Global Medical Oxygen Concentrators And Oxygen Cylinders Market

Market Size in USD Billion

CAGR :

%

USD

3.80 Billion

USD

5.97 Billion

2024

2032

USD

3.80 Billion

USD

5.97 Billion

2024

2032

| 2025 –2032 | |

| USD 3.80 Billion | |

| USD 5.97 Billion | |

|

|

|

|

Medical Oxygen Concentrators and Oxygen Cylinders Market Size

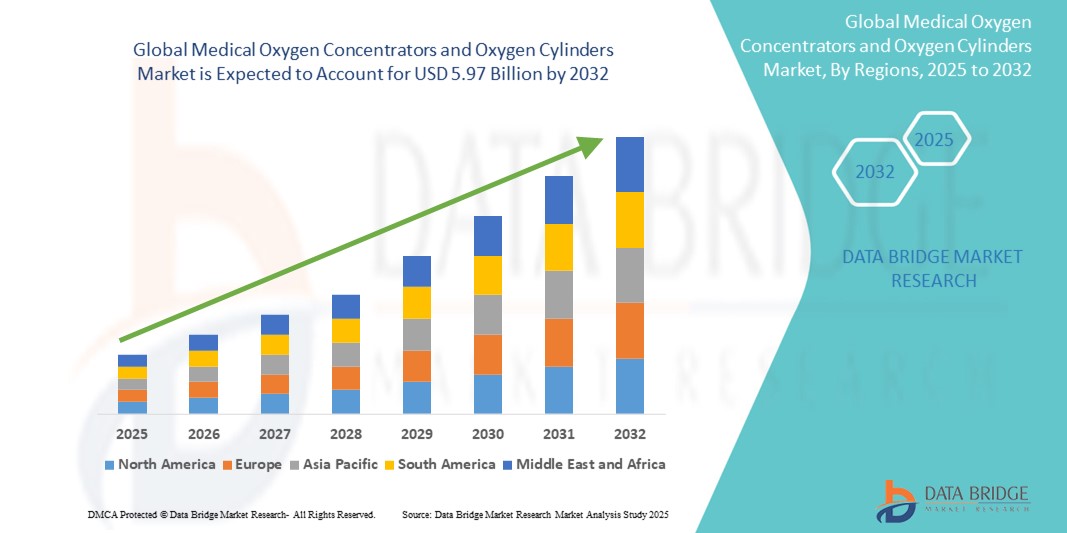

- The global medical oxygen concentrators and oxygen cylinders market size was valued at USD 3.80 billion in 2024 and is expected to reach USD 5.97 billion by 2032, at a CAGR of 5.80% during the forecast period

- The market growth is largely fueled by the increasing prevalence of respiratory diseases such as COPD, asthma, and pneumonia, along with a growing aging population requiring long-term oxygen therapy across home care and clinical settings

- Furthermore, heightened awareness of oxygen therapy's role in emergency and critical care, especially post-COVID-19, and improvements in portable oxygen delivery technologies are driving demand. These converging factors are expanding the global footprint of oxygen concentrators and cylinders, thereby significantly boosting the industry's growth

Medical Oxygen Concentrators and Oxygen Cylinders Market Analysis

- Medical oxygen concentrators and oxygen cylinders, essential for delivering supplemental oxygen to patients with respiratory conditions, are increasingly critical components of healthcare infrastructure across hospitals, home care, and emergency services due to their portability, reliability, and ability to support both acute and chronic respiratory therapies

- The rising demand for these devices is primarily driven by the increasing global burden of chronic respiratory diseases, a growing elderly population, and the need for respiratory support in home settings, especially post-COVID-19, where long-term oxygen therapy has become more widespread

- North America dominated the medical oxygen concentrators and oxygen cylinders market with the largest revenue share of 39.2% in 2024, attributed to advanced healthcare systems, a high prevalence of respiratory illnesses, and substantial government funding for home healthcare infrastructure, particularly in the U.S.

- Asia-Pacific is expected to be the fastest-growing region in the market during the forecast period, fueled by improving healthcare access, increasing healthcare expenditure, and growing awareness of respiratory health management

- Portable oxygen concentrator cylinders segment dominated the medical oxygen concentrators and oxygen cylinders market with a market share of 61.8% in 2024, driven by its established reputation for security and ease of retrofit into existing door setups

Report Scope and Medical Oxygen Concentrators and Oxygen Cylinders Market Segmentation

|

Attributes |

Medical Oxygen Concentrators and Oxygen Cylinders Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Medical Oxygen Concentrators and Oxygen Cylinders Market Trends

“Portability and Technological Innovation in Oxygen Delivery”

- A significant and accelerating trend in the global medical oxygen concentrators and oxygen cylinders market is the surge in demand for lightweight, portable oxygen delivery devices integrated with smart monitoring features. These advances are enhancing patient mobility and enabling long-term oxygen therapy in home and outdoor settings

- For instance, Philips’ SimplyGo Mini and Inogen One G5 are popular portable oxygen concentrators offering compact design, long battery life, and Bluetooth-enabled apps that allow patients and caregivers to track oxygen usage and device performance in real-time.

