Global Home Care Paper Packaging Market

Market Size in USD Billion

CAGR :

%

USD

38.87 Billion

USD

62.43 Billion

2024

2032

USD

38.87 Billion

USD

62.43 Billion

2024

2032

| 2025 –2032 | |

| USD 38.87 Billion | |

| USD 62.43 Billion | |

|

|

|

|

Home Care Paper Packaging Market Size

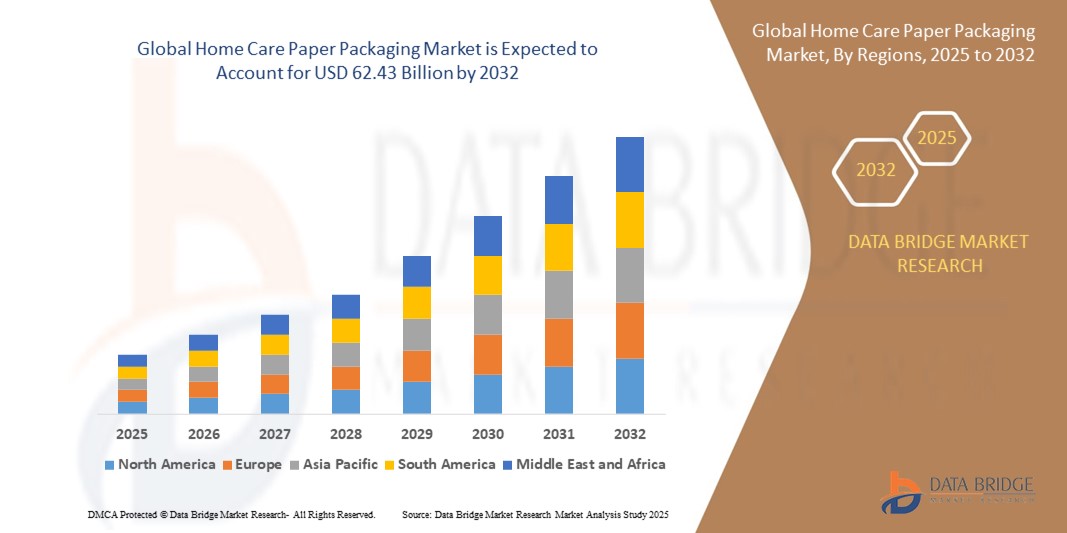

- The global home care paper packaging market size was valued at USD 38.87 billion in 2024 and is expected to reach USD 62.43 billion by 2032, at a CAGR of 6.10% during the forecast period

- The market growth is primarily driven by increasing consumer preference for sustainable and eco-friendly packaging solutions, coupled with stringent regulations on plastic usage and growing environmental awareness

- Rising demand for convenient, recyclable, and biodegradable packaging for home care products is positioning paper-based packaging as a preferred choice, significantly boosting industry growth

Home Care Paper Packaging Market Analysis

- Home care paper packaging, including cartons, pouches, and other paper-based solutions, is gaining traction as a sustainable alternative to traditional plastic packaging in home care applications due to its recyclability, lightweight nature, and alignment with circular economy principles

- The surge in demand is fueled by growing environmental concerns, regulatory pressures to reduce single-use plastics, and consumer preference for green packaging solutions in products such as dishwashing, laundry care, and air care

- Asia-Pacific dominated the home care paper packaging market with the largest revenue share of 40.7% in 2024, driven by high consumption of home care products, rapid urbanization, and strong manufacturing capabilities in countries such as China and India

- North America is expected to be the fastest-growing region during the forecast period due to increasing adoption of sustainable packaging, heightened environmental regulations, and rising consumer awareness of eco-friendly products

- The paper segment dominated the largest market revenue share of 61.09% in 2024, driven by its eco-friendly nature, recyclability, and versatility in packaging solutions such as cartons and pouches

Report Scope and Home Care Paper Packaging Market Segmentation

|

Attributes |

Home Care Paper Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Home Care Paper Packaging Market Trends

Increasing Adoption of Sustainable and Eco-Friendly Packaging Solutions

- The Global Home Care Paper Packaging Market is experiencing a significant shift towards sustainable packaging materials, driven by growing environmental awareness and consumer demand for eco-friendly products

- Paper-based packaging, such as cartons and pouches, is gaining traction due to its recyclability, biodegradability, and lower environmental impact compared to plastic and metal alternatives

- Companies are leveraging advanced technologies to develop innovative paper packaging solutions, such as compostable compressed paper bottles and high-barrier paper pouches, which maintain product integrity while reducing plastic usage

- For instances, brands such as Ecover and Cleancult have introduced paper-based refill cartons and recyclable cardboard packaging for laundry and cleaning products, aligning with consumer preferences for sustainable options

- This trend is enhancing the appeal of paper packaging, particularly for products such as dishwashing, laundry care, and air care, as it supports circular economy initiatives and reduces carbon footprints

