Global Home Blood Pressure Monitors Market

Market Size in USD Billion

CAGR :

%

USD

3.29 Billion

USD

5.60 Billion

2024

2032

USD

3.29 Billion

USD

5.60 Billion

2024

2032

| 2025 –2032 | |

| USD 3.29 Billion | |

| USD 5.60 Billion | |

|

|

|

|

Home Blood Pressure Monitors Market Size

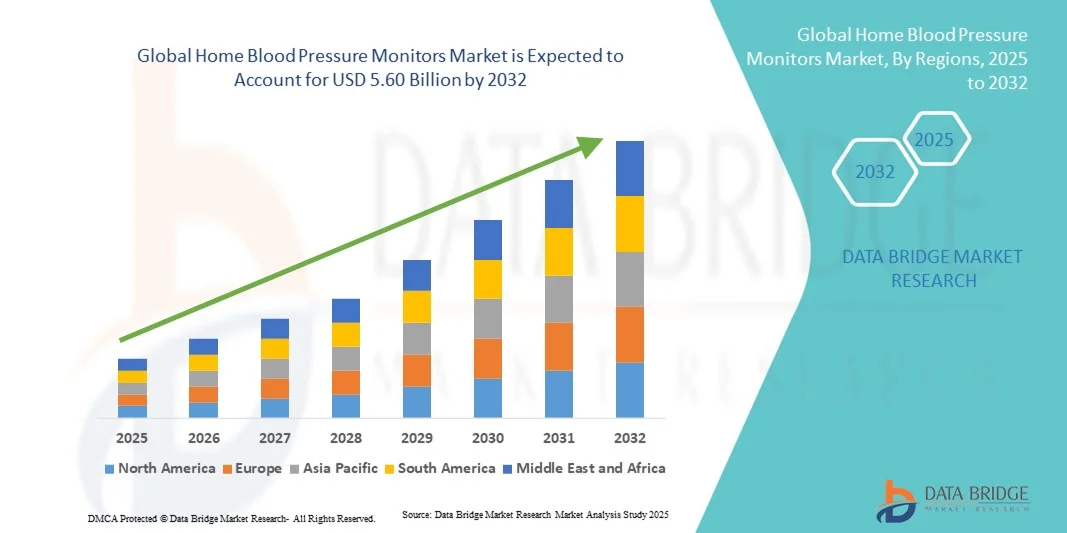

- The global home blood pressure monitors market size was valued at USD 3.29 billion in 2024 and is expected to reach USD 5.60 billion by 2032, at a CAGR of 6.85% during the forecast period

- The market growth is largely fueled by the increasing prevalence of hypertension and cardiovascular diseases, coupled with growing awareness among patients about the importance of regular blood pressure monitoring. Advancements in digital health technologies, including Bluetooth-enabled and smartphone-connected devices, are further driving adoption across both homecare and clinical settings

- Furthermore, rising consumer demand for accurate, portable, and user-friendly monitoring devices is positioning home blood pressure monitors as a preferred solution for proactive health management. These converging factors are accelerating the uptake of Home Blood Pressure Monitors solutions, thereby significantly boosting the industry's growth

Home Blood Pressure Monitors Market Analysis

- Home blood pressure monitors are becoming increasingly essential tools in preventive healthcare and chronic disease management, both in household and clinical settings, due to their convenience, accuracy, and ability to support ongoing monitoring of cardiovascular health. Their growing adoption is driven by the rising prevalence of hypertension, greater health awareness among consumers, and the global shift toward at-home diagnostics

- The escalating demand for home blood pressure monitors is primarily fueled by the rising burden of lifestyle-related diseases, increasing emphasis on self-monitoring, and a preference for non-invasive, easy-to-use medical devices. The integration of digital connectivity features, such as Bluetooth and app-based tracking, further enhances patient engagement and enables healthcare providers to remotely track patient data for better care management

- North America dominated the home blood pressure monitors market with the largest revenue share of 32.55% in 2024, supported by advanced healthcare infrastructure, high consumer awareness, and strong penetration of digital health technologies. The U.S. experienced substantial growth in home blood pressure monitor adoption, particularly due to the increasing incidence of hypertension, favorable reimbursement policies, and the widespread availability of smart, app-enabled monitoring devices

- Asia-Pacific is expected to be the fastest-growing region in the home blood pressure monitors market during the forecast period, driven by increasing urbanization, rising disposable incomes, expanding access to healthcare, and government initiatives promoting preventive health in countries such as China, India, and Japan. The region’s growing middle-class population and rapid adoption of connected health devices are also significant contributors to this surge

