Global Honey Powder Market

Market Size in USD Billion

CAGR :

%

USD

1.46 Billion

USD

2.06 Billion

2024

2032

USD

1.46 Billion

USD

2.06 Billion

2024

2032

| 2025 –2032 | |

| USD 1.46 Billion | |

| USD 2.06 Billion | |

|

|

|

|

Honey Powder Market Size

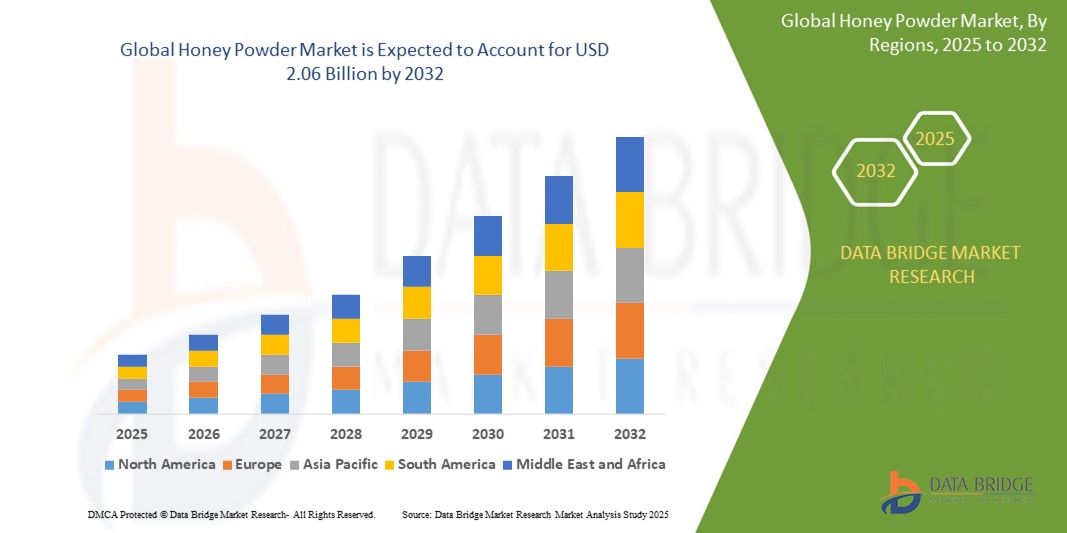

- The global honey powder market size was valued at USD 1.46 billion in 2024 and is expected to reach USD 2.06 billion by 2032, at a CAGR of 4.40% during the forecast period

- The market growth is largely fuelled by the increasing demand for natural and clean-label ingredients in food and beverage formulations. Honey powder serves as a convenient, shelf-stable alternative to liquid honey, offering ease of storage and handling for manufacturers. Its rising application in bakery, confectionery, dairy, and nutraceutical products further propels market expansion

- In addition, growing consumer preference for sugar substitutes and functional foods is boosting its adoption globally

Honey Powder Market Analysis

- The honey powder market is witnessing consistent growth due to rising applications across diverse industries such as food processing, cosmetics, and personal care, where it is valued for its long shelf life and easy integration into formulations

- Manufacturers are increasingly investing in product innovation and expanding product lines to cater to the growing consumer demand for natural and convenient sweetening alternatives

- North America region is expected to witness the highest growth rate in the global honey powder market, driven by increasing consumer demand for natural sweeteners, clean-label food products, and convenient shelf-stable alternatives across food, beverage, and wellness sectors

- Asia-Pacific dominated the honey powder market with the largest revenue share in 2024, supported by the region’s expanding food processing industry and increasing consumer preference for natural sweeteners

- The granulated honey segment held the largest market revenue share in 2024, driven by its wide usage in dry food formulations and ease of blending in bakery and snack products. Its granular texture ensures uniform distribution in recipes and provides an appealing appearance in dry mixes

Report Scope and Honey Powder Market Segmentation

|

Attributes |

Honey Powder Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Honey Powder Market Trends

“Innovation in Beverage Applications”

- Honey powder is gaining popularity in the beverage industry for its ease of solubility and mess-free handling, making it suitable for both hot and cold drink formulations

- It is now featured in instant teas, coffees, and functional drinks, aligning with the rising preference for natural and clean-label ingredients

- Beverage brands are combining honey powder with other flavors such as vanilla or turmeric to create wellness-focused blends that appeal to health-conscious consumers

- A popular example includes a honey-lavender tea mix targeted at spa and relaxation settings, while another brand launched a honey-infused protein shake for fitness enthusiasts

- Single-serve sachets of honey powder are also being introduced for convenience, allowing users to sweeten beverages on-the-go without using liquid sweeteners or artificial alternatives

Honey Powder Market Dynamics

Driver

“Rising Demand for Natural Sweeteners in Food and Beverage Products”

