Global Home Sleep Screening Devices Market

Market Size in USD Billion

CAGR :

%

USD

3.80 Billion

USD

6.75 Billion

2025

2033

USD

3.80 Billion

USD

6.75 Billion

2025

2033

| 2026 –2033 | |

| USD 3.80 Billion | |

| USD 6.75 Billion | |

|

|

|

|

Home Sleep Screening Devices Market Size

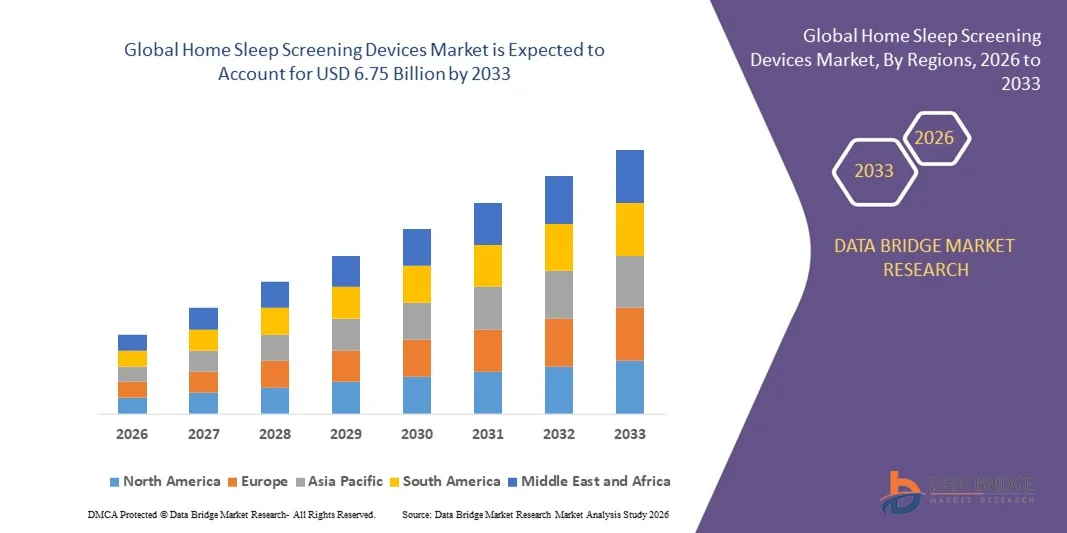

- The global home sleep screening devices market size was valued at USD 3.80 billion in 2025 and is expected to reach USD 6.75 billion by 2033, at a CAGR of 7.43% during the forecast period

- The market growth is largely fuelled by the increasing prevalence of sleep disorders such as insomnia, sleep apnea, and restless leg syndrome, coupled with the growing awareness of sleep health among the global population

- The rising adoption of portable and wearable sleep monitoring technologies, along with the increasing integration of artificial intelligence (AI) and cloud-based data analytics, is further supporting market expansion

Home Sleep Screening Devices Market Analysis

- The growing preference for at-home healthcare solutions and remote patient monitoring is transforming the sleep diagnostics landscape, reducing the need for hospital-based sleep studies

- Technological advancements in miniaturized sensors, wireless connectivity, and mobile app integration are enhancing user convenience and diagnostic accuracy, driving widespread adoption among patients and healthcare providers

- North America dominated the home sleep screening devices market with the largest revenue share of 36.50% in 2025, driven by growing awareness of sleep disorders, increasing adoption of telehealth solutions, and the convenience offered by at-home monitoring devices

- Asia-Pacific region is expected to witness the highest growth rate in the global home sleep screening devices market, driven by rapid urbanization, expanding healthcare access, and rising adoption of digital health and remote patient monitoring solutions

- The sleep monitors segment held the largest market revenue share in 2025, driven by their ability to provide comprehensive sleep tracking and detailed analysis of sleep patterns. These devices often offer advanced features such as oxygen saturation monitoring, heart rate tracking, and integration with mobile applications, making them highly preferred among consumers seeking accurate home-based sleep assessments

Report Scope and Home Sleep Screening Devices Market Segmentation

|

Attributes |

Home Sleep Screening Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Home Sleep Screening Devices Market Trends

