Global Home Healthcare Software Market

Market Size in USD Billion

CAGR :

%

USD

12.21 Billion

USD

24.16 Billion

2024

2032

USD

12.21 Billion

USD

24.16 Billion

2024

2032

| 2025 –2032 | |

| USD 12.21 Billion | |

| USD 24.16 Billion | |

|

|

|

|

Home Healthcare Software Market Size

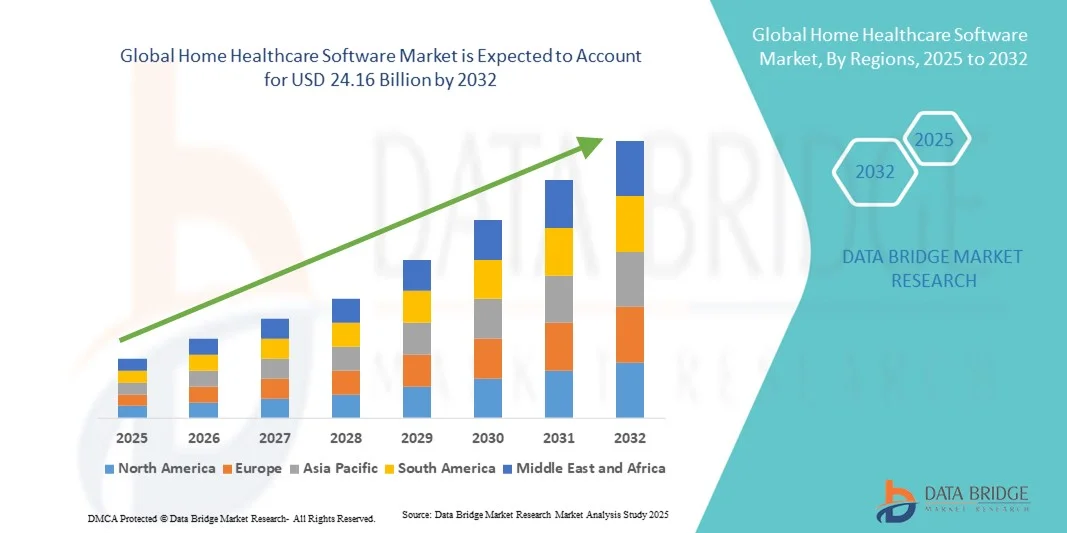

- The global home healthcare software market size was valued at USD 12.21 billion in 2024 and is expected to reach USD 24.16 billion by 2032, at a CAGR of 8.90% during the forecast period

- The market growth of Home Healthcare Software is largely fueled by the growing adoption and technological advancements in connected healthcare devices and digital health solutions, driving increased digitalization across both residential and clinical settings

- Furthermore, rising consumer demand for secure, user-friendly, and integrated platforms for remote patient monitoring, telehealth, and health data management is positioning Home Healthcare Software as a critical solution in modern healthcare delivery. These converging factors are accelerating the adoption of Home Healthcare Software solutions, thereby significantly boosting the overall growth of the industry

Home Healthcare Software Market Analysis

- Home Healthcare Software, offering digital solutions for patient monitoring, care coordination, and telehealth management, is becoming an essential tool for healthcare providers to enhance efficiency, improve patient outcomes, and enable remote care in both residential and clinical settings

- The rising demand for Home Healthcare Software is primarily fueled by the growing adoption of telemedicine, increased patient awareness of remote healthcare services, and the need for streamlined clinical workflows

- North America dominated the home healthcare software market with the largest revenue share of 42.55% in 2024, driven by advanced healthcare infrastructure, high adoption of digital health technologies, and the presence of leading software developers. The U.S. experienced substantial growth due to the integration of electronic health records (EHRs), remote patient monitoring systems, and AI-enabled care platforms, along with favorable reimbursement policies and regulatory support

- Asia-Pacific is expected to be the fastest-growing region in the home healthcare software market during the forecast period, driven by increasing urbanization, rising disposable incomes, expanding internet and mobile penetration, and government initiatives promoting digital health in countries such as China, India, and Japan

- The handheld devices/smartphones segment dominated the home healthcare software market with a revenue share of 46% in 2024, driven by widespread adoption of mobile health applications for monitoring, scheduling, and teleconsultations

Report Scope and Home Healthcare Software Market Segmentation

|

Attributes |

Home Healthcare Software Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Home Healthcare Software Market Trends