- Consumers are shifting towards natural and healthier sweeteners due to growing awareness of the negative effects of refined sugars and artificial alternatives

- For instance, a 2023 consumer survey by the International Food Information Council revealed that over 60% of respondents prefer natural sweeteners in packaged foods

- Honey powder retains the flavor, antioxidants, and antimicrobial properties of raw honey while offering a longer shelf life and easier handling in manufacturing processes

- Its use is expanding across bakery, confectionery, dairy, cereals, snacks, and beverages due to its non-sticky texture and compatibility with high-volume food production

- The clean-label and functional food trend is pushing brands to use honey powder as a natural sweetener and flavor enhancer in health-oriented product lines

- The rise in vegan and plant-based diets is creating opportunities for honey powder in wellness drinks and plant-based foods, appealing to health-focused and label-conscious consumers

Restraint/Challenge

“Fluctuating Raw Honey Prices and Supply Chain Instability”

- Fluctuating prices and limited availability of raw honey are impacting honey powder production, making it costly for manufacturers and disrupting market stability

- For instance, reports in 2023 showed a spike in honey prices across Europe due to prolonged drought conditions affecting bee foraging

- Honey production is highly sensitive to environmental factors such as climate change, pesticide usage, and diseases such as colony collapse disorder, which reduce overall yield

- Higher raw honey costs lead to increased prices of honey powder, discouraging adoption by price-sensitive consumers and food producers in cost-competitive markets

- The global honey supply chain faces challenges such as trade restrictions, customs delays, and regulatory inconsistencies, making sourcing complex and unstable

- Adulteration and inconsistent quality of honey in global markets further hinder consumer trust and present a major challenge for manufacturers seeking to maintain product authenticity and standards

Honey Powder Market Scope

The market is segmented on the basis of form, product, category, process, application, and sales channel.

• By Form

On the basis of form, the global honey powder market is segmented into granulated honey and powdered honey. The granulated honey segment held the largest market revenue share in 2024, driven by its wide usage in dry food formulations and ease of blending in bakery and snack products. Its granular texture ensures uniform distribution in recipes and provides an appealing appearance in dry mixes.

The powdered honey segment is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing adoption in beverages and dairy products. Powdered honey dissolves easily in both hot and cold liquids and is preferred for its longer shelf life and convenience in handling during bulk production.

• By Product

On the basis of product, the market is divided into organic and conventional. The conventional segment accounted for the largest market share in 2024 due to its widespread availability and cost-effectiveness, making it the preferred choice among commercial food processors.

The organic segment is expected to witness the fastest growth rate from 2025 to 2032, owing to growing consumer awareness regarding clean-label products and rising demand for chemical-free, natural ingredients in dietary supplements and premium foods.

• By Category

Based on category, the honey powder market is segmented into polarized and non-polarized. The non-polarized segment led the market in 2024 as it is widely used in food applications requiring neutral flavor enhancement without altering the texture of final products.

The polarized segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its emerging applications in specialty foods and functional beverages that require targeted dissolution and precise sweetness levels.

• By Process

On the basis of process, the market is categorized into spray dry, drum/roller dry, vacuum dry, and others. The spray dry segment dominated the market with the largest share in 2024, favored for its efficiency and ability to retain the nutritional and flavor profile of honey. This method supports large-scale production with consistent output.

The vacuum dry segment is expected to witness the fastest growth rate from 2025 to 2032, as it enables low-temperature drying which preserves bioactive compounds, making it suitable for premium and health-oriented products.

• By Application

Based on application, the honey powder market is segmented into bakery products, dairy products, beauty products, and others. The bakery products segment held the dominant share in 2024 due to high incorporation in cakes, cookies, and cereals as a natural sweetener and flavor enhancer.

The beauty products segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing use of honey powder in personal care formulations for its skin-nourishing and antibacterial properties.

• By Sales Channel

On the basis of sales channel, the market is divided into offline stores and online stores. The offline stores segment led the market in 2024, as supermarkets and specialty health food stores continue to be the primary retail points for bulk and branded honey powder products.

The online stores segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the expansion of e-commerce platforms, attractive discounts, and growing consumer preference for doorstep delivery and wider product variety.

Honey Powder Market Regional Analysis

- Asia-Pacific dominated the honey powder market with the largest revenue share in 2024, supported by the region’s expanding food processing industry and increasing consumer preference for natural sweeteners

- Countries such as China and India are leading contributors due to the high availability of raw honey and a growing demand for shelf-stable, natural ingredients in packaged foods and beverages

- The market benefits from the rising use of honey powder in traditional and modern recipes, with manufacturers incorporating it into snacks, health drinks, and personal care products to cater to evolving consumer trends

China Honey Powder Market Insight

The China honey powder market captured the largest revenue share in Asia-Pacific in 2024, driven by the country’s vast beekeeping industry and high consumption of honey-based products. The growing demand for clean-label and natural sweeteners in food and beverage applications is further accelerating the market. As urban consumers increasingly seek healthier alternatives to refined sugar, honey powder is becoming a favored option in ready-to-eat meals, herbal drinks, and health supplements. The strong presence of local manufacturers and favorable export potential also support market expansion in the country.