- Advanced printing and design capabilities in paper packaging allow for effective branding and product differentiation, making it a preferred choice for manufacturers in the home care sector

Home Care Paper Packaging Market Dynamics

Driver

Rising Consumer Demand for Sustainable Home Care Products

- Increasing consumer awareness of environmental issues and the demand for sustainable home care products, such as dishwashing liquids, laundry detergents, and air care products, are major drivers for the Global Home Care Paper Packaging Market

- Paper packaging enhances product appeal by offering eco-friendly alternatives that align with consumer values, such as recyclable cartons and biodegradable pouches for toiletries and polishes

- Government regulations and initiatives, particularly in regions such as Asia-Pacific, are promoting the use of sustainable packaging materials through policies aimed at reducing single-use plastics

- The growth of e-commerce and home delivery services is boosting the need for lightweight, durable, and recyclable paper packaging, such as corrugated boxes and pouches, to ensure product safety during transportation

- Manufacturers are increasingly offering paper-based packaging as standard or optional solutions to meet consumer expectations and comply with regional sustainability mandates

Restraint/Challenge

High Production Costs and Raw Material Price Volatility

- The high initial costs associated with developing and producing advanced paper packaging solutions, such as high-barrier or compostable paper bottles, can be a significant barrier, particularly for smaller manufacturers or in cost-sensitive markets

- Integrating paper-based packaging into existing production lines can be complex and requires substantial investment in new equipment and processes

- In addition, volatility in raw material prices, such as wood pulp used for paper packaging, poses a challenge, as it can impact production costs and profitability

- Environmental concerns related to deforestation and water consumption in paper production can also hinder market growth, despite the recyclability of paper packaging

- These factors may limit adoption in emerging markets or among cost-conscious consumers, potentially slowing the expansion of the paper packaging segment in the home care industry

Home Care Paper Packaging market Scope

The market is segmented on the basis of material, type, and products.

- By Material

On the basis of material, the Global Home Care Paper Packaging Market is segmented into plastic, paper, metal, and glass. The paper segment dominated the largest market revenue share of 61.09% in 2024, driven by its eco-friendly nature, recyclability, and versatility in packaging solutions such as cartons and pouches. Paper’s dominance is further supported by increasing consumer demand for sustainable packaging and global efforts to reduce plastic waste.

The plastic segment is expected to witness the fastest growth rate of 6.5% from 2025 to 2032, driven by its cost-effectiveness, durability, and flexibility in molding for various home care products. Innovations in recycled and biodegradable plastics are enhancing adoption in response to environmental concerns.

- By Type

On the basis of type, the Global Home Care Paper Packaging Market is segmented into bottles, metal cans, cartons, pouches, and other types. The cartons segment dominated the market with a revenue share of 54.25% in 2024, attributed to its cost-effectiveness, ease of storage, and secure protection for home care products such as detergents and cleaners. Cartons are increasingly adopted by major players such as P&G and Henkel for laundry care and fabric conditioners.

The pouches segment is anticipated to exhibit the fastest growth rate of 7.8% from 2025 to 2032, fueled by the rising popularity of refillable pouches for detergents, soaps, and cleaners. Their lightweight nature and compatibility with e-commerce shipping enhance consumer convenience and sustainability.

- By Products

On the basis of products, the Global Home Care Paper Packaging Market is segmented into dishwashing, insecticides, laundry care, toiletries, polishes, air care, and other products. The laundry care segment accounted for the largest market revenue share of 43.51% in 2024, driven by the consistent global demand for laundry detergents, fabric softeners, and stain removers. The diversity in product formats, such as liquids, powders, and pods, necessitates versatile packaging solutions.

The dishwashing segment is expected to experience the fastest growth rate of 6.9% from 2025 to 2032, propelled by innovations in sustainable packaging, such as refillable containers and eco-friendly materials. Increasing consumer focus on hygiene and convenience in household and commercial applications further drives this segment.

Home Care Paper Packaging Market Regional Analysis

- Asia-Pacific dominated the home care paper packaging market with the largest revenue share of 40.7% in 2024, driven by high consumption of home care products, rapid urbanization, and strong manufacturing capabilities in countries such as China and India

- Consumers prioritize paper packaging for its eco-friendliness, recyclability, and versatility, particularly for products such as laundry care and dishwashing, which require durable and sustainable solutions

- Growth is supported by advancements in paper-based packaging technologies, such as recyclable cartons and pouches, alongside rising adoption in both OEM and retail segments

Japan Home Care Paper Packaging Market Insight

Japan’s home care paper packaging market is expected to witness rapid growth due to strong consumer preference for high-quality, sustainable paper packaging that enhances product safety and convenience. The presence of major consumer goods manufacturers and the integration of paper packaging in branded products accelerate market penetration. Rising interest in eco-friendly aftermarket solutions also contributes to growth.

