Global Home Automation System Market

Market Size in USD Billion

CAGR :

%

USD

67.81 Billion

USD

152.93 Billion

2025

2033

USD

67.81 Billion

USD

152.93 Billion

2025

2033

| 2026 –2033 | |

| USD 67.81 Billion | |

| USD 152.93 Billion | |

|

|

|

|

Home Automation System Market Size

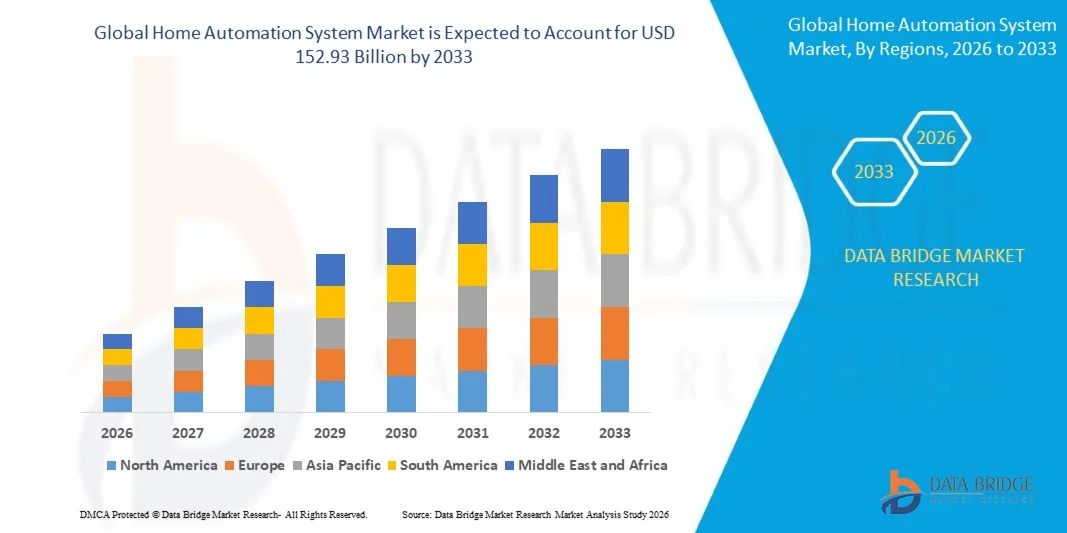

- The global home automation system market size was valued at USD 67.81 billion in 2025 and is expected to reach USD 152.93 billion by 2033, at a CAGR of 10.70% during the forecast period

- The market growth is largely fueled by the growing adoption and technological advancements in connected home devices and smart home systems, leading to increased digitalization across residential, commercial, and industrial settings

- Furthermore, rising consumer demand for integrated, secure, and user-friendly home automation solutions is establishing smart home systems as essential components of modern living and workspace management. These converging factors are accelerating the adoption of home automation systems, thereby significantly boosting the industry’s growth

Home Automation System Market Analysis

- Home automation systems, offering integrated control of lighting, HVAC, security, entertainment, and energy management, are increasingly vital in both residential and commercial environments due to their convenience, efficiency, and ability to enhance lifestyle and operational management

- The escalating demand for home automation solutions is primarily driven by the widespread adoption of smart technologies, rising focus on energy efficiency and security, and growing preference for remote monitoring and intelligent system management

- North America dominated the home automation system market with a share of 39.5% in 2025, due to rising adoption of connected devices, increasing focus on energy efficiency, and heightened awareness of smart home technology

- Asia-Pacific is expected to be the fastest growing region in the home automation system market during the forecast period due to rapid urbanization, rising disposable incomes, and growing interest in smart homes across countries such as China, Japan, and India

- Cloud-Based segment dominated the market with a market share of 62.5% in 2025, due to the scalability, remote accessibility, and real-time monitoring it provides. Cloud-based systems allow seamless integration with smartphones, voice assistants, and IoT platforms, making them popular for residential and commercial users. For instance, Amazon Alexa and Samsung SmartThings leverage cloud deployment to provide centralized control and analytics. The flexibility of software updates and remote troubleshooting further enhances user convenience and system efficiency. Cloud-based deployment is preferred in multi-property or commercial setups where centralized management is critical

