Global Home Care Medical Supplies Market

Market Size in USD Billion

CAGR :

%

USD

10.41 Billion

USD

18.43 Billion

2024

2032

USD

10.41 Billion

USD

18.43 Billion

2024

2032

| 2025 –2032 | |

| USD 10.41 Billion | |

| USD 18.43 Billion | |

|

|

|

|

Home Care Medical Supplies Market Size

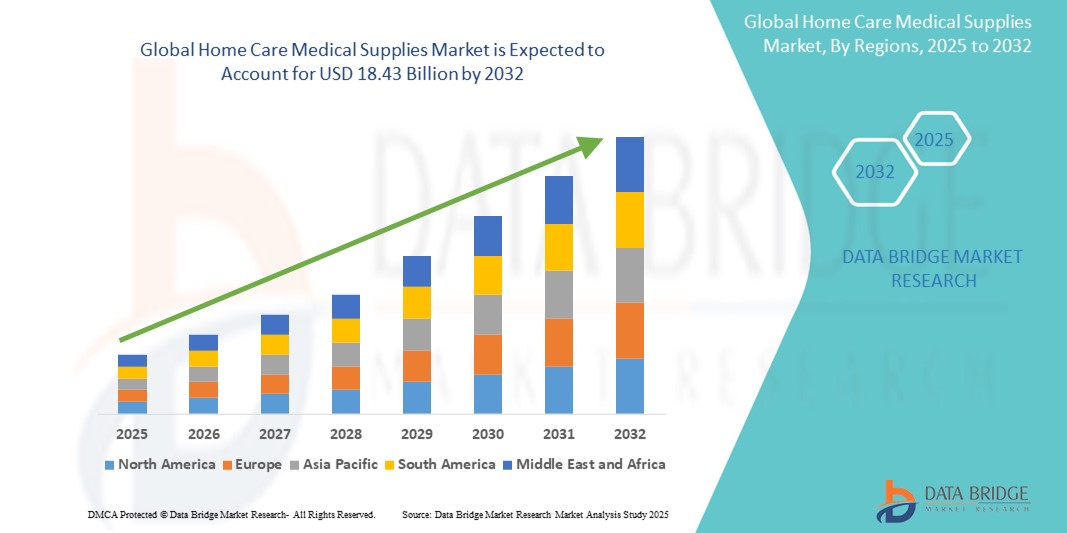

- The global home care medical supplies market size was valued at USD 10.41 billion in 2024 and is expected to reach USD 18.43 billion by 2032, at a CAGR of 8.10% during the forecast period

- This growth is driven by factors such as the increasing aging population, rising prevalence of chronic diseases, and the growing preference for home-based healthcare due to its cost-effectiveness and convenience.

Home Care Medical Supplies Market Analysis

- Home care medical supplies refer to a range of medical devices and products used by patients in a home setting to manage chronic illnesses, post-operative recovery, or aging-related conditions

- The market is primarily driven by the rising geriatric population, increasing prevalence of chronic diseases, and a shift toward cost-effective, home-based healthcare services

- North America is expected to dominate the home care medical supplies market with a market share of 42.6%, due to the presence of advanced healthcare infrastructure, higher healthcare expenditure, and strong reimbursement systems

- Asia-Pacific is expected to be the fastest growing region in the home care medical supplies market with a market share of 20.2%, during the forecast period due to improving healthcare access, rising chronic disease incidence, and aging populations

- Therapeutic equipment segment is expected to dominate the market with a market share of 44.66% due to its widespread use in managing chronic conditions such as respiratory disorders, diabetes, and cardiovascular diseases. Devices such as oxygen concentrators, CPAP machines, and insulin pumps are essential for long-term home care, driving high demand

Report Scope and Home Care Medical Supplies Market Segmentation

|

Attributes |

Home Care Medical Supplies Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Home Care Medical Supplies Market Trends

“Integration of Remote Monitoring & Smart Health Devices in Home-Based Care”

- A significant trend in the home care medical supplies market is the increasing adoption of smart health devices and remote monitoring solutions to manage chronic diseases and post-acute care at home

