Global Hormone Refractory Oncology Drug Market

Market Size in USD Billion

CAGR :

%

USD

5.33 Billion

USD

12.46 Billion

2025

2033

USD

5.33 Billion

USD

12.46 Billion

2025

2033

| 2026 –2033 | |

| USD 5.33 Billion | |

| USD 12.46 Billion | |

|

|

|

|

Hormone-Refractory Oncology Drug Market Size

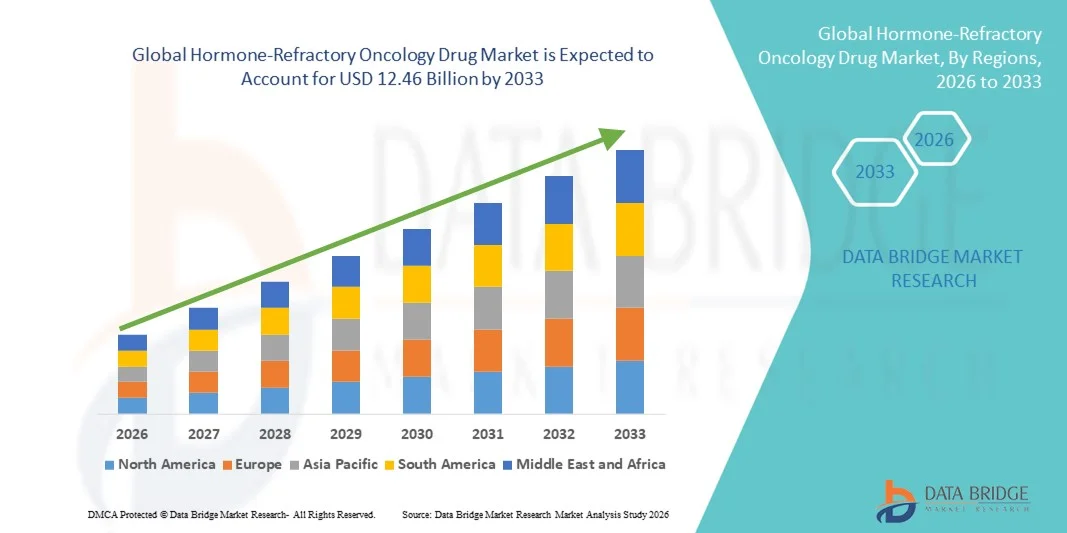

- The global hormone-refractory oncology drug market size was valued at USD 5.33 billion in 2025 and is expected to reach USD 12.46 billion by 2033, at a CAGR of 11.20% during the forecast period

- The market growth is largely fueled by the increasing prevalence of hormone-refractory cancers, rising demand for targeted therapies, and ongoing advancements in oncology drug development

- Furthermore, growing awareness of personalized cancer treatment, coupled with increasing investment in R&D by pharmaceutical companies, is driving the adoption of Hormone-Refractory Oncology Drug solutions, thereby significantly boosting the industry’s growth

Hormone-Refractory Oncology Drug Market Analysis

- Hormone-Refractory Oncology Drugs, offering targeted therapeutic options for patients with cancers resistant to conventional hormone therapy, are increasingly vital components of advanced oncology treatment protocols due to their efficacy in improving survival rates and reducing disease progression

- The escalating demand for these drugs is primarily fueled by the growing prevalence of hormone-refractory cancers, rising awareness of personalized oncology therapies, and increased investment in R&D by leading pharmaceutical companies

- North America dominated the hormone-refractory oncology drug market with the largest revenue share of 42.5% in 2025, driven by a strong presence of pharmaceutical innovators, advanced healthcare infrastructure, high healthcare spending, and rising adoption of targeted oncology therapies, particularly in the U.S.

