Global Holographic Blister Foil Market

Market Size in USD Billion

CAGR :

%

USD

1.78 Billion

USD

2.65 Billion

2024

2032

USD

1.78 Billion

USD

2.65 Billion

2024

2032

| 2025 –2032 | |

| USD 1.78 Billion | |

| USD 2.65 Billion | |

|

|

|

|

Holographic Blister Foil Market Size

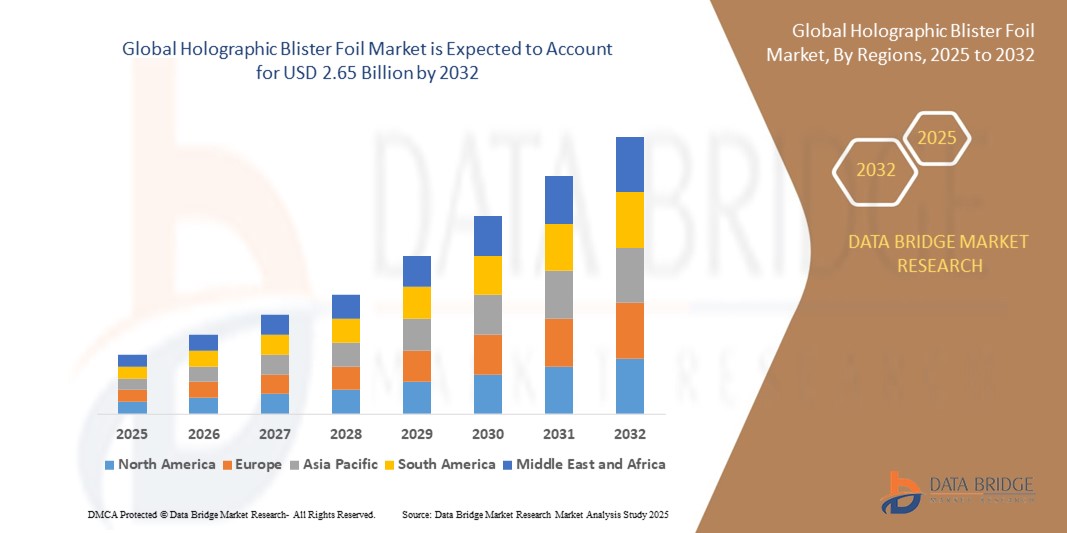

- The global holographic blister foil market size was valued at USD 1.78 billion in 2024 and is expected to reach USD 2.65 billion by 2032, at a CAGR of 5.10% during the forecast period

- The market growth is largely fuelled by the increasing demand for advanced packaging solutions that offer both product security and visual appeal, particularly in the pharmaceutical and consumer goods sectors.

- Rising concerns over counterfeiting in the healthcare and FMCG industries are driving the adoption of holographic blister foils as they provide an effective anti-counterfeit measure along with brand differentiation

Holographic Blister Foil Market Analysis

- The holographic blister foil market is experiencing steady growth, driven by rising demand for secure and visually enhanced packaging across pharmaceutical, food, and personal care industries. Increasing counterfeit incidents in the pharmaceutical sector have pushed manufacturers toward adopting holographic foils that ensure product authenticity and tamper evidence

- Technological advancements in printing and embossing processes, along with the availability of cost-effective raw materials, are enabling large-scale adoption of holographic blister foils. Moreover, consumer preference for attractive, safe, and sustainable packaging solutions is further supporting market expansion globally

- Europe dominated the global holographic blister foil market with the largest revenue share of 39.5% in 2024, driven by stringent regulations on pharmaceutical packaging, rising demand for anti-counterfeit solutions, and the growing focus on sustainable packaging practices

- Asia-Pacific region is expected to witness the highest growth rate in the global holographic blister foil market, driven by increasing pharmaceutical and nutraceutical production, rising disposable incomes, government support for advanced packaging solutions, and growing adoption of holographic and specialty films for secure and attractive packaging

- The thermoforming segment held the largest market revenue share in 2024 due to its widespread use in pharmaceutical and cosmetic packaging, driven by cost efficiency and high production speed. Thermoformed holographic foils also provide enhanced product visibility and improved aesthetics, making them highly preferred for consumer-facing packaging applications

Report Scope and Holographic Blister Foil Market Segmentation

|

Attributes |

Holographic Blister Foil Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Holographic Blister Foil Market Trends

Rising Adoption of Anti-Counterfeit Packaging Solutions

- The growing demand for secure and tamper-evident packaging across pharmaceuticals and FMCG sectors is driving the adoption of holographic blister foils. Their ability to offer both visual appeal and security features helps manufacturers safeguard products from counterfeiting while enhancing brand value

- Increasing cases of counterfeit medicines in emerging economies are pushing healthcare authorities and companies to integrate advanced holographic foils into blister packs, ensuring product authenticity and consumer safety

- The rising e-commerce penetration worldwide is further fueling the need for secure packaging, as products are transported across multiple touchpoints, creating opportunities for advanced anti-counterfeit solutions such as holographic blister foils

