Global Hospital Acquired Infection Control Market

Market Size in USD Billion

CAGR :

%

USD

38.51 Billion

USD

81.94 Billion

2024

2032

USD

38.51 Billion

USD

81.94 Billion

2024

2032

| 2025 –2032 | |

| USD 38.51 Billion | |

| USD 81.94 Billion | |

|

|

|

|

Hospital Acquired Infection Control Market Size

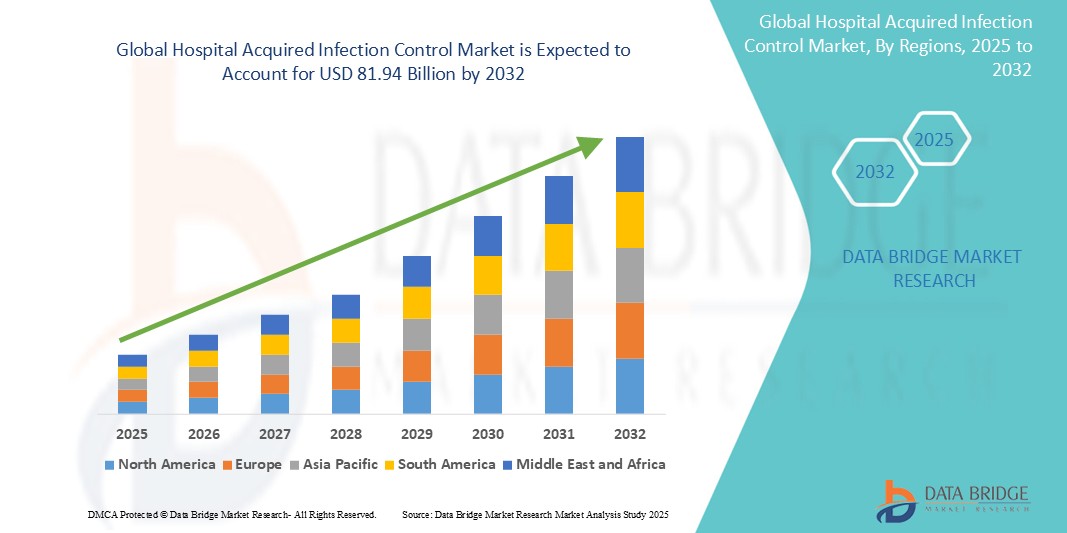

- The global hospital acquired infection control market size was valued at USD 38.51 billion in 2024 and is expected to reach USD 81.94 billion by 2032, at a CAGR of 9.90% during the forecast period

- The market growth is largely fueled by the increasing prevalence of hospital-acquired infections (HAIS) worldwide, which drives the demand for effective infection control products and protocols.

- Rising government initiatives and stringent regulations aimed at improving patient safety and hygiene standards in healthcare facilities are further boosting the adoption of advanced infection control solutions.

- Technological advancements in diagnostic tools and sterilization equipment contribute to enhanced infection detection and prevention, thereby supporting market expansion.

Hospital Acquired Infection Control Market Analysis

- The global hospital acquired infection control market is experiencing significant expansion due to growing emphasis on improving patient safety and healthcare quality with hospitals investing heavily in advanced infection control systems and technologies designed to reduce infection rates and enhance clinical outcomes

- The integration of innovative sterilization equipment and real-time infection monitoring systems is transforming hospital protocols and enabling healthcare providers to respond swiftly to infection threats, thereby reducing hospital stay durations and associated costs

- North America dominates the hospital acquired infection control market with the share of 48.82% in 2024, driven by the strong presence of technologically advanced healthcare infrastructure and high adoption of infection surveillance systems across hospitals and clinical settings

- Asia-pacific is expected to be the fastest growing region in the hospital acquired infection control market during the forecast period due to infection prevention technologies tailored for both large-scale hospitals and smaller healthcare facilities

- The consumables segment dominates the largest market revenue share with 46.93% in 2024, due to their broad applicability in surface, instrument, and skin decontamination protocols in hospitals

Report Scope and Hospital Acquired Infection Control Market Segmentation

|

Attributes |

Hospital Acquired Infection Control Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Hospital Acquired Infection Control Market Trends

