Global Home Insemination Products Market

Market Size in USD Billion

CAGR :

%

USD

4.69 Billion

USD

6.25 Billion

2025

2033

USD

4.69 Billion

USD

6.25 Billion

2025

2033

| 2026 –2033 | |

| USD 4.69 Billion | |

| USD 6.25 Billion | |

|

|

|

|

Home Insemination Products Market Size

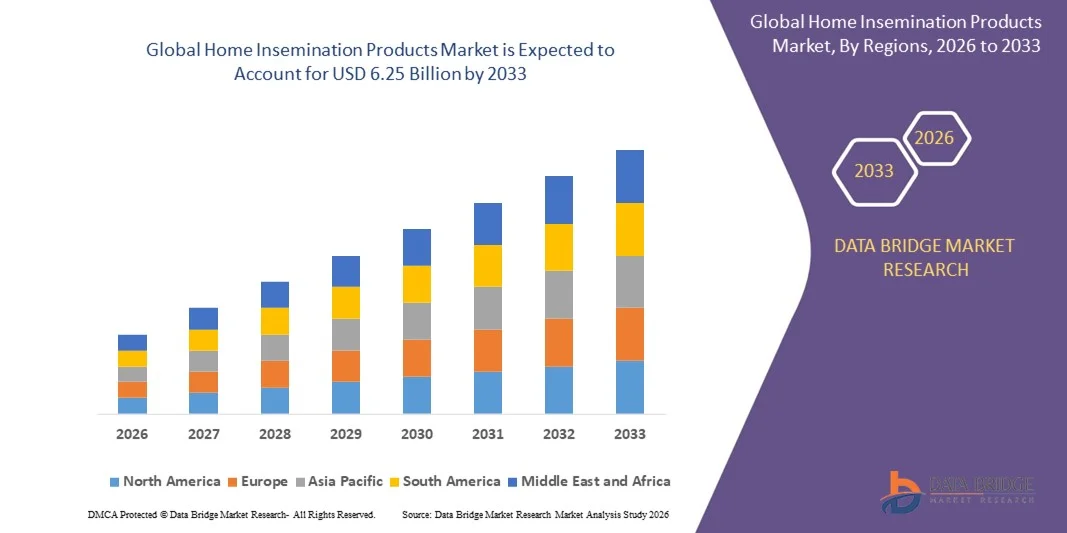

- The global home insemination products market size was valued at USD 4.69 billion in 2025 and is expected to reach USD 6.25 billion by 2033, at a CAGR of 3.65% during the forecast period

- The market growth is largely fueled by increasing awareness and adoption of assisted reproductive technologies, coupled with advancements in user-friendly home conception devices. Rising digitalization and the integration of telehealth and instructional apps are enabling safer, more convenient at-home fertility solutions, enhancing accessibility for consumers seeking privacy and autonomy in conception

- Furthermore, growing demand for reliable, clinically approved, and easy-to-use home insemination kits is establishing these products as a preferred alternative to frequent clinic visits. These converging factors are accelerating the uptake of home-based fertility solutions, thereby significantly boosting the market's expansion

Home Insemination Products Market Analysis

- Home insemination products, including conception devices, insemination kits, and related accessories, are becoming essential tools for individuals and couples pursuing assisted conception at home due to their convenience, discretion, and cost-effectiveness

- The escalating demand for home insemination products is primarily fueled by rising infertility rates, increasing consumer preference for privacy in reproductive health, growing telemedicine adoption, and the availability of advanced, clinically validated products that enhance success rates and user confidence

- North America dominated home insemination products market with a share of in 2025, due to increasing awareness of fertility solutions, rising adoption of home-based conception techniques, and the presence of well-established fertility clinics

- Asia-Pacific is expected to be the fastest growing region in the home insemination products market during the forecast period due to rising infertility rates, increasing disposable incomes, and growing acceptance of assisted reproductive technologies in countries such as China, Japan, and India

- Intracervical insemination segment dominated the market with a market share of 52.5% in 2025, due to its simplicity, safety, and suitability for home use without clinical supervision. This method is widely adopted due to lower costs and minimal technical requirements, making it accessible to a broader consumer base. Increasing awareness about fertility options and comfort with self-administered procedures contribute to its strong market position