Report Scope and Home Automation System Market Segmentation

|

Attributes |

Home Automation System Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Home Automation System Market Trends

“Rising Adoption of AI-Enabled and Predictive Home Automation Systems”

- A significant trend in the home automation system market is the increasing adoption of AI-enabled and predictive automation solutions, driven by growing consumer interest in intelligent, responsive, and integrated home and commercial environments. These systems analyze user behavior, optimize energy usage, and provide seamless control over lighting, HVAC, security, and entertainment systems, elevating convenience and efficiency across residential and commercial applications

- For instance, companies such as Google Nest and Samsung SmartThings are offering AI-powered solutions that learn user patterns, provide predictive recommendations, and automate routines across connected devices. These innovations are enhancing user experience, driving engagement, and reinforcing the value of smart ecosystems in daily life

- The integration of predictive analytics in home automation is expanding rapidly as devices can now anticipate user needs and adjust settings proactively. This is positioning AI-enabled systems as essential components for energy-efficient, intelligent homes and offices that require minimal manual intervention

- The healthcare and assisted living sectors are increasingly leveraging home automation systems to monitor environmental conditions, control medical devices, and ensure resident safety. AI-enabled solutions facilitate personalized automation, improve response times, and support independent living for the elderly or individuals with mobility challenges

- Commercial and enterprise environments are incorporating intelligent home automation systems for energy management, security, and operational efficiency. Predictive and AI-driven features allow organizations to reduce energy costs, optimize space usage, and streamline building operations, driving stronger adoption of advanced automation technologies

- The market is witnessing sustained growth in multi-application automation platforms where AI-enabled systems provide centralized control of lighting, security, HVAC, and entertainment. This trend reinforces the transition toward smarter, more responsive, and interconnected home and building environments globally

Home Automation System Market Dynamics

Driver

“Growing Demand for Integrated, Secure, and User-Friendly Smart Home Solutions”

- The increasing need for secure, user-friendly, and integrated home automation systems is a key driver for market growth. Consumers are seeking solutions that provide centralized control over multiple devices, enhance convenience, and ensure robust security across residential and commercial properties

- For instance, Apple HomeKit and Amazon Alexa offer platforms that integrate multiple smart devices while emphasizing secure and intuitive user experiences. These systems enable seamless control via mobile apps, voice commands, and remote monitoring, strengthening user engagement and encouraging widespread adoption

- The rising adoption of IoT-enabled devices, coupled with increasing awareness of energy efficiency and safety, is boosting demand for comprehensive home automation solutions. Integrated systems allow homeowners and businesses to manage lighting, HVAC, security, and entertainment through unified interfaces, creating a more connected and convenient environment

- The focus on smart energy management and predictive automation is driving consumers toward systems that optimize consumption and reduce operational costs. Businesses and residential users alike are increasingly implementing such solutions to achieve sustainability goals and operational efficiency

- The preference for intuitive interfaces, seamless interoperability, and real-time monitoring continues to propel adoption, positioning integrated, secure, and user-friendly solutions as central to market growth

Restraint/Challenge

“High Initial Costs and Complex System Integration”

- The home automation system market faces challenges due to high upfront investment requirements and the complexity involved in integrating multiple devices and platforms. These factors can limit adoption, particularly among price-sensitive consumers and small enterprises

- For instance, installation of comprehensive automation systems from providers such as Crestron or Control4 often requires professional setup, specialized equipment, and network configuration, which increase costs and deployment timelines

- The diversity of devices, communication protocols, and software platforms adds complexity to system integration and maintenance. Ensuring seamless interoperability between legacy and modern devices while maintaining security standards remains a significant barrier

- Scaling advanced automation solutions across large residential complexes or commercial buildings involves extensive planning, skilled labor, and technical expertise. These requirements contribute to longer implementation periods and higher operational expenditures

- The market continues to encounter constraints in balancing advanced functionality with affordability, as manufacturers and service providers work to deliver comprehensive, reliable, and user-friendly solutions without significantly increasing total costs

Home Automation System Market Scope

The market is segmented on the basis of algorithm, deployment, technology, type, application, and protocols.