- Technological innovation is also improving oxygen flow accuracy and user safety. Devices now come with auto-adjustable oxygen flow based on real-time patient breathing patterns, reducing oxygen waste and enhancing therapy efficiency. Some models, such as the CAIRE Freestyle Comfort, provide pulse and continuous flow options with intelligent delivery systems

- The integration of oxygen therapy devices with remote health monitoring platforms is creating a connected ecosystem, allowing clinicians to adjust oxygen settings remotely and receive alerts in case of usage anomalies or device malfunction

- This trend toward portable, smart, and patient-friendly devices is reshaping the expectations for respiratory care, particularly among aging populations and patients with chronic respiratory conditions. Leading players such as ResMed and Drive DeVilbiss are investing heavily in R&D to enhance device functionality, usability, and digital connectivity to meet this evolving demand

- The rising adoption of portable concentrators in home care and ambulatory settings is expected to continue, driven by an aging global population, a focus on cost-effective care, and the shift toward home-based treatment

Medical Oxygen Concentrators and Oxygen Cylinders Market Dynamics

Driver

“Rising Respiratory Disorders and Shift Toward Home Healthcare”

- The global rise in chronic respiratory diseases such as COPD, asthma, and post-COVID complications is significantly driving the demand for oxygen concentrators and cylinders. According to WHO, over 3 million people die annually from COPD, and millions more suffer from moderate to severe respiratory conditions requiring long-term oxygen therapy

- As healthcare systems increasingly emphasize home-based care to reduce hospital burden and improve patient quality of life, oxygen concentrators and cylinders are becoming essential tools for at-home respiratory support

- For instance, companies such as Inogen and O2 Concepts have developed user-friendly home care concentrators that offer real-time performance monitoring and long battery backup, allowing greater autonomy for patients

- The affordability of home therapy compared to prolonged hospital stays is compelling healthcare providers and patients asuch as to adopt portable and stationary oxygen solutions for long-term use

- The shift is supported by favorable insurance reimbursements and government initiatives in regions such as North America and Europe, aimed at improving accessibility to home healthcare equipment

- This growing trend of decentralized healthcare, combined with the high demand for respiratory support, is propelling the sustained adoption of oxygen therapy devices worldwide

Restraint/Challenge

“Supply Chain Disruptions and Regulatory Compliance Hurdles”

- A key challenge in the global medical oxygen concentrators and cylinders market is the vulnerability of the supply chain, especially during global health crises or raw material shortages. The COVID-19 pandemic exposed severe gaps in oxygen device availability, particularly in low- and middle-income countries

- Regulatory compliance also remains a significant barrier, as oxygen delivery devices must meet stringent quality and safety standards from bodies such as the U.S. FDA, CE, and ISO. Delays in approvals and the need for regional certifications can hinder timely product launches and restrict global distribution

- In addition, the higher upfront cost of portable concentrators with advanced features can limit adoption in cost-sensitive markets, where basic oxygen cylinders are often preferred due to affordability despite their limitations in refill logistics and lack of real-time monitoring.

- To overcome these challenges, manufacturers are focusing on localized production, flexible supply networks, and partnerships with government health agencies. Furthermore, simplified and harmonized regulatory pathways, alongside initiatives to subsidize oxygen equipment in underserved regions, are essential for ensuring equitable access and market stability

Medical Oxygen Concentrators and Oxygen Cylinders Market Scope

The market is segmented on the basis of product, technology, and end use

- By Product

On the basis of product, the medical oxygen concentrators and oxygen cylinders market is segmented into portable oxygen concentrator cylinders and stationary oxygen concentrator cylinders. The portable oxygen concentrator cylinders segment dominated the market with the largest market revenue share of 61.8% in 2024, driven by rising preference for mobility and convenience in home care settings. These devices offer users greater freedom to maintain an active lifestyle while receiving continuous respiratory support. Lightweight designs, longer battery life, and enhanced portability make them ideal for ambulatory and long-term use outside of clinical environments.

