Global Horticulture Mulch Films Market

Market Size in USD Billion

CAGR :

%

USD

3.30 Billion

USD

5.20 Billion

2024

2032

USD

3.30 Billion

USD

5.20 Billion

2024

2032

| 2025 –2032 | |

| USD 3.30 Billion | |

| USD 5.20 Billion | |

|

|

|

|

Horticulture Mulch Films Market Size

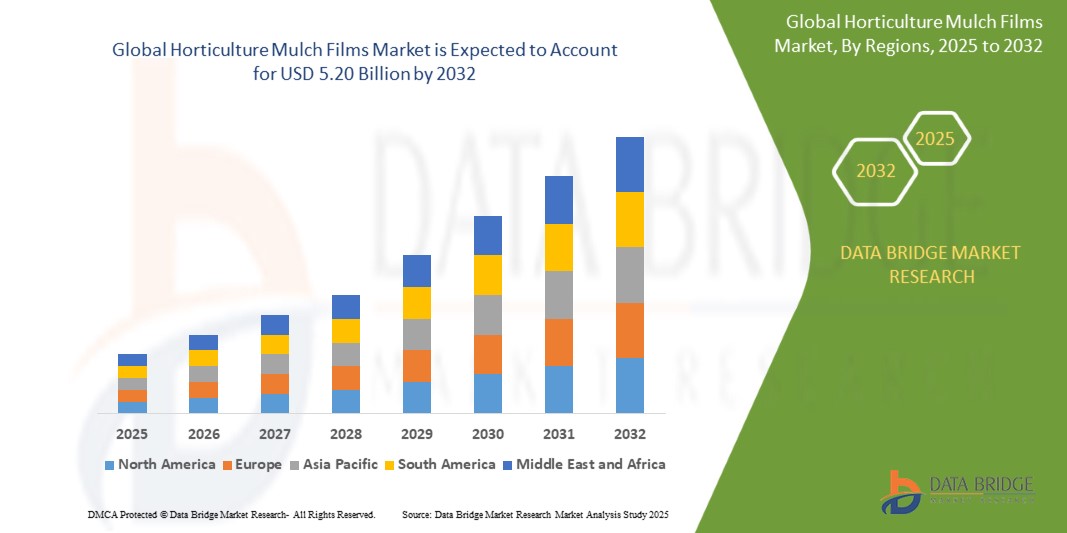

- The global horticulture mulch films market size was valued at USD 3.30 billion in 2024 and is expected to reach USD 5.20 billion by 2032, at a CAGR of 5.20% during the forecast period

- The market growth is largely fuelled by the rising demand for high-yield crop production, increasing adoption of advanced agricultural practices, and the growing awareness of water conservation and soil health management among farmers globally

- In addition, the expansion of greenhouse farming and controlled-environment agriculture is boosting the demand for mulch films that enhance crop protection, reduce soil erosion, and contribute to improved agricultural productivity across various climatic zones

Horticulture Mulch Films Market Analysis

- The rising pressure on farmers to improve crop yield within limited arable land is significantly driving the demand for mulch films that offer better weed control, soil temperature regulation, and moisture retention

- Increasing governmental initiatives promoting sustainable and modern farming methods, especially in developing countries, are supporting market expansion for both biodegradable and polyethylene-based mulch films

- Europe dominated the horticulture mulch films market with the largest revenue share of 37.6% in 2024, driven by a strong emphasis on sustainable agriculture practices, rising demand for high-yield crop production, and favorable government regulations supporting eco-friendly farming inputs

- The Asia-Pacific region is expected to witness the highest growth rate in the global horticulture mulch films market, driven by population growth, increasing food demand, and significant investments in agricultural modernization across key countries such as China, India, and Indonesia

- The black mulch films segment accounted for the largest market revenue share in 2024, primarily due to its widespread application in weed control, moisture retention, and soil temperature regulation. Black films are particularly favored in vegetable and fruit cultivation for their ability to block sunlight, thus preventing weed growth without chemical herbicides. Their cost-effectiveness and compatibility with diverse crops further strengthen their dominance in both open field and greenhouse settings

Report Scope and Horticulture Mulch Films Market Segmentation

|

Attributes |

Horticulture Mulch Films Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Horticulture Mulch Films Market Trends

“Shift Toward Biodegradable and Eco-Friendly Mulch Films”

- Increasing consumer and regulatory pressure to reduce plastic pollution is pushing manufacturers and farmers to adopt biodegradable mulch films that decompose naturally without harming the soil or environment, reducing post-harvest waste and disposal costs for growers

- Governments in regions such as Europe and North America are introducing policies and subsidies that promote eco-friendly agricultural inputs, encouraging the replacement of polyethylene mulch with starch-based or compostable alternatives across various crop applications

- Farmers are becoming more aware of the long-term sustainability benefits of using bio-mulch films, including improved soil health and reduced dependency on labor-intensive retrieval methods after harvest, which is critical for operational efficiency

- Technological advancements are making biodegradable mulch films more cost-competitive and durable, with innovations in materials such as polylactic acid and polybutylene succinate enhancing field performance under varied climatic conditions