Enhanced Convenience Through Advanced Digital Integration

- A significant and accelerating trend in the global Home Healthcare Software market is the increasing adoption of integrated digital platforms that enhance patient care, monitoring, and administrative efficiency. These solutions are enabling healthcare providers to manage patient data, track treatment progress, and communicate with patients in real time, improving overall healthcare outcomes

- For instance, modern home healthcare software allows seamless scheduling, remote patient monitoring, and real-time alerts for caregivers, ensuring timely interventions and optimized resource allocation. Similarly, some platforms provide comprehensive dashboards to track multiple patients, enabling efficient care management across various homecare settings

- Integration with electronic health records (EHR) and cloud-based systems allows healthcare professionals to access critical patient information securely, facilitating data-driven decision-making. These features enhance coordination among caregivers, reduce errors, and support compliance with healthcare regulations

- Mobile and web-based interfaces offer patients and caregivers convenient access to treatment plans, medication reminders, and teleconsultation services, promoting adherence to care protocols and improving patient satisfaction

- The trend towards more interconnected and user-friendly home healthcare platforms is reshaping expectations for home-based care delivery, emphasizing efficiency, transparency, and personalized support. Consequently, companies are developing software with features such as remote monitoring, customizable care plans, and secure data management to meet the evolving needs of both patients and caregiver

- The demand for comprehensive home healthcare software solutions is growing rapidly across residential and clinical settings, as healthcare providers increasingly prioritize seamless workflow integration, enhanced patient engagement, and improved clinical outcomes

Home Healthcare Software Market Dynamics

Driver

Growing Need Due to Expanding Remote Care and Digital Health Adoption

- The increasing prevalence of chronic diseases, aging populations, and the rising need for remote patient monitoring are significant drivers for the heightened demand for Home Healthcare Software

- For instance, in April 2024, Cerner Corporation announced the launch of an advanced cloud-based remote patient monitoring platform aimed at improving care coordination and enabling timely interventions for chronic disease patients. Such initiatives by leading companies are expected to drive the Home Healthcare Software industry growth in the forecast period

- As healthcare providers seek to improve patient outcomes while reducing hospital visits, Home Healthcare Software offers advanced features such as real-time monitoring, electronic health record integration, and data analytics, providing a compelling upgrade over traditional care delivery methods

- Furthermore, the growing adoption of telehealth services and the desire for integrated digital health ecosystems are making Home Healthcare Software an essential component of modern healthcare delivery, enabling seamless communication between patients, caregivers, and clinicians

- The convenience of remote monitoring, virtual consultations, and automated care alerts, coupled with increasing investments in healthcare IT infrastructure, are key factors propelling the adoption of Home Healthcare Software across hospitals, specialty clinics, and homecare providers. The trend towards digital health solutions and the increasing availability of user-friendly software platforms further contribute to market growth

Restraint/Challenge

Concerns Regarding Data Privacy and High Implementation Costs

- Concerns surrounding data privacy and cybersecurity in connected healthcare systems pose a significant challenge to broader market penetration. Home Healthcare Software often stores sensitive patient data, making it a target for potential breaches or unauthorized access, raising anxieties among healthcare providers and patients

- For instance, reports of vulnerabilities in electronic health record systems have made some providers hesitant to adopt remote monitoring or telehealth solutions

- Addressing these concerns through robust encryption, secure authentication protocols, and compliance with regulations such as HIPAA is crucial for building trust among users. Companies such as Philips Healthcare and Allscripts emphasize their advanced security measures and compliance features in their marketing to reassure potential clients

- In addition, the relatively high initial cost of advanced Home Healthcare Software systems compared to conventional care methods can be a barrier to adoption, especially for small clinics or budget-constrained homecare providers. While prices are gradually decreasing, premium features such as AI-based predictive analytics and integrated remote monitoring often come with higher costs

- Overcoming these challenges through enhanced cybersecurity measures, provider education on best practices, and the development of more cost-effective solutions will be vital for sustained market growth

Home Healthcare Software Market Scope

The market is segmented on the basis of equipment, deployment, mode, service, software, and end user.