The stationary oxygen concentrator cylinders segment is expected to witness the fastest CAGR from 2025 to 2032, supported by their use in hospitals, long-term care facilities, and patients requiring higher oxygen output at home. These units are valued for their durability, cost-efficiency, and ability to deliver a continuous oxygen supply without frequent refills.

- By Technology

On the basis of technology, the medical oxygen concentrators and oxygen cylinders market is segmented into continuous flow and pulse flow systems. The continuous flow segment held the largest market revenue share of 67.8% in 2024, driven by its suitability for patients with severe respiratory disorders and its consistent oxygen delivery. This technology is commonly used in stationary systems and hospital setups, where uninterrupted oxygen supply is critical. Its dominance is also supported by its compatibility with a wide range of oxygen therapy accessories and devices.

The pulse flow segment is expected to witness the fastest CAGR from 2025 to 2032, due to increasing adoption in portable concentrators. Pulse flow technology delivers oxygen only when the patient inhales, thereby conserving oxygen and battery life, which is ideal for active patients seeking lightweight, long-lasting solutions. Advancements in sensor-based pulse technology and auto-adjustment features further drive its popularity among home care users.

- By End Use

On the basis of end use, the medical oxygen concentrators and oxygen cylinders market is segmented into home care and non-home care (including hospitals, ambulatory care centers, and emergency services). The home care segment dominated the market with the largest revenue share of 58.6% in 2024, as a growing number of patients with chronic respiratory conditions opt for home-based oxygen therapy. Factors such as increased awareness, aging populations, and preference for non-hospital treatment are propelling demand. The cost-effectiveness of home care, coupled with reimbursement support in key markets, is further contributing to the expansion of this segment.

The non-home care segment is expected to witness the fastest CAGR from 2025 to 2032, particularly in acute care and emergency response scenarios. These settings rely on both portable and stationary devices for rapid oxygen delivery and life-saving interventions. Growth in this segment is supported by the expansion of hospital infrastructure and increased investment in respiratory care facilities globally.

Medical Oxygen Concentrators and Oxygen Cylinders Market Regional Analysis

- North America dominated the medical oxygen concentrators and oxygen cylinders market with the largest revenue share of 39.2% in 2024, attributed to advanced healthcare systems, a high prevalence of respiratory illnesses, and substantial government funding for home healthcare infrastructure, particularly in the U.S.

- Patients and healthcare providers in the region increasingly prioritize convenience, long-term disease management, and cost-effective treatment, making oxygen concentrators and cylinders vital components in both acute and chronic care

- The market is further bolstered by favorable reimbursement policies, increasing geriatric population, and a strong presence of key manufacturers offering technologically advanced, user-friendly, and portable oxygen solutions, reinforcing the region’s leadership in adoption across home and clinical settings.

U.S. Medical Oxygen Concentrators and Oxygen Cylinders Market Insight

The U.S. medical oxygen concentrators and oxygen cylinders market captured the largest revenue share of 82% in 2024 within North America, fueled by the country’s high prevalence of chronic respiratory conditions and strong adoption of home healthcare. The surge in demand for portable oxygen devices, driven by aging populations and post-COVID complications, continues to shape the market. The widespread availability of insurance coverage, coupled with advanced healthcare infrastructure and patient awareness, supports consistent market expansion. Technological innovations in remote monitoring and portable therapy are further enhancing the appeal of these devices across clinical and at-home environments.

Europe Medical Oxygen Concentrators and Oxygen Cylinders Market Insight

The Europe medical oxygen concentrators and oxygen cylinders market is projected to grow at a substantial CAGR throughout the forecast period, supported by a rising burden of respiratory illnesses and increasing investments in healthcare modernization. Growing preference for in-home treatment solutions, particularly for elderly patients and chronic conditions, is encouraging the adoption of oxygen concentrators. The market is seeing widespread deployment in both urban and rural settings, supported by reimbursement frameworks, aging demographics, and a focus on improving healthcare accessibility and continuity of care across EU nations.

U.K. Medical Oxygen Concentrators and Oxygen Cylinders Market Insight

The U.K. medical oxygen concentrators and oxygen cylinders market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising demand for cost-effective home-based oxygen therapy and an aging population. Increased government support for home healthcare services and integration of oxygen therapy into community care programs are accelerating market adoption. Moreover, awareness campaigns around respiratory health and support from the National Health Service (NHS) in deploying home-use concentrators contribute significantly to market growth.

Germany Medical Oxygen Concentrators and Oxygen Cylinders Market Insight

The Germany medical oxygen concentrators and oxygen cylinders market is expected to expand at a considerable CAGR during the forecast period, fueled by strong healthcare infrastructure and a focus on technologically advanced, energy-efficient devices. German consumers emphasize safety, reliability, and innovation, which is reflected in the rising preference for smart, portable concentrators integrated with digital monitoring systems. Increasing investments in elderly care facilities and chronic disease management programs are also bolstering market demand.