- Asia-Pacific is expected to be the fastest-growing region in the hormone-refractory oncology drug market during the forecast period, registering a CAGR of 10.2%, supported by increasing incidence of advanced prostate and breast cancers, expansion of specialty oncology centers, rising healthcare expenditure, and growing access to innovative therapies in countries such as China, India, Japan, and South Korea

- The Monotherapy segment held the largest market revenue share of 46.3% in 2025, owing to simplicity, predictable pharmacokinetics, fewer drug-drug interactions, and ease of administration

Report Scope and Hormone-Refractory Oncology Drug Market Segmentation

|

Attributes |

Hormone-Refractory Oncology Drug Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Hormone-Refractory Oncology Drug Market Trends

Rising Incidence of Advanced Hormone-Refractory Cancers

- The growing prevalence of hormone-refractory cancers, such as advanced prostate and breast cancers, is a key driver of the global hormone-refractory oncology drug market. The increasing number of patients with resistant tumors creates a pressing need for innovative therapies capable of overcoming endocrine resistance

- For instance, in March 2024, Pfizer announced expanded access to its CDK4/6 inhibitor for patients with endocrine-resistant breast cancer, reflecting the rising clinical demand for targeted therapies

- Advancements in molecular diagnostics and biomarker-driven therapy enable physicians to identify patients who are most likely to benefit from specific hormone-refractory drugs, further fueling adoption

- The availability of next-generation aromatase inhibitors, anti-androgens, and estrogen receptor modulators allows for more personalized treatment strategies, improving outcomes for patients with resistant cancers

- Increasing patient awareness, coupled with growing advocacy for early intervention and continuous therapy, encourages adoption of combination regimens that pair standard endocrine therapy with novel targeted drugs, driving market expansion

Hormone-Refractory Oncology Drug Market Dynamics

Driver

Expansion of Targeted and Combination Therapies

- A significant and accelerating trend in the global hormone-refractory oncology drug market is the increasing development and adoption of targeted therapies and combination treatment approaches. These strategies aim to overcome endocrine resistance and improve outcomes in patients with advanced prostate, breast, and other hormone-refractory cancers

- For instance, in June 2023, AstraZeneca announced the global launch of an updated combination regimen pairing its CDK4/6 inhibitor with an aromatase inhibitor for hormone-refractory breast cancer, reflecting the trend toward multi-mechanism treatments

- Another instance is the integration of novel androgen receptor degraders with existing anti-androgen therapies in advanced prostate cancer, enabling improved tumor suppression while minimizing side effects

- Biomarker-driven therapy is also gaining traction, where molecular profiling of tumors guides the selection of the most effective drug combinations for each patient, leading to personalized treatment approaches

- Pharmaceutical companies are increasingly investing in next-generation ER modulators, GnRH antagonists, and aromatase inhibitors with improved safety profiles, longer progression-free survival, and better patient adherence

- This trend reflects a broader focus on precision oncology, where therapy regimens are tailored to individual tumor characteristics, resulting in more effective and durable treatment responses

- Growing collaboration between biotech startups and large pharmaceutical companies accelerates the development of novel combination therapies, enabling faster market entry and broader global accessibility

- The demand for more effective and less toxic treatment options is also driving the trend toward oral, outpatient-friendly formulations that improve quality of life for patients undergoing long-term therapy

- Overall, the market is moving toward more integrated, personalized, and evidence-based treatment solutions, reshaping the expectations of oncologists and patients worldwide

Restraint/Challenge

High Treatment Costs and Regulatory Barriers

- The high cost of advanced hormone-refractory oncology drugs poses a significant challenge to widespread adoption, particularly in developing regions or among patients with limited insurance coverage. Therapies such as novel CDK4/6 inhibitors and targeted anti-androgens often require prolonged administration, contributing to elevated overall treatment expenses

- For instance, reports from Q4 2023 highlighted concerns regarding affordability of combination therapy regimens in middle-income countries, limiting patient access despite clinical effectiveness

- Stringent regulatory approval processes in multiple countries also slow the market entry of new hormone-refractory drugs, delaying availability for patients in need. Companies must conduct extensive clinical trials and meet rigorous safety and efficacy standards before gaining approval, extending time-to-market

- In addition, potential adverse effects and therapy-related toxicities can affect patient adherence, presenting a challenge for physicians and healthcare providers aiming to achieve optimal outcomes

- Overcoming these hurdles through expanded insurance coverage, patient assistance programs, and faster regulatory pathways will be essential for sustaining growth in the global hormone-refractory oncology drug market

Hormone-Refractory Oncology Drug Market Scope

The market is segmented on the basis of type and therapy approach.