- The digital BP monitors segment dominated the home blood pressure monitors market with the largest market revenue share of 62.8% in 2024, attributed to their ease of operation, automated inflation/deflation, and user-friendly interfaces

Report Scope and Home Blood Pressure Monitors Market Segmentation

|

Attributes |

Home Blood Pressure Monitors Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Home Blood Pressure Monitors Market Trends

Enhanced Convenience Through Digital Integration and Remote Monitoring

- A significant and accelerating trend in the global home blood pressure monitors market is the deepening integration of digital technologies such as mobile applications, Bluetooth, and Wi-Fi, enabling users to track, analyze, and share their health data in real time. This connectivity is significantly enhancing user convenience and empowering patients to actively manage their cardiovascular health at home

- For instance, several leading manufacturers are offering home blood pressure monitors that automatically sync with companion smartphone apps, allowing users to maintain digital records of readings and share them instantly with healthcare providers. Such integration is particularly useful for patients with chronic hypertension requiring continuous monitoring

- Advanced devices are now equipped with features such as irregular heartbeat detection, multi-user memory storage, and trend analysis dashboards, providing more intelligent insights for patients and physicians. These features improve diagnostic accuracy, support early intervention, and increase adherence to prescribed therapy regimens

- Furthermore, remote monitoring capabilities allow healthcare providers to receive patient data outside of traditional clinical settings, facilitating virtual consultations, personalized treatment adjustments, and proactive care. This shift aligns with the growing demand for telehealth and value-based healthcare models

- The seamless integration of home blood pressure monitors with broader digital health platforms supports holistic care, enabling patients to manage not only blood pressure but also related conditions such as diabetes and heart disease through connected devices and applications

- This trend towards more intelligent, user-friendly, and interconnected monitoring systems is fundamentally reshaping expectations in home-based cardiovascular care. Consequently, companies are increasingly focusing on developing compact, portable, and clinically validated devices with enhanced connectivity features to cater to rising consumer and healthcare system needs

- The demand for home blood pressure monitors with digital integration and remote monitoring capabilities is growing rapidly across both developed and emerging markets, as consumers increasingly prioritize convenience, preventive care, and comprehensive health management

Home Blood Pressure Monitors Market Dynamics

Driver

Growing Need Due to Rising Hypertension Cases and Preventive Healthcare Adoption

- The rising prevalence of hypertension and cardiovascular diseases worldwide is a significant driver for the heightened demand for home blood pressure monitors. With millions of people affected by lifestyle-related disorders, routine monitoring at home is becoming increasingly essential for early detection, ongoing disease management, and reducing hospital visits

- For instance, in February 2024, OMRON Healthcare launched the HeartGuide 2.0, a next-generation wearable blood pressure monitor that combines traditional cuff-based technology with smartwatch capabilities, enabling users to seamlessly monitor their heart health in real time. Such product advancements are expected to drive the home blood pressure monitors industry growth during the forecast period

- As consumers become more aware of the health risks associated with uncontrolled blood pressure, the preference for reliable, accurate, and easy-to-use monitoring devices is rising. These devices provide key features such as digital tracking, irregular heartbeat detection, and integration with mobile health apps, offering patients and caregivers better tools to manage hypertension effectively

- Furthermore, the growing emphasis on preventive healthcare, supported by government awareness campaigns and favorable reimbursement for chronic disease monitoring, is making home blood pressure monitors an integral component of modern healthcare ecosystems. Their convenience, portability, and compatibility with telehealth platforms further support market expansion across both developed and emerging economies

Restraint/Challenge

Concerns Regarding Device Accuracy and High Initial Costs

- Concerns surrounding the accuracy and consistency of certain home blood pressure monitors pose a significant challenge to broader adoption. While clinical-grade devices provide reliable results, low-cost alternatives sometimes produce inconsistent readings, raising doubts among patients and healthcare professionals about their effectiveness. This has made device validation and adherence to international standards critical for consumer trust

- For instance, regulatory bodies such as the FDA and the European Society of Hypertension (ESH) have highlighted the importance of validated devices to ensure patient safety and data reliability. Failure to meet such requirements can reduce consumer confidence and slow adoption rates

- In addition, the relatively high initial cost of advanced home blood pressure monitoring systems, particularly those with digital connectivity, AI-enabled analysis, or cloud integration, can be a barrier for price-sensitive consumers in developing markets. While basic models are affordable, premium devices with enhanced features often come at a higher price, limiting access to certain demographics

- Although device prices are gradually becoming more competitive, the perception of home medical technology as a premium purchase can still hinder widespread adoption. For sustained market growth, addressing these challenges through improved accuracy validation, increased affordability, and greater consumer education on the benefits of regular monitoring will be essential

Home Blood Pressure Monitors Market Scope

The market is segmented on the basis of type, product, and distribution channel.