Report Scope and Home Insemination Products Market Segmentation

|

Attributes |

Home Insemination Products Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Home Insemination Products Market Trends

Rising Adoption of At-Home Fertility Solutions

- A significant trend in the home insemination products market is the increasing adoption of at-home fertility solutions, driven by the growing need for privacy, convenience, and accessibility in reproductive health. These solutions are enabling individuals and couples to explore conception options in non-clinical settings while maintaining medical oversight

- For instance, companies such as Seattle Sperm Bank and SpermCheck provide at-home insemination kits and fertility testing products that allow users to conduct procedures safely at home with guidance from certified reproductive specialists. These solutions are enhancing user confidence and reducing the need for frequent clinic visits

- The rising focus on personalized fertility care is supporting the trend of integrating advanced home insemination technologies, including sperm collection devices, ovulation tracking, and guided AI-based instructions. This is positioning home insemination products as an important complement to assisted reproductive technologies

- Healthcare providers and fertility clinics are increasingly recommending home-based insemination options for eligible patients, especially for those facing mobility constraints or scheduling challenges. This trend is reinforcing patient-centered approaches and widening access to reproductive care

- Consumer awareness regarding fertility preservation and reproductive planning is driving acceptance of home insemination products. Educational campaigns and online platforms are helping users understand safe and effective practices, fostering broader market adoption

- The market is witnessing innovation in product design, usability, and safety, with features such as easy-to-use applicators, discreet packaging, and sterile supplies. These enhancements are boosting consumer trust and contributing to the overall growth of home-based fertility solutions

Home Insemination Products Market Dynamics

Driver

Increasing Awareness and Acceptance of Assisted Reproductive Technologies

- The growing awareness of assisted reproductive technologies (ART) and their efficacy is driving the adoption of home insemination products, as more individuals seek convenient and private conception methods. This trend is supported by increasing information availability and telemedicine consultations in reproductive health

- For instance, companies such as INVO Bioscience provide at-home insemination and vaginal incubator systems that empower users to perform procedures safely under remote clinical guidance. This is expanding accessibility and reinforcing consumer confidence in non-traditional conception methods

- Rising societal acceptance of alternative family planning options, including single-parent and LGBTQ+ households, is expanding the potential user base for home insemination solutions. The recognition of diverse reproductive needs is contributing to stronger market demand

- Digital fertility platforms and online counseling services are supporting informed decision-making, allowing users to access educational resources, step-by-step guidance, and clinical monitoring from home. This integration of technology is enhancing the adoption of at-home insemination methods

- Continuous research and validation of home-based conception methods are reinforcing their reliability and safety, which encourages more healthcare professionals to recommend these options to patients. This scientific backing is a key driver for broader market growth

Restraint/Challenge

Regulatory and Safety Compliance for Home-Based Conception Products

- The home insemination products market faces challenges due to stringent regulatory and safety compliance requirements, which vary by region and involve complex legal and ethical considerations. Adhering to these standards increases operational complexity for manufacturers

- For instance, companies such as Fairfax Cryobank must navigate FDA regulations, state-level fertility laws, and quality certifications to ensure their products meet safety and efficacy standards. Compliance requirements can slow product launches and increase development costs

- Ensuring sterility, safe handling of biological materials, and accurate instructions for home use adds operational and logistical challenges. Manufacturers must maintain rigorous quality control to protect user health and prevent liability risks

- The lack of harmonized international standards for home-based insemination products creates additional hurdles for companies seeking global expansion. This fragmentation requires tailored regulatory strategies for each market

- Market growth is further constrained by the need to educate consumers on safe usage while complying with medical guidelines, limiting spontaneous adoption. Companies must invest in training, customer support, and regulatory approvals to mitigate safety concerns and ensure responsible market development

Home Insemination Products Market Scope

The market is segmented on the basis of product, type, and end-user.

- By Product

On the basis of product, the Home Insemination Products market is segmented into home conception devices, insemination kits, and accessories. The insemination kits segment dominated the market with the largest revenue share in 2025, driven by their comprehensive nature, ease of use, and affordability for at-home fertility attempts. These kits typically include syringes, collection containers, and guidance materials, making them a preferred option for individuals seeking privacy and convenience. Growing awareness of fertility planning and increasing acceptance of self-administered reproductive solutions further support the dominance of this segment. In addition, the availability of medically guided and hygienic kits enhances user confidence and repeat purchases.