- By Drug Type

On the basis of drug type, the Hormone-Refractory Oncology Drug market is segmented into Anti-Androgens, Aromatase Inhibitors, Estrogen Receptor Modulators, GnRH Agonists/Antagonists, and Others. The Anti-Androgens segment dominated the largest market revenue share of 42.8% in 2025, driven by its established efficacy in controlling hormone-refractory prostate cancer, strong clinical adoption, and inclusion in standard treatment protocols. Anti-Androgens are widely prescribed in hospitals and oncology centers due to predictable pharmacokinetics, fewer drug-drug interactions, and oral administration convenience. Growing prevalence of prostate cancer in aging populations fuels demand. The segment benefits from robust reimbursement policies in developed regions. Technological improvements in formulations have reduced side effects, enhancing patient adherence. Strong physician confidence, continuous clinical validation, and integration into combination therapy protocols reinforce its market dominance. Anti-Androgens are also preferred in resource-limited settings due to cost-effectiveness. Global awareness campaigns and patient education reinforce their adoption. Regulatory approvals and long-term clinical outcomes maintain steady revenue growth. Increasing research into resistance management ensures continued segment leadership. Continuous innovation in delivery and tolerability further supports the dominant position.

The Aromatase Inhibitors segment is anticipated to witness the fastest CAGR of 19.6% from 2026 to 2033, driven by rising adoption in hormone-refractory breast cancer therapy and growing patient awareness. These inhibitors reduce estrogen production and delay disease progression, making them highly effective in clinical practice. Integration with combination therapies enhances efficacy in advanced-stage patients. Expansion of healthcare access in emerging markets supports market growth. Oral administration and low side-effect profiles improve patient compliance. Pharmaceutical companies are developing novel formulations to enhance bioavailability. Inclusion in clinical guidelines and insurance coverage drives adoption. Early intervention protocols increasingly include aromatase inhibitors. Ongoing clinical trials demonstrate superior outcomes, reinforcing physician confidence. Rising prevalence of hormone receptor-positive breast cancer contributes to higher demand. Technological advancements and improved tolerability support rapid uptake. Increased government initiatives for cancer care also fuel market expansion.

- By Therapy Approach

On the basis of therapy approach, the market is segmented into Monotherapy and Combination Therapy. The Monotherapy segment held the largest market revenue share of 46.3% in 2025, owing to simplicity, predictable pharmacokinetics, fewer drug-drug interactions, and ease of administration. Monotherapy is widely used in hospitals, oncology clinics, and specialty centers. Its inclusion in treatment guidelines and suitability for patients with comorbidities enhances adoption. Resource-limited settings favor monotherapy due to cost-effectiveness and lower monitoring needs. Strong clinical outcomes and global awareness campaigns reinforce its leadership. Long-term safety and tolerability support continued use. Standardization in oncology protocols ensures steady revenue growth. Physician confidence and regulatory approvals strengthen adoption. Integration with patient adherence programs enhances effectiveness. Technological improvements in drug formulation further reinforce preference. Consistent clinical validation supports its dominant position. Global reimbursement policies and insurance coverage maintain market stability.

The Combination Therapy segment is expected to witness the fastest CAGR of 18.4% from 2026 to 2033, driven by increasing use in advanced-stage and refractory cancers. Combination therapy targets multiple pathways, reducing resistance and improving therapeutic outcomes. Pharmaceutical companies are investing in novel combination regimens to enhance efficacy. Clinical trial data show superior progression-free survival, supporting physician adoption. High-income regions and specialty centers are leading users. Patient monitoring and personalized treatment plans ensure safe administration. Insurance coverage and guideline inclusion increase accessibility. Innovations in drug delivery and fixed-dose formulations facilitate adoption. Emerging markets are gradually adopting combination therapy due to improved healthcare infrastructure. Integration with supportive care enhances tolerability and compliance. Regulatory approvals of new combinations reinforce market confidence. Rising physician awareness and clinical evidence fuel segment growth.