- By Type

On the basis of type, the home blood pressure monitors market is segmented into upper arm monitors, wrist monitors, and accessories. The upper arm monitors segment dominated the largest market revenue share of 55.4% in 2024, owing to their clinical accuracy, wide adoption in hospitals and home settings, and endorsement by medical associations as the gold standard for blood pressure measurement. These monitors are trusted by healthcare professionals for providing reliable results and are widely recommended for patients managing hypertension. Their compatibility with digital features such as memory storage, irregular heartbeat detection, and smartphone integration has further supported adoption. Growing awareness about cardiovascular health and routine monitoring has increased household usage of upper arm monitors. In addition, the availability of validated, affordable models across various price ranges strengthens their position as the dominant type in the market.

The wrist monitors segment is anticipated to witness the fastest growth rate of 18.7% from 2025 to 2032, driven by their compact size, portability, and ease of use, especially for elderly users. Wrist monitors are increasingly favored for their lightweight design, travel convenience, and ability to provide quick measurements without the need for professional assistance. Growing consumer preference for self-monitoring devices that fit into modern, on-the-go lifestyles has accelerated demand. Improved accuracy in newer models and integration with Bluetooth-enabled apps make them appealing for tech-savvy users. Furthermore, rising adoption in emerging economies due to affordability and availability in retail and online channels supports their rapid CAGR growth.

- By Product

On the basis of product, the home blood pressure monitors market is segmented into sphygmomanometers, digital BP monitors, and ambulatory BP monitors. The digital BP monitors segment held the largest market revenue share of 62.8% in 2024, attributed to their ease of operation, automated inflation/deflation, and user-friendly interfaces. These devices are preferred in both clinical and homecare settings as they eliminate the need for trained professionals and provide accurate readings with minimal effort. Features such as large digital displays, data storage, and connectivity with smartphones enhance their usability. The affordability of digital BP monitors compared to advanced alternatives also boosts mass adoption. Rising awareness campaigns about hypertension management and frequent monitoring needs further reinforce their dominance.

The ambulatory BP monitors segment is expected to witness the fastest CAGR of 20.3% from 2025 to 2032, supported by the growing demand for 24-hour monitoring and detailed blood pressure pattern analysis. These devices are widely used in clinical diagnostics for detecting hypertension variability and white-coat syndrome, providing physicians with comprehensive data to make informed treatment decisions. Increasing adoption in hospitals and specialty clinics reflects the shift towards precision diagnostics and evidence-based care. Technological advancements, such as compact designs and data integration with electronic health records, are fueling adoption. Rising incidences of cardiovascular diseases and the need for accurate monitoring beyond clinical settings will continue to accelerate their growth.

- By Distribution Channel

On the basis of distribution channel, the home blood pressure monitors market is segmented into hospital pharmacies, retail pharmacies, and online stores. The retail pharmacies segment accounted for the largest market revenue share of 48.6% in 2024, as pharmacies remain the most accessible point of purchase for consumers seeking trusted, validated devices. Retailers provide direct access to a wide variety of brands and models, enabling consumers to compare and choose based on price and features. The ability to receive in-person guidance from pharmacists further supports adoption, particularly among elderly patients. Expanding healthcare infrastructure and strong penetration of pharmacies across urban and rural areas strengthen this segment’s dominance.

The online stores segment is projected to witness the fastest CAGR of 22.1% from 2025 to 2032, driven by the rapid growth of e-commerce, rising digital literacy, and increasing comfort with online shopping for medical devices. Online platforms offer the convenience of home delivery, detailed product information, and customer reviews, which help buyers make informed decisions. The availability of discounts, subscription models for healthcare products, and access to global brands not always available in local markets further fuel online adoption. The COVID-19 pandemic accelerated the shift toward digital purchases, and this behavioral change continues to drive sustained growth in this segment.

Home Blood Pressure Monitors Market Regional Analysis

- North America dominated the home blood pressure monitors market with the largest revenue share of 32.55% in 2024, supported by advanced healthcare infrastructure, high consumer awareness, and strong penetration of digital health technologies

- The region benefits from growing emphasis on preventive healthcare and the rising prevalence of hypertension, which continues to drive demand for home monitoring devices

- The presence of leading medical device manufacturers, coupled with strong distribution networks and favorable reimbursement policies, further strengthens the market position of North America

U.S. Home Blood Pressure Monitors Market Insight

The U.S. home blood pressure monitors market captured the largest revenue share within North America in 2024, fueled by the increasing incidence of hypertension and cardiovascular disorders. The widespread adoption of digital and app-enabled monitoring devices, supported by strong integration with telehealth platforms and electronic health records (EHRs), is a key growth factor. Moreover, favorable reimbursement frameworks and consumer preference for at-home monitoring solutions to reduce frequent hospital visits are accelerating adoption across households.

