Global Homecare Surgical Drains Market

Market Size in USD Billion

CAGR :

%

USD

3.37 Billion

USD

3.97 Billion

2025

2033

USD

3.37 Billion

USD

3.97 Billion

2025

2033

| 2026 –2033 | |

| USD 3.37 Billion | |

| USD 3.97 Billion | |

|

|

|

|

Homecare Surgical Drains Market Size

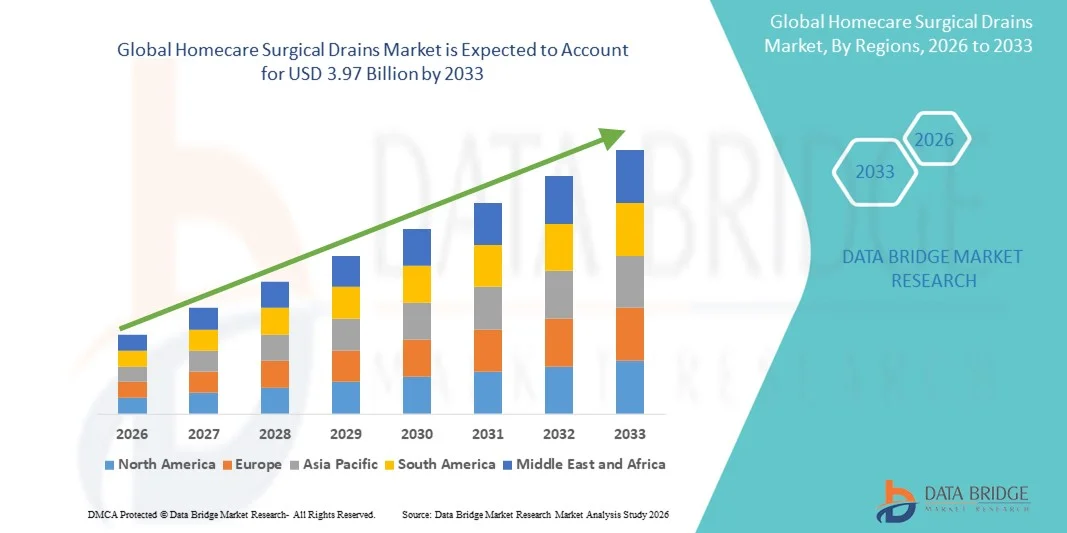

- The global homecare surgical drains market size was valued at USD 3.37 billion in 2025 and is expected to reach USD 3.97 billion by 2033, at a CAGR of 2.07% during the forecast period

- The market growth is largely fueled by the increasing prevalence of chronic diseases, post-surgical complications, and the growing adoption of minimally invasive procedures, leading to a higher need for efficient post-operative fluid management in home settings

- Furthermore, rising patient preference for home-based recovery, coupled with advancements in portable and user-friendly surgical drain devices, is establishing homecare surgical drains as a critical component in post-surgical care. These converging factors are accelerating the uptake of Homecare Surgical Drains solutions, thereby significantly boosting the industry's growth

Homecare Surgical Drains Market Analysis

- Homecare surgical drains, designed for effective post-operative wound management and fluid evacuation, are increasingly vital components of modern home-based healthcare systems due to their ability to prevent infection, promote healing, and reduce hospital readmissions

- The escalating demand for homecare surgical drains is primarily fueled by the rising prevalence of chronic illnesses, the growing number of surgical procedures, and a patient-driven preference for convenient, cost-effective home recovery solutions supported by advancements in medical technology

- North America dominated the homecare surgical drains market with the largest revenue share of 41.5% in 2025, characterized by advanced healthcare infrastructure, higher surgical volumes, and increased adoption of home-based post-operative care. The U.S. market is experiencing substantial growth due to innovations in portable drainage systems and strong insurance support for homecare treatments

- Asia-Pacific is expected to be the fastest-growing region in the homecare surgical drains market during the forecast period, registering a CAGR driven by expanding healthcare access, growing awareness of infection control, and increasing government investments in home health infrastructure

- The Active Drains segment dominated the global market, accounting for 62.4% of total revenue in 2025, owing to their high efficiency in continuous wound drainage and infection control

Report Scope and Homecare Surgical Drains Market Segmentation

|

Attributes |

Homecare Surgical Drains Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Homecare Surgical Drains Market Trends

Growing Focus on Patient Comfort and Advanced Drainage Technologies

- A significant and accelerating trend in the global homecare surgical drains market is the growing focus on improving patient comfort, infection prevention, and portability through the use of advanced drainage systems. Manufacturers are developing devices that minimize discomfort, reduce the risk of leakage, and allow patients to recover safely in homecare settings