Hormone-Refractory Oncology Drug Market Regional Analysis

- North America dominated the hormone‑refractory oncology drug market with the largest revenue share of 42.5% in 2025, primarily driven by a strong presence of pharmaceutical innovators, advanced healthcare infrastructure, high healthcare spending, and rising adoption of targeted oncology therapies

- The region benefits from well-established clinical trial networks, early regulatory approvals, and robust R&D pipelines that accelerate the availability of novel endocrine-resistant cancer drugs. High patient awareness, integrated healthcare delivery, and adoption of combination therapies also strengthen market penetration

- Canada, Mexico, and other North American countries contribute to steady growth, but the U.S. remains the central driver of revenue and adoption

U.S. Hormone‑Refractory Oncology Drug Market Insight

The U.S. hormone‑refractory oncology drug market captured the largest revenue share of 81% in North America in 2025, fueled by advanced oncology centers, early adoption of innovative therapies, and high healthcare expenditure. Patients increasingly prefer targeted therapies for hormone-refractory prostate and breast cancers, including CDK4/6 inhibitors, anti-androgens, and antibody-drug conjugates. Strong collaborations between hospitals, research institutes, and pharmaceutical companies have accelerated clinical trials and drug approvals. Moreover, the U.S. market benefits from widespread access to specialty oncology care, personalized medicine approaches, and the integration of digital health tools for monitoring treatment outcomes, all of which drive sustained market growth.

Europe Hormone‑Refractory Oncology Drug Market Insight

The Europe hormone‑refractory oncology drug market is projected to expand at a substantial CAGR over the forecast period, driven by stringent regulatory frameworks, increasing prevalence of advanced cancers, and rising investment in precision oncology. Western European countries are witnessing strong adoption of targeted endocrine‑resistant therapies, supported by well‑developed healthcare systems and high patient awareness. Germany, France, and Italy account for the majority of market revenue in the region due to their advanced oncology infrastructure and favorable reimbursement policies. Patients and clinicians are increasingly adopting combination therapies involving anti‑androgens, aromatase inhibitors, and CDK4/6 inhibitors, which enhances overall survival outcomes.

U.K. Hormone‑Refractory Oncology Drug Market Insight

The U.K. hormone‑refractory oncology drug market is expected to grow at a notable CAGR during the forecast period, driven by rising prevalence of HR+ and advanced prostate cancers, government initiatives to enhance oncology care, and increasing awareness among patients about available therapeutic options. NICE approvals of drugs such as capivasertib and abemaciclib in combination with endocrine therapy have provided clinicians with more targeted solutions for patients with resistant disease. The U.K.’s strong emphasis on clinical trials and evidence-based treatment protocols is further fostering adoption.

Germany Hormone‑Refractory Oncology Drug Market Insight

Germany hormone‑refractory oncology drug market is a leading market within Europe, benefiting from highly advanced healthcare infrastructure, early adoption of innovative oncology therapies, and strong government support for cancer care programs. The market is expected to grow at a considerable CAGR, supported by rising patient demand for personalized medicine, high prevalence of endocrine-resistant breast and prostate cancers, and a strong presence of pharmaceutical manufacturers conducting local clinical trials. Hospitals and oncology centers are increasingly adopting combination therapies for advanced cases.

Asia-Pacific Hormone‑Refractory Oncology Drug Market Insight

The Asia-Pacific hormone‑refractory oncology drug market is expected to be the fastest-growing region, registering a CAGR of 10.2%, driven by increasing incidence of advanced prostate and breast cancers, expansion of specialty oncology centers, rising healthcare expenditure, and growing access to innovative therapies in countries such as China, India, Japan, and South Korea. Rapid urbanization, improving diagnostic capabilities, and government initiatives promoting oncology care are facilitating adoption of novel therapies.

Japan Hormone‑Refractory Oncology Drug Market Insight

Japan’s hormone‑refractory oncology drug market is growing steadily due to a high prevalence of hormone-refractory breast and prostate cancers, advanced healthcare infrastructure, and strong government support for oncology innovation. Adoption of targeted therapies, including antibody-drug conjugates and combination regimens with endocrine therapy, is driving growth. Aging population and increasing patient awareness are contributing to uptake of innovative oncology treatments.

