Global Home Rehabilitation Products And Services Market

Market Size in USD Billion

CAGR :

%

USD

111.36 Billion

USD

176.02 Billion

2024

2032

USD

111.36 Billion

USD

176.02 Billion

2024

2032

| 2025 –2032 | |

| USD 111.36 Billion | |

| USD 176.02 Billion | |

|

|

|

|

Home Rehabilitation Products and Services Market Size

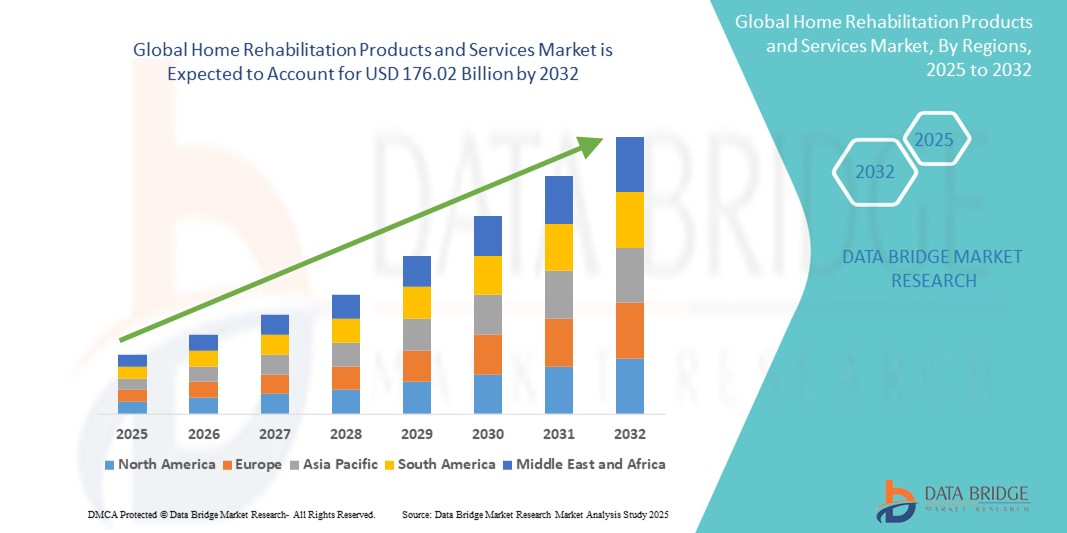

- The global home rehabilitation products and services market size was valued at USD 111.36 billion in 2024 and is expected to reach USD 176.02 billion by 2032, at a CAGR of 5.89% during the forecast period

- The market growth is largely fueled by the rising prevalence of chronic conditions, post-operative recovery needs, and an aging global population, which are significantly increasing the demand for home rehabilitation products and services. Technological advancements in mobility aids, exercise therapy equipment, and tele-rehabilitation platforms are further enhancing at-home patient care and recovery outcomes

- Furthermore, growing consumer preference for cost-effective and convenient recovery solutions outside traditional healthcare facilities is positioning home rehabilitation as a preferred care model. These converging factors are accelerating the adoption of home rehabilitation products and services, thereby significantly boosting the industry's growth

Home Rehabilitation Products and Services Market Analysis

- Home rehabilitation products and services, including mobility aids, body support devices, daily living aids, and therapeutic equipment, are becoming vital components of post-acute care in both home and outpatient settings. Their growing adoption is driven by the rising aging population, a shift toward home-based recovery, and increasing cases of chronic diseases and physical disabilities

- The growing demand for these solutions is primarily fueled by increased healthcare expenditure, a surge in elderly demographics, and greater access to in-home physical therapy and recovery tools. Patients and caregivers are increasingly choosing home rehab solutions that offer comfort, independence, and cost-effectiveness

- North America dominated the home rehabilitation products and services market with the largest revenue share of 40.1% in 2024, attributed to early adoption of advanced home healthcare technologies, favorable reimbursement structures, and the strong presence of key market players

- Asia-Pacific is expected to be the fastest-growing region in the home rehabilitation products and services market, projected to register a CAGR of 9.7% from 2025 to 2032, fueled by rising geriatric populations, increasing disposable incomes, and expanding home healthcare infrastructure across countries such as China, Japan, and India