- For instance, in April 2024, Cardinal Health introduced a next-generation closed suction drain system designed to enhance wound fluid management and reduce the risk of cross-contamination during post-operative recovery. Similarly, B. Braun has invested in drain materials that are more flexible, biocompatible, and resistant to clogging, supporting improved patient outcomes and comfort

- The shift toward value-based homecare is further boosting innovation in surgical drains, emphasizing easy-to-use devices with improved suction control and disposable or compact collection units. The adoption of these advanced systems helps reduce hospital readmission rates, aligning with healthcare providers’ goals to lower costs and improve recovery experiences

- This ongoing focus on ergonomic design, infection control, and personalized wound management is reshaping the market landscape, as healthcare professionals and patients alike prefer minimally invasive drainage solutions suited for home recovery environments

Homecare Surgical Drains Market Dynamics

Driver

Rising Incidence of Surgical Procedures and Shift Toward Home-Based Post-Operative Care

- The global rise in the number of surgical interventions, particularly in orthopedics, oncology, and cardiovascular care, is a major driver of the Homecare Surgical Drains market. As healthcare systems increasingly encourage early patient discharge, the demand for efficient drainage systems that can be safely managed at home has grown substantially

- For instance, in March 2023, Zimmer Biomet expanded its post-surgical recovery portfolio to include advanced wound and drainage management solutions for orthopedic procedures, enabling faster rehabilitation and lowering hospital burden. Such developments demonstrate a clear shift toward integrated recovery solutions in homecare

- In addition, the aging global population, increasing prevalence of chronic diseases, and rising number of minimally invasive surgeries are contributing to greater adoption of surgical drains for wound exudate management

- The growing emphasis on patient-centered care, coupled with government support for home-based treatment and remote monitoring, is further enhancing market expansion. Healthcare providers increasingly recommend closed suction or portable drains that ensure safety, hygiene, and ease of use during recovery

- The trend toward cost-effective, hospital-to-home transition care continues to drive innovation and adoption across both developed and emerging healthcare markets

Restraint/Challenge

Risk of Infection and Limited Patient Compliance in Home Settings

- Despite technological advancements, the risk of infection and improper management of surgical drains in homecare environments remains a major challenge. Inadequate patient education and poor hygiene practices can lead to complications, including blockage or delayed wound healing

- For instance, clinical studies published in 2022 indicated that up to 15% of post-operative infections in home settings are associated with improper drain handling or failure to maintain sterile conditions during fluid disposal. This highlights the ongoing need for better patient training and monitoring systems

- Furthermore, the lack of skilled homecare personnel in certain regions poses challenges for patients requiring assistance with drain maintenance, particularly among elderly or immobile populations

- The high cost of advanced closed-system drains and disposable collection units can also limit adoption in low- and middle-income countries. Despite their proven safety benefits, these products may remain out of reach for budget-constrained healthcare systems

- To overcome these restraints, manufacturers are focusing on developing affordable, easy-to-use, and pre-sterilized drain systems that minimize infection risks, while healthcare providers are implementing telemonitoring and remote consultation tools to guide patients through safe post-surgical recovery at home

Homecare Surgical Drains Market Scope

The market is segmented on the basis of product type, type, and disease.

- By Product Type

On the basis of product type, the Homecare Surgical Drains market is segmented into Active Drains and Passive Drains. The Active Drains segment dominated the global market, accounting for 62.4% of total revenue in 2025, owing to their high efficiency in continuous wound drainage and infection control. Active drains use negative pressure or suction to remove accumulated fluids, minimizing the risk of seroma or hematoma formation. Their precision in fluid management supports faster wound healing and makes them highly preferred for post-surgical recovery in homecare setups. Increased adoption in orthopedic, plastic, and abdominal surgeries—where controlled drainage is crucial—has reinforced their leadership. Moreover, innovations such as portable closed-suction drains and battery-assisted systems by key players like B. Braun and Cardinal Health are further boosting demand across developed regions. The segment benefits from its ability to reduce hospital stay durations and align with the growing trend of outpatient and home-based recovery.

The Passive Drains segment is expected to witness the fastest CAGR of 8.7% from 2026 to 2033, driven by their simplicity, low maintenance, and cost-effectiveness. Passive drains rely on gravity or capillary action for fluid removal, making them suitable for minor surgeries or low-exudate wounds managed at home. Their ease of use, combined with lower cost, is increasing their preference in emerging economies and small healthcare centers. Moreover, the development of silicone-based, hypoallergenic passive drains that improve comfort and reduce skin irritation is further expanding their use. The rising geriatric population and demand for self-manageable post-surgical tools are expected to accelerate this segment’s growth during the forecast period.