- By Equipment

On the basis of equipment, the home healthcare software market is segmented into monitoring equipment, therapeutic equipment, mobility assist, and others. The monitoring equipment segment dominated the largest market revenue share of 42.5% in 2024, driven by the growing reliance on remote patient monitoring for chronic diseases, elderly care, and post-surgical recovery. These devices offer real-time tracking of vital signs, alert caregivers to anomalies, and provide comprehensive data analytics for healthcare providers. Increased awareness of proactive healthcare and the convenience of continuous monitoring at home have accelerated adoption. The integration of monitoring equipment with telehealth platforms enables seamless communication between patients and healthcare professionals, reducing hospital readmissions and ensuring timely interventions. Government initiatives promoting home healthcare and technological advancements further bolster the demand for monitoring solutions. Patients benefit from enhanced safety and better health outcomes, while providers optimize resource utilization and reduce operational costs.

The therapeutic equipment segment is expected to witness the fastest CAGR of 23.1% from 2025 to 2032, driven by rising demand for at-home rehabilitation, chronic disease management, and remote therapy services. Therapeutic equipment encompasses devices for physical therapy, respiratory therapy, and other treatment regimens administered at home. The increasing preference for home-based care, coupled with improved technology integration and real-time monitoring, supports growth. Patients gain consistent therapy without frequent hospital visits, while healthcare providers can track progress through connected platforms. In addition, the growing geriatric population and increased prevalence of lifestyle-related health conditions contribute to rapid adoption. Continuous product innovation and enhanced user-friendly designs make therapeutic equipment more accessible and effective, further accelerating market expansion.

- By Deployment

On the basis of deployment, the home healthcare software market is segmented into on-premise, web-based, and cloud-based solutions. The cloud-based segment held the largest market revenue share of 44% in 2024, due to its scalability, secure remote access, cost-effectiveness, and ability to integrate with multiple healthcare systems. Cloud-based solutions enable real-time patient monitoring, centralized data storage, and easy access for multi-location agencies. They also support telehealth services, ensuring patients receive continuous care without hospital visits. Increasing adoption is driven by the flexibility, lower infrastructure investment, and enhanced collaboration between patients, caregivers, and healthcare providers. The convenience of remote configuration, seamless software updates, and regulatory compliance adds to its dominance.

The web-based segment is expected to witness the fastest CAGR of 21.5% from 2025 to 2032, propelled by its accessibility via standard browsers, minimal hardware requirements, and ability to integrate with multiple devices. Web-based solutions facilitate real-time monitoring, data sharing, and teleconsultation, improving care efficiency. Healthcare providers can manage patient records, appointments, and treatment plans remotely, ensuring enhanced service delivery. The segment benefits from growing digital literacy, demand for remote healthcare, and the trend of connected home-based care systems.

- By Mode

On the basis of mode, the home healthcare software market is segmented into PC/laptop and handheld devices/smartphones. The handheld devices/smartphones segment dominated the market with a revenue share of 46% in 2024, driven by widespread adoption of mobile health applications for monitoring, scheduling, and teleconsultations. Mobile devices provide real-time notifications, remote patient access, and seamless communication with caregivers. The portability, convenience, and user-friendly interfaces enhance patient engagement and adherence to care plans. This segment is further supported by the increasing penetration of smartphones, app-based health platforms, and mobile-compatible medical devices, making care delivery more efficient and accessible.

The PC/laptop segment is expected to witness the fastest CAGR of 22.8% from 2025 to 2032, supported by its robust capabilities for managing large patient datasets, clinical reporting, and administrative functions. PCs/laptops provide healthcare agencies with comprehensive dashboards to monitor therapy progress, billing, and regulatory compliance. The segment benefits from healthcare providers’ preference for detailed analysis, large-screen interfaces, and secure data storage. Integration with electronic health records (EHR) and enterprise management systems further drives growth.

- By Service

On the basis of service, the home healthcare software market is segmented into rehabilitation, infusion therapy, respiratory therapy, pregnancy care, skilled nursing, palliative care, and others. The skilled nursing segment accounted for the largest market revenue share of 41% in 2024, driven by the increasing demand for professional nursing care at home. Skilled nursing services address chronic illnesses, post-surgical care, and elderly support. Patients receive personalized care, medication management, and continuous monitoring, improving health outcomes. Providers benefit from improved patient adherence and reduced hospital stays. The segment is further supported by rising geriatric populations, homecare agency expansion, and government programs promoting at-home medical care. The growing emphasis on patient-centered care and quality of service strengthens its market position.