• By Algorithm

On the basis of algorithm, the Home Automation System market is segmented into behavioural and proactive. The behavioural segment dominated the market with the largest revenue share in 2025, driven by its ability to learn user patterns and automate routines efficiently. Homeowners and businesses prefer behavioural algorithms for energy management and convenience, as these systems adapt to daily usage patterns without constant manual intervention. The segment benefits from integration with smart sensors and AI-driven analytics, providing predictive insights for lighting, HVAC, and security. For instance, companies such as Google Nest use behavioural algorithms to optimize energy usage in smart homes. Strong consumer trust in automated learning systems further reinforces the dominance of behavioural algorithms, particularly in residential and commercial applications.

The proactive segment is expected to witness the fastest growth from 2026 to 2033, fueled by increasing adoption in advanced smart home setups and enterprise environments. Proactive algorithms can anticipate user needs, offering pre-emptive control over systems such as HVAC, lighting, and security. These algorithms enhance user experience through scenario-based automation and personalized recommendations, making them highly attractive in luxury and managed home automation solutions.

• By Deployment

On the basis of deployment, the market is segmented into cloud-based and on-premises. The cloud-based segment dominated the market with the largest revenue share of 62.5% in 2025, driven by the scalability, remote accessibility, and real-time monitoring it provides. Cloud-based systems allow seamless integration with smartphones, voice assistants, and IoT platforms, making them popular for residential and commercial users. For instance, Amazon Alexa and Samsung SmartThings leverage cloud deployment to provide centralized control and analytics. The flexibility of software updates and remote troubleshooting further enhances user convenience and system efficiency. Cloud-based deployment is preferred in multi-property or commercial setups where centralized management is critical.

On-premises deployment is expected to witness the fastest growth from 2026 to 2033, due to rising concerns over data privacy and security. On-premises systems store data locally, reducing dependence on external servers and offering enhanced control over sensitive information. Enterprises and high-end residential users are increasingly adopting on-premises solutions for mission-critical applications, such as security and access control.

• By Technology

On the basis of technology, the Home Automation System market is segmented into network technology and wireless technology. The network technology segment dominated the market with the largest revenue share in 2025, owing to its robust connectivity, reliability, and compatibility with existing wired infrastructure. Network-based systems are widely adopted in commercial buildings and large residential complexes where uninterrupted and high-speed communication between devices is essential. For instance, Crestron offers advanced network-based automation systems for luxury homes and corporate environments. These systems ensure consistent performance across multiple devices and provide centralized monitoring and control.

Wireless technology is expected to witness the fastest growth from 2026 to 2033, driven by increasing preference for flexible installation, reduced wiring costs, and smart device proliferation. Wireless systems support IoT-enabled devices, voice assistants, and mobile apps, making them ideal for retrofit projects and modern homes. The convenience of plug-and-play connectivity and ease of expansion contribute to strong adoption across residential and small commercial setups.

• By Type

On the basis of type, the Home Automation System market is segmented into luxury, DIY, managed, and mainstream. The luxury segment dominated the market with the largest revenue share in 2025, driven by high-end features, personalized automation, and premium integration with home entertainment, HVAC, and security systems. Consumers investing in luxury automation prefer sophisticated design, enhanced user experience, and seamless interoperability with smart devices. For instance, Control4 offers luxury automation solutions with advanced personalization and professional installation services. The demand is further reinforced by affluent homeowners seeking advanced security, energy management, and entertainment control within a unified platform.

The DIY segment is expected to witness the fastest growth from 2026 to 2033, fueled by increasing adoption of cost-effective and easy-to-install home automation solutions. DIY systems appeal to tech-savvy users looking for customizable solutions without requiring professional installation. Growth is supported by user-friendly interfaces, modular devices, and compatibility with smartphones and voice assistants, enabling wider adoption in mainstream households.

• By Application

On the basis of application, the market is segmented into lighting control, security and access control, HVAC control, entertainment control, and others. The security and access control segment dominated the market with the largest revenue share in 2025, driven by rising concerns over residential and commercial safety. Users prefer automated access control, surveillance integration, and real-time alerts to ensure enhanced protection. For instance, companies such as Honeywell provide comprehensive security-focused home automation systems integrating cameras, sensors, and alarm systems. Security applications benefit from the integration of AI and cloud connectivity for real-time monitoring and predictive threat detection.