- By Type

On the basis of type, the Homecare Surgical Drains market is segmented into Bulb-Type Drains and ReliaVac Drains. The Bulb-Type Drains segment held the dominant market share of 58.1% in 2025, primarily due to their compact design, ease of handling, and suitability for home-based wound management. These drains use a squeeze-bulb mechanism to generate suction, allowing patients to monitor and empty drainage easily. Bulb-type drains are extensively used after breast, abdominal, and plastic surgeries due to their portability and low maintenance. Hospitals and homecare providers prefer them for patient comfort and the reduced need for professional assistance. In addition, ongoing advancements such as anti-reflux valves and self-sealing ports are improving safety and usability, making bulb drains the most widely adopted type across global homecare applications.

The ReliaVac Drains segment is projected to witness the fastest CAGR of 9.2% between 2026 and 2033, attributed to their superior suction efficiency and adaptability for complex post-surgical recovery cases. ReliaVac systems feature adjustable vacuum levels that ensure precise fluid evacuation without tissue trauma. Their closed design minimizes infection risk, making them ideal for high-exudate wounds or surgeries involving joint replacements, thoracic, and abdominal procedures. Increasing use in ambulatory surgical centers and the introduction of compact, lightweight ReliaVac units for home use are enhancing accessibility. Growing awareness about infection prevention and demand for consistent drainage performance in long-term recovery are fueling this segment’s expansion.

- By Disease

On the basis of disease, the Homecare Surgical Drains market is segmented into Abscess, Seroma, and Lymphocele. The Seroma segment dominated the market in 2025 with a revenue share of 46.7%, owing to the high incidence of seroma formation following breast, abdominal, and reconstructive surgeries. Homecare management of seromas has become more common due to advancements in closed-suction systems that reduce infection risks and improve drainage precision. Surgeons increasingly recommend portable suction drains for seroma cases to prevent fluid accumulation and facilitate healing. In addition, awareness programs and postoperative kits provided by homecare providers are improving adherence to safe drainage practices, reinforcing segment dominance. The segment’s leadership is further strengthened by product enhancements such as sterile disposable reservoirs and silicone-based tubes that improve patient comfort.

The Lymphocele segment is anticipated to record the fastest CAGR of 9.8% from 2026 to 2033, driven by the increasing number of lymphatic surgeries and cancer-related procedures that require postoperative fluid management. Lymphocele formation is a frequent complication in pelvic or renal surgeries, where efficient home drainage systems are vital for preventing infection or recurrence. The growing use of negative-pressure and vacuum-assisted drainage devices tailored for lymphatic conditions is driving this growth. Moreover, rising awareness about post-surgical fluid retention management and advancements in biocompatible materials designed to minimize tissue irritation are enhancing adoption rates. Homecare solutions that offer portability and real-time monitoring for lymphatic drainage will continue to propel this segment during the forecast period.

Homecare Surgical Drains Market Regional Analysis

- North America dominated the homecare surgical drains market with the largest revenue share of 41.5% in 2025

- Driven by advanced healthcare infrastructure, rising surgical volumes, and the growing preference for home-based postoperative recovery. The region’s market expansion is further supported by favorable reimbursement policies, a well-established home healthcare ecosystem, and the presence of major medical device manufacturers focusing on patient-friendly drain designs

- In particular, the increasing use of portable and disposable surgical drains designed to reduce infection risks and improve mobility is enhancing patient outcomes and fueling adoption across the region

U.S. Homecare Surgical Drains Market Insight

The U.S. homecare surgical drains market captured the largest revenue share in 2025 within North America, attributed to a high rate of surgical procedures, increasing focus on early hospital discharge, and a strong presence of domestic device manufacturers. The growing preference for advanced suction drains and vacuum-assisted systems that enable effective drainage and faster recovery is propelling market growth. Furthermore, continuous innovation in patient-centric product design, such as bulb-type and closed-system drains with safety valves, is contributing significantly to the U.S. market’s expansion.

Europe Homecare Surgical Drains Market Insight

The Europe homecare surgical drains market is expected to grow steadily during the forecast period, supported by a mature healthcare system, rising awareness of infection prevention, and increasing adoption of minimally invasive surgeries. Countries like Germany, the U.K., and France are witnessing a growing shift toward home-based surgical recovery, where drains are essential for fluid management. Furthermore, advancements in sterile materials and user-friendly drain kits are increasing acceptance among both patients and healthcare providers.