- For instance, BASF’s Ecovio mulch film has been widely adopted in European horticulture due to its proven compostability, aligning with EU sustainability targets while delivering comparable yield and soil protection benefits as conventional plastics

Horticulture Mulch Films Market Dynamics

Driver

“Rising Adoption of Advanced Agricultural Techniques and Crop Productivity Optimization”

- Farmers are increasingly using mulch films to improve soil moisture retention, reduce weed proliferation, and stabilize soil temperature, which collectively enhances crop quality and maximizes yield, especially in water-deficient or arid regions where input efficiency is critical

- The push toward protected cultivation and precision farming is driving the integration of mulch films into standard horticultural practices, especially for high-value crops such as berries, tomatoes, and peppers that benefit from microclimate regulation

- Market demand for year-round food production is encouraging the use of mulch films in greenhouses and open-field setups, as they help in extending growing seasons and protecting crops from extreme weather, pest infestation, and soil erosion

- Public and private agricultural extension programs are actively promoting mulch films as part of sustainable farming packages, supporting small and medium growers with access to materials, training, and government-backed subsidies

- For instance, in India, the National Horticulture Mission supports the use of plasticulture technologies including mulch films to increase productivity and water-use efficiency, leading to their rapid adoption across fruit and vegetable farms

Restraint/Challenge

“Environmental Concerns Over Plastic Waste and Disposal Challenges”

- Conventional polyethylene mulch films are non-biodegradable, and their accumulation in fields post-harvest contributes to soil contamination and pollution, raising environmental concerns and limiting their continued use in regulated markets

- Disposal of used mulch films is a logistical and financial burden for farmers, especially in developing regions where waste collection systems are inadequate, forcing many to resort to environmentally damaging methods such as burning or burying

- The lack of economically viable recycling systems for thin agricultural films means most end up in landfills, leading to long-term ecological risks and diminishing the environmental credibility of plasticulture practices among sustainability-focused consumers

- Growing global awareness around plastic waste has led to policy shifts that ban or restrict single-use plastics, including agricultural films, which creates uncertainty for market players relying on traditional products and calls for a transition toward greener alternatives

For instance, China has implemented strict plastic control regulations under its agricultural non-degradable plastic ban policy, pressuring domestic mulch film manufacturers to accelerate innovation in compostable and eco-friendly film solutions

Horticulture Mulch Films Market Scope

The market is segmented on the basis of type and element.

• By Type

On the basis of type, the horticulture mulch films market is segmented into clear/transparent, black, colored, photo-selective, and degradable. The black mulch films segment accounted for the largest market revenue share in 2024, primarily due to its widespread application in weed control, moisture retention, and soil temperature regulation. Black films are particularly favored in vegetable and fruit cultivation for their ability to block sunlight, thus preventing weed growth without chemical herbicides. Their cost-effectiveness and compatibility with diverse crops further strengthen their dominance in both open field and greenhouse settings.

The degradable mulch films segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing environmental concerns and supportive regulatory frameworks promoting sustainable agriculture. These films offer eco-friendly benefits by breaking down naturally after use, eliminating the need for retrieval and disposal. The demand for biodegradable solutions is particularly rising in Europe and North America, where growers face growing pressure to reduce plastic waste in farming operations.

• By Element

On the basis of element, the horticulture mulch films market is segmented into low-density polyethylene (LDPE), linear low-density polyethylene (LLDPE), high-density polyethylene (HDPE), ethylene-vinyl acetate (EVA), polylactic acid (PLA), and polyhydroxyalkanoates (PHA). The LLDPE segment led the market in 2024, owing to its superior mechanical properties, such as flexibility, puncture resistance, and durability under varying climatic conditions. It is widely used across diverse horticultural applications, offering cost efficiency and high adaptability for both small-scale and commercial farms.

The PLA segment is expected to witness the fastest growth rate from 2025 to 2032, supported by rising demand for compostable and plant-based alternatives in mulch film production. PLA-based films decompose naturally and comply with many international standards for biodegradability, making them attractive in organic farming and environmentally conscious agricultural markets. Their growing application across Europe and parts of Asia highlights the shift toward greener and more sustainable mulch film solutions.

Horticulture Mulch Films Market Regional Analysis

- Europe dominated the horticulture mulch films market with the largest revenue share of 37.6% in 2024, driven by a strong emphasis on sustainable agriculture practices, rising demand for high-yield crop production, and favorable government regulations supporting eco-friendly farming inputs

- Farmers across the region are increasingly adopting mulch films to improve soil health, control weeds, and enhance crop quality and yield in both open-field and greenhouse farming.

- The widespread usage of biodegradable and photo-selective mulch films across countries such as Germany, France, and the Netherlands is also promoting innovation and encouraging long-term adoption in modern farming systems

Germany Horticulture Mulch Films Market Insight

The Germany horticulture mulch films market captured the largest revenue share in Europe in 2024, supported by the country’s advanced agricultural infrastructure and strong policy focus on sustainable cultivation practices. German farmers are increasingly turning to degradable mulch films to meet environmental standards while improving efficiency in water usage and crop management. Moreover, the high prevalence of greenhouse farming and precision agriculture technologies further fuels the demand for advanced mulch film products.