The lighting control segment is expected to witness the fastest growth from 2026 to 2033, due to increasing demand for energy-efficient solutions and customizable smart lighting. Smart lighting systems allow users to control brightness, color, and schedules remotely, improving convenience and energy savings. Advanced features such as occupancy-based automation, scene control, and integration with other smart devices drive adoption in residential, hospitality, and commercial settings.

• By Protocols

On the basis of protocols, the Home Automation System market is segmented into network technologies, protocols and standards, and wireless communication technologies. The network technologies segment dominated the market with the largest revenue share in 2025, owing to its reliable wired infrastructure, high-speed communication, and stable performance for multiple connected devices. Enterprise and large residential setups prefer network protocols for centralized management, uninterrupted connectivity, and compatibility with legacy systems. For instance, KNX protocol-based systems are widely adopted in smart buildings for seamless control and monitoring of lighting, HVAC, and security.

Wireless communication technologies are expected to witness the fastest growth from 2026 to 2033, fueled by adoption of Wi-Fi, Zigbee, and Bluetooth-based standards. Wireless protocols offer flexibility, ease of installation, and seamless device integration, particularly suitable for retrofit and DIY solutions. Increasing smart device penetration, voice assistant compatibility, and remote monitoring requirements further drive adoption of wireless communication technologies across residential and commercial sectors.

Home Automation System Market Regional Analysis

- North America dominated the home automation system market with the largest revenue share of 39.5% in 2025, driven by rising adoption of connected devices, increasing focus on energy efficiency, and heightened awareness of smart home technology

- Consumers in the region highly value convenience, personalized automation, and integration of home systems such as lighting, HVAC, security, and entertainment

- The widespread adoption is further supported by high disposable incomes, a tech-savvy population, and preference for remote monitoring and control, establishing home automation systems as a favored solution for residential and commercial applications

U.S. Home Automation System Market Insight

The U.S. captured the largest revenue share in North America in 2025, fueled by rapid adoption of cloud-based and wireless automation systems. Consumers are increasingly prioritizing intelligent control over lighting, HVAC, and security systems for convenience and energy savings. The rising popularity of DIY smart home setups, coupled with integration of voice-controlled systems and mobile applications, further supports market expansion. Moreover, strong partnerships with major smart home platforms such as Amazon Alexa, Google Assistant, and Apple HomeKit are accelerating adoption across urban and suburban households.

Europe Home Automation System Market Insight

The Europe market is projected to grow at a substantial CAGR throughout the forecast period, driven by stringent energy efficiency and security regulations, along with increasing smart home adoption. Urbanization and increasing demand for connected devices are fostering the integration of home automation systems across new constructions and renovation projects. European consumers are drawn to convenience, energy management, and advanced control features, creating strong opportunities in residential, commercial, and multi-family housing applications.

U.K. Home Automation System Market Insight

The U.K. market is expected to expand at a notable CAGR during the forecast period, fueled by the rising trend of connected homes and demand for enhanced security, convenience, and energy efficiency. Concerns regarding safety and home monitoring are prompting homeowners and businesses to adopt intelligent access and energy management solutions. The U.K.’s mature e-commerce ecosystem and strong awareness of smart devices further support market growth.

Germany Home Automation System Market Insight

The Germany market is expected to grow at a significant CAGR, driven by increasing focus on digital security, energy-efficient solutions, and technological innovation. Germany’s well-developed infrastructure, high disposable incomes, and sustainability initiatives encourage adoption of networked and wireless automation systems. Integration with comprehensive home and building management systems is gaining traction, supported by consumer preference for privacy-focused, eco-conscious solutions.

Asia-Pacific Home Automation System Market Insight

The Asia-Pacific market is poised to register the fastest CAGR during the forecast period, driven by rapid urbanization, rising disposable incomes, and growing interest in smart homes across countries such as China, Japan, and India. Government initiatives promoting digitalization, coupled with increased availability of affordable home automation solutions, are fueling adoption. In addition, APAC’s emergence as a manufacturing hub for smart devices is improving accessibility and driving market penetration among middle-class households.