“Rise of Automated Solutions in Infection Control”

- The hospital acquired infection control market is witnessing a steady rise in demand for automated disinfection systems as healthcare facilities seek to minimize human error in infection prevention

- Automated solutions such as ultraviolet light robots and hydrogen peroxide vapor systems are increasingly being adopted for their efficiency and consistency in sterilizing hospital environments

- Hospitals are prioritizing contactless and programmable technologies to maintain strict hygiene standards and improve turnaround time between patient admissions

- Several healthcare facilities have implemented autonomous disinfection robots that sanitize high-risk areas such as intensive care units and surgical rooms without manual intervention

- The growing preference for smart disinfection methods is also driving investments in sensor-enabled equipment that provides real-time data on cleaning performance and infection risks

- In conclusion, this ongoing shift toward automation reflects a broader market trend where hospitals are integrating intelligent infection control tools to improve operational efficiency and patient safety in the current healthcare landscape

Hospital Acquired Infection Control Market Dynamics

Driver

“Growing Emphasis on Patient Safety and Hygiene Standards”

- Hospitals are increasingly prioritizing patient safety and hygiene as they face pressure to reduce infection rates and avoid penalties from health regulators and insurance providers

- For instance, hospitals under the Centers for Medicare and Medicaid Services in the U.S. face financial penalties for high rates of hospital-acquired infections, pushing them to adopt rigorous infection control practices

- Healthcare accreditation bodies are enforcing strict compliance with infection control standards, leading hospitals to invest in sterilization tools, hand hygiene systems, and real-time infection surveillance

- For instance, leading healthcare networks such as Mayo Clinic and Cleveland Clinic have integrated electronic surveillance systems to monitor and manage infection risks effectively

- With patient satisfaction scores and reimbursement now tied to hospital hygiene performance, healthcare facilities are channeling significant resources into infection prevention measures across all departments

- In conclusion, this collective push for safer care environments is directly supporting the growth of the hospital acquired infection control market

Restraint/Challenge

“High Implementation Costs for Advanced Systems”

- The high cost of advanced infection control systems such as automated ultraviolet disinfection robots and smart sterilization units is a major challenge for hospitals with constrained budgets

- For instance, a Tru-D SmartUVC disinfection robot can cost upwards of USD 90,000, making it inaccessible for smaller hospitals or clinics that must prioritize other operational needs

- Many facilities struggle with additional financial demands such as ongoing staff training, equipment maintenance, and regular software updates, all of which increase the total cost of ownership

- Smaller healthcare centers often opt for manual or semi-automated alternatives that may lack consistency or thoroughness in infection control

- The complexity of integrating new technology into existing hospital workflows, along with potential downtime and staff adaptation issues, further slows the pace of adoption

- In conclusion, this cost barrier continues to limit the reach of modern infection control systems despite their proven benefits in reducing hospital-acquired infections

Hospital Acquired Infection Control Market Scope

The market is segmented on the basis of type, communication protocol, unlocking mechanism, and application.

- By Product

On the basis of product, the hospital acquired infection control market is segmented into sterilizers, disinfectors, endoscope reprocessors, microbial testing instruments, reagents, consumables, disinfectants, infection prevention and surveillance software, others. The consumables segment dominates with the largest market revenue share with 46.93% in 2024, owing to their broad applicability in surface, instrument, and skin decontamination protocols in hospitals. For instance, alcohol-based surface disinfectants remain a staple in intensive care units due to their rapid action and effectiveness against a wide range of pathogens. The market also sees strong uptake of disinfectants driven by hospital regulations enforcing frequent sanitation of patient-contact areas.

The endoscope reprocessors segment is anticipated to witness the fastest growth rate from 2025 to 2032, as hospitals increasingly adopt automated, validated solutions for complex device cleaning to reduce cross-contamination risks and meet accreditation standards.

- By Application

On the basis of application, the hospital acquired infection control market is segmented into disease testing, and drug-resistance testing. Disease testing holds a dominant position in the market as hospitals increasingly implement rapid detection technologies to identify infections and isolate affected patients. For instance, real-time PCR tests are commonly used to diagnose hospital-acquired pneumonia and bloodstream infections.