Rise of At-Home Sleep Monitoring and Screening

- The growing adoption of home sleep screening devices is transforming the sleep healthcare landscape by enabling convenient, real-time monitoring of sleep patterns and disorders. These devices allow patients to conduct assessments from the comfort of their homes, improving compliance and facilitating early detection of sleep apnea, insomnia, and other sleep-related conditions. Enhanced monitoring features and integration with smartphone apps also support long-term health tracking and personalized care

- The increasing demand for remote patient monitoring and telehealth services is accelerating the adoption of portable sleep screening solutions. These devices are particularly valuable for patients in rural or under-resourced areas, reducing the need for frequent hospital visits and enabling timely interventions. Integration with cloud-based platforms allows physicians to access patient data remotely, improving care coordination and treatment outcomes

- Ease of use and affordability of modern home sleep screening devices are making them attractive for routine sleep assessments. Patients can track their sleep quality consistently without complex setups or excessive costs, enhancing overall sleep health management. User-friendly interfaces, minimal maintenance requirements, and compact designs further encourage adoption among all age groups

- For instance, in 2024, several healthcare providers in North America reported improved patient adherence and early diagnosis rates after integrating home sleep monitoring kits with telehealth platforms. These devices allowed continuous tracking, personalized feedback, and timely physician consultations. In addition, integration with wearable technologies and smart home devices created a more holistic sleep monitoring ecosystem

- While home sleep screening devices are advancing early detection and patient convenience, their effectiveness depends on device accuracy, user education, and integration with healthcare systems. Manufacturers must focus on enhancing device reliability, data security, and user-friendly designs to fully capitalize on market growth. Investment in AI-driven analytics and predictive algorithms can further improve diagnostic precision and actionable insights

Home Sleep Screening Devices Market Dynamics

Driver

Rising Prevalence of Sleep Disorders and Increasing Awareness Among Consumers

- The rising incidence of sleep disorders such as obstructive sleep apnea, insomnia, and restless leg syndrome is driving demand for home-based sleep screening solutions. Growing awareness of the health risks associated with untreated sleep disorders is prompting consumers and healthcare providers to prioritize early detection. Rising lifestyle-related health issues, including obesity and stress, are further contributing to demand growth

- Consumers are increasingly adopting self-monitoring and digital health solutions to improve sleep quality, reduce fatigue, and manage associated conditions such as cardiovascular diseases and diabetes. This trend is supporting demand for advanced home sleep screening devices. Wearable integration, mobile apps, and personalized insights are enhancing consumer engagement and promoting preventive healthcare practices

- Healthcare initiatives promoting preventive care and telehealth services are enhancing market growth. From insurance coverage for at-home sleep studies to government awareness campaigns, supportive frameworks are helping patients access sleep monitoring solutions more conveniently. Collaborations between hospitals, device manufacturers, and telehealth providers are expanding the reach of home-based diagnostics

- For instance, in 2023, major U.S. healthcare networks expanded telehealth offerings incorporating home sleep monitoring kits, leading to increased diagnosis rates and patient satisfaction. Continuous remote monitoring enabled physicians to detect early symptoms and adjust treatments promptly, improving overall patient outcomes. The integration of AI-powered data analytics further strengthened clinical decision-making

- While awareness and institutional support are driving market adoption, there is still a need to improve device accuracy, affordability, and connectivity to ensure sustained growth and better patient outcomes. Standardization of testing protocols, seamless interoperability with healthcare systems, and enhanced patient training remain crucial for long-term market expansion

Restraint/Challenge

High Cost of Advanced Sleep Screening Devices and Limited Accessibility

- The high cost of sophisticated home sleep screening devices, including wearable monitors and polysomnography-compatible kits, limits adoption among cost-sensitive consumers. Advanced sensors, connectivity features, and AI-driven analytics contribute significantly to overall pricing, making devices less accessible for some populations. Insurance reimbursement limitations further exacerbate affordability challenges

- In many regions, lack of healthcare guidance or training on device usage reduces effective utilization. Consumers may face challenges in interpreting results or configuring devices correctly, impacting the accuracy of home assessments. Insufficient support from healthcare providers and limited educational resources can lead to underutilization and misdiagnosis

- Supply chain and manufacturing constraints, particularly for high-tech sensors and electronic components, can restrict availability and delay market expansion. Limited distribution in remote or underdeveloped areas further hampers adoption. Variations in regulatory standards across regions can also slow device approval and deployment