- For instance, in 2023, several pharmaceutical companies in Asia-Pacific adopted holographic blister foils with QR-coded security layers, enabling real-time verification and traceability for end consumers, boosting both safety and trust

- While adoption rates are climbing, manufacturers need to focus on cost efficiency, scalability, and compliance with global packaging regulations to maximize market potential in both developed and emerging markets

Holographic Blister Foil Market Dynamics

Driver

Increasing Demand for Secure and Visually Appealing Packaging in Pharmaceuticals and FMCG

- The rise in counterfeit drug incidents globally has created a strong push toward secure pharmaceutical packaging solutions. Holographic blister foils provide multi-layered protection, ensuring tamper detection and preventing product duplication. These solutions not only safeguard patient safety but also help pharmaceutical brands maintain compliance with stringent global regulations, protecting brand reputation and consumer trust

- FMCG and healthcare brands are leveraging holographic foils to enhance shelf appeal while simultaneously meeting security and regulatory requirements, boosting overall market demand. The combination of vibrant holographic designs and security features makes products stand out visually, influencing consumer purchase decisions and strengthening product differentiation in competitive markets

- Governments and regulatory bodies are also introducing stricter packaging norms for pharmaceuticals, particularly in high-risk regions, accelerating the integration of anti-counterfeit technologies in drug packaging. Such regulations are encouraging both domestic and multinational pharmaceutical companies to adopt advanced packaging solutions, driving steady market growth across developed and emerging economies alike

- For instance, in 2023, the Indian government mandated advanced security features such as holographic foils on select high-value pharmaceutical products to curb the growing counterfeit medicine problem. Similar initiatives are being explored in Southeast Asia and Latin America, where counterfeit drug circulation remains a significant concern, further reinforcing the need for secure packaging technologies

- As awareness regarding product safety grows, global adoption of holographic blister foils is expected to expand rapidly, creating opportunities for both packaging manufacturers and security solution providers. Continuous technological innovations, such as integrating holograms with QR codes and blockchain-based verification systems, are likely to revolutionize product authentication in the near future

Restraint/Challenge

High Production Costs and Limited Awareness in Emerging Markets

- The advanced manufacturing technologies required for producing holographic blister foils increase production costs, making them less accessible to small and mid-sized pharmaceutical companies in emerging economies. Higher initial investment in specialized equipment and skilled labor requirements limits scalability, especially for firms operating in price-sensitive markets with tight profit margins

- Lack of awareness among rural distributors and small-scale manufacturers regarding the benefits of holographic foils restricts adoption, particularly in cost-sensitive markets. Many local producers prioritize basic packaging methods due to limited knowledge of the security and brand protection advantages offered by advanced holographic technologies

- In many developing regions, packaging priorities are often driven by affordability rather than security, leading to slow integration of advanced anti-counterfeit technologies in mainstream production lines. This is especially evident in rural pharmaceutical supply chains, where low-cost packaging dominates despite rising concerns over counterfeit drug distribution

- For instance, in 2023, several small pharmaceutical firms in Africa cited cost barriers and lack of technical expertise as key reasons for delayed adoption of holographic blister foils in their packaging processes. Limited access to financing options and the absence of local technology providers further discourage smaller manufacturers from upgrading to secure packaging solutions

- To address these challenges, market stakeholders must focus on cost-effective holographic solutions, localized awareness campaigns, and technology partnerships to drive broader market penetration. Collaborative efforts between governments, packaging companies, and pharmaceutical associations can significantly reduce barriers, enabling wider adoption across underserved regions

Holographic Blister Foil Market Scope

The market is segmented on the basis of technology, application, material, end use, and printing technology.

- By Technology

On the basis of technology, the holographic blister foil market is segmented into thermoforming and cold forming. The thermoforming segment held the largest market revenue share in 2024 due to its widespread use in pharmaceutical and cosmetic packaging, driven by cost efficiency and high production speed. Thermoformed holographic foils also provide enhanced product visibility and improved aesthetics, making them highly preferred for consumer-facing packaging applications.

The cold forming segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by its superior barrier properties against moisture, light, and oxygen, ensuring extended product shelf life. Cold-formed holographic foils are increasingly adopted for sensitive pharmaceutical products where maximum protection is required.

- By Application

On the basis of application, the market is segmented into pharmaceutical packaging, cosmetic packaging, food packaging, and electronics packaging. The pharmaceutical packaging segment dominated the market in 2024, driven by rising demand for secure, tamper-evident packaging solutions to prevent counterfeiting and ensure patient safety.

The cosmetic packaging segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the growing trend of premium and visually appealing packaging to attract consumers in the personal care industry.

- By Material

On the basis of material, the market is segmented into aluminum-based foils, polyethylene, polyvinyl chloride, and plastic-based foils. The aluminum-based foils segment accounted for the largest revenue share in 2024 due to their superior barrier properties and durability, making them the preferred choice for pharmaceutical blister packs.

Polyethylene-based foils is expected to witness the fastest growth rate from 2025 to 2032 owing to their flexibility, lightweight nature, and increasing adoption in food and cosmetic packaging applications.

