Global Hospital Electronic Medical Records Emr Systems Market

Market Size in USD Billion

CAGR :

%

USD

15.86 Billion

USD

31.55 Billion

2025

2033

USD

15.86 Billion

USD

31.55 Billion

2025

2033

| 2026 –2033 | |

| USD 15.86 Billion | |

| USD 31.55 Billion | |

|

|

|

|

Hospital Electronic Medical Records (EMR) Systems Market Size

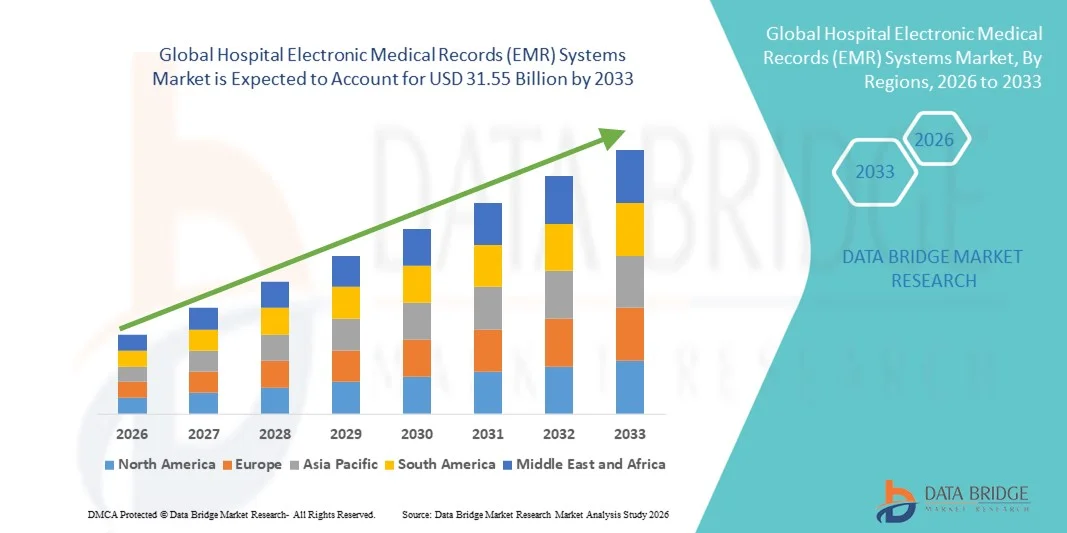

- The global hospital electronic medical records (EMR) systems market size was valued at USD 15.86 billion in 2025 and is expected to reach USD 31.55 billion by 2033, at a CAGR of 8.98% during the forecast period

- The market growth is largely fueled by the increasing digitization of healthcare facilities and the adoption of advanced IT solutions, enabling efficient patient data management, streamlined workflows, and improved clinical decision-making in both hospitals and clinics

- Furthermore, rising demand for secure, interoperable, and user-friendly EMR systems, coupled with regulatory mandates for digital record-keeping, is accelerating the adoption of Hospital EMR solutions, thereby significantly boosting the industry's growth

Hospital Electronic Medical Records (EMR) Systems Market Analysis

- Hospital Electronic Medical Records (EMR) systems — digital platforms that store, manage, and retrieve patient health data — are increasingly essential across healthcare settings due to their ability to improve clinical workflows, enhance patient care, reduce errors, and support interoperability in both hospitals and clinics

- The escalating demand for EMR systems is primarily driven by rising healthcare digitization, regulatory mandates for electronic record‑keeping, growing adoption of cloud‑based and AI‑enabled solutions, and the need for secure and efficient patient data management across healthcare networks

- North America dominated the hospital electronic medical records (EMR) systems market with the largest revenue share of approximately 40% in 2025, supported by advanced healthcare IT adoption, strong regulatory frameworks, and widespread integration of digital health technologies in hospitals and clinics

- Asia‑Pacific is expected to be the fastest‑growing region in the Hospital Electronic Medical Records (EMR) Systems market during the forecast period, driven by expanding healthcare infrastructure, government initiatives for digital health, and rising EMR adoption in emerging economies such as China and India

