Global Hoses Market

Market Size in USD Billion

CAGR :

%

USD

25.23 Billion

USD

40.52 Billion

2024

2032

USD

25.23 Billion

USD

40.52 Billion

2024

2032

| 2025 –2032 | |

| USD 25.23 Billion | |

| USD 40.52 Billion | |

|

|

|

|

Hoses Market Size

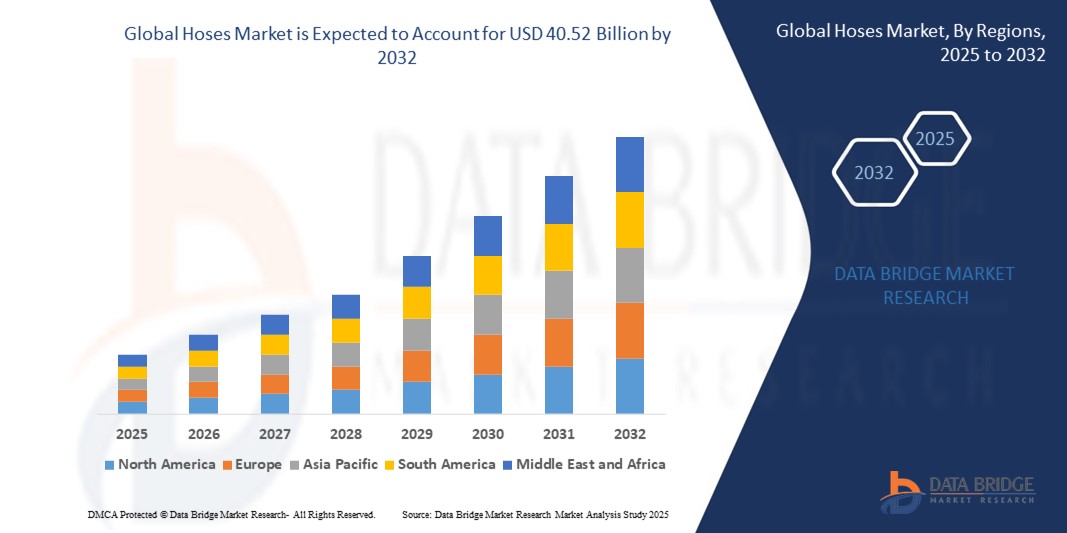

- The global hoses market size was valued at USD 25.23 billion in 2024 and is expected to reach USD 40.52 billion by 2032, at a CAGR of 6.10% during the forecast period

- The market growth is primarily driven by increasing demand for efficient fluid transfer systems across industries, growing industrialization, and the rising need for durable and high-performance hoses in automotive and construction applications

- Rising awareness of the benefits of specialized hoses, such as chemical resistance, high-pressure tolerance, and flexibility, is further propelling demand across both OEM and aftermarket channels

Hoses Market Analysis

- The hoses market is experiencing consistent growth due to the increasing adoption of advanced materials and technologies that enhance hose durability, flexibility, and performance under extreme conditions

- Growing demand from industrial and automotive sectors, coupled with the need for customized solutions for specific media such as hydraulic fluids and food-grade materials, is encouraging manufacturers to innovate with high-performance, eco-friendly, and durable hose solutions

- North America dominates the hoses market with the largest revenue share of 39.2% in 2024, driven by a well-established industrial base, advanced automotive manufacturing, and high demand for specialized hoses in construction and energy sectors

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, fueled by rapid industrialization, increasing automotive production, and growing infrastructure development in countries such as China, India, and Southeast Asian nations

- The hydraulic hoses segment dominated the largest market revenue share of 38.2% in 2024, driven by widespread use in automotive, construction, and oil & gas industries for high-pressure fluid transfer

Report Scope and Hoses Market Segmentation

|

Attributes |

Hoses Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Hoses Market Trends

Rising demand for eco-friendly and lightweight composite hoses

- The global hoses market is experiencing a notable trend toward the development and adoption of specialized hoses tailored to meet specific industry requirements