- By Printing Technology

On the basis of printing technology, the market is segmented into flexography, offset printing, and digital printing. Flexography held the largest market share in 2024 owing to its cost-effectiveness, high-speed production capabilities, and suitability for large-volume printing.

Digital printing is expected to witness the fastest growth rate from 2025 to 2032 as it enables customization, shorter print runs, and faster turnaround times, meeting the rising demand for personalized and on-demand packaging solutions.

Holographic Blister Foil Market Regional Analysis

• Europe dominated the global holographic blister foil market with the largest revenue share of 39.5% in 2024, driven by stringent regulations on pharmaceutical packaging, rising demand for anti-counterfeit solutions, and the growing focus on sustainable packaging practices.

• Manufacturers in the region prioritize packaging security, product authentication, and compliance with EU standards, fueling the adoption of holographic blister foils in pharmaceuticals, nutraceuticals, and cosmetics.

• The rapid expansion of healthcare infrastructure, coupled with technological advancements in printing and packaging processes, is reinforcing Europe’s leading position in the global market.

U.K. Holographic Blister Foil Market Insight

The U.K. holographic blister foil market accounted for the largest revenue share in Europe in 2024, supported by the presence of major pharmaceutical and healthcare manufacturers, rising emphasis on tamper-resistant packaging, and increasing demand for premium cosmetic packaging. The country’s robust regulatory framework and rapid adoption of digital printing technologies further accelerate market growth.

Germany Holographic Blister Foil Market Insight

The Germany holographic blister foil market is expected to witness the fastest growth rate from 2025 to 2032, driven by the country’s advanced manufacturing sector, focus on innovation, and commitment to eco-friendly packaging solutions. Increasing investment in pharmaceutical R&D and growing demand for secure, high-quality packaging materials are fostering market development in Germany.

North America Holographic Blister Foil Market Insight

The North America holographic blister foil market is expected to witness the fastest growth rate from 2025 to 2032, with rising adoption of tamper-evident and visually appealing packaging solutions in the pharmaceutical and cosmetic industries. The region’s focus on packaging safety, branding, and compliance with FDA regulations supports steady market growth across pharmaceuticals, nutraceuticals, and food packaging applications.

U.S. Holographic Blister Foil Market Insight

The U.S. market is expected to witness the fastest growth rate from 2025 to 2032, driven by technological advancements in packaging, increasing consumer awareness of product authenticity, and the rapid expansion of the nutraceutical and healthcare sectors. Growing adoption of digital and flexographic printing technologies for customized and secure packaging further boosts demand in the country.

Asia-Pacific Holographic Blister Foil Market Insight

The Asia-Pacific holographic blister foil market is expected to witness the fastest growth rate from 2025 to 2032, fueled by expanding pharmaceutical production, rising healthcare investments, and increasing consumer awareness regarding drug safety in countries such as China, India, and Japan. Affordable manufacturing capabilities and government initiatives supporting advanced packaging solutions strengthen the region’s growth prospects.

China Holographic Blister Foil Market Insight

The China holographic blister foil market accounted for the largest revenue share in Asia-Pacific in 2024, supported by its booming pharmaceutical manufacturing industry, growing middle-class population, and rising adoption of secure, cost-effective packaging materials across pharmaceuticals, nutraceuticals, and food packaging.

Japan Holographic Blister Foil Market Insight

The Japan holographic blister foil market is expected to witness the fastest growth rate from 2025 to 2032, driven by advanced healthcare infrastructure, strong focus on quality and safety, and growing demand for anti-counterfeit packaging in pharmaceuticals and cosmetics. Japan’s technological expertise and emphasis on sustainable packaging solutions are further accelerating market expansion.

Holographic Blister Foil Market Share

The Holographic Blister Foil industry is primarily led by well-established companies, including:

- Amcor (Australia)

- Bemis (U.S.)

- Essentra (U.K.)

- Dow (U.S.)

- Tekni-Plex, Inc. (U.S.)

- Honeywell International Inc (U.S.)

- DuPont (U.S.)

- Constantia Flexibles Group GmbH (Austria)

- ACG (India)

- Huhtamaki (Finland)

Latest Developments in Global Holographic Blister Foil Market

- In December 2023, Amcor Ltd launched its next-generation Amcor Renu PCR blister packaging solution, integrating post-consumer recycled (PCR) content with enhanced visual features such as high-quality metallization and holography effects. This innovation addresses the rising demand for sustainable packaging while maintaining the aesthetic appeal and functionality of holographic blister foils. The solution is expected to strengthen Amcor’s market position in eco-friendly and premium packaging segments, catering to both pharmaceutical and consumer goods industries

- In September 2023, Constantia Flexibles invested in expanding its holographic and specialty film capabilities at its Pune, India facility. This development aims to enhance production capacity and deliver secure, visually attractive packaging solutions, including holographic blister foils, supporting the growing South Asian market. The expansion is poised to reinforce Constantia Flexibles’ competitiveness and meet the increasing regional demand for high-quality, anti-counterfeit packaging

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Holographic Blister Foil Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Holographic Blister Foil Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Holographic Blister Foil Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.