- The General EMR Solutions segment dominated the market in 2025 with a revenue share of 63.1%, driven by their ability to serve multi-specialty hospitals efficiently

Report Scope and Hospital Electronic Medical Records (EMR) Systems Market Segmentation

|

Attributes |

Hospital Electronic Medical Records (EMR) Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Hospital Electronic Medical Records (EMR) Systems Market Trends

Growing Need for Efficient Healthcare Data Management

- The rising volume of patient data and the increasing complexity of clinical workflows are driving demand for Hospital EMR Systems globally

- Hospitals and clinics are seeking solutions that can streamline patient record management, reduce manual errors, and enhance operational efficiency

- For instance, in 2025, several multi-specialty hospitals in North America implemented advanced EMR systems to improve electronic documentation, patient scheduling, and inter-departmental data sharing

- EMR systems enable real-time access to patient records, laboratory results, and imaging data, allowing clinicians to make timely and informed decisions

- The integration of EMR systems across multiple departments improves collaboration among healthcare providers and reduces administrative overhead

- Healthcare organizations increasingly recognize that effective data management directly impacts patient safety, treatment outcomes, and regulatory compliance

- EMR adoption also supports initiatives such as population health management and predictive analytics, which help in identifying high-risk patients and optimizing resource allocation

- The trend toward digital record-keeping is accelerating in both public and private healthcare institutions, fostering widespread market growth

Hospital Electronic Medical Records (EMR) Systems Market Dynamics

Driver

Rising Government Initiatives and Regulatory Support

- Government policies and regulatory frameworks promoting digital healthcare infrastructure are significant drivers for EMR adoption. Funding programs, incentives, and mandates for electronic health records encourage healthcare providers to implement comprehensive EMR solutions

- For instances, national health IT programs in countries like the U.S., Germany, and Japan have allocated budgets to support EMR system deployment in hospitals and clinics

- These initiatives aim to improve healthcare quality, ensure standardized patient data management, and facilitate interoperability across healthcare facilities

- Compliance with healthcare standards such as HIPAA in the U.S. or GDPR in Europe further encourages hospitals to implement secure and efficient EMR systems

- By adhering to regulatory requirements, healthcare institutions can reduce risks associated with data breaches and improve patient confidentiality

- Government-backed programs also drive investment in training healthcare staff and IT personnel to effectively operate EMR platforms, increasing system adoption and utilization

- Overall, policy support significantly accelerates EMR market growth across developed and emerging regions

Restraint/Challenge

High Implementation Costs and Data Security Concerns

- The relatively high cost of deploying EMR systems, including software, hardware, and training, poses a significant challenge to adoption, particularly in small healthcare facilities and developing regions

- For instance, in 2024, a network of rural clinics in India delayed EMR implementation due to high setup costs and concerns over patient data privacy, highlighting the financial and operational barriers to adoption

- Concerns regarding data privacy, cybersecurity, and unauthorized access to sensitive patient records further restrain market growth

- Healthcare providers may be hesitant to transition from paper-based records or legacy systems due to potential risks and implementation complexity

- Ensuring compliance with stringent regulations, such as HIPAA or GDPR, requires additional investment in security measures, encryption, and staff training

- Although cloud-based EMR solutions are reducing infrastructure costs, initial setup, migration, and integration expenses remain a barrier for smaller institutions

- Addressing these challenges through affordable deployment models, robust security protocols, and training programs is critical for broader adoption

- Further development of user-friendly, cost-effective EMR solutions will be essential to overcome financial and operational hurdles and sustain long-term market growth

Hospital Electronic Medical Records (EMR) Systems Market Scope

The market is segmented on the basis of Component, Type, Delivery Mode, and Hospital Size.