- For instance, in 2024, several sleep technology providers in Asia-Pacific reported delayed deliveries due to sensor component shortages, affecting rollout plans and consumer access. Such disruptions created temporary demand-supply mismatches and slowed market penetration in key emerging economies

- While technological advances improve device functionality and user experience, addressing cost, accessibility, and user training is crucial for long-term adoption and growth of the home sleep screening devices market. Enhancements in affordable, accurate, and connected devices, combined with broader insurance coverage and telehealth integration, will be key to sustained market expansion

Home Sleep Screening Devices Market Scope

The market is segmented on the basis of product, application, and distribution channel.

- By Product

On the basis of product, the home sleep screening devices market is segmented into sleep monitors, wearables, non-wearables, and smart sleep equipment. The sleep monitors segment held the largest market revenue share in 2025, driven by their ability to provide comprehensive sleep tracking and detailed analysis of sleep patterns. These devices often offer advanced features such as oxygen saturation monitoring, heart rate tracking, and integration with mobile applications, making them highly preferred among consumers seeking accurate home-based sleep assessments.

The wearables segment is expected to witness the fastest growth rate from 2026 to 2033, driven by their portability, continuous monitoring capabilities, and convenience for users. Wearable devices are increasingly popular due to their ability to provide real-time feedback, personalized insights, and seamless integration with smartphones and health apps, enhancing user engagement and adherence to sleep health management.

- By Application

On the basis of application, the market is segmented into insomnia, sleep apnea, narcolepsy, sleep deprivation, circadian rhythm disorders, and others. The sleep apnea segment held the largest revenue share in 2025, fueled by the growing prevalence of obstructive sleep apnea and rising awareness of its health risks. Home sleep screening devices for sleep apnea enable early diagnosis, reduce dependency on hospital-based polysomnography, and allow continuous monitoring for effective treatment.

The insomnia segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the increasing incidence of chronic sleep disturbances, stress, and lifestyle-related factors. Devices targeting insomnia provide personalized sleep tracking, behavioral insights, and recommendations to improve sleep hygiene, supporting long-term management and preventive care.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into online, pharmacy, retail stores, hypermarkets and supermarkets, and others. The online segment held the largest market revenue share in 2025 due to the convenience of doorstep delivery, wider product availability, and access to detailed product information and customer reviews. E-commerce platforms also offer competitive pricing and subscription-based services for continuous monitoring.

The pharmacy segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing consumer trust in healthcare professional guidance, easy access to certified devices, and growing partnerships between device manufacturers and healthcare providers. Pharmacies provide a reliable point of purchase for first-time users and encourage adoption through awareness campaigns and on-site demonstrations.

Home Sleep Screening Devices Market Regional Analysis

- North America dominated the home sleep screening devices market with the largest revenue share of 36.50% in 2025, driven by growing awareness of sleep disorders, increasing adoption of telehealth solutions, and the convenience offered by at-home monitoring devices

- Consumers in the region highly value easy-to-use devices, personalized feedback, and integration with mobile apps and telemedicine platforms, facilitating early diagnosis and continuous sleep monitoring

- This widespread adoption is further supported by high disposable incomes, an aging population, and the growing preference for preventive healthcare, establishing home sleep screening devices as a favored solution for both individual consumers and healthcare providers

U.S. Home Sleep Screening Devices Market Insight

The U.S. home sleep screening devices market captured the largest revenue share in 2025 within North America, fueled by rising prevalence of sleep apnea, insomnia, and other sleep disorders. Consumers are increasingly prioritizing early diagnosis and continuous monitoring through convenient, at-home solutions. The growing integration of devices with mobile applications, wearable sensors, and telehealth services further propels the market. In addition, insurance coverage for home-based sleep tests and healthcare initiatives promoting preventive care are significantly contributing to market expansion.

Europe Home Sleep Screening Devices Market Insight

The Europe home sleep screening devices market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by increasing awareness of sleep health, government healthcare initiatives, and the rising adoption of telemedicine. Consumers are seeking reliable and easy-to-use devices for at-home monitoring of conditions such as sleep apnea and insomnia. The region is experiencing significant growth across individual consumers and healthcare facilities, with home sleep devices being increasingly incorporated into telehealth programs.