Drug-resistance testing is anticipated to witness the fastest growth rate due to the global rise in antimicrobial resistance, with healthcare systems adopting it to monitor treatment effectiveness and guide antibiotic use.

- By Technology

On the basis of technology, the hospital acquired infection control market is segmented into phenotypic methods, and genotypic methods. Phenotypic methods remain widely used due to their long-standing clinical reliability in detecting and confirming pathogens. For instance, culture-based identification and antimicrobial susceptibility testing are routine in most hospital laboratories.

Genotypic methods is anticipated to witness the fastest growth and increasing adoption as molecular diagnostics enable faster and more precise infection detection, particularly for resistant organisms that may not be easily identified by traditional methods.

- By Disease

On the basis of application, the hospital acquired infection control market is segmented into hospital acquired pneumonia, bloodstream infections, surgical site infections, gastrointestinal infections, urinary tract infection, others. Hospital acquired pneumonia is the most prevalent condition targeted by infection control protocols, especially in critical care settings. For instance, the implementation of ventilator-associated pneumonia prevention bundles is standard practice in intensive care units.

Bloodstream infections is anticipated to witness the fastest growth, with hospitals enhancing line care practices and monitoring to reduce central line-associated infection rates.

- By End Users

On the basis of end users, the hospital acquired infection control market is segmented into hospitals, ICUS, ambulatory surgical, diagnostic centers, nursing homes, maternity centers, others. Hospitals are the primary users of infection control solutions due to their complex environments and high risk of infection spread. For instance, large multispecialty hospitals integrate infection surveillance software and routine disinfection protocols throughout departments.

Intensive care units is anticipated to witness the fastest growth and increasingly adopting advanced systems due to the vulnerability of patients and the use of invasive medical devices, which require stringent hygiene management.

Hospital Acquired Infection Control Market Regional Analysis

- North America dominates the Hospital Acquired Infection Control market with the share of 48.82% in 2024, driven by the strong presence of technologically advanced healthcare infrastructure and high adoption of infection surveillance systems across hospitals and clinical settings

- Hospitals and care facilities in the region increasingly invest in real-time monitoring, automated sterilization, and data-integrated infection control systems to meet stringent healthcare quality standards

- Many U.S.-based hospitals use advanced disinfection robots and AI-driven outbreak tracking tools to minimize hospital acquired infection risks and ensure regulatory compliance

U.S. Hospital Acquired Infection Control Market Insight

The U.S. hospital acquired infection control market spans a wide spectrum of advanced disinfection systems, real-time surveillance tools, and automated sterilization technologies integrated across healthcare institutions. The scope includes implementation in hospitals, critical care units, long-term care facilities, and outpatient centers with a focus on digital compliance and infection tracking. As healthcare systems in the U.S. Emphasize performance-based outcomes and reimbursement-linked quality metrics, the market continues to expand through the adoption of data-driven and connected solutions that support safe, hygienic environments across complex care delivery networks.

Europe Hospital Acquired Infection Control Market Insight

The Europe hospital acquired infection control market covers a diverse range of clinical and diagnostic tools used to monitor and prevent healthcare-associated infections across hospitals, aged care homes, surgical centers, and public health laboratories. The scope includes products and services aligned with region-wide infection prevention standards and regulatory mandates. With growing investments in healthcare digitization, the market incorporates smart disinfection, microbial testing, and analytics-based infection management systems to support early detection and intervention efforts in various medical environments.

U.K. Hospital Acquired Infection Control Market Insight

The U.K. hospital acquired infection control market focuses on delivering integrated infection control practices through standardized cleaning protocols, automated sterilization, and data-centric outbreak surveillance tools. The scope covers a wide application across hospitals, clinics, care homes, and surgical centers with compliance to national health safety guidelines. In response to increasing emphasis on healthcare quality and patient safety, the U.K. Market extends into the procurement of innovative disinfection solutions and digital infection management platforms that ensure high levels of hygiene control in both public and private medical settings.