- The physical therapy segment dominated the home rehabilitation products and services market with a revenue share of 42.3% in 2024, driven by its broad application in recovery from injuries, surgeries, and musculoskeletal disorders. Its effectiveness in restoring function, reducing pain, and preventing long-term disability makes it a cornerstone of rehabilitation care across diverse patient groups

Report Scope and Home Rehabilitation Products and Services Market Segmentation

|

Attributes |

Home Rehabilitation Products and Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Home Rehabilitation Products and Services Market Trends

“Increasing Integration with Smart Technology for Seamless Patient Support”

- A significant and accelerating trend in the global home rehabilitation products and Services market is the incorporation of smart technologies that improve patient convenience, compliance, and clinical outcomes across homecare settings. These technologies enhance the user experience by enabling intuitive control of rehabilitation devices and improving patient monitoring

- For instance, smart rehabilitation equipment can now connect with health monitoring apps and wearables, allowing therapists to track patient progress in real-time and adjust therapy plans accordingly. Companies are also integrating smart sensors into mobility aids and therapeutic devices to ensure optimal performance and safety for users

- The use of connected solutions in home rehabilitation—such as digitally monitored wheelchairs, speech therapy tools with progress-tracking features, and smart walkers—supports individualized therapy and reduces the need for frequent clinic visits. This offers greater flexibility and encourages patient adherence to therapy routines

- Moreover, smart home integration enables patients with disabilities or elderly individuals to operate rehabilitation tools more conveniently in their own environment. Devices such as adjustable beds, motorized lifts, and voice-activated support systems are improving independence and quality of life

- As expectations for personalized and tech-enabled healthcare rise, leading players are launching home rehabilitation products that sync with mobile apps and electronic health records to promote holistic and continuous care. This trend is reshaping the market by prioritizing user empowerment, remote engagement, and connected recovery pathways

- The demand for smart, intuitive, and user-centric rehabilitation solutions is growing across homecare and eldercare segments, as patients and caregivers increasingly seek accessible, efficient, and technologically advanced support systems

Home Rehabilitation Products and Services Market Dynamics

Driver

“Growing Need Due to Rising Healthcare Demand and Home-Based Recovery Solutions”

- The increasing prevalence of chronic illnesses, disabilities, and post-operative recovery needs—particularly among the aging population—is a key driver of demand in the Home Rehabilitation Products and Services market. This growth is further fueled by the global shift toward home-based care models and the need to reduce hospital readmissions

- For instance, in April 2024, Onity, Inc. (Honeywell International, Inc.) announced advancements in IoT-based self-care security and automation, paving the way for integrated rehabilitation solutions that combine safety and independence at home. Such developments are expected to significantly drive the Home Rehabilitation Products and Services industry over the forecast period

- As patients seek greater autonomy and comfort in managing their recovery, home rehabilitation products such as body support systems, general aids, wheelchairs, and positioning devices are becoming essential. These tools help individuals maintain mobility, function, and quality of life while staying in familiar home environments

- Furthermore, the increasing popularity of in-home therapeutic services—such as physical therapy, occupational therapy, and speech therapy—has amplified the demand for corresponding rehabilitation equipment. These devices are often designed for ease of use, portability, and adaptability across various medical conditions

- The integration of digital monitoring, customizable care plans, and remote connectivity into home rehab equipment enhances the value proposition for patients and caregivers alike. These technologies enable real-time progress tracking and therapist-patient communication, facilitating personalized recovery experiences

- As awareness grows and reimbursement policies evolve in favor of home-based care, the market is expected to experience robust growth across both developing and developed economies. Retail and online distribution channels are also expanding access to innovative, user-friendly rehabilitation solutions, making them more widely available

Restraint/Challenge

“High Initial Costs and Limited Digital Literacy Among Elderly Users”

- Despite promising growth, the market faces challenges including the relatively high cost of advanced home rehabilitation equipment. This can be a barrier for patients in low-income or underinsured populations, particularly in regions with limited public health coverage or reimbursement support

- In addition, older adults—who make up a large portion of the target market—may struggle with adopting technologically enabled rehab tools. Limited digital literacy can hinder the effective use of smart rehabilitation devices that require app-based interaction, sensor monitoring, or remote support systems

- Moreover, maintenance, training, and setup requirements for some complex equipment can discourage adoption among patients seeking simple, hassle-free solutions. This challenge is particularly pronounced in rural or under-resourced settings where in-person support is limited

- To overcome these obstacles, key players are focusing on offering cost-effective product lines, enhancing user-friendliness, and expanding consumer education. Supportive policies and greater integration with telehealth platforms can also help bridge the digital gap and boost market acceptance

Home Rehabilitation Products and Services Market Scope

The home rehabilitation products and services market is segmented into five notable segments based on product type, service type, end-use, distribution channel, and application.