- By Component

On the basis of component, the Hospital EMR Systems market is segmented into Services, Software, and Hardware. The Software segment dominated the largest market revenue share of 58.3% in 2025, driven by the critical need for advanced platforms to manage patient data, streamline clinical workflows, and ensure compliance with healthcare regulations. Hospitals across North America and Europe prioritize software solutions that integrate laboratory information systems, imaging, pharmacy management, and billing functionalities to create a seamless operational ecosystem. The demand for cloud-enabled and on-premise software further supports its dominance, providing flexibility for hospitals of different sizes. Software solutions enhance decision-making with real-time access to patient records, automated alerts, and analytics, contributing to improved patient safety and treatment outcomes. In addition, the increasing adoption of specialty EMR modules for cardiology, oncology, and pediatrics adds to the market share. Healthcare institutions are also adopting software solutions that support telemedicine, remote patient monitoring, and interoperability across multiple facilities, enhancing care continuity. Vendors continuously update software to comply with data privacy regulations such as HIPAA and GDPR, strengthening hospital trust and adoption. Integration with mobile applications for clinicians and administrators ensures better workflow management. The ability to scale software platforms according to hospital size, patient volume, and specialty requirements makes this segment a dominant force in the global EMR market.

The Services segment is expected to witness the fastest CAGR of 12.8% from 2026 to 2033, fueled by the growing demand for implementation, consulting, training, and maintenance services. Services ensure smooth deployment of EMR systems, optimize workflow adaptation, and provide ongoing technical support. With increasing complexity in EMR software and diverse hospital requirements, service offerings have become essential for operational efficiency. Training programs enhance staff competency, reduce errors, and improve adoption rates, particularly in emerging markets. Maintenance services ensure minimal downtime, regular updates, and compliance with evolving healthcare standards. Consulting services help hospitals select solutions tailored to their infrastructure, patient volume, and clinical needs. Hospitals in Asia-Pacific and Latin America are increasingly outsourcing EMR services to ensure cost-effective and efficient implementation. The rise of telemedicine and remote healthcare management is further driving the need for professional service integration. Customized service solutions also improve user experience and optimize EMR utilization across departments. As healthcare facilities expand and upgrade digital infrastructure, the demand for professional services will continue to grow, supporting the rapid CAGR of this segment.

- By Type

On the basis of type, the Hospital EMR Systems market is segmented into General EMR Solutions and Specialty EMR Solutions. The General EMR Solutions segment dominated the market in 2025 with a revenue share of 63.1%, driven by their ability to serve multi-specialty hospitals efficiently. General EMR platforms include core functionalities such as patient registration, appointment scheduling, electronic prescribing, lab integration, and billing management. They offer standardized processes across departments, reducing administrative workload and enhancing patient care quality. Real-time access to clinical data supports faster diagnosis and treatment. Analytics and reporting modules in general EMRs enable hospitals to monitor key performance indicators and optimize resource allocation. Integration with telemedicine platforms and mobile applications further strengthens their adoption. Large hospitals prefer general EMRs for their scalability, compatibility with existing IT infrastructure, and comprehensive support from vendors. Continuous software updates and regulatory compliance features increase trust among healthcare providers. In addition, general EMRs are adaptable to both urban and rural hospital setups, increasing their reach globally. High adoption in North America and Europe reinforces their dominance. The segment’s widespread deployment across various hospital sizes and specialties contributes to its large market share.

The Specialty EMR Solutions segment is expected to witness the fastest CAGR of 14.2% from 2026 to 2033, driven by rising demand in niche domains like oncology, cardiology, orthopedics, and pediatrics. Specialty EMRs offer tailored features, templates, and modules to manage specific clinical workflows, enabling higher precision in patient care. Advanced diagnostic, treatment tracking, and reporting functionalities in specialty EMRs improve treatment outcomes and compliance with specialized clinical standards. Hospitals are increasingly implementing specialty EMRs to support chronic disease management, research studies, and specialized care programs. The rising prevalence of complex medical conditions requires targeted solutions that general EMRs cannot fully address. Adoption is particularly strong in developed regions with high investment in healthcare technology and in emerging markets seeking advanced capabilities. Integration with laboratory systems, imaging devices, and patient monitoring tools ensures seamless clinical operations. Vendor support and customization options further enhance the value proposition of specialty EMRs. Training and consulting services ensure effective usage, accelerating adoption. The growing emphasis on precision medicine and evidence-based care contributes to this segment’s rapid CAGR.