The home conception devices segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by technological advancements and increasing consumer preference for more precise and user-friendly solutions. These devices often improve sperm delivery efficiency and timing accuracy, which appeals to users aiming to increase conception success rates. Rising disposable income and growing demand for advanced at-home fertility solutions are further accelerating adoption.

- By Type

On the basis of type, the Home Insemination Products market is segmented into intracervical insemination and intrauterine insemination accessories. The intracervical insemination segment held the largest market revenue share of 52.5% in 2025, supported by its simplicity, safety, and suitability for home use without clinical supervision. This method is widely adopted due to lower costs and minimal technical requirements, making it accessible to a broader consumer base. Increasing awareness about fertility options and comfort with self-administered procedures contribute to its strong market position.

The intrauterine insemination accessories segment is expected to register the fastest growth during the forecast period, driven by rising preference for clinically aligned methods that enhance conception probability. Although primarily used under professional guidance, growing availability of supportive accessories for preparation and handling is expanding demand. Increasing collaboration between healthcare providers and product manufacturers also supports this growth trajectory.

- By End-User

On the basis of end-user, the Home Insemination Products market is segmented into hospitals & clinics, fertility centres, and home-based users. The home-based segment dominated the market in 2025, driven by increasing preference for privacy, convenience, and cost-effective fertility solutions. Consumers are increasingly opting for home-based insemination due to reduced dependency on clinical visits and greater control over the conception process. Growing social acceptance and online availability of products further strengthen this segment’s leadership.

The fertility centre segment is projected to witness the fastest growth rate from 2026 to 2033, supported by rising infertility rates and increasing reliance on specialized reproductive services. Fertility centres often recommend or retail home insemination products as part of assisted conception plans, boosting demand. Enhanced counseling, professional guidance, and integration of at-home solutions with clinical treatments are key factors driving this rapid growth.

Home Insemination Products Market Regional Analysis

- North America dominated the home insemination products market with the largest revenue share in 2025, driven by increasing awareness of fertility solutions, rising adoption of home-based conception techniques, and the presence of well-established fertility clinics

- Consumers in the region highly value the privacy, convenience, and cost-effectiveness offered by home insemination products, enabling them to manage conception without frequent clinic visits

- This widespread adoption is further supported by high disposable incomes, a technologically inclined population, and growing acceptance of assisted reproductive technologies, establishing home insemination products as a preferred solution for both personal and professional use

U.S. Home Insemination Products Market Insight

The U.S. home insemination products market captured the largest revenue share in 2025 within North America, fueled by increasing awareness of fertility options and rising adoption of at-home insemination kits. Consumers are prioritizing safe, effective, and user-friendly products for conception, while the growing trend of remote healthcare consultations supports home-based solutions. The expanding e-commerce and telemedicine channels further propel market growth, as these platforms facilitate easy access to products and instructional guidance. Moreover, supportive regulatory frameworks and widespread availability of fertility education are significantly contributing to market expansion.

Europe Home Insemination Products Market Insight

The Europe home insemination products market is projected to expand at a substantial CAGR throughout the forecast period, driven by rising infertility rates, increased awareness of assisted reproductive technologies, and the growing preference for at-home conception solutions. The increase in urbanization and technologically adept population is fostering the adoption of home insemination products. Consumers are drawn to the convenience, discretion, and reliability these products offer, supporting growth across residential and clinical applications in countries such as France and Germany.

U.K. Home Insemination Products Market Insight

The U.K. home insemination products market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by heightened awareness of fertility solutions and a desire for privacy and convenience. Concerns regarding time constraints, cost of clinical treatments, and social acceptance are encouraging both individuals and couples to adopt home-based insemination techniques. The country’s robust e-commerce infrastructure and telemedicine services are expected to continue stimulating market growth.

Germany Home Insemination Products Market Insight

The Germany home insemination products market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of fertility treatments and demand for technologically advanced and safe products. Germany’s well-developed healthcare system and emphasis on innovation promote the adoption of home insemination solutions, particularly in urban regions. The integration of guidance via mobile apps and teleconsultations is becoming increasingly prevalent, aligning with local consumer expectations for secure, user-friendly, and effective conception solutions.