- These technologies enable real-time tracking of vital signs and treatment adherence, supporting personalized care and early intervention to reduce hospital readmissions

- For instance, smart blood pressure monitors, glucose meters, and wearable ECG devices are being integrated with mobile apps and cloud platforms, allowing healthcare providers to monitor patients remotely and adjust treatment plans accordingly

- This technological shift is reshaping home healthcare delivery by enhancing patient autonomy, improving clinical outcomes, and fueling demand for advanced, connected medical supplies

Home Care Medical Supplies Market Dynamics

Driver

“Rising Geriatric Population and Chronic Disease Burden”

- The growing global geriatric population, along with the increasing prevalence of chronic conditions such as diabetes, cardiovascular diseases, and respiratory disorders, is significantly driving the demand for home care medical supplies

- Elderly individuals often require long-term care, mobility aids, and regular health monitoring, which makes home-based healthcare a more convenient and cost-effective solution

- As aging populations seek alternatives to institutional care, the market for home-use therapeutic and monitoring equipment continues to expand, supporting independent living and improving quality of life

For instance,

- According to the World Health Organization (2023), the number of people aged 60 years and older will increase from 1 billion in 2020 to 1.4 billion by 2030. This shift is expected to significantly escalate the demand for home healthcare services and products

- Consequently, the expanding elderly population and chronic disease burden are key drivers fueling the growth of the global home care medical supplies market

Opportunity

“Expanding Role of AI and IoT in Smart Home Healthcare Solutions”

- The integration of Artificial Intelligence (AI) and Internet of Things (IoT) in home care medical supplies presents a major opportunity for enhancing personalized and proactive healthcare at home

- AI-enabled devices can monitor health metrics, detect anomalies, and provide predictive alerts, enabling timely medical intervention and better disease management

- IoT-based systems allow seamless data exchange between medical devices and healthcare providers, supporting remote patient monitoring, medication adherence tracking, and virtual consultations

For instance,

- In March 2024, a report by Deloitte highlighted the growing implementation of AI-driven smart health devices such as wearable ECG monitors and automated insulin pumps, which can transmit real-time data to cloud platforms for continuous analysis and physician access. This enables customized care plans and reduces the burden on healthcare facilities

- The advancement of smart technologies in home care medical supplies enhances healthcare delivery, improves patient engagement, and creates new revenue streams for manufacturers, marking a transformative shift in the home healthcare landscape

Restraint/Challenge

“High Initial Costs and Limited Reimbursement Policies”

- The high upfront cost of home care medical supplies and equipment continues to be a significant barrier to market penetration, particularly for patients in low- and middle-income regions

- Products such as oxygen concentrators, dialysis equipment, and mobility aids can be expensive, placing a financial burden on patients and caregivers who may lack sufficient insurance coverage

- In many countries, limited reimbursement frameworks for home healthcare devices further exacerbate this challenge, making it difficult for patients to afford or sustain long-term in-home care solutions

For instance,

- According to an article published by the National Association for Home Care & Hospice in October 2024, a major issue in the U.S. and other markets is the inconsistency in insurance reimbursement policies for home medical equipment, which often delays or restricts patient access to necessary devices. This leads to increased out-of-pocket costs and reduced adoption of advanced home care solutions

- Consequently, the high cost and lack of adequate financial support limit the accessibility and scalability of home care medical supplies, especially in underserved regions, thereby constraining the market’s overall growth potential

Home Care Medical Supplies Market Scope

The market is segmented on the basis of product type and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Product type |

|

|

By Distribution Channel |

|

In 2025, the therapeutic equipment is projected to dominate the market with a largest share in product type segment

The therapeutic equipment segment is expected to dominate the home care medical supplies market with the largest share of 44.66% in 2025 due to its widespread use in managing chronic conditions such as respiratory disorders, diabetes, and cardiovascular diseases. Devices such as oxygen concentrators, CPAP machines, and insulin pumps are essential for long-term home care, driving high demand. In addition, advancements in these devices, which offer improved patient comfort and outcomes, contribute to the segment's growth.