Germany Hospital Acquired Infection Control Market Insight

The Germany hospital acquired infection control market includes a comprehensive range of sterilization systems, infection tracking software, and pathogen testing technologies deployed across healthcare networks. The scope is driven by the country's structured regulatory framework, integration of sustainable infection control solutions, and emphasis on healthcare worker training. Application areas extend into academic hospitals, outpatient clinics, and rehabilitation centers, with increasing investments in eco-friendly and intelligent disinfection tools that align with national sustainability and efficiency objectives.

Asia-Pacific Hospital Acquired Infection Control Market Insight

The Asia-Pacific hospital acquired infection control market covers a broad array of infection prevention technologies tailored for both large-scale hospitals and smaller healthcare facilities. The scope includes diagnostic instruments, surface disinfectants, sterilizers, and infection monitoring software adopted across rapidly expanding urban healthcare systems. With government initiatives promoting digital health transformation, the market continues to grow through widespread adoption of affordable, scalable infection control solutions designed to meet the needs of both developed and emerging healthcare infrastructures in the region.

Japan Hospital Acquired Infection Control Market Insight

The Japan hospital acquired infection control market is defined by its focus on high-precision diagnostic tools, touch-free disinfection systems, and smart integration with other healthcare technologies. The scope spans public hospitals, elderly care homes, specialized clinics, and surgical centers, where infection control is a critical performance indicator. Driven by a high standard of patient safety and technological innovation, the market supports adoption of advanced sterilization methods and surveillance systems that align with the country’s commitment to precision healthcare and elderly population care.

China Hospital Acquired Infection Control Market Insight

The China hospital acquired infection control market covers a rapidly growing demand for both basic and advanced infection control products across hospitals, community health centers, and private clinics. The scope includes a mix of cost-effective disinfectants, sterilization units, and diagnostic instruments manufactured domestically and integrated with smart hospital systems. With the country’s healthcare modernization efforts and push toward smart city development, the market is evolving to include connected infection control platforms and scalable solutions that address both urban and rural healthcare delivery needs.

Hospital Acquired Infection Control Market Share

The hospital acquired infection control industry is primarily led by well-established companies, including:

- Olympus Corporation (Japan)

- Cantel Medical (U.S.)

- Getinge AB (Sweden)

- STERIS plc (U.S.)

- Belimed (Switzerland)

- STEELCO S.p.A. (Italy)

- ASP (U.S.)

- BD (U.S.)

- Crosstex International, Inc. (U.S.)

- Diversey, Inc (U.S.)

- MMM Group (U.S.)

- 3M (U.S.)

- bioMérieux SA (France)

- Sterigenics U.S., LLC (U.S.)

- Cepheid (U.S.)

- Dentsply Sirona (U.S.)

- Mindray Bio-Medical Electronics Co., Ltd (China)

- Randox Laboratories Ltd. (U.K.)

- Ortho Clinical Diagnostics (U.S.)

- Nova Biomedical (U.K.)

- Sysmex Corporation (Japan)

Latest Developments in Global Hospital Acquired Infection Control Market

- In July 2024, Midmark Corporation launched its next-generation M11 and M9 steam sterilizers, designed for enhanced durability & ease of use. These sterilizers feature integrated capabilities to improve instrument processing and compliance documentation efficiencies

- In June 2023, MMM Group and Southwest Clinic partnership established a new CSSD/RUMED facility at the Calw clinic site on Robert-Bosch-Straße 13. This state-of-the-art facility handles the reprocessing of medical products, including Critical C-level items, for four clinics

- In May 2022, Sterigenics U.S., LLC, a provider of sterilization services, expanded its electron beam (E-beam) facility in Indiana. This extension enhances the capacity for sterilizing medical and pharmaceutical products, bolstering safety across the global healthcare sector

- In February 2021, 3M launched the 3M Clean & Protect Certified Badge Program, a robust system designed to enhance facility management. This program offers advanced disinfecting and cleaning solutions, along with comprehensive training, to support the safer resumption of normal operations and activities

- In September 2021, Sodexo has expanded its partnership with Ecolab in the United States for the control of hospital-acquired infections through the Protecta Plus programme. This programme was created to reduce infection risk in hospitals and healthcare facilities by utilising Ecolab's Bioquell hydrogen peroxide vapour technology

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.