China Hormone‑Refractory Oncology Drug Market Insight

China hormone‑refractory oncology drug market accounted for the largest revenue share in Asia-Pacific in 2025, driven by expanding healthcare infrastructure, increasing cancer prevalence, high rates of technological adoption, and strong domestic pharmaceutical manufacturing. Urban centers are witnessing rapid uptake of advanced hormone-refractory oncology therapies, supported by government policies promoting access to innovative drugs.

Hormone-Refractory Oncology Drug Market Share

The Hormone-Refractory Oncology Drug industry is primarily led by well-established companies, including:

- Pfizer (U.S.)

- Novartis (Switzerland)

- AstraZeneca (U.K.)

- Johnson & Johnson (U.S.)

- Roche (Switzerland)

- Bristol-Myers Squibb (U.S.)

- Eli Lilly (U.S.)

- Bayer (Germany)

- Sanofi (France)

- Takeda (Japan)

- AbbVie (U.S.)

- Astellas Pharma (Japan)

- Merck & Co. (U.S.)

- Amgen (U.S.)

- GlaxoSmithKline (U.K.)

- Boehringer Ingelheim (Germany)

- Daiichi Sankyo (Japan)

- Incyte (U.S.)

- Seagen (U.S.)

- Ipsen (France)

Latest Developments in Global Hormone-Refractory Oncology Drug Market

- In January 2025, the U.S. Food and Drug Administration approved datopotamab deruxtecan‑dlnk (Datroway/Dato‑DXd) for adults with unresectable or metastatic, hormone receptor‑positive (HR+) and HER2‑negative breast cancer who progressed on prior endocrine therapy and chemotherapy, providing a novel Trop‑2‑directed antibody‑drug conjugate option for endocrine‑resistant patients. This approval introduced a new targeted treatment alternative to standard chemotherapy for patients whose disease no longer responded to endocrine‑based therapies, addressing a key unmet need in hormone‑refractory cancer

- In January 2025, the FDA also approved fam‑trastuzumab deruxtecan‑nxki (Enhertu) for unresectable or metastatic HR‑positive, HER2‑low and HER2‑ultralow breast cancer that progressed on prior endocrine therapy, significantly expanding treatment options for endocrine‑resistant patients with low HER2 expression. This expanded indication broadened the use of Enhertu beyond HER2‑positive cancers, offering a potent antibody‑drug conjugate therapy to a larger group of patients who had limited endocrine therapy options

- In April 2025, clinical data shared at the ASCO conference reported that AstraZeneca’s Camizestrant significantly delayed disease progression or death by 56% when used with standard therapy in advanced hormone‑positive breast cancer, offering a promising new approach for patients developing resistance to conventional endocrine drugs. These late‑stage trial results highlighted the potential of Camizestrant to reshape treatment paradigms by enabling earlier intervention against resistant tumors through liquid biopsy‑guided administration

- In April 2025, Pfizer advanced prifetrastat (PF‑07248144), a first‑in‑class KAT6 histone acetyltransferase inhibitor, to Phase 3 clinical development for ER+ HER2‑ metastatic breast cancer patients who have progressed after CDK4/6 inhibitors and endocrine therapy, signaling a novel epigenetic approach to overcoming resistance mechanisms. The progression into Phase 3 reflected increasingly sophisticated strategies to tackle endocrine resistance by targeting chromatin regulation pathways

- In April 2025, Celcuity and Pfizer announced plans to begin the Phase III VIKTORIA‑2 trial for gedatolisib, a dual PI3K/mTOR inhibitor, in second‑line treatment of endocrine therapy‑resistant HR+/HER2‑ advanced breast cancer, building on Breakthrough Therapy Designation granted in earlier phases. This initiative underlined the ongoing effort to develop combination or multi‑targeted agents that can effectively bypass common resistance pathways in hormone‑refractory tumors

- In April 2025, the National Institute for Health and Care Excellence (NICE) in the U.K. reversed its position and approved capivasertib (Truqap) in combination with fulvestrant for use on the NHS to treat HR+ HER2‑ advanced breast cancer with specific mutations after endocrine therapy failure, marking a “game‑changing” treatment option for these patients in England and Wales. This decision represented a significant regional adoption of a targeted therapy designed specifically to overcome resistance mechanisms when standard hormone therapies stop working

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.