- By Delivery Mode

On the basis of delivery mode, the Hospital EMR Systems market is segmented into On-premise and Cloud-Based solutions. The On-premise segment dominated the market with the largest revenue share of 54.6% in 2025, due to hospitals’ preference for controlling sensitive patient data internally and ensuring compliance with stringent regulations. On-premise solutions offer reliability, customization, and security advantages, making them the choice of large hospitals and established healthcare institutions. Integration with existing IT infrastructure and legacy systems allows seamless workflow management across multiple departments. Hospitals in North America and Europe exhibit higher adoption due to strong IT infrastructure, regulatory requirements, and emphasis on patient privacy. On-premise EMRs support advanced analytics, clinical decision support, and reporting modules to improve operational efficiency and patient outcomes. The ability to manage system updates internally ensures continuity and reduces downtime. Hospitals with high patient volumes prefer on-premise solutions for stability, security, and scalability. Enhanced control over hardware, software, and network access increases trust and adoption. In addition, these solutions provide comprehensive training and vendor support to ensure smooth operation. On-premise systems are particularly favored where internet connectivity may be inconsistent, ensuring uninterrupted access to critical patient data.

The Cloud-Based segment is expected to witness the fastest CAGR of 15.1% from 2026 to 2033, fueled by the rising adoption in small and medium-sized hospitals seeking cost-effective, scalable, and remotely accessible solutions. Cloud EMRs eliminate the need for significant upfront infrastructure investment while enabling real-time data access across multiple locations. Hospitals in Asia-Pacific, Latin America, and the Middle East are increasingly adopting cloud solutions to expand digital healthcare services and telemedicine programs. Cloud EMRs support interoperability with lab, pharmacy, imaging, and billing systems, enhancing clinical efficiency. The platforms also enable remote monitoring, analytics, and patient engagement tools, improving overall care delivery. Flexibility, automatic software updates, and ease of maintenance make cloud systems attractive for hospitals with limited IT staff. Vendors provide subscription-based models, reducing capital expenditure and enabling faster deployment. The integration of security protocols ensures compliance with data privacy regulations. Cloud-based solutions also support mobile access, enabling clinicians to access patient data on tablets and smartphones. As hospitals continue digital transformation, cloud EMR adoption is expected to grow rapidly, contributing to a high CAGR.

- By Hospital Size

On the basis of hospital size, the Hospital EMR Systems market is segmented into Small and Medium-sized Hospitals and Large Hospitals. The Large Hospitals segment dominated the market in 2025 with a revenue share of 61.7%, due to their high patient volumes, multiple specialties, and complex clinical and administrative workflows. Large hospitals require comprehensive EMR systems to ensure smooth operation across departments, including inpatient, outpatient, emergency, and surgical units. Advanced analytics, reporting, and decision-support functionalities allow administrators to monitor performance and optimize resource allocation. Integration with laboratory, pharmacy, and radiology systems enhances efficiency and improves patient outcomes. Large hospitals typically have trained IT staff and budgets to implement sophisticated EMR platforms. Compliance with international regulations such as HIPAA, GDPR, and other local standards strengthens adoption. Vendors provide customization and ongoing support to meet the needs of high-volume facilities. The adoption of mobile and telehealth functionalities in large hospitals further reinforces their preference for advanced EMR solutions. These hospitals also serve as benchmarks for EMR best practices, influencing adoption in smaller facilities.

The Small and Medium-sized Hospitals segment is expected to witness the fastest CAGR of 13.5% from 2026 to 2033, driven by the increasing affordability of modular EMR solutions, cloud-based deployment, and growing awareness about digital healthcare benefits. Smaller hospitals are adopting cost-effective EMR systems to improve patient care, streamline workflows, and reduce administrative burden. Cloud and SaaS-based platforms allow remote access, interoperability, and scalability without significant capital investment. Integration with mobile apps, telemedicine, and patient portals enhances care delivery and patient engagement. Vendors offer flexible subscription-based models, making EMR adoption feasible for smaller institutions. Regional government initiatives and subsidies for digital healthcare transformation further accelerate adoption. Customizable solutions enable hospitals to implement modules as needed, providing a gradual and manageable transition. The ability to efficiently manage outpatient, inpatient, and specialty services contributes to adoption. Enhanced cybersecurity features, compliance with regulations, and vendor support make EMR systems a viable solution for small and medium-sized hospitals globally.