• By Product Type

On the basis of product type, the home rehabilitation products and services market is segmented into general aids, positioning devices, body support devices, and wheelchairs. The wheelchairs segment held the largest market revenue share of 34.7% in 2024, driven by rising demand among the elderly and post-surgical patients. Technological advancements in electric wheelchairs have enhanced mobility and user independence.

The body support devices segment is expected to witness the fastest CAGR of 9.8% from 2025 to 2032, due to increased use in postural alignment and orthopedic recovery.

• By Service Type

On the basis of service type, the home rehabilitation products and services market is segmented into occupational therapy, speech therapy, physical therapy, and respiratory therapy. Physical therapy dominated the market with a revenue share of 42.3% in 2024, driven by its use across a wide range of recovery needs, such as injury, surgery, and musculoskeletal conditions.

Speech therapy is projected to grow at the fastest CAGR of 10.4% from 2025 to 2032, attributed to rising pediatric neurological disorders and post-stroke rehabilitation demand.

• By End-Use

On the basis of end-use, the home rehabilitation products and services market is segmented into homecare, hospitals and clinics, ambulatory care center, and nursing care center. The homecare segment led the market with the largest revenue share of 45.2% in 2024, supported by the growing preference for in-home recovery and lower costs compared to hospital stays.

The ambulatory care center segment is expected to register the fastest CAGR of 9.5% from 2025 to 2032, driven by rising outpatient services and improved rehab infrastructure.

• By Distribution Channel

On the basis of distribution channel, the home rehabilitation products and services market is segmented into retail store and online channel. The retail store segment captured a 58.1% market share in 2024, supported by physical product assessment and in-store consultations.

The online channel is projected to grow at a fastest CAGR of 11.1% from 2025 to 2032, fueled by increasing digital penetration, product availability, and convenience.

• By Application

On the basis of application, the home rehabilitation products and services market is segmented into disabilities and geriatric people. The geriatric people segment held the highest revenue share of 60.8% in 2024, driven by the increasing aging population requiring long-term rehabilitation care.

The disabilities segment is expected to grow at a fastest CAGR of 9.2% from 2025 to 2032, supported by government initiatives, improved insurance coverage, and technological advances in assistive products.

Home Rehabilitation Products and Services Market Regional Analysis

- North America dominated the home rehabilitation products and services market with the largest revenue share of 40.1% in 2024, driven by a growing aging population, rising prevalence of chronic conditions, and increasing demand for home-based care

- Consumers in the region benefit from advanced healthcare infrastructure, strong reimbursement policies, and an emphasis on post-acute care services at home

- This growing trend is further supported by high healthcare spending, increasing hospital discharge rates to home care, and innovations in physical, occupational, and respiratory therapies tailored for home rehabilitation settings

U.S. Home Rehabilitation Products and Services Market Insight

The U.S. home rehabilitation products and services market captured the largest revenue share of 73.8% within the North America market in 2024. This dominance is attributed to high incidences of neurological, orthopedic, and cardiovascular conditions, as well as growing demand for at-home physical, speech, and occupational therapy services. The robust presence of leading market players, increased funding for homecare infrastructure, and a shift toward value-based care continue to fuel U.S. market growth.

Europe Home Rehabilitation Products and Services Market Insight

The Europe home rehabilitation products and services market is projected to expand at a substantial CAGR throughout the forecast period, driven by strong healthcare systems, increasing elderly population, and efforts to reduce hospital readmissions. Countries like Germany, France, and the U.K. are rapidly adopting home rehabilitation programs supported by government subsidies and insurance coverage.

U.K. Home Rehabilitation Products and Services Market Insight

The U.K. home rehabilitation products and services market is anticipated to grow at a noteworthy CAGR during the forecast period. The market is driven by increasing prevalence of stroke and arthritis, a rise in homecare policies, and government efforts to improve accessibility to post-acute rehabilitation services at home.

