Global Home Outdoor Pest Control Devices Market

Market Size in USD Million

CAGR :

%

USD

211.72 Million

USD

453.83 Million

2024

2032

USD

211.72 Million

USD

453.83 Million

2024

2032

| 2025 –2032 | |

| USD 211.72 Million | |

| USD 453.83 Million | |

|

|

|

|

Home Outdoor Pest Control Devices Market Size

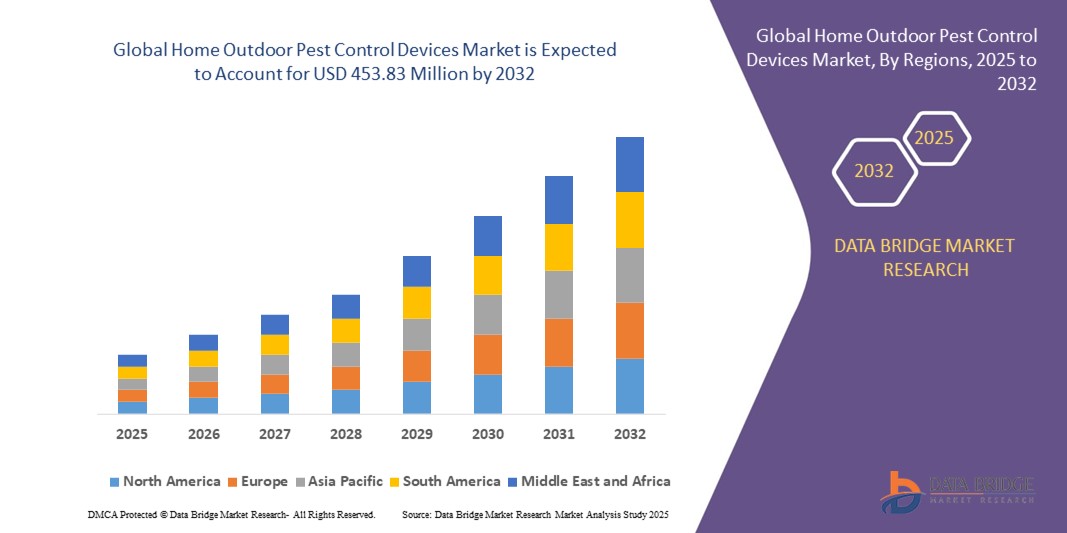

- The global home outdoor pest control devices market size was valued at USD 211.72 million in 2024 and is expected to reach USD 453.83 million by 2032, at a CAGR of 10.00% during the forecast period

- The market growth is primarily driven by increasing consumer awareness of health and hygiene, rising concerns about pest-related diseases, and growing demand for eco-friendly and sustainable pest control solutions

- The surge in demand for residential and commercial pest control, coupled with advancements in solar-powered and battery-powered devices, is further propelling market expansion across both online and offline distribution channels

Home Outdoor Pest Control Devices Market Analysis

- The home outdoor pest control devices market is experiencing robust growth due to heightened consumer focus on safe, effective, and environmentally friendly pest management solutions

- Growing demand from residential and commercial sectors, particularly for chemical-free and solar-powered devices, is encouraging manufacturers to innovate with high-efficiency, durable, and user-friendly products

- North America dominates the home outdoor pest control devices market with the largest revenue share of 35.2% in 2024, driven by a well-established consumer base, high awareness of pest control benefits, and widespread adoption of advanced pest control technologies

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, fueled by rapid urbanization, increasing disposable incomes, and rising awareness of pest-related health risks in countries such as China, India, and Southeast Asian nations

- The insects segment dominated the largest market revenue share of 38% in 2024, driven by the high prevalence of insect-related issues and the demand for effective solutions such as zappers and repellents to combat pests such as mosquitoes, ants, and flies

Report Scope and Home Outdoor Pest Control Devices Market Segmentation

|

Attributes |

Home Outdoor Pest Control Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Home Outdoor Pest Control Devices Market Trends

Increasing Integration of Smart Technology and IoT

- The global home outdoor pest control devices market is experiencing a notable trend toward the integration of smart technology and Internet of Things (IoT) solutions

- These technologies enable real-time pest monitoring, remote control of devices, and data-driven insights into pest activity, improving efficiency and user convenience

- Smart pest control devices, such as IoT-enabled traps and sensors, allow users to receive alerts and track pest activity via mobile apps, facilitating proactive pest management