Hospital Electronic Medical Records (EMR) Systems Market Regional Analysis

- North America dominated the hospital electronic medical records (EMR) systems market with the largest revenue share of approximately 40% in 2025, driven by advanced healthcare IT adoption, strong regulatory frameworks, and widespread integration of digital health technologies in hospitals and clinics. The U.S., in particular, accounted for the largest market share within the region, fueled by rapid EMR implementation, federal mandates promoting meaningful use of electronic records, and investments in hospital digital infrastructure

- Providers increasingly prioritize interoperability, cloud-based systems, and AI-powered analytics to improve patient outcomes and operational efficiency. High awareness among healthcare professionals about EMR benefits, along with the presence of major EMR software vendors, supports market growth. The adoption of mobile EMR solutions and integration with telehealth platforms further enhances convenience and accessibility. North American hospitals are also leveraging EMR systems for data-driven decision-making, streamlined billing, and regulatory compliance

- The region’s robust IT infrastructure, combined with strong government incentives, establishes it as a leading market globally. Continuous innovation in EMR platforms and services sustains adoption in both urban and rural healthcare facilities

U.S. Hospital Electronic Medical Records (EMR) Systems Market Insight

The U.S. hospital electronic medical records (EMR) systems market captured the largest revenue share within North America in 2025, driven by widespread adoption of advanced healthcare IT, federal mandates for meaningful use, and strong regulatory frameworks supporting digital health integration. Hospitals and clinics are increasingly prioritizing interoperability, cloud-based EMR platforms, and AI-powered analytics to improve patient care, operational efficiency, and administrative workflow. The rapid expansion of telehealth and mobile health solutions has further accelerated EMR adoption, enabling real-time access to patient records and improved coordination across care networks. Providers are investing in integrated EMR systems that support clinical decision-making, reduce errors, and ensure compliance with HIPAA and other healthcare regulations. The demand for patient-centric solutions, including portals and mobile applications, is also driving growth. The U.S. market benefits from a high concentration of major EMR software vendors offering advanced analytics, AI integration, and customizable solutions. Hospitals are leveraging EMR platforms to enhance data-driven decision-making, optimize resource allocation, and improve patient engagement. Continuous upgrades in software, cybersecurity, and interoperability reinforce adoption. Government incentives, supportive policies, and robust IT infrastructure further strengthen market penetration. The U.S. remains the largest EMR adopter in North America due to a combination of technological readiness, healthcare digitization initiatives, and strong private and public investment in digital health transformation.

Europe Hospital Electronic Medical Records (EMR) Systems Market Insight

The Europe hospital electronic medical records (EMR) systems market is projected to expand at a substantial CAGR throughout the forecast period, driven by increasing government initiatives for digital health, stringent healthcare regulations, and the need to improve patient care efficiency. Countries such as the U.K. and Germany are witnessing a steady rise in EMR adoption across public and private hospitals due to modernization programs and emphasis on electronic patient records. Healthcare providers are focused on implementing interoperable systems, enabling seamless sharing of patient data across hospitals, clinics, and care networks. The demand for cloud-based EMR solutions and advanced data analytics is growing, facilitating better clinical decision-making. Increasing patient awareness, coupled with investments in hospital IT infrastructure, encourages digital transformation. EMR systems also help hospitals reduce paperwork, improve operational efficiency, and comply with GDPR and other regional data protection laws. Integration with telemedicine, mobile applications, and remote monitoring devices further fuels adoption.