Asia-Pacific Medical Oxygen Concentrators and Oxygen Cylinders Market Insight

The Asia-Pacific medical oxygen concentrators and oxygen cylinders market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by rising respiratory diseases, urban pollution, and expanding access to healthcare services. Countries such as China, Japan, and India are witnessing strong adoption due to government-backed health initiatives and growing demand for affordable, portable oxygen therapy solutions. The region's growing production capacity and competitive pricing further support rapid market penetration across both rural and urban populations.

Japan Medical Oxygen Concentrators and Oxygen Cylinders Market Insight

The Japan medical oxygen concentrators and oxygen cylinders market is gaining momentum due to the country’s aging population, high health literacy, and demand for technologically advanced, compact devices. Emphasis on elder care, combined with Japan’s robust home healthcare systems, is accelerating the use of portable oxygen concentrators. Integration with remote health monitoring and IoT platforms is expanding the capabilities of oxygen delivery, appealing to both healthcare professionals and patients seeking seamless care at home.

India Medical Oxygen Concentrators and Oxygen Cylinders Market Insight

The India medical oxygen concentrators and oxygen cylinders market accounted for the largest market revenue share in Asia Pacific in 2024, driven by the nation’s large population, rising cases of chronic respiratory diseases, and strong demand for accessible home healthcare solutions. Government initiatives promoting healthcare infrastructure, smart city development, and Make in India policies have spurred the growth of domestic manufacturers offering cost-effective oxygen therapy devices. Increasing consumer awareness and digital health integration are further contributing to market expansion across both metropolitan and tier-II cities.

Medical Oxygen Concentrators and Oxygen Cylinders Market Share

The medical oxygen concentrators and oxygen cylinders industry is primarily led by well-established companies, including:

- Medical Depot, Inc. (Canada)

- Koninklijke Philips N.V. (Netherlands)

- Invacare Holdings Corporation (U.S.)

- Nidek Medical Products, Inc. (Japan)

- Inogen, Inc. (U.S.)

- CAIRE Inc. (U.S.)

- O2 Concepts, LLC. (U.S.)

- OxyGo HQ Florida, LLC. (U.S.)

- Precision Medical, Inc. (U.S.)

- Linde PLC (Ireland)

- Chart Industries (U.S.)

- GCE Group (Sweden)

- Drive DeVilbiss Healthcare (U.S.)

- Airgas, Inc. (U.S.)

- Messer SE & Co. KGaA (Germany)

- OrientMEd International (U.A.E.)

- Tecno-Gaz S.p.A. (Italy)

What are the Recent Developments in Global Medical Oxygen Concentrators and Oxygen Cylinders Market?

- In March 2024, Philips Respironics, a global leader in respiratory care, launched its updated SimplyGo Mini portable oxygen concentrator with extended battery life and enhanced digital monitoring capabilities. This upgrade reflects the company’s focus on improving patient mobility and autonomy while enabling real-time data sharing between patients and clinicians for more personalized care. The innovation highlights the growing demand for compact, tech-enabled devices in home oxygen therapy

- In February 2024, Inogen, Inc., a leading medical technology company, announced the development of its next-generation portable oxygen concentrator featuring Bluetooth integration and AI-based breathing pattern analysis. The device aims to optimize oxygen delivery by automatically adjusting output based on the user’s respiratory rate, offering improved therapy efficiency and reduced oxygen wastage. This development underscores the trend toward intelligent, responsive oxygen systems

- In January 2024, Drive DeVilbiss Healthcare expanded its manufacturing capacity in India to meet the growing demand for oxygen concentrators across Asia-Pacific. This move is part of the company's strategy to ensure local availability and faster response during public health emergencies. The facility will also serve as a regional hub for R&D and assembly of next-gen home respiratory solutions

- In December 2023, CAIRE Inc. introduced the FreeStyle Comfort Elite, a wearable portable oxygen concentrator with smart health tracking features, designed to cater to active patients. The device includes real-time usage analytics and integrates with mobile health apps, supporting the broader shift toward remote patient monitoring and home-based chronic care management

- In November 2023, O2 Concepts launched a strategic partnership with multiple U.S. healthcare providers to implement its Oxlife Liberty series across home care and assisted living centers. The collaboration aims to standardize the use of high-efficiency, pulse-dose oxygen concentrators within long-term care programs, furthering the adoption of lightweight, durable, and clinically robust devices for elder and chronic care populations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.