- Advanced materials such as thermoplastics, silicone, and composite hoses are being utilized to enhance durability, flexibility, and resistance to extreme conditions such as high pressure, corrosive chemicals, and harsh temperatures

- Specialized hoses are increasingly critical in industries such as oil and gas, food and beverage, pharmaceuticals, and automotive, where precise performance characteristics, such as FDA compliance or high-pressure tolerance, are essential

- For instance, companies are innovating with silicone hoses for food processing that are odor-free and resistant to cleaning agents, while hydraulic hoses are being designed for construction equipment to withstand heavy loads and abrasive environments

- This trend is driving market growth by offering customized solutions that improve operational efficiency, safety, and compliance with stringent industry standards

- The integration of smart technologies, such as sensors for real-time monitoring of hose performance and wear, is also gaining traction, enabling predictive maintenance and reducing downtime in industrial applications

Hoses Market Dynamics

Driver

Rising Demand for Infrastructure Development and Industrial Applications

- The increasing global focus on infrastructure development, including roads, bridges, and urban projects, is a major driver for the hoses market, particularly for hydraulic and material handling hoses

- Hoses are critical in construction, manufacturing, and automotive sectors for transferring fluids, gases, and materials, supporting applications such as concrete pumping, fuel transfer, and hydraulic systems

- Government initiatives, such as China’s Belt and Road Initiative and India’s Smart Cities Mission, are boosting demand for durable, high-performance hoses in large-scale projects

- The growth of industries such as oil and gas, agriculture, and automotive, coupled with the adoption of automation, is further expanding the need for advanced hose solutions

- The proliferation of renewable energy projects, such as solar farms and wind turbines, is driving demand for specialized hoses capable of functioning under heavy-duty cycles and harsh environmental conditions

Restraint/Challenge

High Costs of Advanced Materials and Regulatory Compliance

- The development and production of specialized hoses using advanced materials such as thermoplastics, silicone, and composites involve significant costs, which can be a barrier for manufacturers and end-users, particularly in cost-sensitive emerging markets

- Integrating smart technologies or high-performance materials into hoses increases manufacturing complexity and expenses, potentially limiting adoption in smaller-scale operations

- Data security and regulatory compliance pose challenges, especially for smart hoses equipped with IoT-enabled sensors, as they collect and transmit operational data, raising concerns about breaches and compliance with regional regulations

- The fragmented regulatory landscape across countries, with varying safety and environmental standards, complicates manufacturing and distribution for global players

- Volatility in raw material prices, such as rubber, PVC, and steel, further impacts production costs, creating challenges for maintaining profitability and market competitiveness

Hoses market Scope

The market is segmented on the basis of media, material, end user, and sales channel.

- By Media

On the basis of media, the North America hoses market is segmented into hydraulic, air and gas hoses, material handling hoses, food hoses, steam hoses, and others. The hydraulic hoses segment dominated the largest market revenue share of 38.2% in 2024, driven by widespread use in automotive, construction, and oil & gas industries for high-pressure fluid transfer. These hoses are critical for hydraulic systems in heavy machinery, ensuring efficient power transmission and operational reliability.

The material handling hoses segment is expected to witness the fastest growth rate from 2025 to 2032, propelled by increasing demand in construction, mining, and agriculture for transferring abrasive materials, slurries, and dry bulk. Advancements in durable, abrasion-resistant materials and the rise in infrastructure projects further accelerate adoption.

- By Material

On the basis of material, the North America hoses market is segmented into rubber hoses, plastic/polymer hoses, metal hoses, composite hoses, silicon hoses, and others. The rubber hoses segment dominated the market with a revenue share of 50.3% in 2024, owing to their flexibility, durability, and widespread use in automotive, industrial, and agricultural applications. Rubber hoses are preferred for their ability to handle diverse fluids and withstand harsh conditions.

The plastic/polymer hoses segment is anticipated to experience the fastest growth rate of 8.2% from 2025 to 2032, driven by their lightweight nature, corrosion resistance, and increasing adoption in automotive and food & beverage industries. Growing environmental concerns and advancements in eco-friendly polymer materials are boosting demand for sustainable hose solutions.

