China, coupled with subsidies (e.g., the U.S. Inflation Reduction Act, 2022), are encouraging OEMs like Ford and Mercedes-Benz to scale high-voltage battery deployments.

- North America is expected to register the fastest growth, fuelled by Advances in battery chemistry by firms like CATL and LG Energy Solution—including NCM and solid-state R&D—have made high-voltage systems more viable for longer-range vehicles.

- The 400V-600V segment is projected to account for a significant market share of approximately 61.5% in 2025, driven by Energy Density and Efficiency Improvements.

Report Scope and Global High Voltage Battery Market Segmentation

|

Attributes |

Global High Voltage Battery Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global High Voltage Battery Market Trends

“Integration of AI, IoT, and Cloud Technologies”

- The incorporation of Artificial Intelligence (AI) and the Internet of Things (IoT) into Battery Management Systems (BMS) is revolutionizing battery performance monitoring. These technologies enable real-time analytics, predictive maintenance, and enhanced safety features, thereby improving the reliability and efficiency of high voltage batteries.

- Cloud platforms facilitate remote monitoring and management of battery systems, allowing for scalable and flexible operations. This is particularly beneficial for large-scale energy storage systems and EV fleets, where centralized data analysis can optimize performance and maintenance schedules.

- In April 2024, Toyota, Solid-state high-voltage battery development for safer, energy-dense applications started gaining traction with investments and prototypes announced.

- High-voltage systems are being adapted for electric aviation and marine applications, offering high energy-to-weight ratios.

Global High Voltage Battery Market Dynamics

Driver

“Electrification of Transportation”

- The global shift towards electric mobility is a primary driver for the HVB market. Governments and automotive manufacturers are investing heavily in EV development, necessitating advanced battery solutions with higher voltage capacities to meet performance and range requirements.

- High voltage batteries play a crucial role in storing energy generated from renewable sources like solar and wind. This integration ensures a stable and reliable power supply, addressing the intermittent nature of renewables and supporting grid stability.

- For instance, In April 2021, NIO Promoting high-voltage battery swaps for EVs as a subscription service, impacting high-voltage pack design and replacement logistics.

- Battery production is becoming localized with new plants from Northvolt (Sweden), ACC (France), and Ultium Cells (U.S.), reducing logistics costs and improving supply resilience.

Opportunity

“Advancements in Battery Chemistry”

- Ongoing research and development in battery materials, such as solid-state electrolytes and alternative cathode compositions, are expected to enhance energy density, safety, and lifespan of high voltage batteries, opening new avenues for application and efficiency.

- Emerging economies are investing in EV infrastructure and renewable energy projects, presenting significant opportunities for HVB manufacturers. For instance, India's Amara Raja Energy and Mobility entered into a licensing agreement with China's Gotion High Tech Co. in June 2024 to produce lithium-ion batteries domestically, aiming to reduce reliance on imports and bolster local manufacturing capabilities.

- For instance, In November 2023, for BYD, Hyundai National policies in Europe, China, and North America are encouraging the shift toward electric mobility, increasing demand for HV batteries.

- Innovations in BMS by firms like Bosch and Analog Devices are improving the safety, performance, and lifespan of high-voltage batteries through real-time monitoring and predictive analytics.

Restraint/Challenge

“Supply Chain Constraints”

- The HVB industry faces challenges related to the sourcing of raw materials, such as lithium and cobalt, which are critical for battery production. Geopolitical factors, mining limitations, and environmental concerns can disrupt supply chains and affect production timelines.

- The development and deployment of high voltage battery systems involve substantial capital investment. Costs associated with research, manufacturing, and infrastructure development can be prohibitive, especially for small and medium-sized enterprises.

- For instance, High-voltage battery packs are still expensive due to advanced materials (e.g., cobalt, nickel) and cooling systems. In 2023, Lucid Motors’ 900V platform added significant cost to vehicle pricing.

- High-voltage batteries require precise cooling and safety mechanisms. General Motors reported challenges with thermal runaway prevention in early 2024 Ultium battery recalls.

Global High Voltage Battery Market Scope

The market is segmented based on Voltage Type, Battery Type, Battery Capacity, Vehicle Type, and Driving Range

|

Segmentation |

Sub-Segmentation |

|

By Voltage Type |

|

|

By Battery Type |

|

|

By Battery Capacity |

|

|

By Vehicle Type |

|

|

By Driving Range |

|

In 2025, 100-250 Miles segment is projected to dominate the Driving Range segment

The 100-250 Miles segment is expected to hold a market share of approximately 29.1% in 2025, driven by Surge in EV Adoption.

The Passenger Cars Vehicle Type segment is expected to account for the largest share during the forecast period in the Vehicle Type market

In 2025, the Passenger Cars Vehicle Type segment is projected to account for a market share of 45.1%, driven by Faster Charging Infrastructure.

“North America Holds the Largest Share in the Global High Voltage Battery Market”

- North America dominates the market due to the global transition toward electric vehicles is driving the demand for high-voltage batteries (400V to 800V systems). Tesla, BYD, and Volkswagen expanded their EV lineups in 2023–2024 with high-voltage battery platforms for faster charging and improved range.

- The U.S. holds a significant share, driven by Surge in EV Adoption.

- High-voltage systems are being adapted for electric aviation (e.g., Rolls-Royce eVTOL projects) and marine applications, offering high energy-to-weight ratios.

“Asia Pacific is Projected to Register the Highest CAGR in the Global High Voltage Battery Market”

- Asia Pacific’s growth is driven by Advanced Battery Management Systems (BMS).

- Asia Pacific is projected to exhibit the highest CAGR due to Grid Storage and V2G Integration.

- High-voltage systems are being adapted for electric aviation (e.g., Rolls-Royce eVTOL projects) and mar.

Global High Voltage Battery Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Tesla,

- BYD Company Ltd.,

- Panasonic Corporation,

- LG Chem,

- Continental AG,

- SAMSUNG SDI CO.LTD.,

- XALT Energy LLC,

- ABB,

- Contemporary Amperex Technology Co. Limited,

- Siemens AG,

- PROTERRA,

- Robert Bosch GmbH,

- Delphi Technologies,

- Mitsubishi Electric Corporation,

- Nissan,

- Johnson Controls,

- ChargePoint Inc.,

- Magna International Inc

Latest Developments in Global High Voltage Battery Market

- In August 2023 NIO Promoting high-voltage battery swaps for EVs as a subscription service, impacting high-voltage pack design and replacement logistics.

- In April 2024, Toyota involved in Solid-state high-voltage battery development for safer, energy-dense applications started gaining traction with investments and prototypes announced.

- In April 2025, Tesla, Rivian, Daimler these companies expanded production of EV trucks and vans (e.g., Tesla Semi, Rivian EDV), requiring large-scale high-voltage battery packs.

- Since 2023: BYD, Hyundai with National policies in Europe, China, and North America are encouraging the shift toward electric mobility, increasing demand for HV batteries.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.