U.K. Home Sleep Screening Devices Market Insight

The U.K. home sleep screening devices market is expected to witness the fastest growth rate from 2026 to 2033, driven by heightened awareness of sleep-related health risks and a growing preference for convenient, at-home monitoring solutions. Rising incidence of sleep disorders and increasing adoption of wearable and smart sleep devices among consumers are fueling market growth. Furthermore, the U.K.’s advanced healthcare infrastructure and growing telehealth ecosystem are supporting widespread adoption of home sleep screening solutions.

Germany Home Sleep Screening Devices Market Insight

The Germany home sleep screening devices market is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing awareness of sleep disorders and demand for technologically advanced, user-friendly devices. Germany’s strong healthcare system, focus on preventive care, and rising adoption of digital health solutions promote the use of at-home sleep monitoring devices. Integration with mobile apps, telehealth services, and personalized sleep coaching is becoming increasingly prevalent, enhancing patient adherence and outcomes.

Asia-Pacific Home Sleep Screening Devices Market Insight

The Asia-Pacific home sleep screening devices market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid urbanization, rising disposable incomes, and increasing prevalence of sleep disorders in countries such as China, Japan, and India. Government initiatives promoting digital health and telemedicine are supporting the adoption of home sleep devices. In addition, the region’s growing manufacturing capabilities for wearable and smart monitoring devices are increasing affordability and accessibility to a wider consumer base.

Japan Home Sleep Screening Devices Market Insight

The Japan home sleep screening devices market is expected to witness the fastest growth rate from 2026 to 2033, due to the country’s aging population, high healthcare awareness, and rapid adoption of smart health monitoring technologies. Consumers are increasingly seeking user-friendly devices integrated with mobile and IoT platforms to monitor sleep quality and detect sleep disorders. The growing focus on preventive care and remote patient monitoring is further supporting market expansion.

China Home Sleep Screening Devices Market Insight

The China home sleep screening devices market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s growing middle class, rising prevalence of sleep disorders, and increased adoption of digital health solutions. Home sleep screening devices are becoming popular among individuals and healthcare providers for early diagnosis and continuous monitoring. Government support for telemedicine, rising health awareness, and availability of affordable devices are key factors propelling market growth in China.

Home Sleep Screening Devices Market Share

The Home Sleep Screening Devices industry is primarily led by well-established companies, including:

• Koninklijke Philips N.V. (Netherlands)

• Garmin Ltd. (Switzerland)

• ResMed (Australia)

• WebMD LLC (U.S.)

• Cleveland Medical Devices Inc. (U.S.)

• NovaSom (U.S.)

• Itamar Medical Ltd (Israel)

• Sleepez USA Inc (U.S.)

• ApneaMed (U.S.)

• SleepWorks, LLC (U.S.)

• VirtuOx, Inc. (U.S.)

• Withings (France)

• CONTEC MEDICAL SYSTEMS CO., LTD (China)

• Advanced Brain Monitoring, Inc. (U.S.)

• Apple Inc. (U.S.)

• Sunbeam Products, Inc. (U.S.)

• Viatom Technology Co., Ltd. (China)

• MD Biomedical Inc. (U.S.)

• Air Liquide Medical Systems (France)

• Singa Technology Corporation (Taiwan)

Latest Developments in Global Home Sleep Screening Devices Market

- In August 2024, ReactDx launched NiteWatch, an FDA-cleared home sleep screening device that monitors six health parameters with validation against polysomnography. This development provides a low-cost, reliable diagnostic tool, expanding the company’s product offerings and strengthening its market presence by addressing the rising demand for dependable at-home testing solutions

- In January 2023, Bresotec Medical received U.S. FDA 510(k) clearance for BresoDX1, its at-home sleep apnea testing device for adults with moderate to severe conditions. This approval enables the company to cater to the growing need for domiciliary sleep diagnostics, enhancing its market position and accessibility of home-based testing solutions

- In February 2024, Vivos Therapeutics introduced VivoScore, a home sleep monitoring device powered by SleepImage, featuring a single-sensor ring recorder connected to a mobile app and cloud-based algorithms. The launch expands the company’s portfolio, offering a convenient, cost-effective solution for sleep screening and diagnosis, benefiting both patients and healthcare providers while boosting market competitiveness

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.