- By End User

On the basis of end user, the North America hoses market is segmented into automotive, industrial, commercial, and residential. The industrial segment held the largest market revenue share of 42.7% in 2024, driven by extensive use in oil & gas, construction, and manufacturing for fluid and material transfer. The robust industrial base in the U.S., coupled with infrastructure investments, solidifies this segment's dominance.

The automotive segment is expected to witness rapid growth from 2025 to 2032, with a projected CAGR of 7.9%, fueled by increasing demand for hoses in fuel, coolant, and air transfer systems in vehicles. The rise in electric vehicle production and the need for lightweight, durable hoses in Canada’s growing automotive sector are key growth drivers.

- By Sales Channel

On the basis of sales channel, the North America hoses market is segmented into indirect and direct. The direct sales channel segment accounted for the largest market revenue share of 60.8% in 2024, driven by manufacturers’ direct partnerships with OEMs and large industrial clients, ensuring customized solutions and streamlined supply chains. This is particularly prominent in the U.S., where established manufacturers such as Gates Corporation and Parker Hannifin dominate.

The indirect sales channel segment is anticipated to grow at a significant rate from 2025 to 2032, driven by the expansion of e-commerce platforms and distributors catering to smaller businesses and residential consumers. The convenience of online procurement and competitive pricing are enhancing accessibility, particularly in Canada’s rapidly growing market.

Hoses Market Regional Analysis

- North America dominates the hoses market with the largest revenue share of 39.2% in 2024, driven by a well-established industrial base, advanced automotive manufacturing, and high demand for specialized hoses in construction and energy sectors

- Consumers and industries prioritize hoses for their durability, flexibility, and ability to handle diverse media such as hydraulic fluids, steam, and gases, particularly in regions with varied industrial and climatic conditions

- Growth is supported by innovations in hose materials, including high-performance polymers and composites, alongside increasing adoption in industrial, automotive, and residential sectors

U.S. Hoses Market Insight

The U.S. hoses market captured the largest revenue share of 82.3% in 2024 within North America, fueled by demand for high-performance hoses in industrial and commercial settings. Increased focus on operational efficiency and safety standards encourages adoption. In addition, evolving regulations on material handling and environmental compliance influence consumer choices, balancing performance with regulatory requirements.

Europe Hoses Market Insight

The Europe hoses market is expected to witness significant growth, driven by regulatory focus on industrial safety and efficiency. Consumers and industries seek hoses that offer high durability and compatibility with various media, such as hydraulic and gas applications. Growth is prominent in industrial and automotive sectors, with countries such as Germany and France showing substantial adoption due to increasing environmental regulations and industrial automation.

U.K. Hoses Market Insight

The U.K. hoses market is expected to experience rapid growth, driven by demand for high-performance hoses in industrial and commercial settings. Increased focus on operational efficiency and safety standards encourages adoption. In addition, evolving regulations on material handling and environmental compliance influence consumer choices, balancing performance with regulatory requirements.

Germany Hoses Market Insight

Germany is expected to witness rapid growth in the hoses market, attributed to its advanced manufacturing sector and strong emphasis on efficiency and sustainability. German industries prefer technologically advanced hoses made from materials such as composites and silicon to optimize performance and reduce maintenance costs. The integration of these hoses in premium industrial equipment and aftermarket solutions supports sustained market growth.

Asia-Pacific Hoses Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by expanding industrial and automotive production, as well as rising disposable incomes in countries such as China, India, and Japan. Increasing awareness of high-quality hose solutions for media transfer and safety is boosting demand. Government initiatives promoting industrial efficiency and environmental sustainability further encourage the adoption of advanced hoses.

Japan Hoses Market Insight

Japan’s hoses market is expected to witness rapid growth due to strong consumer and industrial preference for high-quality, technologically advanced hoses that enhance operational efficiency and safety. The presence of major manufacturing industries and the integration of hoses in OEM applications accelerate market penetration. Rising interest in aftermarket customization also contributes to growth.