U.K. Horticulture Mulch Films Market Insight

The U.K. horticulture mulch films market is expected to witness the fastest growth rate from 2025 to 2032, supported by the increasing focus on sustainable agriculture and organic farming practices. U.K. farmers are adopting biodegradable mulch films to meet stringent environmental regulations and reduce plastic waste in cultivation processes. The strong presence of greenhouse horticulture and government incentives for eco-conscious inputs are further accelerating the adoption of mulch films across fruits, vegetables, and ornamental crop segments.

Asia-Pacific Horticulture Mulch Films Market Insight

The Asia-Pacific horticulture mulch films market is expected to witness the fastest growth rate from 2025 to 2032, driven by population growth, shrinking arable land, and the rising need to enhance agricultural productivity. Countries such as China and India are heavily investing in mulching solutions to address challenges such as soil erosion, water scarcity, and weed proliferation. In addition, the growing adoption of plasticulture techniques and government-backed initiatives to improve farm output are further supporting regional growth.

Japan Horticulture Mulch Films Market Insight

The Japan horticulture mulch films market is expected to witness the fastest growth rate from 2025 to 2032, driven by the country’s advanced agricultural practices and demand for high-quality produce. Japanese farmers utilize mulch films extensively in controlled environments such as polyhouses and vertical farming to enhance crop uniformity and reduce soil-borne diseases. The country's commitment to sustainability and preference for degradable and high-performance mulch films are contributing to innovation and consistent market demand.

China Horticulture Mulch Films Market Insight

The China horticulture mulch films market held the largest revenue share in Asia-Pacific in 2024, driven by extensive use of mulching technology in large-scale fruit and vegetable cultivation. China's strong manufacturing base enables mass production of both traditional and biodegradable mulch films, making them widely accessible to farmers. In addition, government programs promoting plasticulture techniques to improve food security and land efficiency are supporting significant growth in the adoption of mulch films across rural and peri-urban agricultural zones.

North America Horticulture Mulch Films Market Insight

The North America horticulture mulch films market is expected to witness the fastest growth rate from 2025 to 2032, driven by the region’s strong presence of large-scale commercial farms and greenhouse operations. U.S. and Canadian farmers are focusing on sustainable growing practices, with rising demand for UV-resistant, photo-selective, and organic-compatible mulch films. In addition, investments in agricultural innovation and partnerships between film manufacturers and agritech companies are supporting the development of next-generation mulch films for diversified cropping systems.

U.S. Horticulture Mulch Films Market Insight

The U.S. horticulture mulch films market is expected to witness the fastest growth rate from 2025 to 2032, due to increased adoption of precision agriculture and advanced mulching systems across fruit and vegetable production. Farmers are increasingly relying on mulch films to conserve water, regulate soil temperature, and reduce reliance on herbicides. The trend toward biodegradable and eco-friendly options is gaining momentum, supported by research grants and sustainability goals set by agricultural stakeholders and government agencies.

Horticulture Mulch Films Market Share

The Horticulture Mulch Films industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Berry Global Inc. (U.S.)

- Dow (U.S.)

- RKW Group (Germany)

- Kingfa Sci.&Tech. Co.,Ltd. (China)

- BioBag International AS (Norway)

- Al-Pack Enterprises Ltd. (Canada)

- Armando Alvarez Group (Spain)

- Novamont S.p.A. (Italy)

- Rani Group (Finland)

- Polythene UK Ltd (U.K.)

- Kuraray America, Inc. (U.S.)

Latest Developments in Global Horticulture Mulch Films Market

- In December 2022, Dow Chemical Company introduced V PLUS Perform next, a high-performance solution that merges advanced fire safety and energy efficiency with low-carbon, circular raw materials. Tailored to meet specific customer needs, the development aims to support sustainable construction and building applications. This innovation reinforces Dow’s commitment to climate-friendly product offerings, contributing to reduced environmental impact in the global materials market

- In December 2022, BASF SE launched the ColorBrite Airspace Blue ReSource basecoat, the automotive sector’s first biomass balance-based coating. This environmentally conscious product reduces the carbon footprint by approximately 20%, as verified by an independent sustainability consultant. The initiative highlights BASF’s leadership in sustainable automotive coatings, offering eco-friendly options without compromising performance

- In August 2022, BASF introduced a new Thermoplastic Polyurethane (TPU) Paint Protection Film (PPF) in the Asia Pacific region. This durable and transparent film is designed to shield automotive surfaces from scratches and environmental damage. The launch is set to enhance the lifespan and aesthetic appeal of vehicles, boosting demand for premium protective solutions in the automotive aftermarket

- In January 2022, BASF SE unveiled Peptovitae, a series of four patented biomimetic peptides aimed at addressing diverse skin concerns, including aging, hydration, and sensitivity. This innovation marks a significant step in the development of advanced skincare ingredients. It strengthens BASF’s position in the personal care market by offering high-efficacy, science-backed formulations that meet growing consumer demand for targeted skincare solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.