- For instance, companies are developing smart rodent traps and insect zappers that use AI to analyze pest behavior and optimize control strategies, offering tailored solutions for residential and commercial users

- This trend enhances the appeal of pest control devices by providing eco-friendly, user-friendly, and highly effective solutions, driving adoption among tech-savvy consumers and businesses

- IoT integration also supports predictive maintenance of devices, ensuring optimal performance and reducing downtime for critical applications such as livestock and industrial settings

Home Outdoor Pest Control Devices Market Dynamics

Driver

Rising Awareness of Health Risks and Demand for Eco-Friendly Solutions

- Growing consumer awareness of health risks associated with pests, such as mosquito-borne diseases (e.g., dengue, West Nile virus) and rodent-transmitted illnesses, is a key driver for the global home outdoor pest control devices market

- These devices enhance safety by offering solutions such as zappers, rodent traps, and bird deterrents that protect outdoor spaces, including gardens, patios, and commercial properties

- Government initiatives and regulations, particularly in North America, promoting safe and sustainable pest control practices are accelerating the adoption of non-toxic and mechanical devices

- The rise of IoT and advancements in solar-powered and battery-powered devices enable more efficient and environmentally friendly pest control, supporting applications across residential, commercial, industrial, and livestock sectors

- Manufacturers are increasingly offering innovative products, such as citronella candles and ultrasonic repellents, as standard or optional features to meet consumer demand for sustainable and effective pest management

Restraint/Challenge

High Initial Costs and Data Privacy Concerns

- The high upfront costs of advanced pest control devices, particularly those incorporating smart technology, IoT, or solar-powered mechanisms, pose a significant barrier to adoption, especially in cost-sensitive regions such as Asia-Pacific and emerging markets

- Retrofitting existing outdoor spaces with modern pest control systems, such as electric or IoT-enabled devices, can be complex and expensive

- Data privacy and security concerns are a major challenge, as IoT-enabled pest control devices collect and transmit sensitive data, raising risks of breaches or misuse and requiring compliance with stringent data protection regulations

- The varied regulatory frameworks across countries regarding data collection, environmental impact, and chemical usage create operational challenges for global manufacturers and distributors

- These factors may deter adoption in regions with high privacy awareness or economic constraints, limiting market growth despite strong demand in North America, the dominating region, and Asia-Pacific, the fastest-growing region

Home Outdoor Pest Control Devices market Scope

The market is segmented on the basis of type, control method, product, mechanism, application, and distribution channel.

- By Type

On the basis of type, the global home outdoor pest control devices market is segmented into insects, rodents, termites, wildlife, and others. The insects segment dominated the largest market revenue share of 38% in 2024, driven by the high prevalence of insect-related issues and the demand for effective solutions such as zappers and repellents to combat pests such as mosquitoes, ants, and flies. This segment is fueled by rising consumer awareness of health risks associated with insect-borne diseases such as dengue and malaria.

The wildlife segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing urban-wildlife conflicts and the need for humane, eco-friendly solutions such as ultrasonic and reflective bird deterrents. Growing demand for non-toxic wildlife management in residential and commercial settings further accelerates adoption.

- By Control Method

On the basis of control method, the global home outdoor pest control devices market is segmented into chemical, mechanical, and biological. The chemical segment held the largest market revenue share of 60% in 2024, owing to its widespread use and high efficacy in quickly eliminating pests such as insects and rodents. Common chemical solutions include insecticides and rodenticides, favored for their accessibility and immediate results.

The biological segment is anticipated to experience the fastest growth rate of 10.5% from 2025 to 2032, driven by rising consumer preference for eco-friendly and sustainable pest management solutions. Advancements in biopesticides and integrated pest management (IPM) strategies, which minimize environmental impact, are boosting adoption across residential and agricultural applications.

- By Product

On the basis of product, the global home outdoor pest control devices market is segmented into zappers, bird deterrents, citronella candles and torches, rodent traps, and repellents. The zappers segment dominated the market with a revenue share of 36% in 2024, driven by their low-maintenance, chemical-free pest control solutions for outdoor areas, particularly for flying insects such as mosquitoes and flies.

The citronella candles and torches segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by consumer preference for natural, low-cost pest repellent options. These products are increasingly popular for small outdoor gatherings and events, aligning with the trend toward environmentally conscious solutions.