Europe Home Blood Pressure Monitors Market Insight

The Europe home blood pressure monitors market market is projected to grow at a steady pace during the forecast period, driven by increasing awareness of lifestyle-related diseases and the rising adoption of digital healthcare tools. European governments are actively promoting preventive care and encouraging the use of medical devices that enable early detection and management of hypertension. The strong presence of established healthcare systems, combined with growing penetration of connected monitoring devices, is propelling market growth across residential and clinical settings.

U.K. Home Blood Pressure Monitors Market Insight

The U.K. home blood pressure monitors market is anticipated to expand at a notable CAGR throughout the forecast period, supported by the country’s focus on early diagnosis and disease prevention. Rising rates of obesity and hypertension are creating higher demand for home-use monitors, while the National Health Service (NHS) is increasingly encouraging patients to self-monitor as part of broader efforts to ease hospital burdens. The growing adoption of digital health apps and online retail channels also supports market growth.

Germany Home Blood Pressure Monitors Market Insight

The Germany home blood pressure monitors market is expected to record substantial growth during the forecast period, fueled by strong consumer preference for technologically advanced, clinically validated monitoring devices. Germany’s emphasis on innovation, data accuracy, and sustainability is promoting the adoption of advanced digital monitors. Moreover, the country’s robust healthcare infrastructure and widespread physician support for home-based monitoring are contributing to increasing device penetration.

Asia-Pacific Home Blood Pressure Monitors Market Insight

The Asia-Pacific home blood pressure monitors market is poised to grow at the fastest CAGR during 2025 to 2032, driven by rising urbanization, expanding access to healthcare, and government initiatives aimed at preventive health management. Increasing disposable incomes and the rapid adoption of connected health devices in countries such as China, India, and Japan are key contributors to growth. The region’s growing middle-class population is also becoming more health-conscious, fueling demand for affordable, easy-to-use monitoring devices.

Japan Home Blood Pressure Monitors Market Insight

The Japan home blood pressure monitors market is gaining traction, supported by the country’s aging population, high prevalence of hypertension, and strong cultural emphasis on health monitoring. The integration of advanced, compact, and digital devices with mobile applications is driving consumer adoption. Additionally, Japan’s robust technology ecosystem and government-driven preventive care programs are fostering further market expansion.

China Home Blood Pressure Monitors Market Insight

The China home blood pressure monitors market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to the country’s expanding healthcare access, growing middle-class population, and increasing investment in digital health infrastructure. The rising prevalence of hypertension, combined with strong local manufacturing capabilities and government-backed health awareness programs, is boosting adoption. Furthermore, the availability of affordable, connected monitoring devices is helping China emerge as a major growth hub within the region.

Home Blood Pressure Monitors Market Share

The home blood pressure monitors industry is primarily led by well-established companies, including:

- A & D Medical (India)

- Welch Allyn (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Suntech Medical (India)

- Omron (Japan)

- Beurer GmbH (Germany)

- Paul Hartmann AG (Germany)

- Microlife Corporation (Switzerland)

- American Diagnostic (U.S.)

- Rossmax International (Japan)

- Rudolf Riester GmbH (Germany)

- Briggs Healthcare (U.S.)

- Terumo Corporation (Japan)

Latest Developments in Global Home Blood Pressure Monitors Market

- In July 2025, Aktiia received FDA 510(k) clearance for its G0 Blood Pressure Monitoring System, also known as the Hilo Band. This marks the first over-the-counter (OTC) clearance for a cuffless blood pressure monitor in the United States. The device utilizes optical sensors to monitor blood pressure continuously and is designed for consumer use without a prescription

- In July 2025, Omron Healthcare announced plans to establish its first manufacturing facility in Chennai, India. The factory is set to begin operations in March 2025 and will focus on producing blood pressure monitors for the domestic market. This move aims to meet the growing demand for hypertension management solutions in India

- In September 2024, research presented at the American Heart Association's Hypertension Scientific Sessions revealed that many home blood pressure monitor cuffs may not fit a significant portion of U.S. adults. The study indicated that over 17 million adults could experience inaccurate readings due to ill-fitting cuffs, highlighting the need for standardized cuff sizes

- In August 2023, a study published in JAMA Internal Medicine emphasized the importance of using appropriately sized blood pressure cuffs for accurate readings. The research found that standard cuffs often led to inaccurate measurements, particularly in individuals with larger arm circumferences, underscoring the necessity for individualized cuff selection

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.