Global Hiv And Hepatitis Testing Market

Market Size in USD Billion

CAGR :

%

USD

5.61 Billion

USD

9.93 Billion

2024

2032

USD

5.61 Billion

USD

9.93 Billion

2024

2032

| 2025 –2032 | |

| USD 5.61 Billion | |

| USD 9.93 Billion | |

|

|

|

|

HIV and Hepatitis Testing Market Size

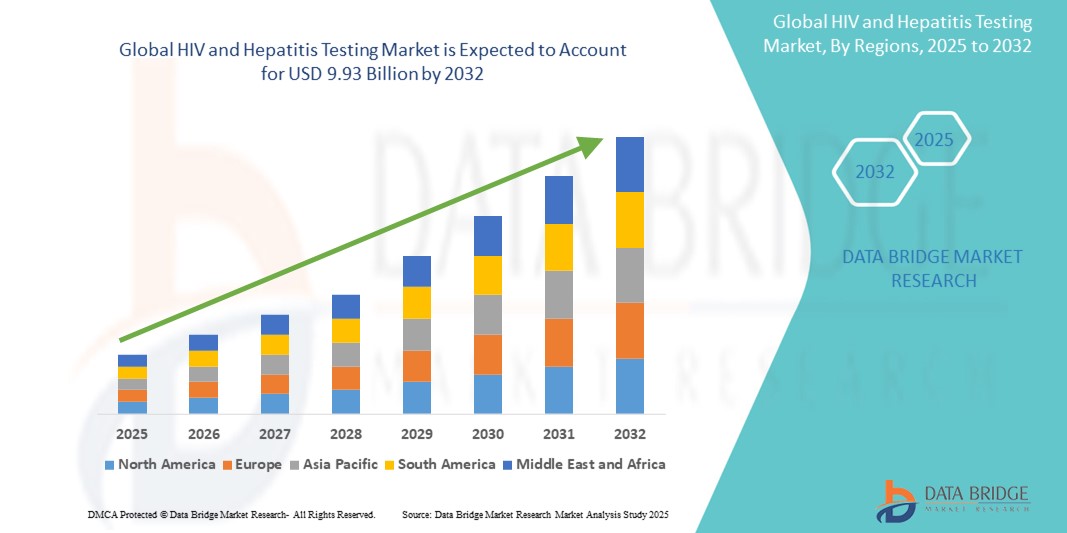

- The global HIV and hepatitis testing market was valued at USD 5.61 billion in 2024 and is expected to reach USD 9.93 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 7.40%, primarily driven by the rising disease prevalence, increased awareness, and advancements in diagnostic technologies

- This growth is driven by factors such as the increasing global burden of HIV and hepatitis infections, expanding government screening programs, and the adoption of advanced, rapid diagnostic test

HIV and Hepatitis Testing Market Analysis

- HIV and hepatitis testing includes a range of diagnostic tools used to detect the presence of HIV and various hepatitis viruses (A, B, C, D, E), playing a crucial role in early detection, treatment planning, and disease surveillance

- The market is significantly driven by the growing global burden of these infections, increasing awareness and screening initiatives, and the need for timely diagnosis to prevent disease progression and transmission. The demand is particularly high in low- and middle-income countries with high prevalence rates and limited access to healthcare

- North America dominates the market, owing to its well-established healthcare infrastructure, high testing penetration, and early adoption of advanced diagnostic technologies

- For instance, the U.S. Centers for Disease Control and Prevention (CDC) supports extensive HIV and hepatitis testing programs, while private and public health sectors consistently invest in innovative testing solutions

- Globally, HIV and hepatitis diagnostic tests are among the most widely adopted infectious disease tests, second only to tuberculosis diagnostics, underscoring their essential role in global health strategies and clinical decision-making

Report Scope and HIV and Hepatitis Testing Market Segmentation

|

Attributes |

HIV and Hepatitis Testing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

HIV and Hepatitis Testing Market Trends

“Shift Toward Rapid, Point-of-Care Testing and Automation”

- One prominent trend in the global HIV and hepatitis testing market is the increasing shift toward rapid, point-of-care (POC) testing and automation in diagnostics