The rehabilitation segment is expected to witness the fastest CAGR of 24.2% from 2025 to 2032, fueled by increasing demand for at-home physical and occupational therapy. Rehabilitation services leverage technology-enabled platforms for remote monitoring, progress tracking, and virtual guidance. Patients benefit from convenience, reduced travel, and personalized therapy plans. Growth is further driven by rising musculoskeletal disorders, aging populations, and increased healthcare awareness. Integration of wearable devices and mobile apps enhances therapy effectiveness, while tele-rehabilitation platforms expand the reach of care providers.

- By Software

On the basis of software, the home healthcare software market is segmented into agency software, clinical management systems, hospice solutions applications, and telehealth solutions. Clinical management systems dominated the market with a revenue share of 43% in 2024, due to their comprehensive capabilities in scheduling, patient record management, billing, and regulatory compliance. These systems allow agencies to streamline operations, enhance patient care quality, and ensure accurate reporting. The widespread adoption of clinical management systems is supported by technological advancements, increasing home healthcare demand, and the need for centralized data management.

Telehealth solutions are expected to witness the fastest CAGR of 25% from 2025 to 2032, driven by increasing adoption of remote consultation, government support, and patient preference for at-home care. Telehealth enables continuous patient monitoring, virtual check-ins, and real-time communication with providers. The segment benefits from rising chronic diseases, digital literacy, and the need for timely interventions. Its scalability, flexibility, and ability to integrate with monitoring and therapy equipment further accelerate growth. Furthermore, advancements in AI-driven diagnostics and wearable devices are enhancing telehealth capabilities, allowing for more personalized and proactive care. Growing partnerships between healthcare providers and technology companies are also expanding service offerings and accessibility, supporting sustained market growth.

- By End User

On the basis of end user, the home healthcare software market is segmented into homecare agencies, hospice care, private duty agencies, and rehabilitation centres/therapy centres. Homecare agencies accounted for the largest market revenue share of 42% in 2024, as they form the backbone of structured care services for elderly and chronically ill patients. These agencies provide comprehensive home-based care, ranging from medical supervision to daily living assistance. The dominance is driven by increased awareness of homecare benefits, growing elderly population, and expansion of private healthcare networks.

Rehabilitation centres/therapy centres are expected to witness the fastest CAGR of 23.5% from 2025 to 2032, supported by the increasing preference for home-based therapy, integration with clinical software, and emphasis on patient recovery programs. These centres leverage technology to monitor progress, adjust therapy plans, and ensure adherence to protocols. Rising musculoskeletal disorders, demand for non-hospital-based care, and growing focus on cost-effective rehabilitation solutions contribute to accelerated growth. In addition, the adoption of tele-rehabilitation and virtual therapy sessions is expanding the reach of these centres to remote and underserved areas. The growing collaboration with healthcare providers and insurance companies further enhances accessibility and affordability, driving sustained market expansion.

Home Healthcare Software Market Regional Analysis

- North America dominated the home healthcare software market with the largest revenue share of 42.55% in 2024, driven by advanced healthcare infrastructure, high adoption of digital health technologies, and the presence of leading software developers

- The market experienced substantial growth due to the integration of electronic health records (EHRs), remote patient monitoring systems, and AI-enabled care platforms, along with favorable reimbursement policies and regulatory support

- Increasing awareness of digital health solutions among healthcare providers and patients is further propelling market expansion, particularly in hospitals, specialty clinics, and homecare services

U.S. Home Healthcare Software Market Insight

The U.S. home healthcare software market captured the largest revenue share within North America in 2024, fueled by the integration of electronic health records (EHRs), remote patient monitoring systems, and AI-enabled care platforms. Favorable reimbursement frameworks, regulatory support, and high patient awareness of digital healthcare solutions are driving substantial adoption. In addition, increasing investments in telehealth and digital therapeutics are accelerating market expansion across hospitals, specialty centers, and homecare services.

Europe Home Healthcare Software Market Insight

The Europe home healthcare software market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by government initiatives supporting digital health adoption, the rising prevalence of chronic diseases, and increased investment in healthcare IT infrastructure. Countries such as Germany, the U.K., and France are witnessing significant growth due to the development of integrated health systems, ongoing clinical research, and the adoption of innovative software platforms. Improved access to digital care solutions and a focus on patient-centric care models are further fueling market expansion across the region.