China Hoses Market Insight

China holds the largest share of the Asia-Pacific hoses market, propelled by rapid industrialization, increasing vehicle ownership, and growing demand for efficient media transfer solutions. The country’s expanding industrial base and focus on cost-effective manufacturing support the adoption of advanced hoses. Strong domestic production capabilities and competitive pricing enhance market accessibility.

Hoses Market Share

The hoses industry is primarily led by well-established companies, including:

- Parker Hannifin Corp (U.S.)

- Continental AG (Germany)

- Tricoflex SAS (France)

- Trelleborg Group (Sweden)

- Manuli Hydraulics (Italy)

- Danfoss (Denmark)

- Gates Corporation (U.S.)

- Schauenburg Hose Technology Group (Germany)

- Masterflex Group (Germany)

- Copely Developments Ltd (U.K.)

- Transfer Oil S.p.A. (Italy)

- MöllerGroup (Germany)

- Gollmer & Hummel GmbH (Germany)

- Colex International Limited, UK. (U.K.)

- Jakob Eschbach GmbH (Germany)

- Artel Rubber Company (Netherlands)

- Gummi Hansen GmbH (Germany)

What are the Recent Developments in Global Hoses Market?

- In April 2025, Continental AG, a global leader in automotive and industrial solutions, launched its latest innovation in data center cooling: the DataGuard and FlexCool premium data cooling hoses. These specialized hoses are designed to ensure thermal stability and prevent overheating, hardware failures, and data loss in sensitive electronic systems. Engineered for direct-to-chip single-phase cooling, they feature peroxide-cured EPDM tubes, UL 94 V-0 flame-rated covers, and exceptional flexibility, making them ideal for modern high-density data centers. This launch reflects Continental’s commitment to supporting emerging high-tech sectors with sustainable and efficient solutions

- In May 2024, Danfoss Power Solutions introduced its latest innovation: the Boston by Danfoss EHP530 and EHP531 antistatic hoses, specifically engineered for oil, fuel, and gas transfer applications. These hoses feature a specialized antistatic rubber compound inner tube, high-tensile textile reinforcement, and copper wire grounding, ensuring protection against static buildup and discharge. With pressure ratings of 10.5 bar (EHP530) and 20.7 bar (EHP531), they offer durability, flexibility, and ease of handling in demanding environments. The launch underscores Danfoss’s commitment to safety-critical applications and reliable performance in the oil and petroleum industry

- In September 2023, Watson-Marlow Fluid Technology Solutions (WMFTS) expanded its Bredel hose pump range with the launch of the Bredel NR Transfer hose, a natural rubber hose designed for general fluid transfer applications. Engineered to withstand pressures up to 12 bar (174 psi), the hose is suitable for handling sludge, food and beverage waste, abrasive slurries, and lightly corrosive chemicals. It complements the existing NR Metering hose and is optimized for long life, chemical compatibility, and low maintenance, making it ideal for industries such as wastewater treatment, construction, and power generation

- In July 2023, LifeGuard Technologies, a leading manufacturer of safety hose systems, introduced the industry’s first patent-pending LifeGuard Vacuum Jacketed Safety Hose, specifically engineered for the transfer of liquid hydrogen and helium. This advanced hose features vacuum insulation with super insulation layers and an integrated LifeGuard Safety Internal Shutoff System, designed to prevent product loss and ensure flow stoppage in the event of emergency separation. Developed in collaboration with GPSS India and Shell-N-Tube, the hose addresses the unique challenges of cryogenic fluid transfer, reinforcing LifeGuard’s commitment to clean energy and industrial gas safety

- In March 2023, Continental AG showcased its next-generation hydraulic hose solutions at the IFPE/CONEXPO trade show in Las Vegas. The company introduced a connected assembly solution powered by smart technology, revolutionizing hose fabrication by improving efficiency, accuracy, and product performance. This system integrates cloud-based CrimpCloud® software and the C-IQ™ mobile app, enabling real-time access to crimp specifications, fitting identification, and assembly guidance. Continental also highlighted its X-Life™ abrasion-resistant thermoplastic hoses, designed for extreme environments, and its Shop in a Box concept—a complete hose assembly cell for on-site operations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.