- By Mechanism

On the basis of mechanism, the global home outdoor pest control devices market is segmented into electric devices, battery-powered devices, and solar-powered devices. The electric devices segment held the largest market revenue share of 55% in 2024, driven by their reliability and effectiveness in pest control, particularly for zappers and electronic traps, which offer consistent performance in various outdoor settings.

The solar-powered devices segment is anticipated to witness the fastest growth rate of 12.8% from 2025 to 2032, driven by advancements in solar panel efficiency and growing consumer demand for sustainable, cost-effective pest control solutions. These devices are particularly appealing in off-grid and remote areas, enhancing their adoption in residential and agricultural applications.

- By Application

On the basis of application, the global home outdoor pest control devices market is segmented into residential, commercial, industrial, livestock, and others. The residential segment dominated the market with a revenue share of 55% in 2024, driven by high consumer demand for pest-free outdoor living spaces, such as gardens and patios, to ensure comfort and safety.

The commercial segment is expected to witness rapid growth from 2025 to 2032, fueled by increasing adoption of pest control devices in commercial spaces such as restaurants, hotels, and warehouses. The need for regulatory compliance and maintaining sanitation standards in these settings drives demand for advanced pest management solutions.

- By Distribution Channel

On the basis of distribution channel, the global home outdoor pest control devices market is segmented into online and offline. The offline segment held the largest market revenue share of 61% in 2024, driven by the accessibility of physical stores and the ability to provide product demonstrations, which influence consumer purchasing decisions.

The online segment is anticipated to witness the fastest growth rate of 11.2% from 2025 to 2032, driven by the increasing popularity of e-commerce platforms, convenience of online shopping, and growing consumer trust in digital retail for pest control products. The expansion of online marketplaces and direct-to-consumer channels further accelerates this trend.

Home Outdoor Pest Control Devices Market Regional Analysis

- North America dominates the home outdoor pest control devices market with the largest revenue share of 35.2% in 2024, driven by a well-established consumer base, high awareness of pest control benefits, and widespread adoption of advanced pest control technologies

- Consumers prioritize pest control devices for health protection, property preservation, and enhancing outdoor living experiences, particularly in regions with high pest prevalence due to diverse climates

- Growth is supported by advancements in pest control technology, such as ultrasonic and solar-powered devices, alongside increasing adoption in residential and commercial applications

U.S. Home Outdoor Pest Control Devices Market Insight

The U.S. home outdoor pest control devices market captured the largest revenue share of 77.3% in 2024 within North America, fueled by strong aftermarket demand and growing consumer awareness of health risks associated with pests, such as mosquito-borne diseases. The trend towards eco-friendly solutions, such as chemical-free zappers and repellents, and increasing regulations promoting safer pest control standards further boost market expansion. The integration of pest control devices in residential settings complements aftermarket sales, creating a diverse product ecosystem.

Europe Home Outdoor Pest Control Devices Market Insight

The Europe home outdoor pest control devices market is expected to witness significant growth, supported by regulatory emphasis on environmental sustainability and consumer demand for health-conscious pest control solutions. Consumers seek devices that offer effective pest management while minimizing environmental impact, such as ultrasonic repellents and biological controls. The growth is prominent in both residential and commercial applications, with countries such as Germany and the U.K. showing significant uptake due to rising health concerns and urban pest challenges.

U.K. Home Outdoor Pest Control Devices Market Insight

The U.K. market for home outdoor pest control devices is expected to witness rapid growth, driven by demand for health protection and property maintenance in urban and suburban settings. Increased interest in eco-friendly devices, such as citronella candles and solar-powered zappers, and rising awareness of vector-borne disease prevention encourage adoption. Evolving regulations balancing pest control efficacy with environmental safety influence consumer choices, promoting compliance with non-toxic solutions.

Germany Home Outdoor Pest Control Devices Market Insight

Germany is expected to witness rapid growth in the home outdoor pest control devices market, attributed to its advanced technological infrastructure and high consumer focus on sustainable pest management. German consumers prefer innovative devices, such as IoT-enabled pest monitoring systems and solar-powered repellents that reduce environmental impact and enhance convenience. The integration of these devices in residential and commercial settings, along with strong aftermarket demand, supports sustained market growth.

Asia-Pacific Home Outdoor Pest Control Devices Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by rapid urbanization, rising disposable incomes, and increasing pest-related health concerns in countries such as China, India, and Japan. Growing awareness of vector-borne diseases, property damage, and the need for pest-free outdoor spaces boosts demand for advanced pest control devices. Government initiatives promoting environmental sustainability and public health further encourage the adoption of innovative solutions such as solar-powered and ultrasonic devices.