- These innovations enable faster, more accessible, and cost-effective screening, particularly in resource-limited settings, by eliminating the need for centralized laboratories and reducing turnaround times for results

- For instance, rapid diagnostic tests (RDTs) for HIV and hepatitis C can deliver accurate results within minutes using minimal equipment, allowing for immediate clinical decisions and reducing patient drop-off

- Automation in laboratory-based testing has also gained traction, enhancing throughput, consistency, and reliability of results—especially valuable for high-volume screening in public health programs

- This trend is transforming disease management strategies by promoting early detection, improving linkage to care, and expanding testing reach, thereby fueling the demand for innovative and efficient diagnostic solutions across global markets

HIV and Hepatitis Testing Market Dynamics

Driver

“Rising Disease Prevalence and Government-Led Screening Initiatives”

- The increasing global prevalence of HIV and hepatitis infections remains a key driver for the growing demand for diagnostic testing across both developed and developing regions

- HIV and viral hepatitis (particularly hepatitis B and C) continue to be major global health concerns, with millions of people unaware of their infection status, necessitating widespread and routine testing for early detection and treatment initiation

- Governments and international health organizations are actively implementing large-scale screening programs, especially in high-burden regions, to curb the spread and impact of these diseases through early diagnosis and intervention

- The availability of funding from global health bodies such as the World Health Organization (WHO), UNAIDS, and the Global Fund further supports the scaling up of testing infrastructure and accessibility

- Advancements in testing technologies—such as rapid diagnostic tests (RDTs), nucleic acid tests (NATs), and multiplex assays—are also contributing to broader and more efficient disease surveillance and diagnosis

For instance,

- In 2023, according to the World Health Organization, approximately 39 million people globally were living with HIV, and an estimated 354 million people were living with chronic hepatitis B or C, underscoring the urgent need for accessible and routine testing services

- In November 2022, the U.S. Department of Health and Human Services emphasized the role of its "Ending the HIV Epidemic" initiative, which aims to reduce new HIV infections by 90% by 2030 through expanded access to HIV testing and treatment

- As HIV and hepatitis continue to pose substantial public health challenges, the increasing efforts toward disease awareness, early detection, and treatment accessibility are driving sustained growth in the global testing market

Opportunity

“Technological Advancements and Expansion of At-Home and Mobile Testing Solutions”

- The integration of advanced technologies such as artificial intelligence (AI), biosensors, and digital health platforms presents a significant opportunity to enhance the accuracy, speed, and accessibility of HIV and hepatitis testing

- AI and machine learning algorithms are increasingly being used to support clinical decision-making, automate result interpretation, and optimize testing workflows—particularly in high-volume and resource-constrained environments

- In addition, the growth of at-home and mobile testing solutions is revolutionizing the market by reaching underserved populations, reducing stigma, and promoting earlier diagnosis and treatment initiation

For instance,

- In February 2024, the U.S. FDA approved an AI-integrated mobile app designed to work with rapid HIV self-tests, enabling users to receive immediate result interpretation and access counseling and linkage-to-care resources—all from their smartphones

- In May 2023, the World Health Organization highlighted the success of pilot programs using self-testing kits and digital platforms in sub-Saharan Africa, which significantly improved testing uptake and early detection rates among key populations

- These advancements not only improve diagnostic reach and efficiency but also empower individuals through greater privacy and convenience. The continuous innovation in digital health and decentralized testing is expected to unlock new growth opportunities in both developed and developing markets

Restraint/Challenge

“Limited Access and Affordability in Low-Resource Settings”

- Despite the growing demand for HIV and hepatitis testing, limited access and affordability remain key challenges in many low- and middle-income countries, where healthcare infrastructure and funding are often insufficient

- The costs associated with high-end molecular diagnostic platforms, laboratory maintenance, trained personnel, and continuous supply of testing kits can hinder large-scale implementation of effective screening programs

For instance,

- In October 2024, a report by Médecins Sans Frontières (MSF) noted that the cost of molecular tests for hepatitis C in some low-income countries can exceed USD 100 per test, making widespread diagnosis and treatment programs financially unfeasible without substantial international aid