The retail pharmacies is expected to account for the largest share during the forecast period in distribution channel market

In 2025, the retail pharmacies segment is expected to dominate the market with the largest market share of 44.79% due to its widespread accessibility and ability to provide immediate, over-the-counter medical supplies. Retail pharmacies offer a variety of home care products, making them a convenient option for patients. In addition, the growing trend of self-care and preventive health measures is boosting the demand for home medical supplies through these outlets.

Home Care Medical Supplies Market Regional Analysis

“North America Holds the Largest Share in the Home Care Medical Supplies Market”

- North America dominates the home care medical supplies market with a market share of estimated 42.6%, driven by the presence of advanced healthcare infrastructure, higher healthcare expenditure, and strong reimbursement systems

- U.S. holds a market share of 39.2%, due to the aging population, high prevalence of chronic diseases, and increasing demand for home-based healthcare solutions

- Strong government initiatives, such as Medicare and Medicaid, which provide financial support for home healthcare services, further fuel market growth

- In addition, the rising preference for home healthcare over hospital-based care due to cost-effectiveness and convenience is contributing to the market expansion in the region

“Asia-Pacific is Projected to Register the Highest CAGR in the Home Care Medical Supplies Market”

- Asia-Pacific is expected to witness the highest growth rate in the home care medical supplies market with a market share of 20.2%, driven by improving healthcare access, rising chronic disease incidence, and aging populations

- Countries such as China, India, and Japan are emerging as key markets, driven by the expanding elderly population and higher adoption of home healthcare solutions for chronic disease management

- Japan, with its advanced healthcare systems and high standard of living, remains a crucial market for home care medical supplies, particularly in areas such as therapeutic equipment and mobility aids

- India is projected to register the highest CAGR of 19.89% in the home care medical supplies market, driven by the growing elderly population, rising chronic diseases, and increasing healthcare access through both urban and rural healthcare initiatives

Home Care Medical Supplies Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Medtronic (Ireland)

- Koninklijke Philips N.V. (Netherlands)

- Johnson & Johnson Services, Inc. (U.S.)

- Abbott (U.S.)

- ResMed (Australia)

- Cardinal Health (U.S.)

- Stryker (U.S.)

- Baxter (U.S.)

- Amedisys (U.S.)

- Fisher & Paykel Healthcare Limited (New Zealand)

- GE Healthcare (U.S.)

- OMRON Healthcare Inc. (Japan)

- Medline Industries, Inc. (U.S.)

- Invacare Holdings Corporation (U.S.)

- Kaiser Foundation Health Plan, Inc. (U.S.)

- Linde PLC (Germany)

- HERSILL (Spain)

- Hill-Rom Holdings, Inc. (U.S.)

- Tandem Diabetes Care, Inc. (U.S.)

- WellSky (U.S.)

Latest Developments in Global Home Care Medical Supplies Market

- In April 2025, ResMed, a leading provider of sleep apnea equipment, confirmed that its products are exempt from U.S. tariffs imposed under President Donald Trump's 'Liberation Day' policy. This exemption, upheld by the White House, applies to disability-related equipment, ensuring continued affordability and accessibility for patients relying on home care devices

- In January 2025, Cardinal Health announced significant investments in its at-Home Solutions division, including the addition of three new warehouses dedicated solely to the delivery of home medical supplies. These strategic expansions aim to enhance efficiency and speed in delivering medical supplies to patients, positioning the company to meet the growing demand for home healthcare services

- In November 2024, Medtronic received U.S. Food and Drug Administration (FDA) approval for its new InPen smartphone software and announced the release of its new Smart MDI system. This system provides real-time information about multiple daily injection (MDI) therapy, enhancing diabetes management for patients using insulin therapy

- In September 2024, Abbott Laboratories announced that its over-the-counter continuous glucose monitor, Lingo, is now available in the U.S. The Lingo aims to help users monitor glucose levels, providing insights into glucose spikes and aiding in better diabetes management

- December 2024, Medline, a leading manufacturer and distributor of medical supplies worldwide, confidentially filed for an initial public offering (IPO) in the United States, potentially valuing the company at up to USD 50 billion. The specific size of the offering remains unspecified, though it is estimated to raise around USD billion

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.