Germany Home Rehabilitation Products and Services Market Insight

The Germany home rehabilitation products and services market is expected to expand at a considerable CAGR during the forecast period, owing to its aging population, innovative healthcare ecosystem, and growing demand for eco-conscious rehabilitation solutions. Increased investment in smart rehabilitation equipment and tele-rehabilitation platforms also contribute to the country's steady market expansion.

Asia-Pacific Home Rehabilitation Products and Services Market Insight

The Asia-Pacific home rehabilitation products and services market is projected to grow at the fastest CAGR of 9.7% from 2025 to 2032. Rapid urbanization, rising middle-class income, and government investments in elderly care are key contributors to this robust growth.China, Japan, and India lead regional adoption due to improved healthcare infrastructure and the emergence of cost-effective home rehabilitation options.

Japan Home Rehabilitation Products and Services Market Insight

The Japan home rehabilitation products and services market contributed 33.7% of Asia-Pacific revenue in 2024. Market expansion is supported by Japan’s high-tech approach to rehabilitation, a fast-aging population, and demand for innovative home-based assistive technologies and therapies.

China Home Rehabilitation Products and Services Market Insight

The China home rehabilitation products and services market dominated the Asia-Pacific region with a market share of 41.2% in 2024, propelled by increasing healthcare investments, a booming middle class, and widespread urbanization.The availability of affordable rehabilitation equipment and strong government backing for eldercare and digital health programs accelerates market growth across both urban and rural segments.

Home Rehabilitation Products and Services Market Share

The home rehabilitation products and services industry is primarily led by well-established companies, including:

- AliMed Inc. (U.S.)

- Enovis Corporation (U.S.)

- Ekso Bionics (U.S.)

- ergoline GmbH (Germany)

- Hocoma (Switzerland)

- Invacare Corporation (U.S.)

- Medline Industries, Inc. (U.S.)

- Performance Health (U.S.)

- Prism Medical UK (U.K.)

- Stryker (U.S.)

- LL CORPUS COGERE Inc. (U.S.)

- Norco Inc. (U.S.)

- Handicare Stairlifts International (Netherlands)

- Dynatronics Corporation (U.S.)

- Medical Depot, Inc (U.S.)

- Foshan Shunkangda Medical Tech Co., Ltd (China)

- GF Health Products, Inc. (U.S.)

- Hospital Equipment Mfg. Co. (India)

- India Medico Instruments (India)

Latest Developments in Global Home Rehabilitation Products and Services Market

- In May 2024, Infinity Rehab entered into a strategic partnership with Wilber Care Center. This collaboration aims to boost Infinity Rehab’s market positioning and broaden its service offerings within the rehabilitation sector. The alliance is designed to improve patient outcomes by leveraging the strengths of both organizations in delivering personalized care

- In April 2024, Encompass Health announced plans to construct a 50-bed inpatient rehabilitation hospital in San Antonio. This initiative was part of the company’s broader strategy to expand its network and strengthen its presence in the rehabilitation ecosystem. The new facility is expected to enhance access to high-quality inpatient rehabilitation services in the region

- In March 2024, The Centers for Medicare & Medicaid Services (CMS) has introduced a new Healthcare Common Procedure Coding System (HCPCS) Level II code for Neurolutions, Inc.'s IpsiHand Upper Extremity Rehabilitation System. This milestone represents the first instance where a brain-computer interface (BCI) controlled therapy has been awarded an HCPCS code, establishing a precedent for thought-activated control devices in the medical field

- In February 2024, Addverb unveiled three new robots designed for a variety of applications, including healthcare. As part of its move into healthcare robotics, the company launched Healan, a cutting-edge medical cobot specifically developed for rehabilitation and imaging purposes. This innovation highlights Addverb’s commitment to integrating automation solutions into the healthcare industry

- In August 2023, ReWalk Robotics Ltd. completed its acquisition of AlterG, Inc., a company known for its Anti-Gravity systems used in neurological rehabilitation. This acquisition strengthens ReWalk’s product portfolio, particularly in the rehabilitation and mobility sectors. By incorporating AlterG's innovative technology, ReWalk aims to enhance its offerings for individuals with neurological conditions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.