- In June 2023, according to the Global Health Supply Chain Program, several sub-Saharan African nations experienced delayed testing services due to procurement issues and the high cost of maintaining diagnostic equipment, leading to missed opportunities for early detection

- Consequently, such challenges contribute to delayed diagnoses, untreated infections, and continued disease transmission. Without increased investment in affordable, decentralized testing solutions and international support, the market’s full potential in high-burden regions may remain unmet, restricting overall global market growth

HIV and Hepatitis Testing Market Scope

The market is segmented on the basis of disease type, test type, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Disease Type |

|

|

By Test Type |

|

|

By End User |

|

HIV and Hepatitis Testing Market Regional Analysis

“North America is the Dominant Region in the HIV and Hepatitis Testing Market”

- North America dominates the global HIV and hepatitis testing market due to its advanced healthcare infrastructure, strong government support for disease surveillance, and widespread adoption of modern diagnostic technologies

- U.S. holds a major share, driven by initiatives such as the “Ending the HIV Epidemic” strategy, increased funding for public health programs, and high awareness levels that support routine and preventive testing

- The presence of leading diagnostic companies, comprehensive insurance coverage for testing services, and integration of digital health tools also strengthen the region’s leadership in the market

- In addition, the strong collaboration between federal agencies, research institutions, and private organizations ensures continuous innovation and early adoption of novel testing technologies

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific is expected to witness the highest growth rate in the HIV and hepatitis testing market, fueled by a high burden of infectious diseases, growing healthcare investments, and expanding screening initiatives

- Countries such as India, China, and Indonesia are key markets due to large at-risk populations, increasing government-led awareness campaigns, and partnerships with global health organizations to scale up testing coverage

- Japan and South Korea are also contributing to growth, with their emphasis on early detection, integration of advanced testing platforms, and strong public health infrastructure

- The rise in decentralized and community-based testing programs, along with increasing adoption of rapid diagnostic tests, is accelerating access to testing services, especially in rural and underserved areas

HIV and Hepatitis Testing Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Abbott (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Cepheid (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Siemens Healthineers AG (Germany)

- Bio-Rad Laboratories, Inc (U.S.)

- QuidelOrtho Corporation (U.S.)

- Danaher Corporation (U.S.)

- Hologic, Inc. (U.S.)

- Grifols, S.A. (Spain)

- PerkinElmer (U.S.)

- BD (U.S.)

- Novartis AG (Switzerland)

- Gilead Sciences, Inc. (U.S.)

- OraSure Technologies Inc. (U.S.)

- Sysmex Asia Pacific Pte Ltd (Singapore)

Latest Developments in Global HIV and Hepatitis Testing Market

- In March 2025, Abbott Laboratories launched its new HIV-1 and HIV-2 rapid diagnostic test, designed to provide accurate results in under 15 minutes. This test combines a simple, portable platform with enhanced sensitivity and specificity, catering to both healthcare settings and community-based screenings, especially in resource-limited areas

- In February 2025, Roche Diagnostics introduced its Cobas 6800/8800 system upgrade, offering improved high-throughput capabilities for hepatitis C testing. The new system significantly reduces the time required for results and enhances automation, providing faster diagnosis in clinical laboratories while supporting large-scale testing efforts

- In January 2025, the World Health Organization (WHO) announced the expansion of its HIV self-testing program across sub-Saharan Africa, aimed at increasing early diagnosis rates. This initiative encourages individuals to take control of their health by providing at-home testing kits that offer confidential results and linkage to care services

- In November 2024, Cepheid launched a new molecular diagnostic platform, the GeneXpert Ultra, which can detect both HIV and hepatitis B and C viruses with high accuracy in just a single test. The platform’s portability and ease of use make it particularly beneficial for point-of-care testing in remote areas, further driving the market for decentralized testing solutions

- In April 2024, the NHS in England launched an expanded testing initiative aimed at eliminating hepatitis C by 2025. This initiative includes the deployment of portable testing units, liver scanning technologies, and outreach programs in high-risk communities such as GP surgeries and drug and alcohol support services

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.