U.K. Homecare Surgical Drains Market Insight

The U.K. homecare surgical drains market is anticipated to expand at a notable CAGR through 2033, driven by the growing emphasis on hospital efficiency and reduction in readmission rates. National Health Service (NHS) initiatives promoting at-home postoperative care are fostering the adoption of portable drainage systems. In addition, growing awareness regarding infection control and the availability of cost-effective, easy-to-use drain solutions are fueling market demand.

Germany Homecare Surgical Drains Market Insight

The Germany homecare surgical drains market is witnessing robust growth, supported by a technologically advanced medical device industry and the country’s focus on sustainable, reusable healthcare solutions. The demand for closed-drain systems with safety features is increasing due to stringent safety standards and infection control protocols. Moreover, hospitals and homecare providers are increasingly adopting drains made of biocompatible materials to improve patient comfort and recovery outcomes.

Asia-Pacific Homecare Surgical Drains Market Insight

The Asia-Pacific homecare surgical drains market is expected to register the fastest CAGR of 11.8% during the forecast period (2026–2033), propelled by rapid improvements in healthcare infrastructure, increasing surgical rates, and growing awareness about home-based care. Countries such as China, India, and Japan are leading the regional demand due to their expanding middle-class population, government initiatives for healthcare modernization, and growing penetration of private homecare services. Technological innovations in drain design and affordability of care devices are further boosting market adoption.

Japan Homecare Surgical Drains Market Insight

The Japan homecare surgical drains market is gaining momentum owing to its aging population, which increasingly requires post-surgical care at home. The country’s emphasis on technological precision and patient safety is encouraging the use of compact, automated, and vacuum-assisted drains. Rising healthcare costs and the need to shorten hospital stays are further driving the transition toward homecare-based surgical recovery solutions.

China Homecare Surgical Drains Market Insight

The China homecare surgical drains market accounted for the largest revenue share in the Asia-Pacific region in 2025, supported by the expansion of hospital networks, growing trauma cases, and government initiatives promoting home healthcare. The presence of leading domestic manufacturers offering affordable, high-quality drainage systems is accelerating adoption. In addition, the rise in cosmetic and orthopedic surgeries, coupled with improving healthcare reimbursement systems, is positioning China as a dominant player in the regional market.

Homecare Surgical Drains Market Share

The Homecare Surgical Drains industry is primarily led by well-established companies, including:

• Cardinal Health (U.S.)

• B. Braun SE (Germany)

• Medtronic (Ireland)

• BD (U.S.)

• Smith & Nephew plc (U.K.)

• Zimmer Biomet Holdings, Inc. (U.S.)

• Stryker Corporation (U.S.)

• Teleflex Incorporated (U.S.)

• ConvaTec Group plc (U.K.)

• Redax S.p.A. (Italy)

• Medline Industries, LP (U.S.)

• Cook Medical (U.S.)

• Andocor N.V. (Belgium)

• Argon Medical Devices, Inc. (U.S.)

• Vygon SA (France)

• AccuDrain Medical (U.S.)

• Surgical Innovations Group plc (U.K.)

• Hollister Incorporated (U.S.)

• Hemovac (U.S.)

Latest Developments in Global Homecare Surgical Drains Market

- In August 2022, Haermonics completed a Series-A funding round to support clinical development and commercialization of its novel pericardial flushing technology, accelerating work on a device designed to reduce post-cardiac-surgery complications by actively flushing the chest cavity and keeping drains patent

- In October 2023, Haermonics publicly launched Haermonics Pure, a first-of-its-kind device that automatically flushes the pericardial space after cardiac surgery to clear blood and clots and reduce the risk of re-operation; the company stated plans to pursue CE and U.S. regulatory pathways following initial clinical use

- In September 2023, Merit Medical launched the Aspira evacuated drainage bottle in the U.S., a compact evacuated-drainage bottle designed for easier handling and at-home use that aims to improve patient comfort and storage efficiency compared with legacy drainage bottles

- In April 2024, Smith & Nephew announced the U.S. launch of RENASYS™ EDGE Negative Pressure Wound Therapy (NPWT) System, positioned for expanded home-based chronic wound care and designed to offer intuitive controls and durable pump performance for ambulatory and home settings

- In December 2024, a major industry research release (market research aggregator reports published late-2024) reiterated that the global surgical drainage/drainage devices market was expanding, citing rising procedure volumes, greater home-care recovery, and adoption of advanced closed-suction and digital drainage systems — and projecting mid-single-digit to high-single-digit CAGR figures for the coming years

- In March 2025, Haermonics registered and began reporting first-in-human/usability activity for its flushing system in clinical study entries, signalling progression from feasibility testing toward broader clinical evaluation and regulatory submissions in cardiac surgery settings

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.