Japan Home Outdoor Pest Control Devices Market Insight

Japan’s home outdoor pest control devices market is expected to witness rapid growth due to strong consumer preference for high-quality, technologically advanced devices that enhance outdoor comfort and safety. The presence of major manufacturers and the integration of pest control devices in residential and commercial settings accelerate market penetration. Rising interest in eco-friendly aftermarket solutions, such as battery-powered repellents, also contributes to growth.

China Home Outdoor Pest Control Devices Market Insight

China holds the largest share of the Asia-Pacific home outdoor pest control devices market, propelled by rapid urbanization, rising vehicle ownership, and increasing demand for health and property protection solutions. The country’s growing middle class and focus on sustainable living support the adoption of advanced devices, such as smart pest control systems. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility, driving growth in both residential and commercial applications.

Home Outdoor Pest Control Devices Market Share

The home outdoor pest control devices industry is primarily led by well-established companies, including:

- Ecolab (U.S.)

- Rollins, Inc. (U.S.)

- Olee International Pte Ltd. (Singapore)

- STV International Ltd (U.K.)

- Rentokil Initial plc (U.K.)

- MASSEY SERVICES, INC. (U.S.)

- Bell Labs (U.S.)

- Bird B Gone LLC. (U.S.)

- Bird-X (U.S.)

- Eaton (U.S.)

- Nixalite of America Inc (U.S.)

- Thermacell (U.S.)

- Spectrum Brands Holdings Inc.(U.S.)

- Woodstream Corporation (U.S.)

What are the Recent Developments in Global Home Outdoor Pest Control Devices Market?

- In October 2024, Northwest Exterminating, a Rollins Inc. company, acquired Enviroguard Pest Solutions to expand its service footprint across Alabama, Tennessee, and Georgia. The acquisition strengthens Northwest’s ability to deliver comprehensive pest management solutions throughout the southeastern United States. With Enviroguard’s strong regional presence and decades of industry experience, the partnership enhances customer service, operational efficiency, and market competitiveness. This strategic move reflects Northwest’s commitment to growth and its focus on environmentally responsible pest control practices, further solidifying its leadership in the region

- In September 2024, Turner Pest Control, a subsidiary of Anticimex, announced the acquisition of Venom Pest Control, further strengthening its presence in central Florida. Venom, based in Clermont, has been a trusted provider of residential and commercial pest management services since 2013. This strategic acquisition enhances Turner’s service coverage across Florida, supporting its continued growth and commitment to delivering high-quality, integrated pest control solutions. By merging operations, Turner aims to elevate service standards and improve accessibility for clients throughout the region, reinforcing its leadership in the southeastern U.S. pest control market

- In July 2024, Envu, a global leader in environmental science innovation, announced a definitive agreement to acquire In2Care®, a Netherlands-based company renowned for its advanced mosquito control technologies. This strategic acquisition expands Envu’s portfolio of eco-friendly mosquito management solutions, including In2Care’s patented InsecTech® platform, which delivers lethal doses to mosquitoes via static-charged coatings. The partnership enables Envu to serve pest control operators, lawn care companies, and public health agencies with sustainable tools to combat vector-borne diseases. The transaction is expected to close by the end of 2024, reinforcing Envu’s commitment to nature-positive innovation

- In June 2024, Greenix Pest Control, ranked as the 14th largest pest control provider in the U.S., announced the acquisition of select regional operations of Insight Pest Solutions based in American Fork, Utah. The deal includes branches in Wisconsin, Ohio, and Indiana, marking a strategic expansion into the upper Midwest. This move strengthens Greenix’s operational footprint, bringing its services to over 200,000 households across 19 states. The acquisition aligns with Greenix’s growth strategy to deliver sustainable, effective pest control solutions while enhancing customer experience and regional capabilities

- In June 2023, the Stanford Center for Innovation in Global Health reported the reappearance of locally transmitted malaria cases in Florida and Texas—the first such instances in the U.S. in over 20 years. This resurgence highlights growing health risks linked to climate change, which is accelerating mosquito development cycles and disease transmission rates. According to the U.S. Environmental Protection Agency (EPA), warmer temperatures and altered rainfall patterns can increase mosquito breeding, biting frequency, and pathogen incubation, amplifying the spread of vector-borne diseases. These developments underscore the urgent need for advanced mosquito control solutions across the United States

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.