Asia-Pacific Home Insemination Products Market Insight

The Asia-Pacific home insemination products market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rising infertility rates, increasing disposable incomes, and growing acceptance of assisted reproductive technologies in countries such as China, Japan, and India. The region's evolving healthcare infrastructure and digitalization initiatives are supporting the adoption of home-based fertility products. Furthermore, the emergence of domestic manufacturers and affordability of home insemination kits are expanding accessibility to a wider consumer base.

Japan Home Insemination Products Market Insight

The Japan home insemination products market is gaining momentum due to the country’s high-tech culture, aging population, and focus on convenience. The adoption of home-based conception solutions is driven by the growing number of couples seeking assisted reproductive options and preference for private, efficient methods. Integration with telehealth services and instructional digital tools is fueling growth, while the demand for secure and easy-to-use products is rising across both residential and clinical settings.

China Home Insemination Products Market Insight

The China home insemination products market accounted for the largest revenue share in Asia Pacific in 2025, attributed to rapid urbanization, rising infertility awareness, and strong technological adoption. China is emerging as a significant market for home fertility solutions, with increasing demand in both residential and fertility clinic settings. Government initiatives promoting reproductive health education, coupled with affordable and widely available products, are key factors driving market growth in the country.

Home Insemination Products Market Share

The home insemination products industry is primarily led by well-established companies, including:

- Rinovum Women’s Health, LLC (U.S.)

- Pride Angel (U.K.)

- KITAZATO CORPORATION (Japan)

- Rocket Medical plc (U.K.)

- Conception Kit (U.S.)

- Conceivex, Inc. (U.S.)

- Hamilton Thorne, Inc. (U.S.)

- Fairhaven Health (U.S.)

- Twoplus Fertility (Singapore)

- B‑Arm Medical Technologies (U.S.)

- Frida Fertility (U.S.)

- Clearblue (Switzerland)

Latest Developments in Global Home Insemination Products Market

- In December 2024, PherDal Fertility Science began taking pre‑orders for its sterile at‑home insemination kit following U.S. FDA Class II clearance, expanding consumer access to medically regulated home conception products. This milestone represents one of the first times a home insemination kit has received formal regulatory backing, significantly boosting user confidence and broadening the market beyond informal or non‑sterile devices. The product’s ready‑to‑order status signals rising acceptance of at‑home fertility solutions by regulatory authorities, encouraging other companies to pursue similar clearances and accelerating overall market growth

- In August 2024, Mosie Baby announced a strategic partnership with WIN, a major family building and well‑being benefits provider, to widen access to its at‑home insemination kit for WIN members and their healthcare providers. This collaboration illustrates how fertility benefits programs are beginning to embrace home‑based conception solutions as part of comprehensive reproductive health offerings, strengthening product uptake by employers and individuals seeking convenient, covered fertility care. Integrating home insemination kits into benefits frameworks elevates the market’s legitimacy and triggers increased demand

- In June 2024, CooperSurgical completed its acquisition of ZyMōt Fertility, which specializes in advanced sperm separation technologies that improve sperm quality for procedures including intrauterine and at‑home insemination. This acquisition enhances CooperSurgical’s product portfolio with cutting‑edge technology designed to increase success rates, indirectly benefiting the home insemination segment by driving innovation in pre‑insemination sperm preparation. Industry consolidation such as this also signals confidence in growth potential, encouraging investment and competition

- In September 2020, MedGyn acquired Thomas Medical, allowing MedGyn to focus on domestic manufacturing and global distribution while providing customers access to Thomas Medical’s product portfolio. This strategic move strengthened MedGyn’s market presence, expanded product availability, and enhanced supply chain capabilities, positively impacting the home insemination products market by improving accessibility and reliability of key devices

- In November 2020, SubhagHealthTech launched VConceive, the world’s first home‑based intrauterine insemination (IUI) kit, catalyzing market evolution by introducing clinical‑grade at‑home conception tools. This development expanded the home insemination product category from basic syringes to more sophisticated devices intended for use beyond simple cervical insemination. The launch helped broaden consumer perceptions of what was feasible outside clinical settings and encouraged other manufacturers to innovate in response to growing demand for advanced home fertility solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.