China Home Care Paper Packaging Market Insight

China holds the largest share of the Asia-Pacific home care paper packaging market, propelled by rapid urbanization, increasing household product consumption, and growing demand for sustainable packaging solutions. The country’s expanding middle class and focus on environmental sustainability support the adoption of paper-based cartons and pouches. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

U.S. Home Care Paper Packaging Market Insight

The U.S. smart lock market is expected to witness significant growth, fueled by strong consumer demand for sustainable and recyclable packaging solutions. The trend toward eco-conscious purchasing and the rise of e-commerce for home care products further boost market expansion. The integration of paper packaging in both branded and private-label products complements retail sales, creating a robust market ecosystem.

Europe Home Care Paper Packaging Market Insight

The European home care paper packaging market is expected to witness significant growth, supported by stringent regulations promoting sustainable packaging and consumer preference for eco-friendly materials. Demand is strong for paper-based cartons and pouches that offer convenience and environmental benefits. Countries such as Germany and France show notable uptake due to increasing environmental awareness and urban consumer trends.

U.K. Home Care Paper Packaging Market Insight

The U.K. market for home care paper packaging is expected to witness rapid growth, driven by consumer demand for sustainable packaging and convenience in urban and suburban settings. Rising awareness of environmental impacts and recyclability encourages adoption. Evolving regulations promoting reduced plastic use influence consumer choices, balancing functionality with sustainability.

Germany Home Care Paper Packaging Market Insight

Germany is expected to witness rapid growth in the home care paper packaging market, attributed to its advanced manufacturing sector and high consumer focus on sustainability and convenience. German consumers prefer innovative paper packaging solutions, such as recyclable cartons, that reduce environmental impact and enhance product usability. The integration of these solutions in both premium and mass-market products supports sustained market growth.

Home Care Paper Packaging Market Share

The home care paper packaging industry is primarily led by well-established companies, including:

- Amcor plc (Australia)

- Ball Corporation (U.S.)

- RPC Group plc (U.K.)

- Winpak Ltd. (Canada)

- AptarGroup Inc.(U.S.)

- Sonoco Products Company (U.S.)

- Silgan Holdings Inc. (U.S.)

- Tetra Laval (Switzerland)

- DS Smith (U.K.)

- Can-Pack S.A. (Poland)

- ProAmpac (U.S.)

- Metsä Board (Finland)

- BillerudKorsnäs (Sweden)

- Mayr-Melnhof Karton (Austria)

- Elopak (Norway)

- AR Packaging (Sweden)

What are the Recent Developments in Global Home Care Paper Packaging Market?

- In November 2024, Amcor plc introduced a new line of eco-friendly paper-based cartons tailored for home care products, with a special focus on laundry detergents. These innovative cartons are made from 100% recycled paperboard and incorporate advanced barrier technologies to ensure product integrity and shelf stability. The launch reflects Amcor’s ongoing commitment to sustainable packaging and its strategy to reduce environmental impact across diverse consumer segments. By combining recyclability with high performance, Amcor continues to lead the way in developing responsible packaging solutions for everyday household needs

- In August 2024, Smurfit Kappa and WestRock officially completed their merger, forming Smurfit WestRock, now recognized as the world’s largest paper-based packaging company. This strategic consolidation brings together extensive expertise and resources, significantly boosting their capabilities in producing sustainable packaging solutions—especially for home care products such as corrugated boxes and paperboard cartons. The merger supports their shared vision of expanding their global footprint, with operations spanning 42 countries, and strengthens their position in the household care market through innovation, scale, and environmental stewardship

- In June 2024, Sonoco Products Company announced a strategic partnership with Unilever to co-develop a new range of fully recyclable paperboard containers for home care products, including dishwashing liquids and cleaning agents. These containers are made from 100% recycled paperboard, with up to 90% post-consumer content, and are designed to reduce reliance on plastic packaging while maintaining product integrity and shelf life. The initiative reflects both companies’ commitment to circular packaging solutions and responds to growing consumer demand for eco-conscious alternatives in everyday household items

- In March 2024, Grove Collaborative Holdings, Inc. unveiled a rebranded Grove Co. product line featuring FSC-certified paperboard packaging for its home care products, including air care and toiletries. This initiative reflects Grove’s mission to reduce reliance on plastic and promote eco-conscious alternatives in everyday household items. The rebrand emphasizes sustainability, ingredient transparency, and design innovation, aiming to resonate with consumers seeking planet-friendly solutions. Grove Co.’s updated packaging also earned recognition in the 2024 Dieline Awards for its bold, sustainable design

- In January 2024, DS Smith PLC acquired a European sustainable packaging firm specializing in paper-based solutions for home care applications. This move enhances DS Smith’s capabilities in producing recyclable cartons and pouches tailored for products such as laundry detergents and cleaning agents. The acquisition supports DS Smith’s strategy to grow its presence in the European market, while reinforcing its commitment to circular packaging, eco-friendly materials, and innovation in fiber-based solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Home Care Paper Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Home Care Paper Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Home Care Paper Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.