Japan Home Automation System Market Insight

Japan’s market growth is driven by high-tech culture, urbanization, and demand for convenient, intelligent home systems. The adoption of home automation is supported by integration with IoT devices such as smart lighting, security, and HVAC controls. Moreover, Japan’s aging population is likely to increase demand for user-friendly automation solutions in both residential and commercial sectors.

China Home Automation System Market Insight

China accounted for the largest market revenue share in Asia-Pacific in 2025, supported by a growing middle class, rapid urbanization, and high adoption of smart technologies. The country is a major market for smart home devices, and home automation systems are increasingly adopted across residential, commercial, and rental properties. The push for smart cities, availability of cost-effective solutions, and strong domestic manufacturers are key factors driving market expansion in China.

Home Automation System Market Share

The home automation system industry is primarily led by well-established companies, including:

- Resideo Technologies Inc. (U.S.)

- Legrand (France)

- Schneider Electric (France)

- Johnson Controls (U.S.)

- Siemens (Germany)

- Ingersoll-Rand plc (Ireland/U.S.)

- ABB (Switzerland)

- Leviton Manufacturing Co., Inc. (U.S.)

- Wirepath Home Systems, LLC, dba Control4 (U.S.)

- Crestron Electronics, Inc. (U.S.)

- ACUITY BRANDS LIGHTING, INC. (U.S.)

- Lutron Electronics Co., Inc. (U.S.)

- Remote Technologies Inc. (U.S.)

- Elan Nortek Security & Control LLC (U.S.)

- ADT (U.S.)

- HARMAN (U.S.)

- Develco Products (Denmark)

- Savant Systems, Inc. (U.S.)

- SmartThings, Inc. (U.S.)

- Nest Labs (U.S.)

Latest Developments in Global Home Automation System Market

- In November 2025, Amazon announced the launch of a new line of smart home devices that integrate seamlessly with its existing Alexa ecosystem. This development is significant for the home automation market as it strengthens Amazon’s position as a market leader and expands its share in the connected devices segment. By offering enhanced compatibility across multiple smart home products, Amazon is likely to attract a wider consumer base and drive adoption of its ecosystem, reinforcing consumer preference for integrated and cohesive smart home solutions. This move also encourages competitors to enhance interoperability and innovation within their own ecosystems

- In September 2025, Apple introduced new privacy features in its HomeKit platform, emphasizing enhanced user security. This strategic initiative impacts the premium segment of the home automation market by differentiating Apple as a trusted provider of secure smart home solutions. Heightened data privacy measures are expected to increase consumer confidence, particularly among privacy-conscious users, thereby strengthening brand loyalty and encouraging adoption of HomeKit-compatible devices. Apple’s focus on secure automation is likely to influence competitors to prioritize similar data protection and privacy standards

- In June 2023, Samsung Electronics Co., Ltd. launched an updated family hub called "SmartThings Home Life," expanding connected living services through the SmartThings app. This update impacts the market by introducing six integrated services—SmartThings Cooking, Air Care, Clothing Care, Pet Care, Energy, and Home Care—enhancing convenience and lifestyle management for consumers. By broadening its service ecosystem, Samsung is driving user engagement and positioning itself as a comprehensive solutions provider, encouraging adoption of smart home devices across multiple applications and increasing customer retention

- In December 2023, Schneider Electric SE and Smartworld Developers Pvt. Ltd. collaborated to create 360-degree home automation solutions. This partnership influences the market by promoting fully integrated and holistic smart home offerings, addressing both residential and commercial needs. The combined expertise of Schneider Electric in energy management and Smartworld Developers in intelligent building solutions is likely to accelerate deployment of advanced automation systems, increase market competitiveness, and stimulate demand for comprehensive, end-to-end home automation solutions

- In May 2023, the Z-Wave Alliance announced the launch of its new Z-Wave 7.0 standard, offering enhanced security and performance for smart home devices. This advancement impacts the market by providing manufacturers with a robust, interoperable protocol for smart devices, boosting consumer confidence in security and reliability. The introduction of Z-Wave 7.0 is expected to drive faster adoption of connected home devices, encourage wider integration of compatible products, and reinforce Z-Wave’s position as a key standard in the wireless home automation ecosystem.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Home Automation System Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Home Automation System Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Home Automation System Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.