U.K. Hospital Electronic Medical Records (EMR) Systems Market Insight

The U.K. hospital electronic medical records (EMR) systems market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by government policies promoting digital healthcare and NHS modernization programs. Hospitals are increasingly adopting EMR platforms to enhance patient care, reduce medical errors, and streamline administrative tasks. The growing focus on patient-centric care, combined with robust IT infrastructure, supports widespread EMR integration. Providers are implementing cloud-based and interoperable EMR solutions for improved data accessibility and collaboration among healthcare professionals. The U.K.’s strong healthcare IT ecosystem, along with initiatives for nationwide health data exchange, encourages further adoption. The integration of EMR systems with mobile apps, telehealth services, and digital reporting tools is also contributing to growth. Rising awareness about the benefits of electronic patient records among clinicians and patients enhances market potential. Continuous upgrades in software, AI-based analytics, and cybersecurity measures reinforce trust and adoption.

Germany Hospital Electronic Medical Records (EMR) Systems Market Insight

The Germany hospital electronic medical records (EMR) systems market is expected to expand at a considerable CAGR during the forecast period, fueled by government initiatives for digital healthcare, advanced hospital IT infrastructure, and growing awareness of the benefits of electronic patient records. Hospitals are increasingly implementing EMR platforms to enhance patient safety, optimize workflows, and support research and analytics. The emphasis on eco-conscious and energy-efficient IT solutions also promotes adoption. Interoperable EMR solutions are gaining traction, enabling seamless data sharing across healthcare facilities. Germany’s focus on innovation, technological integration, and robust cybersecurity measures encourages hospitals to adopt advanced EMR systems. Providers are leveraging cloud-based, mobile-accessible, and AI-enhanced EMR platforms to improve operational efficiency. Rising healthcare expenditure and strong regulatory frameworks further support market growth. Integration with telemedicine and connected health devices enhances patient monitoring and reduces administrative burdens.

Asia-Pacific Hospital Electronic Medical Records (EMR) Systems Market Insight

The Asia-Pacific hospital electronic medical records (EMR) systems market is poised to grow at the fastest CAGR during the forecast period, driven by expanding healthcare infrastructure, rising government initiatives for digital health, and increasing EMR adoption in emerging economies such as China and India. Rapid urbanization, growing middle-class populations, and rising healthcare expenditure are fueling demand for hospital digitization. Countries in APAC are increasingly investing in interoperable, cloud-based EMR solutions to improve patient care, efficiency, and regulatory compliance. The presence of supportive policies, such as India’s National Digital Health Mission and China’s Healthy China 2030 initiative, encourages widespread adoption. The region is witnessing integration of EMR systems with telemedicine, mobile health applications, and IoT-based hospital management solutions. Hospitals are leveraging EMR platforms to reduce paperwork, enhance clinical decision-making, and streamline workflows. Increasing awareness of the benefits of digital records among healthcare providers and patients further propels growth. The availability of affordable EMR solutions, combined with strong IT infrastructure development, supports market expansion. APAC’s position as a manufacturing hub for EMR systems components also boosts accessibility and adoption.

Japan Hospital Electronic Medical Records (EMR) Systems Market Insight

The Japan hospital electronic medical records (EMR) systems market is growing steadily due to the country’s high-tech healthcare environment, rapid urbanization, and emphasis on patient safety and convenience. Hospitals are adopting EMR systems to improve operational efficiency, streamline patient records, and enable integrated care across facilities. Government programs supporting digital healthcare adoption, coupled with investments in hospital IT infrastructure, accelerate EMR deployment. Integration of EMR systems with mobile applications, IoT devices, and telemedicine platforms enhances patient monitoring and access. Japan’s aging population also drives demand for easy-to-use, secure digital health solutions in both residential and clinical settings. Hospitals are increasingly implementing interoperable, cloud-based EMR platforms to improve data accessibility. Awareness of the benefits of EMR systems among healthcare professionals reinforces adoption. Advanced analytics and AI tools integrated with EMR platforms support predictive healthcare and operational optimization. Security, compliance, and privacy measures are emphasized to maintain patient trust.