U.K. Home Healthcare Software Market Insight

The U.K. home healthcare software market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing adoption of telehealth services, digital patient management systems, and enhanced regulatory support for healthcare IT. The rising prevalence of chronic diseases, coupled with patient preference for remote monitoring and home-based care, is encouraging hospitals and specialty clinics to adopt advanced software solutions. Investments in healthcare IT infrastructure and integration with national health programs are further stimulating market growth.

Germany Home Healthcare Software Market Insight

The Germany home healthcare software market is expected to expand at a considerable CAGR during the forecast period, fueled by rising demand for innovative healthcare IT solutions, government incentives for digital health, and growing awareness of efficient care delivery systems. Hospitals, specialty clinics, and homecare providers are increasingly leveraging electronic health records, remote monitoring platforms, and AI-enabled software to improve patient outcomes. The focus on sustainability and streamlined healthcare operations is also promoting market adoption.

Asia-Pacific Home Healthcare Software Market Insight

The Asia-Pacific home healthcare software market is poised to grow at the fastest CAGR during the forecast period, driven by increasing urbanization, rising disposable incomes, expanding internet and mobile penetration, and government initiatives promoting digital health in countries such as China, India, and Japan. Growing awareness of chronic disease management and remote patient monitoring, coupled with investment in healthcare IT infrastructure, is boosting the adoption of Home Healthcare Software solutions. The region’s expanding healthcare access and ongoing digital transformation efforts are further enhancing market opportunities.

Japan Home Healthcare Software Market Insight

The Japan home healthcare software market is gaining momentum due to the country’s rapid urbanization, technologically advanced healthcare infrastructure, and growing focus on patient-centric care. Rising adoption of electronic health records, remote monitoring systems, and digital health platforms in hospitals and specialty clinics is driving market growth. Furthermore, an aging population and increasing demand for home-based healthcare solutions are expected to continue fueling adoption during the forecast period.

China Home Healthcare Software Market Insight

The China home healthcare software market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to the country’s expanding healthcare access, rising middle-class population, and increasing investment in healthcare infrastructure for digital health solutions. Growth is supported by government initiatives promoting telehealth and remote patient monitoring, rising awareness of chronic disease management, and strong adoption of hospital and homecare software platforms. Expanding internet and mobile penetration, along with a focus on healthcare modernization, are key factors driving the market forward.

Home Healthcare Software Market Share

The Home Healthcare Software industry is primarily led by well-established companies, including:

- Koninklijke Philips N.V. (Netherlands)

- Medtronic (Ireland)

- CARDINAL HEALTH (U.S.)

- BAYADA Home Health Care (U.S.)

- Bupa (U.K.)

- Healthcare at Home (U.K.)

- Allscripts Healthcare Solutions (U.S.)

- Oracle (U.S.)

- McKesson Corporation (U.S.)

- Epic Systems Corporation (U.S.)

Latest Developments in Global Home Healthcare Software Market

- In November 2023, LifeSigns introduced its AI-powered remote patient monitoring solution specifically designed for rural and Tier-III cities in India, in collaboration with RailTel. This initiative focuses on improving healthcare access in underserved areas by leveraging AI-driven software and enhanced connectivity, enabling hospitals and clinics to deliver continuous monitoring for patients outside traditional care settings

- In December 2023, AJ Hospital and Research Centre in Mangaluru, India, implemented Dozee’s AI-based contactless remote patient monitoring (RPM) and Early Warning System (EWS) across 50 hospital beds. The software allows clinicians to automatically track vital signs such as heart rate, respiration, and oxygen levels, while generating early alerts to prevent critical health events, showcasing how digital health platforms are enhancing patient safety and efficiency

- In September 2024, Philips completed the acquisition of BioTelemetry, Inc., a leading provider of remote cardiac monitoring and diagnostics. Through this acquisition, Philips strengthened its home healthcare software portfolio, particularly in chronic disease management and remote monitoring, reinforcing its position as a global leader in digital health solutions

- In May 2025, Axle Health secured USD10 million in Series A funding led by F-Prime Capital to expand its AI-powered logistics software for home healthcare providers. The platform optimizes scheduling, routing, and patient engagement, helping care teams deliver timely and efficient in-home services. This development highlights the growing demand for software solutions that streamline operations in the rapidly expanding home healthcare sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.