Japan Honey Powder Market Insight

The Japan honey powder market is expected to witness the fastest growth rate from 2025 to 2032, fueled by the country’s strong preference for traditional remedies and natural ingredients. The aging population is contributing to demand for functional foods with natural sweeteners, while food manufacturers are incorporating honey powder into soups, beverages, and confections tailored for health-conscious consumers. Japan’s innovation in packaging and food technology is also promoting the development of convenient, powdered sweeteners for urban consumers.

Europe Honey Powder Market Insight

The Europe honey powder market is expected to witness the fastest growth rate from 2025 to 2032, propelled by heightened consumer awareness about ingredient transparency and sustainability. The demand for minimally processed, functional sweeteners in dietary and organic products is rising steadily. Countries across the region are promoting natural ingredients in food regulations, which aligns with the increasing use of honey powder in baked goods, breakfast cereals, and dairy items. Moreover, the shift towards eco-friendly packaging and formulations further enhances the adoption of powdered honey in the European market.

Germany Honey Powder Market Insight

The Germany honey powder market is expected to witness the fastest growth rate from 2025 to 2032, backed by a strong demand for natural and additive-free food ingredients. The market is gaining traction among health-conscious consumers and food manufacturers seeking premium, long-lasting alternatives to liquid sweeteners. Germany’s well-established bakery and confectionery sectors are key users of honey powder, while the personal care segment is also expanding its use in natural cosmetic products. The emphasis on sustainable sourcing and local production is further boosting market penetration in the country.

U.K. Honey Powder Market Insight

The U.K. honey powder market is expected to witness the fastest growth rate from 2025 to 2032, supported by rising consumer demand for clean-label and functional ingredients. The shift toward healthier lifestyles is encouraging the use of natural sweeteners in snacks, beverages, and baking products. Food manufacturers are increasingly incorporating honey powder into convenience foods and wellness formulations to meet evolving dietary preferences. In addition, the growing popularity of plant-based and organic products is further driving the adoption of honey powder in the U.K. market.

North America Honey Powder Market Insight

The North America honey powder market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing demand for healthy, low-moisture sweeteners across a variety of applications. The shift toward organic and clean-label food products has led manufacturers to replace synthetic sweeteners with natural alternatives such as honey powder. The U.S. and Canada are witnessing growing use of powdered honey in protein bars, teas, granola, and skincare items, driven by convenience and longer shelf life. Strong retail distribution networks and rising online sales are also contributing to the region’s market growth.

U.S. Honey Powder Market Insight

The U.S. honey powder market accounted for the largest share in North America in 2024, supported by widespread adoption in the food processing and health supplement industries. American consumers increasingly prefer products with reduced sugar and natural ingredients, making honey powder a strategic ingredient in snacks, beverages, and powdered supplements. The market is further strengthened by a robust regulatory framework promoting natural labeling and a growing trend of DIY wellness formulations incorporating powdered honey.

Honey Powder Market Share

The Honey Powder industry is primarily led by well-established companies, including:

- Lamex Food Group Limited (U.K.)

- ADM (U.S.)

- NOREVO (Germany)

- Woodland Foods (U.S.)

- Augason Farms (U.S.)

- amtechingredients (U.S.)

- ASR GROUP (U.S.)

- Ohly (Germany)

- Specialty Products and Technology Inc. (U.S.)

- McCormick & Company, Inc. (U.S.)

- DUTCH GOLD HONEY (U.S.)

- Nature Nate's (U.S.)

- Langnese Honig GmbH & Co. KG (Germany)

- GloryBee (U.S.)

- Aayush Food Products (India)

- Stakich (U.S.)

- Mevive International (India)

Latest Developments in Global Honey Powder Market

- In 2023, Belize Sugar Industries (BSI) successfully attained recertification with zero non-conformities, following an external audit against the updated ProTerra Standard. Compliance with 80% of all indicators, including core ones, is essential for ProTerra certification. This achievement underscores BSI's commitment to meeting stringent sustainability criteria and maintaining high operational standards

- In 2021, Sioux Honey Association made a strategic investment in a new packaging line, increasing their honey powder production capacity by 40%. This move reflects their proactive response to surging market demand for honey powder products. Sioux Honey aims to meet customer needs effectively while capitalizing on expanding market opportunities by enhancing production capabilities

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Honey Powder Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Honey Powder Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Honey Powder Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.