China Hospital Electronic Medical Records (EMR) Systems Market Insight

The China hospital electronic medical records (EMR) systems market accounted for the largest market revenue share in Asia-Pacific in 2025, driven by rapid urbanization, a growing middle class, and increasing technological adoption. The government’s focus on smart hospitals, digital health records, and nationwide EMR standardization promotes market growth. Hospitals are increasingly implementing interoperable and cloud-based EMR solutions to streamline operations, improve patient care, and support regulatory compliance. The push towards smart cities and integrated healthcare systems, along with domestic EMR solution providers, enhances accessibility and affordability. China’s expanding healthcare infrastructure, along with rising awareness among clinicians and patients, drives adoption across urban and rural hospitals. Integration with mobile applications, telemedicine, and IoT devices further accelerates EMR deployment. The market benefits from continuous government investment in digital health programs. Hospitals are adopting AI-powered EMR analytics to improve clinical decision-making and optimize resources. Increasing healthcare expenditure, strong regulatory policies, and technology-driven workflows support sustained market growth.

Hospital Electronic Medical Records (EMR) Systems Market Share

The Hospital Electronic Medical Records (EMR) Systems industry is primarily led by well-established companies, including:

- Cerner Corporation (U.S.)

- Epic Systems Corporation (U.S.)

- McKesson Corporation (U.S.)

- athenahealth (U.S.)

- Meditech (U.S.)

- Siemens Healthineers (Germany)

- GE Healthcare (U.S.)

- Philips Healthcare (Netherlands)

- eClinicalWorks (U.S.)

- NextGen Healthcare (U.S.)

- Optum (U.S.)

- Greenway Health (U.S.)

- HMS Holdings (U.S.)

- AdvancedMD (U.S.)

- Infor Healthcare (U.S.)

- IBM Watson Health (U.S.)

- Oracle Health Sciences (U.S.)

- CompuGroup Medical (Germany)

- NTT Data Healthcare (Japan)

Latest Developments in Global Hospital Electronic Medical Records (EMR) Systems Market

- In January 2021, Philips Healthcare, a global health technology leader, announced the acquisition of Capsule Technologies, a company specializing in medical device integration and data connectivity, aiming to expand Philips’ capabilities in hospital EMR systems and improve clinical data interoperability across hospital networks

- In November 2021, MyHealthcare, a healthcare technology company, launched a new electronic medical record suite designed with specialty clinical workflows, decision support tools, and templates tailored for different clinical procedures, marking a significant product expansion in EMR solutions

- In January 2024, GE Healthcare and InterSystems announced a joint product launch of a cloud‑native data integration layer designed to enhance EMR interoperability across hospital networks, enabling seamless exchange of patient information between disparate EMR systems

- In April 2025, Canada Health Infoway selected Ava, an AI‑enhanced EMR platform, as a recipient of its 2025 Vendor Innovation Program, recognizing Ava’s contributions to interoperability and data exchange among EMR vendors in Canada

- In May 2025, Epic Systems introduced a new AI‑enabled documentation capability integrated into its hospital EHR, designed to streamline clinical note creation and reduce administrative workload for clinicians, marking one of the most significant EMR product innovations of the year

- In July 2025, MEDITECH announced an expansion of its Expanse EMR platform via Google Cloud, offering enhanced cloud‑based scalability, improved data security, and global deployment options for hospitals and health systems seeking modern EMR solutions

- In February 2025, Gulmi Hospital in Lumbini Province, Nepal, modernized its EMR system with support from the World Health Organization’s Nepal office, enhancing data accuracy, interoperability, and efficiency by reducing reliance on paper records and manual documentation

- In August 2025, Narayana Health, a major healthcare provider in India, launched Aira, an AI‑powered documentation tool built on its Athma EMR platform, designed to automate clinical documentation workflows and support improved patient outcomes

- In August 2025, MyMichigan Health and Nimkee Memorial Wellness Center announced a collaborative initiative to integrate MyMichigan’s Epic EMR system using the Epic Community Connect program, enabling shared EMR access, streamlined patient care coordination, and reduced redundant testing

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.